Wyland Stanley Golden Gate Bridge under construction 1935

• US records 2,502 #coronavirus deaths in past 24 hours:

• Ben Hunt @EpsilonTheory

– 2,390 Americans died today of CV-19, the sixth worst day of this nat’l disaster. 2,470 Americans died yesterday, the fifth worst day of this nat’l disaster. I bet you didn’t know that. I bet you thought the death toll was improving. Now ask yourself, WHY wasn’t I told this?

• The coronavirus may have killed more people in the U.S. than is officially known: Total deaths in 7 hard-hit states are nearly 50% above normal, CDC data shows. That’s 9,000 more deaths than were reported as of April 11 in official counts.

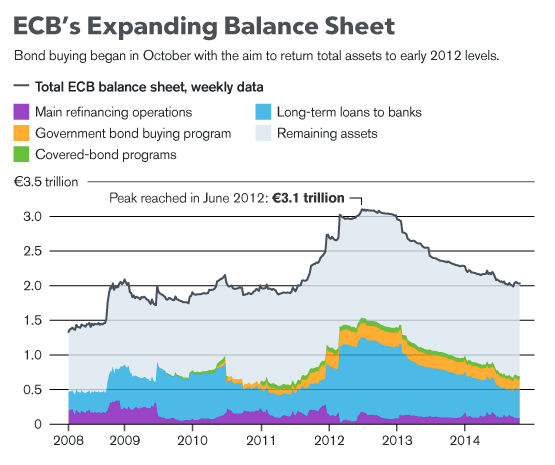

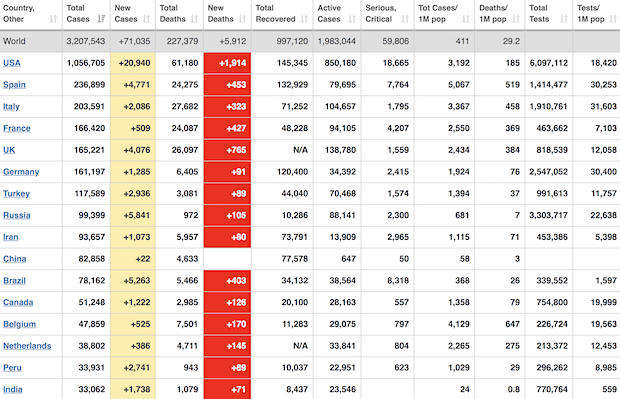

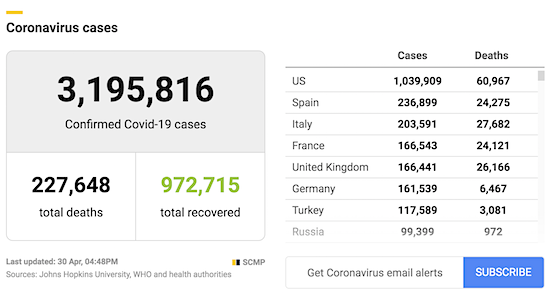

Yesterday we had 6,120 new deaths. Today it’s 10,135. Not sure what caused that surge. I did the screenshots at roughly the same time.

• Cases 3,232,992 (+ 83,759 from yesterday’s 3,149,233)

• Deaths 228,520 (+ 10,135 from yesterday’s 218,385)

From Worldometer yesterday evening -before their day’s close-

From Worldometer – Among Closed Cases, Deaths have fallen to 18%

From SCMP: Note: SCMP has a new layout for its tracker.

From COVID19Info.live: Note: watch Peru, it’s rising fast. As are Russia and Brazil, Mexico.

Found something not corona to start off with today. What an insane tale this has already become. Sidney Powell has promised more soon.

Think back before she became Flynn’s lawyer, and now look at this. The man had been bankrupted by these shenanigans; I still wonder who pays her.

So we have Comey, McCabe, Priestap. And then what about Obama, Hillary, Biden?

• FBI Notes Detail Effort To Frame Michael Flynn (Solomon)

A senior FBI official’s handwritten notes from the earliest days of the Trump administration expressed concern that the bureau might be “playing games” with a counterintelligence interview of then-National Security Adviser Michael Flynn to get him to lie so “we could prosecute him or get him fired.” The notes and other emails were provided to Flynn’s lawyers under seal last week and released Wednesday night by court order, providing the most damning evidence to date of potential politicalization and misconduct inside the FBI during the Russia probe. The notes show FBI officials discussed not providing Flynn a Miranda-like warning before his January 2017 interview — a practice normally followed in such interviews — so that he could be charged with a crime if he misled the agents, the officials said.

“What is our goal? Truth/Admission or to get him to lie, so we can prosecute him or get him fired?,” the handwritten notes of the senior official say. The notes express further concern the FBI might be “playing games.” Multiple officials confirmed to Just the News that the author of the notes is William Priestap, the now-retired FBI Assistant Director for Counterintelligence and the ultimate supervisor for fired agent Peter Strzok, who led the Russia probe. Justice Department officials are investigating whether Priestap’s notes were written in conjunction with meetings he had with top leaders like then-Director James Comey and then-Deputy Director Andrew McCabe, officials said.

