Lesvos town hall mourns the dead Nov 4 2015

As I’ve said a thousand times now.

• China’s Slump Might Be Much Worse Than We Thought (Bloomberg)

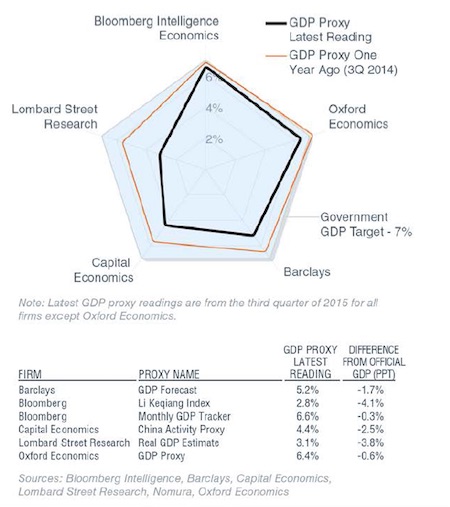

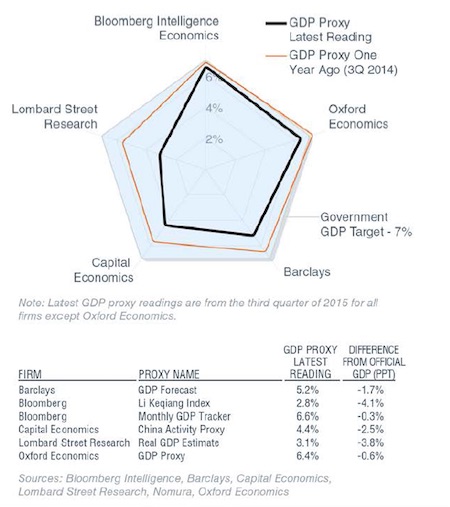

The unreliability of Chinese official economic data has become almost a cliche. A few years before he became China’s premier, Li Keqiang said that the country’s numbers were “man-made” and “for reference only.” If the top economic policy maker of a country says that the numbers aren’t reliable … well, you believe him. But how unreliable? [..] Economic number-fudging is a cheap way to prevent jittery investors from making a stampede for the exits. Of course, knowing this, a number of people have tried to estimate China’s true growth rate. Tom Orlik, Bloomberg’s chief Asia economist, recently rounded up a number of independent figures, and collected them in the following chart:

The numbers range from Lombard Street’s pessimistic figure of a bit more than 3% to Bloomberg Intelligence’s optimistic number of just under 7%. In other words, there is a wide band of uncertainty here. But I would like to suggest a scenario even more pessimistic than the lowest of the numbers above. After reading reports by Peking University professor Chris Balding on the state of China’s financial sector, I think there’s a possibility that China’s growth is lower even than 3%. Chinese electricity usage is growing at more like 1%. Rail freight traffic, though volatile, has suffered some dizzying drops in recent months. These are traditional proxies for heavy industry output. That they are barely growing, if at all, implies that much of Chinese industry has ground to a halt.

China bulls, of course, will argue that the country is merely in the middle of a transition from industry to services, and from wasteful power usage to greater efficiency. That is probably true. But the speed of the transition would have to be incredible to make up for the precipitate drop in industrial activity. Why would China’s service sector and energy efficiency suddenly skyrocket immediately following the bursting of a major stock bubble? One reason is government spending. A stealth stimulus is underway. But another big part of the equation is the financial sector, which has logged stunning growth in recent months despite the stock crash. Why are Chinese financial services growing? Loan growth alone will not do the trick – banks need to be paid in order to log revenue. Or do they? Chris Balding reports:

“[S]ome Chinese researchers…compared the loan payments made by firms to the amount owed to banks…[Their findings imply] that Chinese firms are paying only half the financial costs they should be paying…The amount of revenue that banks are recording from loans is nearly four times the cost firms are associating with those loans…[B]ank revenue [has been] outpacing firm financial cost growth by a factor of almost four.” In other words, the amount of loan payments Chinese banks say they are receiving is a whole lot more than the amount Chinese borrowers say they are paying. If Balding’s numbers are to be believed – and of course, they are only one glimpse into a murky financial system – a large portion of the recent growth surge of China’s financial services sector may simply be fake.

Read more …

Rounding error: “.. the new figures add about 600 million tons to China’s coal consumption in 2012 — an amount equivalent to more than 70% of the total coal used annually by the United States.”

• China Burns Much More Coal Than Reported (NY Times)

China, the world’s leading emitter of greenhouse gases from coal, is burning far more annually than previously thought, according to new government data. The finding could vastly complicate the already difficult efforts to limit global warming. Even for a country of China’s size and opacity, the scale of the correction is immense. China has been consuming as much as 17% more coal each year than reported, according to the new government figures. By some initial estimates, that could translate to almost a billion more tons of carbon dioxide released into the atmosphere annually in recent years, more than all of Germany emits from fossil fuels. Officials from around the world will have to come to grips with the new figures when they gather in Paris this month to negotiate an international framework for curtailing greenhouse-gas pollution.

The data also pose a challenge for scientists who are trying to reduce China’s smog, which often bathes whole regions in acrid, unhealthy haze. The Chinese government has promised to halt the growth of its emissions of carbon dioxide, the main greenhouse pollutant from coal and other fossil fuels, by 2030. The new data suggest that the task of meeting that deadline by reducing China’s dependence on coal will be more daunting and urgent than expected, said Yang Fuqiang, a former energy official in China who now advises the Natural Resources Defense Council. “This will have a big impact, because China has been burning so much more coal than we believed,” Mr. Yang said. “It turns out that it was an even bigger emitter than we imagined.

