Harris&Ewing Army Day Parade, Memories of the World War, Washington DC Apr 6 1939

It’s downright criminal what the EU and ECB have accomplished: “Relationships are complicated these days,” says Katerina. “No-one is even thinking about getting married or having children.”

• Love In A Time Of Crisis In Greece (BBC)

Amid its economic catastrophe, Athens is still a city of trendy cafes, cocktail bars and glamorous, air-kissing young people. As Greeks prepare to vote in Sunday’s general election, anti-austerity party Syriza is ahead in the polls and campaigning under the slogan, “Hope is on its way”. The average wage has fallen to €600 (£450: $690) a month; half of all young people are unemployed and the economy is barely emerging from six years of recession. But Greeks remain determined to maintain their hold on normality. “We don’t have much else,” they say, “we may as well enjoy our freddo cappuccinos.” But despite the drinking, flirting and dating, since the onset of financial disaster, a fundamental change has taken place in Greek society. Deejay Tommy, who works at the fashionable Opus bar in the south Athenian suburb of Glyfada, paints a sad picture of young Greeks waking up every day without a job.

“Things have lost a little bit of their romanticism,” he says. “The crisis has forced love to become a secondary priority. There are other things to worry about. I see many women looking for someone who will have money to take them out, who’ll take them on holidays. I see this quite a lot and it saddens me.” Down the road along the shoreline, the Bouzoukia clubs ring with live renditions of popular Greek love songs. Crowds sipping on vodka throw the singers red carnations and sing along to lyrics of heartbreak and pain. “We save up to come once every few months and we look forward to it,” says Katerina Fotopoulou, 30, at a table with her friends. “We don’t have the money to do much any more. We’re always talking about future plans, going on holiday, but no-one ever does anything.” Living at home, Katerina describes herself as an adult forced to live as a teenager, her life put on hold. Compared with other Europeans, Greeks are still fairly traditional.

For many young women, it is awkward bringing a boyfriend through the front door to meet the parents. And that poses a problem, considering the high numbers unable to afford a place of their own. “Relationships are complicated these days,” says Katerina. “No-one is even thinking about getting married or having children.” Indeed, Greece’s population is shrinking at an increasing pace according to data released by the Hellenic Statistical Authority (Elstat). Since Greece first signed its EU-IMF bailout agreement the number of births has declined rapidly. In 2010 there were 114,766 live births, and by 2013 that number had declined by almost 20,000 (94,134). Obstetrician Leonidas Papadopoulos says miscarriages at the Leto maternity hospital have doubled over the past year. “Maybe it’s down to stress,” he says. “There is no proof, but you can see it in the eyes of the people, there is stress and fear for the future.”

Read more …

“On Monday, national humiliation will be over. We will finish with orders from abroad..”

• Syriza To End Greece’s ‘Humiliation’ (BBC)

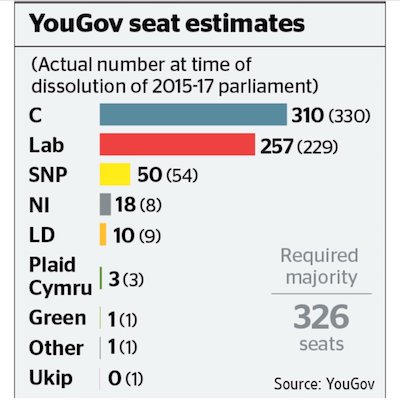

The leader of Greek left-wing party Syriza says an end to “national humiliation” is near, as opinion polls put the party ahead three days before the general election. Alexis Tsipras asked supporters for a clear mandate to enable him to end the country’s austerity policies. He repeated his promise to have half of Greece’s international debt written off when the current bailout deal ends. Greece has endured deep budget cuts tied to the massive bailout. Sunday’s election is being closely watched by financial markets which fear that a Syriza victory could lead Greece to default on its debt and exit from the euro.

“On Monday, national humiliation will be over. We will finish with orders from abroad,” Mr Tsipras told thousands of cheering supporters at the party’s final election rally in Athens. “We are asking for a first chance for Syriza. It might be the last chance for Greece.” Greece has gone through a deep recession and still has a quarter of its workforce unemployed. However, there have been warnings that a Syriza victory could lead to a dangerous confrontation with other eurozone countries. Syriza is tipped to win but without an outright majority, and analysts say the party may struggle to find a coalition partner. Mr Tsipras has said he will not govern with those who support what he has called the policies of German Chancellor Angela Merkel.

