Russell Lee Flood refugee in schoolhouse at Sikeston, Missouri January 1937

A strange point of view is expressed in George Mason University economics professor Tyler Cowen’s NY Times article ‘The Lack of Major Wars May Be Hurting Economic Growth’, strange in more ways than just the obvious ones. Of course we find it counterintuitive to link growth to warfare. And of course we don’t like to make a link like that. But there’s a lot more here than meets the eye. For one thing, the age-old truth that correlation does not imply causality, something Cowen hardly seems to consider at all. Which is curious, and certainly makes his arguments carry a whole lot less weight, and interest. It makes his whole article just about entirely one-dimensional. Here’s an excerpt:

The Lack of Major Wars May Be Hurting Economic Growth

The continuing slowness of economic growth in high-income economies has prompted soul-searching among economists. They have looked to weak demand, rising inequality, Chinese competition, over-regulation, inadequate infrastructure and an exhaustion of new technological ideas as possible culprits. An additional explanation of slow growth is now receiving attention, however. It is the persistence and expectation of peace. The world just hasn’t had that much warfare lately, at least not by historical standards. Some of the recent headlines about Iraq or South Sudan make our world sound like a very bloody place, but today’s casualties pale in light of the tens of millions of people killed in the two world wars in the first half of the 20th century. Even the Vietnam War had many more deaths than any recent war involving an affluent country.

Cowen misses an elephant-sized potential culprit of the continuing slowness of economic growth: debt, in particular the exponentially fast growing debt levels that the – western – has seen since the 1970s. And which have grown to such proportions today that not including them in a list of possible causes is even suspicious.

Counterintuitive though it may sound, the greater peacefulness of the world may make the attainment of higher rates of economic growth less urgent and thus less likely. This view does not claim that fighting wars improves economies, as of course the actual conflict brings death and destruction. The claim is also distinct from the Keynesian argument that preparing for war lifts government spending and puts people to work. Rather, the very possibility of war focuses the attention of governments on getting some basic decisions right – whether investing in science or simply liberalizing the economy. Such focus ends up improving a nation’s longer-run prospects.

A curious argument is made here: a government’s focus on liberalizing an economy would bring more growth. While one might even be inclined to believe that in the present, as IMF-induced ideas of reform and liberalization are all the fad, what proof is there of it in historical records? For instance, did Germany, Japan, Russia and the US actually liberalize their economies in the late 1930s?

Tyler Durden has a respectable response to Tyler Cowen’s piece:

New York Times Says “Lack Of Major Wars May Be Hurting Economic Growth”

The fun part will be when economists finally do get their suddenly much desired war (just as they did with World War II, and World War I before it, the catalyst for the creation of the Fed of course), just as they got their much demanded trillions in monetary stimulus. Recall that according to Krugman the Fed has failed to stimulate the economy because it simply wasn’t enough: apparently having the Fed hold 35% of all 10 Year equivalents, injecting nearly $3 trillion in reserves into the stock market, and creating a credit bubble that makes the 2007 debt bubble pale by comparison was not enough. One needs moar! And so it will be with war. Because the first war will be blamed for having been too small – it is time for a bigger war. Then an even bigger war. And so on, until the most worthless human beings in existence – economists of course – get their armageddon, resulting in the death of billions.

Perhaps only then will the much desired GDP explosion finally arrive? Luckily for Cowen, he stops from advocating war as the ultimate panacea to a slow growth (at least for now: once the US enters a recession with another quarter of negative growth, one can only imagine what lunacy Krugman columns will carry). Instead he frames it as an issue of trade offs: “We can prefer higher rates of economic growth and progress, even while recognizing that recent G.D.P. figures do not adequately measure all of the gains we have been enjoying. In addition to more peace, we also have a cleaner environment (along most but not all dimensions), more leisure time and a higher degree of social tolerance for minorities and formerly persecuted groups. Our more peaceful and — yes — more slacker-oriented world is in fact better than our economic measures acknowledge.”

