Dorothea Lange Negro woman who has never been out of Mississippi July 1936

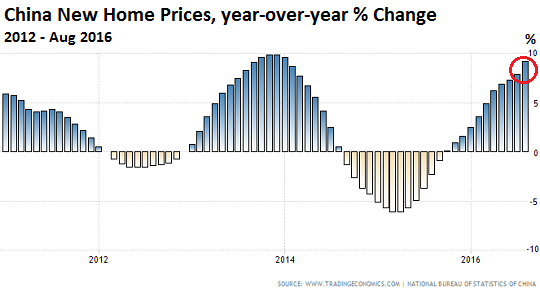

From Australia, but applicable worldwide. Mortgages in housing bubbles are the main engine of money (credit) creation in our economies. Boith governments and banks depend on them for profit, taxes and ultimately survival. Imagine if housing prices halved, the entire construct would collapse. They’ll do anything to keep the game going. And then they will fail.

• The Government Doesn’t Actually Want Housing To Be More Affordable (SMH)

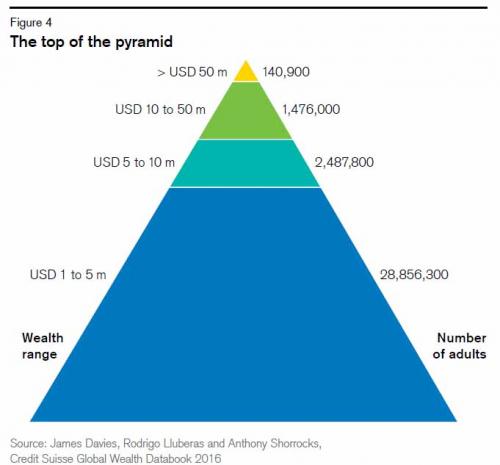

The federal government’s problem with making housing more affordable is that it becomes, by definition, cheaper. And that’s not something that the federal government wants to see happen for some very understandable reasons. Back in the Howard era Australians were encouraged to invest in housing as a form of wealth creation, partially as a way of addressing rental strain and mainly as a way to ensure people had assets and therefore didn’t go selfishly claiming pensions later on. That’s when the negative gearing and capital gains exemptions were introduced that made buying property such a sweet deal. So now there are a lot of Australians who have put their retirement eggs in the basket marked “leveraging the hell out of my mortgage to buy more investment properties” for the last couple of decades and who will be therefore disadvantaged if the value of housing drops.

And then there’s pure self interest at work too, since between a third and half of all our representatives have investment properties – the PM himself owns seven properties, for example. How keen would you say that our parliamentary representatives are to make their portfolios drop in value, especially for something as stupid as the greater good? Also, as well we know thanks to the efforts of the NSW Independent Commission Against Corruption, the NSW Liberals are so beloved by property developers that the party went to some effort to find a way of accepting donations from them despite those donations being completely illegal. If they suddenly become the party that makes property less lucrative, there’d be no donations to justify the creation of opaque entities like the Free Enterprise Foundation.

[..] Will housing become more affordable in Australia? Absolutely! And it could happen one of two ways. This complex web of legislation can be gently and strategically unpicked via careful bipartisan cooperation across our different spheres of government in concert with the private sector in an effort to create a sane, universally beneficial housing system at all levels. Alternatively, we can choose to leave things be until the housing bubble bursts and plunges Australia into a crippling recession. And since this is politics in 2017, we can assume that Plan A is already off the table.

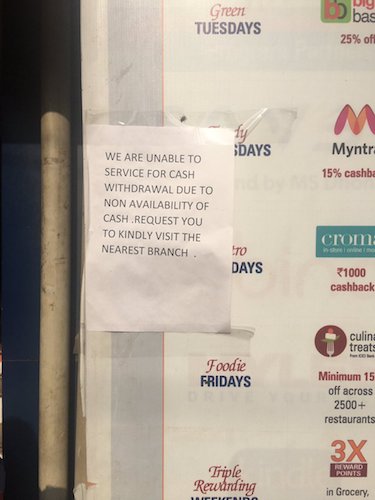

Using cash is fast becoming a revilutionary act.

The cashless society – which more accurately should be called the bank-payments society – is often presented as an inevitability, an outcome of ‘natural progress’. This claim is either naïve or disingenuous. Any future cashless bank-payments society will be the outcome of a deliberate war on cash waged by an alliance of three elite groups with deep interests in seeing it emerge. The first is the banking industry, which controls the core digital fiat money system that our public system of cash currently competes with. It irritates banks that people do indeed act upon their right to convert their bank deposits into state money. It forces them to keep the ATM network running. The cashless society, in their eyes, is a utopia where money cannot leave – or even exist – outside the banking system, but can only be transferred from bank to bank.

The second is the private payments industry – the likes of Mastercard – that profits from running the infrastructure that services that bank system, streamlining the process via which we transfer digital money between bank accounts. They have self-serving reasons to push for the removal of the cash option. Cash transactions are peer-to-peer, requiring no intermediary, and are thus transactions that Visa cannot skim a cut off. The third – perhaps ironically – is the state, and quasi-state entities such as central banks. They are united with the financial industry in forcing everyone to buy into this privatised bank-payments society for reasons of monitoring and control. The bank-money system forms a panopticon that enables – in theory – all transactions to be recorded, watched and analysed, good or bad. Furthermore, cash’s ‘offline’ nature means it cannot be remotely altered or frozen.

