Jessie Willcox Smith From The Princess and the Goblin by George MacDonald 1920

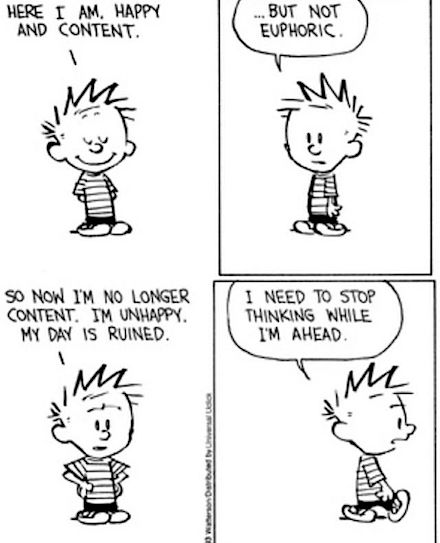

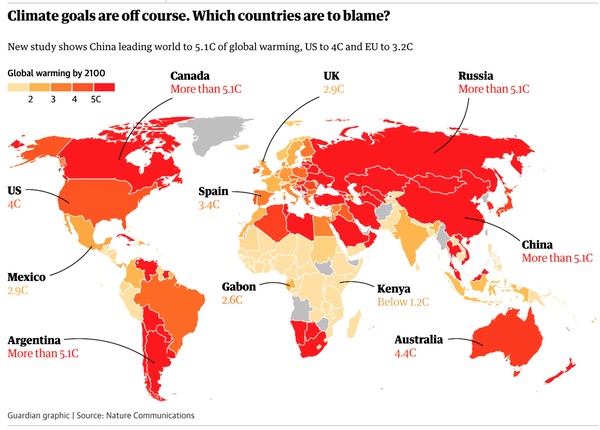

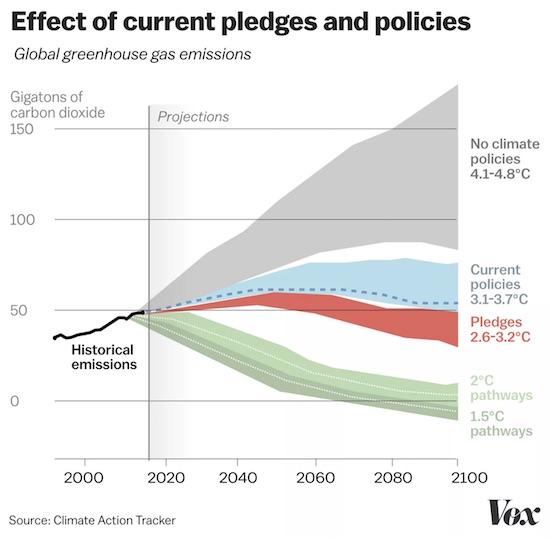

We need to renew the discussion about climate (change) because one side of that discussion claims that the science is settled. And yes, that is the same thing that happened with Covid, and you can even say the same thing that has happened with Ukraine, and with Donald Trump.

In all these cases, one side of the talking controls politics, media and intelligence agencies. But that doesn’t mean they’re right, even though they may seem to be, in everything you read and hear. And if you’ve followed the Covid discussion, and how could you not have, you know how dangerous this can be, how much open discussion is needed.

There are voices who say that the whole Covid thing was just a dress rehearsal meant to gauge how compliant people can be made, with the ultimate target being make them bend over and take it for the climate. For me, the cultural culmination of this is the move from “sustainable energy” to “green energy” to now “clean energy”. All three are absurdly nonsensical terms, but people use them without a second thought.

