Govert Flinck Landscape With An Obelisk 1638

Stolen from Gardner Museum March 18 1990, the single largest art theft in the world. Never recovered.

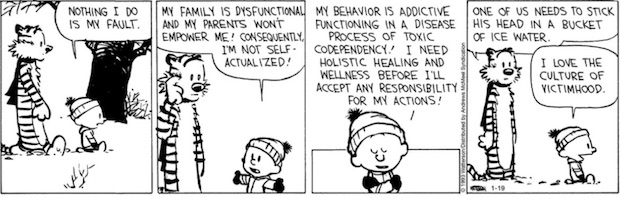

Makers and takers

A quadriplegic man now uses just his BRAIN WAVES to control a mouse cursor, thanks to @ElonMusk's @Neuralink brain implant.

That lets the man play Chess and Civilization VI online, making his life much more fun.

Innovation like that is a reason I call Musk a hero: pic.twitter.com/2lrYuWPPZk

— John Stossel (@JohnStossel) March 20, 2024

US Corp

https://twitter.com/i/status/1770234212379193618

Macgregor

https://twitter.com/i/status/1770459916366442864

Big guy

JIM JORDAN: “Mr. Bobulinski who is the big guy?”

BOBULINKSKI: “Joe Biden.”

JIM JORDAN: “Are you sure?”

BOBULINKSKI: “I am 1000% sure.. and there are other text messages that back that up..” pic.twitter.com/jm955HWA59

— Benny Johnson (@bennyjohnson) March 20, 2024

Rapporteur

Listen to the UN Special Rapporteur at the Human Rights Council asking the International community to stop Israel's ongoing genocide in Gaza. It's past time to act. Children are dying of starvation while the rules-based order is watching and doing nothing.pic.twitter.com/9gMUyJZXHy

— Kim Dotcom (@KimDotcom) March 21, 2024

“This new development represented a revolution in the art of war, and an essential part of the West has not yet understood it completely..”

• The Silver Bullet Against the Barbarian Invasions of the West (Metri)

On February 13, 2024, the United States Senate approved a U.S. $95 billion aid package for Ukraine, Taiwan, and Israel. According to IMF Data, this package represents a higher value than the international reserves of 165 countries. In other words, out of 194 countries with reserves recorded in dollars, only 29 have volumes more significant than the value of the U.S. Senate package. This fact gives an idea of the extravagance of this contribution.

This news, passed on almost ordinarily, reveals two important facts. First, one mentions the extraordinary and disproportionate financing and spending capacity of the United States, used, among other objectives, for the increasing armament of its allies on strategic boards, the promotion of proxy conflicts in regions marked by geopolitical fractures, and, from a longer perspective, the execution of an uninterrupted chronology of wars and military interventions since 1991. Furthermore, this financing and spending capacity also support a broad military structure of global reach with approximately 750 military bases outside its national territory [1].

Regarding this disproportionate financing and spending capacity of the United States, below are some brief observations discussed in depth on other occasions [2]. The position of the U.S. dollar in the international monetary hierarchy and how the world economy began to function after the Cold War have allowed The United States to impose the burden of its violence on the world, mainly due to the role that its public debt plays in the global economic game. It is a system of extortion because, while the world accumulates, with no apparent limit, U.S. Treasuries, Washington carries out a broad agenda of wars and military actions. The current level of indebtedness of the United States federal government is only comparable to that of periods marked by significant war efforts since its federal public debt, measured as a percentage of GDP, has already reached, for example, levels similar to those of the Second World War.

These advantages occur because the absorption of securities issued by the United States has become a necessary policy for other states to act in the exchange markets in defense of their currencies and, thus, protect, at the limit, their autonomy over economic policy instruments. Everything is quite the same for private agents, as having U.S. Treasuries in their portfolios is imperative to deal with the high risks of an intrinsically unstable system. This situation is the core of the United States’ monetary power, much more strategic than the power of financial sanctions itself, whose bases are also the dollar’s position in the international system and widely used by Washington against the targets of its foreign policy.

The second fact related to the news about an aid package for Ukraine, Taiwan, and Israel concerns the objectives of the United States. The priority is not exactly Kyiv, Taipei, or Tel Aviv per se but the role they play for Washington in the regions where they are. The extraordinary contribution of resources reveals, in practice, the White House’s priority targets, namely Moscow, Beijing, and Tehran. These have long been present in different formulations of the National Security Strategy and Washington’s foreign policy documents.

The central point is that the North Atlantic, particularly the United States, has already been surpassed by Russia in developing strategic weapons, especially hypersonic ones. This new development represented a revolution in the art of war, and an essential part of the West has not yet understood it completely. On the other hand, from an economic point of view, China is already the largest economy in the world, corresponding, in 2023, to 18.82% of world GDP based on purchasing power parity (PPP), while the United States, 15.42%. To make matters worse for the West, for more than two decades, Beijing and Moscow have been developing and deepening strategic partnerships in several sensitive fields of international relations: weapons, technology, energy, currency, finance, etc.

“..it should not be difficult to understand the popularity of Putin. While the 1990s was a golden period for the West, it was a nightmare for Russians. The economy collapsed and society disintegrated with truly horrific consequences..”

