Henri Matisse Nu Blue IV 1952

Moody’s worries are the local government financing vehicles and state-owned enterprises, which are umbilically linked to the shadow banks.

You can’t run an entire economy from and in the shadows.

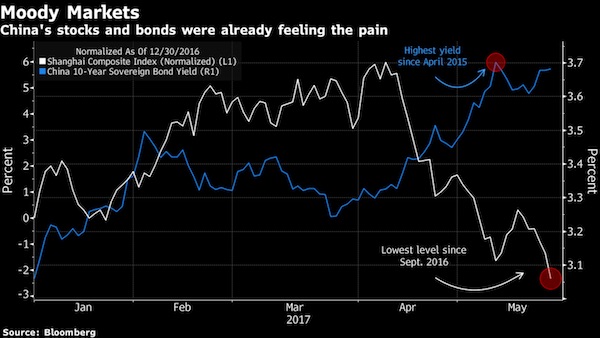

• China Hit by First Moody’s Downgrade Since 1989 on Debt Risk (BBG)

Moody’s Investors Service cut its rating on China’s debt for the first time since 1989, challenging the view that the nation’s leadership will be able to rein in leverage while maintaining the pace of economic growth. Stocks and the yuan slipped in early trading after Moody’s reduced the rating to A1 from Aa3 on Wednesday, with markets paring losses in the afternoon. Moody’s cited the likelihood of a “material rise” in economy-wide debt and the burden that will place on the state’s finances, while also changing the outlook to stable from negative. It’s “absolutely groundless” for Moody’s to argue that local government financing vehicles and state-owned enterprise debt will swell the government’s contingent liabilities, according to a response released by the Ministry of Finance. The ratings company has underestimated the capability of the government to deepen reform and boost demand, the ministry said.

It wouldn’t be the first time a rating company was behind the curve, nor is such pushback unique – U.S. Treasury officials questioned the credibility of a 2011 downgrade from Standard & Poor’s. Still, the move underscores broader doubts over whether President Xi Jinping’s government can simultaneously cut excessive leverage and steady growth, all with a twice a decade reshuffle of top party posts looming later this year. “It is a psychological blow that China will not take kindly to and absolutely speaks to the rising financial pressures,” said Christopher Balding, an associate professor at the HSBC School of Business at Peking University in Shenzhen. That said, “it doesn’t matter much in the grand scheme of things because so much of Chinese debt is held by state or quasi-state actors and minimal amounts are international investors.”

Total outstanding credit climbed to about 260% of GDP by the end of 2016, up from 160% in 2008. At the same time, China’s external debt is low by international standards, at around 12% of gross domestic product, according to the IMF, meaning that a downgrade isn’t likely to be as disruptive as it would be for nations more reliant on international funding. Overseas institutions’ holdings of onshore bonds dropped to 830 billion yuan ($121 billion) as of the end of March, from 853 billion yuan three months earlier, People’s Bank of China data show. That’s less than 1.5% of 63.7 trillion yuan of outstanding notes. Moody’s last cut China’s sovereign rating in 1989, when it downgraded the sovereign to Baa2 from Baa1, according to spokesperson, Manvela Yeung. Moody’s lowered China’s credit-rating outlook to negative from stable in March 2016, citing rising debt, falling currency reserves and uncertainty over authorities’ ability to carry out reforms.

Starting to be painful. At some point, Beijing total control will come up empty.

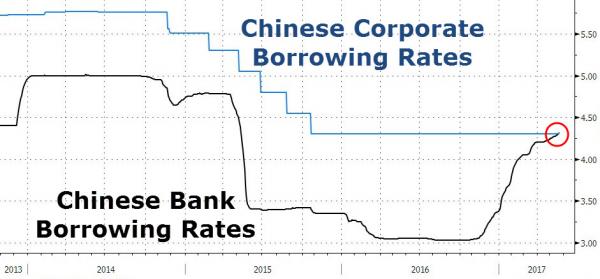

• Chinese Banks Are In Big Trouble (ZH)

That’s not supposed to happen… With the crackdown on financial system leverage underway, Chinese banks (and securities firms) are in big trouble. As we noted previously, China’s bond curve is inverted, yields are surging, and Chinese regulatory decisions shutting down various shadow-banking pipelines has crushed securities firms’ stocks. However, as Bloomberg points out, as China’s deleveraging efforts cut into banks’ profit margins, rising base funding costs and interbank credit risk concerns have pushed banks’ cost of borrowing beyond the rate they charge customers for loans for the first time in history. As the chart shows, the one-year Shanghai Interbank Offered Rate has exceeded the Loan Prime Rate, the first time this has happened since the latter was introduced in 2013. “This is probably just the beginning” and interbank funding costs will rise further amid the drive to reduce leverage, said Xu Hanfei at China Merchants Securities in Shanghai.

