Elliott Erwitt Gateway Center Demolition Area Pittsburgh 1950

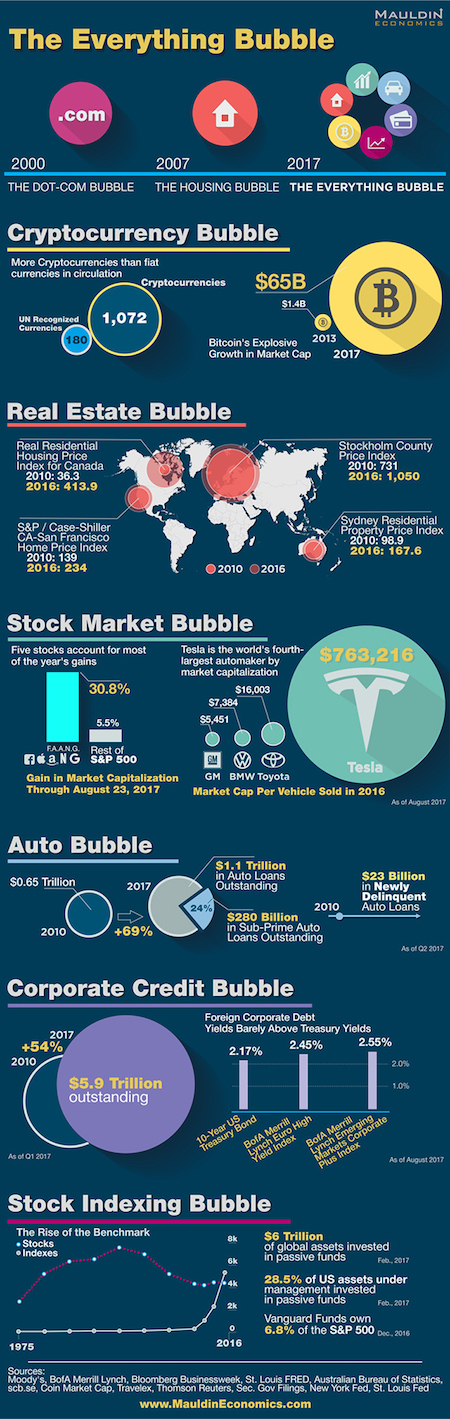

It’s big graphs day today. This is Jared Dillian’s.

• All The Bubbles That Are About To Pop In One Chart (Dillian)

It wasn’t always this way. We never used to get a giant, speculative bubble every seven to eight years. We really didn’t. In 2000, we had the dot-com bubble. In 2007, we had the housing bubble. In 2017, we have the everything bubble. I did not coin the term “the everything bubble.” I do not know who did. Apologies (and much respect) to the person I stole it from. Why do we call it the everything bubble? Well, there is a bubble in a bunch of asset classes simultaneously. And the infographic below that my colleagues at Mauldin Economics created paints the picture best. I don’t usually predict downturns, but this time I bet my reputation that a downturn is coming. And soon.

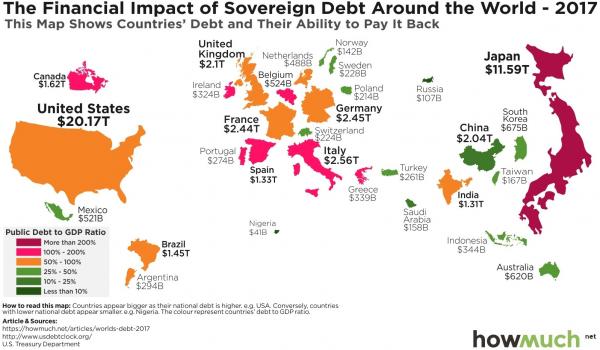

Private debt would be more useful. But okay…

• America’s $20 Trillion Debt In Global Context (HowMuch)

The U.S. federal government just passed a record $20 trillion in publicly held debt. That’s bigger than the entire economy of every country in the European Union, combined. The debt will only grow higher unless President Trump and the U.S. Congress can agree to unprecedented spending cuts combined with tax increases. Don’t count on that happening anytime soon. Most people think that an eye-popping $20+ trillion debt is insurmountable, and in fact, it is the largest in the world by far. But when you look at another fiscal measure—the ratio of debt-to-GDP—the U.S. is not in the worst situation. Our visualization allows you to quickly see how the U.S. government’s debt compares to other countries around the world. The size of the country correlates to the size of the debt. The U.S. and Japan stand out because they have the highest debts in the world ($20.17T and $11.59T, respectively).

