G. G. Bain Jewish Farmers Exhibit, East Broadway, NY 1909

Today looks like a good day to do a shout out and promo for our dear friends Kirsten and Serenity in Melbourne, Oz, who were responsible for the impeccable organization of the tour of Australia Nicole and I did in 2012. So we have living proof that they know how to organize something once they pour their hearts into it, which bodes well for the new project they’re busy setting up.

The Open Food Network focuses on building and facilitating an interactive platform to connect farmers and eaters that are dedicated to good, honest and local food, with full transparency. Of course there are many initiatives out there, from farmers markets to organic food stores, but many people still have problems getting access to good food.

Besides, most ‘fresh’ food is bought in giant supermarket chains, transported over large distances, and subject to centralized control, from Monsanto at seed level, ConAgra as super-producer, to WalMart as super-retailer. And we should not want centralized control, especially not of our basic necessities; that has never been a good idea and it never will be. If we can get the Monsanto’s and WalMarts of this world out of our lives, and at the same time improve the quality of our food, that can only be a good thing.

And if that still doesn’t swing it for you, just think of all the local jobs that will be created if we all buy local food as much as we can. Don’t forget that a dollar spent inside your community is worth 3-4 times more than one spent outside of it. And no, WalMart, and the entire supply chain it stands for, is not your community.

The Open Food Network aims to use the internet to provide a way of organizing all this, community by community. Check it out. Here’s their blurb:

The Open Food Network is an open, online marketplace that makes it easy to find, buy, sell and move sustainable local food. It gives farmers and food hubs easier and fairer ways to distribute food, while opening up the supply chain so eaters can see what’s going on. It’s good for farmers, good for eaters and good for the food hubs, local businesses and communities that want real food.

We are proudly open source and not for profit – creating software with and for the global fair food movement. Contribute now to get this platform launched for use by farmers and food hubs in Australia, with the software available for use all around the world! We know that OFN has the potential to really disrupt our food systems – in a good way. But we need you to get on board now and help make it happen.

How will OFN help fix the food system?

Lots of people are working to break the stranglehold that supermarkets and large agribusiness have over our food system. We’ve spent 3 years talking with many farmers, producers, eaters and local enterprises (like food hubs, independent retailers and co-ops) about how we can work together to take back control of our food. The Open Food Network is our response. By turning the existing food system on its head, the Open Food Network provides efficient ways for buyers (hubs) to connect with many smaller sellers (producers) and distribute food into their communities.

GOOD for Farmers and Producers: There is currently a big gap for farmers between selling through “the big guys” or doing everything themselves to distribute directly to eaters e.g. setting up and running their own online store, farm gate sales and farmers’ markets. For many farmers, these are not enough and take time away from the important work of growing our food. Farmers need scalable, sustainable systems for distributing their food.

OFN makes it easier for farmers to sell directly and possible for them to work together and with others (like food hubs) to streamline marketing and distribution, while maintaining full transparency and control. With the OFN, farmers have the freedom to set prices, choose who they trade with, when, how often and under what terms.

GOOD for Eaters: It’s time to reconnect with our food! We’re ready to abandon the supermarkets and get good, honest produce from people we know. But sometimes it’s hard work to shop and eat locally. OFN makes it easy to access locally grown food direct from the grower or transparently through hubs. Just go online, find what’s near you and shop . . It’s like an online shopping centre, full of local food!

GOOD for Communities and Food Hubs: “Middle men” matter . . the problem is when there are only two! We want every community to have many different ways to get sustainable, local food. Local food enterprises – like buying groups, co-ops or larger scale wholesalers, retailers (and everything in between) can make this possible. OFN provides simple online ordering and shopping tools that make it easy to set up a hub and start moving food – while keeping the farmers and prices transparent all the way through. It removes admin barriers to small and medium sized food hubs working with local farmers

The OFN provides an ultra-flexible system for food hubs, enabling communities to set up what they need. Food hubs using OFN have complete freedom over:

• Your customers – whether they are households, buying groups, institutions, food service etc

• Your mark-ups and fees – OFN has a flexible fee structure so you can set it up how you want it, easy, transparent, independent

• Who you work with – OFN supports diverse networks, partnerships and social enterprises, with relationships and flexible fee structures

The Open Food Network:

• is an online marketplace that farmers and local hubs can use to distribute food

• makes it easier to find, buy, sell and move sustainable local food

• is software that helps organise the trade and distribution of locally grown food

• lets you manage your ordering, scheduling, payment and delivery cycles

• lets eaters order locally grown food from their chosen hub

• puts eaters in touch with the people who grow their food

• lets farmers list their own produce, set their prices and tell their own stories

• basic trading is free for farmers and eaters to use

• is proudly open source and not for profit

Tipping Point Goal: $25,000

Total Funding Goal: $100,000

Tipping Point Goal: We’ve done the numbers and – together with grant funds and some blood, sweat and tears – an additional $25,000 will get the software to the point where we can launch an ‘open beta’ OFN service in Australia (open to anyone in Australia to use for profiles and basic trading). The money will go towards designers, engineers, developers and testers. This is our tipping point goal. If we raise this amount, the campaign will be a success and we’ll get your pledged donation. If not, we won’t get anything. Please help us at least make our tipping point which will get the basic OFN into the hands of all the farmers and communities that need it!