Germany is seen in Greece as taking the hardest line on its debt. Earlier this month, a spokesman for Mrs Merkel said Germany expected Greece to uphold the terms of its international bailout agreement. Under those terms, the EU, International Monetary Fund and European Central Bank – the so-called troika – supported Greece with the promise of €240bn (£188bn) in return for budget cuts and economic reforms. Latest polls show Syriza widening its lead over Prime Minister Antonis Samaras’s centre-right New Democracy party. A poll to be published on Friday by Metron Analysis put Syriza’s lead over New Democracy up to 5.3% percentage points from 4.6 points. Another poll, by Rass, had Syriza 4.8 points in the lead.

Read more …

Things may not run as smoothly as many seem to think.

• Saudi King’s Death Clouds Already Tense Relationship With US (WSJ)

U.S. officials worry that the death of Saudi King Abdullah ushers in a period of new uncertainty in a key relationship that already was tense. In the short term, the death of the king actually might ease strains in the relationship. The Saudi kingdom, as it enters a period of transition, may feel more vulnerable to external threats and eager to show the world that it still has the solid of backing of the U.S.—the country the kingdom always has seen as its ultimate protector. But in the longer term, the transition raises questions about how the new Saudi leadership will see its relations with the region and the wider world. Most likely, it will be a period of what longtime Middle East diplomat Dennis Ross calls “collective leadership.”

That in turn may reduce the Saudis’ ability to move decisively on the difficult and contentious issues—toward Iran, Iraq and the Islamic State uprising, as well as oil policy—that the U.S. and Saudi Arabia have been trying to address together. “I think you get more cautious decision-making,” said Mr. Ross. King Abdullah was seen as a reformer and relatively pro-American when he took office, though he became more repressive internally and less fond of the U.S. over time. The recent sentence of 1,000 lashes given to a writer convicted of insulting Islam sparked widespread condemnation in the West, including from the U.S. State Department. The late Saudi monarch was incensed by President Barack Obama ’s failure to follow through on his threats in 2013 to launch military strikes on the Syrian regime for its alleged use of chemical weapons.

And Riyadh didn’t believe the White House showed strong enough support for Mideast allies, particularly in Egypt, following the eruption of Arab Spring revolts in 2010. Secret talks between the U.S. and Iran—the country the Saudis most fear—over Tehran’s nuclear program also were viewed in Riyadh as a sign of a weakening American-Saudi alliance and proof that the White House was willing to work behind King Abdullah’s back, according to Saudi officials. The new king, the late ruler’s half-brother, Salman bin Abdul Aziz, is less well known and not considered a strong or healthy leader in his own right. That raises questions among U.S. officials about if or how quickly he will be able to consolidate power. As a result, American officials are likely to be guessing to some extent about who is in charge.

Read more …

“King Abdullah did push for modernization of Saudi society, allowing for more rights for women, but those efforts are now likely to be tabled.”

• Saudi Oil Policy ‘Just Took A Turn For The Worse’ (Kilduff)

In earlier time, the death of Saudi Arabia’s King Abdullah bin Abdulaziz Al Saud would have rocked the oil market. The succession plan has always pointed in a direction away from U.S. interests and a turn toward an even harder line on Middle East issues. The antipathy toward Iran will be levered up, and the various Sunni-Shia battles will likely see greater escalation. Oil prices have quickly jumped $1.00 per barrel on the news in a knee-jerk reaction to the uncertainty. What is more likely is an even greater commitment to over supplying the market, in attempt to drive out higher cost producers and hurting Iran and Russia as an additional benefit. King Abdullah did push for modernization of Saudi society, allowing for more rights for women, but those efforts are now likely to be tabled.

There is a famous picture of King Abdullah walking and-in-hand with President George W. Bush through a patch of Blue Bonnets at W’s ranch in Crawford Texas, when oil prices were surging circa 2007. While the short-term plan is likely to attempt to hurt frackers, Iran and Russia via an over-supplied market, the longer-term implications are for oil supply policies that are more hostile toward western consumers. In addition, the appetite for bringing the proxy war to Iran and other Shiite factions in the region will rise, which result in a return of the geopolitical risk premium in the years ahead. U.S.-Saudi relations and longer-term Saudi oil production policy just took a turn for the worse with the death of King Abdullah.