A special prosecutor is reviewing DOJ’s and the FBI’s handling of the Flynn prosecution, which led to the former Trump adviser and retired general pleading guilty to lying to the FBI under a plea deal with Special Counsel Robert Mueller in the Russia case. Flynn’s lawyer Sidney Powell filed a court motion last week saying new evidence has emerged showing Flynn was “framed” and his conviction should be dismissed. The officials said the notes are part of that new evidence and had been withheld from Flynn’s defense team for years even though they were potential evidence of innocence.

#FLYNN docs just unsealed, including handwritten notes 1/24/2017 day of Flynn FBI interview. Transcript: “What is our goal? Truth/Admission or to get him to lie, so we can prosecute him or get him fired?” Read transcript notes, copy original just filed. @CBSNews pic.twitter.com/8oqUok8i7m

— Catherine Herridge (@CBS_Herridge) April 29, 2020

There’s plenty to be said against Flynn, that’s not it. I think of his lobbying for Turkey in 2016.

The Sparrow Project @sparrowmedia on Twitter:

PRO TIP: “The FBI are not your friends, don’t lionize the FBI. Also, Michael Flynn is an Islamophobic, criminal, neo-crusader who should be sent to the gallows for the brutality he oversaw in JSOC, and at Camp Bucca in Iraq, brutality that ultimately gave birth to ISIS.”

• Handwritten Notes, Emails Reveal FBI Agents Set Perjury Trap For Flynn (SAC)

U.S. District Court Judge Emmet G. Sullivan unsealed four pages of stunning FBI emails and handwritten notes Wednesday, regarding former Trump National Security Advisor Michael Flynn, which allegedly reveal the retired three star general was targeted by senior FBI officials for prosecution, stated Flynn’s defense attorney Sidney Powell. Those notes and emails revealed that the retired three-star general appeared to be set up for a perjury trap by the senior members of the bureau and agents charged with investigating the now-debunked allegations that President Donald Trump’s campaign colluded with Russia, said Sidney Powell, the defense lawyer representing Flynn. Moreover, the Department of Justice release 11 more pages of documents Wednesday afternoon, according to Powell.

What is especially terrifying is that without the integrity of Attorney General Bill Barr and U.S. Attorney Jensen, we still would not have this clear exculpatory information as Mr. Van Grack and the prosecutors have opposed every request we have made,” said Powell. It appears, based on the notes and emails that the Department of Justice was determined at the time to prosecute Flynn, regardless of what they found, Powell said. “The FBI pre-planned a deliberate attack on Gen. Flynn and willfully chose to ignore mention of Section 1001 in the interview despite full knowledge of that practice,” Powell said in a statement. “The FBI planned it as a perjury trap at best and in so doing put it in writing stating ‘what is our goal? Truth/ Admission or to get him to lie so we can prosecute him or get him fired.”

The documents, reviewed and obtained by SaraACarter.com, reveal that senior FBI officials discussed strategies for targeting and setting up Flynn, prior to interviewing him at the White House on Jan. 24, 2017. It was that interview at the White House with former FBI Special Agent Peter Strzok and FBI Special Agent Joe Pientka that led Flynn, now 61, to plead guilty after months of pressure by prosecutors, financial strain and threats to prosecute his son. Powell filed a motion earlier this year to withdraw Flynn’s guilty plea and to dismiss his case for egregious government misconduct. Flynn pleaded guilty in December 2017, under duress by government prosecutors, to lying to investigators about his conversations with Russian diplomat Sergey Kislyak about sanctions on Russia. This January, however, he withdrew his guilty plea in the U.S. District Court in Washington, D.C.

He stated that he was “innocent of this crime” and was coerced by the FBI and prosecutors under threats that would charge his son with a crime. He filed to withdraw his guilty plea after DOJ prosecutors went back on their word and asked the judge to sentence Flynn to up to six months in prison, accusing him of not cooperating in another case against his former partner. Then prosecutors backtracked and said probation would be fine but by then Powell, his attorney, had already filed to withdraw his guilty plea.

The documents reveal that prior to the interview with Flynn in January, 2017 the FBI had already come to the conclusion that Flynn was guilty and beyond that the officials were working together to see how best to corner the 33-year military veteran and former head of the Defense Intelligence Agency. The bureau deliberately chose not to show him the evidence of his phone conversation to help him in his recollection of events, which is standard procedure. Even stranger, the agents that interviewed Flynn later admitted that they didn’t believe he lied during the interview with them.

.@AndrewCMcCarthy says we’re seeing a planned out scheme to get a 33 year combat vet (@GenFlynn) to say something inaccurate so they could charge him with the a false statement.

Thank God for @SidneyPowell1 pic.twitter.com/X3xborav1Z

— Josh Cremeans “DirtyTruth” (@AKA_RealDirty) April 30, 2020

As if we couldn’t have guessed. Note the role played by Victoria Nuland.

