Near The Hermitage, SaintPetersburg, Russia 1930

Time to overhaul taxation. Away from income tax. Inevitable.

• The Rich Already Have a UBI (Jacobin)

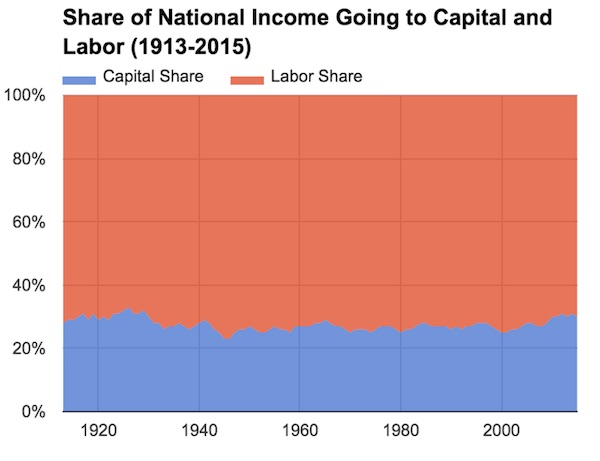

The universal basic income -a cash payment made to every individual in the country- has been critiqued recently by some commentators. Among other things, these writers dislike the fact that a UBI would deliver individuals income in a way that is divorced from working. Such an income arrangement would, it is argued, lead to meaninglessness, social dysfunction, and resentment. One obvious problem with this analysis is that passive income -income divorced from work- already exists. It is called capital income. It flows out to various individuals in society in the form of interest, rents, and dividends. According to Piketty, Saez, and Zucman (PSZ), around 30% of all the income produced in the nation is paid out as capital income. If passive income is so destructive, then you would think that centuries of dedicating one-third of national income to it would have burned society to the ground by now.

In 2015, according to PSZ, the richest 1% of people in America received 20.2% of all the income in the nation. Ten points of that 20.2% came from equity income, net interest, housing rents, and the capital component of mixed income. Which is to say, 10% of all national income is paid out to the 1% as capital income. Let me reiterate: one in ten dollars of income produced in this country is paid out to the richest 1% without them having to work for it. Even if you exclude the capital component of mixed income (since it is connected to work even if the income is not from labor) and housing rents (since these are imputed to homeowners rather than paid to them as cash), that still means that, from equity income and interest alone, the top 1% receives 7.5% of the national income without having to work for it. Put another way: the average person in the top 1% receives a UBI equal to 7.5 times the average income in the country.

If passive income is so destructive, then the income situation of the 1% surely is a national emergency! Where does the 1% get its meaning with all of that free cash flowing in? The fact is that capitalist societies already dedicate a large portion of their economic outputs to paying out money to people who have not worked for it. The UBI does not invent passive income. It merely doles it out evenly to everyone in society, rather than in very concentrated amounts to the richest people in society. The idea of capturing the 30% of national income that flows passively to capital every year and handing it out to everyone in society in equal chunks has been around since at least Oskar Lange wrote about it in the early parts of the last century. This is, to me, the best way to do a UBI, both practically and ideologically. Don’t tax labor to give money out to UBI “loafers.” Instead, snag society’s capital income, which is already paid out to people without regard to whether they work, and pay it out to everyone.

Looks scary.

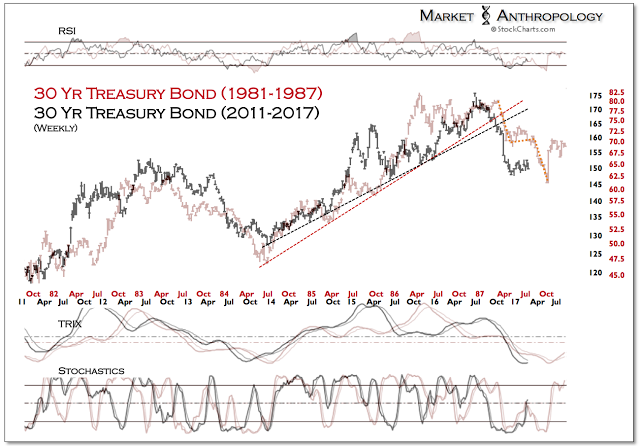

• The Next Market To Break *Should* Be Stocks (MA)

From an intermarket perspective – and in the wake of the major breakdown in Treasuries that manifested last summer akin to 87′, we would argue that the move in equities is likely much more mature than the echo of the record January 1987 sounding that some have recently pointed to for more bullish intermediate bearings. Their reasonings being, that although the markets may be near-term extended, like in January 1987, they still gained another 30% over the following 8 months. The old market adage applied – overbought can still become more overbought. That said, what the data mining ignores here is similar to the benevolent rotation out of bonds and into equities that supported the reflationary blowoff that began after Treasuries broke down in the Spring of 1987, stocks have been under this same strong reflationary momentum since last summer.