This helps to explain why China’s air quality is so poor, and that will make it easier to get national leaders to take this seriously.” The adjusted data, which appeared recently in an energy statistics yearbook published without fanfare by China’s statistical agency, show that coal consumption has been underestimated since 2000, and particularly in recent years. The revisions were based on a census of the economy in 2013 that exposed gaps in data collection, especially from small companies and factories. Illustrating the scale of the revision, the new figures add about 600 million tons to China’s coal consumption in 2012 — an amount equivalent to more than 70% of the total coal used annually by the United States.

Read more …

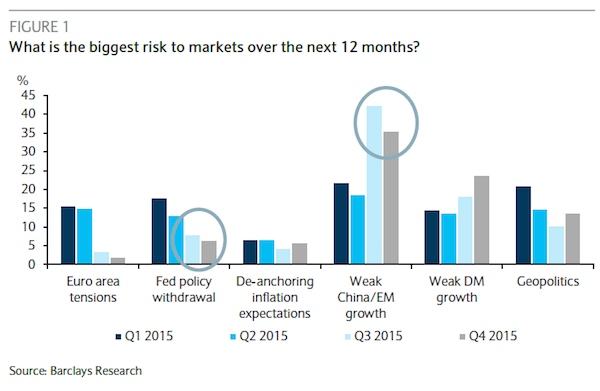

“..concern over growth in China and the rest of the developing world coincided with a rise in the share of investors who think deflation is a larger risk to the markets than inflation.”

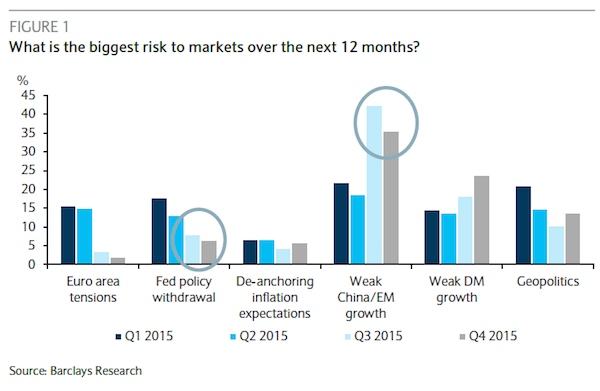

• Investors Are Way More Scared of China Than of Janet Yellen (Bloomberg)

China—not the prospect of the first rate hike from the Federal Reserve in almost a decade—is what keeps investors up at night. Barclays surveyed 651 of its clients around the world to glean their biggest fears, as well as their thoughts on commodities, yields, currencies, and other questions about the market outlook. “Only 7% sees Fed normalization as the main risk for markets over the next 12 months, compared with 36% whose main worry is China,” said Guillermo Felices, head of European asset allocation. The share of investors who judged softness in China and other developing economies to be the biggest risk to markets spiked in the third quarter, the period in which Beijing unexpectedly moved to devalue the yuan. The elevation in concern over growth in China and the rest of the developing world coincided with a rise in the share of investors who think deflation is a larger risk to the markets than inflation.

China’s devaluation sparked similar moves from other nations that had pegged their currencies to the greenback. All else being equal, this process engenders a stronger U.S. dollar and weaker commodity prices, thereby exerting downward pressure on headline inflation rates. As such, investors’ reactions to the Fed’s Oct. 28 statement, which resulted in an increase in the implied odds of a December rate hike, may not fully be reflected in its results. Nonetheless, roughly 40% of those surveyed indicated that they expected the Fed to initiate its tightening phase before the year was out. A plurality of respondents think liftoff will be a negative for risk assets, though only for a short period. “Indeed, the risk of Fed policy withdrawal is at a two-year low, suggesting complacency about the threat of higher rates,” warned Felices.

Read more …

Pon Zi.

• Corporate Debt in China: Above Cruising Altitude (CEW)

By far the most worrying debt in China is held by the corporate sector. Total borrowing by the nonfinancial sector shows that the total debt-to-GDP ratio has reached 240% of GDP as of the first quarter of 2015. The corporate debt-to-GDP ratio was 160% of GDP, or $16.7 trillion as of the first quarter of 2015, and total corporate liabilities up to 200% of GDP when including corporate debt securities (bonds). For some perspective, the corporate debt-to-GDP ratio in the United States is 70%, less than half that of China’s. China’s economy has seen some cyclical scares this year (think stock market and currency), but high corporate debt is a structural issue, potentially leading to a period of slower expansion of credit in an effort to reduce the debt-to-GDP ratio weighing on rapid growth.

Corporate debt has risen faster than expected. As noted in an earlier blog post, in 2013, Standard & Poor’s predicted that China’s corporate debt would be between 136 and 150% of GDP by 2017. This year Standard & Poor’s said China’s corporate debt has already reached 160% of GDP, a figure in line with data from the Bank of International Settlements. Yu Yongding, a senior fellow at the Chinese Academy of Social Sciences (CASS), has calculated that without any fundamental change in the current situation, the corporate debt-to-GDP ratio will reach 200% by 2020. Increased borrowing by state-owned enterprises (SOEs) has contributed significantly to this rise, and SOEs account for around half of all the corporate debt in China. But problematically, SOEs have a much lower return on assets than private firms, as low as one-third.

Which begs the question: If a large SOE is unable to pay its interest payments, what will the government do? Will it take control of the debt, and will the debt therefore be counted as government rather than corporate debt? This would do nothing to the overall credit-to-GDP ratio but may cause moral hazard. Besides corporate debt from bank loans, China has seen dramatic growth of the corporate bond market. Overall this growth is seen as a positive move, as it means the firms are either refinancing old loans with bonds at lower yields or simply expanding their balance sheets using the bond market rather than bank loans. Also helpful is that the majority of corporate bonds in China are in renminbi, protecting them from foreign exchange fluctuations. The IMF reports that total bond issuance in China in 2014 was over $600 billion.