• Steele Testifies Hillary Clinton, Susan Rice Knew About His Anti-Trump Research

Steele recently testified in a British court that he believed both then-Democratic presidential nominee Hillary Clinton and then-Obama National Security Adviser Susan Rice were aware of his dossier research as it was going on in summer 2016. The testimony makes his most direct link yet between his Russia collusion research and the top of the Clinton campaign and Obama White House. Steele told a British court he believed he had been hired by the Fusion GPS firm owned by Glenn Simpson through the Democratic National Committee-linked law firm Perkins Coie to assist the Clinton campaign during the election, according to a transcript of the testimony.

“I presumed it was the Clinton campaign, and Glenn Simpson had indicated that. But I was not aware of the technicality of it being the DNC that was actually the client of Perkins Coie,” Steele testified in March under questioning from lawyers for Russian bankers suing over his research. “You knew it was the leadership of the Clinton presidential campaign didn’t you?” a lawyer for the businessmen asked. “I believed it was the campaign. Yes,” he answered. “The leadership of the Clinton campaign?” he was asked. “Fine, the leadership of the campaign,” Steele conceded. The lawyer persisted. “You also understood that Hillary Clinton herself was aware of what you were doing?” the lawyer asked. “I think Glenn had mentioned it, but I wasn’t clear,” Steele answered.

Then Steele was confronted with what lawyers said were notes he took at a meeting with the FBI in 2016 in which he purported to tell agents that Clinton was aware of his research. The lawyers read from those notes during the court proceedings. The notes, according to the transcript, read: “We explained that Glenn Simpson/GPS Fusion was our commissioner but the ultimate client were the leadership of the Clinton presidential campaign and that we understood the candidate herself was aware of the reporting at least, if not us.” The lawyers prodded: “It’s your note, so we assume it’s accurate?” “Yes,” Steele answered during the March 17 testimony. You can read that testimony here.

[..] A day later in additional testimony, Steele was asked how he came to present some of his dossier findings to the U.S. State Department during an October 2016 meeting with then-Deputy Assistant Secretary of State Kathleen Kavalec. The former British MI6 agent turned private intelligence investigator said his meeting was set up by State officials Jonathan Winer and Victoria Nuland after longtime Clinton adviser and friend Strobe Talbott had reached out to him. “The meeting was set up by a State Department official called John Winer,” Steele explained. “At your request?” the lawyers asked. “No, at his request, his suggestion. He invited us into meet, as I understood it, at her request, Assistant Secretary of State Nuland,” Steele answered.

Not much use waxing nostalgic about a washed out rag.

• The NY Times Used to Correct Its Whoppers. But Not These (Kuntz)

The New York Times is widely admired for owning up to its errors. In addition to the corrections it runs each day, it has a tradition of publishing extensive Editor’s Notes and even full-length investigations when it has determined that flawed reporting misled readers and botched the rough first draft of history.[..] During the last few years the Times has published two other sets of deeply flawed articles that also demand such extended corrections: “The 1619 Project” and its Trump-Russia coverage. It is a sign of how much the Times, and mainstream journalism in general, have changed that it appears highly unlikely the “paper of record” will correct the record.

[..] The Trump-Russia coverage, even with caveats pinning assertions to sources rather than solid evidence, clearly created a false impression that Donald Trump and his team were in cahoots with the Russians. It’s hard to believe that former Times Executive Editor Max Frankel would have written an op-ed for the paper declaring that an “obvious bargain [was] reached during the campaign of 2016” between the Trump campaign and Russia if he hadn’t read those unmistakable insinuations in the Times. The Trump campaign is suing the Times for libel over Frankel’s claims. (Full disclosure: I was hired as an editor at the Times in 1988 under Frankel.)

A fuller accounting by the Times is especially necessary because the media’s pushing of Trump-Russia conspiracy theories was central to an unprecedented and possibly criminal effort to subvert or remove a president under false pretenses. Unless the Times and other sources come clean about who was feeding them misleading and partisan information, we may never understand this momentous chapter of history. Protecting confidential sources is, of course, one of the bedrocks of journalism. The free flow of information depends on people being able to share hard truths without jeopardizing their careers or lives.

But not when sources lie or mislead. When that happens, the confidentiality deal is off and “your responsibility would be to set the record straight,” Lynn Walsh, ethics chair of the Society of Professional Journalists, confirmed to me recently in a general conversation about SPJ’s standards for anonymous sourcing. When sources engage in gross deception on a matter of such import, even committing national security crimes in the process, the news media involved should honor their higher duty – to their readers or viewers – to expose the malfeasance and correct the record.

Even the WHO won’t commit. A handful scary reports of people dying from 70-year old, tried and tested and never lethal, chloroquines, followed by upbeat though opaque stories on remdesivir.