Wonderful from Chris Hamilton.

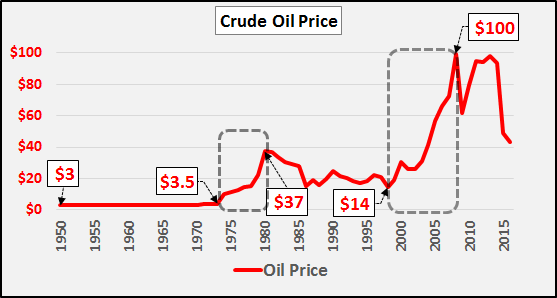

• American Exceptionalism – Population Growth vs Money Growth (Econimica)

Since 1971, and the disconnection of the dollar from a finite gold backing, the value of money (the dollar) has been determined by it’s purchasing power versus the inflation of the assets to be purchased. Thus printing more money has not necessarily created “wealth” if the assets to be purchased are rising as fast or faster than the purchasing power of the “money”. The Fed touts it’s dual mandate of full employment and stable prices…but the result in prices; not so stable. The primary global asset purchasable only in US dollars, crude oil, has told a story of wildly gyrating prices. Since the end of Bretton Woods and the subsequent Congressionally dual mandated roles bestowed on the Fed…crude oil prices have gone bezerk, twice climbing nearly 10x’s within a decade. This is the opposite of stable (particularly compared to the price stability from WWII’s end until the Fed took over).

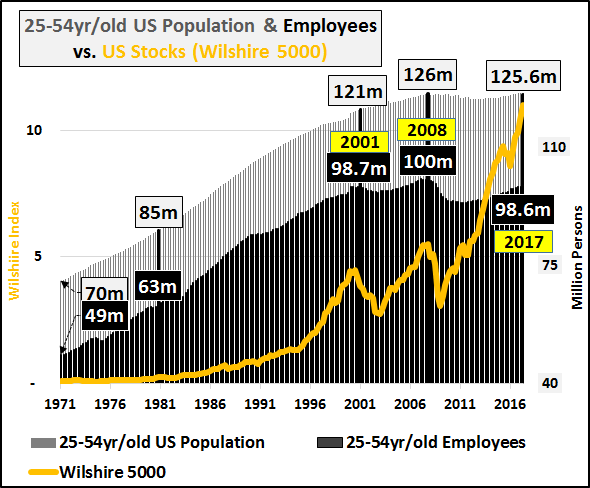

Soooo, theoretically the growth of “money” should be linked to the growth of the population, to ensure an adequate and stable money supply exists for the growing population. In a moment I’ll show you anything but a stable money supply. But first, the chart below shows the total 25-54yr/old US population, those employed among them, and the value in dollars of all publicly traded US stocks (represented by the Wilshire 5000). Something far beyond population growth or employment growth is pushing up the value of dollar based assets, gauging by US stock markets accelerating appreciation.

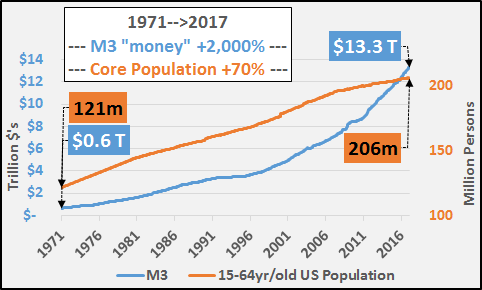

With that in mind, the chart below shows the growth of M3 money (the broadest measure of US “money”) and the broader 15-64yr/old US population since 1971. The money supply has grown in excess of 20x’s (2,000%) vs. the working age population (15-64yr/olds) which has grown less than 1x (nearly 70% increase).

