Dorothea Lange No food, no work, baby died, to be sent back to OK from CA Spring 1937

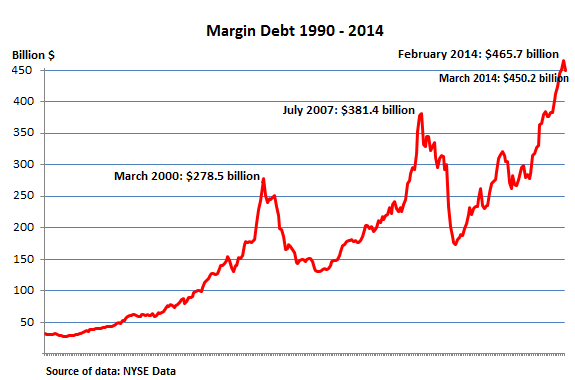

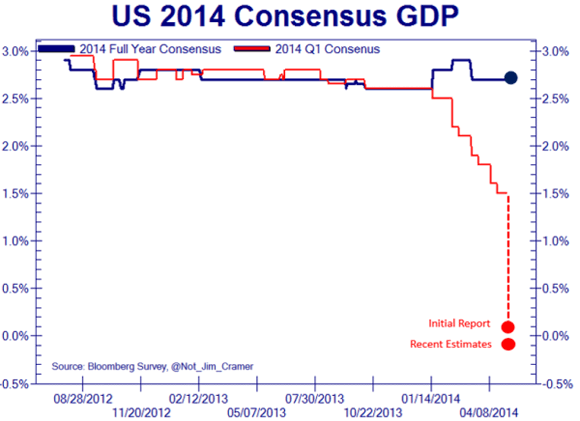

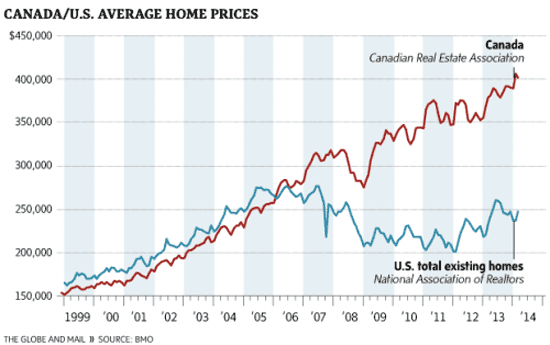

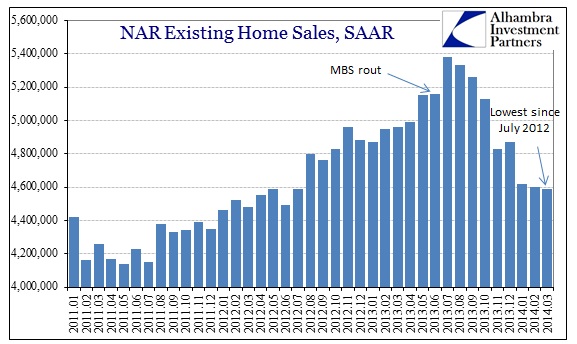

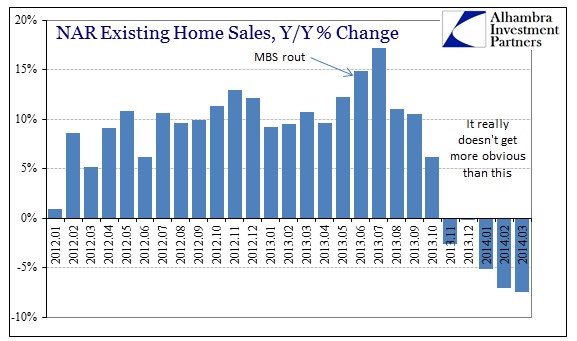

Just a bunch of numbers Reuters published today. Read and weep. While remembering that this spring, after that horrible winter that threw the recovery so terribly off course, would see pent-up demand go crazy. That after the Q1 GDP growth, which has by now been revised to -2% after initially having been predicted to be in the 3%+ range, Q2 would certainly, according to pundits, economists and government agencies, top 3%, if not more. We already know for a fact that’s not going to happen. Unless the US grows faster in June than China did in its heyday. The American economy is getting very seriously hammered, and nobody with access to all the right channels will ever let you know about it other than in a long range rear view mirror where things always look smaller than they appear. The American consumer is necessarily getting hammered just as badly, but as long as the message remains one of growth, bread and circuses (or pink slime and Kardashians), (s)he will wait it out until that glorious promised tomorrow on the horizon just around the corner arrives.

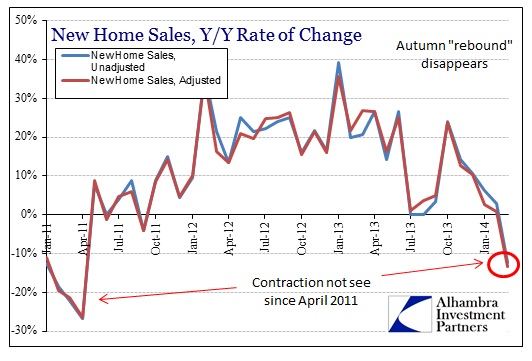

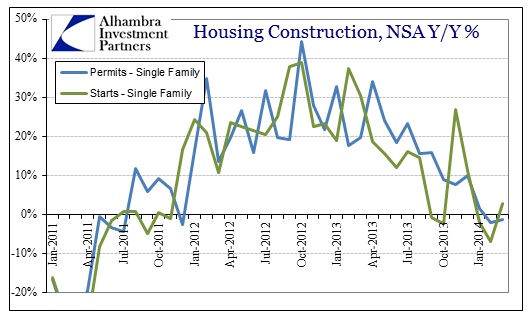

May Home Construction Data Paint Gloomy Picture

U.S. housing starts and building permits fell more than expected in May, suggesting the housing recovery will likely remain slow for a while. Groundbreaking for homes fell 6.5% to a seasonally adjusted annual pace of 1 million units, the Commerce Department said on Tuesday. March’s starts were revised down to show a 12.7% increase instead of the previously reported 13.2% rise. Groundbreaking for single-family homes, the largest part of the market, fell 5.9% in May to a 625,000-unit pace, while starts for the volatile multi-family homes segment decreased 7.6% to a 376,000-unit rate.