• Why Western Media ‘Coverage’ Of Russia Is Incredibly Dangerous (Diesen)

Over tens of thousands of years, we have developed the instinct to organise in groups as a source of security. This is the result of evolutionary biology as survival demands that we organise into “us” versus “them”. In-group loyalty is augmented by assigning contrasting identities of the virtuous “us” versus the evil “other”, which helps stop an individual from straying too far from the pack. Yet, human beings are also equipped with reason and thus the ability to assess objective reality independent of their immediate circle. In international relations, it’s imperative to place yourself in the shoes of the opponent. The rationality required to see the world through the perspective of the “other” is vital for reaching mutual understanding, reducing tensions, and pursuing a workable peace. Every successful peace process and reconciliation in history – from Northern Ireland to negotiations to end apartheid in South Africa – has been based on this.

We expect journalists to be objective in their reporting of reality, which is especially important during war. But this seems to be almost impossible, especially during conflicts. When human beings experience external threats, their herd instincts are triggered as society demands group loyalty and we punish those who deviate. The political obedience demanded during war time usually results in the weakening of freedom of speech, the role of journalism, and democracy. So, how can we understand the reasons for President Vladimir Putin’s immense popularity in Russia and his landslide victory? If we use our reason and resist our tribal instincts, it should not be difficult to understand the popularity of Putin. While the 1990s was a golden period for the West, it was a nightmare for Russians. The economy collapsed and society disintegrated with truly horrific consequences.

The country’s security also collapsed, as NATO expansion meant there was no chance to agree an inclusive European security architecture. This had been outlined in the Charter of Paris for a New Europe in 1990 and the OSCE founding documents. A weakened Russia meant that its interests could be ignored, and NATO was able to invade Moscow’s ally Yugoslavia, in violation of international law. When Putin took over the presidency on 31 December 1999, it was commonplace in the West to predict that Russia would share the fate of the Soviet Union. That is eventual collapse. However, Russia has instead become the largest economy in Europe (by PPP), its society has healed from the disastrous 1990s, its military might has been restored, and new international partners have been found in the East and Global South, as evidenced by the growing role of BRICS.

Furthermore, most Russians believe it’s not a good idea to have major disruptions to leadership in the middle of a NATO-Russia proxy war in Ukraine that is deemed an existential threat. Don’t change horses in midstream as the American proverb, often attributed to Abraham Lincoln, advises. Speaking of the US, the late Mikhail Gorbachev – who was immensely popular there – did not shy away from criticising Putin, when he was still with us. However, he nevertheless argued that Putin “saved Russia from the beginning of a collapse”. Today, any Western journalist repeating this would be immediately branded as a “Putinist” – implying a betrayal of the “us”. Western journalists cannot acknowledge the immense achievements of Russia since 1999 as it could be interpreted as lending legitimacy and signalling support for the “bad” side.

“..This is almost three times higher than the same period last year..”

• Ukraine Lost Over 71,000 Troops Since Start of 2024 – Shoigu (Sp.)

Ukraine has lost more than 71,000 soldiers and over 11,000 units of various weapons since the start of the year, Russian Defense Minister Sergei Shoigu said on Wednesday. “In general, the losses of the Ukrainian armed forces during this period, that is, since the beginning of this year, exceeded 71,000 people and 11,000 units of various weapons. This is almost three times higher than the same period last year,” Shoigu said at a meeting with senior military. Ukraine has also lost four Abrams tanks, five Leopard tanks, six HIMARS multiple rocket launcher systems and five Patriot complexes, the minister added. The Ukrainian forces have lost 3,501 soldiers killed and injured during the attacks on Russian border settlements in Belgorod and Kursk regions, Shoigu added.

“The most active fighting was conducted in the area of the settlement of Kozinka. All enemy attacks were successfully repelled, it was thrown back outside the Russian territory. At the same time, the losses of the Ukrainian armed forces in the direction of the actions of the groups covering the state border for eight days of hostilities amounted to more than 3,500, or rather 3,501 people, of which 790 were killed,” Shoigu said at the board ministerial meeting. The United States is extremely concerned about the achievements of the Russian armed forces in the special operation zone, the minister said. The United States and its satellites are extremely concerned about the success of the Russian armed forces. It is becoming increasingly difficult for them to justify to the Western community the need for further funding and supplies of weapons and ammunition to the armed forces of Ukraine,” Shoigu said.

Russian air defenses struck down 419 drones and 67 missiles that were launched by Ukrainian troops against Russian targets during the three days of presidential voting, Shoigu said. “The Russian forces strengthened security around government and social infrastructure assets, ramping up air defense capabilities to prevent acts of terrorism. During the election, 419 UAVs and 67 missiles were downed,” Shoigu told a ministerial meeting. The Ukrainian armed forces targeted polling places across Russia during last week’s presidential election with tacit approval of their Western military advisers, Sergei Shoigu said. “They intentionally targeted polling places and government institutions while civilians were present there. Both the command of the Ukrainian armed forces and their Western advisers knew it,” Shoigu told a ministerial meeting in Moscow.

Well, he sure won’t let YOU dictate them..

• Putin Won’t Be Allowed To ‘Dictate Peace Terms’ In Ukraine – Germany (RT)

Germany will not let Russian President Vladimir Putin forcibly alter Ukraine’s borders or impose the terms of peace, Chancellor Olaf Scholz has vowed. “We will not accept a dictated peace at the expense of Ukraine,” Scholz told German lawmakers on Wednesday in Berlin. “Law is stronger than violence.” He added that Putin sought to violate that principle with the launch of Russia’s military operation against Ukraine in February 2022. “We will not let him get away with this,” he said. Scholz insisted that Germany’s backing of Ukraine in the conflict with Moscow will not decrease and that expecting otherwise would be a “miscalculation.”