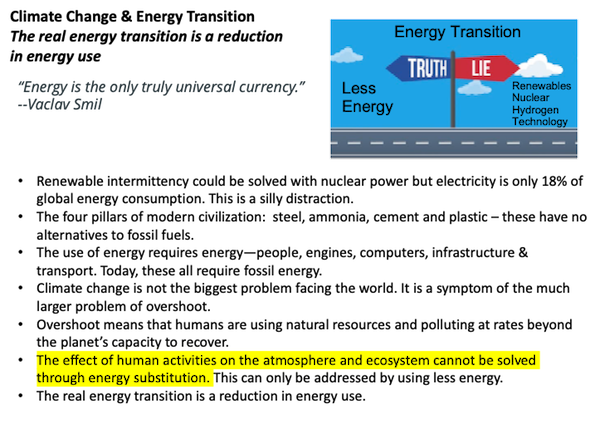

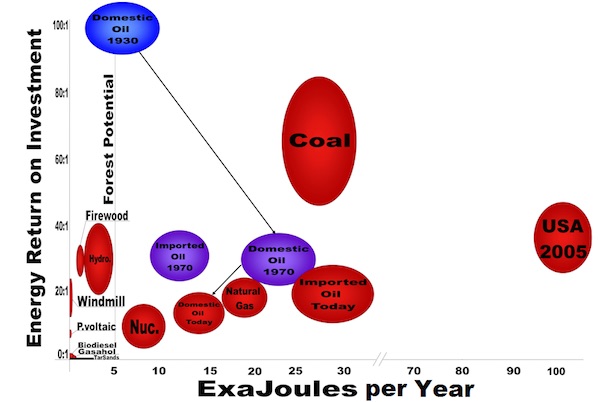

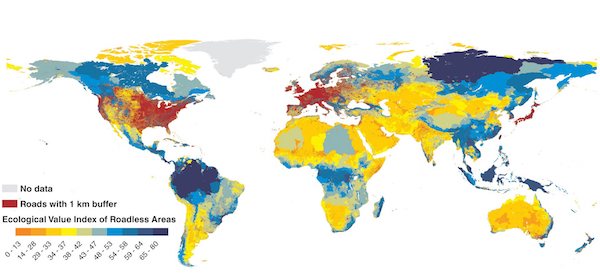

What strikes me about this discussion, if you can still call it that, is that the people alarmed about the climate never come with actual solutions. Wind and solar cannot ever replace oil and gas, but that is how they advertized. They only so-called solutions I see all lead to economic collapse (see Europe today), and that inevitable results in the use of dirtier, not cleaner energy. Just wait till people start burning plastic to keep warm.

I’ve long said that the only answer is using less energy, and that, given our wasteful ways, this is absolutely possible, we can cut our energy use by 90% is se put our minds to it with very little discomfort, but using less energy is not on the agenda. Of course I’ve also long said that we are -biologically- programmed to use as much surplus energy as we can (as all organisms are), so there are plenty dilemmas and contradictions involved.

Why did the age of fossil fuels make us multiply to now have a population of 8 billion, when we started with half a billion? To burn the stuff faster, of course. As much as our transport modes are incredibly energy inefficient, we can still only drive one car at a time.

I’ll start off this new discussion with our commentariat. Long time commenter TAE Summary provides a …summary of points for and against in the climate discussion, while sometime commenter Bishko lets his light shine from his own chemistry background: “I run a business measuring air pollution.” Here we go.

A Tale of Two Narratives, Climate Change Edition

Disclaimer: These narratives are based on multiple sources and neither may represent any particular person’s beliefs

• The Mainstream Narrative

– Greenhouse gasses absorb dark radiation and re-emit it. With more such gasses in the atmosphere, radiation and its attendant heat stays in the earth’s atmosphere instead of escaping into outer space and so the atmosphere and earth itself warm up.

– CO2 is the primary greenhouse gas inducing warming. It has increased from about 280 ppm to 420 ppm, an increase of 50% in the last 200 years and is higher than at any time in the last 800,000 years. The effect of greenhouse gasses is non-linear and a significant tipping point will be at around 450 ppm.

– There is a proven correlation between CO2 levels and global warming both long and short term. Increases in CO2 have caused mass extinction in the past. It takes a long time for life forms to adjust to big changes in CO2 levels.

– One of the effects of global warming is a disruption of the jet stream which causes extreme temperatures both higher and lower than normally seen.

– Another effect of increased CO2 is the acidification of the oceans as CO2 combines with water to form carbonic acid. If left unchecked this will terminate much of the life in the oceans.

– That the earth is getting warmer is obvious to anyone over the age of 50.