Note the tweet below about 65,000(!) Italian RA, lupus patiens on long term hydroxychloroquine. Deadly, right? With a 90% reduction in COVID19 infection rate…

One difference: chloroquine patents have run out, so no big profits for “investors”. Which they will get from remdesivir if it “works”.

• WHO Declines Comment On Remdesivir In COVID-19, Hopes For Best (R.)

A top World Health Organization official declined comment on Wednesday on reports that Gilead Science’s remdesivir could help treat COVID-19, the respiratory disease caused by the novel coronavirus, but said that further data was needed. “I wouldn’t like to make any specific comment on that, because I haven’t read those publications in detail,” Dr Mike Ryan, head of the WHO’s emergencies programme, told an online briefing in response to a question, adding it can sometimes take a number of publications to determine a drug’s efficacy. “Clearly we have the randomised control trials that are underway both in the UK and US, the ‘Solidarity trials’ with WHO. Remdesivir is one of the drugs under observation in many of those trials. So I think a lot more data will come out,” he said. Ryan added: “But we are hopeful this drug and others may prove to be helpful in treating COVID-19.”

The Italian Society for Rheumatology studied 65,000 patients on longterm hydroxychloroquine for RA and Lupus.

Only 20 patients tested positive for COVID-19. No ICU, no deaths.

This is a 90% reduction in infection rate compared to the rest of Italy.https://t.co/Pta97oBA8O

— James Todaro, MD (@JamesTodaroMD) April 28, 2020

Reauters headline spells it out: “US Stocks Surged As Hopes For An Effective COVID-19 Treatment Prompted A Broad Rally”.

• Fauci Says Leak Concerns Fueled His White House Revelation Of Remdesivir Tests (R.)

Concerns over leaks compelled the top U.S. infectious disease official to reveal data on Gilead Sciences Inc’s experimental drug remdesivir, the first in a scientifically rigorous clincial trial to show benefit in treating COVID-19. The dramatic announcement by Dr Anthony Fauci in the Oval Office on Wednesday prompted concerns among scientists that the Trump administration was raising hopes about a coronavirus treatment before sharing the full data with researchers. As a cautionary example of inflating the potential value of a therapy, some pointed to President Donald Trump’s repeated endorsements of malaria drug hydroxychloroquine as a treatment, with no evidence that it works. Newer data suggests the malaria treatments may carry significant risks for some sufferers of the respiratory disease caused by the virus.

Fauci, director of the National Institute of Allergy and Infectious Diseases (NIAID), which is running the trial, said he took the first opportunity to get the word out that patients taking a dummy treatment or placebo should be switched to remdesivir in hopes of benefiting from it. He expressed concern that leaks of partial information would lead to confusion. Since the White House was not planning a daily virus briefing, Fauci said he was invited to release the news at a news conference with Louisiana Gov. John Bel Edwards(D). “It was purely driven by ethical concerns,” Fauci told Reuters in a telephone interview. “I would love to wait to present it at a scientific meeting, but it’s just not in the cards when you have a situation where the ethical concern about getting the drug to people on placebo dominates the conversation.”

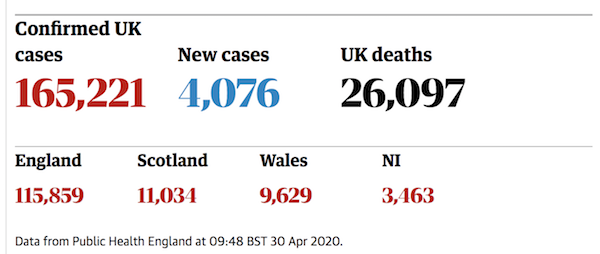

The numbers tell us it’s a matter of days before Britain overtakes Italy in having most deaths in Europe.

• Britain Has Europe’s Second Highest COVID-19 Death Toll (R.)

Britain now has Europe’s second highest official COVID-19 death toll with more than 26,000, according to figures published on Wednesday that raised questions about Prime Minister Boris Johnson’s response to the outbreak. Some 26,097 people died across the United Kingdom after testing positive for COVID-19 as of April 28 at 1600 GMT, Public Health England (PHE) said, citing daily figures that included deaths outside of hospital settings for the first time. That means the United Kingdom has suffered more COVID-19 deaths than France or Spain have reported, though less than Italy, which has Europe’s highest death toll and the second worst in the world after the United States.

“We must never lose sight of the fact that behind every statistic there are many human lives that have tragically been lost before their time,” Foreign Secretary Dominic Raab told reporters. “We are still coming through the peak and…this is a delicate and dangerous moment in the crisis.” Such a high UK death toll increases the pressure on Johnson just as opposition parties accused his government of being too slow to impose a lockdown to limit contagion from the new coronavirus, too slow to introduce mass testing and too slow to get enough protective equipment to hospitals. Johnson returned to work on Monday after recuperating from COVID-19, which had left him gravely ill in intensive care at the peak of the coronavirus outbreak. He celebrated the birth of a baby son on Wednesday.