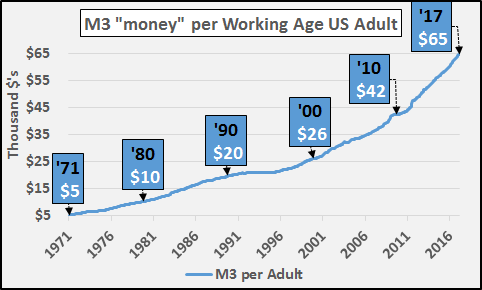

This results in a rising ratio of “money” on a per capita of the core population basis, as the chart below details. The total amount of “money” rose from approximately $5 thousand dollars per working age adult to todays $65 thousand dollars per adult…an increase of 13x’s (1.300%).

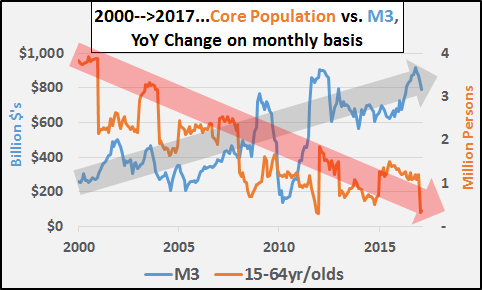

The annual growth of the 15-64yr/old core US population peaked in 2003 and annual core population growth has decelerated by 90% since…while annual M3 growth has doubled over the same time period. [..] The chart below from 2000 into 2017 shows the change in both core population and M3 money supply, showing the year over year change on a monthly basis…and the current fall in core population growth will continue downward, likely turning negative at times over the next year (yet another first for America).

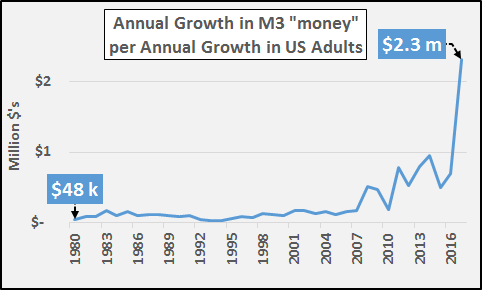

The final chart is the growth in M3 money supply per the growth in the adult, working age population. I’m not an economist or expert on much of anything…but that doesn’t look particularly good to me (something to do with “hyper-monetization” or some such thing). All I can say is the appearance of hockey sticks typically aren’t a good or stable sign but their appearance, just like those of black swans, has become the “new normal”.

It could also fall by 50%.

• Shiller: Stay In The Market, It ‘Could Go Up 50% From Here’ (CNBC)

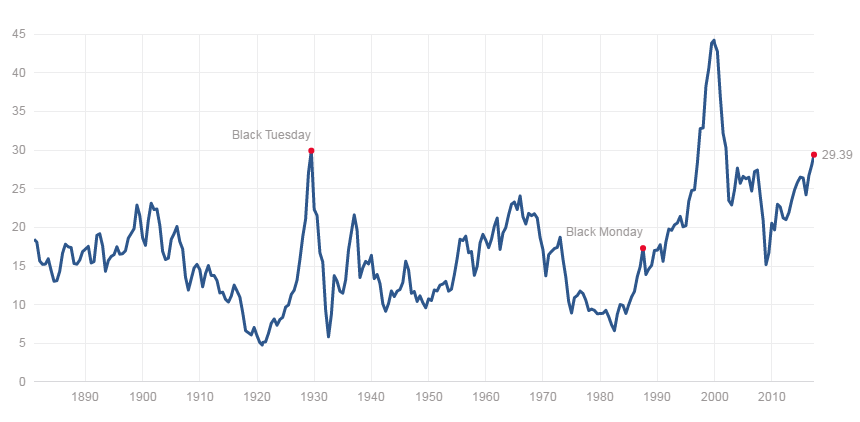

Nobel Prize-winning economist Robert Shiller believes investors should continue to own stocks because the bull market may continue for years. CNBC’s Mike Santoli spoke with Shiller in an exclusive interview for CNBC PRO. Santoli asked Shiller about his market outlook. “I would say have some stocks in your portfolio. It could go up 50% from here. That’s what it did around 2000, after it reached this level, it went up another 50%. So I’m not against investing in the stock market when you consider the alternatives. But I think if one wants to diversify, US is high in its CAPE ratio. You can go practically anywhere else in the world and it’s lower,” Shiller said. “We could even set a new another record high in CAPE, that’s not a forecast.”