Read more …

“This currency war cannot go well. They never have.”

• This Currency War Cannot Go Well: Art Cashin (CNBC)

European Central Bank President Mario Draghi’s quantitative easing announcement Thursday may have been the latest salvo in a currency war, but veteran trader Art Cashin told CNBC that war is being played like a chess match. However, that will change at some point. “That laid-back cerebral attitude is going to disappear. At some point somebody is going to get their currency to a place where it’s going to cause enough pain to somebody else and then it’s going to turn into a real war,” Cashin, director of floor operations for UBS at the New York Stock Exchange, said in an interview with “Squawk on the Street.” On Thursday, the ECB announced an open-ended bond-buying program of 60 billion euros ($70 billion) a month in an effort to boost the region’s low inflation rate.

In fact, Cashin believes about the only thing the ECB achieved was a weaker euro and “not much else.” “The reliance on the LTROs [long-term refinancing operation] again is not going to increase bank lending in Europe as far as I can tell,” he noted. Cashin also expects the waves of deflation to get stronger as currencies fall. “These nations have been exporting deflation but it just hasn’t turned into a tsunami yet,” he said. “When it gets close to that then you’re going to see central banks around the world decide they better get a bit more cooperative.” “This currency war cannot go well. They never have.”

Read more …

“.. for inflation to reach close to a 2.0% threshold medium term, the potential amount of asset purchases needed is €2-3 trillion, not a mere €1 trillion.”

• SocGen Explains Why The ECB’s QE Will Fail: It’s Not Big Enough (Zero Hedge)

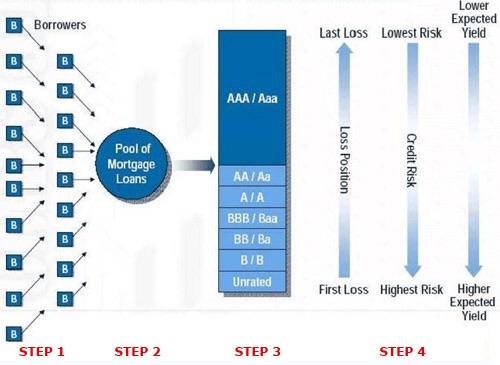

There are a bunch of things in the ECB post-mortem note just released by SocGen’s Michel Martinez, reproduced below, but here are the punchlines. First, on the impact of ECB QE on the economy: “we argue ECB QE could be five times less efficient than in the US. In December, press reports suggested that the ECB had run studies suggesting that a €1000bn QE programme would only boost price levels by 0.2-0.8% after two years, five to nine times less efficient than the studies for the US or the UK. The impact on GDP is not provided, but it would be reasonable to assume the same impact as on inflation on a cumulated basis.”

In other words, it will be an outright failure as it “tries” to boost inflation expectations and the European economy in its current format. That, as a reminder, is its stated purpose. So what does SocGen suggest? Simple: the same thing every Keynesian says when justifying why a piece of occult economic voodoo fails to work: it wasn’t big enough. To wit: “The potential amount of QE needed is €2-3 trillion! Hence for inflation to reach close to a 2.0% threshold medium term, the potential amount of asset purchases needed is €2-3 trillion, not a mere €1 trillion.”

And since there is nowhere near enough bond supply in Europe, the ECB will have to proceed with monetizing, drumroll, stocks. Should the ECB target such an expansion of its balance sheet, it would have to ease some conditions on its bond purchases (liquidity rule, quality…) or contemplate other asset classes- equity stocks, Real Estate Investment Trust-(REIT), Exchange-traded fund (ETF)…- as the BoJ, previously. Because what tens of millions of unemployed Europeans really need to help their lot in life, and to boost their confidence, is for the central bank to buy the stocks sold by the richest 0.001%.

Read more …

“The ECB has launched into a massive bond buying campaign for the sole purpose of redeeming Mario Draghi’s utterly foolish promise to make speculators stupendously rich..”

