Marjory Collins 3rd shift workers waiting to be picked up by car pools around midnight. Baltimore April 1943

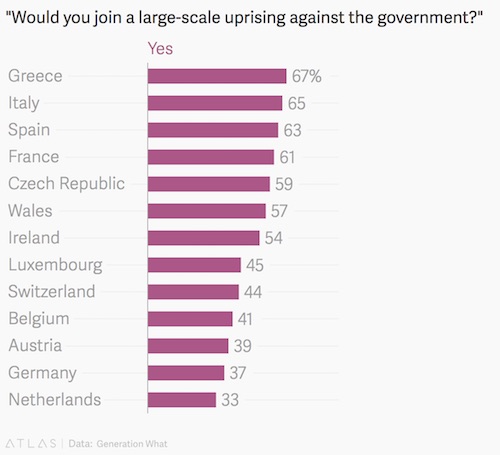

No leveling off today, apparently they couldn’t keep up that illusion. We’re getting close to 100+ deaths daily.

• 86 new deaths vs 73 yesterday.

• 3,399(?!) new cases vs 3,143 yesterday

• First American death, first Japanese death

• By tomorrow, there will be more deaths than from SARS in its entire episode (89 to go)

Major point today is Monday. How many workers will show up for work, if their factories open at all? Tesla announced its Shanghai factory will open, and I’m sure Huawei still operates as well. But this is about shoving many millions of workers into trains, subways etc., ready to infect everyone in their compartments.

Is that worth the risk? Surely it won’t be in Wuhan. But then as we saw yesterday, 400 million Chinese live in some form of lockdown. It’ll be worth watching. Saw footage of crews forcing people into quarantine today that is ugly.

First American casualty: CDC, WHite House must be getting itchy (pun intended).

On a different topic: I see tons of people commenting on the Dems “Debate”, including on my Twitter feed. Many of them are supposedly smart people. But these TV shows exist only to make money for networks. The level of both the people and their discussion is identical to the 2016 GOP debates without Trump.

If you’re -live- commenting on that poor circus, you’ve missed a few steps along the line. Bernie Sanders is the only one worthwhile but he has no chance because he’s too extreme. Warren is sinking like a stone. As is Biden, who never had anything. Buttigieg is the 2020 corporate shill that Hillary was in 2016. The rest just fill space and time with emptiness.

They update the graph but not the numbers in the articles.

• Virus Named NCP For Now, 86 New Deaths, US Citizen Dies In Wuhan (SCMP)

The coronavirus has killed 86 more people in China and been confirmed in a further 3,399, the National Health Commission reported on Saturday. That brings the total number of confirmed cases in the country to 34,546.

The new deaths, 81 in Hubei and five in other provinces, brought the national death toll to 722, as of Friday, the commission said. As well as the 81 deaths, Hubei – the epicentre of the novel coronavirus epidemic – reported earlier on Saturday that it had confirmed 2,841 new cases. The province’s totals are now 24,953 confirmed cases and 699 deaths. A US citizen has died in Wuhan from the new coronavirus, the US embassy said on Saturday, in what appears to be the first confirmed foreign death from the outbreak.“We can confirm that a 60-year-old US citizen diagnosed with coronavirus died at Jinyintang hospital in Wuhan, China, on February 6,” a US embassy spokesman confirmed. “We offer the sincerest condolences to the family for their loss,” the spokesman said. The New York Times reported that the person was a woman and had underlying health conditions, citing two people familiar with the matter. Chinese Foreign Ministry spokeswoman Hua Chunying said on Thursday there were 19 foreigners infected, and two of them had been discharged. The remainder were being isolated for treatment. A Japanese man hospitalised with pneumonia in Hubei’s provincial capital Wuhan, where the first cases emerged, has died. The man is potentially the first Japanese to have died from coronavirus.

[..] China’s National Health Commission has given the virus a temporary official name – novel coronavirus pneumonia, or NCP. The commission announced the new name at a press conference on Saturday and said it should be adopted by China’s government departments and organisations in China until a permanent name for the infection has been determined. The naming of a new virus is decided by the International Committee on Taxonomy of Viruses. A name has been submitted to scientific journals and the committee hopes to announce it within days, the BBC reported.

Very disturbing videos available of people being forced into quarantine.

• Wuhan Facing ‘Wartime Conditions’ As Global Coronavirus Deaths Reach 724 (G.)

Increasingly desperate officials in the quarantined epicentre of the coronavirus outbreak have tightened controls on an already frightened population, likening the growing crisis to “wartime conditions”. Authorities in Wuhan city have started going door to door checking temperatures, and rounding up suspected coronavirus patients for forcible quarantine in stadiums and exhibition centres that are serving as warehouses for the sick, the New York Times reported. The city and country face “wartime conditions”, the paper quoted vice-premier Sun Chunlan, who has been put in charge of the national campaign against the virus, as saying on a visit to Wuhan. She said: “There must be no deserters, or they will be nailed to the pillar of historical shame forever.”