Shiller developed the “cyclically adjusted price-to-earnings ratio” (CAPE) market valuation measure, which is calculated using price divided by the index’s average historical 10-year earnings, adjusted for inflation. The economist’s research found future 10-year stock market returns were negatively correlated to high CAPE ratio readings on a relative basis. However, even though the current CAPE ratio is at 29, which is above the 17 historical average, the economist is not calling for a market decline. “I can see it as a real possibility that stocks prices and house prices would both keep going up for years, but I’m not forecasting that by any means,” he added.

Dragging on.

• German Police Search Daimler Facilities In Dieselgate Probe (DW)

German authorities have raided several locations associated with German premium carmaker Daimler. They acted on an initial suspicion of fraud involving misleading information about emission levels. Prosecutors in the southern German city of Stuttgart confirmed Tuesday they had searched about a dozen locations associated with the maker of Mercedes-Benz cars. The raids came as a result of the company being suspected of fraud and misleading advertising in relation to the selling of diesel-powered vehicles. Prosecutors have yet to provide further details on the raids. They only said the raids were carried out by well over 200 investigators across the country, with the focus of the search in progress on locations in the states of Baden-Württemberg, Lower Saxony, Saxony and the the city state of Berlin.

The carmaker said the investigations targeted “known and unknown employees of Daimler over suspicion of fraud related to the possible manipulation of exhaust gas emissions in passenger cars with diesel engines.” Daimler executives said they were not aware of any emissions scandal, adding that they were fully co-operating with investigators. The automaker had earlier agreed with Germany’s Federal Motor Transport Authority to “voluntarily” recall 247,000 vehicles to remove “potentially problematic technology,” which Daimler said had been installed to prevent engines from being damaged. Daimler has also been in the crosshairs of prosecutors in the US where it faces a number of class-action suits by car owners who have accused the company of not being accurate in stating emissions levels for a number of its diesel-powered models.

You don’t say.

• Canada Must Deflate Its Housing Bubble (BBG Ed.)

Canada’s housing market offers a case study in a contentious economic issue: If a central bank sees a bubble forming, should it act to deflate it? In this instance, the answer should be a resounding yes. A combination of foreign money, local speculation and abundant credit has driven Canadian house prices to levels that even government officials recognize cannot be sustained. In the Toronto area, for example, they were up 32% from a year earlier in April. David Rosenberg, an economist at Canadian investment firm Gluskin Sheff, notes that it would take a decline of more than 40% to restore the historical relationship between prices and household income. Granted, the bubble bears little resemblance to the U.S. subprime boom that triggered the global financial crisis.

Although one specialized lender, Home Capital, has had issues with fraudulent mortgage applications, regulation has largely kept out high-risk products. Homeowners haven’t been withdrawing a lot of equity, and can’t legally walk away from their debts like many Americans can. Banks aren’t sitting on the kinds of structured products that destroyed balance sheets in the U.S. Nearly all mortgage securities and a large portion of loans are guaranteed by the government. That said, the situation presents clear risks. As buyers stretch to afford homes, household debt has risen to 167% of disposable income – the highest among the Group of Seven industrialized nations. This is a serious vulnerability, and a big part of the rationale behind Canadian banks’ recent ratings downgrade. The more indebted people are, the more sensitive their spending becomes to changes in prices and interest rates, potentially allowing an otherwise small shock to result in a deep recession.

What to do? Administrative efforts to curb lending and tax foreign buyers have helped but haven’t solved the problem. That’s largely because extremely low interest rates are still giving people a big incentive to borrow. The Bank of Canada has held its target rate at 1% or lower since 2009, and at 0.5% since 2015, when it eased to counteract the effect of falling oil prices. That’s a very stimulative stance in a country where the neutral rate is estimated to be about 3% or higher. One can’t help but see a parallel with the low U.S. rates and the housing bubble of the early 2000s.

The Violence of Austerity, edited by Vickie Cooper and David Whyte, is published by Pluto Press.

• The Violence of Austerity (OD)

As we move towards the general election, we are paralyzed by what is probably the biggest single issue affecting ordinary people in the country: austerity. We are unable to fully understand both the economic madness of austerity and the true scale of the human cost and death toll that ‘fiscal discipline’ has unleashed. Since coming into power as Prime Minister, Theresa May has made a strategic decision not to use the word ‘austerity’. Instead she has adopted a more palatable language in a vain attempt to distance herself from the Cameron governments before her: “you call it austerity; I call it living within our means.” The experience of countless thousands of people is precisely the opposite: people are actively prevented from living within their means and are cut off from their most basic entitlement to: housing, food, health care, social care and general protection from hardship.