Other countries, like Germany and Brazil, appear much smaller because their debts are comparatively tiny ($2.45T and $1.45T, respectively). We then color-coded each country according to its debt-to-GDP ratio. Green countries have a healthy margin, but dark red and fuchsia countries have debts that are even bigger than their entire economies. The debt-to-GDP ratio is a critical metric for evaluating a country’s fiscal health. It makes a lot of sense for the American government to have a higher debt than a much smaller country, like Germany. That’s why it’s important to consider the GDP of each country, a number which represents the sum of all transactions occurring in the economy. Once you understand the public debt as a percentage of GDP, you get a level playing field for countries on different economic scales. When you think about it like this, the U.S. isn’t even among the ten worst sovereign debts in the world.

Top 10 countries with the Worst Debt-to-GDP Ratios

1. Japan (245% at $11.59B)

2. Greece (173% at $338B)

3. Italy (138% at $138B)

4. Portugal (133% at $274B)

5. Belgium (111% at $111B)

6. Spain (106% at $106B)

7. Canada (106% at $106B)

8. Ireland (105% at $105B)

9. France (98% at $98B)

10. Brazil (82% at $82B)

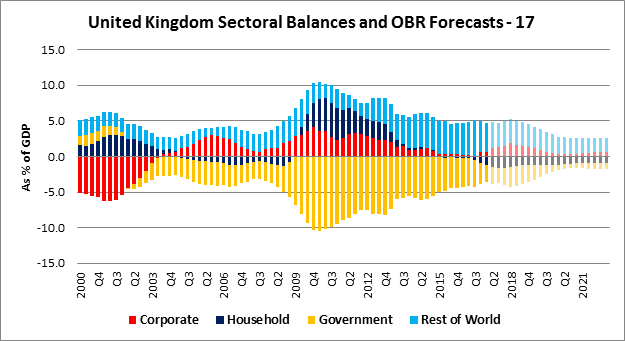

Dave Graeber suggests (strongly) that official UK numbers miss -intentionally or not- a huge chunk of household debt. Government debt could be involved, but even then.

• Accounting Error Spells Chaos For Global Economy (Graeber)

The thing that always struck me is how much the morality of debt—that anyone in debt has only themselves to blame, that deadbeats are contemptible—stubbornly refuses to die. Even now, when the situation is largely engineered by government policy, the first impulse of pundits and other popular moralists is invariably to assume the real problem must, somehow, be a bunch of lazy freeloaders, living beyond their means. As a result, by the standards of public discourse that exist today—that is, the sort of things it’s considered acceptable coming from the mouth of a politician or TV commentator or government economist—it’s not really legitimate to worry about rising levels of household debt simply because it causes misery or deprivation, if it means millions of actual flesh and blood human beings will be living lives of fear, anxiety, and constant humiliation.

Illustration Rachel BoltonIt’s only really legitimate to worry about rising levels of household debt insofar as it might be likely to cause another financial crisis. (Such a crisis, after all, might well affect the lives of the rich and upper reaches of the professional and managerial classes, that is, the kind of lives that policy-makers feel they have to take account of.) And even then, it must be posed as a moral problem caused by irresponsible self-indulgence—as one Daily Mail headline recently put it: “Your neighbour’s shiny new SUV is about to crash the economy!” Yet the two impulses are clearly in tension. To look at debt in macro-economic terms does make it easier to see it as a structural problem, as the result of self-conscious policy decisions. As a result, everyone seems to want to minimise the problem. Here are the numbers that they published in 2017, which a friend of mine who works in the City translated into handy tabular form:

The attentive reader will note that the image is symmetrical. Up to around 2014, at least, the top and bottom half exactly mirror one another. This is exactly as things should be: it’s an “accounting identity”, as in a ledger sheet, debits and credits have to add up. The remarkable thing is that after 2014, they don’t, and in the projected future, the top and bottom are actually quite different. When I first saw this diagram I was startled and confused. Was I missing something? Was there something about the math I didn’t understand? I passed the image on to two different economists and asked just that: isn’t there something wrong with the numbers here?

A version of the ugly duckling. Behind Trump’s words on athletes and the anthem. Many people like the athletes, but some 75% of Americans think they should respect the flag. Trump thought this through.