What’s happened this week of note, and which has helped firm our own near-term expectations, is that several Fed presidents have more than candidly implied that the March meeting is very much in play for another rate hike. And although we had recently suspected that more hawkish posturing would adversely impact precious metals over the short-term, long-term Treasuries now again look vulnerable as well, which would closer resemble the final leg lower in Treasuries in 1987 and the curtain call for equities that fall.

In 1987, the initial breakdown leg in the 30-year Treasury bond registered a decline of ~14%. After remaining in a trading range for another 3 months, bond prices fell roughly another 10%, before finding a low as the equity markets broke down. Through the end of last year, the 30-year Treasury bond had fallen ~16% from its highs last summer. Although we still believe long-term Treasuries offer good relative value to investors as the limits of the US’s mature economic expansion become increasingly visible this year, the more than 2 month trading range now appears susceptible to further near-term weakness, akin to the final leg lower in 1987.

Nice find from Tyler.

• America’s Miserable 21st Century (CM)

Yes, things are very different indeed these days in the “real America” outside the bubble. In fact, things have been going badly wrong in America since the beginning of the 21st century. It turns out that the year 2000 marks a grim historical milestone of sorts for our nation. For whatever reasons, the Great American Escalator, which had lifted successive generations of Americans to ever higher standards of living and levels of social well-being, broke down around then—and broke down very badly. The warning lights have been flashing, and the klaxons sounding, for more than a decade and a half. But our pundits and prognosticators and professors and policymakers, ensconced as they generally are deep within the bubble, were for the most part too distant from the distress of the general population to see or hear it.

[..] In some circles people still widely believe, as one recent New York Times business-section article cluelessly insisted before the inauguration, that “Mr. Trump will inherit an economy that is fundamentally solid.” But this is patent nonsense. By now it should be painfully obvious that the U.S. economy has been in the grip of deep dysfunction since the dawn of the new century. And in retrospect, it should also be apparent that America’s strange new economic maladies were almost perfectly designed to set the stage for a populist storm. Ever since 2000, basic indicators have offered oddly inconsistent readings on America’s economic performance and prospects. It is curious and highly uncharacteristic to find such measures so very far out of alignment with one another.

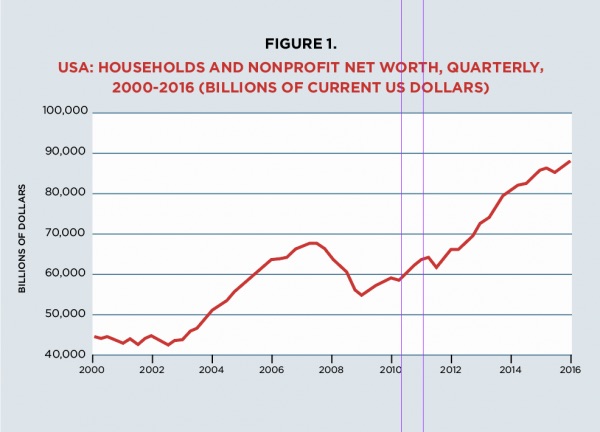

We are witnessing an ominous and growing divergence between three trends that should ordinarily move in tandem: wealth, output, and employment. Depending upon which of these three indicators you choose, America looks to be heading up, down, or more or less nowhere. From the standpoint of wealth creation, the 21st century is off to a roaring start. By this yardstick, it looks as if Americans have never had it so good and as if the future is full of promise. Between early 2000 and late 2016, the estimated net worth of American households and nonprofit institutions more than doubled, from $44 trillion to $90 trillion. (SEE FIGURE 1.)

Although that wealth is not evenly distributed, it is still a fantastic sum of money—an average of over a million dollars for every notional family of four. This upsurge of wealth took place despite the crash of 2008—indeed, private wealth holdings are over $20 trillion higher now than they were at their pre-crash apogee. The value of American real-estate assets is near or at all-time highs, and America’s businesses appear to be thriving. Even before the “Trump rally” of late 2016 and early 2017, U.S. equities markets were hitting new highs—and since stock prices are strongly shaped by expectations of future profits, investors evidently are counting on the continuation of the current happy days for U.S. asset holders for some time to come.