He reiterated his criticism of Putin’s reelection last weekend for a fifth term as president, saying it showed that “Russia is not strong.” However, as EU foreign policy chief Josep Borrell acknowledged in an interview on Wednesday, European allies will be hard-pressed to fill the funding gap if Kiev’s biggest backer, Washington, reduces its support. US President Joe Biden’s administration ran out of funding for Ukraine in January and has struggled to secure congressional approval for over $60 billion in additional military and financial aid. Scholz made his comments as he prepared for an EU summit that is scheduled to begin on Thursday in Brussels.

Major topics of discussion will include efforts to ramp up aid to Ukraine, as well as the bloc’s response to the Israel-Hamas war. Russian forces have made battlefield gains in recent weeks, and US defense chief Lloyd Austin warned on Tuesday that Ukraine’s very survival will be at risk if the West fails to provide more weapons to Kiev. Even as he lobbies allies for more Ukraine aid, Scholz has resisted political pressure to provide Kiev with long-range Taurus missiles, saying that such an escalation could draw Germany into a direct conflict with Russia. Speaking at the Bundestag on Wednesday, he told lawmakers that debate within Germany over the Taurus issue is “nothing short of ridiculous.” He added that the controversy isn’t well understood outside of Germany, saying, “This is embarrassing for us as a country.”

“We call this Kriegstuchtigkeit – being ready, capable and willing to fight. We are on the right track..”

• German Children ‘Must Be Prepared For War’ – Minister (RT)

German children should be made to prepare for war to boost “resilience,” Education Minister Bettina Stark-Watzinger stated on Saturday. She said kids should be taught what to do in the event of conflict and suggested introducing “civil defense” drills in schools so that youngsters will be prepared for the years ahead. “Society as a whole must prepare well for crises, from a pandemic to natural disasters to war. Civil defense is immensely important, and it also belongs in schools. The goal must be to strengthen our resilience,” Stark-Watzinger said in an interview with the Funke media group. She also called for a “relaxed relationship” to be fostered between schoolchildren and the German Armed Forces (Bundeswehr), suggesting that military officers should visit schools to explain what “the Bundeswehr does for our security.” President of the German Teachers’ Association, Stefan Dull, told Bild last week that the minister’s proposal “makes sense.”

“I expect the federal minister to now seek discussions with the education ministers in the federal states,” he said, adding that a “declaration of intent is not enough – politics lessons now have to teach about the war in Ukraine and the pan-European, even global threat situation.” Stark-Watzinger’s initiative reflects the German government’s policy aimed at making the country “war ready” in the face of a potential Russia-NATO conflict, which could happen within a few years, according to senior German defense officials. In February, German Defense Minister Boris Pistorius claimed in an interview with Bloomberg that Russia may attack NATO “in five to eight years.” German chief of defense, General Carsten Breuer, also highlighted the “paramount” importance of making the country’s military ready within the next five years. “We call this Kriegstuchtigkeit – being ready, capable and willing to fight. We are on the right track,” he declared.

“..opposes sending more arms to Kiev along with Ukrainian membership of NATO. He has called for rebuilding relations with Russia..”

• Slovakia’s PM Fico in EU’s Crosshairs as New ‘Headache’ (Sp.)

Ukraine’s patrons in Brussels have Slovakia’s Prime Minister Robert Fico in their crosshairs for a host of reasons. Brussels has accused him of taking a page out of Hungarian Prime Minister Viktor Orbán’s book, reported POLITICO. Just as Hungary was repeatedly the victim of ‘rule-of-law’ disciplinary proceedings brought by Brussels, there are now calls to treat Slovakia “seriously.” Bratislava might risk losing access to European Union (EU) funds, European Parliament Vice President Martin Hojsík (PS) was cited as saying. The EU withheld over €30 billion in cohesion and recovery funds in December 2022 over alleged violations. Orban insisted in 2023 that Hungary had met all the EU’s requirements and that the funds were being diverted to the Kiev regime. s”It is possible that some of it [the money] is already in Ukraine,” he stated at the time. Budapest’s block on EU funding of Ukrainian war efforts forced Brussels to unlock €10 billion ($11 billion) of the funds to Hungary in December.

But Slovakia’s ruling coalition is the new thorn in Brussels’ side. Officials have suggested resorting to EU fund-freezing, this time with respect to Bratislava. The reported pretext is the shutting-down of the Slovak Special Prosecutor’s Office as part of criminal justice reforms Fico said on Wednesday that officials at the office had abused their authority. According to the publication, Slovak MEP and vice-president of the European Parliament Martin Hojsík urged swift measures from the EU if Fico’s government continues on an “illiberal path.” The rhetoric around Fico echoes Brussels’ narrative against Orban. Like Orban, Fico, who returned to government for the fourth time in 2023, opposes sending more arms to Kiev along with Ukrainian membership of NATO. He has called for rebuilding relations with Russia. Last December Orban vetoed an increase in the EU budget for 2024-2027, including 50 billion euros ($55 billion) in macro-financial aid to Kiev.

While Orban did not veto EU accession talks with Ukraine at the time, he warned that Budapest would have “75 more opportunities” to block this process. The Slovak PM has adopted a similarly adamant position on Ukraine. Fico’s Smer party-led government, elected in September 2023, reversed the country’s stance on the Ukraine crisis in favor of halting military aid to Kiev. Fico, dubbed the “Slovak Orban,” stressed that aiding the Kiev regime only prolongs a conflict that Ukraine has no chance of winning. He has repeatedly warned that Western countries could opt for the “worst solution” in the Ukraine crisis, and reiterated his stance of keeping Slovak troops out of the conflict. Fico was highly critical of recent comments by French President Emmanuel Macron suggesting sending European NATO troops to Ukraine. The proposal was rejected by leaders across the continent, including German Chancellor Olaf Scholz.

