Henri Matisse View of Nôtre Dame 1914

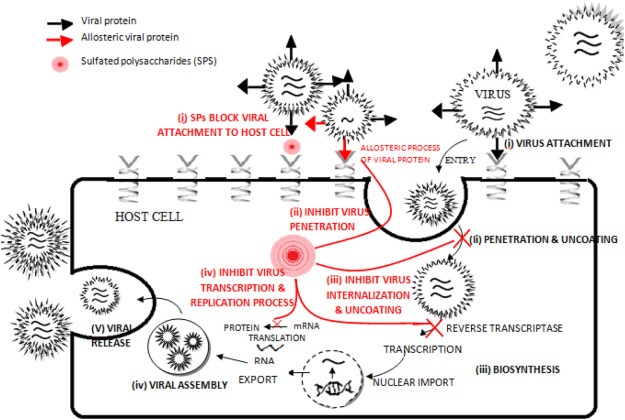

Polysaccharides may work. I think I like the illustration.

Science Direct is an Elsevier publication. We’re getting serious. The shift is slow but real.

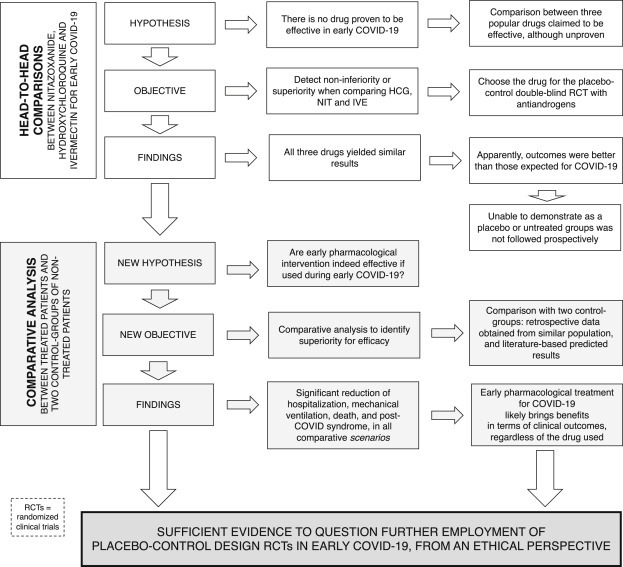

• Early Covid-19 Therapy Significantly Improved Covid-19 Outcomes (SD)

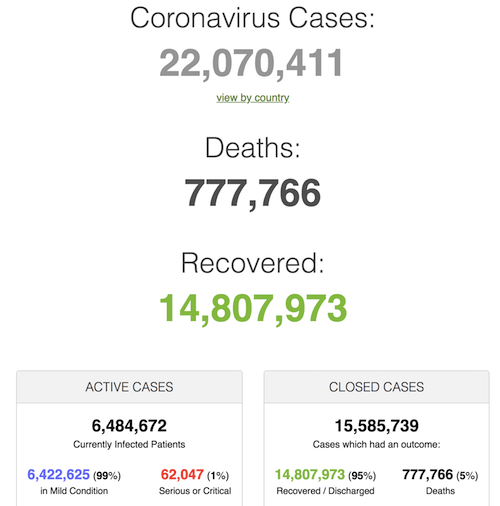

In a prospective observational study (pre-AndroCoV Trial), the use of nitazoxanide, ivermectin and hydroxychloroquine demonstrated unexpected improvements in COVID-19 outcomes when compared to untreated patients. The apparent yet likely positive results raised ethical concerns on the employment of further full placebo controlled studies in early-stage COVID-19. The present analysis aimed to elucidate, through a comparative analysis with two control groups, whether full placebo-control randomized clinical trials (RCTs) on early-stage COVID-19 are still ethically acceptable. The Active group (AG) consisted of patients enrolled in the Pre-AndroCoV-Trial (n = 585). Control Group 1 (CG1) consisted of a retrospectively obtained group of untreated patients of the same population (n = 137), and Control Group 2 (CG2) resulted from a precise prediction of clinical outcomes based on a thorough and structured review of indexed articles and official statements.

