Unknown Medical supply boat Planter, General Hospital wharf on the Appomattox, City Point, VA 1865

“Both Keynesian and monetary economics seem to be in some kind of end game. What comes next is anyone’s guess.”

• Negative Interest Rates Set Up World For Biggest Mass Default Ever (Warner)

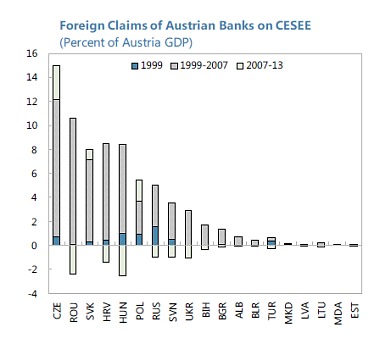

Here’s an astonishing statistic; more than 30pc of all government debt in the eurozone – around €2 trillion of securities in total – is trading on a negative interest rate. With the advent of ECB QE, what began four months ago when 10-year Swiss yields turned negative for the first time has snowballed into a veritable avalanche of negative rates across European government bond markets. In the hunt for apparently “safe assets”, investors have thrown caution to the wind, and collectively determined to pay governments for the privilege of lending to them. On a country by country basis, the statistics are even more startling. According to investment bank Jefferies, some 70pc of all German bunds now trade on a negative yield. In France, it’s 50pc, and even in Spain, which was widely thought insolvent only a few years ago, it’s 17pc.

Not only has this never happened before on such a scale, but it marks a scarcely believable turnaround on the situation at the height of the eurozone crisis just a little while back, when some European bond markets traded on yields that reflected the very real possibility of default. Yet far from being a welcome sign of returning economic confidence, this almost surreal state of affairs actually signals the very reverse. How did we get here, and what does it mean for the future? Whichever way you come at it, the answer to this second question is not good, not good at all. What makes today’s negative interest rate environment so worrying is this; to the extent that demand is growing at all in the world economy, it seems again to be almost entirely dependent on rising levels of debt.

[..] The flip side of the cheap money story is soaring asset prices. The bond market bubble is just the half of it; since most other assets are priced relative to bonds, just about everything else has been going up as well. Eventually, there will be a massive correction, in which creditors will suffer sickening losses. Nobody can tell you when that moment will arrive. We live in an “extend and pretend” world in which economies pathetically fight between themselves for any scraps of demand. One burst of money printing is met by another in an ultimately futile, zero-sum game of competitive currency devaluation.

As if on cue, along comes another soft patch in Britain’s economic recovery, with first-quarter growth quite a bit weaker than expected. Like a constantly receding horizon, the point at which UK interest rates begin to rise is pushed ever further into the future. It’s like waiting for Godot. When Bank Rate was first cut to 0.5pc in response to the financial crisis, markets expected rates to start rising again in a year. Six years later, Bank Rate is still at 0.5pc and markets still expect them to rise in a year. In Europe it’s not for four years. Both Keynesian and monetary economics seem to be in some kind of end game. What comes next is anyone’s guess.

More negative interest ‘unintended crap’.

• German Bunds Are Tanking After Big Investors Say to Get Out (Bloomberg)

Investors gave the clearest sign yet they’re losing patience with the record-low yields on euro-area government bonds in a selloff that spared no market. Yields on Germany’s bunds surged the most in two years as traders shunned an auction of the nation’s debt. Bond titan Jeffrey Gundlach of DoubleLine Capital egged on the declines, saying he’s considering making an amplified bet against the securities. His comments echoed Janus Capital’s Bill Gross, who once managed the world’s largest bond fund. He said bunds were the “short of a lifetime.”

The bond slump reflects growing angst among investors after the ECB’s €1.1 trillion quantitative-easing program sent yields to unprecedented lows from Germany to Spain. Emerging signs of inflation in the 19-nation economy are also hurting demand. “These are influential voices that offer a contrarian view when the German bond market appears to be at an extreme level, so there’s definitely going to be an impact on the market,” said Salman Ahmed, a global strategist at Lombard Odier Investments Managers in London.

“The problem for the Federal Reserve is in an economy that is roughly 70% based on consumption, when the vast majority of American’s are living paycheck-to-paycheck…”

• The Real Financial Crisis That Is Looming: Consumer Spending (STA)

It is important to remember that the total population in the US is currently around 320 million. In other words, more than 1:3 individuals in the United States is currently being supported by some form of government assistance. This is at a time when roughly 70 cents of every tax dollar is absorbed by government welfare programs and interest service on $18 Trillion in debt. Here is the problem with all of this. Despite Central Bank’s best efforts globally to stoke economic growth by pushing asset prices higher, the effect is nearly entirely mitigated when only a very small percentage of the population actually benefit from rising asset prices. The problem for the Federal Reserve is in an economy that is roughly 70% based on consumption, when the vast majority of American’s are living paycheck-to-paycheck, the aggregate end demand is not sufficient to push economic growth higher.

