Pablo Picasso Woman in an armchair (Olga) 1922

The needle and the damage done…

https://twitter.com/i/status/1486436415390904321

(“Let’s Go, Brandon!”) And Let’s go, Canadian truckers!

• The Revolt Begins (Jim Kunstler)

For now, the truckers seem determined to stick around and disrupt the Canadian capital. Their estimated 50,000 rigs could surround the city and create siege conditions, where food supplies and other goods won’t get in, starving the government into surrendering on its mandates and restrictions. So far, the local Ottawa police have stood by with a very light hand, and there are rumors that they are on the same page as the truckers against federal overreach. Will Mr. Trudeau resort to using the military to break up the revolt? Good luck with that. Like virtually every other “advanced” nation, Canada depends on trucks and truckers to move everything needed for everyday life. The truckers can just say no… we don’t feel like working this month. No poutine or Cornish pasties for you, Ottawa! Then what? Throw them all in jail? How will that help move stuff from Point A to Point B?

It kind of looks like they have Mr. T over a Molson barrel. For now, it’s a stand-off, but it looks to me like the Prime Minister must resign and whoever takes charge next will have to rapidly rethink the country’s entire Covid-19 policy in a not-insane direction. The Canadian revolt appears to be inspiring similar operations in the US, where a movement has started for a massive trucker convoy from California to Washington, DC — the swampy pivot-point of Covid tyranny under the phantasm known as “Joe Biden” — as a very general way of saying we’ve had enough of being pushed around by political grifters and their bureaucratic subalterns.The Covid-19 saga gets darker every day, while the official alibis, cover-stories, and disinfo ops bend ever deeper toward an arc of criminality. The US government has lied about every plot-line in the two-year horror show. In fact, a conscientious observer would have to conclude the following:

That the government’s highest-paid employee, Dr. Anthony Fauci, led surreptitiously in the creation and release of a bioweapon; that he and his cohorts, along with the pharma companies, and other interested parties such as the Bill and Melinda Gates Foundation and the World Health Organization, enabled the release of so-called “vaccines” (genetic treatments) that were at least as deadly as the disease itself; that as a result of the shots many people of all ages will die before their natural time; that the process is already underway as documented in the all-causes death data tallied by insurance companies; that the same government officials maliciously suppressed viable, inexpensive, FDA-approved treatments for Covid-19 in order to herd the populace into receiving dangerous “vaccines”; that said officials have worked strenuously to muddle and fake the statistics that would show who is actually dying of what; and that the entire fiasco appears to have been ginned up in order to systematically control the population in ways contrary to our natural rights while killing off a substantial number of us.

Wishful thinking?

• Now Is the Time for Mass Resignations From Within the Ruling Class (Tucker)

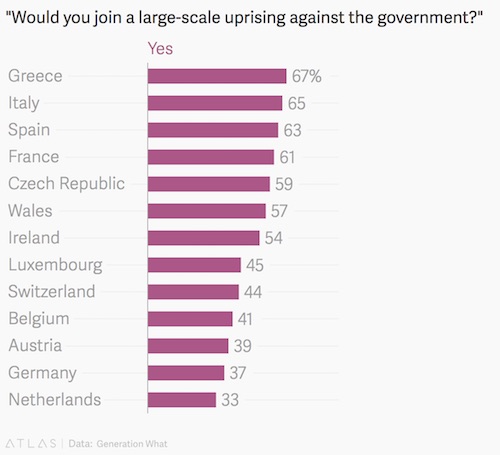

We’ve been assured by David Hume (1711–1776) and Etienne de la Boétie (1530–1563) that government rule is untenable when it loses the consent of the governed. “Resolve to serve no more,” wrote Boétie, “and you are at once freed. I do not ask that you place hands upon the tyrant to topple him over, but simply that you support him no longer; then you will behold him, like a great Colossus whose pedestal has been pulled away, fall off his own weight and break into pieces.” That’s inspiring but what does it mean in practice? What precisely is the mechanism by which the overlords in our time are effectively overthrown? We’ve seen this in totalitarian states, in states with one-man rule, in states with unelected monarchies.

But unless I’m missing something, we’ve not seen this in a developed democracy with an administrative state that holds the real power. We have scheduled elections but those are unhelpful when 1) elected leaders are not the real source of power, and 2) when the elections are too far in the distant future to deal with a present emergency. One very easy and obvious path away from the current crisis is for the ruling class to admit error, repeal the mandates, and simply allow for common freedoms and rights for everyone. As easy as that sounds, this solution hits a hard wall when faced with ruling-class arrogance, trepidation, and the unwillingness to admit past errors for fear of what that will mean for their political legacies. For this reason, absolutely no one expects the likes of Trudeau, Ardern, or Biden to humbly apologize, admit that they were wrong, and beg the people’s forgiveness. On the contrary, everyone expects them to continue the game of pretend so long as they can get away with it.