Patients were matched for sex, age, comorbidities and disease severity at baseline. Compared to CG1 and CG2, AG showed reduction of 31.5–36.5% in viral shedding (p < 0.0001), 70–85% in disease duration (p < 0.0001), and 100% in respiratory complications, hospitalization, mechanical ventilation, deaths and post-COVID manifestations (p < 0.0001 for all). For every 1000 confirmed cases for COVID-19, at least 70 hospitalizations, 50 mechanical ventilations and five deaths were prevented. Benefits from the combination of early COVID-19 detection and early pharmacological approaches were consistent and overwhelming when compared to untreated groups, which, together with the well-established safety profile of the drug combinations tested in the Pre-AndroCoV Trial, precluded our study from continuing employing full placebo in early COVID-19.[..] Drugs offered included azithromycin 500mg daily for five days for all patients, in association with one of the following: hydroxychloroquine 400mg daily for five days, nitazoxanide 500mg twice a day for six days, or ivermectin 0.2mg/kg/day in a single daily dose for three days, In addition, repurposed drugs, including dutasteride 0.5mg/day for 15 days and spironolactone 100mg twice a day for 15 days, were optionally offered. Vitamin D, vitamin C, zinc, apibaxan, rivaroxaban, enoxaparin and glucocorticoids were added according to clinical judgement, the risk for thrombosis and progression of the disease to the inflammatory stage. Patients that decided to adhere to any treatment were included in the AG. All patients of AG and CG1 groups were followed longitudinally for 90 days for the occurrence of a new-onset or persistence of physical or mental manifestations.

Of the 585 subjects, all patients used azithromycin. A total of 357 patients used NIT, 159 used HCQ and 110 patients used IVE, alone with azithromycin or in combination with other drugs. Of the 357 patients that used NIT, 69 used the same in combination with HCQ, 46 used in combination with IVE, 146 used in combination with SPIRO, and 27 males used in combination with DUTA. Of the 110 patients that used IVE, 22 used in combination with HCQ, 82 used in combination with NIT, 66 used in combination with SPIRO and four males used in combination with DUTA. Of the 159 patients that used HCQ, 21 used in combination with IVE, 113 used in combination with NIT, 86 used in combination with SPIRO and seven males used in combination with DUTA.

Not one word on how severe their cases are. Typical.

• Up To 100 May Already Be Infected In New Zealand Covid Outbreak (G.)

New Zealand’s coronavirus cluster has grown to 21, with a strong link discovered to a case at the border, as the country began day two of a national lockdown. On Thursday, New Zealand reported another 11 cases of the Delta variant in the community, all in Auckland. The prime minister, Jacinda Ardern, also announced that children between the ages of 12-15 would now also be eligible for the vaccine, from 1 September. “My message to parents who will need to of course provide consent for the children, is that I would not have been a part of a process and approving this, unless I believed it was safe, because around that table, we are parents too, all affected by these decisions, so we take them very seriously,” she said. The first case, a 58-year-old man from Auckland, emerged on Tuesday, prompting the government to put the entire country into a level 4 lockdown – the highest level of restrictions.

Ardern said genome sequencing has linked the cluster to a returnee from Australia. A New Zealander returned from Sydney on a managed red-zone flight and tested positive for the Delta variant on 7 August before being moved to quarantine the next day. After becoming unwell, they were transferred to Middlemore hospital, on 16 August. “This is a significant development and means now we can be fairly certain how, and when, the virus entered the country, and that based on timelines, there are minimal, possibly only one, or maybe two, missing links between this returnee and cases in our current outbreak,” Ardern said. The period in which cases were in the community is relatively short, she said, adding that it was unlikely the virus was spread at the hospital because the case was transferred there just one day prior to the first positive local case being discovered.

Ardern thanked the 58-year-old man for getting tested when he did. “If it wasn’t for you getting tested when you did, this could be a much, much more difficult situation. Having said that, I know we’re all prepared for cases to get worse before they get better. There is always a pattern with these outbreaks.” The prime minister cautioned that the country would need to remain open to other possibilities, but that the new information gives officials the confidence to focus on how the virus was transmitted, with a particular focus on the isolation and quarantine facilities. “Today we believe we have uncovered the piece of the puzzle we were looking for, and that means our ability to circle the virus, lock it down and stamp it out generally has greatly improved.”

In real life, we’ve seen levels of 4-5 times higher (get me a booster!). But the Guardian brings it to you gently.

And stupidly: “But the fact that they can have high levels of virus suggests that people who aren’t yet vaccinated may not be as protected from the Delta variant as we hoped.”

• Jabbed Adults Infected With Delta ‘Can Match Virus Levels Of Unvaccinated’ (G.)