While monetary policies increased the wealth of those that already have wealth, the Fed has been misguided in believing that the “trickle down” effect would be enough to stimulate the entire economy. It hasn’t. The sad reality is that these policies have only acted as a transfer of wealth from the middle class to the wealthy and created one of the largest “wealth gaps” in human history. The real problem for the economy, wage growth and the future of the economy is clearly seen in the employment-to-population ratio of 16-54-year-olds. This is the group that SHOULD be working and saving for their retirement years. With 54% of this prime working age-group sitting outside of the labor force, it is not surprising that in a recent poll 78% of women in the U.S. want a “man with a J.O.B.”

The current economic expansion is already pushing one of the longest post-WWII expansions on record which has been supported by repeated artificial interventions rather than stable organic economic growth. While the financial markets have soared higher in recent years, it has bypassed a large portion of Americans NOT because they were afraid to invest, but because they have NO CAPITAL to invest with. The real crisis that is to come will be during the next economic recession. While the decline in asset prices, which are normally associated with recessions, will have the majority of its impact at the upper end of the income scale, it will be the job losses through the economy that will further damage and already ill-equipped population in their prime saving and retirement years.

With consumers again heavily leveraged with sub-prime auto loans, mortgages, and student debt, the reduction in employment will further damage what remains of personal savings and consumption ability. That downturn will increase the strain on an already burdened government welfare system as an insufficient number of individuals paying into the scheme is being absorbed by a swelling pool of aging baby-boomers.

“Spending on nonresidential structures, including office buildings and factories, dropped 23.1%..”

• US Economy Grinds To A Halt In First Quarter 2015 (Bloomberg)

The world’s largest economy sputtered to a near-halt in the first quarter, choked by a slump in U.S. business investment and exports that dimmed hopes for a meaningful short-term rebound. GDP rose at a 0.2% annualized rate after advancing 2.2% the prior quarter, Commerce Department data showed Wednesday in Washington. After their meeting, Federal Reserve policy makers said some of the headwinds holding back the U.S. will probably fade and give way to “moderate” growth. While the economy is likely to bounce back from the temporary restraints of harsh winter weather and delays at West Coast ports, the harm caused by the plunge in fuel prices and stronger dollar may be longer-lasting.

“There’s not a whole lot of momentum heading into the second quarter,” said Mike Feroli, chief U.S. economist at JPMorgan. “We expect the economy to be better, but some of the details in this report are cautionary.” Stocks fell as investors weighed the timing for a possible Fed rate increase. The Standard & Poor’s 500 Index declined 0.4% to 2,106.85 at the close in New York. The median forecast of 86 economists surveyed by Bloomberg projected GDP would rise 1%. Forecasts ranged from little change to a 1.5% gain. It was the weakest performance since the first three months of last year, when bad weather also damped growth.

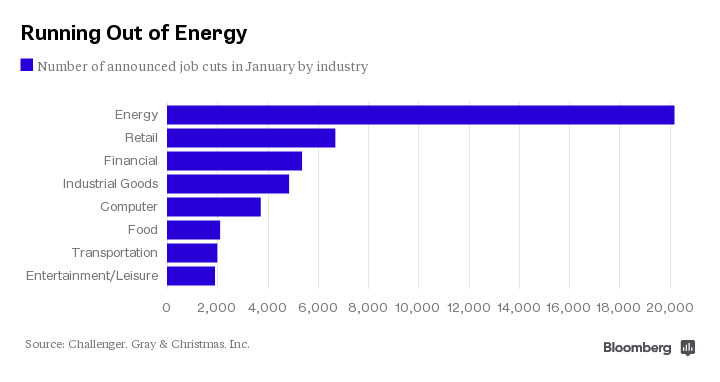

Corporate fixed investment decreased at a 2.5% annualized pace in the first quarter, the biggest decline since the end of 2009. Spending on nonresidential structures, including office buildings and factories, dropped 23.1%, the most in four years. The decline reflected weakness in petroleum exploration as oil companies slashed budgets on the heels of plunging crude prices. Spending on wells and mines fell at a 48.7% annualized rate in the first three months of the year, the biggest drop since the second quarter of 2009, when the economy was still in the recession. Halliburton, the world’s second-biggest provider of oilfield services, has said it expects to reduce capital spending by 15% this year and accelerated the pace of job cuts ahead of its takeover of Baker Hughes.

From the Fed bullhorn himself. It’s a matter of redefining terms. Apparently winter, though there is one every year, is now a ‘transitory factor’.

• Fed Stays Vague on Rate-Hike Timing, but Sees Slower Growth as Blip (Hilsenrath)

Federal Reserve officials attributed the economy’s sharp first-quarter slowdown to transitory factors, in effect signaling an increase in short-term interest rates remains on the table for the months ahead although the timing has become more uncertain. The Fed now needs time to make sure its expectation of a rebound proves correct after a spate of soft economic data. That means the chances for a rate increase by midyear have diminished, a point underscored by the Fed’s statement released Wednesday after a two-day policy meeting. “Economic growth slowed during the winter months, in part reflecting transitory factors,” the Fed said.