Meanwhile another three people on a cruise liner off Japan have tested positive, bringing the total number of confirmed cases to 64. Foreign passengers on another ship, Holland America’s Westerdam, have also been barred, with suspected virus patients on board, according to authorities. The ship, with more than 2,000 people, was near Okinawa and seeking another port. More than 34,500 people have been infected around the world, the vast majority inside China and two-thirds of them in Wuhan and surrounding Hubei province. There have been 724 deaths, all but two of them in mainland China.

Chinese scientists claimed they may have found the animal source of the outbreak, based on genetic analysis, though their results have yet to be published. The coronavirus is thought to have originated in bats but passed through an intermediate host before infecting humans. The researchers have identified a coronavirus in pangolins that is 99% similar to the one causing the current outbreak. The only scaly mammal, the long-snouted, ant-eating pangolin is endangered but often hunted for meat or use in Chinese medicine.

You are not allowed to leave the city. The government loves you and takes care of you in a special hospital where our research team will try a new drug on you. pic.twitter.com/QPUkh8TwPU

— Russian Market (@russian_market) February 7, 2020

How about those who only look Chinese?

• Royal Caribbean Bans All Chinese Nationals From Its Cruise Ships (G.)

The US cruise ship company Royal Caribbean has announced that would-be passengers and crew with Chinese passports will be banned from all of its cruise ships – regardless of when they were last in the country at the centre of the coronavirus outbreak. The measure – which also covers people with Hong Kong and Macau passports – comes amid growing concerns over the fast-spreading virus, which has killed more than 700 people and affected individuals in at least 25 countries. But it was likely to face criticism from Beijing, which has bridled at sweeping travel bans on its citizens, and from human rights activists who have denounced such restrictions as discriminatory.

Friday’s announcement by the Miami-based company came after four travelers who were onboard the company’s Anthem of the Seas cruise ship were hospitalized in New Jersey after experiencing feverish symptoms. According to Royal Caribbean, the passengers had come from China for the cruise from the port of Bayonne, New Jersey, to the Bahamas, and were hospitalized out of caution. “None of the four guests being tested by [the Centers for Disease Control and Prevention] showed any clinical signs or symptoms of coronavirus,” Royal Caribbean said in a statement. “We will delay our [next] departure until tomorrow.”

They added, however, that one guest did test positive for influenza A. The CDC reports no one in New Jersey has been found with the virus so far. The four are among more than two dozen Chinese nationals who were screened for signs of the new virus onboard the cruise ship. None of them were reportedly from Wuhan, the city at the center of the outbreak.

Monday should be interesting. How much production will come back online? What will stocks do?

• Tesla Shanghai Factory To Restart On Feb 10, Authorities To Assist (R.)

U.S. electric carmaker Tesla’s factory in China’s financial hub of Shanghai will resume production on Feb. 10 with assistance to help it cope with a spreading epidemic of coronavirus, a Shanghai government official said on Saturday. Many factories across China shut in late January for the Lunar New Year holiday that was originally due to end on Jan. 30 but which was extended in a bid to contain the spread of the new flu-like virus that has killed more than 700 people. Tesla warned on Jan. 30 that it would see a 1-1.5 week delay in the ramp-up of Shanghai-built Model 3 cars as a result of the epidemic, which has severely disrupted communications and supply chains across China.

Tesla Vice President Tao Lin said this week that production would restart on Feb. 10. “In view of the practical difficulties key manufacturing firms including Tesla have faced in resuming production, we will coordinate to make all efforts to help companies resume production as soon as possible,” Shanghai municipal government spokesman Xu Wei said. The $2 billion Shanghai factory is Tesla’s first outside the United States and was built with support from local authorities. It started production in October and began deliveries last month.

What Zero Hedge received a permanant Twitter ban for.

• White House Asks Scientists To Investigate If 2019-nCoV Was Bio-Engineered (ZH)

A week ago, we published details that raised questions about the source of the Wuhan novel coronavirus, specifically questioning the official theory for the spread of the Coronavirus epidemic, namely because someone ate bat soup at a Wuhan seafood and animal market as a fabricated farce. The real reason behind the viral spread, we suggested, was that a weaponized version of the coronavirus (one which may have originally been obtained from Canada), was released by Wuhan’s Institute of Virology (presumably accidentally ), China’s only top, level-4 biohazard lab, which was studying “the world’s most dangerous pathogens.” At the time we summarized the series of dots and asked “real reporters” to connect them:

- One of China’s top virology and immunology experts was and still works at China’s top-rated biohazard lab, the Wuhan Institute of Virology, which some have affectionately called the real Umbrella Corp.