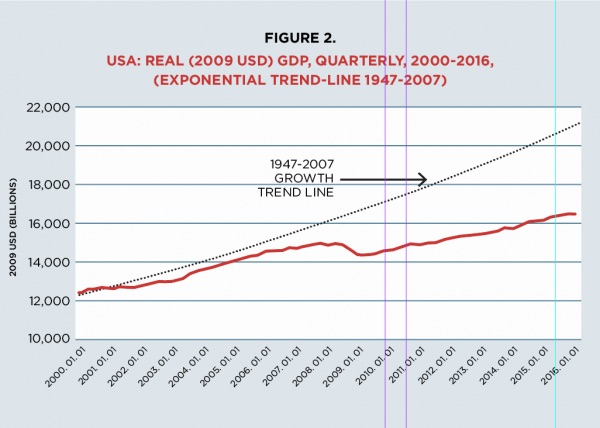

A rather less cheering picture, though, emerges if we look instead at real trends for the macro-economy. Here, performance since the start of the century might charitably be described as mediocre, and prospects today are no better than guarded. The recovery from the crash of 2008—which unleashed the worst recession since the Great Depression—has been singularly slow and weak. According to the Bureau of Economic Analysis (BEA), it took nearly four years for America’s GDP to re-attain its late 2007 level. As of late 2016, total value added to the U.S. economy was just 12% higher than in 2007. (SEE FIGURE 2.) The situation is even more sobering if we consider per capita growth. It took America six and a half years—until mid-2014—to get back to its late 2007 per capita production levels. And in late 2016, per capita output was just 4% higher than in late 2007—nine years earlier. By this reckoning, the American economy looks to have suffered something close to a lost decade.

It all means very little without new debt data. Are they still trying to borrow growth? You bet.

• China Cuts GDP Growth Target to 6.5%, Targets Reforms, De-Leveraging (CNBC)

China is aiming to expand its economy by around 6.5% in 2017 as it continues to implement a proactive fiscal policy and maintain a prudent monetary policy, Premier Li Keqiang said on Sunday. Top leaders at the National People’s Congress are tolerating slightly slower economic growth this year to give them more room to push through reforms to deal with a build-up in debt. A lending binge and increased government spending last year have fueled worries about high debt levels and an overheating housing market. GDP officially grew 6.7% in 2016, the slowest in 26 years, but within the government’s target range of 6.5 to 7%. That 6.5% growth target is “needed to achieve the employment objective,” Li said in his prepared remarks.

The government announced ambitious jobs plans, including to ensure that every family has at least one breadwinner, which is key as jobs are cut in major state-owned enterprises. As the government moves away from manufacturing-led growth, Beijing is tasked with quickly finding new employment for millions of workers, or risk the possibility of social unrest as unemployment looms China says it expects 11 million new urban jobs will be created this year, but that still wont keep pace with the 15 million new workers the government estimates will enter the market, according to prepared remarks. The government will continue to focus on the coal and steel sectors, with plans in place to cut steel production capacity. But experts were skeptical of the idea that certain economic growth levels would be “needed” for employment reasons.

“There is not now nor has there ever been any magical connection between GDP and jobs. You can have capital-intensive 6.5% GDP growth and not create enough jobs and you can have 3.5% labor-intensive GDP growth and create more than enough jobs,” said Derek Scissors, a resident scholar at the American Enterprise Institute and chief economist of the China Beige Book. “The Chinese government’s position for the past 20 years has been that the nutrition content of food doesn’t matter at all, only the number of calories.” This doesn’t make any sense economically, but it’s perfectly clearly politically,” he said, noting that China had said it needed greater GDP growth when its labor force was actually expanding, as opposed to its current contraction.

Becoming unaffordable?