The people on the streets today, and those willing to tell pollsters that they are fed up, are saying: no more. What does it mean for the ruling class not to get away with this nonsense anymore? Presuming that they do not resign, they do not call off the dogs of mandates and lockdowns, what is the next step? My instincts tell me that we are about to discover the answer. Electoral realignment seems inevitable but what happens before then? The obvious answer to the current instability is mass resignations within the administrative state, among the class of politicians that gives it cover, as well as heads of media organs that have propagandized for them. In the name of peace, human rights, and the renewal of prosperity and trust, this needs to happen today. Bury the pride and do what’s right. Do it now while there is still time for the revolution to be velvet.

Justin French

— Wittgenstein (@backtolife_2022) February 1, 2022

“It almost feels like China has taken over the world..”

• Mandatory Covid Rules Morph Into Global Power-grab (Mitch Feierstein)

Enter 2020 and the China virus aka COVID-19. Why was no one allowed to focus or ask about treatment protocols? Instead, a financially conflicted, unelected, 80-year-old bureaucrat named Anthony Fauci dictated tyrannical policies with narratives that had more holes in them than a 100 Kilo block Swiss cheese. Lord Fauci ratcheted the level of public fear up to 11 out of ten and issued the first lie, “two weeks to stop the spread”. Next, he bristled, “masks don’t work”, later demanding “mandatory masks”. Fauci’s dictates became more dictatorial and changeable than a kindergartener’s game of “Simon says”. These mandatory Covid rules morphed into several years of the most unprecedented global and tyrannical power-grab ever made by governments.

Let’s be clear; this authoritarian creep is the greatest existential threat to our western system of freedom—free speech, democracy, and liberty—in history. It almost feels like China has taken over the world. The mantra: It is mandatory you take four doses of an experimental biological agent with questionable efficacy, or we will destroy you, for which the side effects seem underreported, and the effectiveness appears overstated. The dishonest media unleashed an army of apparatchik Karen’s anyone daring non-compliance. If this pandemic was so terrible as to allow government tyranny, destruction of SMEs, and the middle class, why have we not seen a massive increase in total year-on-year global morbidity rates? Now, after using coercion: the fear of death and or the denial to earn a living to force unwilling members of society to participate in mass medical experiments, we have unprecedented numbers of deaths of working-age people ages 18-64 occurring.

A massive number of unexplained deaths have been reported by all insurance companies in Q3 and Q4 of 2021 [..] Regarding these deaths, OneAmerica’s CEO stated, “It may not have said COVID on the death certificates, but deaths in this age group are up massively”. Actuarial data is generally the most accurate data available. We know mass participation in the Pfizer, Moderna, and Astra Zeneca medical experiments with unknown long-term consequences; could these deaths be related? Why is the media not all over his story?

“..now that the Berlin Wall of the tyrants has been breached, it’s just a matter of time before the shockwaves are felt far and wide.”

• We Are All Canadian Truckers Now! (Ron Paul)

We all remember where we were when the Berlin Wall came down. While it may have seemed that communist rule would go on forever, when the people decided that they had enough suddenly the wall fell. Just like that. Thus it is after two years of Covid authoritarianism that in Canada the largest truck convoy in history has smashed through the Berlin Wall of tyranny. I have watched as the Canada I once respected as a haven for antiwar Americans in the 1960s turned into one of the most repressive countries on earth. I wondered how a freedom-loving people could allow themselves to be abused by these mini-Stalins without a peep. But then Canada stood up and showed the rest of the world that freedom can triumph over tyranny if the people demand it. As I say, no army can stop an idea whose time has come.

Canadian prime minister Justin Trudeau had been basking in his ability to terrorize the population in the name of fighting a virus. He was so confident in his seemingly unlimited power that he felt he could ridicule any Canadian with different views. The prime minister said in a recent interview that unvaccinated Canadians were “extremists,” “misogynists,” and “racists.” When the Canadian truckers stood up to his tyranny and began their historic convoy to Ottawa, he thought he could continue ridiculing people. The truckers and their supporters were just a “small fringe minority” who hold “unacceptable views,” he confidently claimed. For Trudeau, love of liberty is just an “unacceptable view.”