Real estate, construction, mining, and energy production have been leading the increase in leverage. These cyclical sectors loaded up on credit after the 2008 financial crisis and have some of the most highly leveraged firms in China. The rise in corporate debt in China is one of the most pressing issues for future growth. A drop in corporate revenue could prompt a number of defaults, lowering overall economic growth and reducing revenue further—a vicious cycle. Potential headwinds include normalizing interest rates in the United States, decreasing capital efficiency, disinflation, or a property market slowdown. Moreover, banks lend about half of their loans to corporations, so a rise in corporate defaults could have broader banking implications, including liquidity concerns and nonperforming loans.

Read more …

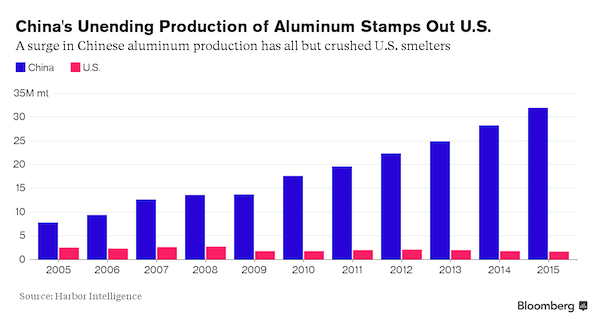

“If prices don’t recover, the researcher predicts almost all U.S. smelting plants will close by next year..”

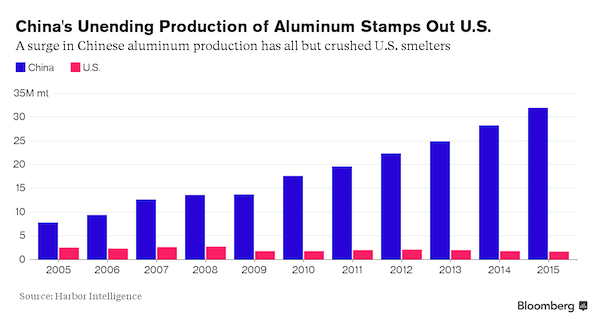

• A 127-Year-Old US Industry Collapses Under China’s Weight (Bloomberg)

Alcoa’s latest aluminum-making cutback is signaling the end of the iconic American industry. For 127 years, the New York-based company has been churning out the lightweight metal used in everything from beverage cans to airplanes, once making it a symbol of U.S. industrial might. Now, with prices languishing near six-year lows, it’s wiping out almost a third of domestic operating capacity, Harbor Intelligence estimates. If prices don’t recover, the researcher predicts almost all U.S. smelting plants will close by next year. While that’s a big deal for the U.S. industry and the people it employs, it doesn’t mean much for global supplies. Alcoa’s decision to eliminate 503,000 metric tons of smelting capacity accounts for about 31% of the U.S. total for primary aluminum, but less than 1% of the global total, according to Harbor.

For more than a decade, output has been moving to where it’s cheaper to produce: Russia, the Middle East and China. A global glut has driven prices down by 27% in the past year, rendering American operations unprofitable and accelerating the pace of the industry’s demise. “You’ve seen a fair clip of closures in the U.S., that is just unfortunate, but a development that’s very difficult to change,” Michael Widmer at Bank of America said. “It means you’ll just have to purchase from somewhere else.” That’s exactly what Jay Armstrong, the president of Trialco is doing. The company, which turns aluminum into finished manufactured products, now buys about 80% of the supplies it turns into car wheels from overseas. That’s up from 40% five years ago, he said. “It’s not the kind of business where we’re going to pay more and buy all American,” Armstrong said in a telephone interview. “It’s too competitive a business to do that.”

Read more …

Not.Going.To.Happen. So what then?

• Xi Says China Needs at Least 6.5% Growth in Next Five Years (Bloomberg)

China’s president signaled policy makers will accept slower growth, but not much slower, as details of a blueprint set to define his term as leader were released Tuesday. Annual growth should be no less than 6.5% in the next five years to realize the goal to double 2010 gross domestic product and per capita income by 2020, President Xi Jinping said Tuesday, according to the official Xinhua News Agency. The 13th five-year plan, details of which were announced Tuesday, is the first to confront an era of sub-7% economic growth since Deng Xiaoping opened the nation to the outside world in the late 1970s. “Policy makers still want to maintain a high growth pace, while the policy expectation is tuned slightly lower,” said Tao Dong at Credit Suisse in Hong Kong.

“The stance of policy makers is to gradually transform to a ’new normal.’ But to maintain the peoples’ confidence, the bar is set relatively high.” China will seek to increase the yuan’s convertibility in an orderly manner by 2020 and change the way it manages currency policy, according to the Communist Party’s plan. Authorities will opt for a “negative list” foreign-exchange system – an approach that lets companies do anything that’s not specifically banned – and open the finance industry as it promotes the yuan’s inclusion in the International Monetary Fund’s Special Drawing Rights basket, Xinhua reported. The proposals coincide with heightened anxiety over China’s economic outlook following a stock market slump and a surprise yuan devaluation in August that roiled global markets.

China will target medium- to high-speed growth during the period, and officials pledged to reduce the income gap, further open up to overseas investment and boost consumption, according to the draft. Officials said they will accelerate financial system reform and promote transparent and healthy capital markets while also overhauling stock and bond sales. They’ll continue reforms of the fiscal and tax systems and transfer some state capital to pension funds. [..] Xi’s growth baseline matches guidance provided by Premier Li Keqiang, who said Sunday that China needs average growth of more than 6.5% in the next five years to meet the goal of achieving a “moderately prosperous” society by 2020. Xi and Li are managing the priorities of both reforming the economy and keeping short-term growth fast enough so that structural changes don’t cause a hard landing.