And people are dying as a result of these austerity effects. In February, Jeremy Corbyn made precisely this point when he observed the conclusions of one report that 30,000 people were dying unnecessarily every year because of the cuts to NHS and to local authority social care budgets. But this is really only the tip of the iceberg. The scale of disruption felt by people at the sharp end of these benefit reforms is enormous. Countless thousands of others have died prematurely following work capability assessments: approximately 10,000 according the government’s own figures. People are dying as a result of benefit sanction which has fatal impacts on existing health conditions, such as diabetes and heart disease. Austerity is about dismantling social protection. The crisis we face in social care is precipitated by cuts to local authority funding.

In the first 5 years of austerity, local authority budgets were cut by 40%, amounting to an estimated £18bn in care provision. A decade of cuts, when added up, also means that some key agencies that protect us, such as the Health and Safety Executive and the Environment Agency will have been decimated by up to 60% of funding cuts. Scaling back on an already paltry funding in these critical areas of regulation will lead to a rise in pollution related illness and disease and will fail to ensure people are safe at work. The economic folly is that austerity will cost society more in the long term. Local authorities are, for example, housing people in very expensive temporary accommodation because the government has disinvested in social housing.

The crisis in homelessness has paradoxically led to a £400 million rise in benefit payments. The future costs of disinvesting in young people will be seismic. Ending austerity would mean restoring our system of social protection and restoring the spending power of local authorities. It would mean, as all the political parties except the Conservatives recognise, taxing the rich, not punishing the poor in order to pay for a problem that has its roots in a global financial system that enriched the elite. It would also mean recognizing that the best way to prevent the worsening violence of austerity and to rebuild the economy is to re-invest in public sector jobs.

The Greek government is being played for fools. Given how long this has been going on, one might suggest they are.

• IMF Wants More Realism In Eurozone Assumptions On Greece (R.)

The IMF needs to see more realistic euro zone assumptions about Greece’s economy and more detail on planned debt relief measures to join a bailout, IMF’s European Department head Poul Thomsen said. Thomsen said the IMF and Greece’s euro zone lenders made progress in talks on Monday, but were not yet quite there. “We still think there is a need for more realism in assumptions and more specificity,” Thomsen said on Tuesday. The euro zone and the IMF agreed on Monday that Greece would have to keep a primary surplus – the budget balance before debt servicing – at 3.5% of GDP for five years after the bailout ends in 2018. But officials said the size of the surplus afterwards was still under discussion and there were also differences on economic growth assumptions, especially that forecasts used for debt relief plans spanned dozens of years. A group of euro zone countries led by Germany wants the IMF to join the Greek bailout, now handled by euro zone governments alone, to increase credibility. The IMF says that it will only join if Greece is granted debt relief.

Greece will be declared eligible for inclusion in the ECB’s QE only AFTER the central bank says it will taper QE.

• QE Remains A Long Shot For Greece (K.)

Greece is nowhere near a swift inclusion in the ECB’s QE program, according to senior officials at domestic banks. They argue that the issue of the national debt, and securing its sustainability in a way that would satisfy the IMF too, constitutes a particularly complex problem that may well be too hard to resolve by next month’s Eurogroup. They therefore consider Greece’s entry into the ECB’s bond-buying program this summer unlikely – instead expecting it to happen after the German election in the fall, either by the end of 2017 or in early 2018. Some go as far as expressing concern as to whether Greece will make it in at all before the program ends.

While there are more and more voices within the ECB speaking in favor of concluding the program earlier, Greece would like enjoy its benefits for more than two years. Greek banks are hoping a formula will be found at the next Eurogroup, on June 15, that will allow the disbursement of the next bailout tranche while putting off any decisions on the debt. The most optimistic observers note there is a chance of Greece entering QE between July and September and next month’s Eurogroup will be crucial to this end. The ECB argues that Greece’s inclusion in the bond-buying program requires the safeguarding of the debt’s sustainability.

In this context political statements or a mere reference to a series of measures will not suffice, as they will have to constitute legally binding pledges, which is highly unlikely before the German election. Goldman Sachs stated in an analysis that this country is not likely to fulfill the terms the ECB has set to join QE before the reduction of the monthly rate of bond purchases is activated. It also highlighted the high rate of bad loans as a point of concern that might also delay the decision for Greece to enjoy the benefits of QE. Similarly, Citi estimates that without an agreement on the easing of the debt, both inclusion in QE and a return to the bond markets would be quite difficult for Greece.