This hampers central banks in implementing ‘innovative’ monetary policies, such as setting negative interest rates that slowly edit away bank deposits in order to coerce people into spending. Governments don’t really mention that monetary policy agenda. It isn’t catchy enough. Rather, the key weapons used by the alliance are more classic shock-and-awe scare tactics. Cash is used by criminals! People buy drugs with cash! It’s the black economy! It supports tax evasion! The ability to present control as protection relies on constant calls to imagine an external enemy, the terrorist or Mafiosi. These cries of moral panic are set in contrast to the glossy smiling adverts about digital payment. The emerging cashless society looms like a futuristic sunrise, cleansing us of these dangerous filthy notes with rays of hygienic, convenient, digital salvation.

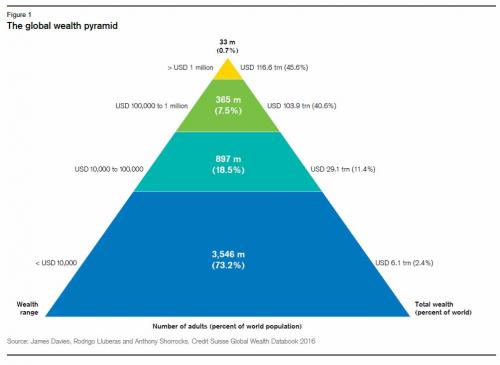

From Thomas Paine to Henry George, the reason for UBI has long been known. Call it ‘ground rent’ or ‘land value tax’. Tax the ownership class, not the workers. ‘Birthright’ may sound strange today, but is it really?

• Basic Income Isn’t Just A Nice Idea. It’s A Birthright (G.)

Every student learns about Magna Carta, the ancient scroll that enshrined the rights of barons against the arbitrary authority of England’s monarchs. But most have never heard of its arguably more important twin, the Charter of the Forest, issued two years later in 1217. This short but powerful document guaranteed the rights of commoners to common lands, which they could use for farming, grazing, water and wood. It gave official recognition to a right that humans nearly everywhere had long just presupposed: that no one should be debarred from the resources necessary for livelihood. But this right – the right of habitation – came under brutal attack beginning in the 15th century, when wealthy nobles began fencing off common lands for their own profit.

[..] the success of basic income – in both the north and south – all depends on how we frame it. Will it be cast as a form of charity by the rich? Or will it be cast as a right for all? Thomas Paine was among the first to argue that a basic income should be introduced as a kind of compensation for dispossession. In his brilliant 1797 pamphlet Agrarian Justice, he pointed out that “the earth, in its natural, uncultivated state was, and ever would have continued to be, the common property of the human race”. It was unfair that a few should enclose it for their own benefit, leaving the vast majority without their rightful inheritance. As far as Paine was concerned, this violated the most basic principles of justice.

Knowing that land reform would be politically impossible (for it would “derange any present possessors”), Paine proposed that those with property should pay a “ground rent” – a small tax on the yields of their land – into a fund that would then be distributed to everyone as an unconditional basic income. For Paine, this would be a right: “justice, not charity”. It was a powerful idea, and it gained traction in the 19th century when American philosopher Henry George proposed a “land value tax” that would fund an annual dividend for every citizen. The beauty of this approach is that it functions as a kind of de-enclosure. It’s like bringing back the ancient Charter of the Forest and the right of access to the commons. It restores the right to livelihood – the right of habitation.

Yeah, output cuts. Sure.

• Oil Falls On Lower China Growth Targets, Doubts On Russian Output Curbs (R.)

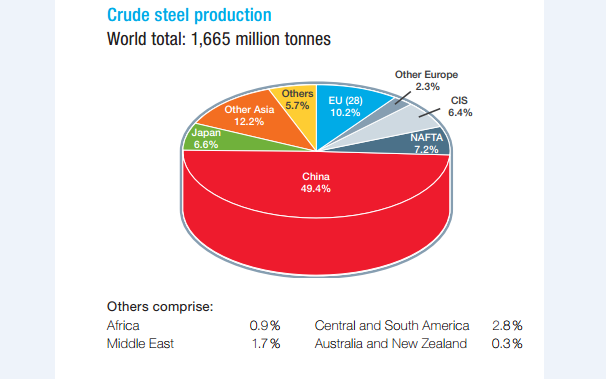

Oil prices fell in Asian trade on Monday, wiping out some of the gains of the previous session amid worries lower growth targets in China could cut oil demand and ongoing concern over Russia’s compliance with a global deal to cut oil output. But worries over escalating violence in the Middle East put a floor under prices. Brent crude futures dropped 29 cents, or 0.5%, to $55.61 a barrel as of 0638 GMT after settling 1.5% higher in the previous session. U.S. West Texas Intermediate (WTI) crude futures fell 30 cents, or 0.6%, to $53.03 a barrel after closing the previous session up 1.4%. “The main drag affecting markets today is the lowering of growth targets by China and tighter regulatory controls which implies less demand for oil and commodities in general,” said Jeffrey Halley at Oanda brokerage in Singapore.