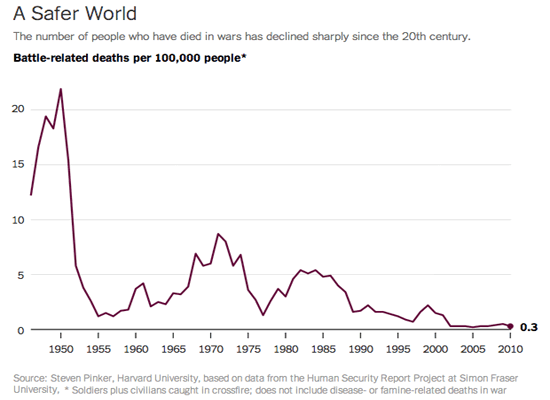

But Durden doesn’t bring up, let alone address, the debt situation either. Let’s go to the graph Cowen posted with his article, and then talk correlation and causality:

So yes, there were fewer battle related deaths. And over the past years, we’ve seen less economic growth. But how and why does that mean one leads to another? One more thing, before we continue, about debt: without having the ‘made for the hockey stick model’ exponential rise in debt levels basically ever since Nixon dumped Bretton Woods – or gold – in 1971, it should be awfully obviously clear to everyone that we would have much less economic growth, at least as far as it’s expressed in GDP numbers and the like. We have borrowed much of our growth since the 1970s, we just didn’t realize it at first, and many still don’t.

John Haskell in the Bangor Daily News has another reaction to Cowen in ‘War and Economic Growth’ , in which he claims, quoting Ezra Klein, that the reason government R&D spending is inefficient is that it’s tied up in military projects – I think his ‘defense’ is a very manipulative and misleading term to use in this context -. Still what neither do address is why that is. Though, granted, they do suggest that while it may be economically inefficient, it is ‘politically efficient’.

And yes, there is some possible link between that and my own idea that R&D spending is tied up in defense projects, because 1) that’s where it was in times the US did indeed go to war, and the idea stuck, because 2) this situation solidified the position of the military industrial complex, which knows just what politicians to target with which lobbyists. In fact, since Eisenhower warned the American people about it, it’s grown enormously and should today really be labeled the financial military political industrial complex. At least it now it truly deserves the moniker ‘complex’.

However that may be, Cowen’s is overall still a strange argument. Because a ‘lack of war’ is not the only thing that changed since the ‘glory days’ of economic growth. Ever since the ‘battle related deaths’ peak in the graph, which occurred in 1950, and the later and smaller peak in 1970, not only did debt rise exponentially, so did for instance the world population, which went from 2.5 billion in 1950 to almost double 3.7 billion in 1970 to almost double again 7.1 billion today. And while undoubtedly some part of that can be explained by a ‘lack of warfare’, then again, a probably much bigger part of it is due to better medicine, falling child death rates and longer life expectancies. I’m not claiming this leads to lower economic growth, that’s Cowen’s hobby horse, I’m just saying that fewer war casualties is just one stat that changed since WWII, and I find it far-fetched – I’m being polite here – to pick out one stat from a very long list and hammer it till you’re tired. Because he does that, and ignores so much else, Cowen and his argument have very little credibility.

And I can go on. Another thing that changed since 1950 is that people, certainly in the west, got a whole lot richer. Since about 1980 more and more of that was borrowed, but the feeling remained. And still does, because people are simply not told that they have become much poorer. And as long as the feeling persists, we might want to consider that maybe we have arrived at such a thing as enough economic growth after all. That maybe economic growth is just so yesterday, and peace is the new black.

Maybe the concept of economic growth belongs only in outdated economics textbooks, from whence spouts the notion that growth equals happiness, and therefore if war is the only way to achieve – strong – growth, we can be happy only when we wage war. Maybe people don’t want all that economic growth al that much, maybe they have a notion deep inside that they’re satisfied, that they have enough gadgets and frills, and they just want their kids to grow up to be happy, and absolutely not send them to war. And you can call that a ‘slacker’ attitude if you will – again a manipulative choice of words -, but that’s perhaps nothing but yet another misleading term.

There is no rational ground on which to believe that there is no possibility of people reaching a point of satiation when it comes to growth. The biggest problem there is seems more likely to be the system in which we live, which is still based on notions that no longer hold, on economics textbooks that are based solely on political preferences (economics is nothing but politics in disguise), and on groups that have held on to power, and expanded it, for 100 years or more, and whose grip on power depends on their ignorant foot soldiers believing in growth. Those groups may win the day and lead us into more and, given the “improvements” in weapons systems, more extreme warfare. But that doesn’t in any way lend credence to Tyler Cowen’s ‘war and growth’ ideas, especially when he refuses to acknowledge other growth correlations such as debt and population numbers, and thereby fails to establish any causality. This myth is busted.