- Since 2009, Peng has been the leading Chinese scientist researching the immune mechanism of bats carrying and transmitting lethal viruses in the world.

- His primary field of study is researching how and why bats can be infected with some of the most nightmarish viruses in the world including Ebola, SARS and Coronavirus, and not get sick.

- He was genetically engineering various immune pathways (such as the STING pathway in bats) to make the bats more or less susceptible to infection, in the process potentially creating a highly resistant mutant superbug.

- As part of his studies, Peng also researched mutant Coronavirus strains that overcame the natural immunity of some bats; these are “superbug” Coronavirus strains, which are resistant to any natural immune pathway, and now appear to be out in the wild.

- As of mid-November, his lab was actively hiring inexperienced post-docs to help conduct his research into super-Coronaviruses and bat infections.

- Peng’s work on virology and bat immunology has received support from the National “You Qing” Fund, the pilot project of the Chinese Academy of Sciences, and the major project of the Ministry of Science and Technology.

Of course, that is all ancient history and Zero Hedge was permanently banned from Twitter for raising such a conspiracy theory about a publicly-searchable person working a publicly-searchable place.

Then again, how bad is a Twitter ban?

If Big Tech can’t protect themselves, they won’t protect you.

• Twitter Accounts Of Facebook, Messenger Hacked (R.)

Twitter confirmed on Friday that the official Twitter accounts of social media giant Facebook Inc and its Messenger platform were hacked. A Twitter spokesperson said in an emailed statement that the accounts were hacked through a third-party platform. “As soon as we were made aware of the issue, we locked the compromised accounts and are working closely with our partners at Facebook to restore them,” the Twitter spokesperson said. Seperately, Facebook also confirmed that some of its official social media accounts were hacked on Friday. “Some of our corporate social accounts were briefly hacked but we have secured and restored access,” Facebook spokesman Joe Osborne said.size:13px;color: #FF2222;font-weight:bold”

Though Sondland is an outlier, you had all these people, including Yovanovich, Fiona Hill, talking about “set” American foreign policy, though they knew that’s the presidents responsibility.

It’s more about that than about the testimony itself, though the two clearly overlap.

• Sondland Axed Hours After Vindman Twins Escorted Out Of White House (ZH)

Today’s Trump admin casualties continue to stack up, after it was reported that Ambassador Gordon Sondland was fired Friday afternoon. “I was advised today that the president intends to recall me effective immediately as United States Ambassador to the European Union,” Sondland said in a Friday statement, expressing gratitude to Trump for having “given me the opportunity to serve.” Sondland testified in Trump’s impeachment inquiry that there was no quid pro quo when President Trump asked Ukrainian President Volodomyr Zelensky to investigate the Bidens while withholding US military aid (unbeknownst to Zelensky at the time).

Sondland later flipped his story, claiming that he told a top Ukrainian official that a meeting with President Trump may be contingent upon its new administration committing to investigations Trump wanted, according to the New York Times. Sondland’s departure comes one week after anti-Trump impeachment witness and former US ambassador to Ukraine announced her retirement from the State Department. Her departure follows her removal as Ambassador at the request of Ukraine. [..] Anti-Trump impeachment witness Lt. Col. Alexander Vindman and his twin brother have been fired and escorted out of the White House by security, according to his Alexander Vindman’s attorney.

Vindman, a Ukraine specialist who sat on the National Security Counsel who was accused of being coached by House Intel Committee Chairman Adam Schiff (D-CA), was present on a July 25 phone call between President Trump and Ukrainian President Volodomyr Zelensky, when the US president asked that Ukraine investigate former VP Joe Biden and his son Hunter, as well as claims of pro-Clinton meddling in the 2016 US election. He was also notably counseling Ukraine on how to counter President Trump’s foreign policy according to the New York Times, which led some to go as far as accuse him of being a double agent.