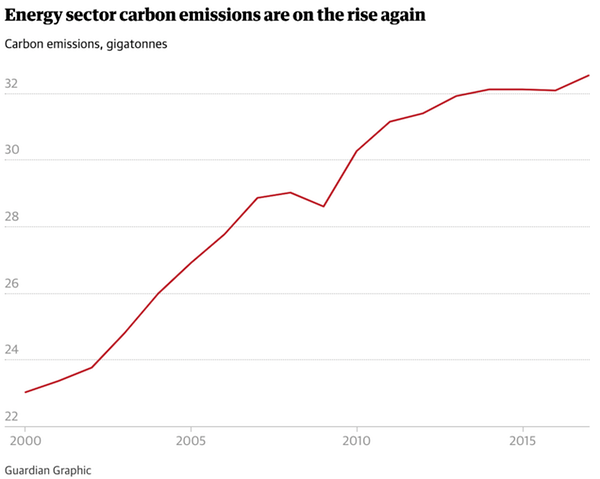

– CO2 emission and therefore global warming is primarily due to humans burning coal, oil and natural gas.

– Nothing is being done to actually combat climate change because of the immense profits to be made from selling fossil fuels. Climate change is a consequence of our continued financial ponzi scheme. None of the so-called climate change initiatives are sincere or effective.

– Expect mass extinction on earth including humans by 2050.

– People who deny climate change ignore the facts and are victims of propaganda. Their beliefs are similar to religious hopium.

• The Counter Narrative

– While it is true that greenhouse gasses absorb and re-emit dark radiation, it has not been proven that this action increases global temperatures. Energy absorption by CO2 levels off as concentrations increase after which there just isn’t much more energy to absorb. The models used to predict the effects of CO2 in the atmosphere are too simplistic.

– The CO2 increase in the last 200 years is only from 0.028% to 0.04% or 0.016%, an insignificant amount. Such a small increase in concentration has little effect. Water vapor is much more prevalent in the atmosphere and more involved in warming than CO2.

– CO2 is necessary and beneficial for plant life and higher concentrations will increase crop yields and be a net benefit for mankind. Epochs with higher levels of CO2 had more abundant life compared to now. Plants today could use more CO2.

– There is no proven correlation between CO2 levels and global warming. The earth has had both dramatically hotter and cooler temperatures with the same level of CO2 we have now. The earth has not gotten any warmer in the last 20 years. We are just experiencing normal, erratic weather. We have recently seen a lot of extremely cold weather which contradicts global warming.

– Increased CO2 will not acidify the oceans. As CO2 is absorbed by the oceans it will form insoluble carbonates and act as a carbon sink. Even with ocean acidification fish will survive like they did in other epochs with high CO2.

– The idea that humans can affect the climate is hubris. The climate changes naturally, always has and always will. Solar radiation is the biggest contributor to warming of the planet and especially the oceans and is outside human control. Human activity is insignificant to the climate.

– The global war on climate change is a way to grab power, reduce the population and save resources for the elites. It is a political tool. The people preaching climate change are themselves big CO2 emitters and huge hypocrites.

– Humans are very adaptable. Even with the natural shifts in climate that we are experiencing mankind will continue to thrive for a good long time.

– People who believe in climate change ignore the facts and are victims of propaganda. Their beliefs are similar to religious paranoia.

“The whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by an endless series of hobgoblins, most of them imaginary.”

– HL Mencken

The Great Lie. One of the Hobgoblins.

If you want to better understand the Anthropomorphic Climate Change Hoax read on.

I am a chemist. I run a business measuring air pollution. In chemistry there is a scientific tool known as spectroscopy. The principle of spectroscopy is measuring the absorption or transmission of “light” through matter.

“Light” is in quotes because for true scientists the electromagnetic spectrum is a continuum of frequencies that begins with the very very low frequencies, say below one cycle per second, (alpha brain waves are 8 cps btw) all the way up to ultra high frequencies of X-rays and Gamma rays and beyond.

Different forms and compositions of matter absorb or transmit different frequencies of “light”. For example, a 0.1 mm thickness of aluminum can stop visible light that would easily transit one hundred miles through air. However, in spectroscopy, we vary the frequency of the light that we use to “study” the material so that we end up with a “Spectra” of the material as we vary the frequency. In chemistry, these Spectra are used to tease out compositions of materials as well as their concentrations.