Less than a week later, as tens of thousands of trucks began entering the capital with millions of supporters behind them, the “brave” Canadian prime minister had fled the city and shuffled off to an undisclosed location. As Elon Musk Tweeted, “It would appear that the so-called ‘fringe minority’ is actually the government.” The Canadian mainstream media is obviously just as obedient to the regime as ours. They ignored the Freedom Convoy for as long as possible. There was almost no reporting. Then, when it became impossible to ignore, they began to attack and ridicule instead of trying to report it accurately. It was disgusting and almost comical to see a “reporter” from the Canadian Broadcasting Corporation suggest that the Canadian Freedom Convoy was cooked up by Putin and the Russians!

Thousands of trucks have arrived in Ottawa. They demand an end to covid tyranny. They are backed by millions of citizens, who braved the Canadian winter at night to cheer the truckers on. This protest is so important because it’s not limited to Canada. The truckers are being supported worldwide, and a similar convoy is being planned from California to Washington, DC. In a US where grocery store shelves are increasingly bare, the truckers have more leverage than the powers-that-be would like to admit. If I were prime minister of totalitarian Australia or New Zealand – or most anywhere in Europe – I would be getting pretty nervous right now. Just as the Covid tyranny descended across the globe in a seemingly coordinated fashion, now that the Berlin Wall of the tyrants has been breached, it’s just a matter of time before the shockwaves are felt far and wide.

“Nazi symbolism, racist imagery and desecration of war memorials”

• Trudeau Reappears To Denounce ‘Freedom Convoy’ Truckers (RT)

Canadian Prime Minister Justin Trudeau reappeared in public after several days, criticizing the “Freedom Convoy” of truckers protesting his vaccine mandates in Ottawa as tainted by racist, Nazi extremists desecrating war memorials. After reports that he had been moved to an “undisclosed location” over the weekend due to security concerns, Trudeau emerged from hiding on Monday to announce that he tested positive for Covid-19 – despite having had it before, and being triple-vaccinated. He then held a virtual press conference to denounce the protest. “Canadians were shocked, and frankly disgusted by the behavior of some people protesting in our nation’s capital,” he said. “We are not intimidated by those who hurl insults and abuse at small business workers and steal food from the homeless.”

He also referenced reports in the Canadian media that at least three protesters climbed onto the National War Memorial and danced on the Tomb of the Unknown Soldier, and that a Nazi flag and a Confederate flag were spotted at the protest. “Nazi symbolism, racist imagery and desecration of war memorials” are not acceptable free speech but “an insult to memory and truth,” Trudeau said. “We won’t give in to those who fly racist flags, we won’t cave to those who engage in vandalism or dishonor the memory of our veterans.” Trudeau also appealed to the “nearly 90% of truckers who’ve gotten vaccinated” who he said were doing the right thing by continuing to work, saying that “the behavior on display this weekend does not represent you.” “You can rely on us to continue to stand with you and allow you to do your jobs safely,” the PM added.

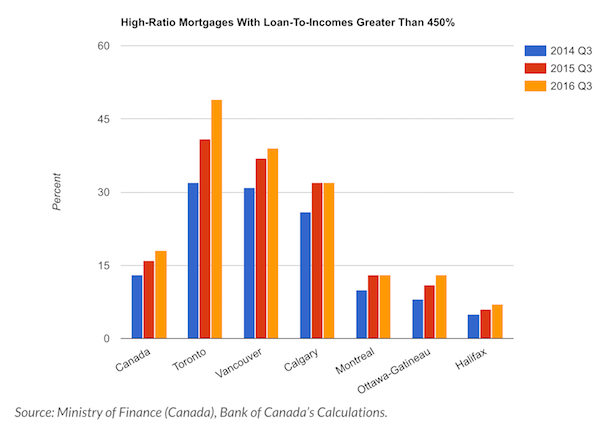

80,000 is a big number…

• No 10 Set For U-turn Over Mandatory Covid Jabs For NHS Staff In England (G.)

Downing Street appears likely to drop its policy of dismissing frontline NHS and care staff in England who refuse Covid vaccinations, a minister has strongly indicated, after nursing and care organisations called for this to happen. A decision would be made “in the course of the next few days”, according to Simon Clarke, the chief secretary to the Treasury. He said the lower severity of the Omicron variant of Covid did “open a space” for the policy to be reversed. The apparent imminent U-turn came as the Royal College of Nursing argued that both the change in severity from Omicron and the number of NHS vacancies meant the mandatory vaccination policy should be dropped.