• The Lack of Major Wars May Be Hurting Economic Growth (NY Times)

The continuing slowness of economic growth in high-income economies has prompted soul-searching among economists. They have looked to weak demand, rising inequality, Chinese competition, over-regulation, inadequate infrastructure and an exhaustion of new technological ideas as possible culprits. An additional explanation of slow growth is now receiving attention, however. It is the persistence and expectation of peace. The world just hasn’t had that much warfare lately, at least not by historical standards. Some of the recent headlines about Iraq or South Sudan make our world sound like a very bloody place, but today’s casualties pale in light of the tens of millions of people killed in the two world wars in the first half of the 20th century. Even the Vietnam War had many more deaths than any recent war involving an affluent country.

Counterintuitive though it may sound, the greater peacefulness of the world may make the attainment of higher rates of economic growth less urgent and thus less likely. This view does not claim that fighting wars improves economies, as of course the actual conflict brings death and destruction. The claim is also distinct from the Keynesian argument that preparing for war lifts government spending and puts people to work. Rather, the very possibility of war focuses the attention of governments on getting some basic decisions right — whether investing in science or simply liberalizing the economy. Such focus ends up improving a nation’s longer-run prospects.

It may seem repugnant to find a positive side to war in this regard, but a look at American history suggests we cannot dismiss the idea so easily. Fundamental innovations such as nuclear power, the computer and the modern aircraft were all pushed along by an American government eager to defeat the Axis powers or, later, to win the Cold War. The Internet was initially designed to help this country withstand a nuclear exchange, and Silicon Valley had its origins with military contracting, not today’s entrepreneurial social media start-ups. The Soviet launch of the Sputnik satellite spurred American interest in science and technology, to the benefit of later economic growth.

• That’s Right -Blame It On The Lack Of War! (Zero Hedge)

It is no secret that as the Fed’s centrally-planned New Normal has unfolded, one after another central-planner and virtually all economists, have been caught wrong-footed with their constant predictions of an “imminent” economic surge, any minute now, and always just around the corner. And yet, nearly six years after Lehman, five years after the end of the last “recession” (even as the depression for most rages on), America is about to have its worst quarter in decades (excluding the great financial crisis), with a -2% collapse in GDP, which has been blamed on… the weather.

That’s right: economists are the only people who will look anyone in the eye, and suggest that it was harsh weather that smashed global trade, pounded retail sales (in the process freezing the internet because people it was so cold nobody shopped online), and even with soaring utility usage and the Obamacare induced capital misallocation still led to world’s largest economy to a 5% plunge from initial estimates for 3% growth in Q1. In other words, a delta of hundreds of billion in “growth lost or uncreated” due to, well, snow in the winter.

Sadly for the same economists, now that Q2 is not shaping up to be much better than Q1, other, mostly climatic, excuses have arisen: such as El Nino, the California drought, and even suggestions that, gasp, as a result of the Fed’s endless meddling in the economy, the terminal growth rate of the world has been permanently lowered to 2% or lower. What is sadder for economists, even formerly respectable ones, is that overnight it was none other than Tyler Cowen who, writing in the New York Times, came up with yet another theory to explain the “continuing slowness of economic growth in high-income economies.” In his own words: “An additional explanation of slow growth is now receiving attention, however. It is the persistence and expectation of peace.” That’s right – blame it on the lack of war!

As I said a few times: it’s too profitable, once it’s been widely accepted, to not delve into, even for Beijing.