Opposition Labour Party leader Keir Starmer criticised Johnson’s response to the world’s worst public health crisis since the 1918 influenza outbreak. Johnson had spoken of Britain’s “apparent success” in tackling COVID-19 in a speech to the nation on Monday. “We are possibly on track to have one of the worst death rates in Europe,” Starmer told parliament. “Far from success, these latest figures are truly dreadful,” he added, referring to previously published data. Starmer said his calculations showed 27,241 had died in the UK from COVID-19, the lung disease caused by the coronavirus. In mid-March the government’s chief scientific adviser said keeping Britain’s death toll below 20,000 would be a “good outcome”.

Government reveal their failures piecemeal, after shouting out loud about BIG targets. This model does require cooperation of the media at all times.

• UK To Miss 100,000 Coronavirus Tests Target, Minister Admits (G.)

The UK government is likely to miss its target of carrying out 100,000 coronavirus tests by the end of April, a cabinet minister has admitted. After weeks of ministers insisting the deadline would be met, Robert Buckland, the justice secretary, said it was “probable that we won’t” reach it on Thursday but said it was likely in the next few days. “Even if we don’t hit it, we will in the next few days hit that target. We are up to 52,000 being tested, capacity is rising and I think it was right to set an ambitious target. Sometimes if you don’t hit a target on the due date, the direction of travel is the most important thing. And I believe we are going to get there and move beyond it because we need more,” he told Sky News.

The target was set by Matt Hancock, the health secretary, on 2 April as the government came under pressure over low testing levels. At that point, there was capacity for 12,799 daily tests in England, with just over 10,650 tests carried out. The total as of 9am on Wednesday was 52,429 tests with capacity to do 73,000, but only 33,000 individuals were tested because of multiple retests. [..] .. hospital leaders launched a strident attack on the government’s testing strategy, regardless of the target. Saffron Cordery, the deputy chief executive of NHS Providers, which represents foundation trusts in England, dismissed the 100,000 target as a “red herring” that distracted from the lack of a coherent overall strategy.

NHS Providers said in a report on Wednesday: “NHS trust leaders believe they have done all they can to support the national testing effort so far but are increasingly frustrated with the lack of clarity on how the testing regime will be developed for this next phase. “At the moment they feel they are on the end of a series of frequent tactical announcements extending the testing criteria to new groups with no visibility on any longer term strategy, and are being expected at the drop of a hat to accommodate these changes with no advance notice or planning.”

Might be good news. Might even be very good. But it’s also yet another condemnationn of testing as a whole.

• Seoul Tests Find False Positives, Not Reinfections In Recovered Patients (KH)

South Korea’s infectious disease experts said Thursday that dead virus fragments were the likely cause of over 260 people here testing positive again for the novel coronavirus days and even weeks after marking full recoveries. Oh Myoung-don, who leads the central clinical committee for emerging disease control, said the committee members found little reason to believe that those cases could be COVID-19 reinfections or reactivations, which would have made global efforts to contain the virus much more daunting. “The tests detected the ribonucleic acid of the dead virus,” said Oh, a Seoul National University hospital doctor, at a press conference Thursday held at the National Medical Center.

He went on to explain that in PCR tests, or polymerase chain reaction tests, used for COVID-19 diagnosis, genetic materials of the virus amplify during testing, whether it is from a live virus or just from fragments of dead virus cells that can take months to clear from recovered patients. The PCR tests cannot distinguish whether the virus is alive or dead, he added, and this can lead to false positives. “PCR testing that amplifies genetics of the virus is used in Korea to test COVID-19, and relapse cases are due to technical limits of the PCR testing.” As of Sunday, 263 people in Korea tested positive for the disease again after being declared virus-free, of which 17 were minors or teens, the National Medical Center said. “The respiratory epithelial cell has a half-life of up to three months, and RNA virus in the cell can be detected with PCR testing one to two months after the elimination of the cell,” Oh said.