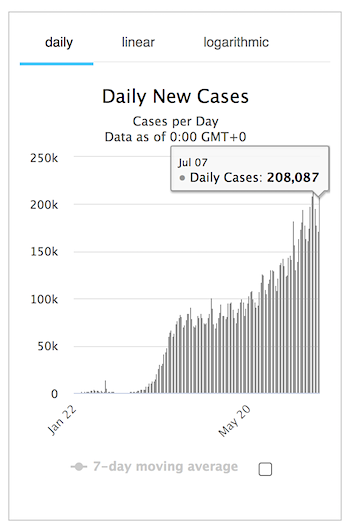

Fully vaccinated adults can harbour virus levels as high as unvaccinated people if infected with the Delta variant, according to a sweeping analysis of UK data, which supports the idea that hitting the threshold for herd immunity is unlikely. There is abundant evidence that Covid vaccines in the UK continue to offer significant protection against hospitalisations and death. But this new analysis shows that although being fully vaccinated means the risk of getting infected is lower, once infected by Delta a person can carry similar virus levels as unvaccinated people. The implications of this on transmission remain unclear, the researchers have cautioned.

“We don’t yet know how much transmission can happen from people who get Covid-19 after being vaccinated – for example, they may have high levels of virus for shorter periods of time,” said Sarah Walker, a professor of medical statistics and epidemiology at the University of Oxford. “But the fact that they can have high levels of virus suggests that people who aren’t yet vaccinated may not be as protected from the Delta variant as we hoped.” Positive tests, hospitalisations and deaths linked to Covid have been rising slowly in the UK recently. In the week to 18 August, 211,238 people had a confirmed positive test result, an increase of 7.6% compared with the previous seven days. Over the same period, there have been 655 deaths within 28 days of a positive test, a rise of 7.9% versus the previous seven days.

Hospitalisations have also risen slightly, with 5,623 going into hospital with coronavirus between 8 August 2021 and 14 August 2021, a rise of 4.3% compared with the previous seven days. The study, which is yet to be peer-reviewed, found vaccine performance has waned against Delta versus the previously dominant Alpha variant. The analysis did not directly investigate whether the lower level of vaccine protection against Delta affected jabs’ ability to prevent severe disease. However, Dr Penny Ward, a visiting professor in pharmaceutical medicine at King’s College London, noted: “The low incidence of hospitalisation seen to date suggests that in this respect at least the vaccines are protecting individuals from developing severe Covid.”

“.. as Biden Forces Mandatory Vaccines For Any Worker Paid by Medicare and Medicaid Money..”

• Get Ready for a Nationwide Eldercare Shortage (CTH)

…As predicted, and the ‘next step’ will be colleges, universities, students and anyone receiving federal education funding, loans or grants. Today, the White House occupant announced a federal regulatory requirement that all nurses and healthcare workers who work in facilities funded by Medicaid and/or Medicare will be required to be vaccinated. Ironically Joe Biden noted that nurses, those professionally trained in healthcare systems – who understand the issues of vaccination, are at a lower vaccination rate than the less trained and educated population. “Vaccination rates among nursing home staff significantly trail the rest of the country“, Biden said; while never questioning ‘why’. As pointed out recently, a large subset of the vaccine resistant population are the most educated.

[Speech Transcript] – […] “Today, I’m announcing a new step. If you work in a nursing home and serve people on Medicare or Medicaid, you will also be required to get vaccinated. More than 130,000 residents in nursing homes have sa- — have sadly, over the period of this virus, passed away. At the same time, vaccination rates among nursing home staff significantly trail the rest of the country.” The downstream consequence from this action will be a shortage of healthcare providers in nursing homes. This has already become an issue for hospitals coast to coast who require vaccinations of their staff. CTH has been warning about the Chicago network behind Biden and their objective. We have accurately predicted their moves, but what we cannot determine is how the larger American electorate will respond to these encroachments.

As go the Sacklers, so goes Pfizer.

• Former Purdue Pharma Chair Denies Responsibility For US Opioid Crisis (AP)

The former president and board chair of Purdue Pharma told a court Wednesday that he, his family and the company are not responsible for the opioid crisis in the United States. Richard Sackler, a member of the family who owns the company, was asked whether each bears responsibility during a federal bankruptcy hearing in White Plains, New York, over whether a judge should accept the OxyContin maker’s plan to settle thousands of lawsuits. For each, he gave a one-word answer: “No.” Richard Sackler’s denial of responsibility for the opioid crisis comes a day after another Sackler family member said the group wouldn’t accept a settlement without guarantees of immunity from further legal action.