Total Funding Goal: Additional funds raised up to $100K will build the features we need for a full beta public launch in March 2015. Amazing volunteers, our own money, and seed grants from VicHealth and Sustainable Table have enabled us to get this far. And we’ve been able to provide enough features to do working trials with our fabulous hub partners in Australia and abroad. But there’s so much more that could be done.

We understand what is needed. If we raise more money, we can build more of it. Word is spreading and there are food hubs, networks and developers around the world who are keen to get on board. We want to help that happen . . so … Funds raised over $5,000 in any individual country will support a mini-pilot with partners in that country. It would be amazing to raise enough funds to build features AND set-up local chapters internationally.

• ECB Interest Rates Too Low For Germany, Says Bundesbank Chief (Reuters)

The European Central Bank’s interest rates are too low for Germany, Bundesbank chief Jens Weidmann said on Saturday, adding that ECB monetary policy should remain expansive for no longer than absolutely necessary. Speaking at a Bundesbank open day for the public, Weidmann noted that many savers in Germany were irritated by low interest rates but said these were aimed at supporting investment and consumption. The ECB cut interest rates to record lows last month as part of a package of measures to breathe life into a sluggish euro zone economy, where inflation is running far below the central bank’s target and there is a dearth of credit to smaller firms. The German economy, Europe’s largest, has been outperforming other countries in the bloc, however.

“It is clear that monetary policy, when seen from a German viewpoint, is too expansive for Germany, too loose,” Weidmann told a crowd at the start of the open day. “If we pursued our own monetary policy, which we don’t, it would look different.” “But we are in a currency union,” he said. “That means that in our monetary policy decisions, we must orientate ourselves to the whole currency union.” Repeating a warning he has made previously about the risks of leaving policy loose for too long, Weidmann added: “This phase of low interest rates, this phase of expansive monetary policy, should not last longer than is absolutely necessary.” Bundesbank Vice President Claudia Buch said property prices were overvalued in some big city areas in Germany by up to 20-25%, but that there was no acute risk of a price bubble forming.

• CalPERS Ex-CEO Guilty Plea Explains Why Bankers Make So Much Money (Forbes)

The ex-CEO of CalPERS, Fred Buenrostro, has just pleaded guilty to accepting doucers, cash bribes and fees for placing investment business with a specific firm. The economic point that this helps us elucidate is why bankers and fund managers make such vast incomes normally. It’s a concept called “efficiency wages”. Essentially, when stripped right down, if people are handling or responsible for a large amount of money then pay them very well. So that it’s not actually worth their trying to do anything naughty, the risk of losing that high income is greater than what they can gain by being naughty. Here’s the actual announcement of Buenrostro’s plea:

Buenrostro is the former Chief Executive Officer (CEO) of the California Public Employee Retirement System (CalPERS). In pleading guilty, Buenrostro admitted to conspiring with Alfred J. Villalobos, founder and operator of ARVCO Capital Research LLC (ARVCO). Buenrostro acknowledged in court today that he understood that Villalobos operated ARVCO as a placement agent that solicited investments by public pension funds into private equity funds. Buenrostro also admitted that he understood that ARVCO was typically paid an agreed-upon fee based on the percentage of the total dollar amount invested by the public pension fund.

To put it simply (and do note that Villalobos has not been found guilty of anything at all as yet and is thus innocent of all charges) there’s a layer of agents, or introducers, in the fund management industry. A pension fund, say, is looking around for where to invest, various fund management firms are looking for people to invest and those who introduce one to the other will get a (small) slice of the amount invested. The accusation is that Buenrostro favoured Villalobos in such allocations and then received various parcels of cash, had his wedding paid for etc. as a result. Again, note that Buenrostro has pleaded guilty, Villalobos is innocent. So far so grubby: but this gives us an insight into why pay is so darn high right across the fund management and financial industry. Simply because these people are handling such vast amounts of money. There’s therefore obviously a temptation to make off with some of that vast river of cash that flows through such offices.

• 80% Of The Light In Space Is Missing (RT)

Scientists now believe that a tremendous amount of light that would otherwise be illuminating our universe is mysteriously absent. How much light exactly? According to new research conducted by a team of international scientists and funded in part by NASA, the National Science Foundation and the Ahmanson Foundation, around 80 percent of the universe’s light is nowhere to be found. “It’s as if you’re in a big, brightly lit room, but you look around and see only a few 40-watt lightbulbs,” astronomer Juna Kollmeier – a Carnegie Institution for Science professor and the lead author of the new study on missing light said in a statement this week. “Where is all that light coming from? It’s missing from our census.”

Kollmeier and company have published their research in the latest edition of The Astrophysical Journal Letters, and there they explain further why they have reason to believe that the universe is missing around 400 percent of its light. Along with Benjamin Oppenheimer and Charles Danforth of CU-Boulder’s Center for Astrophysics and Space Astronomy, Kollmeier reported that the amount of light that should be emitted from ionized tendrils of hydrogen in the universe is only a fraction of what it should be. “Something is amiss in the universe,” they write. “There appears to be an enormous deficit of ultraviolet light in the cosmic budget.”