Permits to build homes declined 6.4% to a 991,000-unit pace in May, pulling back from the 1.06 million units touched in April. Economists had expected permits to dip to a 1.05-million unit pace. Permits for single-family homes rose 3.7% to a 619,000 unit-pace. They continue to lag groundbreaking, suggesting single-family starts could fall in the months ahead. A survey on Monday showed confidence among single-family home builders increased in June, but fell short of reaching the threshold considered favorable for building conditions. Permits for multi-family housing tumbled 19.5% to a 372,000-unit pace.

Michael Snyder throws together some numbers on US debt, and I’m not even sure he counts all entitlement programs in the proper manner.

Total Debt In America Hits A New Record High Of Nearly 60 Trillion Dollars

What would you say if I told you that Americans are nearly $60 trillion in debt? When you total up all forms of debt including government debt, business debt, mortgage debt and consumer debt, we are $59.4 trillion in debt. That is an amount of money so large that it is difficult to describe it with words. For example, if you were alive when Jesus Christ was born and you had spent $80 million every single day since then, you still would not have spent $59.4 trillion by now. And most of this debt has been accumulated in recent decades. If you go back 40 years ago, total debt in America was sitting at about $2.2 trillion. Somehow over the past four decades we have allowed the total amount of debt in the United States to get approximately 27 times larger.

Total consumer credit in the U.S. has risen by 22% over the past three years alone, 56% of all Americans have a subprime credit rating, 52% of Americans cannot even afford the house that they are living in. There is more than $1.2 trillion dollars of student loan debt, $124 billion dollars of which is more than 90 days delinquent. Only 36% of all Americans under the age of 35 own a home, a new record. US national debt is $17.5 trillion dollars. Almost all of that debt has been accumulated over the past 40 years. In fact, 40 years ago it was less than half a trillion dollars.

By now I’m thinking it’s no wonder the housing numbers for May were so atrocious. What else can you expect? Michael also points to a WSJ article from May 2013 on global debt numbers:

Total World Debt Load at $223.3 trillion, 313% of GDP

Economists at ING found that debt in developed economies amounted to $157 trillion, or 376% of GDP. Emerging-market debt totaled $66.3 trillion at the end of last year, or 224% of GDP. The $223.3 trillion in total global debt includes public-sector debt of $55.7 trillion, financial-sector debt of $75.3 trillion and household or corporate debt of $92.3 trillion. (The figures exclude China’s shadow finance and off-balance-sheet financing.) Per-capita indebtedness is still just $11,621 in emerging economies (and rises to $12,808 if you exclude the two largest populations, China and India). For developed economies, it’s $170,401. The U.S. alone has total per-capita indebtedness of $176,833, including all public and private debt.

Every child born in America has a $176,833 debt sticker on its head. But wait! Central banks to the rescue! As I wrote yesterday, US and UK and Japanese and Chinese government debt, which still keep growing very rapidly, have increasingly been swallowed up whole by their respective central banks, which are now well on their way to buy up their own and each other’s asset markets too. And that, too, increases debt, and not a little bit, though it’s perhaps through a backdoor. The process keeps the money- and powerholders of a present failed and long since broke(n) system in place at a huge cost to everyone else, including future generations. And perhaps the only hope of escaping it is a crash, which will be far more severe than merely heartbreaking. Excerpts from a Nassim Taleb and Mark Spitznagel discussion explain how that might work.

Inequality, Free Markets, and Crashes

Mark Spitznagel and Nassim Taleb started the first equity tail-hedging firm in 1999. Since then these two friends and colleagues have helped popularize so-called “black swan” investing, with Spitznagel as the founder and CIO of hedge fund Universa Investments and Taleb as an academic and author of The Black Swan. The two men recently sat down to discuss Spitznagel’s new book, The Dao of Capital.

Nassim Taleb: Mark, your book is the only place that understands crashes as natural equalizers. In the context of today’s raging debates on inequality, do you believe that the natural mechanism of bringing equality — or, at the least, the weakening of the privileged — is via crashes?

Mark Spitznagel: … one can absolutely say logically and empirically that asset-market crashes diminish inequality. They are a natural mechanism for this, and a cathartic response to central banks’ manipulation of interest rates and resulting asset-market inflation, as well as other government bailouts, that so amplify inequality in the first place. So crashes are capitalism’s homeostatic mechanism at work to right a distorted system.

Taleb: I see you are distinguishing between equality of outcome and equality of process. Actually one can argue that the system should ensure downward mobility, something much more important than upward one. The statist French system has no downward mobility for the elite. In natural settings, the rich are more fragile than the middle class and we need the system to maintain it.

Spitznagel: … what’s hidden beneath all the aggregate income-inequality data is much cross-sectional downward mobility, in that most people in the right tail of income spend very little time there. The transience of success is assured by natural entrepreneurial capitalism, and is precisely what works about it: unseating the top, driving out the lucky and unworthy. Without this dynamic, capitalism doesn’t work. It isn’t even capitalism, but rather oligarchic central planning. Yet modern government chips away at this dynamic in so many ways, most significantly by providing floors and safety nets to crony bankers and other financial punters.

That we so casually ignore the implications of this goes to the main point of my book: In the words of Bastiat, we pursue a small present good which will be followed by a great evil to come, rather than a great good to come at the risk of a small present evil. The latter is what I call roundaboutness, which is central to strategic decision making, especially investing. It is about counter-intuitively heading right in order to better go left, or taking small losses now — and willingly looking like an idiot — to build a strategic advantage for later. In Daoism it is wei wuwei or shi. In economics it is Robinson Crusoe, who starves himself by not spending all his time fishing by hand and instead spends time making a boat and net, in order to catch many more fish later. We have roundaboutness to thank for civilization itself.

Taleb: … we need a “negative state” for law enforcement, something like the U.S. federal state or the traditional empire during Pax Romanaor Pax Ottomana. In this idea the role of the state is protection, not to promote education or, say, corn fructose, which we know have worse adverse consequences when coming top-down from a powerful centralizer and, hence, implemented at a large scale. In my work the central mission of the state is to protect the environment, to shield me from irreversible harm done to my backyard by people who don’t have skin in the game and are protected by limited liability. There are things that can be done by the state, and only the central state. Do you agree?

Spitznagel: I definitely agree that the only conception of the state that makes any sense is the “night watchman” variety, which exists only to enforce the rules of the game rather than trying to pick the winners and losers (whether it’s financial institutions or monoculture crops). There is a deep tradition in classical liberalism and modern libertarianism that stresses the importance of limiting government action to the defense of life and limb — a defense of “negative liberty” — rather than the “positive” conception where it is the job of the government to promote literacy, full employment, equality, and so forth. [..]