• The American Golden Calf (PL)

As a young boy, I enjoyed my family’s bantam chickens that laid very small eggs and hatched very small chicks. Theirs was a small and miniature world. One day one of my bantams started sitting on eggs to hatch its chicks. Something happened to her eggs but she continued to sit, so I decided to put a duck egg under her. Duck eggs are at least three times bigger than bantam eggs and take a few days longer to hatch, but she dutifully sat on the egg several days longer. She hatched the duckling and, as you can imagine, it thought that his world was normal and that the bantam hen was his mother. The duckling eventually grew into a full sized mallard duck, probably five or six times the size of its bantam mother. The full-grown duck would follow its hen mother around as would normal chicks. It was a funny sight to watch.

But I remember thinking, even as a small boy, that the duck’s entire reality was that the bantam hen was his mother and that was the way the world worked. He had no need to consider anything else. This is the world of the American people today. Their perceptions of reality control them and they who control their perceptions control the American people. Our perception of America has always been that she is the mother country and ordained by God, good and just and a beacon of freedom. This is hammered into our psyches from our early days. From pre-school up, we are taught to worship the state. I don’t know if it is still done, but in the public (non)education system, for many years, schoolchildren across the South — and elsewhere, I suppose — recited the Pledge of Allegiance each morning.

Political rallies and government meetings are still often begun with a recitation of the pledge. People say it with patriotic fervor, with their hands placed dutifully on their hearts. Sporting events, political rallies and other public venues are often kicked off with the playing and/or singing of the Star Spangled Banner. Before the song begins, people are instructed to rise, men to remove their hats,and people place their hands over their hearts. They don’t realize its value as a propaganda tool. We have come to equate the flag, the pledge and the national anthem with patriotism, and patriotism with government, country and support for government, support for foreign wars and veterans. Anything less is “un-American.”

“What happens when a bimbo defaults on her boob loan? How narrow minded of me.”

As I was driving to work yesterday morning on the Schuylkill Expressway a commercial comes on the radio from a plastic surgeon advertising for anyone looking for a better set of boobs. I had never heard a plastic surgeon commercial before, so I thought that was unusual. But, that wasn’t the best part. This plastic surgeon was offering no money down 18 month interest free financing on your new boobs. I wonder if they are moving boobs with subprime debt the same way the auto companies have used subprime debt to move cars. Of course, when a deadbeat defaults on an auto loan the car is easily repossessed. What happens when a bimbo defaults on her boob loan? How narrow minded of me. What happens when some dude who wants to be a bimbo defaults on his/her loan? I guess it was just a matter of time before breast enhancement met debt enhancement in this warped world of materialism, narcissism, financialization, and delusions.

Now that revolving credit has reached a new all-time high of $1 trillion and total consumer debt outstanding has exceeded it’s 2008 peak at $12.8 trillion, the Fed has completed its job of helping the average American again in-debt themselves up to their eyeballs. This is considered a success story in this twisted, perverted, bizarro world we call America today. The solution to an epic debt induced global financial catastrophe caused by Federal Reserve easy money, Wall Street fraud, and Washington DC corruption has been to increase global debt by 50% since 2007, with virtually all of it created by central bankers and the governments they control. In what demented Ivy League educated academic mind would piling $68 trillion more debt on the backs of taxpayers as a cure for a disease caused by the initial $149 trillion of debt be considered rational and sustainable? It’s like having pancreatic cancer and trying to cure it with a self inflicted gunshot.

The following two pieces are fom the same article.

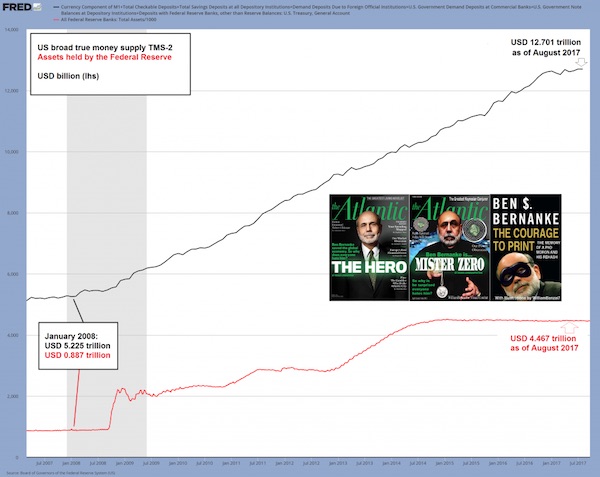

• Bernanke Past the Point of No Return (AM)

