Salvador Dali Neo-Cubist Academy (Composition with Three Figures) 1926

Alex

Breaking! Former FBI Director James Comey Taken Into Custody By US Secret Service After He Publicly Called For The Assassination Of President Trump pic.twitter.com/9MkVCs4GOK

— Alex Jones (@RealAlexJones) May 16, 2025

“The steps we examine would not have either defense or deterrence as their prime purpose… Rather, they are conceived of as elements in a campaign designed to unbalance the adversary, causing Russia to compete in domains or regions where the United States has a competitive advantage.”

https://twitter.com/rinalu_/status/1923732232293781742

Patel

Patel says the quiet part out loud. The building is bugged and is compromised. Wow! pic.twitter.com/JcX57UeUBt

— The Disrespected Trucker (@DisrespectedThe) May 17, 2025

Clinton list

https://twitter.com/KarluskaP/status/1923770579917603022

SCOTUS

https://twitter.com/mrddmia/status/1923823175810646037

Homan

https://twitter.com/VigilantFox/status/1923467551855739257

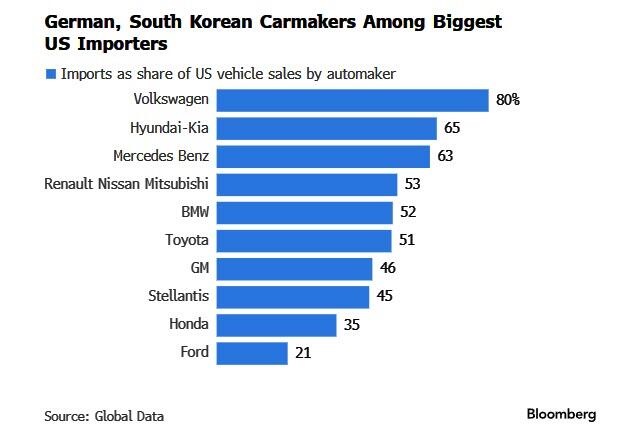

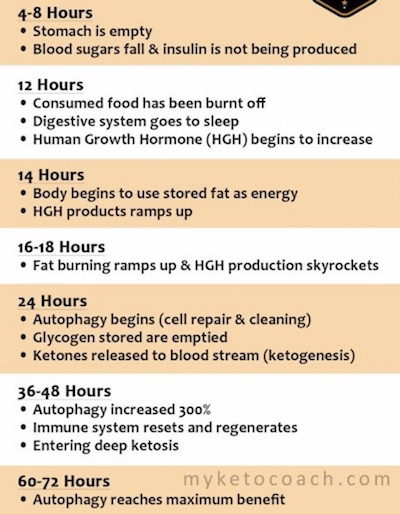

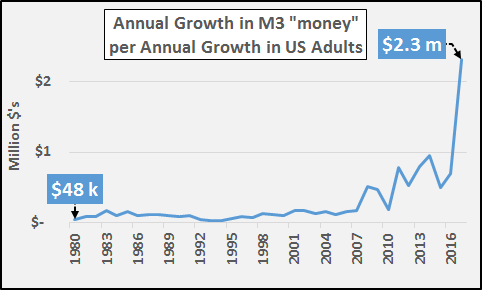

Data

The Biden admin caught red handed.

Senator Ron Johnson: "The Department of Defense, the Biden administration is on notice. They must preserve these records”

They tried to cover up an 1100% increase in neurological events, showing up the year of the covid mRNA rollout.

The… pic.twitter.com/UNDf4kaCYJ

— Humanspective (@Humanspective) May 17, 2025

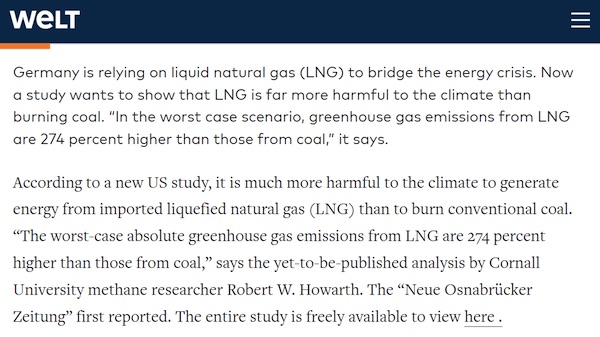

Ed Dowd

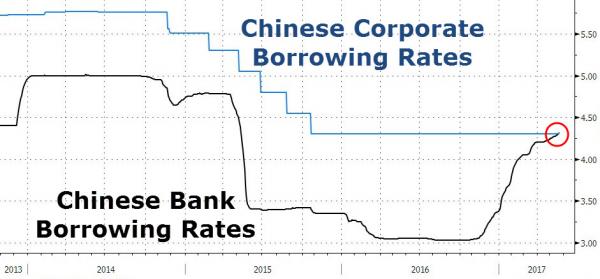

Black Swan watch. #BOJ

The Bank of Japan is caught between responding to their weak economy (stimulus ) or torching the yen carry trade to protect their currency by raising rates. pic.twitter.com/zuMWIKAsMb

— Edward Dowd (@DowdEdward) May 16, 2025

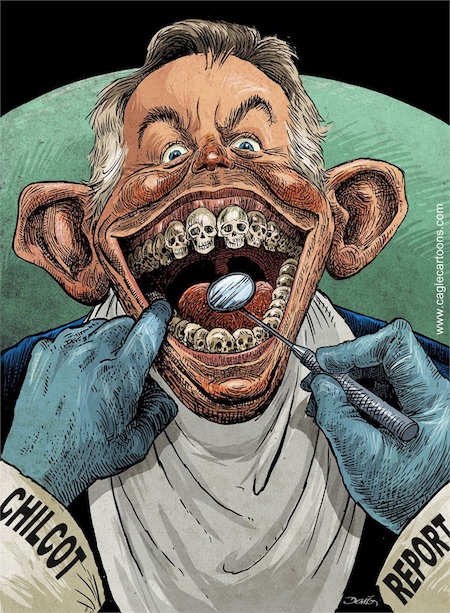

Orban

https://twitter.com/zoltanspox/status/1923366358357533027

Logan

If you are looking for indications that there will be real accountability, this is a strong one. pic.twitter.com/DTOCBGRUaX

— Lara Logan (@laralogan) May 17, 2025

“I think Putin is tired of this whole thing.”

You bet.

• Putin Is ‘At The Table’ For Ukraine Talks – Trump (RT)

Russian President Vladimir Putin would like to resolve the Ukraine conflict, his US counterpart, Donald Trump, has said. He added that he is certain Washington and Moscow will be able to make a deal and put an end to the hostilities. On Friday, Russian and Ukrainian delegations held a meeting in Istanbul, which marked the first direct talks since 2022. Both sides agreed to exchange lists of conditions for a potential ceasefire, conduct a major prisoner swap, and discuss a follow-up meeting. In a Fox News interview aired the same day, Trump pushed back against the notion that Putin does not want to engage in any kind of talks over Ukraine. “He is at the table, and he wanted this meeting,” the US president said, adding: “I think Putin is tired of this whole thing.”

According to Trump, however, his involvement is essential to a breakthrough in the peace process. “I always felt there can’t be a meeting without me because I don’t think a deal’s gonna get through,” he said. Nevertheless, he expressed optimism about the chances of reaching a settlement. “I have a very good relationship with Putin. I think we’ll make a deal. We have to get together, and I think we’ll probably schedule it.” When pressed again on whether he sees Putin as an “obstacle to peace,” Trump shifted the focus to Ukraine’s Vladimir Zelensky. “I had a real rough session with Zelensky, because I didn’t like what he said. He was not making it easy… He doesn’t have the cards,” he said, explaining that Ukraine is fighting against a “massive army.” Trump was apparently referring to a public spat with the Ukrainian leader during which he accused Zelensky of ingratitude for past US military aid and “gambling with World War III.”