The Fed also said that although growth and employment had slowed officials expected a return to a modest pace of growth and job market improvement, “with appropriate policy accommodation.” The gathering concluded a few hours after the Commerce Department reported the U.S. economy grew at a 0.2% annual rate in the first quarter. It was the worst performance in a year, pocked with evidence of a slowing trade sector and anemic business investment. The report also showed annual consumer price inflation slowed in the first quarter. For now, the Fed isn’t signaling any shift in its policy stance. It repeated it would keep its benchmark short-term interest rate, the federal funds rate, near zero, where it has been since December 2008.

Officials in March opened the door to rate increases later this year, by removing from the policy statement assurances rates would stay low. The statement said, as it did in March, that the Fed would raise rates when officials become reasonably confident that inflation is moving toward the Fed’s 2% objective and as long as the job market continues to improve. Officials sought to acknowledge the recent economic downshift in their policy statement, while keeping their options open. The pace of job gains moderated, the Fed statement said, and measures of labor-market slack were little changed. Business investment softened and exports declined.

Ambrose and his opinionsm always fun. But do heed this: “Once you strip out a surge in inventories – often a pre-recession warning – the economy contracted sharply.”

• Ignore The ‘Whiff Of Panic’ As US Economy Stalls (AEP)

The US economy has suddenly stalled. A blizzard of shockingly weak figures raise the awful possibility that America’s six-year growth cycle since the Great Recession has already rolled over, with unsettling implications for the world. Worse yet, this apparent exhaustion is taking hold even before the Federal Reserve has begun to raise interest rates or to drain any of its $3.7 trillion of quantitative easing and balance-sheet expansion. Former US Treasury Secretary Larry Summers warned in Davos earlier this year that the Fed typically needs to cut rates by three or four percentage points to combat each cyclical downturn. It is currently at zero. “Are we anywhere near the point when we have 3pc or 4pc running room to cut rates? This is why I am worried,” he said.

“Nobody over the last 50 years, not the IMF, not the US Treasury, has predicted any of the recessions a year in advance, never,” he said. We should not ignore his warnings lightly, yet for once I am an optimist, clinging to the belief that the US will recover from the strange “air pocket” of early 2015. A siege of snow and ice across the North East over the late winter – for the second year in a row, and some say evidence of a drastically slowing Gulf Stream – has obscured the picture. The first flash of data is often wrong, in any case. Yet the latest GDP figures are indisputably atrocious. “It is hard to put lipstick on that pig: This is unequivocally a very weak report,” said Harm Badholz from UniCredit. The slump in the annual growth rate to 0.2pc in the first quarter does not convey the full horror of it.

Once you strip out a surge in inventories – often a pre-recession warning – the economy contracted sharply. Investment in business buildings and factories fell 23pc. “A whiff of panic is in the air,” said the Economic Cycle Research Institute. The putatitve post-winter rebound keeps disappointing. Citigroup’s economic surprise index has tumbled to deeply negative levels. The Conference Board’s index of consumer confidence fell from 101.4 to 95.2 in April. The Fed has clearly been caught off-guard. Bill Dudley, the New York Fed chief, said as recently as last week that the growth rate had probably dipped to around 1.5pc in first quarter but would soon climb back to its two-year trend path of 2.7pc.

It is by now clear that the 15pc surge in the dollar’s trade-weighted index since June – one of the two most dramatic dollar spikes of the post-war era – has done more damage than expected. It has tightened monetary policy through the exchange rate before the Fed has even pulled the trigger. Exports fell 7.3pc in the first quarter, further evidence that the rotating devaluations carried out by one economic bloc after another are doing little more than stealing demand from others in a beggar-thy-neighbour world of quasi-depression.

“..you won’t find any direct mentions of the strength of the greenback.”

• Fed, White House Fail To Mention The D-Word (MarketWatch)

There’s a word that both the Federal Reserve and the White House didn’t mention Wednesday that has played havoc with the U.S. economy this year – the dollar. Search the text of the Federal Open Market Committee’s statement, or the statement put out by the White House after the disappointing first-quarter gross domestic product report, and you won’t find any direct mentions of the strength of the greenback. Part of that is down to politics and the mantra that only the Treasury speaks about the dollar. Because, without mentioning the dollar, the Fed pretty well describes what has happened.

“Inflation continued to run below the Committee’s longer-run objective, partly reflecting earlier declines in energy prices and decreasing prices of non-energy imports,” the Fed said. That doesn’t sound like much, but look carefully at the back part of that sentence — the reference to “decreasing prices of non-energy imports.” That’s another way to say that consumers and businesses can buy more stuff and services from abroad for less. And, why is that? Because the dollar is up 26% against the euro over the last 52 weeks, and about 17% vs. a broader set of currencies as measured by the WSJ dollar index. The White House allusion to the dollar is even more subtle.