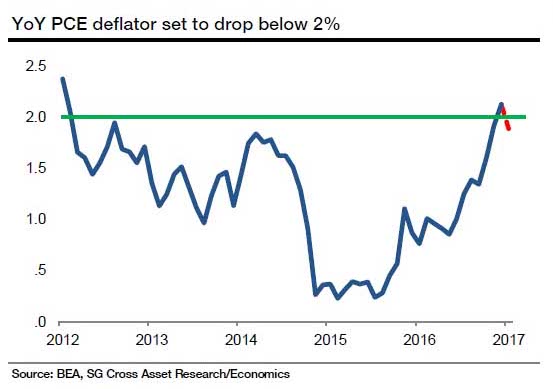

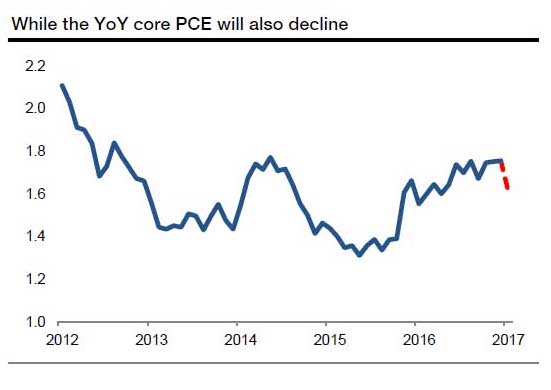

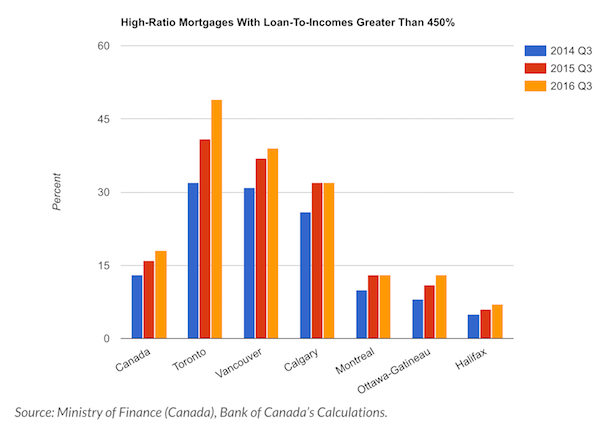

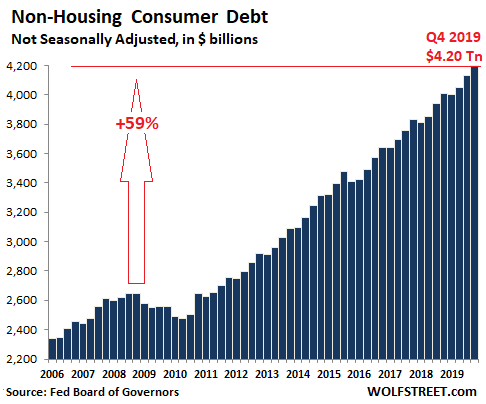

Why the Fed is stuck. They can’t raise rates ever again.

• Mortgage Rates Hit Three-Year Low; Housing Inventory Bottoms Out (F.)

Mortgage rates continued their downward slide this week, hitting their lowest point in three years. According to Freddie Mac, the average rate on 30-year, fixed-rate mortgages clocked in at 3.45%—down from 3.51% last week and 4.41% a year ago. It’s the third week in a row that rates have dropped, largely thanks to investor concern surrounding the coronavirus outbreak. Here’s how Joel Kan of the Mortgage Bankers Association explains it: “The 10-year Treasury yield fell around 20 basis points over the course of last week, driven mainly by growing concerns over a likely slowdown in Chinese economic growth from the spread of the coronavirus. This drove mortgage rates lower, with the 30-year fixed-rate decreasing for the fifth time in six weeks.”

The decrease has spurred a rise in refinancing applications. According to MBA’s weekly mortgage survey, refinance activity was up 15% for the week and 183% over the year. Overall, refinances made up nearly 65% of all mortgage activity last week. There’s room for more refis, too. According to analysis from financial data firm Black Knight, this latest drop opens the door for more than 11.3 million homeowners to refinance. On average, they could shave about 0.75% off their rate and $268 on their monthly mortgage payments. If credit scores and loan-to-value ratios aren’t factored in, there are actually 22 million homeowners who technically have a mortgage rate at least 0.75% over today’s averages.

Refinances aside, sliding rates have also caused other upticks. MBA’s data shows rising loan balances, increased jumbo loan activity and more interest in adjustable-rate loans in recent weeks. And according to Sam Khater, Freddie Mac’s chief economist, a jump in purchase activity should also follow. “The combination of very low mortgage rates, a strong economy and more positive financial market sentiment all point to home purchase demand continuing to rise over the next few months,” Khater says. The latest Home Purchase Sentiment Index from Fannie Mae backs that up, with 59% of respondents saying it’s a good time to buy a home. The only problem? That’d be historically low inventory.

Make borrowing cheap and they won’t see it coming.