The previous words of Richard Sackler, now 76, are at the heart of lawsuits accusing the Stamford, Connecticut-based company of an outsized role in sparking a nationwide opioid epidemic. In the 1996 event to launch sales of OxyContin, he told the company’s sales force that there would be “a blizzard of prescriptions that will bury the competition”. Five years later, as it was apparent that the powerful prescription pain drug was being misused in some cases, he said in an email that Purdue would have to “hammer on the abusers in every way possible”, describing them as “the culprits and the problem”. For those reasons, the activists crusading against companies involved in selling opioids often see Richard Sackler – who was president of the company from 1999 to 2003, chair of its board from 2004 through 2007, and a board member from 1990 until 2018 – as a prime villain.

[..] Sackler, whose father was one of three brothers who nearly 70 years ago bought the company that later became Purdue Pharma, didn’t recall emails he wrote a decade or more ago; whether Purdue’s board approved certain sales strategies; whether a company owned by Sackler family members sold opioids in Argentina; or whether he paid any of his own money as part of a settlement with Oklahoma to which the Sackler family contributed $75m. Often, he answered questions with more questions, asking for precision. When Edmunds asked him if he knew how many people in the US had died from using opioids, Sackler asked him to specify over which time period. Edmunds did: 2005 to 2017. “I don’t know,” Sackler said. He said that he had looked at some data on deaths in the past, though. (The US Centers for Disease Control has tallied more than 500,000 deaths in the US to opioid overdose, including both prescription drugs and illicit ones such as heroin and illegally produced fentanyl, since 2000.)

How did that country get so scary so fast?

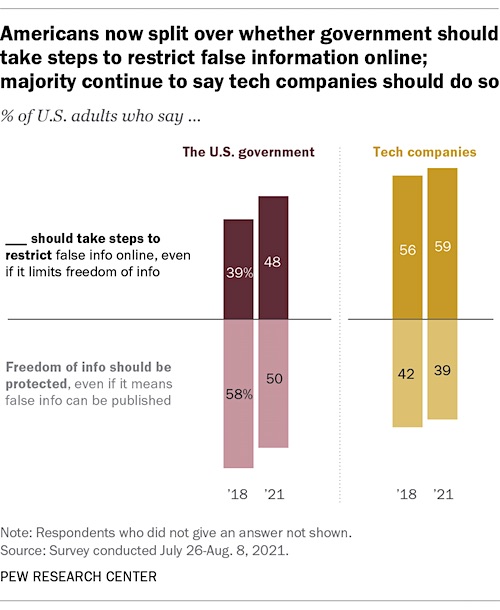

And how can a government or Big Tech restrict false information when they are the biggest source of it? You know, just in theory …..

• How Americans View Government Restriction Of False Information (Pew)

Amid rising concerns over misinformation online – including surrounding the COVID-19 pandemic, especially vaccines – Americans are now a bit more open to the idea of the U.S. government taking steps to restrict false information online. And a majority of the public continues to favor technology companies taking such action, according to a new Pew Research Center survey. Roughly half of U.S. adults (48%) now say the government should take steps to restrict false information, even if it means losing some freedom to access and publish content, according to the survey of 11,178 adults conducted July 26-Aug. 8, 2021. That is up from 39% in 2018. At the same time, the share of adults who say freedom of information should be protected – even if it means some misinformation is published online – has decreased from 58% to 50%.

When it comes to whether technology companies should take steps to address misinformation online, more are in agreement. A majority of adults (59%) continue to say technology companies should take steps to restrict misinformation online, even if it puts some restrictions on Americans’ ability to access and publish content. Around four-in-ten (39%) take the opposite view that protecting freedom of information should take precedence, even if it means false claims can spread. The balance of opinion on this question has changed little since 2018. Partisan divisions on the role of government in addressing online misinformation have emerged since 2018. Three years ago, around six-in-ten in each partisan coalition – 60% of Republicans and GOP-leaning independents and 57% of Democrats and Democratic leaners – agreed that freedom of information should be prioritized over the government taking steps to restrict false information online.