In late November 2008, Federal Reserve Chairman Ben Bernanke put in place a fait accompli. But he didn’t recognize it at the time. For he was blinded by his myopic prejudices. Bernanke, a self-fancied Great Depression history buff with the highest academic credentials, gazed back 80 years, observed several credit market parallels, and then made a preconceived diagnosis. After that, he picked up his copy of A Monetary History of the United States by Milton Friedman and Anna Schwartz, turned to the chapter on the Great Depression, and got to work expanding the Fed’s balance sheet. Now here is something all those “Great Depression experts” always neglect to mention: the Fed’s holdings of government securities expanded my more than 400% between late 1929 and early 1933.

Friedman’s often repeated assertion that the Fed “didn’t pump enough” in the early 1930s – which is held up as the gospel truth by nearly everyone – is simply untrue. It is true that the money supply collapsed anyway – but not because the Fed didn’t try to pump it up. Many contingent circumstances mitigated against money supply expansion: too many banks went bankrupt, taking all their uncovered deposit money to money heaven, as there was no FDIC insurance; only 50% of all banks were even members of the Federal Reserve system; no-one wanted to borrow or lend in view of the massive economic contraction and the Hoover administration’s ill-conceived interventionism. We can also tentatively conclude that the economy’s pool of real funding was under great pressure, which was exacerbated as a result of the trade war triggered by the protectionist Smoot-Hawley tariff enacted in June 1930.

The collapse in international trade and investment meant that the pool of savings of the rest of the globe was no longer accessible. Bernanke’s dirty deed commenced with the purchase of $600 billion in mortgage-backed securities, using digital monetary credits conjured up from thin air. By March 2009, he’d run up the Fed’s balance sheet from $900 billion to $1.75 trillion. Then, over the next five years, he ballooned it out to $4.5 trillion. All the while, Bernanke flattered his ego with platitudes that he was preventing Great Depression II. Did it ever occur to him he was merely postponing a much-needed financial liquidation and rebalancing? Did he comprehend that his actions were distorting the economy further and setting it up for an even greater bust?

Perhaps Bernanke understood exactly what he was doing. As many readers have insisted over the years, the Fed works for the big banks and big money interests. Not Main Street. Regardless, the Fed recognizes that the optics of its $4.5 trillion balance sheet have become a bit skewed. The Great Recession officially ended over eight years ago. Why is the Fed’s balance sheet still extremely bloated?

US broad true money supply TMS-2 and assets held by the Federal Reserve

A 6.5 year plan.

• Janet Yellen’s 78-Month Plan for US National Monetary Policy (AM)

By our back of the napkin calculation, starting with October’s initial $10 billion reduction, then incrementally increasing the reduction by $10 billion each quarter until hitting $50 billion per month, and then contracting by $50 billion a month from there, it will take 78-months for the Fed to get its balance sheet back to $900 billion (i.e., where it was before Bernanke’s act of depravity). Thus, in roughly six and a half years, or in March 2024, monetary policy will be back to normal. If you recall, the Soviets operated under five-year plans for the development of the national economy of the USSR. Now, Yellen, an ardent central planner and control freak, has charted the Fed’s 78-month plan for the national monetary policy of the United States. Have you ever heard of something so ridiculous?

However, while the Soviets were zealous believers in their plans, we suspect the Fed will be as committed to the cause as a fat person to a New Year’s Day diet. In truth, the Fed will never, ever reduce its balance sheet to $900 billion. They won’t even get close; they are well past the point of no return. In the early 1930s the Soviet planners under Stalin had a great idea: why not fulfill the 5 year plan in four years? This showed that nothing was impossible for the “new Soviet man” and two plus two was henceforth five. As Marxists will explain, this is in perfect keeping with the rules of polylogism. Even the laws of mathematics must bend to proletarian logic. For starters, financial markets will not allow the Fed to execute its 78-month tightening program according to plan. At some point, credit markets will have a severe reaction.

This would ripple through stock markets and nearly all assets that are propped up by cheap credit. What’s more, if this doesn’t panic the Fed from its master 78-month monetary policy plan, the economy will. No doubt, at some point within the next 78-months the U.S. economy will shrink. What will the Fed do then? Will they continue to tighten in the face of a contracting economy? No way. They will ease, and then they will ease some more. They won’t stop until it is near impossible for an honest person to work hard, save their money, and pay their way in life. Many fine fellows were already pickled over by the Fed in the last easing cycle and lost their way. More are bound to follow.