The US president went on to criticize the policy of assisting Ukraine adopted by his predecessor, Joe Biden. “Every time… he [Zelensky] came to Washington, he walks out with $100 billion… I think he’s the greatest salesman in the world, far better than me,” Trump said, adding that Congress has grown frustrated with this as well. The Ukrainian leader was initially reluctant to agree to the talks in Istanbul proposed by Russia without any conditions, insisting that they should be preceded by a 30-day ceasefire. Moscow has not ruled out the idea in principle, but said Kiev could use the pause to rebuild its battered military. Despite initial pushback, Zelensky sent a delegation to Istanbul after Trump insisted that “Ukraine should agree to this immediately.”

First call is Putin. Makes you wonder what Trump will tell Zelensky after that call. Because we know what Putin will say.

• Trump to Have Phone Calls with Putin and Zelensky on Monday (DS)

In an effort to stop the “bloodbath” in the war between Russia and Ukraine, President Donald Trump will have separate phone calls with Vladimir Putin and Volodymyr Zelenskyy on Monday. Trump will first speak with the Russian leader and the “subjects of the call will be, stopping the ‘bloodbath’ that is killing, on average, more than 5,000 Russian and Ukrainian soldiers a week, and trade,” Trump wrote on Truth Social Saturday morning. “I will then be speaking to President Zelenskyy of Ukraine and then, with President Zelenskyy, various members of NATO,” Trump wrote. “Hopefully it will be a productive day, a ceasefire will take place, and this very violent war, a war that should have never happened, will end. God bless us all!!!”

Russia invaded Ukraine over three years ago, a move Trump says would not have happened had he been president at the time. Trump has made ending the war between the two countries a key priority of his administration. Since returning to the White House in January, Trump and Putin have spoken by phone but have not met in person. Trump has met twice with Zelenskyy, first in a contentious meeting at the White House in February. The two leaders met alone at the Vatican on the sidelines of Pope Francis’ funeral in April. The announcement of the Monday phone calls comes one day after delegations from Russia and Ukraine met in Istanbul for the first direct talks between the two nations since March 2022.

Putin proposed the direct peace talks but chose not to attend the meeting in Istanbul. Trump encouraged Zelenskyy to meet with Putin after the Russian leader suggested the talks and Zelenskyy flew to Turkey, but ultimately did not attend the meeting. Secretary of State Marco Rubio was present for the talks on Friday, but acknowledged beforehand that he did not expect a breakthrough without key leaders in the room. Following the less than two-hour meeting in Istanbul, Ukrainian official familiar with the talks told Reuters that Russia is demanding Ukraine pull all its troops out of the regions Russia has claimed before a ceasefire is agreed upon.

While no clear results toward peace were reached during Friday’s meeting, the two nations did agree to a large prisoner swap of 1,000 prisoners of war on each side. Vladimir Medinsky, a top Kremlin aide who led the Russian delegation, said each delegation did agree for both sides to present a ceasefire plan in detail and that talks will continue. “Ukraine is ready to take all realistic steps to end this war,” Zelenskyy wrote on X Friday. “President Trump wants to end this war,” Zelenskyy continued in a series of posts on X. “We need to keep working closely with him and stay as coordinated as possible. Long-term U.S. support is also essential. An American backstop is needed. It’s important that we all work together, on every level, to make that happen.”

What would be the use?

• Putin-Zelensky Meeting ‘Possible’ – Kremlin (RT)

Russian President Vladimir Putin and Ukraine’s Vladimir Zelensky could hold talks if the ongoing peace efforts between Russian and Ukrainian delegations result in progress and firm agreements, Kremlin spokesman Dmitry Peskov said on Saturday. His comments come after the first direct negotiations between Moscow and Kiev since 2022. On Friday, Russian and Ukrainian representatives sat down for a two-hour Turkish-mediated meeting in Istanbul. The sides agreed to exchange their ceasefire proposals and to discuss a potential follow-up meeting, according to Moscow’s chief negotiator, Vladimir Medinsky. Moscow and Kiev also agreed to a major prisoner exchange, he said, adding that Russia is “satisfied” with the results of the talks and is ready to “resume contacts” with Kiev.

Speaking to reporters on Saturday, Peskov said a meeting between Putin and Zelensky “is possible but only as a result of the work of the delegations of both sides and reaching specific agreements.” He added that a key issue for Moscow remains the question of who Ukraine would authorize to sign any potential agreements reached by the negotiators. Peskov was referring to the fact that Zelensky’s presidential term expired last year. The Ukrainian leader refused to call a new election, citing martial law. Russia considers him “illegitimate,” insisting that legal authority in Ukraine now lies with the parliament. Peskov also declined to comment on leaks regarding the terms Russia reportedly presented to Ukraine during the talks. “Negotiations… must be conducted strictly behind closed doors. This is in the interest of the effectiveness of these negotiations,” he said.

The Kremlin spokesman noted that Russia has not held talks with the US on the results of the negotiations in Istanbul, adding that Moscow is not currently contemplating altering the line-up of its delegation, while confirming that the sides “agreed to exchange the list of ceasefire terms.” Ukraine and its backers initially demanded that Moscow agree to a full and unconditional 30-day ceasefire as a prerequisite for talks. Russia expressed concern that a pause would only benefit Kiev and allow it to regroup its battered troops. Instead, it proposed holding direct negotiations without preconditions. While initially reluctant to accept the offer, Zelensky changed his mind after US President Donald Trump insisted that “Ukraine should agree to this [Istanbul talks] immediately.”

What exactly is supposedly “maximalist” about terms everyone has known for years?

Russia doesn’t really want the regions, but it wants the Russians who live there, to be safe. And not just for today. No-one in the Kiev side can guarantee that.

• Russia’s Maximalist Demands At Istanbul Peace Talks Revealed (ZH)

The Kremlin has said on Saturday that a future meeting between Presidents Putin and Zelensky is still ‘possible’ – despite no breakthroughs at Friday’s Istanbul talks by delegations representing the warring sides. Putin spokesman Dimitry Peskov said a meeting between the Russian president and Zelensky “is possible but only as a result of the work of the delegations of both sides and reaching specific agreements.” Peskov underscored that one of the major hurdles is remains the question of who Ukraine would authorize to sign any potential agreements assuming the negotiations could produce firm settlement proposals. Moscow’s stance all along has been that Zelensky is illegitimate given he canceled elections under martial law, and has run far past his authorized term in office. Kiev, however, has said that the national constitution allows for this in war time.

As for the content of Friday’s talks and reports that Moscow demanded a Ukrainian troop withdrawal from all the four easter territories, including Donetsk, he said, “Negotiations… must be conducted strictly behind closed doors. This is in the interest of the effectiveness of these negotiations.” One key thing the two sides did agree to is a large prisoner swap involving 1,000 POWs – which would be the single biggest of the war.

But Ukraine has rejected the Kremlin’s demand of de-facto recognizing the loss of its territories. Zelensky has time and again emphasized “this is Ukraine’s land” – and has vowed to fight on, despite mounting losses and serious manpower issues. The following is reportedly among Moscow’s top list of demands, which can be described as maximalist (at least from the West’s perspective), per a new Bloomberg report:

• Ukraine agreeing to neutral status regarding NATO

• No foreign troops in Ukraine

• No nuclear weapons in Ukraine

• De-facto recognition of Crimea and lost eastern territories as now Russia’s

• Withdrawal of Kiev forces from these territories before a ceasefire takes effectBut once again, Peskov has not officially confirmed this list, and precise details discussed at Istanbul remain subject of speculation amid leaks to the press. The US and Russia on Saturday held a phone call, in a post-Istanbul talks debriefing: Russian Foreign Minister Sergei Lavrov held a phone call with his US counterpart Marco Rubio, Russia’s Foreign Ministry said on Saturday, to discuss the direct talks between Moscow and Kyiv in Istanbul. “Lavrov noted the positive role of the United States in helping Kiev eventually accept Russian President Vladimir Putin’s proposal to resume the Istanbul talks,” the foreign ministry statement said, adding that Russia was ready to continue working with the US on the matter.