“Earlier in March, Robert Fico stressed that he was “not convinced of the sincerity of the West to achieve peace in Ukraine.”

• Split Over Ukraine Aid Prompts ‘Unprecedented’ Czech-Slovak Rupture (Sp.)

Robert Fico rode to his fourth term as prime minister in Slovakia in 2023 on a wave of discontent over EU support for Ukraine in the NATO proxy conflict against Russia. Like Hungarian Prime Minister Viktor Orban, Fico has been against sending weapons to Kiev, and urged for maintaining good relations with Russia. Waning desire to continue propping up the Kiev regime is increasingly becoming a deal breaker in relations between states, government, and politicians. Disagreements over further support for Ukraine have caused an “unprecedented rupture” between the Czech and Slovak governments, The Washington Post has underscored. While the two countries, which emerged after the bifurcation of Czechoslovakia, have maintained warm relations until now, the past month has witnessed a growing split between them, the publication pointed out.

The government in Prague, led by Prime Minister Petr Fiala, is fervidly pro-Kiev, while Slovakia’s PM Robert Fico has been adamantly against sending weapons to Ukraine, Kiev’s potential NATO membership, and sanctions on Russia. There had never been “open rhetorical confrontation” between the two governments until NATO’s proxy conflict against Russia in Ukraine, it was stressed. Prague, which has been overly zealous in its eagerness to provide Ukraine with ammunition, opted for an unprecedented snub earlier in March. It suspended intergovernmental consultations with Bratislava in the wake of a meeting between the Slovak Foreign Minister Juraj Blanar and his Russian counterpart, Sergey Lavrov. Fiala noted at the time that, “it is impossible to conceal the fact that there are significant differences of opinion on some key foreign policy issues.”

In response, Robert Fico openly addressed Fiala in a video posted on social media, where he warned Prague against putting Slovak-Czech relations “in danger.” “We note that the Czech government has decided to jeopardize them because it has an interest in supporting the war in Ukraine, while the Slovak government talks about peace. Your decision will not affect our sovereign policy,” the Slovak prime minister said. Robert Fico’s Smer party-led government, elected in the September 2023 general election, reversed the country’s stance on the Ukraine crisis in favor of stopping military supplies to Kiev. Fico, dubbed the “Slovak Orban” after his Hungarian counterpart, who also opposes confrontation with Russia, stressed that aiding the Kiev regime weakens the Slovak Armed Forces and only prolongs a conflict that Ukraine has no chance of winning.

Earlier in March, Robert Fico stressed that he was “not convinced of the sincerity of the West to achieve peace in Ukraine.” He added in a social media post that “the Western strategy of using the war in Ukraine to weaken Russia economically, militarily and politically is not working.” Fico was also sharply critical of recent comments by French President Emmanuel Macron suggesting the possibility of European troops being sent to Ukraine. The proposal was broadly rejected by leaders throughout the continent, including Italian Prime Minister Giorgia Meloni and German Chancellor Olaf Scholz. Fico’s sovereign foreign policy, undeterred by pressure from the West, is similar to the stance adopted by Hungary’s Prime Minister Viktor Orban. Budapest has since the beginning of the Ukraine conflict been consistently calling for a ceasefire and peace negotiations between Moscow and Kiev, and opposed sanctions on Russian energy. In March 2022, Hungary’s parliament banned the delivery of weapons to Ukraine from the country’s soil.

“Then, it’s on the road to Avdeyevka. Nothing, absolutely nothing prepares us to confront total devastation. In my nearly 40 years as a foreign correspondent, I’ve never seen anything like it – even Iraq..”

• Donetsk, Avdeyevka, Mariupol – on the Road in Electoral Donbass (Pepe Escobar)

They have waited 10 long, suffering years to vote in this election. And vote they did, in massive numbers, certifying a landslide reelection for the political leader who brought them back to Mother Russia. VVP may now be widely referred to as Mr. 87%. In Donetsk, turnout was even higher: 88,17%. And no less than 95% voted for him. To follow the Russian electoral process at work in Donbass was a humbling – and illuminating – experience. Graphically, in front of us, the full weight of the collective West’s relentless denigration campaign was instantly gobbled up by the rich black soil of Novorossiya. The impeccable organization, the full transparency of the voting, the enthusiasm by polling station workers and voters alike punctuated the historical gravity of the political moment: at the same time everything was enveloped in an impalpable feeling of silent jubilation.

This was of course a referendum. Donbass represents a microcosm of the solid internal cohesion of Russian citizens around the policies of Team Putin – while at the same time sharing a feeling experienced by the overwhelming majority of the Global South. VVP’s victory was a victory of the Global Majority. And that’s what’s making the puny Global Minority even more apoplectic. With their highest turnout since 1991, Russian voters inflicted a massive strategic defeat to the intellectual pigmies who pass for Western “leadership” – arguably the most mediocre political class of the past 100 years. They voted for a fairer, stable system of international relations; for multipolarity; and for true leadership by civilization-states such as Russia. VVP’s 87% score was followed, by a long shot, by the Communists, with 3.9%. That is quite significant, because these 91% represent a total rejection of the globalist Davos/Great Reset plutocratic “future” envisioned by the 0.001%.