China aims to expand its economy by around 6.5% this year, Premier Li Keqiang said in his work report at the opening of the annual meeting of parliament on Sunday. That is lower than the 6.7% growth achieved last year. China also plans to cut steel and coal output this year in an effort to tackle pollution, its top economic planner said on Sunday, while China’s newly appointed banking regulator vowed on to strengthen supervision of the lending sector. Meanwhile, figures by Russia’s energy ministry released last week showed February oil output was unchanged from January at 11.11 million barrels per day (bpd), casting doubt on Russia’s moves to rein in output as part of a pact with oil producers last year. That came as oil prices rose on Friday as the dollar weakened modestly after a speech by Fed Chair Janet Yellen, which suggested a rate increase would come at the end of its two-day meeting on March 15.

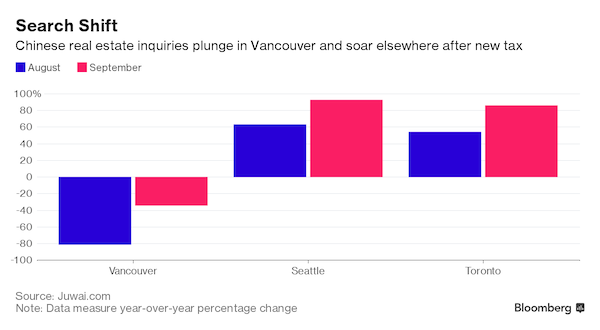

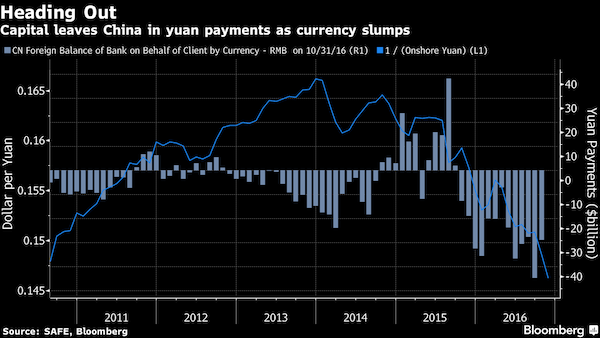

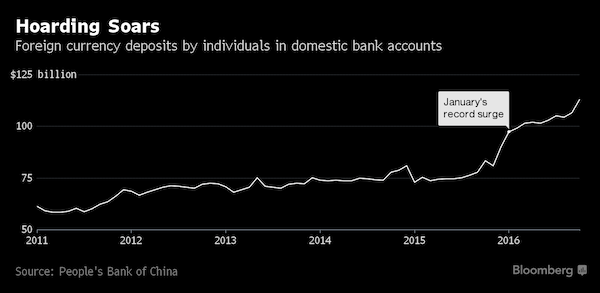

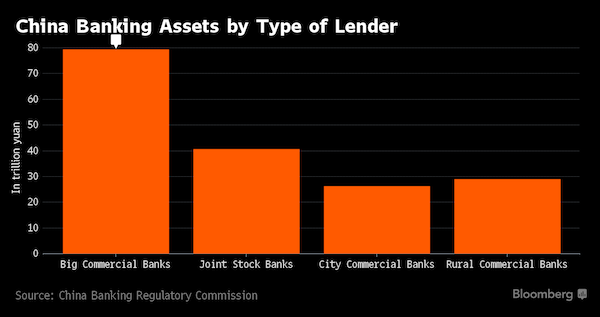

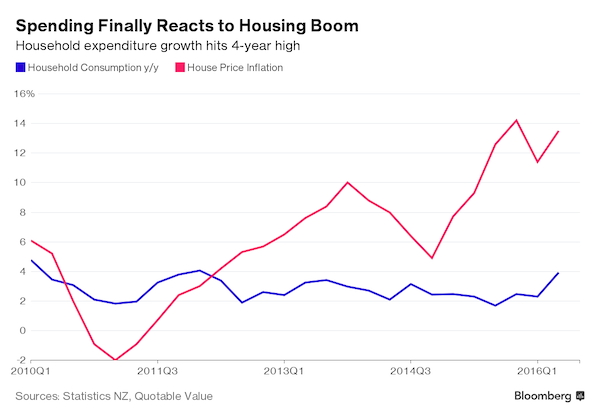

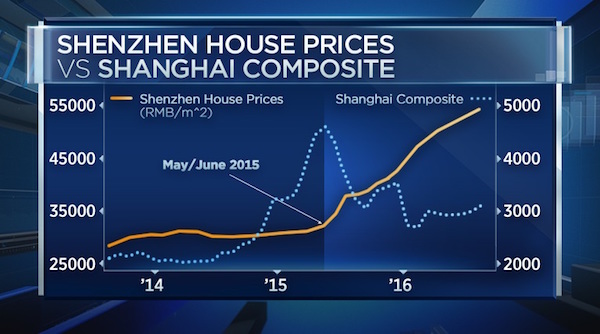

“China’s great ball of money.”