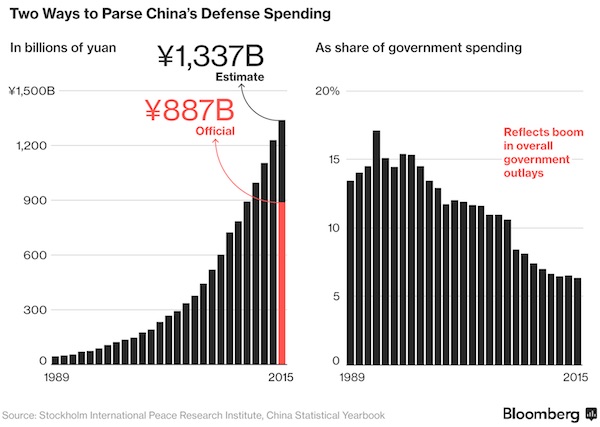

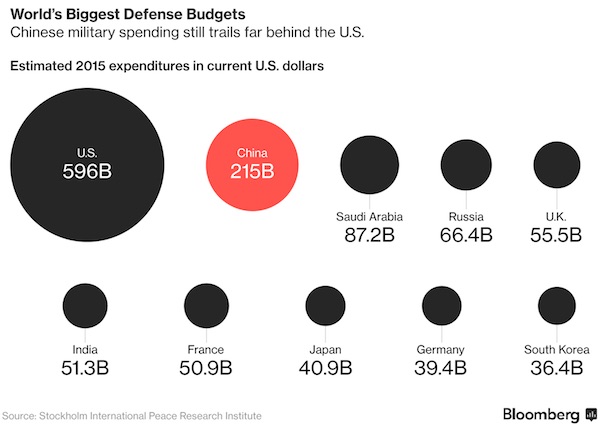

• China Signals Slower Increase In Defense Spending (BBG)

China indicated a continued slowdown in defense spending growth this year, as President Xi Jinping presses ahead with a sweeping military overhaul. The defense budget will rise “about 7%,” National People’s Congress spokeswoman Fu Ying told a briefing ahead of China’s annual legislative session in Beijing. An actual spending target wasn’t expected until Sunday, when the Ministry of Finance releases its 2017 budget at the start of the 11-day legislative gathering. Last year, the country budgeted a 7.6% uptick in military spending to 954.4 billion yuan (equal to $147 billion at the time), the slowest increase since a 7.3% rise in 2010. Seven% would be the slowest expansion in more than a decade, tracking the broader trend in the country’s economy.

The increase consolidates China’s lead as the world’s second-largest military spender, accounting for more than 10% of the global arms total, said Siemon Wezeman, a senior researcher with the Stockholm International Peace Research Institute. More than two decades of expansion have helped China build a modern military capable of projecting force further from its coasts, while spurring anxious neighbors to upgrade their own defenses. Fu said China was committed to peace and described tensions in the South China Sea, where the country’s land reclamation campaign has been criticized by the U.S. and rival claimants, as “easing.” “We advocate dialogue and peaceful solutions to disputes of sovereignty and maritime rights,” said Fu, a former vice foreign minister and ex-ambassador to the U.K. “Meanwhile, we should possess the capacity to protect our sovereignty and interests.”

Don’t count her out.

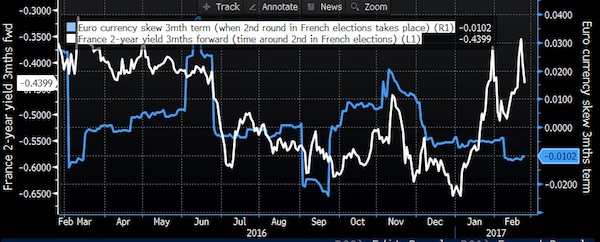

• The Priced-In Risk of Marine Le Pen’s Victory (BBG)

Markets trade in the probability of certain events happening. In case an event has high risk, a “tail” is priced in. Those tail risks typically show up in certain corners of the markets. Today, tail risks are priced in for a potential unexpected outcome in the French elections. That tail risk is on the rise now that polls of the second round of voting indicate a tight race between center candidate Emmanuel Macron and the far-right candidate Marine Le Pen. Tail risks can be viewed in a linear way. For example, the German 2-year bond (“Schatze”) reached an all-time negative yield of -92 basis points when Le Pen recently gained in the polls.

As a result, the German 2-year yield became negatively correlated with the price of French bonds and stocks. A generic view is that German bonds are a reflection of the “tail risk” that Le Pen is victorious. However, there are technical reasons to explain the fall of German 2-year bonds. Those technicalities are a scarcity of German bond collateral in the repurchase market and the ECB’s purchase of German bonds yielding less than the deposit rate. This is what makes the 2-year German bond “overvalued” and therefore not as accurate a reflection of the true tail risk in France. There are other areas in markets that provide a better idea of how much of a Le Pen win is priced in.