Meanwhile: “We didn’t say five. We said eight.”…

Story has been making rounds that Ukrainians were outraged when Russia negotiators said that Ukrainian soldiers must leave the four new Russian regions as part of ceasefire, to which the Moscow delegation replied "Next time it will be five."

Now, our reporter in Istanbul got to… pic.twitter.com/4ZafhhR2PN

— Margarita Simonyan (@M_Simonyan) May 16, 2025

The White House is likely to latch on to anything positive regarding these talks that it can; however, President Trump has clearly been exerting pressure for more speedy resolution, and is growing impatient. The Europeans are ready to slap more sanctions on Moscow, and Washington has also warned that this would essentially be plan B if Russia doesn’t cooperate. But Russia’s fresh maximalist demands will be a hard sell.

“Russia has stated that the Ukraine conflict could be settled if Kiev commits to permanent neutrality, demilitarization, denazification, and recognizes the “territorial reality on the ground.”

• Kiev’s Backers ‘Frustrated’ By Trump’s Stance On Ukraine Talks (RT)

European NATO members are “frustrated” with US President Donald Trump’s “constant swerving” on Ukraine peace talks, which undermines their ability to pressure Russia, Bloomberg reported on Friday, citing sources. Kiev’s backers are uncertain regarding what Trump will do following the inconclusive Turkish-mediated talks between Russia and Ukraine in Istanbul on Friday, according to the news agency. The meeting was the first direct engagement between the belligerents since 2022. Key European NATO members initially believed that Trump supported their plan to impose new sanctions on Russia if it rejected the demand for a 30-day unconditional ceasefire with Ukraine, the article said. Moscow has stated that it is open to a ceasefire “in general,” but has expressed concern that it would only give Ukraine time to regroup and rest its battered forces.

However, the West’s unified front apparently started to crumble after Moscow proposed direct Russia-Ukraine talks in Istanbul without any preconditions, according to Bloomberg. The overture prompted the US president to insist that Kiev “immediately” agree to restart dialogue, despite Vladimir Zelensky’s reluctance to do so without a ceasefire.One European official expressed hope that the Istanbul meeting would “make it clear to Trump that the Russians aren’t serious about peace talks,” prompting the US to respond decisively. Some European leaders reportedly believe that Trump may still follow through on earlier threats to impose secondary sanctions and banking restrictions on Moscow.

Others, however, are said to be skeptical about whether Trump – who has repeatedly said he wants to meet with Russian President Vladimir Putin to settle the Ukraine conflict – has an appetite for drastic measures. At the Istanbul meeting, discussions included ceasefire options, a prisoner exchange, and plans for a potential follow-up meeting. Vladimir Medinsky, Russia’s top negotiator, said Moscow is “satisfied” with the results of the Istanbul talks and is ready to “resume contacts” with Kiev. Russia has stated that the Ukraine conflict could be settled if Kiev commits to permanent neutrality, demilitarization, denazification, and recognizes the “territorial reality on the ground.” Kiev, however, has ruled out any territorial concessions to Moscow.

Then keep Zelensky out of the room. And Europe too.

• US Opposes ‘Endless Negotiations’ On Ukraine – Rubio (RT)

The US does not want negotiations between Russia and Ukraine to drag on indefinitely, Secretary of State Marco Rubio has said, emphasizing that Washington expects concrete results. He made the remarks after Russia and Ukraine held their first direct talks in three years in Istanbul on Friday. The countries agreed on a prisoner swap involving 1,000 people on each side, and to continue contacts once both parties have prepared detailed ceasefire proposals. “On the one hand, we’re trying to achieve peace and end a very bloody, costly, and destructive war. So there’s some element of patience that is required,” Rubio said in an interview aired Sunday on CBS News’ Face the Nation with Margaret Brennan.

“On the other hand, we don’t have time to waste. There are a lot of other things happening in the world that we also need to be paying attention to. So we don’t want to be involved in this process of just endless talks. There has to be some progress, some movement forward,” he added. Rubio said the US would examine ceasefire proposals from both Russia and Ukraine. “If those papers have ideas on them that are realistic and rational, then I think we know we’ve made progress,” he said. The diplomat confirmed that the US is ready to impose further sanctions on Russia if no deal is reached. He expressed confidence that both chambers of Congress would pass Senator Lindsey Graham’s bill introducing 500% tariffs on imports from countries that purchase Russian oil, natural gas, and uranium.

According to the White House, Rubio spoke with Russian Foreign Minister Sergey Lavrov by phone on Saturday, reiterating President Donald Trump’s call for an immediate ceasefire. Moscow has rejected demands for an unconditional 30-day ceasefire, insisting that talks must address the “root causes” of the conflict, including Ukraine’s aspirations to join NATO – a move Russia considers a threat to its national security. President Vladimir Putin has maintained that a lasting truce would require Ukraine to halt its mobilization, stop receiving weapons from abroad, and withdraw troops from Russian territory. He also warned that Kiev would likely use a temporary ceasefire to rearm and regroup.

“.. If the talks have any chance of succeeding, the American side must take responsibility for the war it started and fueled..”

• Talks In Istanbul Are A Start…The Real Show To Come Is Trump And Putin (SCF)

The talks in Istanbul this week provide a prospect for peace. It bears emphasizing that the three-year proxy war could have been avoided if diplomacy had been permitted by Washington in early 2022 instead of being sabotaged. Three years on, we have a new president in the White House, and there appears to be a more enlightened policy. Or maybe it’s an implicit admission that the U.S. proxy war agenda is a failure and can’t go on. In any case, Trump and his envoys are unequivocally saying that they want to stop the bloodshed in Ukraine. That’s a big change from his predecessor, Joe Biden, who vowed to back Ukraine for as long as it takes in a fantastical, reckless pursuit to strategically defeat Russia. It was the Biden administration, along with the British government, that intervened to scupper nascent peace talks in March 2022 between Russia and Ukraine for a peace deal. Washington and London coaxed the Kiev regime to fight on with promises of more weapons.

The result: three more years of intense conflict, which have caused millions of casualties, mainly on the Ukrainian side. The proxy war has come perilously close to provoking an all-out world war between nuclear powers. Trump appears to want peace. If he is genuine in that intention, then the American president will have to address the root causes of the conflict. Russia has consistently explained the deeper causes of NATO aggression and the militarization of Ukraine as a hostile bridgehead on its borders since the CIA-orchestrated coup in Kiev in 2014. The American president has shown petulance at times, urging Ukraine and Russia to get down to a peace deal. He has even threatened Russia with more (futile) economic sanctions. What the Trump administration needs to understand is that resolving deep causes of conflict requires commensurate negotiations and a realistic commitment to lasting geopolitical security arrangements.

The talks in Istanbul this week to explore a peaceful resolution were initiated by Russian President Vladimir Putin in an announcement last week. Russia’s delegation was led by Putin’s senior aide, Vladimir Medinsky. That speaks of consistency and commitment. Medinsky led the peace talks three years ago in Istanbul, which were then sabotaged in April 2022 by the American and British intervention. This week, the Russian side held preliminary bilateral talks with the Americans led by Secretary of State Marco Rubio. Subsequently, the Russian and Ukrainian delegates engaged in a meeting convened by Turkish diplomats. It was the first direct encounter between Russian and Ukrainian officials since the March 2022 negotiations. It is not clear if follow-up meetings will take place. But at least one might say that talks took place.