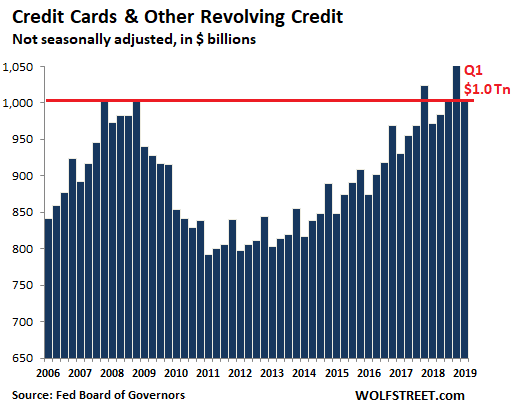

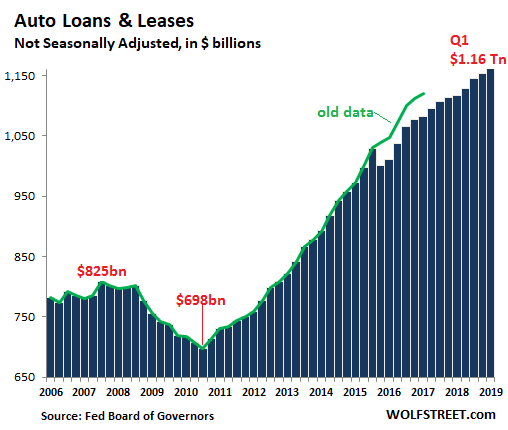

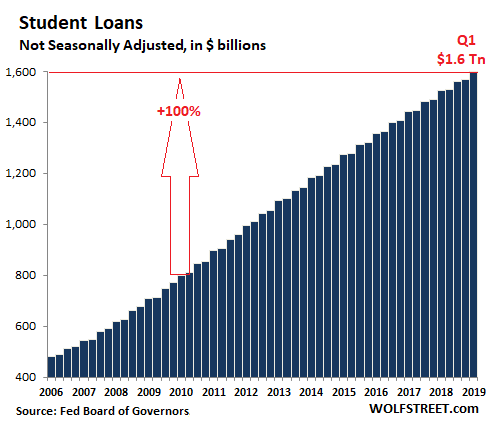

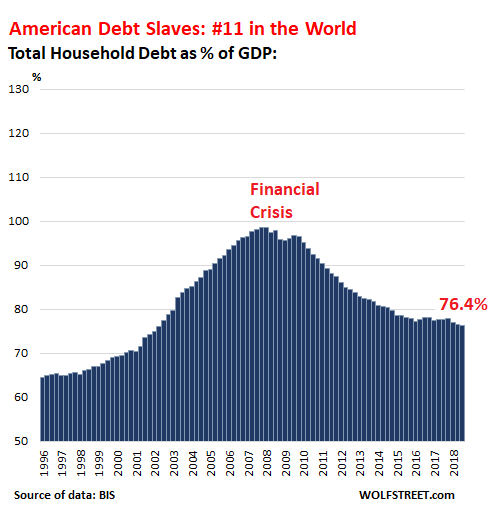

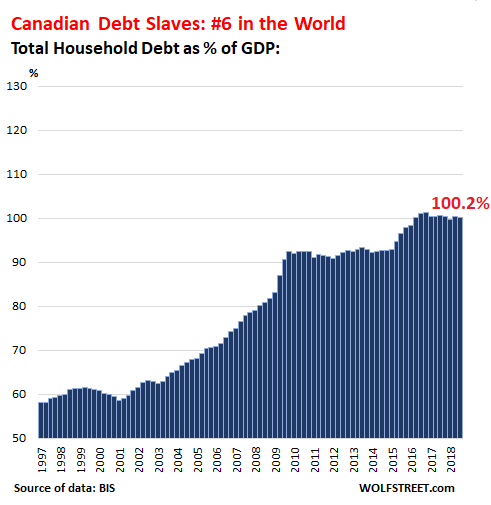

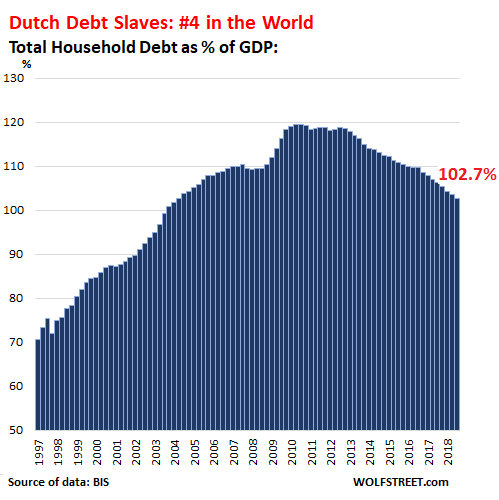

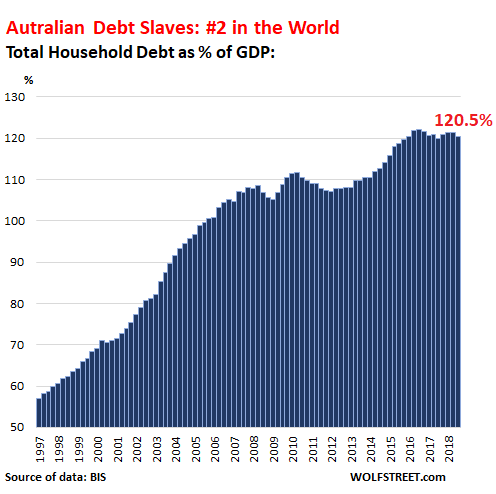

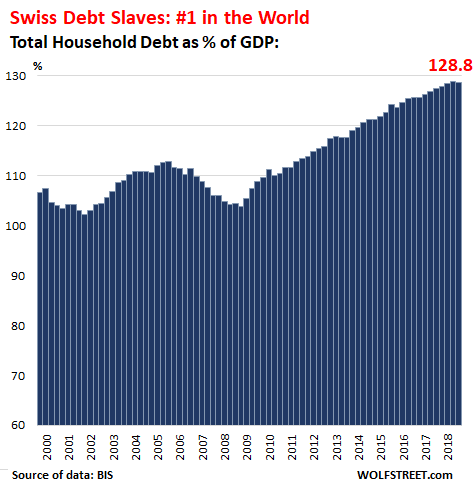

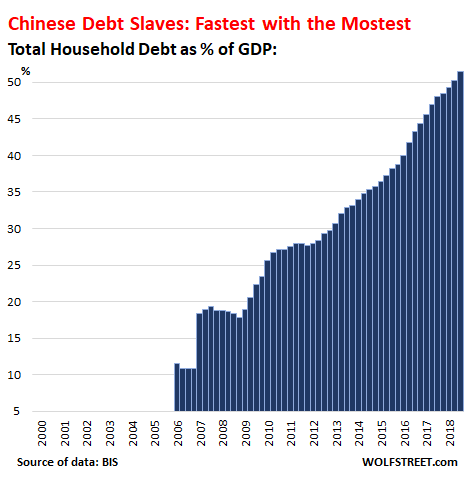

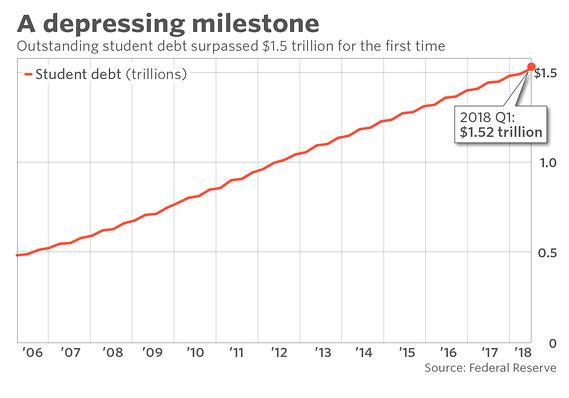

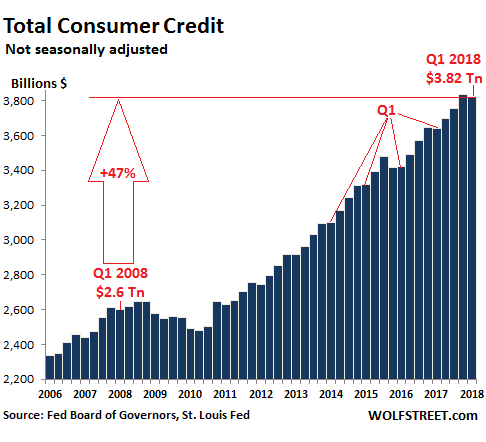

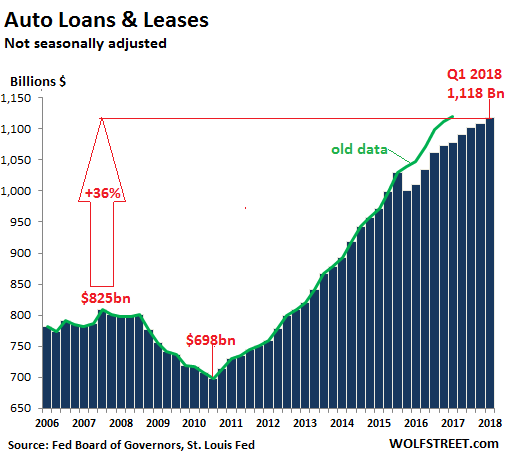

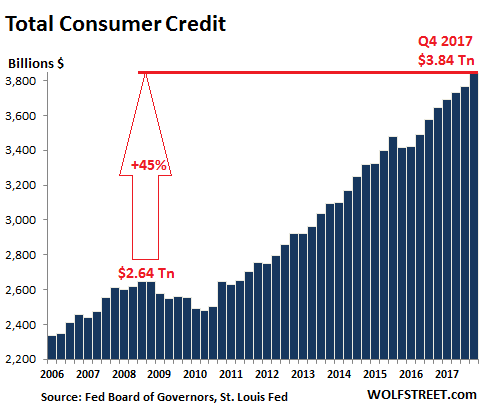

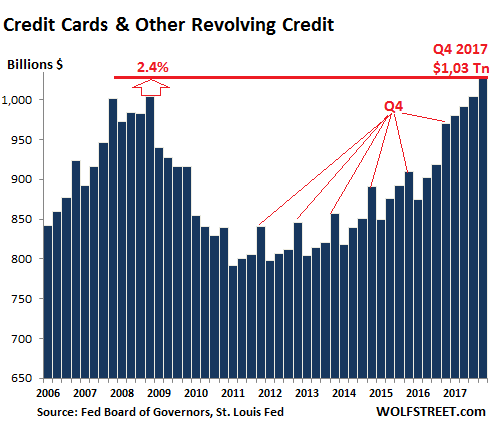

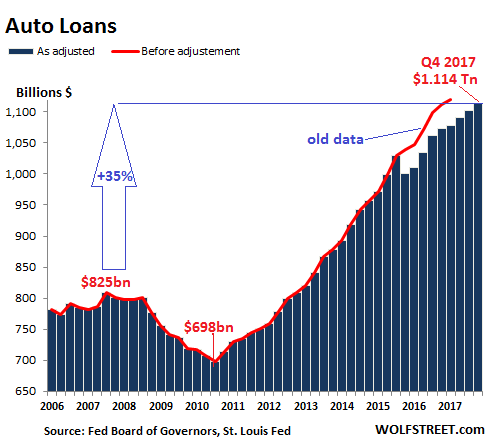

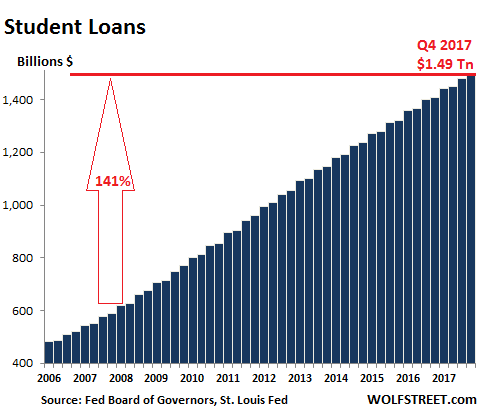

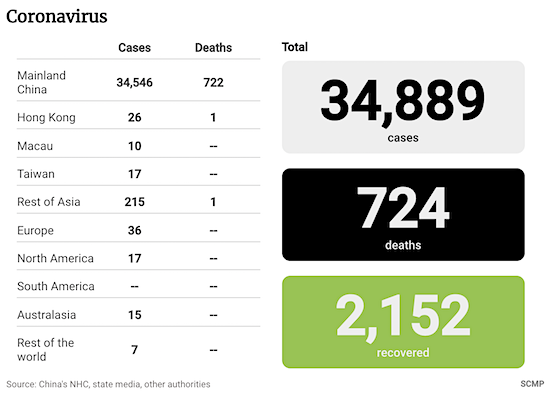

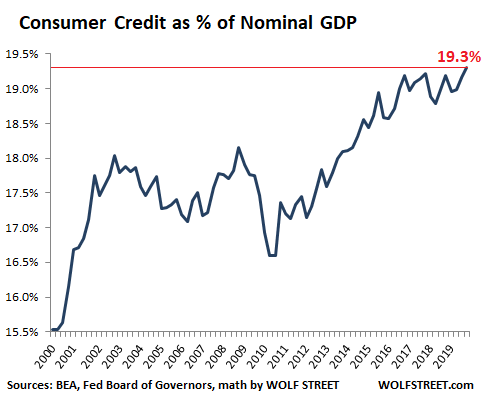

• The State of the American Debt Slaves, Q4 2019 (WS)

Consumer debt – student loans, auto loans, and revolving credit such as credit cards and personal loans but excluding housing-related debts such as mortgages and HELOCs – jumped by $187 billion in the fourth quarter 2019, compared to a year earlier, or by 4.7%, to a record $4.2 trillion, according to Federal Reserve data released Friday afternoon. Almost all non-housing consumer debts translate into consumer spending on goods and services, which is added to GDP. That $187 billion increase in consumer debt in 2019 amounted to nearly a quarter of the $849 billion increase in nominal GDP over the same period. Without this $187 billion in additional spending funded by $187 billion in additional debt, the US economy would not have grown 2.3% in 2019, but only about 1.8%.

This is why economists from the Fed on down want policies that encourage consumers to spend money they don’t have. It’s the American thing to do. And if there’s a hiccup down the road, so be it. And now there are some hiccups. How heavy is the burden of this consumer debt on consumers? For a substantial part of Americans, there is no burden. They pay off their credit card balances every month, they have no student loans, and if they financed their vehicles it may be through leases that they took out not because that’s the only way they could buy the vehicle but because they saw various advantages in leasing.