Tail risks can be seen in currency options. The options market use a measure called “skew.” This is the difference between the implied volatility of puts and calls. A negative skew means currency markets price euro puts with higher implied volatility than the currency’s calls. In the case of negative skew, the currency market thinks the risk for depreciation of a currency is large. The skew of the euro currency has been on a steady decline since President Donald Trump was elected in November, as seen in Fig. 1. On the other hand, the French bond market has seen a surge in yields discounted to the second round of the presidential election, on May 7. Rising yields are a sign of uncertainty about the outcome of the election. Fig. 1 shows how markets are pricing a “tail risk” of an adverse election outcome. And this tail risk seems to be increasing by the day.

I like Blanchard’s notion that “the reason unemployment is decreasing is productivity growth is so low.” But I don’t get that he overlooks, when saying “why is demand growth not stronger?”, that so many people have simply lost the means to spend. That seems to be a curious blind spot for an IMF economist. it’s not about pessimism, it’s about not having any money.

• Self-Fulfilling Pessimism (Vox)

Why is it that demand growth is not stronger? In this video, Olivier Blanchard discusses his research on long-run forecasts and unexpected decreases in consumption. This video was recorded at the American Economic Association in Chicago in January 2017.

“..one is more likely to be drinking poison in a golden cup than an ordinary one.”

• Only The Rich Are Poisoned (Taleb)

When people get rich, they shed their skin-in-the game driven experiential mechanism. They lose control of their preferences, substituting constructed preferences to their own, complicating their lives unnecessarily, triggering their own misery. And these are of course the preferences of those who want to sell them something. This is a skin-in-the-game problem as the choices of the rich are dictated by others who have something to gain, and no side effects, from the sale. And given that they are rich, and their exploiters not often so, nobody would shout victim. I once had dinner in a Michelin-starred restaurant with a fellow who insisted on eating there instead of my selection of a casual Greek taverna with a friendly owner operator, his second cousin as a manager and his third cousin once removed as a receptionist.

The other customers seemed, as we say in Mediterranean languages, to have a cork plugged in their behind obstructing proper ventilation, causing the vapors to build on the inside of the gastrointestinal walls, leading to the irritable type of decorum you only notice in the educated upper classes. I note that, in addition to the plugged corks, all men wore ties. Dinner consisted in a succession of complicated small things, with microscopic ingredients and contrasting tastes that forced you to concentrate as if you were taking some type of exam. You were not eating, rather visiting some type of museum with an affected English major lecturing you on some artistic dimension you would have never considered on your own. There was so little that was familiar and so little that fit my taste buds: once something on the occasion tasted like something real, there was no chance to have more as we moved on to the next dish.

Trudging through the dishes and listening to some b***t by the sommelier about the paired wine, I was afraid of losing concentration. I costs a lot of energy to fake that I was not bored. In fact I discovered an optimization in the wrong place: the only thing I cared about, bread, was not warm. It appears that this is not a Michelin requirement. I left the place starving. Now if I had a choice I would have had some time-tested recipe (say a pizza with very fresh ingredients, or a juicy hamburger) in a lively place –for a twentieth of the price. But because the fellow dinner partner could afford the expensive restaurant, we ended up the victims of some complicated experiments by a chef judged by some Michelin bureaucrat. It would fail the Lindy effect: food does better through minute variations from Sicilian grandmother to Sicilian grandmother. It hit me that the rich people were natural targets; as the eponymous Thyestes shouts in Seneca’s tragedy, thieves do not enter impecunious homes, and one is more likely to be drinking poison in a golden cup than an ordinary one.

The Turkish foreign minister claims the right to campaign among Turkish residents in Germany and Holland. Nobody wants that. Imagine if Mexico would take its political campaigns to US streets.

• Austrian Chancellor Calls For EU-Wide Ban On Turkish Campaigning (R.)

Austrian Chancellor Christian Kern on Sunday called for a European Union-wide ban on campaign appearances by Turkish politicians to avoid having individual member countries like Germany come under pressure from Ankara. Turkey said on Saturday it would defy opposition from authorities in Germany and the Netherlands and continue holding rallies in both countries to urge Turks living there to back an April 16 referendum to boost President Tayyip Erdogan’s powers. Turkish Foreign Minister Mevlut Cavusoglu criticized German and Dutch restrictions on such gatherings as undemocratic, and said Turkey would press on with them in the run-up to the vote. Kern, in an interview published in the Welt am Sonntag newspaper, said the measure would weaken the rule of law in Turkey, limit the separation of powers, and violate the values of the EU.