Guess who’s lying in wait… it will be found out that a creature long held to be extinct was merely hibernating in its cave, sharpening its claws.

China’s just shifting debt around, hoping it’ll end up under a carpet some place. But the zombies merely start infecting healthy businesses.

• A Private Solution For China’s Zombie Company Problem? Unlikely (R.)

China’s latest push to revive its bloated state-owned sector is set to pick up pace this year, with bankers and investors expecting possible spin-offs and asset sales to follow a key Communist Party Congress in October. But the effort is likely to only involve a limited role for private money, even as Beijing has been promoting it as crucial for reforming state-owned enterprises (SOEs), according to people familiar with China’s plans. Beijing would likely lean on cash-rich SOEs like China Life Insurance and Citic Group to bail out the largest of the struggling companies, the people said. They cited China Life stepping in to help China Unicom raise $12 billion last month. A limited role for private capital would raise questions about the depth of any overhaul of the SOEs.

China hopes to speed up the reforms in order to meet ambitious economic growth targets and manage its corporate debt burden. “The current model allows winners, companies doing better, to partially own those doing worse,” said Alicia Garcia-Herrero, chief Asia Pacific economist at Natixis. “In other words, this is a reshuffling of profit, loss among SOEs to a large extent.” China Life is in talks with China Three Gorges New Energy, a unit of the country’s top hydropower developer, according to sources familiar with the matter. China’s state-run companies dominate the country’s key industries, from banking to insurance, energy, and telecoms. They retain an edge over their private rivals in investing both locally and overseas, in part thanks to easier financing.

But they also produce lower returns than their private counterparts and account for the biggest proportion of the bad loans on the books of the country’s banks. The fund raising by Unicom, a state-owned telecoms group, had sparked hopes for the mixed ownership effort, as outlined in a 2015 government plan. The partial privatization of Unicom in August, involving 14 investors, including the tech giants Alibaba and Tencent, was welcomed by markets. But, as Beijing balanced the need for cash with the need for control, China Life ended up with a 10.6 percent stake in the company, nearly a third of the total sold. New investors, including China Life, were given three of 15 board seats.

Feels half ass.

• More Chinese Cities Impose Property Control Measures (R.)

A number of second-tier cities in China have rolled out property speculation curbs in an effort to cool home property sales, according to the official Xinhua News Agency and documents published by some municipal governments. The city of Shijiazhuang, southwest of Beijing, has banned investors from selling newly bought homes for up to five years, while Changsha in Hunan province banned homeowners from buying a second property for up to three years from the time of their first home purchase, Xinhua said. Changsha has also limited property sales to non local residents to one unit per person. The city of Chongqing, as well as Nancang in the southern province of Jiangxi, meanwhile, banned transactions of new and second-hand homes for two years after purchase.

The various measures took effect last week. Additionally, Xian in Shaanxi province has asked real estate developers from Monday to report home prices to local price-monitoring departments before sale and reiterated its pledge to crack down on property price manipulation and speculation. The latest property clampdowns follow moves in June by two Chinese cities, Xian in Shaanxi and Zhenzhou in Henan province, to cool their property markets. Average new home prices in China’s 70 major cities rose 0.2 percent in August from a month ago, data from the statistics bureau showed.

I’m not convinced. Besides, Google and Facebook already are branches of the intelligence industry.

• The Tide Is Starting To Turn Against The World’s Digital Giants (G.)

In his wonderful book The Swerve: How the Renaissance Began, the literary historian Stephen Greenblatt traces the origins of the Renaissance back to the rediscovery of a 2,000-year-old poem by Lucretius, De Rerum Natura (On the Nature of Things). The book is a riveting explanation of how a huge cultural shift can ultimately spring from faint stirrings in the undergrowth. Professor Greenblatt is probably not interested in the giant corporations that now dominate our world, but I am, and in the spirit of The Swerve I’ve been looking for signs that big changes might be on the way. You don’t have to dig very deep to find them. Some are pretty obvious. In 2014, for example, the European Court of Justice decided that EU citizens had the so-called “right to be forgotten” and that Google would have to comply if it wanted to continue to do business in Europe.