Read more …

“..Xinhua cited Xi as saying that annual growth should be no less than 6.5% in the next five years to achieve the Communist Party’s aim of doubling GDP per capita from 2010 by the end of the decade..”

• China’s Xi Says 6.5% Annual Growth Enough To Meet Goals: Xinhua (AFP)

Growth of only 6.5% a year in 2016-2020 will be enough for China to meet its wealth goals, President Xi Jinping said on Tuesday according to the official news agency Xinhua. The report came as the ruling Communist party issued guidelines for the next five-year plan for the world’s second-largest economy, whose slowing growth has alarmed investors worldwide. The first documents released by the leadership conclave did not include a numerical growth target. But Xinhua cited Xi as saying that annual growth should be no less than 6.5% in the next five years to achieve the Communist Party’s aim of doubling GDP per capita from 2010 by the end of the decade. It said he made the remarks in a speech, without giving direct quotes. The doubling target is part of achieving what China’s ruling party calls a “moderately prosperous society” in time for the 100th anniversary of its foundation.

The comments are the clearest indication yet that Beijing will reduce its target growth rate from the current “around 7%”, after expansion slowed last quarter to its lowest in six years. Some economists say that the current figure is unattainable going forwards, and that trying to do so risks derailing painful but necessary markets reforms. The country has faced economic turbulence in recent months as it attempts to transition its economy from years of super-charged growth to a more modest pace it has dubbed the “new normal”. Botched stock market interventions and a sudden currency devaluation have rattled confidence in the country’s leadership, which has staked its legitimacy on maintaining an aura of economic infallibility.

Read more …

“..during the three weeks in August after China devalued its currency, Goldman Sachs calculated that another $200 billion may have left.”

• China’s Money Exodus (Bloomberg)

The ranks of China’s wealthy continue to surge. As their economy shows signs of weakness at home, they’re sending money overseas at unprecedented levels to seek safer investments — often in violation of currency controls meant to keep money inside China. This flood of cash is being felt around the world, driving up real estate prices in Sydney, New York, Hong Kong and Vancouver. The Chinese spent almost $30 billion on U.S. homes in the year ending last March, making them the biggest foreign buyers of real estate. Their average purchase price: about $832,000. Same trend in Sydney, where Chinese investors snap up a quarter of new homes and are forecast to double their spending by the end of the decade. In Vancouver, the Chinese have helped real estate prices double in the past 10 years.

In Hong Kong, housing prices are up 60% since 2010. In total, UBS Group estimated that $324 billion moved out last year. While this year’s numbers aren’t yet in, during the three weeks in August after China devalued its currency, Goldman Sachs calculated that another $200 billion may have left. So how do these volumes of cash get out when Chinese are limited by rules that allow them to convert only $50,000 per person a year? The methods include China’s underground banks, transfers using Hong Kong money changers, carrying cash over borders and pooling the quotas of family and friends – a practice known as “smurfing.” The transfers exist in a gray area of cross-border legality: What’s perfectly legitimate in another country can contravene the law in China.

“It’s not legal for people to use secret channels to move money abroad, because this is smuggling,” says Xi Junyang, a finance professor at Shanghai University of Finance & Economics. “But the government has kept a laissez-faire attitude until recently.” Now, policy makers are starting to take the outflow seriously. While it’s not about to run out of money, China has intensified a crackdown on underground banks that illegally channel cash abroad. It’s also trying to capture officials suspected of fleeing overseas with government funds. Longer term, China has pledged to remove its currency controls and make the yuan fully convertible by 2020.

Read more …

There’s so much more of this in the pipeline.

• Standard Chartered’s Bad Loans Reveal Cracks in Asian Economies (Bloomberg)

As China’s growth sputters, the troubles at Standard Chartered are another bad omen for what were once Asian economic darlings. The bank, which generates most of its income in the region, had gambled on success in emerging markets such as India, which instead saddled the lender with delinquent loans. As a result, the company which opened its offices in Mumbai under Queen Victoria is now axing 15,000 jobs and is asking investors for $5.1 billion. “Standard Chartered are Asian specialists and are in all the main markets in the region, so in looking at them you can get a good sense for credit direction and lending appetite,” said Mark Holman at TwentyFour Asset Management. For now, Asia still has fewer corporate debt defaults than other developing countries, but rising leverage from India to Indonesia point to the risk of further nonpayments.

More stringent conditions from banks like Standard Chartered are slowing loan growth in the region, exposing more fissures in the corporate credit market. “The picture that emerges is that Asian credit cycles are far more advanced than those in Europe and loan losses and impairment charges are mounting,” Holman said. Like other developing nations, Asian companies took advantage of low interest rates overseas to go on a borrowing binge. The move is backfiring as slower economic growth makes it more difficult to pay back the obligations. Fitch Ratings warned on Nov. 2 that 11% of India’s loans will fall into the category of “stressed assets” in the fiscal year ending in March 2016 and only improve “marginally” the next year. In China, Sinosteel, a state-owned steelmaker, missed an interest payment last month, becoming the latest firm that teeters on the verge of default.

Read more …

It’s still only about money: “VW said it estimated the “economic risks” of the latest discovery at €2 billion..”