The key to any prospect of ending the conflict depends on Washington demonstrating the requisite commitment. Trump said this week again that he would like to hold a summit with Putin as “soon as possible.” The Kremlin has also said that a formal presidential meeting is desirable. Kremlin spokesman Dmitry Peskov cautioned that there must first be adequate preparation for meaningful discussions. That implies that any top-level meeting must be cognizant of Russia’s demands for a resolution, one that deals with the historic, systematic causes of the proxy war. Western politicians and media denying Russia’s perspective are delusional or duplicitous. To claim that the conflict is all about “unprovoked Russian aggression” against “democratic Ukraine” and “Russian expansionism” towards Europe is a travesty.

It’s a bogus narrative that precludes peaceful resolution. Trump seems to be aware of that. But he needs to go beyond a superficial “peace broker” charade. If Trump wants a gimmicky big summit with Putin for PR ratings, as his tour of the Middle East this week illustrates his egotistical wont, he can forget it. The meetings this week in Turkey can be seen as preliminary technical discussions. However, President Trump needs to take the lead. Appropriately, a peaceful resolution will only happen at the senior level of the U.S. and Russian governments. That’s because the United States is the primary protagonist in the proxy war against Russia. It is clear from the antics and theatrics of the Kiev regime this week that there is no prospect of a meaningful, lasting peace if negotiations are confined to that level.

Ukrainian President Vladimir Zelensky does not even have constitutional legitimacy after cancelling elections last year. His erratic behavior of grandstanding and mudslinging at the Russian diplomatic efforts proves that he is not capable of substantive negotiations. The European leaders are also an impediment to achieving an authentic peace settlement. Even before delegations met this week in Istanbul, various non-entity European politicians were disparaging Russia’s diplomatic initiative. Macron, Starmer, Merz, Von der Leyen and Kallas were desperately trying to insult the Russian president, indulging Zelensky’s PR stunt demanding a face-to-face meeting with Putin in Istanbul. The European Union also timed an announcement this week to double its supply of heavy-calibre munitions to Ukraine. Another provocation.

France’s Macron sought to impose a precondition for the talks by demanding a 30-day ceasefire. That was a flagrant attempt to sabotage the negotiations before they even started. These people are not honest about ending the worst war in Europe since the end of World War Two. Disgracefully, they want the bloodshed to continue for their political survival and gratifying their obsessive Russophobic fantasies. If Trump wants to end NATO’s proxy war against Russia, he will have to sideline the European naysayers and the Kiev puppet regime. Their involvement is counterproductive. One suspects that Trump already knows that. An American and Russian agreement at the highest level is the only way to bring the war to an end. It is no use for the American side pretending that they are mere peace brokers. They are the main protagonist, not the European lapdogs nor the Kiev regime. Preliminary talks are all very well. But they are just that. Preliminary. If the talks have any chance of succeeding, the American side must take responsibility for the war it started and fueled.

Lavrov: “In April 2022, Russian and Ukrainian negotiators reached agreement in Istanbul. If that agreement had been observed, Ukraine would have preserved part of Donbass. But every time another agreement, always accepted by Russia, is broken, Ukraine shrinks in size.”

• The Istanbul Kabuki – Decoded (Pepe Escobar)

Did President Putin really change the game by proposing the resumption of negotiations on the proxy war in Ukraine in Istanbul – over three years after the first ones were scotched by NATO? It’s complicated. And depends on which “game” we’re talking about. What the Russian move instantly accomplished was to throw into total disarray the European warmongering Three Stooges (Starmer, BlackRock chancellor, Le Petit Roi) Cocaine Express. Irrelevant Europe was not even at the table in Istanbul – except via extensive previous briefing of the low-rent, shabby-dressed Ukrainian delegation. That was compounded by the noisy barking threat in the sidelines advocating “more sanctions” to “pressure Russia”. In March 2022 in Istanbul, Kiev could have stopped the war. Every one of us who were in Istanbul at the time could foresee that Kiev would eventually have to be forced to the table all over again.

So in essence we are back to the same negotiation – with the same top Russian negotiator, competent historian Vladimir Medinsky, heading a delegation composed by pros, but with Ukraine now facing over a million dead; deprived of at least four regions – more on the way; what’s left of its mineral wealth de facto controlled by the US; and a horrendous black hole that passes for an “economy”. We are talking about country 404 territory. During the negotiations on Friday, Medinsky went straight to the point:“We don’t want war, but we are ready to fight for a year, two, three – as long as it takes. We fought with Sweden for 21 years [the Great Northern War, 1700-1721, as it is known in Russia]. How long are you ready to fight?” That’s the geopolitical/military state of things for Kiev and their “to the last Ukrainian” warmongering backers: either you capitulate, or we’re going to hurt you even more.

What’s the point of these negotiations? Turkiye under uber-opportunist Sultan Erdogan in fact hosted a P.R. meeting between Moscow, Kiev and itself – with the Ukrainians unleashing a blitzkrieg of infantile tantrums only designed to influence global public opinion. In sharp contrast, the head of the Russian Direct Investment Fund, Kirill Dmitriev, did his best to put a positive spin on the proceedings. Istanbul 2.0, Dmitriev asserted, achieved a large exchange of prisoners (1,000 on each side); ceasefire options to be presented by both sides; and a continuation of dialogue. That’s not much. Well, at least they discussed in the same language: Russian. Nothing was lost in translation. A serious case can be made that to propose the resumption of these negotiations, under this format, was meaningless.

There’s no evidence in the horizon both parties might touch the fundamental issue anytime soon: the whole geopolitical strategic equation in Eastern Europe, from the Barents Sea to the Black Sea and beyond – leading to an “indivisibility of security” new deal with global repercussions. That implies that whatever track these negotiations may follow further on down the road, they are an objective impossibility. Meanwhile, the proxy war in Ukraine – and the SMO – will go on. That would also suggest that the Moscow security establishment considers the neo-nazi instrumentalized goons in Kiev at best as a re-enactment of the 6th Army of Paulus, with which you negotiate the end of a battle, but not the end of the war. Even NATO semi-realists as retired Commodore Steven Jermy have been forced to admit that “Russia is in the driving seat” and clueless Europeans “appear to believe that the losers should dictate the terms of ceasefire or surrender.”

All the barking by the – European – chihuahuas of war cannot disguise the fundamental geopolitical/military fact: a massive NATO humiliation. Trump’s humongous problem is that he has to manage it – and sell it to domestic public opinion and the global public opinion as some sort of “deal” he struck with Putin. It’s enlightening once again to go back to Grandmaster Lavrov, always the uber-realist, back in September 2024: “In April 2022, Russian and Ukrainian negotiators reached agreement in Istanbul. If that agreement had been observed, Ukraine would have preserved part of Donbass. But every time another agreement, always accepted by Russia, is broken, Ukraine shrinks in size.”

Now back to the (Great) Game. Kiev negotiators eventually admitting Ukrainian capitulation means a NATO capitulation and an Empire of Chaos capitulation. That’s the ultimate anathema for the US ruling classes. Even an ultra-negotiated, carefully managed Ukrainian surrender will be an impossible sell – not to mention Washington under Narcissus Drowned Trump acknowledging a strategic defeat.

Because that will mean the Empire of Chaos losing Eurasia for good: the ultimate Mackinder/Brzezinski nightmare. Coupled with the consequential solidification of the multi-nodal, multipolar world. The Russia-China stategic partnership is very much aware of every nook and cranny in this larger-than-life process. Beyond the current Turkish kabuki, they clearly understand the Big Eurasia Equation. Beijing is fully aware NATO’s real goal was always to confront it via Russia. Ukraine was NATO’s pawn to take down Russia then get to China from the West. The goal of the US ruling elites as they configured their thalassocratic empire remains to blockade China from the West by land and sea, using Russia; then use Taiwan as a staging area to blockade China from the East by sea. No wonder control of Taiwan is a Chinese strategic imperative.