• Ebola Spreads to Sierra Leone Capital Freetown as Deaths Rise (Bloomberg)

The worst outbreak of Ebola moved to Sierra Leone’s capital of Freetown where an Egyptian was found with the city’s first confirmed case of the disease. The unidentified Egyptian national had traveled from Kenema, the largest city in the nation’s Eastern Province, and checked into a clinic east of Freetown, Sidie Yahya Tunis, director of Information, Communication and Technology at the Ministry of Health and Sanitation, said by phone today. The person was moved back to the Ebola center in Kenema, he said. “The Ebola disease usually spreads to other places when suspected or confirmed cases in one community move to another, they abandon treatment centers to stay with relatives or they seek treatment outside the Ebola centers,” Tunis said.

There have been 99 Ebola deaths in Sierra Leone out of 315 laboratory-confirmed cases, the ministry said in an e-mailed statement today. The ministry said yesterday that 92 people had died out of 305 cases. Cases of the hemorrhagic fever have killed more than 540 people in Guinea, Sierra Leone and Liberia in an outbreak that according to the World Health Organization may last another three to four months. The toll is greater than the 280 people killed in 1976, when the virus was first identified near the Ebola River in what is now the Democratic Republic of Congo. The rapid spread of the virus is largely due to people moving across borders as well as cultural practices that are contrary to public health guidelines, such as people touching the body of a deceased relative before the funeral.

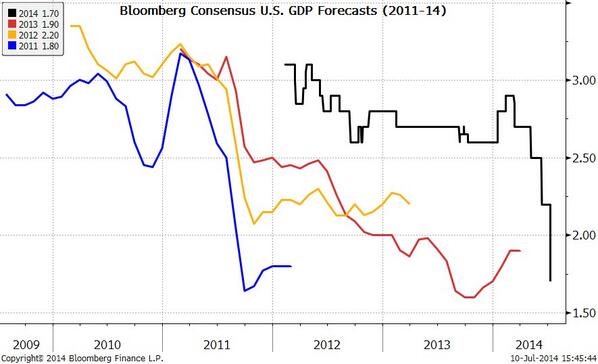

• The Wall Street GDP Forecast “Escape Velocity” Scam (Stockman)

There is nothing more predictable than the bevy of Wall Street economists who come charging out of the blocks early each year proclaiming that money printing by the Fed will finally work its magic, and that real GDP growth will hit “escape velocity”. But this year the markdowns have come fast and furious. After the disaster of Q1 and the limp data reported for Q2 to-date, the revised consensus outlook for 2014 at 1.7% is already below the tepid actual results of the last three years. So much for the year when “screaming” growth was certain to happen. The graph below is all the proof that is needed to demonstrate that Wall Street has become a pure Fed enabled casino. If honest “price discovery” was actually functioning, the stock market would not be at nosebleed heights, capitalizing hockey sticks that never materialize. Instead, it would be discounting a badly impaired economy that is stuck in a sub-2% rebound—and one that is dangerously at risk owing to the third and greatest financial bubble the Fed has created during this century.

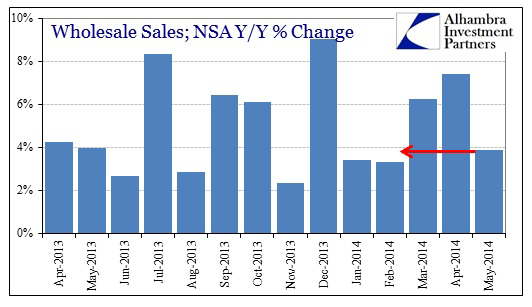

• More Incoming Q2 Data: No Escape Velocity (Alhambra)

The wholesale inventory estimates seem to have raised more than a bit of optimism. I think that is highly misplaced for both GDP and the economy. On the GDP calculation side, there needs to be another huge gain in inventory to be “highly supportive” due to the second derivative nature of the estimate. As for the economy, even on a seasonally-adjusted basis, wholesalers are taking a dimmer view of holding inventory. The mainstream narrative, which has been copied almost word for word across the media, is here:

U.S. wholesale inventories rose in May, reinforcing the view that economic growth should surge in the second quarter following a weak first three months of the year.

This flips around what is actually taking place, as sales are lagging not surging. Whether you take it in the form of seasonally-adjusted or raw nominal data, there is nothing to suggest the pace of sales is appreciably better than the first quarter. If anything, the sales pattern continues to lag what would actually be consistent with sustainable growth. In fact, wholesale sales in May were only slightly better on a year-over-year basis than January and February.