The National Care Association said it would also welcome a change of policy, while warning that many unvaccinated care staff had already lost their jobs in the run-up to the 1 April deadline. Speaking in a TV clip on a visit to Essex, Boris Johnson also indicated a likely change, saying Sajid Javid, the health secretary, “is saying a bit more later on about how you might deal with different variants of coronavirus because they have different implications when it comes to transmission”. The Guardian reported this month that an internal document drawn up by the Department of Health and Social Care said the growing evidence on the Omicron variant cast doubts over the new law’s “rationality” and “proportionality”.

Asked about reports of a change to the policy, Clarke told Sky News that ministers had hoped to find “the right balance between having the maximum impact for measures that support public safety in the face of the virus, but also have the minimum impact in terms of our wider freedoms as a society”. He added: “And it’s in that context that a decision was made last autumn to make sure we went ahead with the mandatory vaccination policy, and that was because, obviously, we had the Delta variant, which was extremely dangerous, and was taking a huge toll on our society, and we had to make sure that people going into hospital, very vulnerable people, whether they had Covid or another condition which required treatment, weren’t going to be faced with an increased risk of infection on the wards.

“We continue to monitor that situation very, very closely. What we know about Omicron is that it is much, much more transmissible but less severe – any decision that is taken this week will reflect that reality.

“..the signatories of the open letter to Spotify declared the episode a “mass-misinformation event” and used it as an example to bill Rogan as a menace to public health.”

• Why Joe Rogan Remains The World’s Most Popular Podcaster (Cheong)

While ‘The Joe Rogan Experience’ has enough content to drive itself, much of the public curiosity about the show has been fanned by the hatred the corporate media has for its host. Described by CNN in 2020 as “libertarian-leaning,” Rogan has voted for a wide variety of political candidates, including Libertarian Party nominees Ron Paul and Gary Johnson in 2012 and 2016, and even endorsed left-winger Bernie Sanders in the 2020 Democratic primaries. His politics are fairly middle of the road in terms of American politics. He’s fiscally conservative, but somewhat socially progressive, drawing the line when it comes to open borders, transgenderism in children, the participation of biologically male athletes in women’s sports, and high taxes. He’s also a strong supporter of free speech and the right to bear arms, which places him at odds with the majority of Democrats.

His remarks about transgenderism in sport became a bone of contention for Sanders’ progressive supporters, who described his views as “transphobic.” The subsequent outrage in gay, trans, and other communities over the senator’s embrace of Rogan’s endorsement was one of the more intricate and multifaceted political controversies of the election. In 2021, Rogan kicked the hornet’s nest when he was infected with coronavirus. Having been unvaccinated, he opted to use the antiparasitic drug ivermectin, monoclonal antibody therapy, and a host of other controversial treatments to aid his recovery. CNN claimed he had consumed “horse dewormer” – a point he took up with CNN fixture Dr. Sanjay Gupta when the neurosurgeon was a guest on his podcast. While ivermectin is used in veterinary medicine, it’s also approved for humans, and Rogan said it had been prescribed to him by a doctor – although the US Food and Drug Administration has never approved it as a treatment for Covid-19.

Rogan’s refusal to be vaccinated, his opposition to vaccine mandates, and his willingness to give airtime to guests who have been accused of “spreading medical misinformation” have resulted in numerous calls to get him deplatformed. More recently, he became the target of 270 “experts” – not all of whom, it should be noted, are medical professionals – who objected to the podcast having featured Dr. Robert Malone, one of the co-creators of the mRNA vaccine, because of the views he had expressed in it about the pandemic. Dr. Malone has been banned from Twitter for violating the platform’s Covid-19 misinformation policies, and the signatories of the open letter to Spotify declared the episode a “mass-misinformation event” and used it as an example to bill Rogan as a menace to public health.

‘Godfather of Grunge’ Neil Young then issued the platform with an ultimatum: that he would remove his music unless it removed Rogan, and then following through with his warning. Several other musicians, including Joni Mitchell, then followed suit. In an apparent concession, Spotify’s CEO announced new policies on “combating misinformation” about Covid-19, albeit without referencing Rogan by name. The streaming service will now make sure its creators “understand accountability” for posting “dangerous” content that dismisses Covid-19 as “a hoax” and “promotes or suggests” that coronavirus vaccines “are designed to cause death,” and listeners will be directed to “trusted sources” on these issues.

“Voices on the left are now up in arms because Rogan is showcasing the arguments of critics of Big Pharma.”