Enter Mackinder panic – all over again: the China-Russia strategic partnership can beat NATO hands down – and Russia, by itself, is already doing it. Xi and Putin once again discussed the chessboard in detail, in person, prior to the Victory Day parade last week in Moscow. The endgame, once again, is clear: the US losing the entire Eurasian land mass. Ukraine, under these immense geopolitical imperatives, is only a sovereign-deprived pawn in the (Great) Game. As for the tantrum-addicted clown in Kiev, he is merely an actor with no authority whatsoever, negotiations included. He is completely dominated by Ukrainian neo-Nazis who will kill him if and when the war is over. He merely fronts for them and gets paid off. And that’s why – enthusiastically supported by inconsequential London, Paris and Berlin – he’s obsessed to continue a Forever War destroying the very nation he claims to represent.

“This Istanbul meeting has taken place because of Moscow’s initiative, not that of the West or Ukraine. It was Putin who, on May 11, suggested, in essence, two things: First to start direct talks without preconditions. And second – this is the part everyone in the West pretends to miss – to do so by re-starting talks where “they were held earlier and where they were interrupted.” That was, of course, a clear reference to the Istanbul negotiations in the spring of 2022.”

“Putin’s offer of re-starting the Istanbul talks amounted to a second chance for a Kiev regime that – judging by its atrocious record of sacrificing Ukraine to brutal Western geopolitics – it certainly does not deserve. But ordinary Ukrainians do.”

• Istanbul Talks 2.0 Are A Great Chance For Zelensky To Accept Reality (Amar)

Despite Ukraine’s and the EU’s worst efforts at underhanded sabotage, the Istanbul talks – the first direct Russian-Ukrainian talks in three years – have now taken place. They may be over for now, they may continue soon. They may still turn into a dead end or they may help get somewhere better than war. What is clear already is that they are not meaningless. The question is what that meaning will be once we look back on them from the near future of either peace or continuing war. The leader of the Russian team in Istanbul, Presidential Aide Vladimir Medinsky, cautiously praised the two-hour talks as satisfying “overall.” A substantial prisoner exchange has been agreed (but not in the “all-for-all” format Ukraine unrealistically called for). Ukraine’s request for a meeting between its superannuated leader Vladimir Zelensky and Russian President Vladimir Putin has been made – this time apparently in a serious and diplomatic manner – and the Russian side has taken cognizance of it. Both sides have agreed to detail their vision of a potential future ceasefire and then to meet again.

This is much better than nothing. It’s also not a miracle breakthrough. But those expecting or even demanding the latter only have themselves to blame. That sort of thing was never in the cards. And that’s normal. For diplomacy, especially to end a war, is a complex activity for patient adults, by definition. It is also historically normal that such negotiations take place while fighting is still ongoing. It is silly and simply dishonest to pretend – as do Ukraine, its obstinate European backers, and sometimes (now depending on the mood on any given day) the US – that negotiations can only happen with a ceasefire in place. Medinsky has pointed out this basic fact in an important interview on Russia’s most watched political talk show. Westerners should pay attention. Because he’s right and, perhaps even more importantly, it’s yet another clear signal from Moscow that it will not walk into the simple-minded Western-Ukrainian trap of a ceasefire without at least a very clear path to a full peace.

Indeed, Medinsky referenced the Great Northern War of 1700-1721 to illustrate that Russia will fight as long as it takes. And that it’s a very bad idea not to take a comparatively good deal from Moscow when you are offered one, because the next one will be worse. Zelensky has already done this to his own country once or even twice (depending on how you count). During these second-chance Istanbul talks, an unnamed Russian representative warned Ukraine that if it misses this opportunity again, then the next one will involve additional territorial losses, again, as Russian TV reported. But let’s zoom out for a moment: There is a very simple thing about the current talks between Russia and Ukraine that virtually everyone in Western mainstream media and politics apparently cannot process. So let’s clarify the obvious: This Istanbul meeting has taken place because of Moscow’s initiative, not that of the West or Ukraine.

It was Putin who, on May 11, suggested, in essence, two things: First to start direct talks without preconditions. And second – this is the part everyone in the West pretends to miss – to do so by re-starting talks where “they were held earlier and where they were interrupted.” That was, of course, a clear reference to the Istanbul negotiations in the spring of 2022.As intelligent observers suspected immediately, these first Istanbul talks ended without results because the West instructed the Kiev regime to keep fighting. This is not a matter of opinion anymore. The evidence is in and unambiguous. Even the head of Ukraine’s 2022 negotiating team, David Arakhamia, has long publicly admitted two things: First, that Russia was offering Kiev a very advantageous deal back then, demanding no more than neutrality and an end to unrealistic NATO ambitions; everything else, to quote Arakhamia, was merely “cosmetic political seasoning.”

And second, that it was indeed the West that told Zelensky to bet on more war instead. And to his eternal shame, Zelensky chose to betray his country by obeying the West. That means – like it or not – that Putin’s offer of re-starting the Istanbul talks amounted to a second chance for a Kiev regime that – judging by its atrocious record of sacrificing Ukraine to brutal Western geopolitics – it certainly does not deserve. But ordinary Ukrainians do. Regarding Zelensky, he should have been elated and grateful to get a chance to, if not make up for his horrific decision in 2022 (that’s impossible), at least to finally correct it. But Zelensky has remained Zelensky. His response to the Russian offer was – as so often – stunningly narcissistic, megalomanic, and dishonest. Instead of seizing the chance for his country and himself, Zelensky started a transparent maneuver to put Russia in the wrong so as to impress, above all, US president Donald Trump.

Western politicians and mainstream media, meanwhile, spent tankerloads of venom on denouncing Moscow and Putin, accusing them of sabotaging the talks – which, again, Russia actually initiated – in, allegedly, two ways: by Putin not attending in person and by, as they claim, sending only a “low-level” team instead. These Western information war talking points have been so ubiquitous that it feels – once again – as if everyone is copying from the same, daft memo. Take the Bloomberg version, for instance. It can stand for all the others. Bloomberg is right about one thing: The composition of the Russian delegation – while by no means “low-ranking,” actually – was bound to “fall far short” of Kiev’s expectations. But that was the result not of Moscow’s decisions, but of Kiev’s inflated expectations and the way Zelensky tried to realize them. Once Zelensky had, in essence, made a public ultimatum out of his baseless demand that Putin attend in person, it was, obviously, extremely unlikely to happen.

Not much left to gain. Europe is Swiss cheese.

• What Does Russia Have To Gain From The EU Now? (Bordachev)

When Russian President Vladimir Putin recently remarked that Russia and Western Europe would “sooner or later” restore constructive relations, it was less a statement of policy than a reminder of historical inevitability. For now, there are no signs of readiness on the part of the EU. But history is full of unexpected reversals, and diplomacy has always required patience. Still, when that moment comes, Russia will have to ask a hard question: what, exactly, does it have to gain from Western Europe? At present, the answer appears to be very little. EU leaders behave as though Russia remains the same country they remember from the 1990s – isolated, weakened, and desperate to be heard. That world is gone. Today’s Russia neither needs Western European approval nor fears its condemnation.

And yet EU officials continue speaking in tones of paternalism and ultimatums, as if they still believe they represent something decisive on the world stage. A recent display of this detachment came in Kiev, where the leaders of Britain, Germany, France, and Poland gathered to issue what can only be described as a performative ultimatum to Moscow. The content was irrelevant; it was the posture that was telling. One could only wonder: who, exactly, do they believe is listening? Certainly not Russia, and increasingly, not the rest of the world either. Western Europe today poses no independent threat to Russia. It lacks both military capability and economic leverage. Its real danger lies not in strength but in weakness: the possibility that its provocations could drag others into crises it cannot control. Its influence has diminished, and it has largely burned the bridges that once made cooperation costly for Russia.