In chemistry, we immediately run into the phenomenon known as “Extinction” or the “Extinction Coefficient” where our sample, suspended in the “light” beam blocks the light so completely that there is no useful data coming through the sample like the aluminum above. The Spectra is at complete absorption or 0% transmission. Not useful. When this happens, you dilute the sample or make it thinner so there is greater penetration of the “light” so you can obtain a Spectra.

In the other extreme, your sample may be too transparent in the spectrum that interests you to obtain a Spectra. The Spectra is a complete transmission or 0% absorption or near enough. Also not useful. In this case you make the sample more concentrated or increase the path length of the cell making the sample “thicker”.

As this relates to our atmosphere. The “cell length” of absorption of solar radiation is a somewhat abstract concept. If you assume that the atmosphere “ends” at 50 or 100 miles above us, you can make calculations. However, at any one time there is only one point in the atmosphere where the sun is coming down at exactly 90 degrees.

This changes moment by moment as the earth rotates and seasons change. Everywhere else the sun is coming down at an angle which increases it’s path length. At the poles much of the sun goes straight through the atmosphere and never touches the earth and exits out the other side. The perfect tangent. This is what causes the “ozone holes” not the fluorocarbons. A separate hoax and separate discussion.

So, with all these varying path lengths, and variable densities (absorption also changes with pressure) and changes of state (clouds are liquids suspended in gas) you get a complex absorption process.

However, you can easily measure the solar spectrum at the earth’s surface (or at any altitude) to obtain the measurements that show you which frequencies are absorbed partially or totally or not at all. This spectrum shows thousand of “holes” where thousands of frequencies of light zip through the atmosphere, carrying their entrained “photonic energy”.

The “Hard UV” radiation that hits our upper atmosphere is absorbed by the oxygen molecules when they are still quite dilute at 20 to 25 miles up where the atmospheric pressure is almost a vacuum. These UV frequencies are at “extinction” because they never penetrate very far into our atmosphere. The UV frequencies that are “softer” the so-called UVA and UVB are of a lower frequency and exist at what is considered the Ultra Violet Cutoff for our atmosphere.

Hard Ultra Violet frequencies cannot penetrate down to the surface since they are absorbed to “extinction” at much higher altitude. Our atmosphere at sea level would need to be near these vacuum conditions for these “Hard UV” photons to reach the surface, or there would need to be no oxygen in the atmosphere. Neither would allow life to exist here.

Any and all light the reaches the earth’s surface is either absorbed, reflected or refracted. Some of the absorbed light enters into chemical reactions where it is “trapped” as chemical energy. Photosynthesis comes to mind but there are others. This is a very small fraction of the total received. Some is reflected. The fact that you can “see” is a confirmation that a great deal of the light that reaches the earth is reflected. Since all of this light that reached the surface has already been “filtered” through the atmosphere, these reflected photons have a great propensity to “exit” the atmosphere as well since their frequencies have not been shifted very much.

The multi spectral sunlight that hits a green leaf is partially absorbed and partially reflected. The reflected light is green because the “useful” frequencies have been deducted from the spectrum by the chlorophyll to operate the plant’s chemical factory. The remaining non-useful light is reflected away as waste. That color green was always “inside” that sunlight that came down and is reflected away to your eye, camera, bird wing or to space. This is why you can see green forests from the space station, that green frequency is not absorbed by the components of the atmosphere.

All these processes occur on femtosecond time scales. The light travels from the sun in about 8 minutes transits our atmosphere in about 5/10,000 of a second, hits the leaf and is reflected back out to space in another 5/10,000 of a second and continues it’s journey throughout the universe to an unknown end.

Light that is absorbed by material at the earth’s surface has a different journey. The energy is absorbed by the electronic configuration of the molecules that it hits. This forms an electronic “excited state” where the electrons of the material move to a “higher” orbit. This excited state can be used by plants to run their chemical processes, or, in inanimate matter, can exist for a period of time (usually only femtoseconds) until it is re-emitted as a lower frequency photon or photons.