In one and the same Union, laws and rights are widely divergent. That is not a union.

• In Germany, Syrian Man Wins Case Against Deportation To Greece (AP)

Germany’s highest court has upheld a complaint by a Syrian whose asylum claim was rejected because he’d already been granted asylum in Greece. The man, whose name wasn’t released, arrived in Germany in 2015. He told officials he had already been granted protection in Greece but had been living on the street there and received no support from the Greek government. The man’s claim in Germany was rejected, meaning that he risked deportation to Greece. Germany’s Federal Constitutional Court said Tuesday that a lower court had wrongly failed to take account of a lack of welfare payments for refugees in Greece and to check whether there were assurances that the man would be given at least temporary housing. Judges sent the case back to the lower court to reconsider.

Who cares about human rights declarations when elections are coming up?

• Elder Refugees Seeking Asylum in Europe Left Stranded in Greece – HRW (GR)

There are many unnecessary delays and arbitrary barriers which keep older refugees and asylum seekers stranded in Greece, unable to reunite with family members who have legal status in the EU, Human Rights Watch said on Monday. According to their publication on Monday, EU: Older Refugees Stranded in Greece, one of the main issues that older refugees face is that family reunification does not focus on reuniting an entire family, but spouses and parents with minor children who are under the age of 18. Hundreds of older refugees and asylum seekers currently in Greece who have fled war zones and persecution are waiting to learn if they will be allowed to reunite with adult family members who have been granted residency in another EU country. Although EU law provides for family reunification for older people, lack of clarity or explicit provisions governing the process means that they can remain in limbo, far from their family for prolonged periods of time.

“These older people, already victims of conflict and persecution, hoped to find protection in the EU after treacherous journeys to Greece, and to be reunited with their family,” said Bethany Brown, researcher on older people’s rights at Human Rights Watch. “Now they don’t know if they will ever see their relatives again.” While several barriers are common to all asylum seekers, they can have a more significant impact on older people. Older people have been shown, in some contexts, to have significantly higher rates of psychological distress than the general refugee population, and often suffer from health issues, injuries and violence during displacement, and frailty that can be exacerbated by time and uncertainty.

A little piece of news. But a good one.

• Tasmania Bans Super Trawlers From Its Waters (AAP)

Tasmania’s parliament has passed laws banning super trawler fishing vessels from operating in the state’s waters. Legislation was given a green light on Wednesday, with Liberal government MP Mark Shelton confirming that any future attempts to allow freezer trawler vessels would require an act of parliament. “Our bill should give recreational fishers additional comfort that any future attempt to let super trawlers into the small pelagic fishery will be met with parliamentary hurdles,” he said.

Graecopithecus freybergi.

• Fossils Cast Doubt On Human Lineage Originating In Africa (R.)

Fossils from Greece and Bulgaria of an ape-like creature that lived 7.2 million years ago may fundamentally alter the understanding of human origins, casting doubt on the view that the evolutionary lineage that led to people arose in Africa. Scientists said on Monday the creature, known as Graecopithecus freybergi and known only from a lower jawbone and an isolated tooth, may be the oldest-known member of the human lineage that began after an evolutionary split from the line that led to chimpanzees, our closest cousins. The jawbone, which included teeth, was unearthed in 1944 in Athens. The premolar was found in south-central Bulgaria in 2009.

The researchers examined them using sophisticated new techniques including CT scans and established their age by dating the sedimentary rock in which they were found. They found dental root development that possessed telltale human characteristics not seen in chimps and their ancestors, placing Graecopithecus within the human lineage, known as hominins. Until now, the oldest-known hominin was Sahelanthropus, which lived 6-7 million years ago in Chad. The scientific consensus long has been that hominins originated in Africa. Considering the Graecopithecus fossils hail from the Balkans, the eastern Mediterranean may have given rise to the human lineage, the researchers said.

The findings in no way call into question that our species, Homo sapiens, first appeared in Africa about 200,000 years ago and later migrated to other parts of the world, the researchers said. “Our species evolved in Africa. Our lineage may not have,” said paleoanthropologist Madelaine Böhme of Germany’s University of Tübingen, adding that the findings “may change radically our understanding of early human/hominin origin.” Homo sapiens is only the latest in a long evolutionary hominin line that began with overwhelmingly ape-like species, followed by a succession of species acquiring more and more human traits over time.