The West’s cold war fantasies are now detached from the material realities of global power. The EU elite’s fundamental miscalculation is assuming that Russia still views the western part of the continent as a model to emulate. But today’s Russia has little reason to aspire to European institutions, politics, or economic design. Indeed, in areas such as digital governance and public administration, Russia is ahead. Western European efforts to “modernize” Russia through consulting and institutional outreach have long since lost relevance. EU stagnation is not just political but also technological. Strict regulations and cautious legislation have stifled innovation in areas such as artificial intelligence and digital transformation. In fields where other European nations could once have partnered with Russia, different global actors have already stepped in.

The reality is that Western Europe has little to offer that Russia cannot obtain elsewhere. In education, too, Western Europe’s attraction has faded. Its academic institutions increasingly serve as conduits for intellectual siphoning, rather than genuine exchange. What was once a strength is now perceived as an instrument of cultural dilution. To be clear, Russia is not rejecting diplomacy with other European powers. But such diplomacy must be grounded in mutual benefit – and right now, Western Europe offers little. The real tragedy is that many European leaders were raised in a post-Cold War world that taught them they would never face consequences. That arrogance has calcified into a kind of strategic illiteracy. Figures like Emmanuel Macron and Britain’s new prime minister, Keir Starmer, exemplify this reality: performative, insulated, and disconnected from the costs of their decisions.

“We can see now though that this idea of the tail wagging the dog, even if once it might have been true to some extent, has now been dealt with head on by Trump.”

• Trump’s Middle East Theatricals Were All About Putting Bibi In His Place (Jay)

Was it Bill Clinton in the White House with Benjamin Netanyahu who, in a press conference, muttered those vulgar and certainly immortal words “who’s the f*** superpower around here?” The question was really about whether the U.S. is running Israel and its activities in the Middle East or it is in fact Israel which is running the U.S. In recent months in both the Biden administration and the Trump one which followed, many pundits have claimed that Israel is in control of U.S. foreign policy, with some even going as far as speculating that this control even goes beyond the Middle East itself. This cabal of online commentators made so much of how Trump adjusted Bibi’s seat when he sat down in the Oval Office. We can see now though that this idea of the tail wagging the dog, even if once it might have been true to some extent, has now been dealt with head on by Trump.

His visit to the Middle East and his impressive speech in Saudi Arabia which mocked the bellicose approach to bombing civilians was a direct message to Netanyahu in Israel: America is back. Trump is literally taking control of U.S. foreign policy in the region and pushing back Israel’s attempts to bomb its way to peace, whether this be in Gaza, Lebanon, Syria or, of course, in Iran. The move comes at a tough time in the region where the country which seemed to bring about a revolution with the Arab Spring – Tunisia – is falling into an abys as it becomes a leading example of a dictatorship which knows no limits on its brutal suppression. For Netanyahu, a number of pundits now are pointing to the “clear light” between Trump and him with some claiming that these two leaders aren’t even talking anymore. Trump defied him by talking to Iran, negotiating with the Houthis and now scrapping sanctions in Syria.

Israel cannot even dream of attacking Iran with the U.S. help and so a big part of Netanyahu’s mojo has been removed. And now Trump is calling the shots on aid to Gaza, but stopped short of calling for the Palestinians to have their own state. Yet his move on Syria is telling. Israel’s plans were always to have head-chopping extremists running the show – which they backed in the Syria civil war – with a constant mayhem present so that they can always take advantage of the chaos while ensuring that the path which once stood between Tehran and Beirut is always blocked. Trump’s announcement that all sanctions will be lifted will not be welcomed by Bibi who will see the move as a stunt by the Donald to demonstrate who is running the show, although the announcement itself might prove to be premature.

Senator Lindsey Graham states only Congress can change the country’s designation as a “state sponsor of terror” and that Trump must make his case to Congress for that to happen. “That report has not been received, and Congress has the opportunity to review this action if it chooses. The designation of Syria as a state sponsor of terrorism has tremendous ramifications apart from the sanctions,” Graham stated. The senator stated that he is sure that Congress must be informed before sanctions are lifted, and the legislative body would then “make an informed decision on whether or not it should approve the change in designation.” But he also stated that Israel’s opinion matters and that Congress would consult Netanyahu so it’s fair to say that Syria’s fate is still yet to be decided regardless of whatever Trump has said at the podium in Riyadh.

It would appear that Bibi and Trump are set to clash now and we shouldn’t be surprised at what resources Trump will deploy to show Israel’s leader that Trump is both serious about peace in the region but also that Israel must put aside its warmongering – which may well include even supporting a two-state solution, pushed more recently by France and the UK. And then we will see who is the f*** super power and who is the client state. Almost certainly the fate of Syria and Gaza will be used as a rod for Bibi’s back until he succumbs to Trump’s rule.

There’s not enough time to do the negotiations with 100+ nations properly.

• Trump Just Made a Huge Move on Tariffs (Margolis)

President Donald Trump demonstrated once again why he’s the master of the art of the deal. During his trip to the Middle East, Trump made it clear that countries dragging their feet on trade negotiations are about to face the music. So far, the trade negotiations are going well, and the economic apocalypse that Democrats claimed was going to happen hasn’t. It’s nothing new for Democrats to be wrong, and while they’re still harboring delusions that Trump is going to kill the economy, his latest move is likely to send them into a tailspin. Trump isn’t playing around. With over 150 countries clamoring to make deals with the United States, the president announced that Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick will be sending letters to these nations in the coming weeks, essentially telling them that tariffs might rise again soon.

“We have, at the same time, 150 countries that want to make a deal, but you’re not able to see that many countries,” Trump said in Abu Dhabi on Friday. “So at a certain point, over the next two to three weeks, I think Scott and Howard will be sending letters out, essentially telling people — we’ll be very fair — but we’ll be telling people what they’ll be paying to do business in the United States.” CNN has more. “Trump on April 9 paused his massive so-called reciprocal tariffs, which he announced on what he called “Liberation Day” on April 2. The reprieve was supposed to be for 90 days, to allow countries to negotiate with the administration. Trump officials have said around 100 countries have offered to negotiate deals, setting a tremendously difficult task before US trade negotiators to race against the clock to make new commitments.

Without those negotiated deals, Trump could impose reciprocal tariffs – some of which are as high as 50%. The tariffs aren’t technically reciprocal, and many smaller countries with large trade gaps with the United States would end up with significant tariff burdens. “I guess you could say they could appeal it, but for the most part I think we’re going to be very fair, but it’s not possible to meet the number of people that want to see us,” Trump said.” And the results are already rolling in. The United Kingdom, showing remarkable foresight, quickly secured a deal that limits its tariffs to just 10%, the first formal agreement since Trump’s “Liberation Day” announcement in early April. That’s what happens when you negotiate in good faith with the Trump administration. But perhaps the most significant development is happening with China. The communist regime, which initially tried to play hardball, is now singing a different tune.

According to Trump, they “wanted to make that deal very badly.” Both nations have temporarily suspended tariffs that had reached a staggering 100%, with a 90-day window to hammer out a permanent agreement. This is exactly why the American people elected Trump to a second term. He understands that the only way to fix decades of terrible trade deals is to negotiate from a position of strength. The administration’s approach is that countries should either come to the table ready to deal fairly or face the consequences. The liberal media might wring its hands about trade wars, but Trump is proving once again that his approach works. With 150 countries practically begging to negotiate, it’s obvious who holds the cards. As these next few weeks unfold, we’re about to see which nations understand the new reality of trading with America and which ones need to learn the hard way. That’s what real leadership looks like.