• China’s Collateral Rehypothecation Fraud Is Systemic (Zero Hedge)

It’s official – everyone’s involved! According to the 21st Century Business Herald, at least 17 financial institutions involved in copper, aluminum and other nonferrous metals financing business face losses of almost 15 billion Yuan (not including the contagious rehypothecated collateral chains involved) due to the over-invoicing of the Qingdao port. Crucially, it appears that the evaporation of collateral (i.e. multiple loans secured by the same collateral) has been confirmed officially and banks such as Standard Chartered have already ceased any new business via this supposedly secured channel. Via Caijing (via Google Translate),

According to the 21st Century Business Herald, Qingdao, where at least 17 banks involved in copper, aluminum and other nonferrous metals financing business, which 17 banks, including China Eximbank, the establishment of diplomatic five rows of workers and peasants, China, Minsheng, Industrial, Investment, CITIC five medium-sized banks, also includes Prudential, Qilu, Rizhao, Weihai, Weifang, Shandong and other local financial institutions, coupled with a remote city in Hebei banking firm. Informed sources said 17 financial institutions involved in the financing amount Qingdao Port trade finance business in non-ferrous metals 14.8 billion yuan from top to bottom, including single-family Eximbank in 4 billion and down, accusing him of involving an amount of more than 1 billion are down.

At the end of the first quarter of 2014, the outstanding loans in foreign currencies, Qingdao 998.46 billion, of which the balance of the manufacturing sector was 228.53 billion; 15 billion equivalent to 1.5% of total outstanding loans to local financial institutions, manufacturing 6.5% of the loan balance . Qingdao Port nonferrous metals repercussions in the financial institutions financing fraud also caused the divergence. Next, the bank is bound to tighten credit financing, a thorough investigation of existing financing facilities of collateral, which will further exacerbate the bad debt exposure process. [..]

As early as the end of April, the CBRC supervision quarterly meeting, the China Banking Regulatory Commission had warning, “the steel industry trade violations financing model has been copied to sign the copper, coal, iron ore, soybeans and other commodities trade finance field.” [..] Commodity trade finance risks for the first time and industries with excess capacity, and real estate financing platform tied to become the focus of regulatory agencies in the field of credit risk prevention. For a number of foreign banks involved in financing scam Qingdao Port nonferrous metals foreign banks, including Standard Chartered Bank, had previously announced a halt for some Chinese metal financing business from new customers.

The effects are already clear in Copper and Iron Ore prices.. next we see if the physical gold bid re-appears as CCFD unwinds continue and credit contracts for all but the most creditworthy names in China (and there’s not many of them left).

Behind the times and weak from the Economist.

• Commodity Finance In China: Collateral Damage (Economist)

At the best of times, seizing collateral on defaulted loans in China is a fraught task, plagued by patchy enforcement. These are not the best of times in the port of Qingdao, a trading hub in the north-east. Police are investigating whether companies have committed fraud by pledging the same holdings of copper and aluminium to multiple banks, multiple times. The banks are scrambling to see how much of the metal sitting in Qingdao’s warehouses actually belongs to them. More than just a fraud, the tale exposes China’s financial idiosyncrasies and the lengths to which firms sometimes go to borrow money. Regulators have tried to choke off credit to metal traders in recent years as part of efforts to slow pell-mell construction. Traders have devised a simple workaround.

Banks have been willing to grant them letters of credit to fund purchases of metal. The traders have used the credit to buy some and then, on occasion, immediately resell it, leaving them with cash to invest in high-yielding shadow-bank products. This ruse can earn enticing returns. The gap between the traders’ investment returns and their funding costs can reach ten percentage points. And that is before fraud enters the picture. By obtaining letters of credit from different banks to buy the same copper again and again, traders amplify their returns. The crucial ingredient in this deceit is a receipt of ownership issued by the warehouse where the metal sits. The 21st Century Business Herald, a Chinese newspaper, said receipts tied to the same stash of metal had been issued ten times.

Financial alchemy of this kind is common on the margins of China’s banking system. But in this case, it comes with global connections. First, there is China’s demand for commodities. The Qingdao investigation will make banks more reluctant to grant letters of credit, even when legitimate, hampering imports and so weighing on prices. Second, foreign banks have been big issuers of letters of credit to Chinese metals traders. Goldman Sachs estimates that commodity-backed deals account for as much as $160 billion, or about 30%, of China’s short-term foreign-exchange borrowing. Only a tiny sliver of that is believed to be at risk in Qingdao, but foreign creditors may become more skittish. Call it collateral damage.

Can only get worse.