• Slowing Customer Traffic Worries U.S. Retailers (WSJ)

American retailers may have more than a weather problem. Family Dollar said fewer shoppers came into its stores in the three months through May 31, pushing sales down 1.8%, excluding newly opened or closed stores. In a move to win back traffic, the dollar chain said it would begin carrying beer and wine nationally next year, adding to the tobacco, frozen food and other consumables that now make up 73% of sales. “Our results continue to reflect the economic challenges facing our core customer and an intense competitive environment,” Chief Executive Howard Levine said. The discounter’s message echoed that of Container Store whose shares fell sharply midweek after its chief executive told investors that the company and its fellow store chains are in a “retail funk.” “We’ve come to realize it’s more than just weather,” Container Store CEO Kip Tindell said. Falling traffic led to the first drop in quarterly sales at the company in more than three years.

Investors flocked to the seller of bins, boxes and shelves when it went public last November, and shares more than doubled on opening day to close at $36.20. But so far this year, shares have dropped nearly 44%, as Container Store has succumbed to some of the pressures weighing on retail broadly. Results at retailers haven’t been uniformly bad this spring. But there are enough negatives to shake earlier hopes that shoppers would whip out their wallets and resume shopping after the long, tough winter. The mixed showing continues to cloud the optimism arising from stronger job growth and rising consumer confidence. The unemployment rate dropped to 6.1% in June, marking the best stretch of job growth in almost a decade. But five years into the economic expansion, big chains like Wal-Mart and Kroger remain divided over whether consumers are indeed bouncing back.

• Something Seems Off About The US Economy (BI)

Over a three-week span starting next Monday, 72% of the S&P 500’s members will report earnings, but some of the early indications about this earnings season, especially from companies highly exposed to the U.S. consumer, have not been encouraging. On Tuesday afternoon, two companies that are all about consumer spending, Bob Evans and The Container Store, reported earnings that were disappointing. But even more discouraging were the comments from company executives. Bob Evans, which wrapped up its fiscal year 2014 in its most recent quarter, said its results were impacted by severe weather (an oft heard refrain during the first quarter), as well as high food costs. In the upcoming year, the company’s CFO, Mark Hood, said, “consumer confidence continues to be adversely impacted by ongoing macroeconomic headwinds, including health care costs and unemployment which disproportionately affects lower- and middle- income consumers.”

Also on Tuesday afternoon, Container Store CEO Kip Tindell said in the company’s earnings release that, “Consistent with so many of our fellow retailer, we are experiencing a retail ‘funk.'” Wednesday evening, Lumber Liquidators, a specialty hardwood flooring retailer, said that the consumer demand it experienced following the tough winter didn’t carry into May and June. CEO Robert Lynch said, “The improvement in customer demand we experienced beginning in mid-March did not carry into May, and June weakened further. Our reduced customer traffic has coincided with certain weak macroeconomic trends related to residential remodeling, including existing home sales, which have generally been lower in 2014 than the corresponding periods in 2013.”

Thursday morning saw more downbeat commentary from a retailer, this time Family Dollar. Following the company’s report, which saw that same store sales fell 1.8% during the quarter, CEO Howard Levine said, “Our results continue to reflect the economic challenges facing our core customer and an intense competitive environment.” And then yesterday afternoon, Gap topped off the week of discouraging retail commentary by reporting June same-store sales that fell 2% year-over-year. According to data from Bloomberg, sales were expected increase 0.8%. Gap’s management, however, was light on additional color. This rash of discouraging retail data, however, makes the broader U.S. economic picture seem murky.

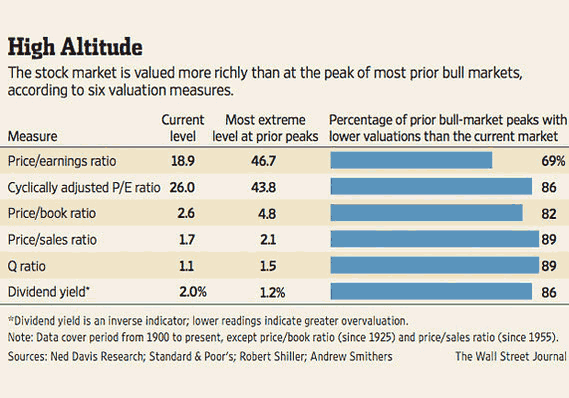

• US Stocks Will Be ‘Very Disappointing’ For 10 Years (MarketWatch)

U.S. stocks are overvalued – and have been for months. That is what six well-known measures of valuation show. While that doesn’t mean a bear market is imminent, there is a high probability that investment returns over the next decade will be below average, according to Yale University economics professor and Nobel laureate Robert Shiller. Investors shouldn’t expect that what has worked for them over the past five years will continue to work in the future. One way to gauge the market’s valuation is to compare it to past bull-market peaks. There have been 35 since 1900, according to Ned Davis Research, a quantitative-research firm. Five of these six valuation ratios show the market is more overvalued today than it was at between 82% and 89% of those peaks. They are:

• The cyclically adjusted price/earnings ratio championed by Shiller, calculated by dividing the S&P 500 by its average inflation-adjusted earnings per share over the past decade.

• The dividend yield, which is the%age of a company’s stock price represented by its total annual dividends.

• The price/sales ratio, calculated by dividing a company’s stock price by its per-share sales.

• The price/book ratio, calculated by dividing a company’s stock price by its per-share book value, an accounting measure of net worth.