• Mario Draghi: Charlatan Of The Apparatchiks (David Stockman)

Well, he finally launched “whatever it takes” and that marks an inflection point. Mario Draghi has just proved that the servile apparatchiks who run the world’s major central banks will stop at nothing to appease the truculent gamblers they have unleashed in the casino. And that means there will eventually be a monumental crash landing because the bubble beneficiaries are now commanding the bubble makers. There is not one rational reason why the ECB should be purchasing $1.24 trillion of existing sovereign bonds and other debt securities during the next 18 months. Forget all the ritual incantation emanating from the central bankers about fighting deflation and stimulating growth. The ECB has launched into a massive bond buying campaign for the sole purpose of redeeming Mario Draghi’s utterly foolish promise to make speculators stupendously rich by the simple act of buying now (and on huge repo leverage, too) what he guaranteed the ECB would be buying latter.

So today’s program amounts to a giant bailout in the form of a big fat central bank “bid” designed to prop up prices in the immense parking lot of French, Italian, Spanish, Portuguese etc. debt that has been accumulated by hedge funds, prop traders and other rank speculators since mid-2012. Never before have so few – perhaps several thousand banks and funds – been pleasured with so many hundreds of billions of ill-gotten gain. Robin Hood is spinning madly in his grave. The claim that euro zone economies are sputtering owing to “low-flation” is just plain ridiculous. For the first time in decades, consumers have been blessed with approximate price stability on a year/year basis, and this fortunate outbreak of honest money is mainly due to the global collapse of oil prices—not some insidious domestic disease called “deflation”. Besides, there is not an iota of proof that real production and wealth increases faster at a 2% CPI inflation rate compared to 1% or 0%.

Read more …

“Ultimately, €1.1 trillion over 18 months versus euro area GDP is roughly a third of what the BOE or Fed did under similar circumstances..”

• Mario Draghi’s QE Blitz May Save Southern Europe At Risk Of Losing Germany (AEP)

Mario Draghi has achieved a spectacular triumph. His headline offering of €60bn a month in quantitative easing comes in the face of scorched-earth resistance from the German Bundesbank and the EMU creditor core. It is finally big enough to make an economic difference. Yet today’s shock-and-awe action by the ECB comes three years late, after the eurozone has already been allowed to drift into deflation, and very nearly into a triple-dip recession. The fact that the ECB is having to act on this scale a full six years into the world’s post-Lehman recovery is in itself an admission that policy has been horribly behind the curve. Mr Draghi told us year ago in Davos that warnings of deflation were jejune and that QE was out of the question. His hands were tied, of course, whatever he really thought at the time. He could not move too far beyond the ECB’s centre of gravity. He had to demonstrate that all else had failed, and all else did then fail.

It comes after six years of mass unemployment that has ravaged southern Europe, eroded the job skills of a rising generation, left hysteresis scars, and lowered the growth trajectory and productivity speed limit of these countries for a quarter century hence. It comes as the eurozone’s GDP is still languishing well below its pre-Lehman peak, with Italian industrial output down 24pc, back to levels first achieved in 1980. The bond purchases will not begin until March. They are cribbed about with conditions that may ultimately prove damaging and possibly fatal. Adam Posen, head of Washington’s Peterson Institute, said the QE blitz is large, but not as overwhelming as some think. “It will make some difference. It’s not going to be enough to fully offset deflationary forces, let alone restore growth, but to the degree that Draghi was able to make it sound open ended is a good thing,” he said.

“Ultimately, €1.1 trillion over 18 months versus euro area GDP is roughly a third of what the BOE or Fed did under similar circumstances, and it’s likely to take more money to get the same effect in Europe right now,” he said. The limits of delayed action are by now well known. Bond yields are already down to 14th Century lows. The ECB cannot force them much lower, though Mr Draghi did say cheerfully that it would buy debt with negative rates, prompting audible murmurs of alarm from German journalists. The decision amounts to an act of political defiance by a majority bloc in the Governing Council – unmistakably a debtors’ cartel of Latin states and like-minded states – and therefore opens an entirely new chapter of the EMU story. This Latin revolt is to violate the sacred contract of EMU: that Germany gave up the D-Mark and bequeathed the Bundesbank’s legacy to the ECB on the one condition that Germany would never be out-voted on monetary issues of critical importance.