• Iron Ore Declines to Lowest in 21 Months Amid Qingdao Port Probe (Bloomberg)

Iron ore fell to the lowest since 2012 on concern that a probe into commodity financing at China’s Qingdao port may hurt demand for the raw material amid a global seaborne glut. Ore with 62% iron content delivered to the port of Tianjin declined 0.7% to $90.90 a dry ton today, the lowest level since September 2012, according to The Steel Index Ltd. Prices lost 3.8% this week and retreated in eight of the past nine weeks. Chinese and foreign banks are examining loans linked to metals at Qingdao amid concern that risks are more widespread in the country, where traders use commodities from copper to iron ore and rubber to get funding.

Iron ore slumped 32% this year as mining companies from BHP Billiton to Rio Tinto expanded output, deepening a global surplus as growth slowed in China, the world’s largest buyer. Banks are more vigilant about iron ore financing,” Marcus Garvey, a London-based commodity analyst at Credit Suisse Group AG, said by e-mail. “Credit is clearly tight for a lot of people in the sector.” Banks including Standard Chartered Plc, Citigroup Inc. and Standard Bank Group are reviewing potential fallout from Qingdao, where officials are checking whether metal stockpiles fell short of collateral obligations.

• Detroit Reaches Deal With Bondholders in Bankruptcy Talks (BW)

Detroit cleared another hurdle in its effort to end a landmark $18 billion municipal bankruptcy, reaching a deal with the insurer of taxpayer-backed bonds on how to treat debt holders. Details are being put into final written form, according to a statement filed today with the court in Detroit by the mediators appointed to help broker a deal. The mediators didn’t say how much the bondholders, who are owed about $163.5 million, would recover or how much insurers would have to pay to cover any losses on the limited tax, general obligation bonds, or LTGOs. “The settlement recognizes the unique status and niche of the LTGOs in the municipal finance market,” the mediators said.

Municipal bond investors have been watching Detroit’s bankruptcy because the city has argued that its general obligation bonds aren’t secured by any collateral. That contradicted long-held assumptions among investors that such bonds had priority over other obligations, such as some government services and employee benefits. “It’s an enormous negative for general obligation bondholders to receive anything below par,” Matt Fabian, managing director of Municipal Market Advisors, a Concord, Massachusetts, research firm, said in a phone interview. “It implies more risk for general obligation secured bondholders in Michigan.”

And that’s a good thing. Group psychology is very different from individual psychology, and what works in one often does not in the other. Think modest.

• We’re Losing Faith In Global Change (Observer)

Localism is all in the interpretation. So to Eric Pickles, it’s decentralising planning. In surfing culture, it’s the right, assumed by local surfers, to chase non-locals off their wave breaks. And now environmental localism is beginning to mean something too. Something big. Might it even refresh the parts other green movements can’t reach, and take them mainstream? Certainly, the London venue where I hosted the Observer Ethical Awards last week was bursting with eco talent from grassroots organisations. This has been the case over the past two years – a surge of entrants and finalists who aren’t waiting for legislative change or government leads and are forging ahead with sustainable plans in their own communities. Case in point: the winners of our inaugural community energy award, Lancaster Co-housing, who fought off property developers to claim their site and have constructed an impressive co-housing community.

According to a new report from the Fabian Society, Pride of Place, this grassroots, people-power approach is on the money. Not only is this a trend – it’s also something that needs to happen if environmentalism is to have any chance of mainstream traction in the UK and, you might contend, any chance of achieving anything significant. As it stands, environmentalism is not pulling in the punters. The report’s authors, Natan Doron and Ed Wallis, lay the blame at the feet of a movement with too great a dependency on three things: elite-level engagement, the rationalism of climate science and the agency of top-down legislation. Environmentalism, they argue, should begin at home, focusing on issues that people are actually concerned with, rather than “abstract” international issues, such as climate change.

Suggesting all this to Rob Hopkins, who set up the UK’s first Transition Town, in Totnes, south Devon, in 2005, is the very definition of teaching your grandmother to suck eggs. The theory behind the Transition network is that communities build resilience through sustainable blueprints for energy, food and transport and more. This will enable them to cope when the world runs out of oil or climate change kicks in. In practice, the apocalyptic motivation seems to have been eclipsed as communities in 43 countries decide it’s just quite a smart way to live. “When people are presented with big-scale stuff they have no influence,” says Hopkins. “You have what we might call ‘a national debate’ but what’s that? If we had taken our energy blueprint the national government route and tried to lobby on a national level, we’d have found so many obstacles in our way, including resistance and barriers from lobbyists for national energy companies.”