Today, 70% of Republicans say those freedoms should be protected, even it if means some false information is published. Nearly as many Democrats (65%) instead say the government should take steps to restrict false information, even if it means limiting freedom of information. Partisan views on whether technology companies should take such steps have also grown further apart. Roughly three-quarters of Democrats (76%) now say tech companies should take steps to restrict false information online, even at the risk of limiting information freedoms. A majority of Republicans (61%) express the opposite view – that those freedoms should be protected, even if it means false information can be published online. In 2018, the parties were closer together on this question, though most Democrats still supported action by tech firms.

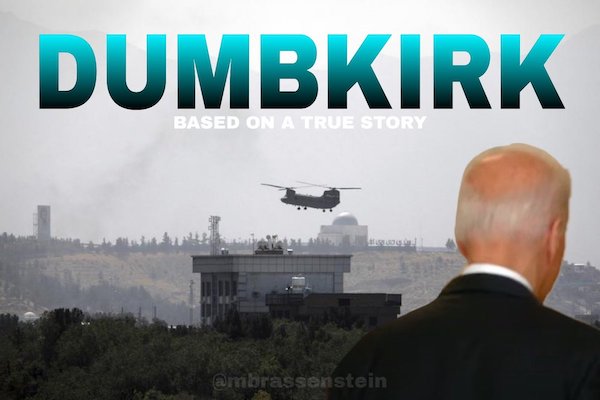

Washington hasn’t processed its defeat yet.

• New US Air Force Secretary Wants To “Scare” China (Antiwar)

Researching and developing new weapons technologies is a key part of the Pentagon’s strategy to counter China. In an interview with Defense News, President Biden’s new Air Force secretary said he’d like to see the US military field the type of new technologies that “scare China.” Frank Kendall, who was sworn in as Air Force secretary on July 28th, made it clear in the interview that he is focused on China. “I’ve been obsessed, if you will, with China for quite a long time now — and its military modernization, what that implies for the US and for security,” he said. Hyping up the threat of China’s military serves the Pentagon to justify more spending, and Kendall hinted that he believes the Air Force doesn’t have a sufficient budget. “The Air Force has been overly constrained,” he said.

“I think we’ve not been allowed to do things we really need to do to free up resources for things that are higher priority. We’ve had a very hard time getting the Congress to allow us to retire older aircraft.” One project that Kendall discussed is the B-21 bomber, which is currently being developed. “I think that’s going to be something that will be intimidating, it’s going to be very capable. And there are a few others like that that are coming down the pipeline. … But I think we have to be continuously thinking about other things that will be intimidating to our future enemies.” The Pentagon budget requested by President Biden prioritized spending on new weapons technology. The budget request asked for over $112 billion for research, development, testing, and evaluation, known as RDT&E. Besides new long-range bombers, US military leaders are calling for investment in technology like artificial intelligence, robotics, space and cyber capabilities, and hypersonic missiles.

And then you will have what?

• Fire The Military And Intelligence Bigs Who Bungled Afghanistan – Now (NYP)

This is the biggest foreign failure in most Americans’ lifetimes, and there needs to be an accounting. The normal course of business after government bungling nowadays is that everyone involved tut-tuts a bit, then gets a raise and a promotion, while the government goes back to business as usual. But in a sane nation, failure would be punished. To begin with, Milley must resign or be fired. And the same for our triple-masking defense secretary, Lloyd Austin. This was a failure that happened on their watch, and it happened through bad management. We could have pulled out without nearly the level of chaos, confusion and terror.

But Milley and Austin weren’t on top of their jobs. They may feel that firing is unfair, but they’d be getting off light by the standards of military history: In the 18th century, the British executed an admiral, John Byng, for failing to “do his utmost” in combat. It was harsh, but the Royal Navy became more aggressive. Likewise, the intel agencies and officers who provided the bad, er, intelligence need to go. Many others who failed, from contractors to lower-level officers and bureaucrats, need to go, too. You punish a bureaucracy by shrinking its staff and cutting its budget. That needs to happen here. The brass and agencies will complain that it was Biden who ultimately made the call. Indeed, they are already furiously leaking to that effect to the press.

Maybe they’re right. But it’s up to voters to fire the president at the ballot box. If they thought what Biden planned was disastrous, they should have resigned in protest. But they didn’t. Meanwhile, we also need a probe, with independent investigators with strong powers. That should be followed by deep structural changes in a military that hasn’t really won a war since well before I was born. Bottom line: Our military must be disciplined to win wars, rather than promote gender ideology and postmodern race theories (at home or abroad). None of this will transpire, of course. Our society is run by a technocratic-managerial class that never pays a price for failure. Democracy is a glossy finish over an unelected administrative state that isn’t really accountable to anyone and measures success or failure in terms of budgets, p.r. and power, not results.