“..[that] [the Republicans] had always been “war and peace,” that Trump had changed it to “peace and war.”

• Scott Jennings, Bill Maher Light It Up on Trump’s Powerful Speech (Arama)

President Donald Trump gave a stirring speech in Saudi Arabia this week of what might be termed an outline of the “Trump Doctrine,” a revival of peace through strength, but recognizing that you don’t always have to be interventionist.

.@POTUS: The gleaming marvels of Riyadh and Abu Dhabi were not created by the so-called nation-builders… who spent trillions of dollars failing to develop Kabul and Baghdad… the birth of a modern Middle East has been brought about by the people of the region themselves. pic.twitter.com/SluRou2mv6

— Rapid Response 47 (@RapidResponse47) May 13, 2025

“Before our eyes, a new generation of leaders is transcending the ancient conflicts and tired divisions of the past and forging a future where the Middle East is defined by commerce, not chaos,” the president said, “where it exports technology, not terrorism; and where people of different nations, religions, and creeds are building cities together, not bombing each other out of existence — we don’t want that.” He skewered those who failed, saying that, “in the end, the so-called ‘nation builders’ wrecked far more nations than they built, and the interventionalists were intervening in complex societies that they did not even understand themselves. They told you how to do it, but they had no idea how to do it themselves.”

In that, you can see how ridiculous the “dictator” talk about Trump is. He’s the man of the Abraham Accords, who brought more peace in the Middle East, who’s trying even now to bring peace to Ukraine. But he’s also the guy who will act with strength and take out people who attack us; he will put America first. How unique was that speech? Even Bill Maher thought it was a radically different take, on HBO’s “Real Time” show on Friday, which included guest Scott Jennings.

President Trump has flipped "war and peace" to "peace and war" — and even people on the left are getting on board.

When even @billmaher's @RealTimers audience is applauding the new Trump doctrine, it's clear a seismic shift is underway. pic.twitter.com/PrjMn8CRCn

— Scott Jennings (@ScottJenningsKY) May 17, 2025

Jennings then went on to say how we [the Republicans] had always been “war and peace,” that Trump had changed it to “peace and war.” “He talks about peace more than he talks about war. He’s still hawkish enough to bomb people who need to be bombed like the Houthi rebels,” Jennings said. He’s “Peace through Strength,” like Reagan. Jennings continued, “Putting peace ahead of war is pretty popular with the American people.” That got big applause from Maher’s audience, which Jennings termed a seismic shift. It’s not just foreign policy where Trump is bringing transformative change in policy, bringing the government back to reality and more in touch. You can also see it by moving the FBI out of its ivory tower in D.C. and to middle America. Jennings spoke about breaking up that D.C. concentration to put the workers into the middle of the country, so they would have a “better understanding”:

https://twitter.com/VigilantFox/status/1923626513221537931?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1923626513221537931%7Ctwgr%5E6c720826bbbde35fc82cd8b4a40e023c7f52a9ce%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Fredstate.com%2Fnick-arama%2F2025%2F05%2F17%2Fscott-jennings-and-bill-maher-talk-trumps-powerful-speech-transformative-change-hes-bringing-n2189210

That also got a lot of cheers. Peace through strength, and getting more in touch with what Americans want. It’s hard to argue with that as a doctrine. Team Trump has been thinking outside the box, and it’s refreshing after four years of Biden malaise.

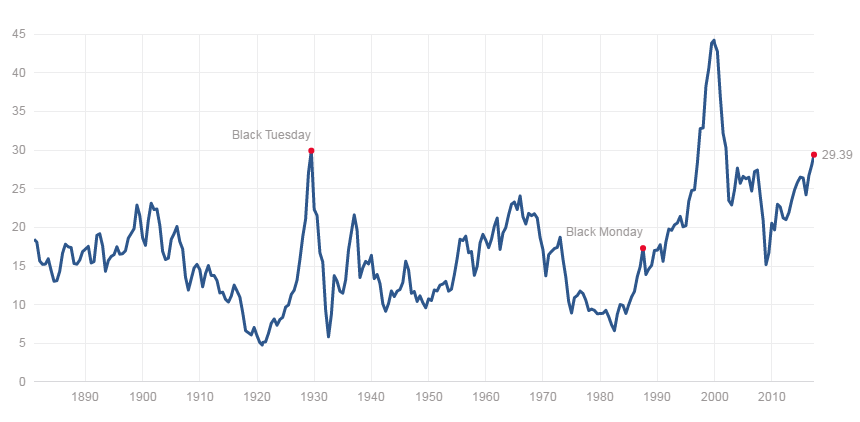

“..Moody’s “would not have stayed silent as the fiscal disaster of the past four years unfolded” if the agency “had any credibility.”

The timing is curious. Is this the worst situation in 108 years?! Or has Moody’s gone TDS woke?

• Moody’s Delivers First US Credit Rating Downgrade Since 1917 (RT)

Moody’s has stripped the US of its perfect triple-A credit rating, citing increasing concerns over debt affordability. The rating agency had held the country’s sovereign credit rating at the highest possible level since 1917. The move brings the 116-year-old agency into line with its global rivals. Fitch Ratings downgraded the US rating to AA+ from AAA in August 2023, and Standard & Poor’s cut it to AA+ from AAA in August 2011. The reduction to Aa1 “reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns,” Moody’s said in a statement released on Friday.The agency noted that successive US administrations and Congress have failed to reach an agreement on measures to reverse the pattern of large annual fiscal deficits and rising interest costs.

Moody’s stated, however, that the US retains exceptional credit strengths, citing its size, resilience, dynamism, and the role of the dollar as the global reserve currency. Earlier this month, Treasury Secretary Scott Bessent warned about the possibility of a default as soon as August, calling for either raising or suspending the debt ceiling – a statutory limit on how much the federal government can borrow – to avoid running out of money to cover federal expenses. The US reached its ceiling of $36.1 trillion in January. Once the limit is hit, the government is legally barred from borrowing further to meet its obligations. The total federal debt has climbed to $36.2 trillion, according to official figures.

The Treasury has avoided default by using so-called “extraordinary measures” – mainly accounting maneuvers such as suspending contributions to federal employee retirement funds – to keep up with its financial commitments. Under former President Joe Biden, the debt ceiling was raised three times. The current president, Donald Trump, has argued that the cap should be eliminated entirely, calling it pointless if it’s routinely lifted. He has argued that the concept of a debt ceiling “doesn’t mean anything, except psychologically.” Commenting on the rating downgrade, White House spokesperson Kush Desai said on Friday that Moody’s “would not have stayed silent as the fiscal disaster of the past four years unfolded” if the agency “had any credibility.” He also claimed that the Trump administration is currently dealing with the “mess” left by the previous administration.

‘sundance’ deep dive.

• Biden’s DOJ – Merrick Garland was AG In Name Only for a Specific Reason (CTH)

There has been a lot of discussion about who was running the Biden administration against the backdrop of numerous revelations about his cognitive incapacity while in office. However, one key point keeps being overlooked about the DOJ during his tenure. Merrick Garland was not selected to be Joe Biden’s Attorney General because the crew in control of the events wanted Merrick Garland as Attorney General. Garland was removed from his position as DC Circuit Court Justice in order to make room for Ketanji Brown-Jackson to take Garland’s place, get Senate confirmed and then await the resignation of Supreme Court Justice Stephen Bryer. {GO DEEP} As a standalone Supreme Court nominee, Judge Ketanji Brown-Jackson would have been a radical pick.