In May this year, the European commission fined Facebook €110m for “providing misleading information” about its takeover of WhatsApp. And in June the commission levied a whopping €2.4bn fine on Google for abusing its monopoly in search. Since the European commission is the only regulator in the world that seems to have the muscle and inclination to take on the internet giants, these developments were relatively predictable. What’s more interesting are various straws in the wind that show how digital behemoths are losing their shine. Many of these relate to Brexit and the election of Donald Trump, and to the dawning of a realisation that Google and Facebook in particular may have played some role in these political earthquakes.

This was not because the leadership of the two companies actively sought these outcomes, but because people began to realise that the infrastructure they had built for their core business of extracting users’ data and selling it to companies for ad-targeting purposes could be – and was – “weaponised” by political actors in order to achieve political goals. Public concern about these discoveries was not exactly mollified by the responses of the companies’ bosses – which were variously dismissive, evasive (“it’s just the algorithms – nothing to do with us”), disingenuous, inept and politically naive. They had to be like that, because a franker response would reveal that taking responsibility for what happens on their platforms would vaporise the business model that has made them so rich and powerful.

Why let Uber grow as big as it has and only then act?

• Why Uber’s Fate Could Herald Backlash Against ‘Digital Disruptors’ (G.)

In the mind of many Uber supporters, the Transport for London (TfL) decision – coming a few days before Khan’s appearance at the Labour party conference – revealed an organisation in thrall to established labour interests. Sources told the Observer that the decision was communicated to Uber only two minutes before it was announced and that there had been only one meeting in the last year between the company and the senior team at TfL who insisted that the licence renewal could not be discussed. “TfL has once again caved into pressure from unions who never miss an opportunity to rip off passengers,” said Alex Wild, research director at the rightwing pressure group Taxpayers’ Alliance. The pushback against the laissez-faire philosophy of the US west coast’s tech community is being waged on both sides of the Atlantic.

In the US, calls to regulate technology companies have made strange bedfellows of Democratic senator Elizabeth Warren and ex-White House aide and Breitbart chief Steve Bannon. Last week the former chief strategist to Donald Trump reiterated his view that firms such as Facebook and Google should be regulated like “public utilities”. Meanwhile progressives such as Warren warn of the monopolistic behaviour of Google, Amazon, and Apple while pushing for a renewed debate over antitrust laws. “Silicon Valley is going from being heroes to villains,” said Vivek Wadhwa, a distinguished fellow and adjunct professor at Carnegie Mellon University. “It’s been brewing for quite a while, but there’s a big shift happening.” But, still, the speed of this shift has surprised many. “In our wildest dreams we didn’t think TfL would refuse the licence,” said Maria Ludkin, legal director at the GMB union. “We thought they’d attach conditions to make sure Uber would improve passenger and driver safety.”

[..] Ironically, while many drivers like Abdul have leapt to Uber’s defence, it was the company’s treatment of them that drew attention to the aggressive corporate culture which brought about its downfall in the capital. Last October, following a case brought by the GMB that has wide-ranging implications for all companies in the gig economy, an employment tribunal ruled that Uber’s UK drivers should be classed as workers rather than as self-employed. “We’d had an epidemic of companies saying their people are self-employed when in fact, when you examine their rights and responsibilities, the way they’re acting each day, it’s pretty clear they’re either fully employed or are workers entitled to sickness pay, etc,” Ludkin said. “We brought the Uber case because we had so many drivers coming to us. We looked at their contracts and thought it was a ludicrous idea that 30,000 of them were self-employed, which was Uber’s position.”

Let’s see what’s left of the famed French protests. Note: the US is not alone in contesting crowd sizes.

• France’s Far-Left Leader Urges French ‘Resistance’ Against Macron (R.)

French far-left opposition party leader Jean-Luc Melenchon drew tens of thousands to a rally on Saturday against President Emmanuel Macron’s labor reforms, aiming to reinforce his credentials as Macron’s strongest political opponent. Trade union protests against Macron’s plan to make hiring and firing easier and give companies more power over working conditions seem to be losing steam, but Melenchon said his “France Unbowed” party was calling on unions to join them and together “keep up the fight”. “The battle is not over, it is only starting,” Melenchon told the crowd gathered on the Place de la Republique where the rally against what Melenchon has called “a social coup d‘etat” ended.