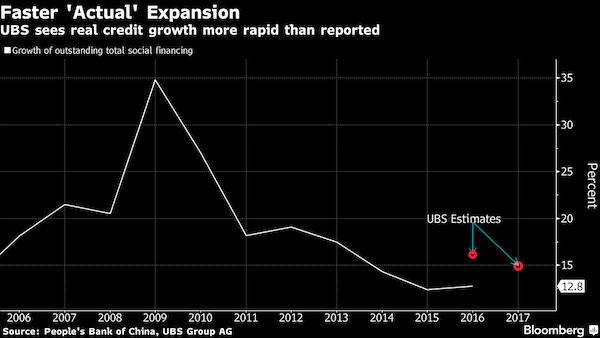

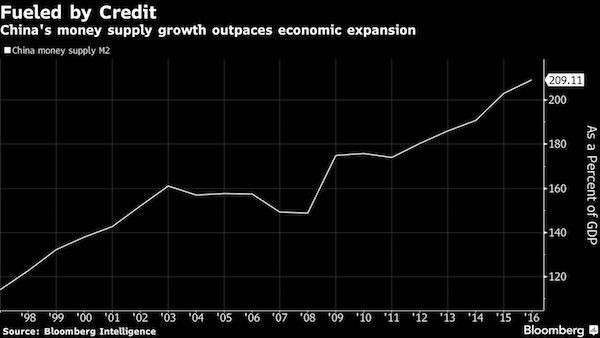

• China’s Credit Target Implies Adding Entire German GDP This Year (BBG)

China’s credit engine will keep humming this year, adding the rough equivalent of Germany’s annual economic output to its already massive stock of total social financing (TSF), according to estimates derived from the nation’s 2017 targets. Adding higher equity market financing and about 5 trillion yuan ($725 billion) worth of local government bond swaps to the official credit growth target of 12%, analysts at UBS see TSF expansion of 14.8% this year. They calculate that’s equal to a whopping 23 trillion yuan, or $3.3 trillion, addition to the amount of total credit already swishing around the world’s second-largest economy. “China’s pace of leverage increase will be slowing, albeit not by that much,” economists led by Hong Kong-based Wang Tao wrote in a report.

“The government’s intention for a still strong pace of credit growth and recent notable tightening in China’s money market and bond market attest to the difficulties facing the PBC in balancing monetary policy.” China’s great ball of money creates a constant headache for policy makers as money flows from asset class to asset class, creating bubbles along the way. It’s a particular dilemma for the People’s Bank of China because it needs new credit to generate the kind of growth its leaders desire – around 6.5% or higher if possible this year. The M2 money supply target was cut to 12% this year from 13% in 2016, while still higher than the 11.3% actual expansion last year.

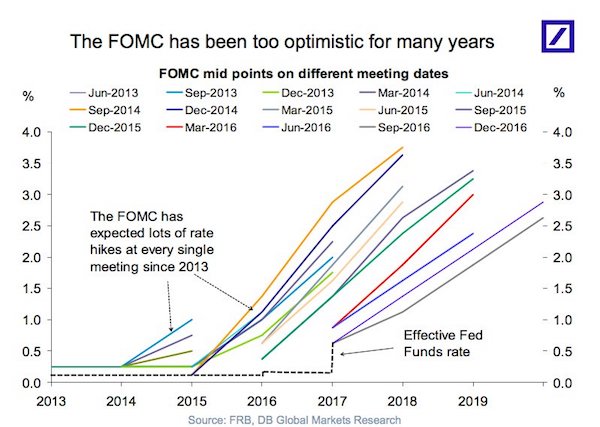

So wrong so many times, and still taken serious. You’d almost admire them for it.

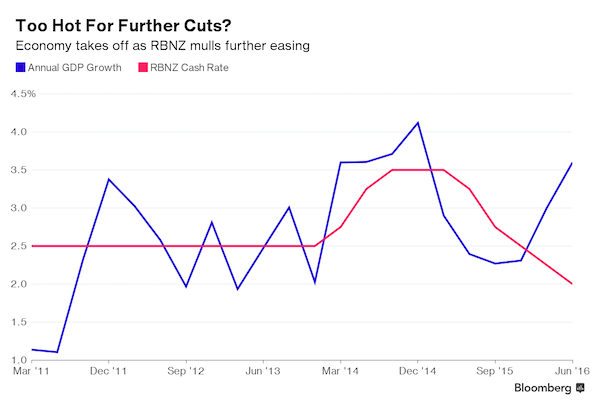

• Record-Breaking Stocks A Bad Reason For The Fed To Raise Interest Rates (BI)

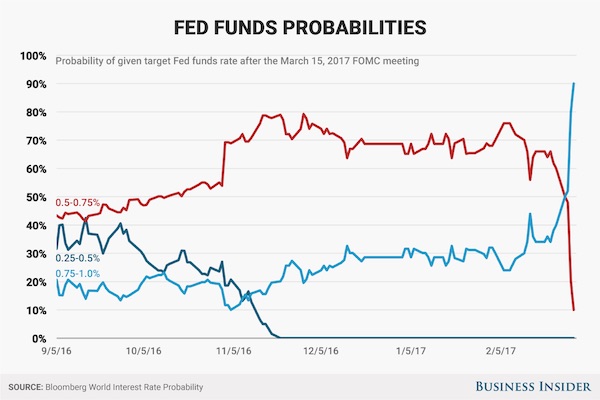

Federal Reserve officials say their decisions on interest rate policy hinge on the ebb and flow of economic data, not the whims of financial markets. They have repeatedly downplayed the effect of short-term market fluctuations in their policy moves, aimed at maintaining a strong labor market and 2% inflation over the medium term. But the thing about markets is, they don’t really matter until they suddenly do. That may be the case at the moment, with Fed officials suddenly signaling in unison, without major changes in the economic data, that an increase in interest rates is coming this month. Investors accordingly shifted from considering a March hike as rather a long shot to seeing it as a near sure possibility in just two weeks. What changed? The stock market continued to set new records without much underlying economic impetus.