Judge Brown-Jackson was a known activist in the DC District Court; however, by removing Garland as chief circuit justice and replacing him with KBJ, who needed Senate confirmation as chief circuit justice, she could get through a later Senate confirmation easier and then sit on the Supreme Court for thirty years. Garland was removed to make room for KBJ. It was a strategy. Garland was a U.S. Attorney General in name only. The actual lead of the DOJ was from Obama’s crew, Deputy AG Lisa Monaco. WHY? Back in 2009 President Obama selected Eric Holder to be Attorney General. AG Holder’s role was to lead the Lawfare ‘fundamental transformation’ we have seen in the 16 years since. In the 2010 midterms, Obama was “shellacked,” that triggered AG Holder to ask the Treasury Department to participate in a “special research project.” {Go Deep}

The IRS was asked for the Schedule-B’s of groups who were registered as “patriot” groups (Tea Party Patriots) and other names associated with the political uprising against Barack Obama and the takeover of federal healthcare, ie Obamacare. The Cincinnati field office of the IRS then sent the DOJ a batch of CD-ROM’s containing the names of the individual donors listed on the IRS 501-c (3)(4) forms. That list was then compiled and used by the federal government to target the donors and supporters. A whistleblower came forward; the IRS controversy swirled in 2012. On September 25, 2014, the Justice Department said Attorney General Eric Holder would resign as soon as his successor is confirmed. Holder was succeeded by Loretta Lynch on April 27, 2015. Lynch was selected because she was the bridge to Hillary Clinton’s campaign in 2016. Remember the Bill Clinton and Loretta Lynch tarmac meeting? It’s all connected. [Sidebar – the reporter who broke the story of the Arizona Clinton/Lynch tarmac meeting later died from “suicide.”]

Summary so far: Obama appointed Holder to lead and create the weaponized Lawfare transition within Main Justice. Eric Holder did just that, and also created the DOJ-National Security Division (to use FARA investigations against DC operatives as leverage). Holder then left the DOJ, took the special research project data, and went to work in California. Loretta Lynch was then appointed as the transitional AG between Obama and Hillary Clinton. That was the plan. The DOJ/FBI would protect Clinton’s interests, and that’s exactly what they did in 2015 and 2016. Eric Holder was then hired by the State of California right after the surprising and unexpected election result of 2016. Eric Holder then began constructing the BETA test for what was to come later. Eric Holder organized the motor-voter rolls in California to auto-register illegal alien voters. The California legislature passed a law permitting illegal aliens to get drivers licenses.

Eric Holder’s program linked those drivers licenses automatically to voter registration. Do you remember the 2018 mid-term election in California? For weeks after 2018 election day in California, the new process of mail-in ballots changed the entire election day outcome. California was the BETA test for the national 2020 mail-in ballot fraud system. It all links back to the California ballot and illegal alien voter registration operation carried out by Eric Holder. Eric Holder was Obama’s weaponized Attorney General (2009-2015). Loretta Lynch was the Attorney General in place to facilitate the transition to Hillary Clinton (2015-2016). Merrick Garland was Biden’s Attorney General (2021) to pave the way for Ketanji Brown-Jackson to be a U.S. Supreme Court Justice (2022). Lisa Monaco was the person running the day-to-day DOJ operations (2021-2025). KBJ was put into the planning book back in February 2020, yes, 2020!

It was February 25th, 2020, to be precise, just four days before the South Carolina Democrat primary. South Carolina Representative James Clyburn went backstage at the presidential debate and told Biden, “You’ve had a couple of opportunities to mention naming a Black woman to the Supreme Court,” Clyburn lectured his friend of nearly half a century, like a schoolteacher scolding a child. “I’m telling you, don’t you leave the stage tonight without making it known that you will do that.” {link} Unbeknownst to Biden at the time, just two days earlier Barack Obama and James Clyburn came to an agreement and created the most consequential alliance of the 2020 Democrat campaign. Barack Obama the figurative and ideological leader of the movement known as “Black Lives Matter”, and James Clyburn the figurative and ideological leader of the political construct within the African Methodist Episcopal (AME) church, had struck a deal.

Obama and Clyburn really had no choice but to come to an agreement and form the alliance. If they did not act fast, Bernie Sanders was gaining momentum, and they could not have Sanders at the top of the 2020 ticket, because he was too outside the club system which was now almost exclusively focused on racial identity as a tool for political power. A Bernie Sanders -vs- Donald Trump general election would have been a disaster; and it would be almost impossible for the racial operatives in the key precincts [Atlanta (GA), Philly (PA), Clark County (NV), Wayne County (Mich), Madison (WI)] to feel inspired enough to risk themselves and commit fraud to help Bernie win.To get rid of Sanders, BLM and AME aligned. This was the actual moment when Hillary Clinton was cast into the pit of irrelevance in Democrat politics. Within the agreement, Obama and Clyburn selected Biden as the tool they could easily control to deliver on their larger, progressive, leftist intentions.

A few days later, James Clyburn then endorsed Biden while Barack Obama began making phone calls telling each of the other candidates to drop out in sequence and support Biden or else the club would destroy them. The only one told not to drop out yet was Elizabeth Warren, as she would be needed as the insurance policy, the splitter against Bernie Sanders. Each of the candidates was promised the traditional indulgences for toeing the party line, and the rest is history. Joe Biden wandered around doing what everyone told him to do, which was mostly stay in his basement and let the club work on his behalf, until the club delivered the nomination. Inside that process, the strategic map was modified to ensure Ketanji Brown-Jackson would advance to the Supreme Court.

With Biden installed, he would select Merrick Garland as his Attorney General. Judge Garland was an important judge on the important DC Circuit Court. Garland’s replacement would need to be a Senate confirmed seat for that Circuit Court assignment. Brown-Jackson would be put into Garland’s open spot, and the Senate could not deny her the SCOTUS confirmation, having just confirmed her months before. {Go Deep} It was always the team around -and including- Barack Obama operating in the background of Biden.

Schneider

NEW: Rob Schneider publicly DARES Dr. Fauci and Rochelle Walensky to take all 72 childhood vaccine doses on stage—if they really believe they’re safe.

“I’d like to see you show up and get the whole [schedule] if you think it’s so safe,” he said.

“Get the whole recommended… pic.twitter.com/WKuFP4e1vu

— The Vigilant Fox 🦊 (@VigilantFox) May 16, 2025

Cole

Already happening pic.twitter.com/NV79SPxwin

— “Sudden And Unexpected” (@toobaffled) May 17, 2025

Yeadon

"The formulation [for mRNA injections] was chosen [in] the full knowledge it would accumulate in the ovaries of girls".

Mike Yeadon, former chief scientist and Vice President at Pfizer:

"The mRNA products from Moderna and Pfizer-BioNTech, they were encapsulated in a… pic.twitter.com/tWKvVfDi8k

— Humanspective (@Humanspective) May 17, 2025

https://twitter.com/EricLDaugh/status/1923525533159027176

Lipstick

https://twitter.com/Rainmaker1973/status/1923699988049072173

Paint

— Rob Schneider 🇺🇸 (@RobSchneider) May 16, 2025

Elk

Weighing in at up to 320 kg, elks stand as one of the biggest deer species on earth.

But don't think that just because an elk is large that it's slow. A mature bull can run as fast as 70 km/h and jump almost 3 meters high.pic.twitter.com/6u947e3as3

— Massimo (@Rainmaker1973) May 18, 2025

Hammer

Nerves of stainless steel pic.twitter.com/m6DFIevwkw

— Nature is Amazing ☘️ (@AMAZlNGNATURE) May 17, 2025

Rap1946

First rap song ever recorded, 1946 pic.twitter.com/UZIpKINUeb

— Historic Hub (@HistoricHub) May 17, 2025

Cliff

70-year-old priest climbs a 250-meter cliff every day — and has done it for 56 years — to feel closer to God pic.twitter.com/NMZX632yeH

— non aesthetic things (@PicturesFoIder) May 17, 2025

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.