• VW Admission Suggests Cheats Went Much Further Than Diesel Emissions (Guardian)

The crisis at Volkswagen has deepened after the carmaker found “irregularities” in the carbon dioxide levels emitted by 800,000 of its cars. An internal investigation into the diesel emissions scandal has discovered that CO2 and fuel consumption were also “set too low during the CO2 certification process”, the company admitted on Tuesday night. The dramatic admission raises the prospect that VW not only cheated on diesel emissions tests but CO2 and fuel consumption too. VW said it estimated the “economic risks” of the latest discovery at €2bn (£1.42bn). The company said the “majority” of cars involved have a diesel engine, which implies that petrol cars are involved in the scandal for the first time.

Matthias Müller, chief executive of VW, said: “From the very start I have pushed hard for the relentless and comprehensive clarification of events. We will stop at nothing and nobody. This is a painful process, but it is our only alternative. For us, the only thing that counts is the truth. That is the basis for the fundamental realignment that Volkswagen needs.” VW said it will now work with the authorities to clarify what took place during the CO2 tests and “ensure the correct CO2 classification for the vehicles affected”. Müller added: “The board of management of Volkswagen AG deeply regrets this situation and wishes to underscore its determination to systematically continue along the present path of clarification and transparency.”

VW has already admitted fitting a defeat device to 11m vehicles worldwide that allowed them to cheat tests for emissions of nitrogen oxides. The carmaker has put aside €6.7bn to meet the cost of recalling the 11m vehicles, but also faces the threat of fines and legal action from shareholders and customers. The company has hired the accountancy firm Deloitte and the law firm Jones Day to investigate who fitted the device into its vehicles. It is understood that the carmaker believes a group of between 10 and 20 employees were at the heart of the scandal.

Read more …

“VW is leaving us all speechless..”

• VW Emissions Issues Spread to Gasoline Cars (Bloomberg)

Volkswagen said it found faulty emissions readings for the first time in gasoline-powered vehicles, widening a scandal that so far had centered on diesel engines. Separately, the company’s Porsche unit said it’s halting North American sales of a model criticized by U.S. regulators. Volkswagen said an internal probe showed 800,000 cars had “unexplained inconsistencies” concerning their carbon-dioxide output. Previously, the automaker estimated it would need to recall 11 million vehicles worldwide — more than Volkswagen sold last year. It was unclear how much overlap there was between the two tallies. The company said the new finding could add at least €2 billion to the €6.7 billion already set aside for fixes to the affected vehicles but not litigation, fines or customer compensation.

The crisis that emerged after Volkswagen admitted in September to cheating U.S. pollution tests for years with illegal software has shaved more than one-third of the company’s stock price and led to a leadership change. Today’s revelation adds to the pressure on Volkswagen’s new chief executive officer, Matthias Mueller, who replaced Martin Winterkorn and was previously head of Porsche. Volkswagen’s supervisory board said it will meet soon to discuss further measures and consequences. “VW is leaving us all speechless,” said Arndt Ellinghorst, a London-based analyst with Evercore ISI. [..] The 3.0-liter diesel motors targeted on Monday by a U.S. Environmental Protect Agency probe aren’t part of the latest finding. The company rejected allegations that its cheating on diesel-emissions tests included Porsche and other high-end vehicles.

The EPA said its new investigation centers on the Porsche Cayenne and VW Touareg sport utility vehicles and as well as larger sedans and the Q5 SUV from Audi. But then late Tuesday, Porsche’s North American division said it would voluntarily discontinue sales of diesel-powered Cayennes from model years 2014 to 2016 until further notice. The Atlanta-based unit’s statement reiterated that the EPA notice was unexpected and that owners can operate their vehicles normally. “We are working intensively to resolve this matter as soon as possible,” Porsche said in the statement.

Read more …

Porsche is worried about ‘its results’. It should rethink that one.

• VW Says Fuel Usage Understated On Some Models; Porsche Warns (Reuters)

Volkswagen on Tuesday said it had understated the fuel consumption of 800,000 cars sold in Europe, while majority stakeholder Porsche Automobil Holding warned that VW’s latest findings could further weigh on its results. The latest revelation about fuel economy and carbon dioxide emissions, which Germany’s largest automaker said represented a roughly €2 billion economic risk, deepened the crisis at VW. The scandal initially centered on software on up to 11 million diesel vehicles worldwide that VW admitted vastly understated their actual emissions of smog-causing pollutant nitrogen oxide. U.S. environmental regulators said on Monday that similar “defeat devices” were installed on larger 3.0 liter engines used in luxury sport utility vehicles from Porsche and Audi, although VW has denied those allegations.

Porsche’s North American unit said it was discontinuing sales of Porsche Cayenne diesel sport utility vehicles until further notice, citing the allegations. The latest findings that VW understated fuel consumption and carbon dioxide emissions, areas which U.S. regulators have yet to address, were disclosed as VW continues a broad review of its handling of all pollution-related issues. While the findings mostly apply to smaller diesel engines, one gasoline-powered engine is also affected. “VW is leaving us all speechless,” said Arndt Ellinghorst of banking advisory firm Evercore ISI. “It seems to us that this is another issue triggered by VW’s internal investigation and potentially related to Europe.” The carmaker said it would immediately start talking to “responsible authorities” about what to do about the latest findings.

Read more …

Will Hugh be the greater fool?

• Hugh Hendry: “Today We Would Advise You That You Don’t Panic!” (Zero Hedge)

In his latest letter, he valiantly trudges on down the path of bullish abandon and tries to convince if not so much others as himself why continuing his desertion of the bearish camp he did two years ago is the right thing to do, and how in the aftermath of the VIX explosion in August, he “learned to stop worrying and love the bomb.” Key highlights:

… it is ironic that we are perhaps best known for advising “that you panic”. However, if you are anxious at the wrong time it can prove very painful. Today, we would advise that you don’t panic!