It really is an eco”system”.

• Deforestation Leaves Fish Undersized And Underfed (BBC)

Deforestation is reducing the amount of leaf litter falling into rivers and lakes, resulting in less food being available to fish, a study suggests. Researchers found the amount of food available affected the size of young fish and influenced the number that went on to reach adulthood. The team said the results illustrated a link between watershed protection and healthy freshwater fish populations. The findings have been published in Nature Communications. “We found fish that had almost 70% of their biomass made from carbon that came from trees and leaves instead of aquatic food chain sources,” explained lead author Andrew Tanentzap from the University of Cambridge’s Department of Plant Sciences.

“While plankton raised on algal carbon is more nutritious, organic carbon from trees washed into lakes is a hugely important food source for freshwater fish, bolstering their diet to ensure good size and strength,” he added. Dr Tanentzap observed: “Where you have more dissolved forest matter you have more bacteria, more bacteria equals more zooplankton. “Areas with the most zooplankton had the largest, fattest fish,” he added, referring to the study’s results. The team of scientists from Canada and the UK collected data from eight locations with varying levels of tree cover around Daisy Lake, Canada, which forms part of the boreal ecosystem.

Smart and brave man.

• Pope Francis Warns The Global Economy Is Near Collapse (HuffPo)

The global economic system is near collapse, according to Pope Francis. An economy built on money-worship and war and scarred by yawning inequality and youth unemployment cannot survive, the 77-year-old Roman Catholic leader suggested in a newly published interview. “We are excluding an entire generation to sustain a system that is not good,” he told La Vanguardia’s Vatican reporter, Henrique Cymerman. (Read an English translation here.) “Our global economic system can’t take any more.” The pontiff said he was especially concerned about youth unemployment, which hit 13.1% last year, according to a report by the International Labor Organization. “The rate of unemployment is very worrisome to me, which in some countries is over 50%,” he said. “Someone told me that 75 million young Europeans under 25 years of age are unemployed. That is an atrocity.”

That 75 million is actually the total for the whole world, according to the ILO, but that is still too much youth unemployment. Pope Francis denounced the influence of war and the military on the global economy in particular: “We discard a whole generation to maintain an economic system that no longer endures, a system that to survive has to make war, as the big empires have always done,” he said. “But since we cannot wage the Third World War, we make regional wars,” he added. “And what does that mean? That we make and sell arms. And with that the balance sheets of the idolatrous economies — the big world economies that sacrifice man at the feet of the idol of money — are obviously cleaned up.”

Yeah, right…

• Citigroup, BofA Said to Face US Lawsuits as Talks Stall

Citigroup and Bank of America are facing the prospect of being sued by the Justice Department after officials broke off talks aimed at settling probes into the banks’ sales of mortgage-backed bonds. Justice Department officials suspended negotiations with the banks June 9 because they’re unsatisfied with the offers, said a person familiar with the discussions who asked not to be named because they are confidential. A civil lawsuit against Citigroup could be filed as early as next week, the person said. The department has asked for more than $10 billion from New York-based Citigroup and $17 from Bank of America, though prosecutors are willing to consider proposals below those amounts, the person said. Bank of America has offered about $12 billion while Citigroup has put forward less than $4 billion, the person said.

“Even though talks have broken off, it doesn’t mean they can’t be restarted,” after lawsuits are filed, said Matthew Axelrod, a former senior Justice Department official whose firm is handling lawsuits against banks, including Bank of America and Citigroup, over mortgage-backed securities. The Justice Department is taking a tougher approach following criticism that it hadn’t done enough to punish large institutions for their role in the collapse of home prices and ensuing financial market turmoil. Prosecutors are demanding multibillion-dollar penalties from banks for wrongdoing including tax evasion and sanctions violations and have used the threat of lawsuits to reach settlements.

HA!