$300 million per day for 20 years.

• We Failed Afghanistan, Not the Other Way Around (Taibbi)

On MSNBC the other night, Rachel Maddow told a story about visiting Afghanistan a decade ago. She described being taken on a tour of a new neighborhood in Kabul of “narco-palaces,” what she called, “big garish, gigantic, rococo, strange-looking places” that hadn’t existed before the Americans arrived. This was said to be symbolic of the “fantastically corrupt elites” among the Afghan political class who put themselves into position to siphon off big chunks of the “billions of dollars per month” we sent into the country. Noting that, “the U.S. effort and expenditure in that country did build some stuff, roads and waterways and schools,” Maddow decried the fact that “so much of what we put in by the boatload was shoveled off by a fantastically corrupt elite.”

She showed video of Taliban conquerors lounging around in the tackily furnished homes of former Afghan officials in Kabul, pointing out that, “dictator chic is the same the world over.” In a not-so-subtle dig at Donald Trump, she added, “And they really like gold fixtures.” From Vietnam to Iraq to Afghanistan, the pattern of American officials showering questionable political allies abroad with armfuls of cash is a long-established practice. However, the idea that this is the reason the “missions” fail in such places is just a continuation of the original propaganda lines that get us into these messes. It’s a way of saying the subject populations are to blame for undermining our noble efforts, when the missions themselves are often preposterous and, moreover, the lion’s share of the looting is usually done by our own marauding contracting community.

It’s bad enough that Maddow/MSNBC played a big part in delaying the withdrawal last year with hype of the bogus Bountygate story, which gave one last (false) dying breath to the war rationale. This latest criticism of theirs ignores the massive amounts of corruption that were endemic to the American side of the mission. Contractors made fortunes monstrously overcharging the taxpayer for everything from private security, to dysfunctional or unnecessary construction projects, to social programs that either had no chance for success, or for which metrics for measuring success didn’t exist. The Special Inspector General for Afghan Reconstruction (SIGAR) some years ago identified “$15.5 billion of waste, fraud, and abuse… in our published reports and closed investigations between SIGAR’s inception in 2008 and December 31, 2017,” and added an additional $3.4 billion in a subsequent review.

All told, “SIGAR reviewed approximately $63 billion and concluded that a total of approximately $19 billion or 30 percent of the amount reviewed was lost to waste, fraud, and abuse.” Thirty percent! If the overall cost of the war was, as reported, $2 trillion (about $300 million per day for 20 years), a crude back of the envelope calculation for the amount lost to fraud during the entire period might be $600 billion, an awesome sum. It could even be worse than that. SIGAR for instance also looked at a $7.8 billion sum spent on buildings and vehicles from 2008 on, and reported that of that, only $343.2 million worth “were maintained in good condition.” They added that just $1.2 billion of the original expenditure was used as intended. By that metric, the majority of the monies spent in Afghanistan might simply have gone up in smoke in bogus or ineffectual contracting schemes.

Either the IMF distances itself from the US, or it becomes irrelevant.

• IMF Suspends Afghanistan’s Access To Resources (Hill)

The International Monetary Fund (IMF) on Wednesday announced it was suspending Afghanistan’s access to its resources due to what it called a “lack of clarity” surrounding the recognition of the country’s government after the Taliban took control of the capital city of Kabul. “As is always the case, the IMF is guided by the views of the international community,” a spokesperson for the IMF said in a statement, according to Reuters. “There is currently a lack of clarity within the international community regarding recognition of a government in Afghanistan, as a consequence of which the country cannot access SDRs or other IMF resources.” This move by the IMF comes after the Biden administration reportedly froze Afghan government reserves held in U.S. banks, blocking the Taliban from accessing billions in funds.

“Any Central Bank assets the Afghan government have in the United States will not be made available to the Taliban,” one administration official told The Washington Post. It is currently unclear whether the Taliban will be recognized by the international community, though China has indicated that it is open to establishing formal relations, being one of the few countries that did not evacuate its embassy when the Afghan government fell. Shortly after the Taliban entered Kabul on Sunday, Secretary of State Antony Blinken was asked by CNN’s Jake Tapper if the U.S. would ever recognize the Taliban as a legitimate government. “A future Afghan government that upholds the basic rights of its people and that doesn’t harbor terrorists is a government we can work with and recognize,” Blinken said.