… I see the whole “R>G” [meaning return on capital is greater than the rate of growth] thing as taking bubble observations and rationalizing their extrapolation forever, thus simultaneously neglecting both the incidence of asset bubbles and what’s so bad about them. Such enormous shortsighted errors follow from the noisy duration of the “long term.” And exploiting these errors is the name of the game. In everyone’s scorn of the roundabout lies its greatest edge.

The main metaphor of my book is the “Yellowstone effect”: A massive fire in Yellowstone Park in 1988 opened the eyes of foresters to the fact that a century of wildfire-suppression, and with it competition- and turnover-suppression, had only delayed, concentrated, and by far worsened the destruction — not prevented it. This isn’t just about dead-wood accumulation creating a fragile tinderbox network. The real issue is how our tinkering artificially short-circuits the fundamental capacity of the system to allocate its limited resources, correct its errors, and find its own balance through the internal communication of information that no forestry manager could ever possibly possess.

But that capacity is still there, and homeostasis ultimately wins through a raging inferno. This is a cautionary tale for our economy. A crash, or the liquidation of assets that have grown unimpeded by economic reality (as if there were more nutrients in the ecosystem than there actually are), looks to academics and bureaucrats – and just about everyone else as well – like the system breaking down. It is actually the system fixing itself.

Taleb: … First, intervention — in general, whether medical, governmental, or other — has side effects and needs to be treated exactly as we do with other complex systems: only when extremely necessary. Second, counter to naïve conservatism, nature is not conservative, it destroys and creates species every day, but it does so in a certain pattern: Its destruction has the effect of isolating the system from large-scale harm. It does not try to preserve the past; it only tries to preserve the system. Finally, liberty is not an economic good, but an existential one. The economic good is a mere bonus. The argument that liberty is good for economic activity or for growth of the system feels lowly and commercial. If you were a wild animal, would you elect to be in a zoo because the economy is better over there than in the wild?

It may seem unacceptable, or tough, or unfair, that the only way out of the present illusionary economic system, and all the trinkets we have to thank it for, is by a giant crash. But once you realize that it must crash no matter what, and that you are really nothing but an animal caged by the system, what should you choose? I think perhaps it’s a choice between your weaknesses and your strengths. Though I know it’s not nearly as simple as that, because the crash will erase much of what we hold dear, for whatever reason we do that. It’s probably good to acknowledge that the choice is not between crash or no crash, but between weakness and strength, and that a crash is a system fixing itself back to health, something that has a lot of positive connotations, even if that is the only positive feature it has. Wait, there’s one other: our children will see a lot of the debts they are now being born with, disappear. But it will come at an unprecedented price.

And of course if you add entitlement programs ….

• Total US Debt Soars To Nearly $60 Trillion, Foreshadows New Recession (RT)

America – its government, businesses, and people – are nearly $60 trillion in debt, according to the latest economic data from the St. Louis Federal Reserve. And private debt – not government borrowing – is the biggest reason for the huge deficit. Total US debt at the end of the first quarter of 2014, on March 31 totaled almost $59.4 trillion – up nearly $500 billion from the end of the fourth quarter of 2013, according to the data. Total debt (the combination of government, business, mortgage, and consumer debt) was $2.2 trillion 40 years ago. “In 50 short years, debt has gone from being a luxury for a few to a convenience for many to an addiction for most to a disease for all,” James Butler wrote in an Independent Voters Network (IVN) op-ed. “It is a virus that has spread to every aspect of our economy, from a consumer using a credit card to buy a $0.75 candy bar in a vending machine to a government borrowing $17 trillion to keep the lights on.”

Nuff said: “needs” of Chinese issuers will increase to $20 trillion through the end of 2018, a third of the $60 trillion in global funding “needs”. Who’s going to print all those needs?

• China Bigger Than U.S. With $14 Trillion in Company Debt (Bloomberg)

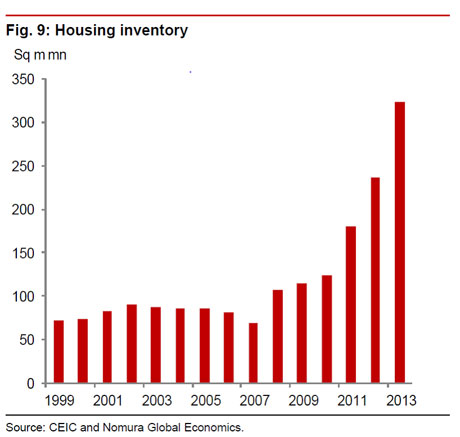

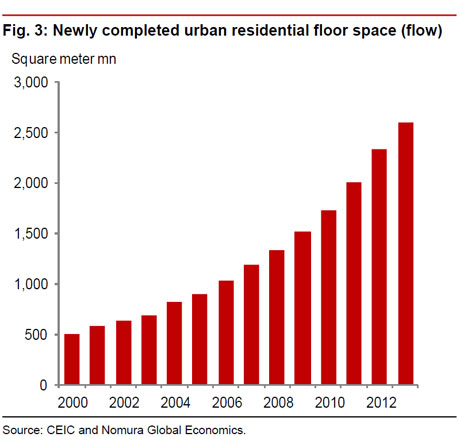

Chinese companies borrow more than their American counterparts as the world’s second-largest economy takes center stage in corporate-debt markets. Borrowers from China had $14.2 trillion in debt at the end of last year, exceeding every other country including the U.S., which had $13.1 trillion in company obligations, according to a report dated June 15 by Standard & Poor’s. Needs of Chinese issuers will increase to $20 trillion through the end of 2018, a third of the $60 trillion in global funding needs.

Borrowings in the Asia-Pacific region will overtake both North America and Europe by 2016 as China and neighboring countries widen their lead as the world’s largest group of corporate borrowers, according to S&P. Bonds, as opposed to loans, will also become a more important source of financing, increasing 3.5%, or almost $3.1 trillion. “Higher risk for China’s borrowers means higher risk for the world,” Jayan Dhru, S&P’s global head of corporate ratings in New York, wrote in the report. “The U.S. continues on the path to economic recovery while the euro zone struggles with marginal growth, but the bottom line is that this is a China story.”

We know why.