Written by Jason Furman, the chairman of the Council of Economic Advisers, the White House statement does note that volumes of U.S. exports are sensitive to foreign GDP growth. This weak growth has of course helped the dollar to rise. Furman has previously been on the record about the dollar being a headwind for U.S. growth. Whether the new tone is a result of pressure internally from colleagues at Treasury or more a political shift isn’t clear. Either way, both the Fed and the White House are finding it hard to ignore the biggest elephant in the room.

They’re going to get homesick for Varoufakis soon.

• Firebrand Greek Minister Risks Fresh Schism With Europe (Telegraph)

Hopes that a revamped Greek bail-out team would finally break a two-month deadlock with creditors took a fresh blow on Wednesday, as the Leftist government’s firebrand energy minister pledged “no surrender” to international lenders. Highlighting a deep schism within the ruling party over Greece’s future in the single currency, Panagiotis Lafazanis said there could be “no compromise” with creditor powers, who were seeking “subordination and surrender” from his government. “Our government will not bow down, neither will it surrender,” wrote Mr Lafazanis in a Greek newspaper. “Syriza will not accept an agreement that would be incompatible to its radical commitments.” A popular figurehead of the party’s radical Left Platform, Mr Lafazanis attacked the Troika for “water-boarding” the Greek economy, choking its people into submission.

“If our ‘partners’ and the IMF believe that they will blackmail us using the refusal of financing as a weapon, and that they will terrorise the Greek people forever using the ‘bogeyman’ of default and of a national currency, they are woefully deluded.” The energy minister, who has ties with Moscow, has been one of the fiercest critics of the Troika’s plans to undercut Athens’ promises to address Greece’s “humanitarian crisis” through raising wages and pensions for the poorest. He added the country could gradually get on its feet after a euro exit, but warned monetary union would be “subjected to a grave and mortal wound” should Greece be forced out.

The intervention comes amid hope that Athens was edging closer to agreeing the basis for its reforms-for-cash programme, after a two-month hiatus that has pushed the country towards insolvency. A newly established Greek bail-out team, headed by Oxford-educated minister Euclid Tsakalotos, was due to present a draft reform list to officials in Brussels on Wednesday. The appointment of the softly-spoken Marxist economist came after Brussels had grown increasingly exasperated by the stalling tactics of finance minister, Mr Varoufakis. But insisting he was still at the forefront of talks, the “rock-star” former academic said he remained “in charge of the negotiations with the eurogroup”.

“[the new head of] the Greek negotiating team in the debt talks said Greece had to keep to its “red lines” on reforms and that any “areas of compromise” should be within the “political plan” of the radical government.”

• Greece Close To Minimum Agreement Deal With Creditors: Deputy PM (Guardian)

Greece could seal a deal with its creditors in early May, its deputy prime minister said on Wednesday, as the country prepared a new list of reforms and the ECB provided more support to its beleaguered banks. But Yannis Dragasakis warned it was likely to be only a “minimum agreement” to unlock the delayed funds Greece needed to avoid default. He said: “Now we are going to a minimum agreement with actions that can be taken immediately. But [in the long-term] not just any solution will suffice. The solution has to be viable. After the interim agreement a long discussion about the debt, primary surpluses, investment and growth will follow.”

A eurozone official told Reuters time was running out to reach a deal about releasing the emergency funds, which amount to €7.2bn, since the country needed to begin negotiating a third bailout agreement before the current programme runs out at the end of June. Otherwise it faced the prospect of default or having to leave the eurozone. He said: “We are not talking about weeks any more, we are talking about days.” If the latest Greek proposals were approved, eurozone finance ministers could endorse the deal at their next meeting on 11 May. Greece’s creditors are demanding economic reforms in exchange for more bailout cash. But the impasse could still prove difficult to break, since the new reforms were not expected to offer any major new concessions even though previous plans had been rejected.