• The Q ratio, calculated by dividing a company’s market capitalization by the replacement cost of its assets.It is noteworthy that there is such agreement among these ratios even though each calculates the market’s valuation in a profoundly different way. The sixth data point — the traditional price/earnings ratio, which focuses on trailing or projected 12-month earnings — is the one that paints the least-bearish picture. Still, it shows the market to be more overvalued than it was at 69% of those past market peaks. Shiller argues that the P/E doesn’t have as good a forecasting record as his cyclically adjusted variant. Some investors are ignoring the warning signs from these valuation ratios, since the bull market has continued higher even though the measures have told much the same story for some time.

Well, that seals it.

• Economists Don’t Expect US Recession (CNBC)

Although economists have trimmed their estimates for second-quarter U.S. gross domestic product (GDP) growth, they don’t believe the economy will hit a recession this year or next. The National Association for Business Economics’ Outlook survey of 50 economist, taken just days after the release of the June jobs report, also found economists believe the Federal Reserve will hike rates earlier than previously expected. The panelists’ median forecast for annual second-quarter 2014 real GDP growth is 3%, down from the 3.5% median forecast when the full Outlook survey was last released in June. But in a positive sign, economists said the probability of the U.S. economy entering a recession in 2014 or 2015 is extremely low, with 60% of panelist saying the odds were less than 10%. “Notwithstanding the difficult start to the year, opinion is widespread that the economy is on solid footing,” said Timothy Gill, Outlook survey chair.

The minutes from the Fed’s latest policy meeting did not indicate did not indicate that the central bank intends raise interest rates ahead of schedule. But with unemployment and inflation getting closer to the Fed’s target levels, analyst are predicting that rate hikes could come sooner rather than later. More than half of those surveyed forecast the Fed will next increase its federal funds rate target in the first half of 2015, with a plurality of almost 37% expecting a hike during the second quarter of next year. Another 36% said they expect an initial rate hike in the second half of next year. The results are nearly reversed from the June survey, when 33% expected a rate increase in the first half of 2015 and 53% expected a hike in the second half.

• Fed Presidents Differ on Timetable for Raising Interest Rate (Bloomberg)

Federal Reserve presidents disagreed today on whether a decline in the U.S. unemployment rate to the lowest level in almost six years warrants advancing the timing for an interest-rate increase. Philadelphia Fed President Charles Plosser said the Fed risks losing credibility by waiting too long to raise rates, and economic data are already suggesting a need to tighten policy. Chicago’s Charles Evans and Atlanta’s Dennis Lockhart countered that low inflation and labor-market slack will allow the central bank to wait until the second half of 2015 or 2016.Plosser, speaking in a Bloomberg Television interview with Michael McKee in Jackson Hole, Wyoming, said “we are closer than a lot of people might think” to the first interest-rate increase since 2006. If the Fed waits too long, he said, “we’ll lose credibility. We may lose control of inflation.” Fed officials are approaching their goals for full employment and price stability faster than they had forecast, sharpening the debate over the timing of a rate increase. St. Louis Fed President James Bullard warned this week that inflation will rise above the Fed’s target late next year. “Monetary policy ought to be reacting to the data,” Plosser, 65, said. “We are on a path that says low for long and we have no plans to raise interest rates anytime soon, yet as the data keeps telling us, we ought to be raising rates.”

• Fed Fears Risks Posed By Exit Tools; Plan Almost Done (Reuters)

Federal Reserve officials are cautiously nearing completion of a new plan for managing interest rates, concerned that some of the new tools they are likely to rely on could pose unintended risks in a crisis. The central bank has devoted extensive debate to the matter over the past two months and officials “have made a lot of progress” on a strategy to return monetary policy to a more normal footing after years of coping with crisis, Chicago Federal Reserve Bank President Charles Evans said on the sidelines of an economic conference here. However, the sheer magnitude of the amounts of money used to combat the crisis – $2.6 trillion sitting at the Fed as bank reserves and $4.2 trillion held by the Fed in various securities – may complicate the U.S. central bank’s ability to control its target interest rate once the decision is made that it should be raised. A decision to begin increasing interest rates is expected in the middle of next year.

In recent weeks, the Fed has neared consensus that its workhorse tool will be the interest it pays banks on excess reserves on deposit at the Fed – giving the central bank a direct way to encourage banks to either take money out of circulation and leave it at the Fed, or lend it elsewhere. Another tool would have a similar impact but apply more broadly, using overnight repurchase agreements that would let money market funds and other institutions as well as banks essentially make short-term deposits at the Fed. The worry is that if financial conditions tighten, those large funds of money would flee to the repo facility as a safe haven, depriving the economy of credit and making a potential crisis even worse. “The broad concern is whether we want to facilitate what could be a period of financial stress by providing in a large or unlimited way that refuge, and whether that would tend to exacerbate a financially stressful situation,” said Atlanta Fed President Dennis Lockhart.