Thermodynamics forbid the new photon from being re-emitted at the same or a higher frequency (higher energy) although there are modern high tech exceptions to this (thermal imaging scopes &c where additional energy is added to the matrix).

So this new lower frequency photon is once again either absorbed, reflected or transmitted out into space.

If the new lower frequency photon is absorbed onto something, it means that it’s frequency was just right to enter into the electron cloud of this new molecule forming a new “excited state”. This is once again re-emitted as a new-new lower frequency photon which follows the same process of reflection, transmission or absorption. All matter is constantly emitting photons that are being absorbed by the matter around them.

The higher energy (from hotter atoms) photons relatively quickly reach equilibrium with its surroundings. Hotter things emit faster and more energetic photons. Think of a hot skillet taken off the stove. Doesn’t take but a few minutes to “cool” to room temperature. Some convection, some radiation of photons. All the convected heat also gets emitted as photons from the atoms that did the convecting.

Once again, all these things occur at very short time scales.

The photon that get’s absorbed and re-emitted at infrared frequencies follows this cascade in nanoseconds depending on the time it takes the photon to travel to the next absorption site, either microns away to kilometers. If the photon’s frequency is of a wavelength where it cannot exit the atmosphere since there are many molecules of say CO2 there to absorb it, it gets absorbed and then re-emitted at a lower frequency. Eventually, the photon is emitted at a frequency that has no “absorbers” around. All it sees is open sky and is gone. Nanoseconds. The atmosphere has many “frequency holes”.

CO2 has a Spectra, look at it if you can find one wide enough, see the thousands of holes in it. The fact that it can absorb in some infrared frequencies does not mean that it absorbs all infrared frequencies. The infrared spectrum is much much broader than the visible spectrum.

Clouds are a complicating issue in all this since they are composed of small droplets of liquid. The Spectra of liquids is usually different from the gas phase. However, that said, clouds are quite transparent to some frequencies of infrared light. Infrared imaging cuts right through fog and clouds thus no absorption at those frequencies.

So, overall, the sun’s energy that enters earth’s system does not stay here long. The heat that builds up during the day in the soil, rocks, water and air spends the next few hours emitting and re-emitting lower and lower frequency photons to each other and to the sky as they approach the new dawn. Cloudy nights can offer a reflecting surface to slow their exit from the atmosphere of certain frequencies but even a cloudy night gets quite cold by morning since those lower frequency infrared photons pass right through the clouds.

If you ever spent a sunset in a desert you realize how quickly the air loses it’s heat to infrared photons and the desert’s surface does not reheat the air above it much. The radiation pressure of a clear night sky is very weak and these infrared photons coming off the land are exiting en-mass.

The CO2 concentration in the atmosphere has also reached “extinction” in that the frequencies that CO2 absorbs, almost none of those photons escape back out of the atmosphere to space. They are, however, re-emitted at lower frequencies almost as soon as they are absorbed. This is the point of the person who wrote about the “sunglasses” analogy where more CO2 is just adding more sunglasses.

I like to use the ink in the pool analogy. If you are underwater in your pool and looking across to the light under the diving board you are getting near 100% transmission (of the visible not IR). If someone throws an ink well into the pool and stirs it around, your ability to see the light drops. Adding additional ink makes it drop more. At some point you have complete absorption and cannot see any light. Adding more ink to the pool does not make you see less. You have reached “extinction”.

You could of course swim towards the light until you could see it again. Then more ink would make it opaque again. CO2 in our atmosphere has reached “extinction” a very long time ago, long before life arrived. This CO2 Hobgoblin has been so effective since almost none of the people, and unfortunately almost none of the scientists understand, or they refuse to understand these principles.

This dissertation is a slightly simplified version of reality. I tried to keep the concepts intact without going into too many sidelines. A nit picker, including myself can find many nits to pick, but I think that I’m getting the main points across.

These concepts are not difficult to understand. It is all founded in base level physics and chemistry. Applying your intellect to the understanding of how all this works clears away the “fog of agenda”.

Plant potatoes.

A hobgoblin is a spirit of the hearth, typically appearing in folklore, once considered helpful but since the spread of Christianity has often been considered mischievous. Shakespeare identifies the character of Puck in his A Midsummer Night’s Dream as a hobgoblin.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.