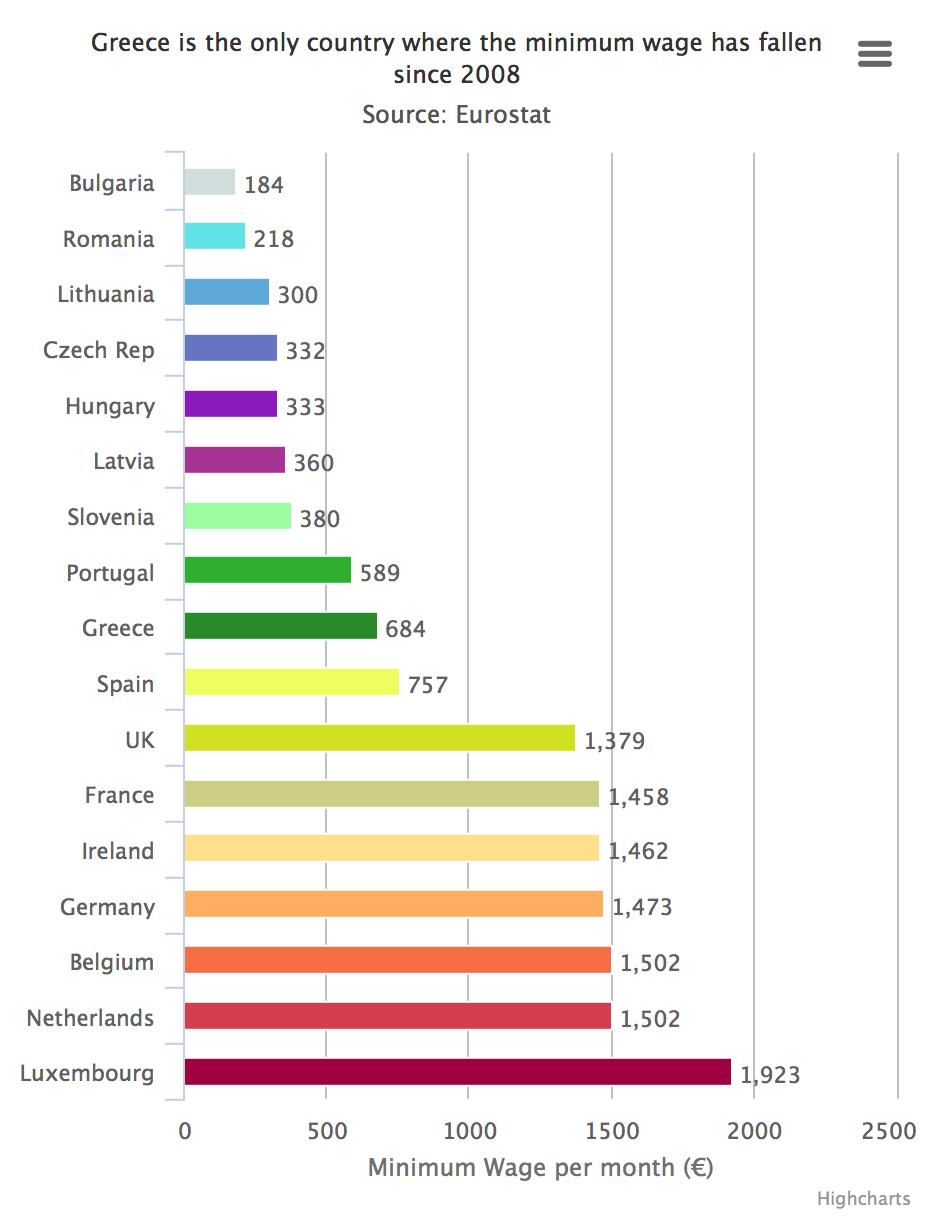

Due to be presented to the Greek parliament this week, they are said to include measures to clamp down on corruption and tax evasion, as well as tax and public administration reforms and a delay in plans to raise the minimum wage. But the Syriza-led government will continue resisting significant changes to pensions or reforms of the labour market. Euclid Tsakalotos, the Oxford-educated economics professor who now heads the Greek negotiating team in the debt talks, said Greece had to keep to its “red lines” on reforms and that any “areas of compromise” should be within the “political plan” of the radical government, which was elected on an anti-austerity ticket.

“Energy Minister Panayiotis Lafazanis cast doubt on whether Greece and its lenders could reach an “honorable compromise.” Alternate Minister for Social Security Dimitris Stratoulis said there was no way the government would accept “painful compromises.”

• Reinforced Greek Finance Team Heads To Brussels For Talks (Kathimerini)

A reinforced Greek team is to resume tough negotiations with representatives of the country’s international creditors in Brussels on Thursday, with some new proposals from the Greek side expected to be discussed, in a bid to make some progress toward a deal. According to a senior Finance Ministry official, the Greek delegation to Brussels involves 18 people, ranging from government negotiators to technocrats expected to provide eurozone officials with some of the accounting data they have struggled to obtain to date. The talks are expected to continue until Sunday as time is running short for Greece to conclude an agreement with its creditors before state cash reserves run out.

Meanwhile in Athens, the Cabinet is on Thursday set to discuss the proposed provisions of a multi-bill being drafted by a new “political negotiating team” and which is expected to recommend changes to Greece’s public sector and tax administration but not to tackle key areas of contention such as pensions and the labor market. A government official indicated that the government’s “red lines” would remain in place, noting however that the provisions have not been “written in stone.” The thorny issues of pension and labor sector reforms, along with privatizations and the size of this year’s primary surplus target, are expected to dominate talks in Brussels, however, as creditors are keen for progress in some of these areas. Greek officials are hoping that an extraordinary Eurogroup could be called before the one scheduled to take place on May 11.