• The Baltic Dry Index Is Having Its Worst Year Ever (Zero Hedge)

At 906, the Baltic Dry Index slumped to 12-month lows showing absolutely no signs whatsoever of the Q2 renaissance in global growth that has been heralded by all the highly-paid meteoroconomists. In fact, thanks to increasing fears over China’s commodity financing ponzi scheme, this is the worst year for the Baltic Dry on record. Of course, we will hear the echo chamber of ‘over-supply’ of ships rather than any ‘under-demand’ of actual aggregate product argument but the circularity of this argument is entirely lost on status quo huggers who viewed rising dry bulk commodity prices as indicative of growth (and built more ships) as opposed to the ponzi-financing scheme it really was… mal-investment writ large once again in a manipulated (and mismanaged) world.

• 1930s Show Monetary Reflation Won’t Revive Main Street (Alhambra)

On Monday I examined the character change of post-interest rate targeting recoveries. By comparing recession/recovery cycles before and after 1990 it becomes obvious that the entire process of economic cycles has been altered. As such, the relative track of the Great Recession earned that name in sharp contrast to the much shorter and less dramatic recessions between the end of World War II and 1990. I have been asked to add the Great Depression to that examination, particularly in contrast to the Great Recession. On its face, the Great Recession is dwarfed by the immense nature of the downturn of the 1930’s by any measure. That doesn’t mean there is nothing interesting about comparing the two periods. In fact, doing so leads to some striking similarities, if not in scale then at least in trajectory and shortcomings.

Using just the labor market, there are problems of data comparability since the Establishment Survey only goes back to 1939. What is available as a substitute is annual rather than monthly, and is modern rather than contemporary. Most statistical accounts from that age have been recreated using more “modern” techniques, which leads to both positive and negative attributes. In my analysis, there are more negatives in the highly adjusted, probabilistic series than the originals. With that in mind, for our purposes here I am using the factory employment and payroll indices in the original Federal Reserve Bulletins. These are, of course, narrower in scope, measuring just one economic sector, than the Establishment Survey, which tallies all business-related employment (though omitting most self-employment). Even with that caveat in mind, it makes a worthwhile contrast in how dramatic the collapse after June 1929 actually was measured against recent experience

What have we come to, and what’s yet to come?

• In 33 U.S. Cities, It’s Illegal to Feed the Homeless (PolicyMic)

The news: In case the United States’ problem with homelessness wasn’t bad enough, a forthcoming National Coalition for the Homeless (NCH) report says that 33 U.S. cities now ban or are considering banning the practice of sharing food with homeless people. Four municipalities (Raleigh, N.C.; Myrtle Beach, S.C.; Birmingham, Ala.; and Daytona Beach, Fla.) have recently gone as far as to fine, remove or threaten to throw in jail private groups that work to serve food to the needy instead of letting government-run services do the job.

Why it’s happening: The bans are officially instituted to prevent government-run anti-homelessness programs from being diluted. But in practice, many of the same places that are banning food-sharing are the same ones that have criminalized homelessness with harsh and punitive measures. Essentially, they’re designed to make being homeless within city limits so unpleasant that the downtrodden have no choice but to leave. Tampa, for example, criminalizes sleeping or storing property in public. Columbia, South Carolina, passed a measure that essentially would have empowered police to ship all homeless people out of town. Detroit PD officers have been accused of illegally taking the homeless and driving them out of the city.

The U.N. even went so far as to single the United States out in a report on human rights, saying criminalization of homelessness in the United States “raises concerns of discrimination and cruel, inhuman or degrading treatment.” “I’m just simply baffled by the idea that people can be without shelter in a country, and then be treated as criminals for being without shelter,” said human rights lawyer Sir Nigel Rodley, chairman of the U.N. committee. “The idea of criminalizing people who don’t have shelter is something that I think many of my colleagues might find as difficult as I do to even begin to comprehend.”

Must Read.

• Pentagon Preparing For Mass Civil Breakdown (Guardian)

A US Department of Defense (DoD) research programme is funding universities to model the dynamics, risks and tipping points for large-scale civil unrest across the world, under the supervision of various US military agencies. The multi-million dollar programme is designed to develop immediate and long-term “warfighter-relevant insights” for senior officials and decision makers in “the defense policy community,” and to inform policy implemented by “combatant commands.” Launched in 2008 – the year of the global banking crisis – the DoD ‘Minerva Research Initiative’ partners with universities “to improve DoD’s basic understanding of the social, cultural, behavioral, and political forces that shape regions of the world of strategic importance to the US.”