In a warning to Macron, who has said he will not bow to street pressure, Melenchon said: “It is the street that defeated the kings, it is the street that defeated the Nazis,” while the crowd chanted “Resistance! Resistance!” It remains to be seen whether Melenchon and his party have the capacity to mobilize the kind of street resistance which forced the last two presidents to dilute their own attempts to loosen the labor code. Melenchon tweeted that over 150,000 demonstrators had turned up while police put the number at 30,000. A campaign rally in March, weeks before the presidential election, drew some 130,000 people, party officials had said.

Pitting police forces against each other is a recipe for trouble. Peaceful resistance is teh way to go for Catalonia. But…

• Spain Rebuffed in Boosting Control Over Catalonia’s Police (BBG)

Police in Spain’s rebel region of Catalonia rejected giving more control to the central government in defiance of authorities in Madrid who are trying to suppress an independence referendum on Oct. 1. The SAP union, the largest trade group for the 17,000-member Mossos d’Esquadra regional force, said it would resist hours after prosecutors Saturday ordered that it accept central-government coordination. The rejection echoed comments by Catalan separatist authorities. “We don’t accept this interference of the state, jumping over all existing coordination mechanisms,” the region’s Interior Department chief Joaquim Forn said in brief televised comments. “The Mossos won’t renounce exercising their functions in loyalty to the Catalan people.”

The disobedience may fuel speculation the Mossos aren’t committed to work with the national Civil Guard in Spain’s largest regional economy. The standoff came a day after Prime Minister Mariano Rajoy’s government acknowledged it’s sending more reinforcements to help control street demonstrations and carry out a separate court order to halt the vote. Officials in Madrid have quietly rented cruise ships including the Rhapsody and moored them in Catalan ports as temporary housing for riot police and other security officials being sent to the region in what El Correo newspaper said may ultimately exceed the number of Mossos by the referendum date.

“100% of the system run by the Puerto Rico Power Authority is offline”. How long till people will start dying in hospitals?

• No Storm Ever Destroyed a Grid Like Maria Ruined Puerto Rico’s (BBG)

You don’t even have to leave the airport to see that Hurricane Maria has laid waste to Puerto Rico’s power grid. On Friday, the San Juan airport was abandoned. No electricity meant no air conditioning, and no air conditioning meant hot and muggy air wafting through the terminals. Ceilings were leaking. Floors were wet. Only the military, relying on its own sight and radar systems, was landing planes. The airport is one of the first places crews will restore power – whenever they can get to it. Hundreds are still waiting for the all-clear to move in and start the arduous task of resurrecting Puerto Rico’s grid. The devastation that Maria exacted on Puerto Rico’s aging and grossly neglected electricity system when it slammed ashore as a Category 4 storm two days ago is unprecedented – not just for the island but for all of the U.S.

100% of the system run by the Puerto Rico Power Authority is offline, because Maria damaged every part of it. The territory is facing weeks, if not months, without service as utility workers repair power plants and lines that were already falling apart. “I have seen a lot damage in the 32 years that I have been in this business, and from this particular perspective, it’s about as large a scale damage as I have ever seen,” said Wendul G. Hagler II, a brigadier general in the National Guard, which is assisting in the response. No federal agency dared on Friday to estimate how long it’ll take to re-energize Puerto Rico. If it’s any indication of how far they’ve gotten, the island’s power authority known as Prepa is only now starting to assess the damage.

“We are only a couple of days in from the storm – there could be lots of issues and confusion at the beginning of something like this,” said Kenneth Buell, a director at the U.S. Energy Department who is helping lead the federal response in Puerto Rico. “We are in the phase where we have people queued up and lining up resources.” What Buell does know is Puerto Rico’s power plants seem inexplicably clustered along the island’s south coast, a hard-to-reach region that was left completely exposed to all of Maria’s wrath. A chain of high-voltage lines thrown across the island’s mountainous middle connect those plants to the cities in the north.

Puerto Rico’s rich hydropower resources have also taken a hit. On Friday, the National Weather Service pleaded for people to evacuate an area in the northwest corner of the island after a dam burst. “All areas surrounding the Guajataca River should evacuate NOW. Their lives are in DANGER!,” the service said on Twitter. And that’s not to mention the state of Puerto Rico’s grid before the storm. Government-owned Prepa, operating under court protection from creditors, has more than $8 billion in debt but little to show for it. Even before the storm, outages were common, and the median plant age is 44 years, more than twice the industry average.