… by withdrawing the “Greenspan put” and using their asset purchase schemes to eviscerate any notion of value, the authorities have paradoxically created a safer yet more paranoid market.

… first it was Europe, then the high yield credit space with the vulnerabilities of the shale oil issuers, and then it was back to Greece and then the mother of them all, China, with its falling property and stock prices seemingly knocking economic growth and making a sizeable devaluation inevitable. And yet nada… the weeping prophets have failed to force a crisis after one hell of a go.

… perhaps we are being premature and the cards are about to fall. Or perhaps there simply are no dead bodies in the system and the global economy has proven itself much more resilient to shocks. We certainly believe that if we had been forewarned two years ago that the dollar would rise versus selected EM currencies by 50% and that important commodities such as oil and iron ore would fall by 50% we would never have been able to predict just how orderly things have turned out at both the company and sovereign level. The turmoil it seems has remained contained within financial markets in a very curious way.

… perhaps it’s time to stop worrying and love the bomb?

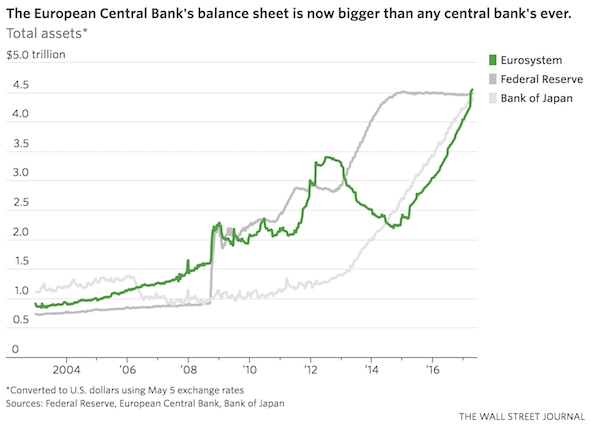

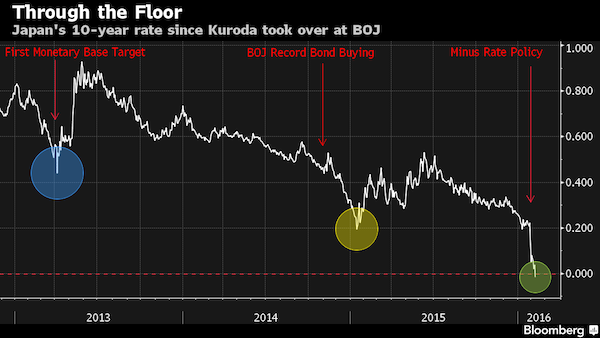

Actually at last check, practically all the “bears” predicted exactly what happened: trapped by their own policies, central banks would have no choice than to unleash another onslaught of easing. This is precisely what happened when first the ECB previewed its QE2, then the PBOC cut rates, then Sweden boosted QE, then the BOJ said it would “not hesitate” to act (and would have done so had other central banks not pushed the Yen lower thanks to its carry trade status). The real question, Hugh, is how much time did the latest doubling down by the world’s central banks buy? We should know the answer in 2-4 months.

Read more …

“What policymakers will do, in all likelihood, is hope and pray, and when that fails, they will likely double down on monetary extremism. ”

• Hugh Hendry Says “Don’t Panic”; Paul Singer Says You May Want To (Zero Hedge)

Businesspeople in today’s world are either concerned, actively sweating or oblivious to the rumblings and dangers around them. We recommend that both investors and businesspeople be highly alert to the implications of populism, the increasing concentration of power into the hands of unaccountable elites and the dissipation of the rule-of-law protections of liberty. It is very odd and dangerous that governments, satisfied with policies which, by raising asset prices (stocks, bonds, real estate, high-end art), are seemingly designed to make the rich richer, nevertheless simultaneously excoriate inequality as the cause of slow growth and societal disquiet. It is also strange that policymakers are not concerned by the obvious failure of monetary extremism to achieve the predicted levels of growth, or by the risks that may exist either in the continuation of the monetary experiment or in its ultimate unwinding.

Policymakers who are sticking with the failed policy mix have invented creative explanations for why growth has been so bad for such a long a period of time. The most prevalent (and tautological) of these explanations is “secular stagnation,” a theory that the developed world simply cannot grow faster due to ageing populations, growth-destructive technologies and competition from cheap labor around the world. We disagree with this theory, and assert that it can be examined for validity only after a full range of first-line “fiscal” policies (as we have defined them) has been put firmly and comprehensively in place. In contrast to the “secular stagnationistas,” we believe that there is a great deal of low-hanging fruit (that is, far higher rates of growth in incomes, jobs and national wealth) to be had from simple changes in leadership and policies.

The question of the day is: What will be the policy response of the developed world toward the currently deteriorating (at least in EMs and China) conditions, and the policy response if the deterioration spreads to Europe and the U.S.? If we know anything about the policy decision-making landscape in developed countries, it is that policymakers are all on super-keen-alert for signs of deflation (which they basically equate with credit collapse — a false and misleading connection, but that is a topic for another day). They will not remain passive in the face of a renewed global recession and/or financial crisis. So what will they do next, and how will it affect global markets? We can be reasonably certain that policymakers will not leap into action on the fiscal measures that we have described as the front-line policies needed to meaningfully quicken economic growth. Try to imagine more flexible and business-friendly tax, regulatory and labor policies being enacted by current political leadership in the U.S., Europe and Japan.