When the Fed released minutes from its end of January meeting, they showed members “expressed concern that the low level of implied volatility in equity markets appeared inconsistent with the considerable uncertainty attending the outlook.” The Fed comments on the broad health of the financial markets all the time, but that kind of focus on stock volatility is less common. Fed Chair Janet Yellen and her Vice Chair Stanley Fischer, both speaking on March 3, appeared to seal the deal for a rate increase at the Fed’s upcoming March 14-15 meeting — with Yellen indicating that a hike is coming barring a drastic disappointment in next week’s February jobs report. Fischer was also was fairly unequivocal. “If there has been a conscious effort to move up our hike expectations I am going to join it,” he told a monetary policy conference in New York, sponsored by the University of Chicago’s Booth School of Business.

Carswell is the only MP for Ukip. Farage hates him now. But he has some points: “Trump – or Geert Wilders in the Netherlands – is where you end up when you ignore legitimate public concerns and there isn’t a safety valve. “

• Leaving The EU Is The Start Of A Liberal Insurgency (Carswell)

What is Nigel Farage so cross about? We won the EU referendum, for goodness sake. Since 23 June, I’ve been walking on sunshine. My mood has been a state of Zen-like bliss. Alongside Boris Johnson, David Owen, Gisela Stuart and all of those involved in the official Vote Leave campaign, I spent the referendum arguing that leaving the EU would be an opportunity to make Britain more open, outward-looking and globally competitive. It is becoming increasingly clear to me that this is where Brexit is going to take us. [..] Brexit is often bracketed alongside the election of Donald Trump and the rise of the new radical populist movements in many western countries. But to me the EU referendum result was a safety valve. Trump – or Geert Wilders in the Netherlands – is where you end up when you ignore legitimate public concerns and there isn’t a safety valve.

Throughout history oligarchy has emerged in societies in which power was previously dispersed: in the late Roman republic, and in early modern times in the Venetian and then the Dutch republics. Each time, the emergence of oligarchy was always accompanied by an anti-oligarch insurgent reaction.Many of today’s new radical movements aren’t oligarchs, but an anti-oligarchy insurgency. Trump is no American Caesar about to cross some constitutional Rubicon. Yet such insurgents often ended up unwittingly assisting the oligarchs. In Rome the Gracchi brothers, with their Trump-like concern about cheap migrant labour, caused so much civil strife that an all-powerful emperor seemed a better bet. In Venice, the anti-oligarch rebel Bajamonte launched an unsuccessful coup – and in doing so gave the elite a pretext to create a new, superpowerful executive arm of government, the Council of Ten.

Created to respond to the crisis for six weeks, it ran the republic for the next 600 years. The Dutch anti-oligarch De Witt was so inept, he paved the way for the return of a strong stadtholder, or king. So, too, today. If chaotic, angry insurgents such as France’s Marine Le Pen and the rightwing populist Alternative for Germany party are the alternative, then being governed by remote, unaccountable elites sitting in central banks and Brussels doesn’t seem so unattractive after all. But Brexit isn’t anything like that. It is the beginning of a liberal insurgency. Brexit means that we take back control from the supranational elite. Power can be dispersed outward and downwards. Those who make public policy might once more answer to the public. Cheer up – it might even mean that there is less space for anger in our politics too.

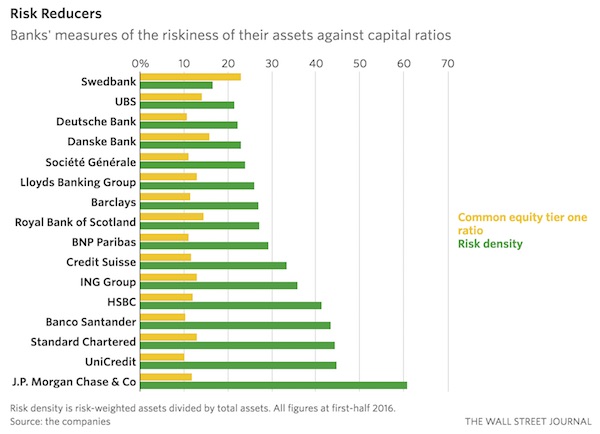

“Even after a recent rally, the stock is 29% lower than when Cryan took the helm in 2015…”

• Deutsche Bank CEO Cryan Has A New Strategy: Reverse His Old Strategy (BBG)

Deutsche Bank CEO John Cryan tore up his own turnaround plan in an admission that the 17-month-old effort flopped. Germany’s largest bank late Sunday approved measures – most crucially, plans to raise about $8.5 billion in a share sale – that effectively restart what has already been the most turbulent transformation in its recent history. Among the moves: naming two deputy CEOs who may now be positioned to succeed Cryan; selling a piece of the asset-management business and abandoning the sale of the consumer-banking unit, which was the linchpin of the blueprint he scrapped. Speaking on Monday, Cryan said the deputies were installed at his request as the company will focus more on the German market with the reintegration of Postbank, which he said reflects a strong performance by the unit and a changed environment for banks.