• Market Will Crash, Just Don’t Know Catalyst: Marc Faber (CNBC)

The market is setting up for a big decline that could be as bad as the crash of 1987, according to Marc Faber, known as “Dr. Doom.” He just isn’t sure exactly what will set it off. “The problem with crashes, you never know beforehand precisely what is the catalyst,” the publisher of the Gloom, Boom & Doom report told CNBC’s “Closing Bell.” It could come from the credit market, equities being perceived as too expensive or a geopolitical event, he added. His comments came a day after he told “Futures Now” that the asset bubble has begun to burst. “I think it’s a colossal bubble in all asset prices, and eventually it will burst, and maybe it has begun to burst already,” Faber said Tuesday.

He’s calling for a 30 percent decline in the S&P 500. “I think that the global economy does not support the current valuations,” he said Wednesday. Corporations “have had record profits, largely because they are buying back their own shares and so the number of shares is diminishing where revenue growth is basically flat.” In fact, he said the bond market, which is more sophisticated than the stock market, does not believe in a strong economic recovery and neither does he. Faber has been calling for a major correction for years. So far, the market hasn’t followed his theory, but he said that could be setting it up for an even bigger fall. “Since 2012, I said it would be healthy for the markets to have a meaningful correction, but it could be that we are in a year like ’87 when we go straight up and then we don’t have a correction but a more significant crash,” he said.

• 6.8 Magnitude Earthquake Strikes Off Fukushima Coast (RT)

A 6.8 magnitude earthquake hit off the coast of Japan, with its epicenter located some 129 kilometers from the city of Namie in Fukishima prefecture, US Geological Survey reported. The quake was centered at a depth of about 10km, according to the Japan Meteorological Agency (JMA). Tsunami advisories have been issued for the Fukushima prefecture, as well as for nearby Iwate and Miyagi prefectures. There were no reports of abnormalities at Fukushima-1 nuclear plant following the quake, TEPCO reported.

• Portuguese Bank Crisis Is The Tip Of The Iceberg (MarketWatch)

The Portuguese crisis over Banco Espirito Santo should be a reality check for European markets. Espirito Santo is just the excuse – real problems lie far deeper. The European Central Bank has been playing with fire, with junk bonds ultimately funded by German taxpayers. Investors are waking up and smelling smoke, and at some point they will get singed. Three companies are involved in the Espirito Santo mess. Banco Espirito Santo is the largest publicly traded commercial bank in Portugal. Its controlling shareholder, Espirito Santo Financial Group, owns 25% of its shares. The privately held parent company, Espirito Santo International, owns 49% of Espirito Santo Financial Group (and therefore part of Banco Espirito Santo). It is this parent company that is likely to default on its payments. Even if Espirito Santo International defaulted, Banco Espirito Santo does not necessarily have to go under, but it might.

The problem is that Banco Espirito Santo is a weak institution irrespective of its parent holding companies, dabbling in risky assets in emerging markets that saner banks would not touch. Its risk management department needs a major shakeup. For instance, the bank has invested in Angola, setting up a subsidiary known as Banco Espirito Santo Angola (BESA). BESA has relied on Banco Espirito Santo for its funding, with loans in Angola amounting to 220% of deposits. Bad loans have exploded in Angola in recent years, rising by 84% from 2010 to 2013. BESA’s assets include €6 billion worth of loans payable, and Banco Espirito Santo has a 55% stake in the bank.

The government of Angola, a former Portuguese colony, has given the bank a “personal guarantee” amounting to 70% of the bank’s loans. There is doubt about whether the bank can retain solvency in the event of a crisis, even with the guarantee. An anti-corruption organization in the country, Maka Angola, has claimed that the reason for the guarantee was several hundred million dollars’ worth of loans given to powerful figures in the Angolan regime. However, the authenticity of these claims is unclear. There is also trouble closer to home for Banco Espirito Santo: It has lent over €1 billion to its various parent companies. Should Espirito Santo International default, Banco Espirito Santo will fall below the capital ratio mandates set by Basel III at the same time that the European Central Bank prepares to do stress tests.

Shares in Banco Espirito Santo were suspended from trading yesterday by the Portuguese government after they fell 17%. Prior to that, Espirito Santo Financial Group pulled its own shares from trading due to “ongoing material difficulties” at Espirito Santo International. The catalyst for the sell-off appears to have occurred July 9 when Espirito Santo International delayed repayment on short-term debt owed to customers of its Swiss bank. That was not the first time Espirito Santo International has been in trouble. In December, it sold €6 billion of debt to Espirito Santo Financial Group, exposing investors to even more losses should the company fail, in what the Wall Street Journal called “financial gymnastics.” In May, Espirito Santo Financial Group released an audit of Espirito Santo International, revealing that there were several irregularities on its balance sheet, making its outlook more negative that previously thought.

The debt of Banco Espirito Santo is government-guaranteed, leading to good ratings but also potential moral hazards. Given the size of the conglomerate, it is possible that one or more of the companies will require a bailout if things deteriorate. The Bank of Portugal has said it believes Banco Espirito Santo is not at risk, despite the problems at its parent companies. It also said explicitly that it had €6 billion on hand to rescue the banking sector if necessary.