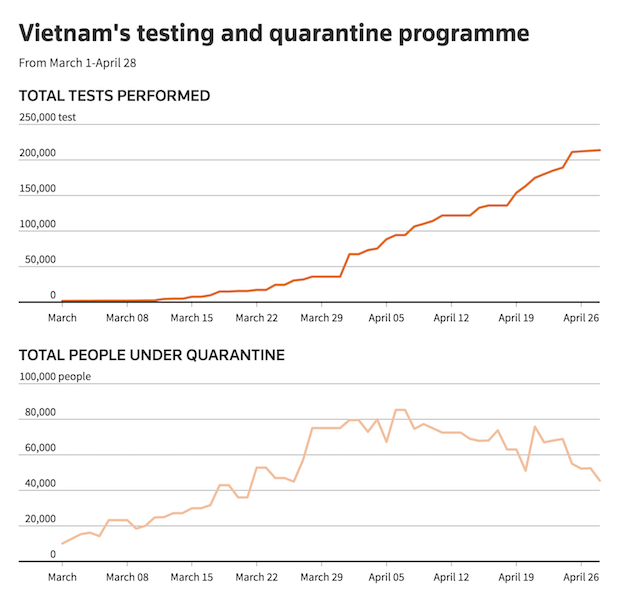

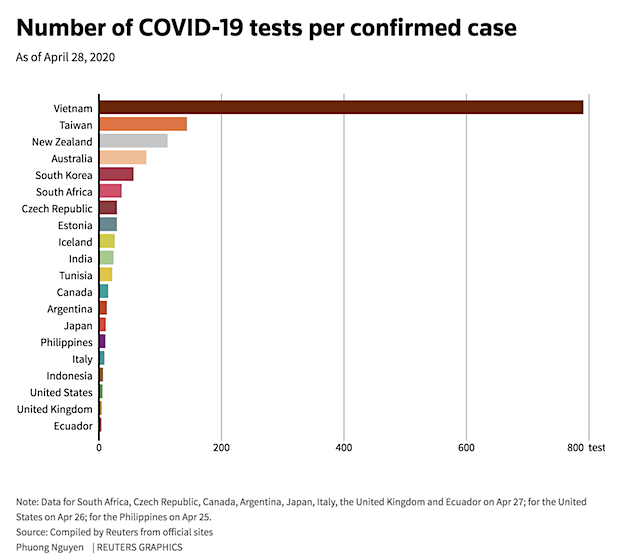

I saw the first graph here and thought something doesn’t add up. Vietnam didn’t do mass testing, 213,000 in a country of 96 million people is nothing compared to the 6.1 million in the 320 million US.

What the second graph shows is the clue: Vietnam tests a lot compared to confirmed cases.

• After Aggressive Mass Testing, Vietnam Says It Contains COVID19 Outbreak (R.)

Vietnam, a country of 96 million people which shares a border with China, is signalling that it has succeeded where many wealthier and more developed countries have not by containing the new coronavirus. The government is officially reporting a relatively small 270 cases and zero deaths. That puts the country on course to revive its economy much sooner than most others, according to several public health experts interviewed by Reuters. Its slightly more populous regional neighbour the Philippines, in comparison, has reported almost 30 times as many cases and more than 500 deaths. These public health experts say Vietnam was successful because it made early, decisive moves to restrict travel into the country, put tens of thousands of people into quarantine and quickly scaled up the use of tests and a system to track down people who might have been exposed to the virus.

“The steps are easy to describe but difficult to implement, yet they’ve been very successful at implementing them over and over again,” said Matthew Moore, a Hanoi-based official from the U.S. Centers for Disease Control and Prevention (CDC), who has been liaising with Vietnam’s government on the outbreak since early January. He added that the CDC has “great confidence” in the Vietnamese government’s response to the crisis. Vietnam increased the number of laboratories that can test for COVID-19, the disease caused by the new coronavirus, from three at the beginning of the outbreak in January, to 112 by April. As of Wednesday, 213,743 tests had been conducted in Vietnam, of which 270 were positive, according to health ministry data. That ratio of 791 tests to every confirmed case is by far the highest in the world, according to data from health ministries compiled by Reuters. The next highest, Taiwan, has conducted 140 tests for every case.

[..] “It is organised, it can make country-wide policy decisions that get enacted quickly and efficiently and without too much controversy,” said Guy Thwaites, director of the Oxford University Clinical Research Unit in Ho Chi Minh City. Thwaites said the number of positive tests processed by his organisation’s lab was in line with government data. He said the hospital where he works on the wards – Ho Chi Minh City’s 550-bed Hospital for Tropical Diseases, serving a population of 45 million people in southern Vietnam – had not admitted any additional cases not reflected in the government’s numbers. “If there was ongoing and unreported or unappreciated community transmission, we would have seen the patients in our hospital. We have not,” he said. Thwaites said his organisation’s lab increased capacity from being able to do around 100 tests a day to around 1,000 a day.

Get yourself tested. Don’t wait.

• Los Angeles To Offer Free Coronavirus Tests To All Residents (NBC)

Los Angeles will begin offering free coronavirus tests to all residents no matter if they have symptoms or not, Mayor Eric Garcetti said Wednesday. Garcetti said that all residents of Los Angeles County can get the tests. The website to schedule tests says it is open to any county resident regardless of symptoms. Those with symptoms will be given priority. The mayor said he believes Los Angeles is the first major city to offer tests to all residents. He said they now have enough testing capacity to handle the increased tests. Testing rules had previously been relaxed to allow grocery store workers, first responders and other essential workers with exposure to the virus to get tests regardless of whether they have symptoms. Health officials say that even those without symptoms can spread the virus.

All you need to know is America doesn’t like small. But people can still buy from small farms. All it may take is some effort.