• Why Japan’s Debt Markets Are Frozen (Bloomberg)

As Japan gets the inflation it’s been craving all these years, the bond market is doing something very surprising: nothing. Far from panicking over each uptick in the consumer price index, traders are pushing Japanese government bond yields lower. Today’s 10-year bond rate is 0.58% compared with 0.735% at the start of 2014, even though the CPI is rising at a 3.4% year-over-year rate. Anyone else confused? This disconnect owes much to Haruhiko Kuroda’s unprecedented asset-buying spree. By gobbling up an ever-larger number of bonds at auction and in the secondary market, the Bank of Japan governor has essentially paralyzed the market. What’s more, this is becoming a global phenomenon as hedge fund managers from New York to London to Singapore bemoan the death of market volatility.

My Bloomberg View colleague Mark Gilbert looked through the lens of economist Hyman Minsky, who argued that long periods of market stability and harmony can reach tipping points, which then rapidly degenerate into chaos. What worries me is that central banks in Frankfurt, Tokyo and Washington now find themselves on a treadmill from which there’s no escape. As it accelerates, their bond-buying efforts will have to keep pace. Over time, there’s no doubt that the world’s biggest central banks are headed toward the widespread monetarization of debt – effectively nationalizing bond markets and raising troubling questions. Not least of them: How exactly does a central bank withdraw from a market it essentially owns? Kuroda is now the biggest player in Japan’s $9.6 trillion bond market. As I pointed out last August, Kuroda appears to have one eye on the playbook of Korekiyo Takahashi, whose radical debt-buying policies as finance minister back in the 1930s had the Tokyo establishment calling him their John Maynard Keynes.

Former Federal Reserve Chairman Ben Bernanke credited Takahashi with “brilliantly rescuing Japan from the Great Depression through reflationary policies.” Yet three problems arise when it becomes hard to know where a central bank’s balance sheet ends and the debt market begins. One is the loss of volatility that traders and companies need to buy and sell things. Heavily sedated from the BOJ’s monetary tonic, bond-market transacting has all but stopped and price ranges are stuck in their tightest ranges ever. That’s also carried over into the stock market, where big price swings are becoming a thing of the past.

A second problem is losing the vital information that a liquid debt market affords. If Japan’s bond bubble does pop one day, as shortsellers like J. Kyle Bass of Hayman Capital Management have long predicted, it could come out of nowhere. The normal warning signals — yield spikes and spreads between debt instruments — are being deadened as we speak. The third is finding an exit strategy. If Japan’s experience with quantitative easing these last dozen years tells us anything, it’s that restoring normalcy is devilishly hard. Debt markets become addicted to central-bank stimulants and weaning them off is easier said than done. Just yesterday, International Monetary Fund head Christine Lagarde said the Fed may have scope to keep interest rates at zero for longer than investors expect. How right she is about that!

China buys real assets with virtual money.

• How China Is Keeping US Bond Yields Low (CNBC)

China’s efforts to weaken its currency could be bolstering U.S. Treasurys and weighing on a rally in the dollar against the euro. The Asian nation’s currency actions, thought to be an effort to boost its slowing economy, have contributed to these unlikely trading patterns, market participants say. It’s the latest way in which China’s economy has become intertwined with the U.S., five years after an American real estate bust elicited finger-pointing at the role Chinese funds played in cheap U.S. mortgages. The 10-year Treasury yield fell from over 3% at the start of the year to an 11-month low of 2.44% at the end of the May; it more recently traded at 2.60%. The push lower in yields came even amid signs that the U.S. labor market recovery is picking up. All things being equal, yields were primed to rise.

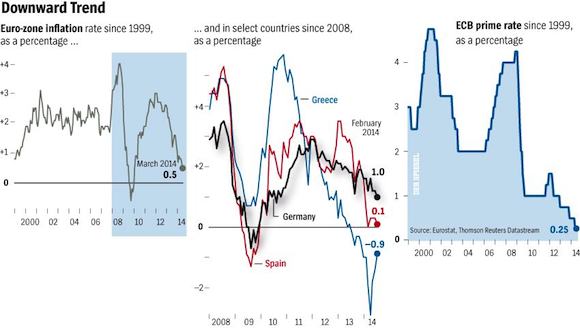

The dollar has similarly moved at cross-purposes to what’s expected as the economy strengthens and the Federal Reserve starts to tighten monetary policy. The dollar fell 0.2% against the euro in the first quarter, even as declining euro-zone inflation made it more likely that the European Central Bank would have to ease further. The dollar is up 1.5% against the euro this year, a modest bump compared to expectations. As U.S. Treasury yields have fallen this year, companies and consumers have found it less expensive to borrow money. Simultaneously, the lack of a major dollar rally against the euro means that U.S. exports are more competitive than they were expected to be.

Among the variety of explanations, demand from China continues to grab the attention of traders and strategists. It starts with the depreciation of the Chinese yuan against the dollar in 2014. Some attributed the move to the government’s desire to shake out speculators betting on a continued rise in the Chinese currency, while others point to the fact that a weaker currency makes Chinese exports more attractive. Whatever the reason, the dollar rose 2.7% against the yuan in the first quarter of 2014, marking the first quarterly gain since the three months ended June 2012, according to FactSet data. To accomplish that depreciation, China has sold yuan and bought dollars, leaving it with a huge pile of American currency in its reserve. In the first quarter, China’s official data show its foreign-exchange reserves rose by $129 billion to $3.95 trillion, touching an all-time high.

The myth of central bank omnipotence.

• Don’t Worry, Central Banks Have Your Back! (Alhambra)

The biggest bubble in the world right now is the belief in central bank omnipotence. The biggest risk takers in the world right now reside within the confines of the global central banks, especially the US Federal Reserve. They are taking huge risks with policies they barely understand and while one could excuse them for at least attempting to do what other policymakers won’t, it is hubris to believe they will see in real time what they have until recently denied even with the benefit of hindsight. This belief in omnipotence is not just something the general public has swallowed but extends even to the people who run the world’s central banks. The bulls of the world believe the world’s central banks have it all under control. So Don’t Worry, Be Bullish. You’ll probably be right until the myth of central bank omnipotence, one the Fed has fostered and has no macro-prudential policy to offset, is finally punctured.

Get ’em out.

• Central Banks Becoming Major Investors In Stock Markets (MarketWatch)

Some leading central banks have become major players on world equity markets in a development that could potentially contribute to overheated asset prices. The buildup of central-banking interest in equities is one of the unexpected consequences of the last few years’ fall in interest rates, which has depressed the returns on central banks’ foreign exchange reserves and driven them to find alternative investment targets. In the years since the financial crisis, central banks have leapt to the forefront of public policy making. They have taken responsibility for lowering interest rates, for maintaining stability of financial institutions, and for buying up government debt to help economies recover from recession. Now it seems that they have become important in another area, too, in starting to build up holdings of equities. Central banks as investors need to cope with demands wrought by sheer size — competition, complexity and cost.