On Election Day Two, at section 198 in downtown Donetsk, not far from Government House, it was possible to fully measure the fluidity and transparency of the system – even as Donetsk was not spared from shelling, in the late afternoon and early evening in the final day of voting. Afterwards, a strategic pit stop in a neighborhood mini-market. Yuri, an activist, was buying a full load of fresh eggs to be transported to the nearly starving civilians who still remain in Avdeyevka. Ten eggs cost the equivalent of a dollar and forty cents. At Yasinovata, very close to Avdeyevka, we visit the MBOU, or school number 7, impeccably rebuilt after non-stop shelling. The director, Ludmilla Leonova, an extraordinary strong woman, takes me on a guide tour of the school and its brand new classrooms for chemistry and biology, a quaint Soviet alphabet decorating the classroom for Russian language. Classes, hopefully, will resume in the Fall.

Close to the school a refugee center for those who have been brought from Avdeyevka has been set up. Everything is spotlessly clean. People are processed, entered into the system, then wait for proper papers. Everyone wants to obtain a Russian passport as soon as possible. For the moment, they stay in dormitories, around 10 people in each room. Some came from Avdeyevka, miraculously, in their own cars: there are a few Ukrainian license plates around. Invariably, the overall expectation is to return to Avdeyevka, when reconstruction starts, to rebuild their lives in their own town. Then, it’s on the road to Avdeyevka. Nothing, absolutely nothing prepares us to confront total devastation. In my nearly 40 years as a foreign correspondent, I’ve never seen anything like it – even Iraq. At the unofficial entry to Avdeyevka, beside the skeleton of a bombed building and the remains of a tank turret, the flags of all military batallions which took part in the liberation flutter in the wind.

Each building in every street is at least partially destroyed. A few remaining residents congregate in a flat to organize the distribution of essential supplies. I find a miraculously preserved icon behind the window of a bombed-out ground floor apartment.

Aka: Boeing’s in really big trouble.

• Boeing Mulls Sale Of Defense Assets – Bloomberg (RT)

Boeing might sell at least two of its defense unit businesses to improve its finances amid mounting safety concerns, Bloomberg reported on Tuesday, citing unnamed sources familiar with the discussions. The world’s second largest aircraft manufacturer by market capitalization recently hit severe turbulence, with its shares plummeting amid a series of quality control scandals that have resulted in grounded planes and numerous safety checks. Boeing has engaged financial advisers to gauge interest in several of its smaller units, including Digital Receiver Technology and unspecified defense programs under the corporation’s global services division, sources told Bloomberg, adding that efforts have been underway for about a year. The aerospace giant is also reportedly mulling options for divesting its stake in United Launch Alliance (ULA), the rocket-launch joint venture co-owned with Lockheed Martin.

Earlier this year, media reports emerged that ULA had attracted interest from Jeff Bezos’ Blue Origin. Any defense sale by Boeing, one of the Pentagon’s prime contractors, would face scrutiny from US regulators as concerns about consolidation among the biggest suppliers are increasing, Bloomberg said. Moreover, antitrust regulators such as Lina Khan, chairwoman of the Federal Trade Commission, have reportedly been critical of Boeing’s monopoly over US civil aircraft production. The plane maker is now facing a wave of safety audits of its 737 MAX 9 in the wake of a near-catastrophic accident on January 5, when an Alaska Airlines flight bound for California from Portland, Oregon, had to turn back after a door panel blew off at 16,000 feet, injuring several of the 171 passengers aboard.

Boeing shares have lost more than 30% since the accident. On Tuesday, Federal Aviation Administration (FAA) head Mike Whitaker told Reuters that the manufacturer needed to improve safety culture and address quality control issues before it would be allowed to boost production of the 737 MAX, previously labelled by Boeing as “the safest airplane” on the market. A US safety audit of the manufacturing process of the troubled jet reportedly found dozens of shortcomings, including the use of dish soap and a hotel key card as makeshift tools. It had been previously reported that the FAA identified 97 “non-compliance” issues at Boeing and failed the aircraft maker on 33 out of 89 product audits. The regulator temporarily grounded all 737 MAX 9 jets in the US for safety inspections.

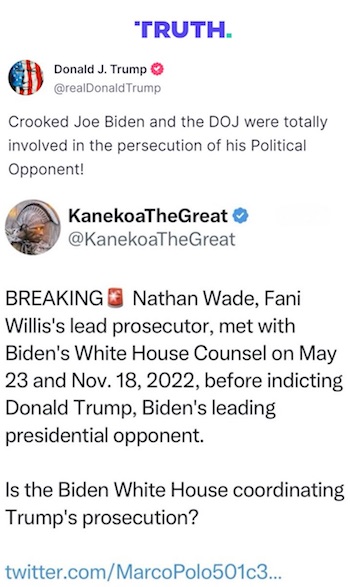

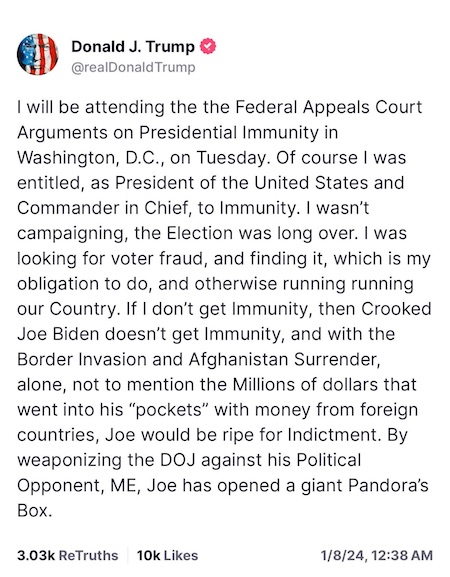

“..now new information we’re getting is that Liz Cheney ran that committee.”