• Small Farms, Stressed And Underfunded, Struggle For Coronavirus Relief (IC)

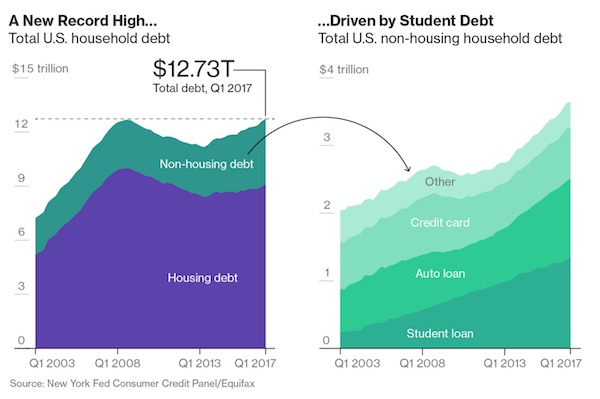

Before coronavirus hit, farmers in the U.S. were already hurting from years of falling food prices, severe weather, and, more recently, President Donald Trump’s trade war. “We’ve had a record number of farm bankruptcies [in the U.S.], total farm debt is at $425 billion, [and farmer] incomes have fallen by about half since 2013,” said Eric Deeble, policy director at the National Sustainable Agriculture Coalition, which supports small and mid-sized family farms. Now, with the global pandemic closing factories and restaurants and disrupting supply chains, already stressed farms are grappling with lower demand and fewer markets to sell in, as well as a presidential administration that favors relief for big businesses over small.

Small farmers in particular — those who sell directly to farmers markets, schools, and other local food hubs — are facing an existential crisis, as they face slim odds of accessing competitive federal stimulus money. They have reason to be pessimistic. In recent years, federal subsidies to help struggling farmers have flowed almost exclusively to large corporate farms. Of the roughly $28 billion the Trump administration has distributed to food producers to offset losses from his trade wars, almost all went to big farms. Advocates for small farmers say this is driven in part by the preference of Trump’s agriculture secretary, Sonny Purdue, who has encouraged farmers to get bigger farms if they wanted to stay in business. “Big get bigger and small go out … and that’s what we’ve seen,” he told a group of Wisconsin dairy farmers in 2018, echoing Richard Nixon’s agriculture secretary, who infamously told farmers in the 1970s to “get big or get out.”

While 91 percent of U.S. farms are small — defined by the federal government as an operation with gross cash income under $250,000 — large farms account for 85 percent of the country’s farm production. The public health crisis has already had a devastating impact on agriculture across the country. A report released in mid-March by the National Sustainable Agriculture Coalition estimated that small farms would see a $689 million decline in sales from March to May this year due to Covid-19, leading to a payroll decline of $103 million and a total loss to the economy of $1.3 billion. Now, as the pandemic shows no sign of slowing, the coalition worries that the impact for small farmers will be even more substantial — which could lead many small farms to permanently close.

When are they planning to tell us that renewable energy is not renewable?

• COVID19 Crisis Will Wipe Out Demand For Fossil Fuels – IEA (G.)

Renewable electricity will be the only source resilient to the biggest global energy shock in 70 years triggered by the coronavirus pandemic, according to the world’s energy watchdog. The International Energy Agency said the outbreak of Covid-19 would wipe out demand for fossil fuels by prompting a collapse in energy demand seven times greater than the slump caused by the global financial crisis. In a report, the IEA said the most severe plunge in energy demand since the second world war would trigger multi-decade lows for the world’s consumption of oil, gas and coal while renewable energy continued to grow. The steady rise of renewable energy combined with the collapse in demand for fossil fuels means clean electricity will play its largest ever role in the global energy system this year, and help erase a decade’s growth of global carbon emissions.

Fatih Birol, the IEA’s executive director, said: “The plunge in demand for nearly all major fuels is staggering, especially for coal, oil and gas. Only renewables are holding up during the previously unheard of slump in electricity use.” Renewable energy is expected to grow by 5% this year, to make up almost 30% of the world’s shrinking demand for electricity. The growth of renewables despite a global crisis could spur fossil fuel companies towards their goals to generate more clean energy, according to Birol, but governments should also include clean energy at the heart of economic stimulus packages to ensure a green recovery. “It is still too early to determine the longer-term impacts,” said Birol. “But the energy industry that emerges from this crisis will be significantly different from the one that came before.”

What makes Sweden so successful.

• Swedish City To Dump Ton Of Chicken Manure In Park To Deter Visitors (G.)

The university town of Lund in Sweden is to dump a tonne of chicken manure in its central park in a bid to deter up to 30,000 residents from gathering there for traditional celebrations to mark Walpurgis Night on Thursday. “Lund could very well become an epicentre for the spread of the coronavirus on the last night in April, [so] I think it was a good initiative,” the chairman of the local council’s environment committee, Gustav Lundblad, told the Sydsvenskan newspaper. “We get the opportunity to fertilise the lawns, and at the same time it will stink and so it may not be so nice to sit and drink beer in the park,” Lundblad said, adding that the only potential drawback was that the smell may not be confined to the park.