Many of these challenges are self-feeding. Whereas 20 years ago only a small number of public investors carried genuine weight in investment markets, the proliferation of such institutions is now a fact of life. Central banks’ foreign-exchange reserves have grown unprecedentedly fast, especially in the developing world. The same authorities that are responsible for maintaining financial stability are often the owners of the large funds that add to liquidity in many markets. Large and similar-minded public-sector investors can show herd-like behavior, seeking the illusive return, for example in the “search for yield” in many markets and thus creating fresh volatility. Evidence of an increase in equity-buying by central banks and other public-sector investors has emerged from a survey of publicly owned or managed investments compiled by the Official Monetary and Financial Institutions Forum (OMFIF), a global research and advisory group.

The OMFIF research publication, Global Public Investor (GPI) 2014, launched on June 17, is the first comprehensive survey of $29.1 trillion worth of investments held by 400 public-sector institutions in 162 countries. The report focuses on investments by 157 central banks, 156 public pension funds and 87 sovereign funds. There are worries that central banks may be over-stretching themselves by operating in too many areas. Jens Weidmann, president of Germany’s Bundesbank – which retains a highly important, conservative role in the euro area in spite of the establishment of the supranational European Central Bank to run the continent’s single currency – spoke yearningly last week of the need for “central banks to shed their role as decision-makers of last resort and, thus, to return to their normal business.” He said this “would help to preserve the independence of central banks, which is a key precondition to maintaining price stability in the long run.”

A 10-year old vulture funds suit.

• Argentina Refuses To Submit To US Supreme Court ‘Extortion’ On Debt (FT)

President Cristina Fernández said that Argentina cannot comply with US court orders to pay $1.5bn in cash to winners of a decade-long debt dispute, the position her country was left in on Monday when the US Supreme Court refused to hear her government’s final appeal. Delivering a nationally broadcast address Monday night, Ms Fernández expressed willingness to negotiate, but said there was no way that Argentina could pay in cash, in full, starting just two weeks from now, which is what the US courts have ordered. “What I cannot do as president is submit the country to such extortion,” Ms Fernández said. Under the US court orders, Argentina must hand over $907m to the plaintiffs, or lose the ability to use the US financial system to pay an equal amount due June 30 to holders of other Argentine bonds.

Ms Fernández said the total owed to the plaintiffs is $1.5bn including interest, and paying it all immediately in cash in the way that the courts had ordered could trigger another $15bn in other cash payments to the remaining holders of defaulted debt. That “is not only absurd but impossible”, since it represents more than half the central bank’s remaining foreign reserves, she said. She vowed to keep making payments on the vast majority of the country’s performing debts, which are held by bondholders who agreed previously to provide debt relief that enabled Argentina to rebound from its economic crisis of 2001. Even if Argentina cannot use the US financial system to do so, she said, teams of experts were working on ways to avoid such a default and keep Argentina’s promises. Meanwhile, she suggested that she has a moral obligation not to make the court-ordered payments to NML Capital and other investors she calls “vulture funds”.

This could be the consequence.

• Argentina Debt Crisis Fears Grow After US Supreme Court Ruling (Guardian)

Fears of a fresh debt crisis in Argentina intensified after a ruling by the US supreme court left South America’s second biggest economy facing the choice of paying so-called “vulture funds” in full or risk a fresh debt default. Share prices fell by 6% at the start of trading in Buenos Aires and the price of Argentinian bonds fell after America’s highest court refused to hear an appeal against a ruling by a lower court that came down in favour of creditors who bought up debt worth $1.3bn (£770m) at rock-bottom prices after the financial crisis of more than a decade ago. The ruling is the culmination of a decade-long legal battle in which Argentina has sought to avoid paying creditors who refused to accept the terms of a debt restructuring that followed the country’s savage financial crisis of 2001-2.

In an attempt to make the country’s debt more manageable, the then government in Buenos Aires offered bondholders a deal in which they would get regular payments of interest provided they accepted a more than 70% reduction in the value of their investment. More than 92% of creditors agreed to the offer – in many cases reluctantly – but a number of hedge funds, spearheaded by Paul Singer’s NML corporation held out. Argentina argued that the funds bought most of the debt at a deep discount after the default and have sought to thwart the country’s efforts to restructure in two separate debt swaps in 2005 and 2010. The country, which grew rapidly after it devalued the peso and defaulted on around $100bn of debt in 2002 but has since suffered from uncomfortably high levels of inflation, is now under pressure to come to terms with the hedge funds before the next scheduled payments on the restructured debt at the end of the month. If it refuses or fails to do so, it would technically be in default.

And it will cut it again. And again.

• IMF Cuts US 2014 Growth Forecast by 30% (WSJ)

The International Monetary Fund, forecasting that U.S. inflation will sit below the Federal Reserve’s 2% target through 2017, said the central bank should keep its policy rate near zero even longer than investors now expect. In its annual review of the U.S. economy, the IMF cut its forecast for U.S. economic growth this year by 0.8%age point to 2%, citing a harsh winter, a struggling housing market and weak international demand for the country’s products. The fund maintained its 3% growth outlook for next year, saying a meaningful economic rebound is under way. Still, the IMF said significant slack remains in the economy and U.S. officials must do more to stimulate growth in the near term. At the same time, the U.S. must cut spending and raise revenue in the long term to avoid public debt overwhelming the country’s finances, the fund said.

The remarks came ahead of a Fed policy meeting this week where officials will consider whether to change or clarify guidance on future rate decisions. Markets currently expect the Fed to begin raising rates—from near zero where they’ve been since late 2008—in the middle of next year. “We’re not that certain,” IMF Managing Director Christine Lagarde said in a news conference. She pointed to uncertainty over how much unemployment will fall over the next year. Nigel Chalk, the IMF’s U.S. mission chief, said the fund expects “relatively high unemployment and a lot of slack in the labor market” to persist, and consumer inflation to remain well below target into 2017. That is why the fund said the U.S. government should boost near-term spending, notably on infrastructure, education, job training and child-care subsidies. Fund economists argue more government stimulus would take the burden off the Fed and reduce the risk that easy-money policies fuel too much risky investing.

Lip service.