• House May Refer January 6 Committee Members for Obstruction (ET)

The chair of a House subcommittee warned that some members of a controversial Jan. 6 investigatory subcommittee could face charges of hiding and destroying documents Rep. Barry Loudermilk (R-Ga.) said in an interview last week that he may refer former members of the committee to the Department of Justice for prosecution after a report that he commissioned found that its members allegedly hid information from the public. “As far as holding people accountable, yes, they should be,” Mr. Loudermilk told Just the News last week after the report was released, referring to the possibility that committee members will face punishment. “But I think that’s going to be a little ways down the road, because there is so much more information that we need to get. “And we need to build not only this, to get the truth out to the American people, but see just how big this case potentially is for obstructing.”

However, the Georgia lawmaker suggested that there are “other options,” including censuring and ethics referrals. “But also consider there are members of that Select Committee who are no longer members of Congress. So they may fall under a different scenario,” Mr. Loudermilk told the media outlet. “So we do have the tools of members of Congress, but also, active members of Congress have certain protections. So we’ll have to work on that. Because as you talked about earlier, we’re in uncharted territory right now. And so we’re going to have to work through this.” He also said that he believes that Rep. Bennie Thompson (D-Miss.), the chairman of the now-disbanded Jan. 6 select committee, allowed then-Rep. Liz Cheney (R-Wyo.) to make decisions for the panel. “There’s still documents that we need to get hold of. We still don’t have passwords for the encrypted documents,” Mr. Loudermilk said. “It’s amazing that you know, when I asked the former Chairman Bennie Thompson, ‘All I want you to do is give me the passwords.’ He said, ‘I don’t even know what you’re talking about.’

“Well, I think it’s coming down to he probably didn’t, because now new information we’re getting is that Liz Cheney ran that committee.” On March 12, a previously undisclosed transcript of the House Jan. 6 Select Committee’s interview with an unnamed Secret Service officer who drove the presidential SUV on Jan. 6 provided new information about outgoing President Donald Trump’s actions that day. That transcript of the driver contradicted key witness Cassidy Hutchinson’s testimony—namely her claim that President Trump tried to grab the wheel of his presidential car. President Trump “never grabbed the steering wheel,” the Secret Service agent said, according to a transcript reviewed by The Epoch Times last week. “I didn’t see him lunge to try to get into the front seat at all.”

The testimony was given to the Democrat-dominated select committee convened to investigate the events of Jan. 6, 2021, in the previous Congress, but the transcript wasn’t released by the committee. House Republicans said in the new report that Ms. Hutchinson’s version of the story was false, according to the driver’s testimony. “Despite the driver of the president’s SUV testifying under oath that the Hutchinson story was false, the select committee chose to validate and promote Hutchinson’s version of the story as fact,“ they stated in the report. ”The select committee hid the driver’s full testimony and only favorably mentioned his testimony in its final report, it did not release the full transcript.”

Mr. Thompson said in a statement that his panel explained in 2022 that it had to send some transcripts to the executive branch for review “to protect sensitive information as well as the privacy of witnesses.” He said the panel’s final report “took into account the testimony of all witnesses” and that “all the evidence points to the same conclusion: Donald Trump wanted to join his violent mob as it marched on the Capitol.” In response to the report last week, Ms. Cheney, who lost her Wyoming Republican primary by more than 40 percentage points, suggested on social media platform X that Mr. Loudermilk and others are lying and trying to “cover up what [President Trump] did” on Jan. 6. She also recently wrote that people should instead read her committee’s report.

“..working people of all shades and colors are much more interested in maintaining their livelihoods than railing against wokeism..”

• Can you Slam Wall Street and Still Win an Election? Ask Sherrod Brown (Leopold)

When I recently learned that Senator Sherrod Brown (D, OH) had reissued his 2019 essay, called “Wall Street’s War on Workers: Stock Buybacks,” I was shocked. My new book is called Wall Street’s War on Workers, and also focuses in part on the job-destructive impact of stock buybacks. Who stole what from whom? Senator Brown didn’t know about my book, his essay was written before I started my book, and despite deep research I did not see his essay until two weeks ago. So, I was surprised, but I immediately understood why we both adopted the same big picture framework to understand the economy, and similar language to share our understanding with working people. As a labor educator, I’ve found that the big-picture framework is as important, maybe even more important, than facts and figures.

In our complex world, problems hit working people from all angles — job insecurity, job loss, the high costs of housing, discrimination, kids who can’t afford to move out, and on and on. To make sense of this mosaic, a framework helps hold the pieces together. In our educational program we see clearly that working people are hungry for a coherent explanation that connects the dots. And without a compelling alternative, the pressing need for frameworks can lead towards conspiracy theories. Brown and I are using the Wall Street War on Workers big picture framework for four reasons.

1/ It’s flat out true. Wall Street’s insatiable desire to extract wealth via stock buybacks, leveraged buyouts, hostile takeovers, and the like, are destroying the livelihoods and the well-being of thousands of working people each day in every sector of the economy.