Then there is another group of Americans where every month is a mad scramble to make ends meet. Some earn good money but live above their means. Others are scraping by every month on low incomes. Both are up to their ears in debt. They’re one or two paychecks away from defaulting on that debt. That’s where the debt burden is, and that’s where the risks are. But in terms of overall consumer debt, this bifurcation gets averaged out. When measured against the size of the US economy, that $4.2 trillion in consumer debt amounts to 19.3% of nominal GDP, the highest ever in the data. Here are the last two decades:

Bolsonaro to the rescue.

• Brazil Gives Big Tobacco Companies 30 Days Notice In Smoking Lawsuit (R.)

The world’s largest cigarette makers, British American Tobacco Plc and Philip Morris International, will have until early March to defend themselves in a lawsuit in Brazil over compensation for tobacco-related diseases. Since last year, the companies have refused to receive subpoenas delivered to their local subsidiaries in the lawsuit brought the Brazilian solicitor general’s office. Souza Cruz Ltda, Philip Morris Brasil Industria e Comercio Ltda and Philip Morris Brasil SA, which produce 90% of the cigarettes sold in Brazil, maintained they were subsidiaries only and notifications had to be sent directly to their parent companies’ headquarters in Britain and the United States.

But the federal judge hearing the case in Porto Alegre, Graziela Bündchen, ruled on Tuesday that the companies are the operational wings of the parent companies and fully capable of relaying the notifications to their head offices. She gave them 30 days to present their defenses. The solicitor general’s office, known as the AGU, said in a statement on Thursday that the cigarette companies had tried to delay the lawsuit, which will now be able to proceed in seeking “the just compensation the Brazilian people deserve.” The landmark lawsuit was filed by the AGU in May against the two multinational companies seeking to recover the public health costs for the treatment of 26 tobacco-related diseases over the previous five years.

“..a character drawn from the neo-gothic Joker phase of American history ..”

• Slapstick Suicide (Kunstler)

With Adam Schiff and Jerrold Nadler cast as Laurel and Hardy, the Democratic Party entered the slapstick phase of its self-destruction, moving from one botched scheme to the next amidst a chaos of falling pianos, splintered two-by-fours, and crashed bi-planes. The old 1930s screen comedies usually also featured a “grand dame” character making herself ridiculous, like Margaret Dumont in Duck Soup, and congressional central casting has fashioned just such a late-career role for Nancy Pelosi, all fluster and spleen, and well-supplied with comic props like the carefully pre-torn State of the Union address she ceremoniously sundered on Tuesday night. Can someone drop an anvil on her, please?

[..] Meanwhile, in case you have forgotten, scores of public officials from the Obama administration stand to be indicted as we enter the heart of the spring primary season. On top of three failed seditious attempts to overthrow Mr. Trump since 2016, a cavalcade of perp walks for all that may finally force the recognition among the battered true believers in the Holy Church of Maddow that a genuine coup d’état has been running for three solid years, whether or not you like Donald Trump. They came close to turning the USA into a banana republic.

The news media is saying that President Trump had “his best week ever.” My sense of him hasn’t changed: he remains the Golden Golem of Greatness, a kind of mystical and mystifying comic figure himself, but not of the 1930s slapstick sort, more like a character drawn from the neo-gothic Joker phase of American history — and, hey, he really did spring full-blown on the scene from our real-life Gotham City. I was impressed, during his Thursday post-acquittal White House gala, at the stunning incoherence of his remarks, his facility for leaving absolutely every thought hanging unfinished in mid-sentence as he turned to the next uncompleted thought. I can’t say for sure that this makes him an ineffective manager of the nation’s affairs, but it does leave you kind of wondering. The fact remains, though, that his antagonists have behaved much worse, and now they are going to be punished.

Bring T-shirts.

• Antarctic Base Records Hottest Temperature Ever (R.)

A research base in the Antarctic has recorded the hottest temperature ever for the continent amid rising concern about global warming that has caused an increase in the melting of ice sheets around the south pole. The Esperanza base on the northern tip of the Antarctic peninsula recorded a temperature of 18.3 degrees Celsius (64.94 degrees Fahrenheit), the highest on record, the World Meteorological Organization (WMO) said on Friday. “(This) is not a figure you would normally associate with Antarctica even in the summertime. This beat the former record of 17.5 degrees C, which was set back in 2015,” WMO spokeswoman Clare Nullis told reporters in Geneva.

“The Antarctic peninsula … is among the fastest warming regions of the planet. We hear a lot about the Arctic, but this particular part of the Antarctic peninsula is warming very quickly.” The temperature was recorded at the Argentine base on Thursday. Scientists believe global warming has caused so much melting at the south pole that the giant ice sheet is now on course to disintegrate. This would see an eventual global sea level rise of at least three meters (10 feet) over centuries.

The Automatic Earth cannot survive without your support. Please donate.