Yet the developments underscore how, almost two years after he took over, Deutsche Bank has been unable to plot a course to a more profitable future while seeking to eliminate 9,000 jobs. “We want to move back into modest growth mode, controlled growth,” Cryan said in the interview. “The operating environment in the U.S. but also increasingly in the euro zone and especially in Germany looks strong. And so I’m reasonably confident about the future.” Deutsche Bank fell 5.4% at 9:16 a.m. in Frankfurt trading, the biggest drop more than four weeks. Before today, the shares had rallied 44% in the past six months. Even though they’re being tapped for a capital infusion for the fourth time since 2010, some investors welcomed the developments as a way to end questions about the firm’s financial strength. S

elling a minority stake in the asset-management unit within the next two years and unloading some assets at the investment bank will help raise another 2 billion euros ($2.1 billion) of capital. Deutsche Bank’s last three capital increases raised about €21.7 billion – compared to the current market value of €26.4 billion. Even after a recent rally, the stock is 29% lower than when Cryan took the helm in 2015. “The shareholder dilution is enormous,” said Michael Huenseler, an investor at Assenagon Asset Management, which holds a stake in Deutsche Bank. “But at the same time, this package should end what has been hurting Deutsche Bank for so long: the discussion about the capital situation. Now the bank has to prove that it can be profitable.”

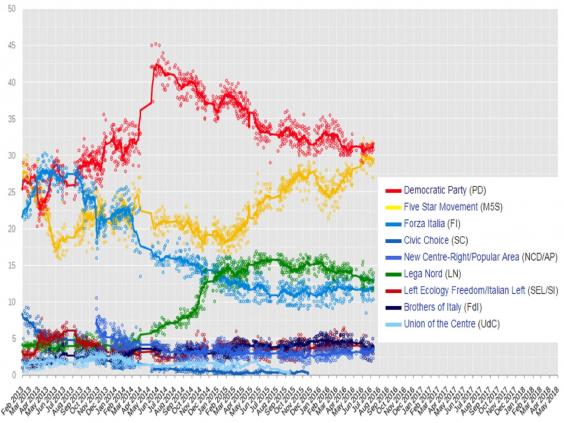

A boiling cauldron that will keep festering a for a while longer. Italy has a long-standing ownership class that won’t give up easily. Corruption, the mob, the church, secret lodges.

• Renzi’s Return Clouded By Probe Into Father, Government Minister (BBG)

Matteo Renzi’s comeback risks being undermined by a judicial investigation into the father of the Italian former prime minister and a government minister. Rome prosecutors on Friday were due to question Tiziano Renzi, 65, over an accusation of influence-peddling, his lawyer said. The elder Renzi is alleged to have obtained promises of monthly sums of money from Alfredo Romeo, a Naples entrepreneur, in return for mediating on his behalf for public works contracts, Italian news agency Ansa reported. The ex-premier’s father has denied any wrongdoing. [..] “If the investigation goes ahead, it will surely hurt Matteo Renzi’s prospects even if he has nothing to do with it,” said Sergio Fabbrini, director of the school of government at Luiss University in Rome. “This is the most critical moment of his political career, he has to find a new strategy.”

Tiziano Renzi’s lawyer Federico Bagattini said in a telephone interview that his client had done nothing illicit. “We deny that he ever asked for anything, that he ever promised he would intervene, and that he ever received any money or any other benefit,” Bagattini said. Tiziano Renzi said Thursday he had nothing to hide. “I have never asked for money. I never took any. Never,” he said in a statement reported by Ansa. [..] The anti-establishment Five Star Movement, which has made denunciations of political corruption one of its main platforms, has seized on the case. It submitted on Thursday a parliamentary vote of no confidence against Sports Minister Luca Lotti, a close ally of Matteo Renzi, which will test the government’s majority.

Lotti is also under investigation in the case for allegedly revealing confidential information, according to Italian news media, a charge he denied in a post on Facebook on Thursday. Five Star “talks of kick-backs, arrests, contracts – all things which I have nothing to do with,” Lotti wrote. The office of Franco Coppi, Lotti’s lawyer, did not respond to an emailed request for comment on Friday. The case is “an atomic bomb on Italian politics,” Five Star co-founder Beppe Grillo, who wants a referendum on Italy’s membership of the euro, wrote on his blog. “When it explodes, no one will be able to find shelter. Today more than ever we need honesty in institutions.”

It didn’t start yesterday. Western media have been killing off their own credibility for propaganda reasons, for many years.

• The Iraq War Stench Lingers Behind Today’s Preoccupation With Fake News (G.)

[..] with trust in the establishment at an all time low, the institutional heft of traditional media companies becomes a liability rather than an asset, enabling Trump to successfully turn the “fake news” label onto his opponents. Much of that goes back to Iraq. “The period of time between 9/11 and the invasion of Iraq represents one of the greatest collapses in the history of the American media,” says Gary Kamiya. “Every branch of the media failed, from daily newspapers, magazines and websites to television networks, cable channels and radio. “Bush administration lies and distortions went unchallenged, or were actively promoted. Fundamental and problematic assumptions about terrorism and the ‘war on terror’ were rarely debated or even discussed. Vital historical context was almost never provided. And it wasn’t just a failure of analysis. With some honourable exceptions, good old-fashioned reporting was also absent.”