• IMF Urges US To Raise Minimum Wage (MarketWatch)

The International Monetary Fund on Monday called on the U.S. to raise its minimum wage, but refrained from naming a specific level, saying that’s up to Congress. In its annual review of the U.S. economy, the IMF said increasing the minimum wage and expanding the Earned Income Tax Credit would help raise the incomes of millions of poor, working Americans. Christine Lagarde, the IMF’s managing director, told reporters an increase in the minimum wage — now $7.25 an hour — “would be helpful from a macroeconomic point of view.” The fund’s recommendation will be well received by congressional Democrats and the Obama administration, both of which have been pushing for an increase to $10.10. The proposed increase has been hampered by an election-year stalemate over major policy issues. House Republicans don’t plan to take up a bill to increase it and Senate Democrats don’t have enough members to get it through their chamber. Lagarde said the amount of an increase “needs to be decided by legislators.”

Pension funds and 401(k)’s are the only remaining source of wealth that has not been borrowed. Vultures circling.

• Retirees Suffer as 401(k) Rollover Boom Enriches Brokers (Bloomberg)

Kathleen Tarr says AT&T employees looked to her as “their de facto 401(k) expert.” Visiting their homes and offices, she advised them on their retirement plans as they called up balances on computer screens. Actually, Tarr worked for Royal Alliance Associates, a brokerage firm owned by insurer AIG. She encouraged hundreds of departing AT&T employees to roll over their retirement money into the kind of risky high-commission investments that Wall Street’s self-regulatory agency warns against on its website.

Tarr and her business partner reaped hundreds of thousands of dollars a year in commissions and trips to the Bahamas and Florida resorts. Not all of her clients fared as well, and 37 of them have filed complaints against her, according to Financial Industry Regulatory Authority records reviewed by Bloomberg News. Tarr and Royal Alliance say the investment choices were appropriate. “It’s scary,” said Maria Lew, a former AT&T administrative assistant and Tarr client whose account balance has fallen to $100,000 from $390,000. She fears she will lose her home, and her kitchen ceiling has a gaping hole because of a leak that will strain her budget to fix. “There are days when I go to sleep and I can’t stop thinking about it.”

• Study Asserts Startling Numbers Of Insider Trading Rogues (NY Times)

There is often a tip. Before many big mergers and acquisitions, word leaks out to select investors who seek to covertly trade on the information. Stocks and options move in unusual ways that aren’t immediately clear. Then news of the deals crosses the ticker, surprising everyone except for those already in the know. Sometimes the investor is found out and is prosecuted, sometimes not. That’s what everyone suspects, though until now the evidence has been largely anecdotal. Now, a groundbreaking new study finally puts what we’ve instinctively thought into hard numbers — and the truth is worse than we imagined. A quarter of all public company deals may involve some kind of insider trading, according to the study by two professors at the Stern School of Business at New York University and one professor from McGill University. The study, perhaps the most detailed and exhaustive of its kind, examined hundreds of transactions from 1996 through the end of 2012.

The professors examined stock option movements — when an investor buys an option to acquire a stock in the future at a set price — as a way of determining whether unusual activity took place in the 30 days before a deal’s announcement. The results are persuasive and disturbing, suggesting that law enforcement is woefully behind — or perhaps is so overwhelmed that it simply looks for the most egregious examples of insider trading, or for prominent targets who can attract headlines. The professors are so confident in their findings of pervasive insider trading that they determined statistically that the odds of the trading “arising out of chance” were “about three in a trillion.” (It’s easier, in other words, to hit the lottery.) But, the professors conclude, the Securities and Exchange Commission litigated only “about 4.7% of the 1,859 M.&A. deals included in our sample.”

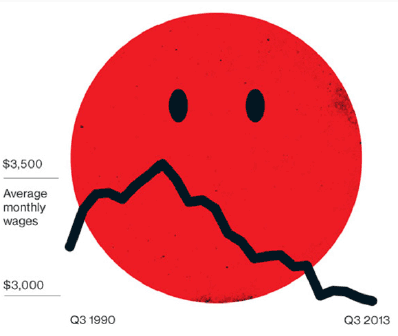

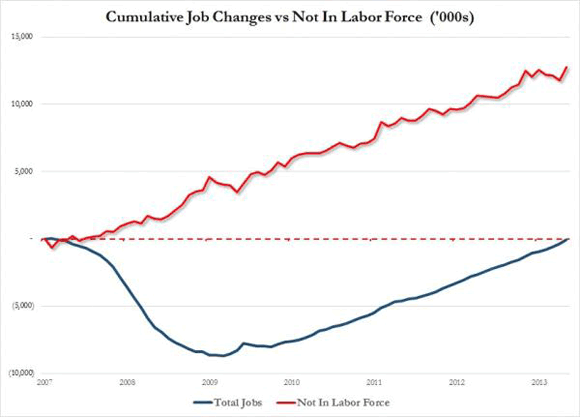

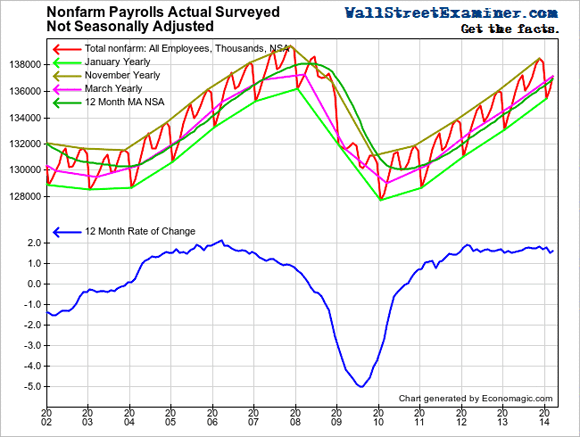

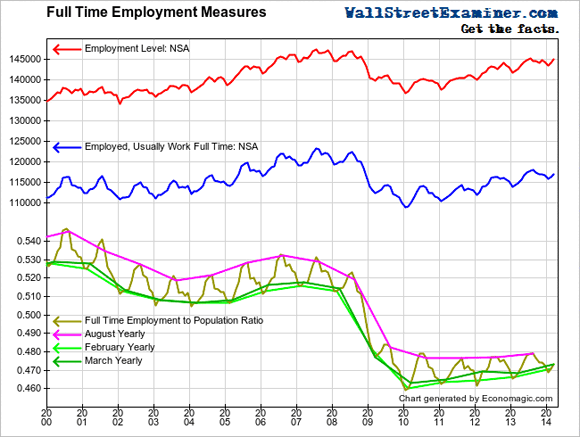

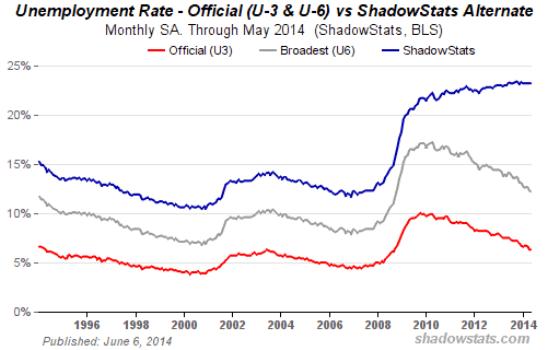

• They’re Lying To Us, Part 1: Unemployment (John Rubino)