2/ The framework rings true to working people. It’s understandable. It makes sense of their reality. It explains why they, and so many others around them, have gone from one mass layoff to the other. And it explains why they feel so strongly that the system is rigged against them.

3/ The framework breaks through fatalism. The dominant media explanation is that mass layoffs can’t be helped because technological change and globalization are unstoppable forces akin to natural laws. Wall Street’s War on Workers highlights human agency. Laws and regulations were changed to enable Wall Street to kill jobs at will for reasons that have nothing to do with new technology or trade. In the high-tech sector, for example, more than 260,000 workers experienced mass layoffs last year, and another 50,000 are gone so far this year. Almost none of those jobs were lost either due to globalization or new technologies, AI or otherwise.

4/ It’s good politics. Senator Brown wouldn’t be pushing this framework in the middle of a tight reelection campaign unless he believed it could help him deepen his base of support among working people, especially in areas that became increasingly Republican over the past two presidential elections. It’s one thing for Bernie Sanders and Elizabeth Warren to take on Wall Street in their very liberal states. No one will defeat them. But Brown is using the anti-Wall Street frame to get reelected in Ohio, which has become solidly red. In our labor education courses, working people of all political persuasions find the anti-Wall Street framework very compelling.Clearly, Brown does not believe that Ohio working people are fixated on anti-wokeness and blinded by racism, homophobia, xenophobia. He understands that working people of all shades and colors are much more interested in maintaining their livelihoods than railing against wokeism. My book provides compelling data that also shows increasing working-class liberalism, not illiberalism, on hot-button issues like immigration, gay rights, and racism. Ohio’s embrace of a constitutional amendment in 2023 that wrote abortion access into the state’s constitution confirms Brown’s intuitions and my findings. It’s one thing, however, for a labor educator to use the “Wall Street’s War on Workers” framework. To keep my job, I don’t have to run against Wall Street’s cash. But Sherrod Brown is taking a risk, maybe a big risk. And he’s not running away from the challenge or being mealy-mouthed about how Wall Street is ripping off the working class.

A federal appeals court overruled the Supreme Court?!

• Mexico to Deny Entry to Migrants Deported From Texas Under New SB4 Law (Sp.)

The Mexican government does not intend to accept its citizens who will undergo repatriation from Texas under the US state’s new SB4 legislation, the Mexican Foreign Affairs Secretariat said on Wednesday. “Mexico reiterates its legitimate right to protect the rights of its nationals in the United States and to determine its own policies regarding entry into its territory. Mexico recognizes the importance of a uniform migration policy and the bilateral efforts with the United States to ensure that migration is safe, orderly and respectful of human rights, and is not affected by state or local legislative decisions. In this regard, Mexico will not accept, under any circumstances, repatriations by the State of Texas,” the ministry said in a statement published while the law was briefly in effect. The foreign ministry condemned the SB4 law, saying that the legislation is aimed at disrupting migration flow by “criminalizing” the migrants, the ministry said.

“Mexico categorically rejects any measure that allows state or local authorities to exercise immigration control, and to arrest and return nationals or foreigners to Mexican territory. Mexico also questions legal provisions that affect the human rights of the more than 10 million people of Mexican origin who live in Texas, and give rise to hostile environments in which the migrant community is exposed to hate speech, discrimination and racial profiling,” the statement read. Close to 8 million migrants have illegally entered the United States via the southern border since Joe Biden became president in 2021. On Tuesday, the US Supreme Court temporarily granted the state of Texas authority to carry out a state law known as SB4 that allows local authorities to arrest migrants suspected of entering the United States illegally from the southern border and return them to Mexico regardless of their country of origin. Hours after, a federal appeals court froze the law.

“..if you’re trying to run an honest broker campaign against corrupt traditional parties, it’s not the best approach. It’s actually a turn-off.”

• RFK Jr. Destroys His Candidacy With VP Pick? (Roger Simon)

I interviewed Robert F. Kennedy Jr. for Epoch TV’s “Roller Coaster” series and also attended one of his birthday parties. In both instances, I liked the man, found him to be intelligent and personable, and also unafraid to take stands against the über-conformist Democratic Party, notably on health care and, to some degree, on the dangers of the Central Intelligence Agency. Although I have been an unabashed Donald Trump supporter since he came down the escalator and continue to be so, I would not have been disappointed, even pleased, had former President Trump chosen Mr. Kennedy as his vice-presidential candidate. Unlikely as it may have been, it could have helped bring our fractured country together. No longer.

If reports are true—and, in that regard, the website name www.kennedyshanahan.com was reportedly registered by one of his campaign operatives on March 13—Mr. Kennedy has chosen attorney Nicole Shanahan as his running mate. I find this bizarre, to say the least, not to mention disappointing. Whatever his intentions, such a ticket would drive this country even further apart because Ms. Shanahan is a self-described “progressive.” But that’s only the tip of a disturbing iceberg I will get to in a minute. Let’s start with this. Mr. Kennedy, of all people, should know that the basic requirement for a vice presidential candidate, now more than ever, is that a person be qualified to assume the presidency at a moment’s notice. We have had disasters in that regard, dodging several bullets, including vice presidents Spiro Agnew, Mike Pence, and (for now, holding one’s breath) Kamala Harris. Mr. Trump has made clear that qualification for the presidency is now his first consideration, as it should be.