Let’s look at the most famous example of how the media was used to make the Iraq war happen. On September 8 2002, the New York Times published a major story by Michael R Gordon and Judith Miller asserting that Iraq had “stepped up its quest for nuclear weapons and … embarked on a worldwide hunt for materials to make an atomic bomb”. The piece cited no named sources whatsoever. Rather, it attributed all its significant claims simply to anonymous US officials – and, by so doing, it helped launder the Bush administration’s talking points, lending a liberal imprimatur to unverified (and totally untrue) claims. When the key members of the Bush administration launched a publicity blitz to make the war happen, they were able to quote the New York Times as evidence: in effect, reacting to newspaper revelations for which they themselves were responsible.

For instance, during a CNN appearance, Condoleeza Rice urged the public to support an invasion on the basis that “we don’t want the smoking gun to be a mushroom cloud”. She’d lifted the phrase directly from Gordon and Miller – who’d taken it from the administration. Elsewhere, Gordon and Miller referred to Iraq’s supposed interest in acquiring high-strength aluminium tubes as an illustration of its nuclear ambitions. Again, the claims came from Bush officials. But when, at the UN General Assembly, Bush told the story, he sounded as if he were repeating a New York Times scoop. A similar circularity defined the propaganda campaign conducted in other countries.

In case you were still wondering why an entire country and its people are being obliterated.

• Saudi Arabia Stealing 65% of Yemen’s Oil in Collaboration with US, Total (AHT)

“63% of Yemen’s crude production is being stolen by Saudi Arabia in cooperation with Mansour Hadi, the fugitive Yemeni president, and his mercenaries,” Mohammad Abdolrahman Sharafeddin told FNA on Tuesday. “Saudi Arabia has set up an oil base in collaboration with the French Total company in the Southern parts of Kharkhir region near the Saudi border province of Najran and is exploiting oil from the wells in the region,” he added. Sharafeddin said that Riyadh is purchasing arms and weapons with the petro dollars stolen from the Yemeni people and supplies them to its mercenaries to kill the Yemenis. Late in last year, another economic expert said Washington and Riyadh had bribed the former Yemeni government to refrain from oil drilling and exploration activities, adding that Yemen has more oil reserves than the entire Persian Gulf region.

“Saudi Arabia has signed a secret agreement with the US to prevent Yemen from utilizing its oil reserves over the past 30 years,” Hassan Ali al-Sanaeri told FNA. “The scientific research and assessments conducted by international drilling companies show that Yemen’s oil reserves are more than the combined reserves of all the Persian Gulf states,” he added. Al-Sanaeri added that Yemen has abundant oil reserves in Ma’rib, al-Jawf, Shabwah and Hadhramaut regions. He noted that a series of secret documents by Wikileaks disclosed that the Riyadh government had set up a committee presided by former Saudi Defense Minister Crown Prince Sultan bin Abdel Aziz. “Former Saudi Foreign Minister Saud al-Faisal and the kingdom’s intelligence chief were also the committee’s members.”

“If I want to come to Germany, I will, and if you don’t let me in through your doors, if you don’t let me speak, then I will make the world rise to its feet..”

• Turkey’s Erdogan Compares German Behavior With Nazi Period (R.)

Turkish President Tayyip Erdogan accused Germany on Sunday of “fascist actions” reminiscent of Nazi times in a growing row over the cancellation of political rallies aimed at drumming up support for him among 1.5 million Turkish citizens in Germany. German politicians reacted with shock and anger. German Justice Minister Heiko Maas told broadcaster ARD that Erdogan’s comments were “absurd, disgraceful and outlandish” and designed to provoke a reaction from Berlin. But he cautioned against banning Erdogan from visiting Germany or breaking off diplomatic ties, saying that such moves would push Ankara “straight into the arms of (Russian President Vladmir) Putin, which no one wants”.

The deputy leader of Chancellor Angela Merkel’s Christian Democratic Union (CDU) party said the Turkish president was “reacting like a wilful child that cannot have his way”, while a top leader of the CDU’s Bavarian sister party described Erdogan as the “despot of the Bosphorus” and demanded an apology. German authorities withdrew permission last week for two rallies by Turkish citizens in German cities at which Turkish ministers were to urge a “Yes” vote in a referendum next month on granting Erdogan sweeping new presidential powers. Berlin says the rallies were canceled on security grounds. However, Turkish Economy Minister Nihat Zeybekci spoke at large events in Leverkusen and Cologne on Sunday while protesters stood outside.

The row has further soured relations between the two NATO members amid mounting public outrage in Germany over the arrest in Turkey of a Turkish-German journalist. It has also spurred growing demands for Merkel to produce a more forceful response to Erdogan’s words and actions. A poll conducted for the Bild am Sonntag newspaper showed that 81% of Germans believe that Merkel’s government has been too accommodating with Ankara. Germany, under an agreement signed last year, relies on Turkey to prevent a further flood of migrants from pouring into Europe. The lead article in German news magazine Der Spiegel on Sunday urged Merkel to free herself from the “handcuffs of the migrant deal”.

[..] A defiant Erdogan said he could travel to Germany himself to rally support for the constitutional changes to grant him greater power. “Germany, you have no relation whatsoever to democracy and you should know that your current actions are no different to those of the Nazi period,” Erdogan said at a rally in Istanbul. “If I want to come to Germany, I will, and if you don’t let me in through your doors, if you don’t let me speak, then I will make the world rise to its feet,” he told a separate event.