“I am not a fertiliser expert, but as I understand it, it is clear that it might smell a bit outside the park as well,” Lundblad admitted. “These are chicken droppings, after all. I cannot guarantee that the rest of the city will be odourless. But the point is to keep people out of the city park.” Sweden has opted for a light touch approach to containing Covid-19, eschewing the strict lockdowns imposed by its Nordic neighbours and much of the rest of Europe and favouring personal responsibility over draconian enforcement. Walpurgis Night, celebrated on 30 April, is widely marked across central and northern Europe with parties and bonfires. The festivities are classed as “spontaneous” so cannot be banned by authorities, but to avoid the risk of spreading the coronavirus many towns and cities in Sweden have asked citizens to give the tradition a miss this year.

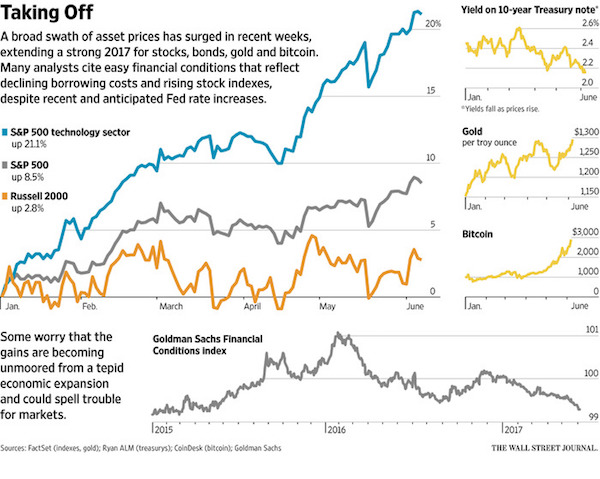

Just in case you still thought there are financial markets.

• Stock Surge Is A Bear Market Rally That Will Collapse – Bianco (CNBC)

Market researcher James Bianco warns April’s big run will collapse. His reason: Investors are too bullish. “I understand the market has been up a lot since the March low. But what I see in the market is a retracement rally that looks very similar to the first type of rallies that you get in protracted bear markets,” the Bianco Research president told CNBC’s “Trading Nation” on Wednesday. Bianco warned last month the coronavirus turmoil would be worse than the financial crisis. In early March, he put all his money in cash and never looked back — despite the bounce. So far this month, the S&P 500 is up almost 14%. If the trend holds, it’ll be the index’s best showing since 1974.

Meanwhile, the Dow is up more than 12% in the same period and is on track for its best monthly performance since January 1987. “We’ll revisit the 2,200 S&P low, if not make a lower low — probably by late summer,” he said. “That’s going to come because we’re going to find out now is a critical time for the market.” Bianco predicts there will be an overwhelming realization that life isn’t getting back to normal when then economy starts to reopen. “What the market seems to be thinking is we’re going to restart, and we’re all going to pretend that it’s 2019,” said Bianco. “And, we’re all going to stand on the subway platform with 500 other people waiting for the next train.”

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the process.

Thanks for your generosity.

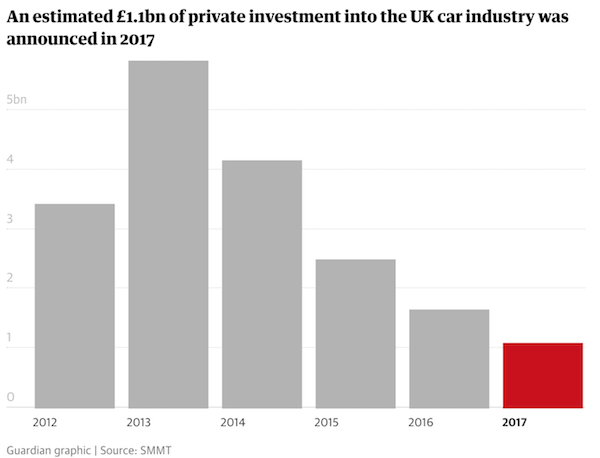

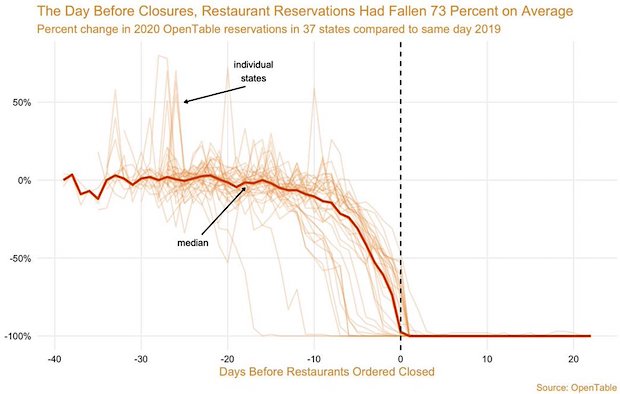

Before the lockdowns:

Free America now… from psychopaths! pic.twitter.com/jm9TKY4HTo

— Nassim Nicholas Taleb (@nntaleb) April 29, 2020

— General Flynn (@GenFlynn) April 29, 2020

Support the Automatic Earth for your own good.