Sorry, our imaginations — never inert — just can’t get there. What policymakers will do, in all likelihood, is hope and pray, and when that fails, they will likely double down on monetary extremism. This landscape is essentially baked, unless you think that sometime in the near future the global economy will turn higher, either on its own or in anticipation of such policy measures in the future. To many policymakers today, jawboning seems like a magic button, since markets often create the desired result in anticipation of possible future actions. Consequently, governments may be able to get a particular outcome without requiring the central bankers to actually take any action.

Read more …

This is nothing yet. Wait till next year’s pring cleaning.

• Europe’s Biggest Banks Are Cutting 30,000 Jobs, More To Come (Bloomberg)

Standard Chartered became the third European bank in less than two weeks to announce sweeping job cuts, bringing the total planned reductions to more than 30,000, or almost one in seven positions. The London-based firm said Tuesday it will eliminate 15,000 jobs, or 17% of its workforce, as soaring bad loans in emerging markets hurt earnings. Deutsche Bank last week announced plans for 11,000 job cuts, while Credit Suisse said it would trim as many as 5,600 employees. The three firms, which all named new chief executive officers this year, are undertaking the deepest overhauls since the financial crisis as stricter capital rules erode profitability. Standard Chartered and Credit Suisse will tap shareholders for funds, while Deutsche Bank scrapped its dividend for this year and next to conserve capital.

“It’s just further evidence that Europe’s banks didn’t adapt quickly enough to the post-crisis world and are now playing catch up,” said Christopher Wheeler at Atlantic Equities in London. More bloodletting may be on the way. UniCredit is considering as many as 12,000 job cuts as it seeks to improve profit and capital levels, people with knowledge of the discussions said last week. The numbers, which are still under review, increased from 10,000 a month ago and may change depending on the outcome of asset sales. The largest Italian bank reports earnings next week. Including jobs lost through asset sales, John Cryan, Deutsche Bank’s co-CEO since July, intends to eliminate 26,000 employees, or a quarter of the workforce, by 2018. Tidjane Thiam, Credit Suisse’s new CEO, will shed jobs in the U.S., U.K. and Switzerland.

Read more …

“..the big six banks in this country control 97% of all trading assets in the U.S. and 93% of all derivatives.”

• Wall Street/Washington Revolving Door More Dangerous Than Ever: Prins (Yahoo)

What are the consequences of regulators leaving government work to join the financial services industry, and vice versa? Nomi Prins, a Senior Fellow at Demos, chronicles the problems of the revolving door between Washington and Wall Street in her latest book “All the Presidents’ Bankers.” “The difference is that now people know each other less in their personal lives before they make those transitions,” she says. “Now it’s a little more like ‘I know you from the industry of Wall Street and Washington’ as opposed to ‘We hung out and our dads smoked cigars together.’ Prins notes that there was more personal accountability in the relationships between Wall Street and Washington during the mid-20th century.

She points out that before the crash of 1929, the Morgan bank (predecessor of J.P. Morgan) had strong connections with Presidents Coolidge and Hoover. Yet, a shift in the relationships occurred during the Great Depression. “There was this accountability moment where the bankers that ascended to run these banks, to run Chase, to run Citibank & they wanted economic stability throughout the country,” she says. “They actually thought [stability] was important for confidence in the banking system & people would actually keep their money there and trust that they had a future with this bank, so the relationships with individuals and corporations and countries all mattered.” Prins says that the modern-day deterioration of the bank-customer relationship is a direct result of the growing size and risk profiles of bank behemoths.

“The banks are so big right now [and] they have access to so much of apercentage of the deposits of individuals, she says. “The leverage is so much higher on the back of those deposits, the bailouts that have happened for numerous reasons in the past 25 years have all been an indication that is okay to take more reckless bets.” And while the idea of banks being “too big to fail” caused widespread Main Street anger towards Wall Street, Prins believes the policy of government bailouts will continue post-Financial Crisis as banking has become more concentrated. She noted that the big six banks (J.P. Morgan, Citi, Bank of America, Goldman Sachs, Morgan Stanley, Wells Fargo) in this country control 97% of all trading assets in the U.S. and 93% of all derivatives.

Prins also added that the anti-banking rhetoric of many U.S. Presidents (remember President Obama’s Wall Street “fat cats”?) has a long history, but one that is at odds with actual policy. It goes all the way back to Woodrow Wilson and the creation of the Federal Reserve, she said. “In practice Woodrow Wilson was behind the creation of the Fed, which we know now has substantiated a lot of Wall Street losses, has a $4.5 trillion book. It’s the largest hedge fund in the world right now…But [Dodd Frank] hasn’t fundamentally changed the concentration of power. The revolving door…influences the risk inherent to what’s going on on Wall Street. It hasn’t made the economy more stable with respect to the banking industry, which is an industry that infiltrates every aspect of our individual and political lives.

Read more …

“..to force nations to accept new financial products and services, to approve the privatisation of public services and to reduce the standards of care and provision.”

• Gathering Financial Storm Just One Effect Of Corporate Power Unbound (Monbiot)

What have governments learned from the financial crisis? I could write a column spelling it out. Or I could do the same job with one word: nothing. Actually, that’s too generous. The lessons learned are counter-lessons, anti-knowledge, new policies that could scarcely be better designed to ensure the crisis recurs, this time with added momentum and fewer remedies. And the financial crisis is just one of the multiple crises – in tax collection, public spending, public health and, above all, ecology – that the same counter-lessons accelerate. Step back a pace and you see that all these crises arise from the same cause. Players with huge power and global reach are released from democratic restraint. This happens because of a fundamental corruption at the core of politics.

In almost every nation the interests of economic elites tend to weigh more heavily with governments than do those of the electorate. Banks, corporations and landowners wield an unaccountable power, which works with a nod and a wink within the political class. Global governance is beginning to look like a never-ending Bilderberg meeting. As a paper by the law professor Joel Bakan in the Cornell International Law Journal argues, two dire shifts have been happening simultaneously. On one hand governments have been removing laws that restrict banks and corporations, arguing that globalisation makes states weak and effective legislation impossible. Instead, they say, we should trust those who wield economic power to regulate themselves.