One of the frustrating things about the monthly US jobs report is the way everyone focuses on the wrong number. The headline says “unemployment falls…” which sounds great, while the small print, which almost no one seems to read, explains that most of the improvement is due to people dropping out of the labor force. The number of new jobs created is frequently small or negative. It’s understandable – though of course not admirable – that the government would try to spin its economic statistics to make itself look good. What is less understandable is why the media, whose job is supposedly to report the truth, are willing to take the lie at face value. So it’s worth noting when someone breaks from the pack and actually analyzes the data, as the New York Times did today:

Measuring Recovery? Count the Employed, Not the Unemployed

South Carolina’s unemployment rate dropped to 5.3% in April, lower than in December 2007, when it stood at 5.5% on the eve of the Great Recession. The share of South Carolina adults with jobs, however, has barely rebounded. The same contrast is visible in most states. Unemployment rates, the most familiar and famous of labor market indicators, are nearing pre-recession lows. But the shares of adults with jobs — or employment rates — look much less healthy. The reason is that the numbers are not quite two sides of a coin. The employment rate counts everyone with a job, while the unemployment rate counts only people actively seeking work. It excludes most people who are unemployed.

Here’s a chart from John Williams at ShadowStats showing how unemployment would look if the government counted the people dropping out of the workforce as unemployed. The blue line includes all drop-outs, and is not only at Depression-era levels but is still rising. In an honest world, this “bleak reality,” as the New York Times puts it, would be the story. And though the Times omits the obvious discussion of why the government is focusing on the wrong number, the paper still deserves recognition for lifting the curtain a bit.

Do you want your environmentalists to play with your donations in the casino? If not, maybe there are nobler goals.

• Greenpeace Loses $5.2 million in Failed Currency Wager (Bloomberg)

Add Greenpeace International to the ranks of losers in the $5.3 trillion-a-day global foreign exchange market. The Amsterdam-based nonprofit organization said it lost $5.2 million last year after an employee bet that the euro wouldn’t strengthen against other currencies, Greenpeace said on its website. Greenpeace, which runs environmental campaigns in more than 40 countries, didn’t name the employee, who worked in its international finance unit and has been relieved of his position. “We are obviously very embarrassed and we are apologetic,” said Mike Clark, interim executive director of Greenpeace USA, in a telephone interview from Washington. “Mistakes do happen and we will make sure something like this will not happen again.”

Greenpeace said it entered into contracts last year to buy foreign currency at a fixed exchange rate while the euro was gaining in strength. This resulted in a loss against a range of other currencies. The euro rose 4.2% against the dollar in 2013. The organization said it didn’t find evidence of fraud and will conduct an independent audit into the employee’s actions. The loss added to Greenpeace’s €6.8 million 2013 budget deficit. Greenpeace said it had income of €72.9 million in 2013 out of a global budget of about €300 million. Greenpeace said it is funded with many different currencies and valuations change rapidly. The nonprofit said it will make changes to planned infrastructure projects, and won’t reduce spending on its core campaigns on environmental change.

• Heads, You Lose (Jim Kunstler)

The Iraq fiasco already threatens to spike oil prices way beyond the $107 level of today. That will crush whatever remains of the US economy all over again. God knows what it might do to the financialized Rube Goldberg shadow economy of counterparty booby traps that overlays an abyss of unpayable debt. You can’t squash price discovery forever, and one morning you might wake up to discover that the price of all those shenanigans was your political heritage. Oh, one more thing: not much attention is being paid to Saudi Arabia, but note that it has been the chief sponsor of Sunni insurgency everywhere but Saudi Arabia itself, and that the genie they let out of that flask will probably come back and tear that country to shreds, especially in so far as King Abdullah at age 90 is a virtual mummy, and that many other clans besides the Saud tribe have designs on the throne (and its mighty revenue stream from oil production).

Add to that inter-tribal tension the possibility of an ISIS-style insurgency in Saudi Arabia itself, with righteous Islamic puritan warriors drawn from all over the region, and you have quite the recipe for a global clusterfuck. Surely a lot of things would get broken in the event. Given all the jealousy and ill-feeling and toward Saudi Arabia, it is a wonder that over the last 30 years no mischief-makers have, for instance, blown up the Ras Tenura oil terminal on the Persian Gulf. That would put the schnitz on global oil supply lines on a world war scale. For the moment, it is hard to see how anything can be salvaged in Iraq. The ISIS may cause enough havoc there to shut down Iraqi oil production forever. They can start World War III. They can inspire insurgencies across the whole Islamic world and beyond. The caliphate they establish will then have to figure out how to support a population twenty times as great as the region truly can support with a medieval economy. Sooner or later, they’ll be selling shrunken heads in the souks.

• Bailout Economics 2014: Predators Prosper, Prey Perish (Tavakoli)

Almost six years after the financial crisis, JPMorgan, Citigroup, and Bank of America face fines of around $12 billion each for their role in mortgage malfeasance. In the context of the damage done and the bailout money poured into banks; the fines are miniscule and won’t even cover reparations in one or two blighted areas. This is after a series of post-crisis banking scandals revealing the fragility of the banking system and after JPMorgan Chase was the only bank to receive an SEC fine combined with an admission of wrongdoing for its well-publicized London Whale incident. Officers of JPMorgan Chase have not been held accountable. Moreover, banks harbor massive balance sheet risk against which they hold insufficient capital. Timothy Geithner, former president of the Federal Reserve Bank of New York, a bank regulator during the run up to the financial crises, and later the Secretary of the Treasury, claims that no one knew housing prices could fall.