• The Left Tries to Deplatform . . . Critics of Big Pharma? (Geraghty)

You may love Joe Rogan, you may hate him, or you may not have strong feelings about him. I suspect that many of people who profess to hate Joe Rogan have either never listened to him or have listened to little more than a snippet. Zaid Jilani observed, “It’s interesting seeing so many conservatives rally around Joe Rogan when he’s probably more liberal than 90 percent of Americans. Agnostic dude who loves drug legalization, Bernie Sanders, thinks the CIA is awful, etc.” He later made the accurate point that the “average episode of Rogan is about [mixed-martial arts] or drugs and these folks think it’s like a Satanic cult ritual.”

Perhaps conservatives are rallying around Joe Rogan because they don’t need a figure to agree with 100 percent of their worldview in order to conclude that he is worth defending from an angry mob that desires censorship of differing views. It’s very clear that the people who are the most determined to “deplatform” Rogan — to force Spotify to cancel his show, and likely with that, get his videos off of YouTube as well — are battling a cartoon-like caricature that they’ve drawn in their heads. If you listen to Rogan defend his choices in a recently taped video, you’ll see that he’s not a lunkhead, and seems the opposite of a wide-eyed extremist ideologue, hungry to hammer a twisted narrative into brainwashed followers:“There’s a lot of people who have a distorted perception of what I do — maybe based on soundbites or based on headlines of articles that are disparaging. The podcast has been accused of spreading dangerous misinformation. Specifically, about two episodes — a little about some other ones, but specifically about two. One with Dr. Peter McCullough and one with Dr. Robert Malone. Dr. Peter McCullough is a cardiologist, and he is the most published physician in his field in history. Dr. Robert Malone owns nine patents on the creation of MRNA-vaccine technology and is at least partially responsible for the creation of the technology that led to MRNA vaccines. Both these people are very highly credentialed, very intelligent, very accomplished people and they have an opinion that is different from the mainstream narrative. I wanted to hear what their opinion is. I had them on, and because of that, those episodes in particular, were labeled as being dangerous, had dangerous misinformation in them.

The problem I have with the term disinformation, especially today, is that many of the things we thought of as misinformation a short while ago are now accepted as fact. For instance, eight months ago, if you said, “If you get vaccinated, you can still catch Covid, and you can still spread Covid” — you would be removed from social media. They would ban you from certain platforms. Now, that’s accepted as fact. If you said, “I don’t think cloth masks work,” you would be banned from social media. Now, that’s openly and repeatedly stated on CNN. If you said I think it’s possible that Covid-19 came from a lab, you would be banned from many social-media platforms. Now that’s on the cover of Newsweek.* All of those theories, that at one point in time were banned, were openly discussed by those two men that I had on my podcast, that have been accused of “dangerous misinformation.” I do not know if they’re right. I don’t know, because I’m not a doctor, I’m not a scientist. I’m just a person who sits down, and talks to people, and has conversations with them. Do I get things wrong? Absolutely. I get things wrong. But I try to correct them. Whenever I get things wrong, I try to correct them. Because I’m interested in telling the truth.”

For a guy who’s supposed to be a dangerous megalomaniac who’s indoctrinating people into a hardline, deceitful ideology, Rogan seems awfully humble about what he knows and doesn’t know. De-platform Joe Rogan? We should give him a medal and hold him up as a role model for conducting probing, open-minded, respectful interviews. Want to know something spectacularly ironic? Drs. McCullough and Malone are opponents of Covid-19 vaccines in large part because of their skepticism and suspicion of the profit motive of big pharmaceutical companies. Voices on the left are now up in arms because Rogan is showcasing the arguments of critics of Big Pharma.

“..an impossibility unless the vaccine was interfering with building that titer or destroyed existing antibody titers if jabbed after being infected and recovered.”

• Since We’re Taking Shots…. (Denninger)

It is impossible to inject something without some of it ending up in the circulation — that is, in and around the endothelium. That begs the obvious question as to which is more-dangerous: A definite exposure of your endothelium to the spike from an injection or a possible one from infection if, and only if, you get severely hammered? Nobody knows and nobody has done the work to find out. Despite the signal in December of 2020 we went ahead anyway without first disproving that the balance of harms went the wrong way especially in healthy, low-risk individuals.

On top of this we knew very early on that there was no reduction in transmission from the jabs; a person who had a “breakthrough” was just as infectious (per Fauci and the CDC itself) and thus might be more-dangerous because by hiding symptoms you make the problem worse. If I do not know I’m sick I will not self-isolate in my home since I have no reason to suspect I’m infected. An inoculation that does not prevent infection, replication or transmission but prevents symptom expression is thus not only bad from a public health perspective its disastrous. Indeed one can reasonably make the argument that intentional blinding of symptoms is involuntary manslaughter. We have historical precedent for this, incidentally, in the fiasco surrounding the DTP vaccine in the 1970s and the twenty-fold higher case rate for pertussis today after the formula for that jab was changed to DTaP, a non-sterilizing inoculation that prevents neither infection or transmission. Do you think I can’t read history and the CDC’s own data on pertussis cases?