He also called for the EU to end discussions with Turkey about membership in the bloc and scrap or restrict €4.5 billion in aid planned for Turkey through 2020. “We should reorient relations with Turkey without the illusion of EU membership,” Kern told the newspaper. “Turkey has moved further and further away from Europe in the past few years. Human rights and democratic values are being trampled. Press freedom is a foreign word,” he said. Kern criticized Ankara’s arrest of German-Turkish journalist Deniz Yucel, a correspondent for Die Welt newspaper, and many other journalists, academics and civil servants, and called for Yucel’s immediate release. At the same time, he said, Turkey remained an important partner in issues of security, migration and economic cooperation, and said Ankara had lived up to its obligations under the migrant deal struck with the EU.

The demise of a nation.

• Greece, Getting Smaller (Maria Katsounaki)

“Instead of ‘Little Greece’ we need a serious Greece,” former Prime Minister Costas Simitis told the Delphi Economic Forum on Friday. As he spoke, Athens was suffocating again because of a mass transit strike, “unknown persons” were destroying ticket validating machines on buses, Eurostat’s figures showed that Greece is the consistent champion in unemployment, at 23% (with the next country, Spain, at 18.2% and the eurozone average at 9.6%), while a report from the Cologne Institute for Economic Research (IW) named Greece the leader in the percentage rise of poverty. The talks between the Greek government and its creditors show more differences than convergence, while Politico reported that the government has asked the World Bank for technical and financial assistance…

Each of the issues we mentioned has a past, present and future. They are not the same – some are tied to the economic crisis, other are not. One could argue that putting them together is aimed at making an impression. But let’s ask ourselves how the destruction of ticket validating machines was allowed to become a hobby. How have illegality and criminality become normal? How will unemployment and poverty be reduced when every investment crashes against denial, suspicion and compulsive behavior? When the only thing that grows is the amount of taxes and social security fees that we must pay? Let us ask ourselves this: When did the discussion that for a strike to be held “50% plus 1” of employees must agree, so as to put an end to the impunity of minorities?

Why has union leadership that is allied to political parties become “the right to strike” whereas any effort at reform serves the interests of the “economic oligarchy”? How can anyone trust a government that, while “negotiating hard” at the same time declares “the crisis is over,” while behaving as if this were a Third World country? Every day we are further gone in our illness and further from recovery. Little Greece is neither honest nor serious. It is not size that makes her lack credibility, but the ever-deeper national autism, the constant repetition of the performance “we are fighting for solutions” while caring nothing for solutions.

Got to keep that border open.

• Canada: No Plans To Clamp Down At Border To Deter Migrants (R.)

Canada will not tighten its border to deter migrants crossing illegally from the United States in the wake of a U.S. immigration crackdown because the numbers are not big enough to cause alarm, a government minister said on Saturday. Public Safety Minister Ralph Goodale said the issue had not risen to a scale that required hindering the flow of goods and people moving across the world’s longest undefended border. Hundreds of people, mainly from Africa and the Middle East, have defied winter conditions and walked across the border, seeking asylum. They are fleeing President Donald Trump’s immigration crackdown, migrants and refugee agencies say.

It is not common to have so many asylum seekers in the United States looking for refuge in Canada over such a short period. The influx poses a political risk for Prime Minister Justin Trudeau, who faces pressure from the left, which wants more let in, and from the right, which fears an increased security risk. “We are concerned and we will deal properly with the extra hundreds (crossing illegally),” Goodale told reporters at a televised news conference in Emerson, Manitoba. “But the full border deals with 400,000 people moving in both directions every day. It also handles C$2.5 billion in trade every day. “It is critically important for us to make sure that it is strong and secure. At the same time, it needs to be efficient and expeditious.”

Since it’s impossible to deport millions of people, clearer heads are called for.

• America’s Millions Of Undocumented Mexicans Live In Fear Of Deportation (G.)