Among the projects awarded for the period 2014-2017 is a Cornell University-led study managed by the US Air Force Office of Scientific Research which aims to develop an empirical model “of the dynamics of social movement mobilisation and contagions.” The project will determine “the critical mass (tipping point)” of social contagians by studying their “digital traces” in the cases of “the 2011 Egyptian revolution, the 2011 Russian Duma elections, the 2012 Nigerian fuel subsidy crisis and the 2013 Gazi park protests in Turkey.” Twitter posts and conversations will be examined “to identify individuals mobilised in a social contagion and when they become mobilised.” Another project awarded this year to the University of Washington “seeks to uncover the conditions under which political movements aimed at large-scale political and economic change originate,” along with their “characteristics and consequences.” The project, managed by the US Army Research Office, focuses on “large-scale movements involving more than 1,000 participants in enduring activity,” and will cover 58 countries in total.

• Electronic War Games Blamed For Jets Vanishing Off Radars In Europe (RT)

Electronic military exercises were to blame for the mysterious disappearance of dozens of planes from air-traffic control screens in the heart of Europe, Slovak authorities have said. About 50 planes temporarily disappeared from radars in Austria, Germany, the Czech Republic, and Slovakia between June 5 and June 10, Austria’s flight safety monitor said. German and Czech air traffic control also reported brief disappearances. Slovakia blamed the outages on planned military exercises. “The disappearance of objects on radar screens was connected with a planned military exercise which took place in various parts of Europe…whose goal was the interruption of radio communication frequencies,” the Slovak air traffic services said in a statement. “This activity also caused the temporary disappearance of several targets on the radar display, while in the meantime the planes were in radio contact with air traffic controllers and continued in their flight normally.”

Right after the problem with the radars was detected, the organizing party was made aware and the exercises were stopped, Slovakia’s air traffic services added.Slovakia did not mention a military force involved in the exercises, but Austrian media pointed towards NATO. Austrian daily Kurier reported on June 7 that the first disappearance problems coincided with NATO conducting electronic warfare exercises in Hungary. During the exercises NATO was reportedly using devices that can interfere with enemy radar, according to the Telegraph. German air traffic control stated that it is trying to identify the cause of the outages. “Planes disappeared from screens for a matter of seconds, here and there. The outages were sporadic and not grave…It must have been an external source of disruption,” a spokesperson said. Authorities said the outages did not pose any serious threat.

Go VT!

• Trade Groups Sue Vermont Over GMO Labeling Law (Burlington Free Press)

Four national organizations whose members would be affected by Vermont’s new labeling law for genetically engineered foods filed a lawsuit Thursday in federal court challenging the measure’s constitutionality. “Vermont’s mandatory GMO labeling law — Act 120 — is a costly and misguided measure that will set the nation on a path toward a 50-state patchwork of GMO labeling policies that do nothing to advance the health and safety of consumers,” the Grocery Manufacturers Association said in a statement about the lawsuit. “Act 120 exceeds the state’s authority under the United States Constitution and in light of this GMA has filed a complaint in federal district court in Vermont seeking to enjoin this senseless mandate.” The Legislature passed the labeling law in April, and Gov. Peter Shumlin signed the bill in May. The labeling requirements would take effect in two years: July 1, 2016.

Lawmakers, the governor and the attorney general expected the law to be challenged in court. Trade groups had promised to fight the law in court. Attorney General William Sorrell noted Thursday he had advised lawmakers as they deliberated that the law would invite a lawsuit from those affected “and it would be a heck of a fight, but we would zealously defend the law.” “We have been gearing up,” Sorrell said when reached Thursday afternoon in New York City. His office had yet to be served with the complaint. “I want to see the nature of the attack on the law,” he said, but added, “I don’t think there are going to be any surprises.” The statement from the Grocery Manufacturers Association summarizes the grievances of the four plaintiff organizations: GMA, the Snack Food Association, the International Dairy Foods Association and the National Association of Manufacturers.

Home › Forums › Debt Rattle Jun 14 2014: The Busted Myth Of War And Growth