• Piggy Banks Being Raided Signal Swedish Housing Dilemma (Bloomberg)

Increasing numbers of Swedes are turning to family and friends for help in buying a home, side stepping government efforts to cool soaring housing prices and growth in private debt. Swedes who received non-bank assistance to fund mortgages rose to 52% in the period from 2012 to 2014, the highest level since at least the 1970s and up from 25% in the early 2000s, according to data last month from state-owned mortgage lender SBAB. The rising numbers seeking help to buy a home are a sign that Sweden is struggling to find answers to rising personal debt even after the government capped mortgages at 85% of a property’s value in 2010 to slow house-price growth. Prior to that, first-time buyers could often get a loan covering 100% of the purchase price.

“The big problem for policy makers is the high household indebtedness,” said Bengt Hansson, an analyst at Sweden’s National Board of Housing, Building and Planning, in an interview last month. “It’s obvious by now that the loan-to-value cap hasn’t been sufficient to solve the debt problem and a stronger amortization culture is long overdue.” The lack of rental housing and the difficulty of being able to afford a first home have left many young adults struggling to start their own lives. Almost a quarter of Swedes 18 to 34 were living with their parents in 2012, compared with 19% a decade ago, according to Eurostat. “The combination of the mortgage cap and price gains have resulted in more people needing help with the down payment,” Tor Borg, chief economist at SBAB, said in an interview last month. “This is a big problem for the young in particular.”

That development looks unlikely to change, as policy makers contemplate further measures to stem debt growth. The financial regulator, which has twice raised the risk weights banks must apply to their mortgage assets, has said it would consider lowering the mortgage cap further if problems persist and the government is now preparing to force amortization. Low rates over the past years and a limited housing supply have fueled a surge in home prices and pushed debt levels to records in the $550 billion economy.

• Bulgaria To Allow Its Fourth-Biggest Bank To Collapse (Reuters)

Bulgaria is to allow its fourth-biggest lender to collapse and will hive off its healthy activities into a separate bank as it moves to clear up the mess from the country’s worst financial scandal since the 1990s. The central bank said it was removing Corporate Commercial Bank’s (Corpbank) license and alerting prosecutors to the possibility that its main shareholder stole money from the bank just before the central bank took over its operations. The scandal broke last month when Corpbank clients unnerved by media reports accusing top shareholder Tsvetan Vassilev of shady business deals dashed to withdraw their savings. The bank run spread quickly to another lender and saw Sofia announce a protective $2.3 billion credit line, a reminder that parts of Europe’s financial system are still far from secure despite progress from the worst days of the financial crisis.

“The results of the review of Corporate Commercial Bank speak, to put it mildly, about actions incompatible with the law and good banking practices,” the central bank said in a statement as it published the results of an audit. It said much of the documentation to back up 3.5 billion levs ($2.43 billion) out of Corpbank’s total 5.4-billion-lev loan portfolio was missing. The documents were, it believed, “most likely destroyed in the days before the central bank sent administrators there.” A significant part of the loan portfolio was linked to parties related to Corpbank’s main shareholder, the central bank said. Central bank administrators found Vassilev had withdrawn 205 million levs from the bank via a third party just before the state took control. Prosecutors would need to determine whether that withdrawal amounted to theft, the central bank said.

• Allianz CEO: “Euro Crisis Is Not Over” (Bloomberg)

When asking Allianz SE’s chief investment officer about the euro area’s sovereign debt woes, be prepared for an emphatic response. “The fundamental problems are not solved and everybody knows it,” Maximilian Zimmerer said at Bloomberg LP’s London office. The “euro crisis is not over,” he said. While extraordinary stimulus from the European Central Bank has encouraged investors to pile into the region’s government bonds this year, that’s not a sufficient remedy for Zimmerer, who oversees 556 billion euros ($757 billion) at Europe’s largest insurer. Countries are still building up their debt piles, and that’s storing up trouble for the future, he said. As Zimmerer was speaking, investors were getting a reminder of the volatility that was rife through the sovereign debt crisis that started in 2009, as sliding stocks and bonds of Portuguese financial institutions rippled across the region’s markets.

“There is only one country where the debt level last year was lower than 2012 and this is a signal the debt crisis can’t be over, only a recognition of the debt crisis has changed,” Zimmerer said on July 9. “If the debt levels are not going down in the end we will have a problem, that is for sure.” Euro-area governments are still grappling to get their debt under control in the wake of the region’s financial-market turmoil, which left five countries needing international aid and triggered the biggest restructuring in history in Greece. Only Germany reduced its debt-to-gross-domestic-product ratio last year, according to data published by the European Union’s statistics office in Luxembourg in April. Allianz is reducing holdings of euro-area government debt to avoid low interest rates after the bond-market rally incited by the ECB, Zimmerer said. The Munich-based insurer is planning to move cash from fixed income into “real assets” such as infrastructure and real estate, he said.