A eurozone official told Kathimerini that an agreement at the May 11 meeting was unlikely while stressing that Greece has “days, not weeks” to conclude a pending review. A possible scenario, he said, is that eurozone officials could issue a positive statement. This might encourage the ECB to allow Greek banks to increase their exposure to T-bills. While Deputy Prime Minister Yiannis Dragasakis insisted that an agreement with lenders could be reached at the beginning of May, other SYRIZA ministers appeared more skeptical on Wednesday. In an op-ed published in Crash magazine, Energy Minister Panayiotis Lafazanis cast doubt on whether Greece and its lenders could reach an “honorable compromise.” Alternate Minister for Social Security Dimitris Stratoulis said there was no way the government would accept “painful compromises.”

The tourist sector, especially on the islands, is one of the main tax evaders.

• Transactions Over €70 On Larger Greek Islands To Be Plastic Only (Kathimerini)

A draft plan by the government to increase state revenues, which is to be submitted to the Brussels Group on Thursday, includes increasing the luxury tax by 30%, imposing an accommodation levy on hotels with three stars or more, and the obligatory use of credit or debit cards for transactions of €70 euros or more on islands that have more than 3,000 inhabitants. The latter measure will apply to the islands of Rhodes, Lesvos, Chios, Kos, Samos, Syros, Naxos, Santorini, Limnos, Kalymnos, Thasos, Myconos, Paros, Andros, Tinos, Icaria, Leros, Karpathos, Skiathos, Skopelos, Milos, Patmos and Symi.

Given the track record of Bloomberg’s economists team, I guess this means there won’t be a Grexit.

• Majority of Financial Pros Now Say Greece Is Headed for Euro Exit (Bloomberg)

Greece, mired in a protracted financial crisis and at loggerheads with its bailout stewards, will leave the euro, according to the majority of investors, analysts, and traders in a Bloomberg survey. 52 % of the respondents in the Bloomberg Markets Global Poll believe the cash-strapped country will leave the 19-nation bloc at some point, compared with 43% who see Greece remaining in the euro for the foreseeable future. In answer to the same question in mid-January, just 31% of poll respondents predicted a Greek exit and 61% had the country staying in. The downbeat assessment of Greece’s prospects, more than five years after the country’s first bailout, comes as the country stands on the edge of a financial abyss.

Prime Minister Alexis Tsipras has so far failed to squeeze a loan payment out of his country’s institutional creditors as he sticks to his pledge to dial back austerity, while the nation’s banks stay on ECB life support. “The banking sector is Greece’s Achilles heel, and if the ECB decides to stop funding, then the situation will be even more fragile than it is at the moment,” said Diego Iscaro, a senior economist at research company IHS Global Insight in London. “That could trigger an exit—eventually.” Having lost access to capital markets and being ineligible for the ECB’s regular financing operations, Greece’s banks are reliant on the ECB-approved Bank of Greece Emergency Liquidity Assistance.

Out of options.

• Bank Of Japan Keeps Policy Steady In 8-1 Vote (CNBC)

The Bank of Japan (BOJ) kept policy steady in an 8-1 vote Thursday, maintaining its massive easing program of purchasing 80 trillion yen ($670 billion) worth of assets annually. The BOJ is ignoring signs its efforts to boost inflation toward a 2% target are stalling, Marcel Thieliant, a Japan economist at Capital Economics, said in a note. He had forecast the central bank would step up easing at this meeting. “The bank obviously considers the slowdown in inflation since the autumn to be a temporary phenomenon, blaming it mostly on the plunge in energy prices. In our view, there is more to it than that,” he said.

“The economic recovery is stalling, wages are barely rising, and inflation excluding food and energy is near zero, too.” Analysts had broadly expected the BOJ would leave its easing program intact, but the Nikkei business daily had reported the central bank could lower its median inflation estimate for fiscal 2015 from the current 1% in its semiannual report. The new figure will likely fall somewhere between 0.5-1%, the report said.

Not a country with an overly elevated general IQ. It fits right in with the rest of the ‘developed’ world.

• New Zealand Rockstar Economy All Smoke And Noise (NZ Herald)

With our currency effectively at parity with the Australian dollar and house prices booming everything must be great in the “rockstar” New Zealand economy, right? I’m not so sure. Let’s look at the economic growth achieved in 2014. Headline real GDP growth was a very impressive 3.5%. However, population growth was 1.6% so per capita GDP growth was only about 1.8%. Commodity prices – in particular dairy – had a big run up in 2014 resulting in a positive impact of around $5 billion to nominal GDP. Working out the contribution to real GDP growth is difficult, but if we assume about half of this fed through directly into GDP, then that accounts for about 0.9% of growth. Likewise the Christchurch rebuild got into full swing and probably added a further 0.6%.