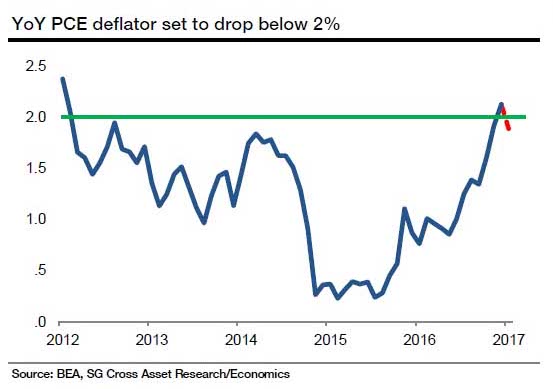

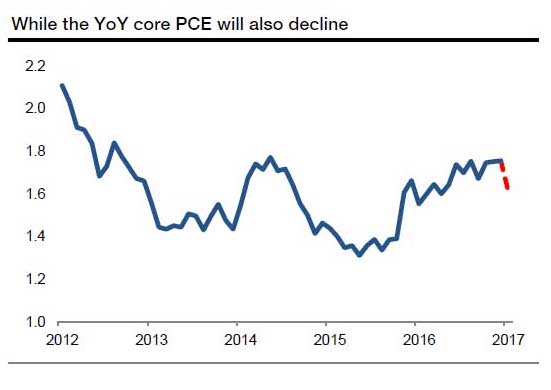

What’s worse is that we now know the jabs don’t work with any degree or durability at all. How do we know this? Because the CDC has proved it with their own contemporary data, that’s how. The >65 cohort is the most vaccinated in the United States. Indeed, the CDC says that 88.3% of those >65 have been fully vaccinated, and 64.3% have received boosters, that is, the third shot.

The proof they don’t work is that the CDC also reports that hospitalization among those >65 for Covid is roughly as high or higher this winter as it was last winter when there were no shots. With nearly 90% of that age cohort fully vaccinated across the entire United States if the jabs worked to prevent severe disease we would see a ratable decrease in hospitalization among that cohort. Indeed, since we know natural immunity is protective against severe disease for much longer than the jabs, at least one year, again by the CDC’s own data, if the jabs did nothing we’d expect to see a lower rate among that segment of the population simply because many of them already had the virus and survived. There are simply not enough unvaccinated and uninfected seniors remaining if the jabs work and yet there is in fact no decrease at all compared with last winter’s surge among the most-vaccinated population subgroup.

This strongly implies that what the jabs are doing is producing VEI (vaccine-enhanced infection); that is, causing actual harm and either wildly potentiating first infections or, far worse, destroying immunity from infection whether prior to or subsequent to vaccination such that people are getting the virus a second or subsequent time and not mildly either; they’re getting hammered since this is not relying on “infections”, it’s hospitalizations. We knew the latter was likely this summer, incidentally, because “N” protein seroprevalence in Britain flatlined during Delta — an impossibility unless the vaccine was interfering with building that titer or destroyed existing antibody titers if jabbed after being infected and recovered.

Never mind that there’s evidence these jabs may be back-boosting other common coronaviruses. That was known to be a risk in May of 2021. We see that in the data too; people showing up in the ER and Urgent Care with “covid-like illness” but they don’t have Covid, and a huge percentage of them are vaccinated. Are these jabs turning the common OC43 and HKU1 coronaviruses, that usually produce mild colds, into severe disease events? Maybe — and we knew they might in May of last year but didn’t bother to follow up on that either. Since OC43 is believed to have been the cause of a Covid-like pandemic in the 1890s if this proves up we will have screwed millions of Americans — or even perhaps tens of millions — instead of helping them.

“Once again our experience reinforces previous reports that effective [anti-retroviral drugs are] the key to controlling such events.”

• COVID-19-Infected HIV Patient Developed 21 Mutations (ET)

A South African woman suffering from “poorly controlled” HIV who also had COVID-19 for nine months saw the CCP virus develop at least 21 mutations while in her body, a recent preprint study found. The woman, 22, was able to overcome the CCP (Chinese Communist Party) virus which causes COVID-19, within six to nine weeks after she started taking anti-retroviral medication that is used to treat HIV, according to researchers at Stellenbosch and the University of KwaZulu-Natal. They concluded that “increased vigilance is warranted” among HIV patients who contract COVID-19 to “prevent the emergence” of COVID-19 variants. Notably, the Omicron variant was first discovered in South Africa in November 2021, and U.S. health officials say it’s now the dominant strain across the United States.