And Erdogan will want something in return.

• US Asks Ankara For Steps To Ease Aegean Tension (K.)

American officials have urged Ankara to refrain from action that would further escalate tension with fellow NATO member Greece in the Aegean Sea, Kathimerini understands, adding that the issue was raised during the Munich Security Conference last month, as well as during private contacts in Ankara. Sources told Kathimerini that US Secretary of State Rex Tillerson raised the topic with Turkish Foreign Minister Mevlut Cavusoglu on the sidelines of the Munich gathering last month. Assistant Secretary of State John Heffern reportedly asked Turkish officials for steps that will help reduce the recent spike in tensions with Greece.

A few days later, the same sources said, US Ambassador to Ankara John Bass met with Turkey’s Foreign Ministry Undersecretary Umit Yalcin to put pressure in the same direction. Yalcin is said to have attributed the standoffish behavior of the Turkish military to the army’s damaged morale by developments following July’s failed coup attempt. Analysts however say that any autonomy of the Turkish armed forces has been heavily compromised in the wake of the coup. Greek Foreign Minister Nikos Kotzias is expected to travel to Washington for a meeting with Tillerson in the coming days. Talks are to be followed by a telephone conversation between Prime Minister Alexis Tsipras and US President Donald Trump.

Growth is not possible in Greece today. The entire austerity edifice would have to be reversed.

• Greece Desperate For Growth Strategy As Public Mood Darkens (G.)

In navigating the country’s economic collapse, every one of Athens’ post-crisis governments has at some point attempted to change the narrative by diverting attention to development and growth. But the latest shift comes amid evidence that prime minister Alexis Tsipras’s two-party administration has gone a step further, approaching the World Bank for a €3bn loan to finance employment policies and programmes.

The move would highlight the desperation of a government tackling ever-growing poverty rates. Last week, the Cologne Institute for Economic Research said poverty in thrice-bailed out Greece had jumped 40% between 2008 and 2015, by far the biggest leap of any European country. Tsipras has been told he will have to enforce labour market reforms and further pension and income tax cuts if Greece is to realistically achieve a primary surplus of 3.5% – before interest payments are taken into account – once its current rescue programme expires in August 2018. The country faces debt repayments of over €7bn in July and with its coffers near empty would be unable to avert default – and inevitable euro exit – if additional loans weren’t forthcoming.

The prospect of more cuts, when pensions have already been slashed 12 times and some retirees are surviving on little more than €300 a month, has exacerbated the sense of gloom in the eurozone’s weakest member state. “We will have to compromise,” Dragasakis admitted. “Even if such demands are totally irrational,” he said, adding that Greece’s real problem was that it was primarily caught up in an ugly dispute between its lenders over what to do with a debt load close to 180% of GDP. The IMF has projected the pile will reach an “explosive” 275% of output if not relieved – a move that Germany, the biggest provider of bailout funds, refuses steadfastly to agree to. “It is why we have not completed the review,” said Dragasakis of the progress report Athens must conclude to secure further assistance.

The Greek government has been accused of deliberately delaying implementation of reforms. “This government won’t deliver reforms because it doesn’t believe in them,” said the centre-right main opposition leader Kyriakos Mitsotakis at the Delphi forum. As in antiquity, when kings, warriors and philosophers descended on Delphi at times of uncertainty to consult the Pythia, or prophetess, about their future, politicians, policy gurus, economists and academics gather annually at the place once regarded as the centre of the world to debate Greece’s plight. “What we need is a masterplan and a vision to get out of this crisis,” said Nikos Xydakis, the former European affairs minister who is now parliamentary spokesman for the ruling Syriza party. “A masterplan in financial terms but also a vision for a new identity of Greeks once this crisis ends.”

How mankind gets rid of itself, and can’t help doing it.

• Polluted Environments Kill 1.7 Million Children A Year (R.)

A quarter of all global deaths of children under five are due to unhealthy or polluted environments including dirty water and air, second-hand smoke and a lack or adequate hygiene, the World Health Organization (WHO) said on Monday. Such unsanitary and polluted environments can lead to fatal cases of diarrhea, malaria and pneumonia, the WHO said in a report, and kill 1.7 million children a year. “A polluted environment is a deadly one – particularly for young children,” WHO Director-General Margaret Chan said in a statement. “Their developing organs and immune systems, and smaller bodies and airways, make them especially vulnerable to dirty air and water.” In the report – “Inheriting a sustainable world: Atlas on children’s health and the environment” – the WHO said harmful exposure can start in the womb, and then continue if infants and toddlers are exposed to indoor and outdoor air pollution and second-hand smoke.

This increases their childhood risk of pneumonia as well as their lifelong risk of chronic respiratory diseases such as asthma. Air pollution also increases the lifelong risk of heart disease, stroke and cancer, the report said. The report also noted that in households without access to safe water and sanitation, or that are polluted with smoke from unclean fuels such as coal or dung for cooking and heating, children are at higher risk of diarrhea and pneumonia. Children are also exposed to harmful chemicals through food, water, air and products around them, it said. Maria Neira, a WHO expert on public health, said this was a heavy toll, both in terms of deaths and long-term illness and disease rates. She urged governments to do more to make all places safe for children. “Investing in the removal of environmental risks to health, such as improving water quality or using cleaner fuels, will result in massive health benefits,” she said.