The queue starts outside the consulate gate soon after dawn and stretches up Park View street. The visitors speak in low murmurs, exchanging the latest rumours. A dragnet in Glendale. Checkpoints in Highland Park. People deported for jaywalking. For speaking Spanish. Some visitors say they have sold their furniture to create an emergency fund. Others wonder if they should stop going to work and pull their kids from school. Overreactions? Wise precautions? No one knows. They’ve come here for answers. Inside the gate hulks a nondescript, cream-coloured office block. Lights flicker into life on a pale winter day and by 7am all is aglow: the consulate general of Mexico in Los Angeles is open for business. It is a lighthouse, of sorts, for undocumented Mexicans caught in the political maelstrom that is Hurricane Trump.

“I’m here to make a plan,” said Juana Sanchez, 53, a seamstress who has stitched and sewed in LA’s fashion district for 29 years. A plan for what? She managed a tight smile. “Deportation.” The immigration policies gusting out of the White House have chilled the US’s estimated 11 million undocumented people, half of whom are Mexican. The new president has vastly widened the numbers deemed priorities for expulsion. “As we speak tonight we are removing gang members, drug dealers that threaten our communities and prey on our very innocent citizens,” he told a joint session of Congress last week. “Bad ones are going out as I speak and as I promised throughout the campaign.”

The Mexicans who flock to the LA consulate say that in reality Immigration and Customs Enforcement (ICE) is sweeping up caretakers, students, mothers – anyone who entered the US illegally, and is thus a law-breaker. “Trump is the world’s worst terrorist. He has the Latino community terrorised,” said Rosa Palacios, a careworker with a nine-year-old granddaughter who weeps in fear at losing relatives. The hostility outdid previous anti-immigrant crackdowns, she said. “It is worse than when they thought we were infected.”

Mexico may well come out of this a stronger country.

• Mexico Opens Legal Aid Centers At US Consulates To Defend Migrants (R.)

Mexico opened legal aid centers at its 50 consulates across the United States on Saturday to defend its citizens, the Mexican government said, amid worries of a crackdown on illegal immigration under U.S. President Donald Trump. Foreign Minister Luis Videgaray exhorted the U.S. government to respect the rights of Mexicans and called for the United States to allow a path to legality for undocumented migrants. “We are not promoting illegality,” Videgaray said, according to a video of an event at the Mexican consulate in New York provided by the foreign ministry, saying that Mexico supported following the law, but that means respecting human rights. Trump has issued orders to initiate tougher deportation procedures during his first month in office, following up on campaign vows to fight illegal immigration and to build a wall on the U.S.-Mexico border.

“Today we are facing a situation that can paradoxically represent an opportunity, when suddenly a government wants to apply the law more severely,” Videgaray said. “It is becoming more than evident that to apply the law, which is the obligation of any state, would also imply a real economic damage to this country which highlights the need for immigration reform, an immigration reform that resolves once and for all the legal status of the people,” Videgaray said. The Pew Research Center estimates there are nearly 6 million undocumented Mexicans living in the United States. Late last month, Videgaray expressed “worry and irritation” about Trump’s new policies to U.S. Secretary of State Rex Tillerson and Homeland Security chief John Kelly when they visited Mexico for talks on immigration and security.

There is so much international law concerning the rights of refugees, written especially after wars, but none of it seems to matter much.

• Stranded Refugees Denied UK Asylum Face ‘Life In Limbo (O.)

Almost half of the refused asylum seekers who are unable to leave the UK have considered committing suicide, according to new research that criticises government rules for forcing individuals into destitution and a life in limbo. Interviews with asylum seekers refused permission to remain, in the UK but who cannot go home because they lack a passport, their nationality is disputed or there is no viable route back to their country, also found that half have considered or are applying for statelessness. The British Red Cross charity said such individuals should be allowed temporary leave to remain and work if they meet Home Office requirements, sparing people from years living in penury.

The charity said it knew of cases where women trapped in this situation had resorted to paying for a place to sleep with sex. It cited one Algerian who has been in the UK for 17 years who wassleeping on the streets and warned that those stuck in such limbo frequently suffer periods of homelessness alongside debilitating mental health issues, and that survival depended on the goodwill of friends and charities. Analysis by the Guardian last week revealed that Britain is one of the worst destinations in western Europe for people seeking asylum. Based on in-depth interviews with 15 people, the British Red Cross report found chronic stress, insomnia, anxiety and depression, with one refused asylum seeker from Sudan, a victim of torture, describing that he self-harms by banging his head against the wall.

No conclusive figures exist on the numbers of people who cannot leave the UK, although a freedom of information response from the Home Office reveals that 1,096 people lodged an application for statelessness in the UK after being refused asylum, following the introduction of new guidance in April 2013.