He sounded like a very silly man when he said over and over on his recent book tour that sophisticated financiers didn’t understand the dynamics of a housing bubble. I never once heard him mention well-documented fraud, despite the massive fraud uncovered by Congressional investigations. With men of Geithner’s ilk having their back and the potential of huge financial rewards, many rational men of weak character assessed the risks and rewards of fraud and chose to enrich themselves, since the chances of being held accountable were slim. It turns out they were correct. No one I know disputes the need for bailouts and interventions, but all of us—except a handful who have banking officers’ direct numbers on speed dial for deal purposes—question the absence of indictments of senior banking officials (for a variety of forms of malfeasance) and the corrupt people they funded: among others, mortgage lenders. All of these banks continue to benefit from opacity and massive government support.

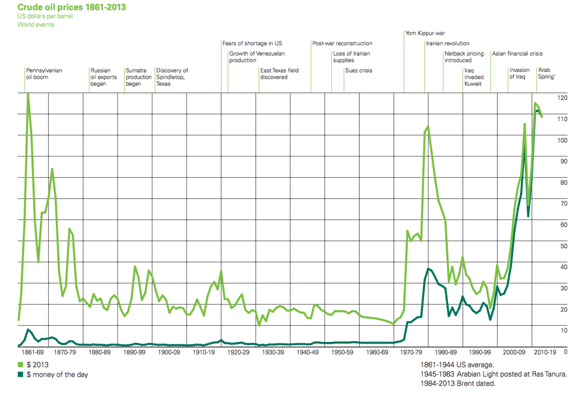

Nice graph.

• The History Of Oil Prices Since The Lincoln Presidency (BI)

Today, BP released its statistical energy review for 2014. Among the highlights: • Energy consumption accelerated despite sluggish economic growth, • Coal was the world’s fastest-growing energy source, thanks to China and India, • Average oil prices exceeded $100 per barrel for a third consecutive year, despite massive supply growth in the US. But our favorite chart is here: It shows the price of oil every year since Abraham Lincoln became president. It’s annotated with major oil shock events — though the first major event cited, the oil gusher in Titusville, Pennsylvania is slightly misleading. That in itself did not cause markets to surge, but rather a host of factors including the Civil War and the changing face of transport in America.

As was obvious from the get go. The economy trumps the environment.

• Coal’s Share Of Energy Market At Highest Level In 44 Years (Guardian)

Coal has reached its highest market share of global energy consumption for more than 40 years, figures reveal, despite fears that its high carbon emissions make it a prime cause of climate change. The use of coal for power generation and other purposes grew by 3% in 2013 – faster than any other fossil fuel – while its share of the market breached 30% for the first time since 1970, the BP Statistical Review reports. The figures were published as Prof Nick Stern, author of the influential climate change report the Stern Review, said his latest research indicated the economic risks of unchecked climate change were bigger than previously estimated. Europe is among the regions using more coal, increasing imports from the US, where coal has been displaced in power stations by even cheaper shale gas.

But developing countries such as China and India are also huge coal users, although BP pointed out that energy growth overall in China dropped to 4.7% last year from 8.4% in 2012. Christof Ruhl, BP’s chief economist and author of its statistical review, said this “dramatic slowdown” put a question mark over China’s official economic growth figure for 2013 of 7.7%. The accuracy of Chinese economic statistics have long been a subject for debate but few are willing to directly challenge them for fear of upsetting such an important emerging powerhouse. “It is not easy to reconcile the slowdown in energy growth numbers and official [gross domestic product] numbers … you can draw your own conclusions from that,”Ruhl said.

Wonder how many people who’ve lived off fishing for generations become the victims of industrial overfishing here.

• Pacific Nation Bans Fishing in One of World’s Largest Marine Parks (NatGeo)

A tiny island nation that controls a vast area of the Pacific Ocean has announced it will ban all commercial fishing in a massive marine park that is the size of California. Anote Tong, the president of Kiribati—a chain of islands about halfway between Hawaii and Fiji—announced Monday that commercial fishing will end in the country’s Phoenix Islands Protected Area on January 1, 2015. “We will also close the area around the southern Line Islands to commercial fishing to allow the area to recover,” said Tong, who spoke at the Our Ocean conference hosted by the U.S. State Department in Washington, D.C. The southern Line Islands also will be closed to fishing by the beginning of next year.

The Phoenix Islands and the southern Line Islands represent some of the most pristine coral reef archipelagos in the Pacific, says National Geographic Explorer-in-Residence Enric Sala, who led the first underwater expedition to the five uninhabited southern Line Islands in 2009 as part of National Geographic’s Pristine Seas project. Sala’s team of scientists found healthy coral reefs, abundant predator populations, and pristine lagoons carpeted with giant clams and shark nurseries. “Diving in the southern Line Islands is like getting in a time machine and traveling back to the reefs of the past, when sharks—and not humans—were the top predators,” says Sala. Marine scientist Amanda Keledjian of Oceana, an international nonprofit focused on ocean conservation, calls Kiribati’s announcement “very significant.” Decreasing the impact of fishing will “preserve biodiversity, large predators, and reefs,” says Keledjian.

Good.

• Obama Will Propose Vast Expansion Of Pacific Ocean Marine Sanctuary (WaPo)

President Obama on Tuesday will announce his intent to make a broad swath of the central Pacific Ocean off-limits to fishing, energy exploration and other activities, according to senior White House officials. The proposal, slated to go into effect later this year after a comment period, could create the world’s largest marine sanctuary and double the area of ocean globally that is fully protected. The announcement — details of which were provided to The Washington Post — is part of a broader push on maritime issues by an administration that has generally favored other environmental priorities. The oceans effort, led by Secretary of State John F. Kerry and White House counselor John D. Podesta, is likely to spark a new political battle with Republicans over the scope of Obama’s executive powers.

The president will also direct federal agencies to develop a comprehensive program aimed at combating seafood fraud and the global black-market fish trade. In addition, the administration finalized a rule last week allowing the public to nominate new marine sanctuaries off U.S. coasts and in the Great Lakes. Obama has used his executive authority 11 times to safeguard areas on land, but scientists and activists have been pressing him to do the same for untouched underwater regions. President George W. Bush holds the record for creating U.S. marine monuments, declaring four during his second term, including the one that Obama plans to expand. Under the proposal, the Pacific Remote Islands Marine National Monument would be expanded from almost 87,000 square miles to nearly 782,000 square miles — all of it adjacent to seven islands and atolls controlled by the United States. The designation would include waters up to 200 nautical miles offshore from the territories.