What do we know of Ms. Shanahan? Not much, except that she is a philanthropist to largely progressive causes and that she is very rich. She reportedly helped pay for Mr. Kennedy’s Super Bowl ad to the tune of $4 million via a Super PAC. The ad got mixed reviews and ended up with the candidate apologizing to his family. How rich Ms. Shanahan really is is unclear, but it is clear the bulk of her money comes from her divorce from Sergey Brin, co-founder of Google and, depending on the source, the ninth richest man on the planet. RFK Jr.’s campaign had been luffing and needed a boost. He looked to the financial. It’s hard to blame him, because that’s the putrid state of American politics. But if you’re trying to run an honest broker campaign against corrupt traditional parties, it’s not the best approach. It’s actually a turn-off. This is rather sad because of the optimism and excitement he initially engendered.

Let’s see it first.

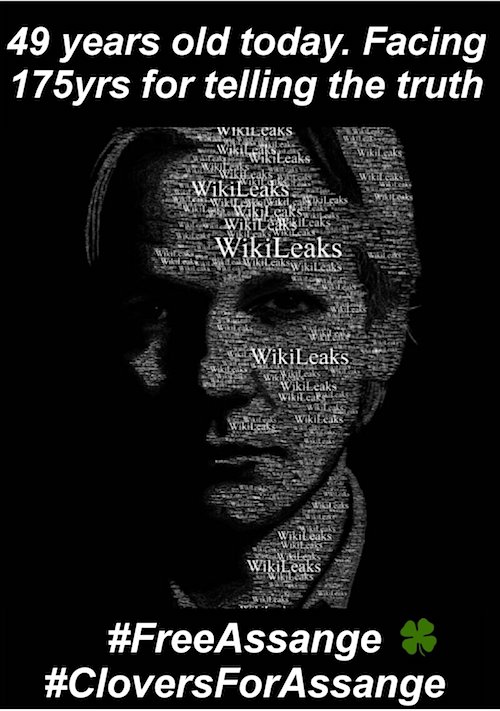

• DOJ Mulling Plea Deal For Assange: He Could Finally Walk Free (ZH)

The Biden administration might be looking for a way to bring the 14-year long legal drama centered on WikiLeaks founder Julian Assange to an end. Britain’s High Court will at some point in the next weeks finally decide whether to extradite him to the United States, but a surprise breaking story from The Wall Street Journal says the US is exploring other alternatives. The Wednesday WSJ report says, “The U.S. Justice Department is considering whether to allow Julian Assange to plead guilty to a reduced charge of mishandling classified information, according to people familiar with the matter, opening the possibility of a deal that would end a lengthy legal saga triggered by one of the biggest classified intelligence leaks in American history.” Ever since Metropolitan Police officers were allowed into the Ecuadorian Embassy in London on April 11, 2019 – where he had been holed up for years, Assange has been in the legal fight of his life while incarcerated at Belmarsh prison. If he’s extradited he’ll likely spend life in prison at the infamous ADX Florence supermax prison in Colorado.

A plea deal means the whole crisis for him and his family could finally come to an acceptable and peaceful end after all of these years. “Justice Department officials and Assange’s lawyers have had preliminary discussions in recent months about what a plea deal could look like, according to people familiar with the matter, a potential softening in a standoff filled with political and legal complexities,” according to details in the WSJ report. “The talks come as Assange has spent some five years behind bars and U.S. prosecutors face diminishing odds that he would serve much more time even if he were convicted stateside.” In February of this year, Assange’s cause received a big boost when his native Australia issued formal request to the US and UK that charges against Julian Assange be dropped. The motion adopted by Australian parliament at that time emphasized “the importance of the UK and USA bringing the matter to a close so that Mr. Assange can return home to his family in Australia.”

Given Australia is a close US ally and member of the ‘Five Eyes’ intelligence group, this was a huge win for Assange. It’s very possible that this act alone may have pushed the Biden administration to take a more conciliatory stance. However, the US deep state is still without doubt seeking revenge after years of humiliation and tens of thousands of leaked documents revealed by WikiLeaks which exposed US state secrets and sometimes war crimes. There are still many obstacles to overcome if such a plea deal were to ever become reality, and the clock is ticking, notes WSJ further: The discussions remain in flux and the talks could fizzle. Any deal would require approval at the highest levels of the Justice Department. Barry Pollack, a lawyer for Assange, said he has been given no indication that the department will take a deal. A Justice Department spokesman declined to comment.

The report details, “If prosecutors allow Assange to plead to a U.S. charge of mishandling classified documents—something his lawyers have floated as a possibility—it would be a misdemeanor offense.” And this would be the ideal outcome for Assange and his legal team: “Under such a deal, Assange potentially could enter that plea remotely, without setting foot in the U.S. The time he has spent behind bars in London would count toward any U.S. sentence and he would likely be free to leave prison shortly after any deal was concluded.” Let’s hope that the celebratory day comes soon where Assange can actually walk out of Belmarsh a free man.

Is this where John Cleese got the idea for the Silly Walks department?

Evzones, the Presidential Guard of Greece.pic.twitter.com/Mdt859zevq

— Figen (@TheFigen_) March 20, 2024

Dubai-New York

https://twitter.com/i/status/1770453666446602547

Hippo bite

https://twitter.com/i/status/1770426704382554591

Turtle

https://twitter.com/i/status/1770524511156253129

Mates

https://twitter.com/i/status/1770569627879247907

Zaouli

Zaouli is a traditional dance of the Guro people of central Ivory Coast.

One of the most difficult dances to perform. pic.twitter.com/kJMtJ6aBze— Figen (@TheFigen_) March 20, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.