So real GDP growth per capita, excluding the one-off effects of surging commodity prices and the Christchurch rebuild, was about 0.3%. Not quite so flash. The big problem is that the quality of our GDP growth has been low. GDP growth per capita is a much better measure of increased prosperity than simple GDP growth because it adjusts for the growth in our population. New citizens place demands on our social and physical infrastructure and the costs of those demands need to be met from the overall economic pie. Given that the media and most economists tend to focus on overall GDP growth, it’s no wonder politicians are hooked on the drug that is immigration: it’s an easy way to boost perceived GDP growth, despite significant cost to our infrastructure.

Those costs tend to be hidden in the short term; pressure on housing, demand for social services and further congestion on motorway and transport systems already at breaking point. Given we are a small, open economy, we need to be smart about what we do. The world is finely balanced at the moment: global growth is tepid and China’s growth in particular is slowing rapidly which may cause serious problems. Government debt levels globally are at record highs, Europe is a mess and Australia is facing real economic challenges as unemployment threatens to rise to 7% by the year’s end. I sense that as a nation we lack a plan and there is a real absence of leadership at both a local and a national level. We need to ask: What sort of economy do we want and how do we achieve it?

As the rising housing market allows for politicians to hide from sight their failures, the economy spins out of tilt.

• It’s Now Impossible For Most Poor Australian Families To Find A Home (Guardian)

A review of housing rental affordability released on Thursday shows that for most people on low incomes, finding an affordable place to rent is impossible. Anglicare Australia’s annual snapshot of rental affordability shows that while there has been a slight increase in affordability for low income households, for the vast majority of those living on benefits – such as Newstart or on the minimum wage – the cost of renting causes significant financial hardship. When we talk about housing affordability the most common discussion is about the cost of buying a house. And yet for 30% of people, while buying a house may be an ambition, the more immediate housing affordability issue is affording to pay rent rather than the mortgage.

For the past five years Anglicare Australia has conducted a national survey of properties to provide a “snapshot of rental affordability”. Rather than survey households, the snapshot looks at the marketplace by examining the cost of renting properties nationwide. This year it involved a survey of some 65,614 properties. The report considers the affordability of these properties for households on different government benefits such as single people on Newstart, those on the single parenting payment, the disability support pension, as well as those on the minimum wage. It considers an affordable property one in which the rent takes up “less than 30% of the household’s income.” This accords with the general view of a household being in “housing stress” if “housing costs are greater than 30% of disposable income and that household’s income is in the bottom 40% of the income distribution.”

How many guesses did you need?

• Who is to Blame for the Tragedy in Yemen? (Viktor Mikhin)

Artificially created by the West and their minion – Saudi Arabia, the Yemen crisis is unfolding according to their pre-planned scenario. Instead of helping the fraternal Yemen in the peaceful settlement of internal disputes, Riyadh has followed the lead of the US and begun to use military means to establish its dictatorship. At first, as planned, the first phase of the plan was carried out, i.e. the bombing of peaceful cities, towns and villages from planes of the so-called Arab coalition, when pilots developed combat experience launching bomb strikes in the absence of any air defense. During this phase, the United States actively helped the Saudis with intelligence, logistics and organization of military air sorties.

But even in such circumstances, Saudi pilots did not particularly trouble themselves over launching attacks on actual militant targets of Houthis, but prefered to bomb major cities such as Sana’a, Aden and many others. “The air raids in which our valiant falcons participated along with our brothers from the countries of the coalition eliminated all threats to the security of the kingdom and neighboring countries by destroying heavy weapons and ballistic weapons, which Houthi groups and forces under the control of Ali Abdullah Saleh had taken over,” reads a statement quoted by state media in Saudi Arabia. However, the fact is that these bombings by “glorious falcons” harmed mostly civilians; women, the elderly and children. According to WHO, as a result of the armed conflict, 944 civilians had been killed and another 3,487 wounded in Yemen from March 19 to April 17, 2015.

Then, according to the plan developed by the Pentagon, Saudi troops began entering the Yemen territory. The coalition of Arab countries announced the launch on the night of April 21 to 22 of a new operation in Yemen called “Restoration of Hope”. According to Saudi media, the goal of the operation is to restore the political process and fight against terrorism, and combat Houthi military activity. The official representative of the coalition command, Brigadier General Ahmed Asiri, said that its forces will continue the naval blockade of Yemen in order to prevent the supply of arms to the rebels. “If necessary, we will again resort to force. Under the new operation, we will do everything to stop all maneuvers by the Houthis,” said Ahmed Asiri.

“Developing personal dependence is no easy feat and requires resolute will power to continue on this long and rambling path.”

• Going Rogue: 15 Ways to Detach From the System (Tess Pennington)

It is much too complicated to get into how the “system” was created. That said, the purpose is to enslave through debt and to create an interdependence that will force you and your family to never truly find the freedom you are seeking. It manipulates and convinces you to continue purchasing as a sort of status symbol to make you think you are living the good life; while all along, it has enslaved you further. Wonder why we have all of these holidays where you have to buy gifts? The system needs to be fed and forces you into further enslavement. If you don’t buy into this facilitated spending spree, you are socially shamed. Collectively speaking, the contribution from our easy lifestyle and comfort level has created rampant complacency and a population of dependent, self-entitled mediocres.