On the other hand, the same governments devise draconian new laws to reinforce elite power. Corporations are given the rights of legal persons. Their property rights are enhanced. Those who protest against them are subject to policing and surveillance – the kind that’s more appropriate to dictatorships than democracies. Oh, state power still exists all right – when it’s wanted. Many of you will have heard of the Trans-Pacific Partnership and the proposed Transatlantic Trade and Investment Partnership (TTIP). These are supposed to be trade treaties, but they have little to do with trade, and much to do with power. Theyenhance the power of corporations while reducing the power of parliaments and the rule of law. They could scarcely be better designed to exacerbate and universalise our multiple crises – financial, social and environmental.

But something even worse is coming, the result of negotiations conducted, once more, in secret: a Trade in Services Agreement (TiSA), covering North America, the EU, Japan, Australia and many other nations. Only through WikiLeaks do we have any idea of what is being planned. It could be used to force nations to accept new financial products and services, to approve the privatisation of public services and to reduce the standards of care and provision. It looks like the greatest international assault on democracy devised in the past two decades. Which is saying quite a lot.

Read more …

Damn right. Damn late too.

• Merkel Warns Of Balkans Military Conflicts Amid Migrant Influx (AFP)

German Chancellor Angela Merkel warned that fighting could break out in the Balkans, along the main route of migrants trying to reach Europe, if Germany closed its border with Austria, in remarks published Tuesday. Amid ever-louder calls for Merkel to undertake drastic action to stem the tide of people entering her country, she again rejected the appeals, noting that tensions were already running high between the Western Balkans countries. With an eye to deep rifts exposed after Hungary closed its frontier with Serbia and Croatia, Merkel said blocking the border with Austria to refugees and migrants would be reckless. “It will lead to a backlash,” Merkel was quoted in media reports as saying late Monday in an address to members of her conservative Christian Democratic Union (CDU) in the western city of Darmstadt.

“I do not want military conflicts to become necessary there again,” Merkel added, referring to the Balkans. She said disputes in a region already ravaged by war in the 1990s could quickly escalate, touching off a cycle of violence “no one wants.” Germany has become the main destination for people fleeing war and poverty in the Middle East, Africa and Asia via the Balkans, with up to one million people expected this year. The EU vowed last month to help set up 100,000 places in reception centres in Greece and along the migrant route through the Balkans as part of a 17-point action plan devised with the countries most affected by the crisis. But just as Merkel attempts to convince European partners to share out the burden more fairly, she has faced a revolt from within her own conservative alliance against the welcome she has extended to people escaping violence and persecution.

Read more …

Must take this out of the hands of the EU. All it is is a facade for sociopaths to hide behind.

• European Union States Have Relocated Just 116 Refugees Out Of 160,000 (Guardian)

EU member states have so far relocated only 116 refugees of the 160,000 they are committed to relocating over the next two years, according to new figures. EU members states agreed in September to relocate 160,000 people in “clear need of international protection” through a scheme set up to relocate Syrian, Eritrean, and Iraqi refugees from the most affected EU states – such as Italy and Greece – to other EU member states. So far 116 people have been relocated, and only 1,418 places have been made available by 14 member states, according to data released on Tuesday by the European Commission. A total of 86 asylum seekers have been relocated from Italy, and 30 asylum seekers will travel from Athens to Luxembourg on Wednesday.

Denmark, Ireland and the UK have an opt-out from the scheme, but Britain is the only member state that has said it will not contribute to the relocation. The EU’s emergency relocation mechanism is only one facet of the broader refugee crisis. Syria, Iraq and Eritrea account for the majority of those crossing the Mediterranean. According to the UNHCR, more than one in two are fleeing from Syria. While 6% of those arriving via the Mediterranean are originally from Iraq, and 5% from Eritrea. Not all those seeking asylum remain or travel via Italy or Greece. About 770,000 asylum applications were lodged across the EU in the first nine months of 2015, compared to 625,920 in all of 2014 and 431,090 in 2013. This has contributed to a backlog of applications.

At the end of last year there were just under 490,000 pending applications across EU member states. In July of this year, the figure stood at 632,000. The backlog is not showing signs of receding any time soon: for every asylum decision made there are 1.8 new applications. Approximately 240,000 applications were processed between January and June this year. Over the same six months, 432,345 applications were filed. However, the European Commission data also reveals that beyond the logistical challenges, a “large number of member states has yet to meet financial commitments” and “too few member states” have responded to calls to help Serbia, Slovenia and Croatia; among the most used routes by asylum seekers, with essential resources such as beds and blankets.

Read more …

What happened to numb the rich west the way it did?

• Greek Coast Guard Says 5 Refugees Die In Boat Accident Tuesday Night (AP)

Greece’s coast guard says the total number of people rescued from a boat carrying people from Turkey to the nearby Greek island of Lesvos has increased to 65, while a total of five bodies were recovered from the water. The coast guard said Wednesday that the bodies were those of three children and two men. There were no further missing people reported. The migrant boat ran into trouble north of Lesvos Tuesday night. The coast guard says a total of 457 people were rescued between Tuesday morning and Wednesday morning in 13 separate incidents. More than 600,000 people have arrived in Greece so far this year, with most arriving on Lesbos. From there, they make their way to the Greek mainland on ferries and then head overland to more prosperous EU countries in the north. Thousands of migrants are stranded on Lesvos due to a ferry strike that began Monday.

Read more …