“This case, like others before, describes a potential pathway for the emergence of novel variants,” the scientists said in the pre-print study, adding that it is still a hypothesis and much more data is needed. “Our experience reinforces previous reports that effective anti-retroviral treatment is the key to controlling such events.” South Africa has the world’s largest HIV epidemic. About 8.2 million of out its 60 million population is infected with the virus. According to the researchers, the patient observed in the study had developed around 10 mutations on the CCP virus spike protein, which allows it to bind to cells, along with 11 other mutations. Some of the mutations were similar to those seen in the Omicron and Lambda variants, whereas others were consistent with mutations that allow the virus to bypass antibodies.

“Once again our experience reinforces previous reports that effective [anti-retroviral drugs are] the key to controlling such events. Once HIV replication is brought under control and immune reconstitution commences, rapid clearance of [the CCP virus] is achieved, probably even before full immune reconstitution occurs,” they said. “This underscores the broader point that gaps in the HIV care cascade need to be closed which will benefit other conditions and public health problems, too, including COVID-19.”

Twitter thread with 11 clips. I lifted out nrs 7 and 8, where Dr. Nagase describes the process that -potentially- allows mRNA to enter and transform your DNA.

• Documents via FOI from Pfizer (Delaney)

Documents via FOI from Pfizer… from over 40000 test subjects 31% suffered death & life long complications. Information was SENT to government health authorities in APRIL 2021

I can’t read the name Nuland without getting shivers.

• Newly Released State Memos Undercut Democrats’ Ukraine Impeachment Story (JTN)

Just months before Joe Biden forced his firing, Ukraine’s chief prosecutor was told by U.S. State Department officials that they were “impressed” with his anti-corruption plan and fully supportive of his work, according to newly released memos that cast doubt on a key Democrat impeachment narrative. During former President Donald Trump’s first impeachment trial two years ago, House Democrats alleged that Ukrainian Prosecutor General Viktor Shokin was fired in March 2016 because State officials were widely displeased with his anti-corruption efforts and not because Shokin’s office was investigating the Ukrainian gas firm that had given then-Vice President Biden’s son Hunter a lucrative job.

But the memos obtained by Just the News and the Southeastern Legal Foundation under a Freedom of Information Act request show senior State Department officials — including then-Secretary of State John Kerry — were sending the opposite message to Shokin the summer before his firing. “We have been impressed with the ambitious reform and anti-corruption agenda of your government,” then-Assistant Secretary of State for European and Eurasian Affairs Victoria Nuland personally wrote Shokin in an official letter dated June 9, 2015 that was delivered to the prosecutor two days later by then-U.S. Ambassador Geoffrey Pyatt.

Nuland, now President Biden’s undersecretary of state, wrote that “Secretary Kerry asked me to reply on his behalf” to let Shokin know he enjoyed the full support of the United States as he set out to fight endemic corruption in the former Soviet republic. “The ongoing reform of your office, law enforcement, and the judiciary will enable you to investigate and prosecute corruption and other crimes in an effective, fair, and transparent manner,” Nuland added. “The United States fully supports your government’s efforts to fight corruption and other crimes in an effective, fair and transparent manner.”

“..this Nation, for all its hopes and all its boasts, will not be fully free until all its citizens are free.”

• JFK Revisited: Through the Looking Glass by Oliver Stone (Curtin)

Two of the greatest speeches ever delivered by an American president bookend this extraordinary documentary film. It opens with President John F. Kennedy giving the commencement speech at American University on June 10, 1963 and it closes with his civil rights speech to the American people the following day. It is a deft artistic touch that suggests the brevity of JFK’s heroic efforts for world peace and domestic racial equality and justice before he was assassinated in a public execution in Dallas, Texas on November 22, 1963. In the former anti-war speech, he called for the end to the Cold War with the Soviet Union, the halt to the arms race, and the abolishment of war and its weapons, especially nuclear. He said:

“What kind of peace do I mean? What kind of peace do we seek? Not a Pax Americana enforced on the world by American weapons of war. Not the peace of the grave or the security of the slave. I am talking about genuine peace, the kind of peace that makes life on earth worth living, the kind that enables men and nations to grow and to hope and to build a better life for their children – not merely peace for Americans but peace for all men and women – not merely peace in our time but peace for all time.” In the latter address to the American people, having just sent National Guard troops to the University of Alabama to make sure two black students were admitted despite the racist objections of Governor George Wallace, his words transcended the immediate issue at the university and called for the end to the immoral and illegal discrimination against African Americans in every area of the nation’s life. He said:

“One hundred years of delay have passed since President Lincoln freed the slaves, yet their heirs, their grandsons, are not fully free. They are not yet freed from the bonds of injustice. They are not yet freed from social and economic oppression. And this Nation, for all its hopes and all its boasts, will not be fully free until all its citizens are free.” Having framed the documentary thus, Oliver Stone and the screenwriter James DiEugenio do a masterful job of explaining what really happened in the years of Kennedy’s short presidency, why he was such a great threat to the CIA and the military-industrial complex, what really happened when they killed him, and how the Warren Commission, the CIA, and the corporate media have worked hand-in-hand to this day to cover up the truth.

The current two-hour version of JFK Revisited: Through the Looking Glass will be followed in a month or so by a more detailed four-hour version. The importance of this film is twofold: It establishes an updated historical record since the Assassination Records Review Board (AARB) was established as a result of Stone’s 1991 breakthrough film, JFK, which forced the release of previously hidden documents, and, more importantly, it emphatically shows why JFK’s assassination is crucial for understanding the United States today. For without a clear and unambiguous accounting of why he was killed and by whom (I do not mean the actual shooters), and who in the government and media has covered it up, we are doomed to repeat the past as this country has been doing ever since.

“Russia has already declared that banning it from the Swift system for international monetary transactions will result in the immediate halt of Russian energy supplies to Europe.”

• Checkmate in Ukraine (Ritter)

Despite the repeated Western warnings, Russia is highly unlikely to invade Ukraine — at least not yet. Instead, Russia appears to be entering a new phase of crisis management that seeks to exploit the weaknesses in the U.S./NATO alliance highlighted by their written responses to its demands. First, Russia will keep the diplomatic option open, but on its terms. Moscow has already engaged in so-called Normandy Format talks involving Russia, France, Germany and Ukraine over the ongoing crisis in Donbas. In the initial meeting, all parties agreed to respect the cease-fire in effect and to meet again in 10 days — the exact opposite of any imminent invasion by Russia. Note the absence of the U.S. and NATO from these talks.

Next, Russia will turn the threat of sanctions against the U.S. and Europe. Russia has already declared that banning it from the Swift system for international monetary transactions will result in the immediate halt of Russian energy supplies to Europe. Russia is expected to sign major economic agreements with China soon that will further insulate it from economic sanctions. China has made it clear it supports Russia in the current crisis, recognizing that if the West prevails against Russia, it will soon face a similar attack. Finally, Russia will exploit U.S. hypocrisy on spheres of influence and military alliances by entering military relationships with Cuba, Venezuela and Nicaragua and deploying a naval squadron to the Caribbean, with the potential for additional force deployments in the future.

With these three measures, Russia seeks to further isolate the U.S. from NATO and Europe. In the end, the U.S. will be confronted with one of two options, either agree to trade NATO’s open-door policy for Russian agreement not to deploy into the Western Hemisphere, or force a confrontation that will result in a Russian invasion of Ukraine that is seen by Europe as being the fault of the U.S.. The chess pieces are already being moved. While the U.S. may not see it, a Russian checkmate can be predicted sooner, rather than later.

“..his replacement glue-on vanity eyebrows are still stuck on a delivery truck somewhere..”

• Trudeau Tests Positive For Fascism (BBee)

From an undisclosed hiding place outside Canada’s capital city, Prime Minister Justin Trudeau confirmed for the world that he has tragically tested positive for fascism. “I took the fascism test this morning,” said Trudeau, beginning to sob. “And the test came back positive. I understand this may come as devastating news to freedom-loving Canadians, and I am here to assure you that everything will be ok… after I crush you underneath the jackboot of government tyranny until you learn to start obeying me.” “Together, we will achieve strength through unity, and unity through faith. In SCIENCE.”

According to sources, Trudeau will remain in his hiding place under quarantine until all the scary protesting truckers go away, after which he will emerge to grind his people into the very dust until they accept his vision for a glorious fascist future for Canada. Fortunately, his plans have been delayed as his replacement glue-on vanity eyebrows are still stuck on a delivery truck somewhere, and the fascist dictator refuses to be seen without them.

• Merck’s COVID-19 pill encourages sexually actively men “to use a reliable method of contraception correctly and consistently during treatment and for at least 3 months after the last dose of molnupiravir. The risk beyond 3 months after the last dose of molnupiravir is unknown..“

• Paxlovid interacts with 32 classes of drugs. Not 32 drugs….32 classes.

• Both are apparently less toxic than ivermectin per the FDA.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.