We no longer count on our sound judgement, capabilities and resources. The system keeps everything in working order so we don’t have to depend on ourselves, and furthermore, don’t want to. I realize that many of the readers here do not fall into this collectivism, as you see through the ideological facade and know that the system is fragile and can crumble. Breaking away from the system is the only way to avoid the destruction of when it comes crumbling down. When you don’t feed into the manipulation tactics of the system, or enslave yourself to debt, and possess the necessary skills to sustain yourself and your family when large-scale or personal emergencies arise, you will be far better off than those who were dependent on the system. Those who lived during the Great Depression grew up in a time when self-reliance was bred into them and were able to deal with the blow of an economic depression much easier. Which side of this would you want to be on?

Those who had the patience to learn the necessary skills, ended up surviving more favorably compared to others who went through the trying times of the Depression. Now is the time to get your hands dirty, to practice a new mindset, skills, make mistakes and keep learning. Developing personal dependence is no easy feat and requires resolute will power to continue on this long and rambling path. To achieve this you have to begin to break away from the confines of the system. You don’t have to run off to the woods to be the lone wolf. Simply by asking yourself, “Will your choices and the way you spend your time lead to more independence down the road, or will it lead to greater dependence?”, will help you gain a greater perspective into being self-reliant. As well, consider ignoring the convenient system altogether. This will help you to detach yourself from complacency and stretch your abilities and your mindset.

Say hello and wave goodbye.

• The Last 3 Bornean Rhinos Are in Race against Extinction (Scientific American)

s there any hope of saving the Bornean rhinoceros (Dicerorhinus sumatrensis harrissoni) from extinction? Sadly, the chances of that happening seem to grow slimmer and slimmer. Experts once estimated that the rapidly disappearing forests of Sabah, Malaysia, could have hidden up to 10 Bornean rhinos—a subspecies of the critically endangered Sumatran rhino, of which fewer than 100 remain scattered around Borneo, Sumatra and mainland Malaysia. But this month Sabah’s environmental minister reported some devastating news: It appears that there are no more wild rhinos in the state. There are, however, three Bornean rhinos in captivity in Sabah, all at the Borneo Rhino Sanctuary in Tabin Wildlife Reserve. One of them, a female named Iman, was captured from the wild a little over a year ago after she fell into a pit trap.

When she was rescued, Iman was proclaimed the species’s “newest hope for survival.” Sanctuary veterinarians even suspected she was pregnant at the time. That didn’t turn out to be true. Ultrasound tests conducted soon after Iman’s arrival at the sanctuary revealed that the mass in her uterus wasn’t a fetus. It was a vast collection of tumors that would make it impossible for her to ever get pregnant naturally. A male named Tam and another female, Puntung, also live at the sanctuary. According to WWF Malaysia, Puntung is also incapable of breeding because she has “severe reproductive tract pathology, possibly due to having gone unbred in the wild for a long time.”

So all hope is lost, right? Well, not so fast. Both Iman and Puntung are still producing immature eggs called oocytes. It might be possible to combine those oocytes with Tam’s sperm to produce embryos in the lab, which could then be implanted back into one of the two females or a rhino of another species. Late last month the Malaysian government pledged about $27,700 toward financing artificial insemination techniques for the task. That’s just a fraction of the money the Borneo Rhino Alliance says it needs for the task, but it’s a start.

Not bad at all!

• Heaviest Element Yet Known To Science is Discovered: Governmentium (Not PC)

News from the Scientific World: New Element Discovered

Victoria University of Wellington researchers have discovered the heaviest element yet known to science. The new element, Governmentium (symbol=Gv), has one neutron, 25 assistant neutrons, 88 deputy neutrons and 198 assistant deputy neutrons, giving it an atomic mass of 312. These 312 particles are held together by forces called morons, which are surrounded by vast quantities of lepton-like particles called pillocks. Since Governmentium has no electrons, it is inert. However, it can be detected, because it impedes every reaction with which it comes into contact.

A tiny amount of Governmentium can cause a reaction that would normally take less than a second, to take from 4 days to 4 years to complete. Governmentium has a normal half-life of 1 to 3 years (in NZ). It does not decay, but instead undergoes a re-organisation in which a portion of the assistant neutrons and deputy neutrons exchange places. In fact, Governmentium’s mass will actually increase over time, since each reorganisation will cause more morons to become neutrons, forming isodopes.

This characteristic of moron promotion leads some scientists to believe that Governmentium is formed whenever morons reach a critical concentration. This hypothetical quantity is referred to as a critical morass. When catalysed with money, Governmentium becomes Administratium (symbol=Ad), an element that radiates just as much energy as Governmentium, since it has half as many pillocks but twice as many morons.