• Las Vegas Drought Drains Lake Mead to Lowest Since 1937 (Bloomberg)

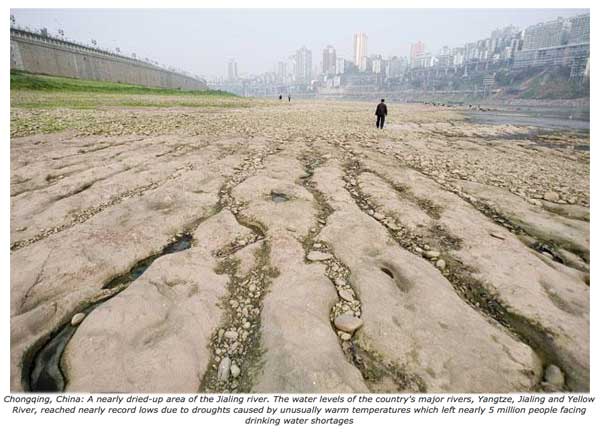

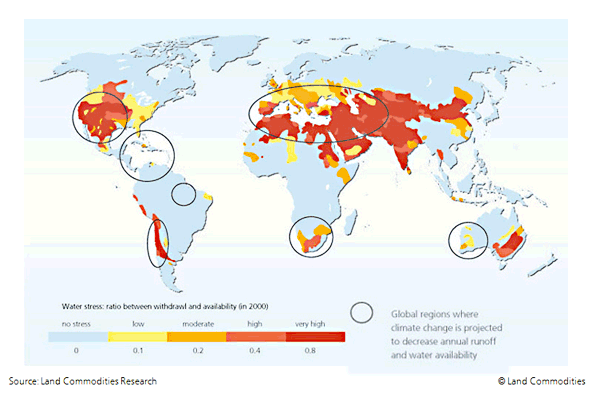

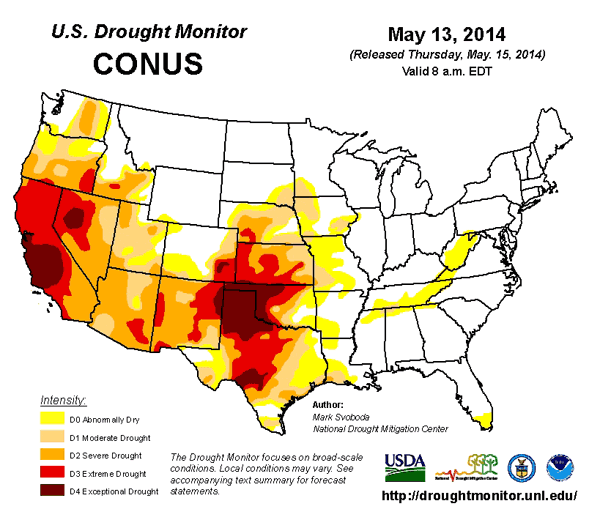

Lake Mead, the man-made reservoir that supplies 90% of the water for 2 million people in the Las Vegas area, has been reduced by drought to the lowest level since it was filled in 1937, according to the federal government. The lake, now at 39% of capacity, has been dropping since 2012, according to U.S. Bureau of Reclamation data, as much of the western U.S. has suffered the most serious drought in decades. The shortfall is endangering water supplies to the residents and 43 million annual visitors to the driest metropolitan area in the country. Lake Mead, created by Hoover Dam in 1936 and 1937, holds mountain snowmelt from the Colorado River for farms, homes and businesses predominately in southern Nevada, southern California and most of Arizona. No metropolitan area depends on the lake more than Las Vegas, which lacks groundwater or other local sources.

“This is significant because it’s a resource used by three states,” said Rose Davis, a spokeswoman for the bureau, which manages the supply. “We all have to keep an eye on it because it’s the major water source for three areas. It concerns us all very much.” The lake’s surface, which reached a record high of 1,225 feet above sea level in July 1983, is now at about 1,083 feet, according to the bureau. If the level drops below 1,050 feet, one of the two intakes that feed water to Las Vegas will become inoperable. At 50 feet lower, the other would fail. Since 2008, contractors have been boring through rock to create a third conduit to draw water from as low as 860 feet. About 55% of Nevada, already the nation’s driest state, is under “extreme” or “exceptional” drought conditions, the worst grades on the U.S. Drought Monitor, a federal website. Portions of California, New Mexico and Colorado also are in the “exceptional” category, according to the monitor.

• 1001 Blistering Future Summers (Climate Central)

If it feels hot to you now in the dog days of this summer, imagine a time when summertime Boston starts feeling like Miami and even Montana sizzles. Thanks to climate change, that day is coming by the end of the century, making it harder to avoid simmering temperatures. Summers in most of the U.S. are already warmer than they were in the 1970s. And climate models tell us that summers are going to keep getting hotter as greenhouse gas emissions continue. What will this warming feel like? Our new analysis of future summers illustrates just how dramatic warming is going to be by the end of this century if current emissions trends continue unabated.

For our Blistering Future Summers interactive we have projected summer high temperatures for the end of this century for 1,001 cities, and then showed which city in the U.S. — or elsewhere in the world, if we couldn’t find one here — is experiencing those temperatures today. We’ve highlighted several striking examples on the interactive, but make sure to explore and find how much hotter summers will likely be in your city. By the end of the century, assuming the current emissions trends, Boston’s average summer high temperatures will be more than 10°F hotter than they are now, making it feel as balmy as North Miami Beach is today. Summers in Helena, Mont., will warm by nearly 12°F, making it feel like Riverside, Calif.