“Conversely, a government that doesn’t do that, that doesn’t uphold the basic rights of its people, including women and girls, that harbors terrorist groups that have designs on the United States, our allies and partners, certainly, that’s not going to happen,” he added.

No boycott possible. There will always be customers.

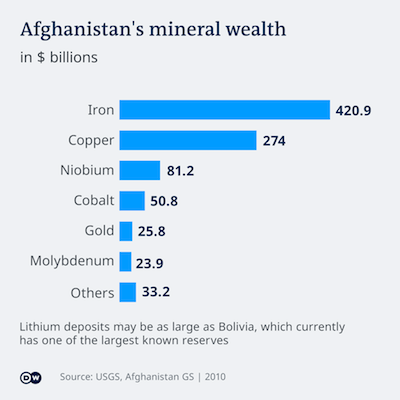

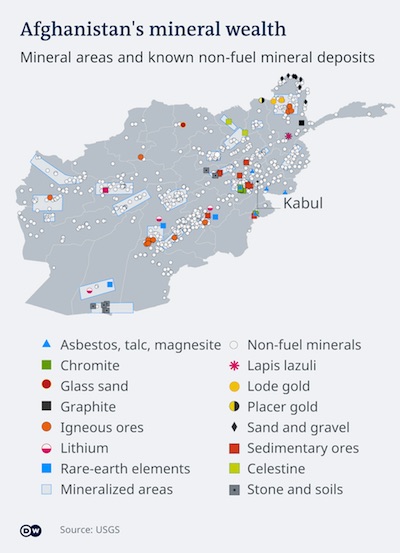

• Taliban To Reap $1 Trillion Mineral Wealth (DW)

The Taliban have been handed a huge financial and geopolitical edge in relations with the world’s biggest powers as the militant group seizes control of Afghanistan for a second time. In 2010, a report by US military experts and geologists estimated that Afghanistan, one of the world’s poorest countries, was sitting on nearly $1 trillion (€850 billion) in mineral wealth, thanks to huge iron, copper, lithium, cobalt and rare-earth deposits. In the subsequent decade, most of those resources remained untouched due to ongoing violence in the country. Meanwhile, the value of many of those minerals has skyrocketed, sparked by the global transition to green energy. A follow-up report by the Afghan government in 2017 estimated that Kabul’s new mineral wealth may be as high as $3 trillion, including fossil fuels.

Lithium, which is used in batteries for electric cars, smartphones and laptops, is facing unprecedented demand, with annual growth of 20% compared to just 5-6% a few years ago. The Pentagon memo called Afghanistan the Saudi Arabia of lithium and projected that the country’s lithium deposits could equal Bolivia’s — one of the world’s largest. Copper, too, is benefiting from the post-COVID global economic recovery — up 43% over the past year. More than a quarter of Afghanistan’s future mineral wealth could be realized by expanding copper mining activities. While the West has threatened not to work with the Taliban after it effectively seized control of Kabul over the weekend, China, Russia and Pakistan are lining up to do business with the militant group — further adding to the US and Europe’s humiliation over the fall of the country.

As the manufacturer of almost half of the world’s industrial goods, China is stoking much of the global demand for commodities. Beijing — already Afghanistan’s largest foreign investor — is seen as likely to lead the race to help the country build an efficient mining system to meet its insatiable needs for minerals. “Taliban control comes at a time when there is a supply crunch for these minerals for the foreseeable future and China needs them,” Michael Tanchum, a senior fellow at the Austrian Institute for European and Security Policy, told DW. “China is already in position in Afghanistan to mine these minerals.”

One of the Asian powerhouse’s mining giants, the Metallurgical Corporation of China (MCC), already has a 30-year lease to mine copper in Afghanistan’s barren Logar province. Some analysts, however, question whether the Taliban have the competence and willingness to exploit the country’s natural resources given the income they generate from the drug trade. “These resources were in the ground in the 90s too and they [the Taliban] weren’t able to extract them,” Hans-Jakob Schindler, senior director at the Counter Extremism Project, told DW. “One has to remain very skeptical of their ability to grow the Afghan economy or even their interest in doing so.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.