Nor is the irritation confined to Germany. The Tweede Kamer of the Dutch parliament was up in arms today, the scene of fulminating protests from across the party spectrum. “Dutch taxpayers should not be made liable for the debts of the Italian state,” said the liberal VVD party. Mr Draghi said there was a “large majority on the need to trigger (QE) now, so large we didn’t need to vote”. That is an elegant way to describe a pitched battle. No doubt we will learn over coming days just how many hawks voiced their protest, and with what vehemence. He also said that the decision to pool 20pc of the risk through collective purchases was pushed through by “consensus”, the ECB’s euphemistic term for disagreement. This is an uncomfortable fudge.

Read more …

“Outside the U.S., the rest of the world’s economy is grappling with dropping prices and slower growth. While the recent crash in oil prices has accelerated the trend, prices of raw materials and natural resources have been falling since the Great Recession ended.”

• ECB Bond Plan Won’t Fix Europe’s Economy (CNBC)

It’s a start, but it’s not a cure for Europe’s deepening economic stagnation. Borrowing from the playbook of their U.S. and Japanese counterparts, European central bankers Thursday embarked on a highly anticipated plan to buy hundreds of billions of dollars’ worth of government bonds to try to revive growth by pumping cash into the financial system. ECB President Mario Draghi announced an open-ended pledge to buy 60 billion euros ($70 billion) worth of private and public bonds every month in a program that could amount to as much as a trillion euros. The long-awaited—and, many say, long-overdue—program will start in March and last through September 2016, Draghi told reporters. The hope is that the bond-buying spree—known as quantitative easing—will help reverse a worrisome drop in prices that has recently spread throughout the euro zone.

First tried in Japan in the early 2000s, and then deployed in 2008 by the U.S. Federal Reserve, the goal of quantitative easing is to boost growth by lowering interest rates and making cash easier and cheaper to borrow, spurring lending and spending. In the U.S., Fed officials recently decided to end a third round of QE after sucking up more than $3 trillion in bonds. Though the Fed policy was not without critics, it is generally credited with helping to get the U.S. economy and banking system back on its feet after the worst financial crisis since the Great Depression. Europe is not alone in facing the perils of falling prices and economic slowdown. Outside the U.S., the rest of the world’s economy is grappling with dropping prices and slower growth. While the recent crash in oil prices has accelerated the trend, prices of raw materials and natural resources have been falling since the Great Recession ended.

Read more …

“It was promised that it would yield new investment. It has not. It was promised that it would “pump money into the economy”. It has not.”

• QE For The Eurozone Is A Huge Confidence Trick. It Should Fool No One (Guardian)

At last the euro’s lords and masters have accepted that something must be done about their zone’s lamentable growth. They will unleash a massive bond-buying programme totalling a reported €1tn. The former BBC economic pundit Stephanie Flanders told the world it was “Santa Claus time”; the ECB has ridden to the rescue. No it has not. Europe’s great and good, partying on the slopes of Davos, are like courtiers at the Congress of Vienna. They are blinded by snow and celebrities. Santa Claus gives presents to people; the ECB gives presents to its banks. It is merely tipping large sums of money into the vaults of precisely the institutions whose crazy lending caused the crash of 2008, and which have been failing Europe’s economy ever since. There is absolutely no requirement on these banks to release this money into private or commercial bank accounts.

Given the fear of over-lending that regulators have struck into bank bosses since the collapse of Lehman Brothers, the money will simply build up reserves. That is exactly what has happened to quantitative easing in Britain since 2010: there has been no surge in bank lending, except into property investment. Quantitative easing is a gigantic confidence trick. It was promised that it would yield new investment. It has not. It was promised that it would “pump money into the economy”. It has not. It was also feared that printing money would lead to hyper-inflation. It has not, for the simple reason that no one gets to spend the money. It is a bookkeeping transaction between a central bank and a commercial bank. It means nothing as long as banks are told to build up their reserves. Money in circulation matters. The whole of Europe, including Britain, is chronically short of demand, which is why deflation is such a menace.

If no one can afford to buy anything, no one will sell anything or invest money in making anything. The chronic imbalance between northern and southern states of the eurozone, previously ameliorated by selective devaluation, has bound poor and rich countries alike in a rictus of cash starvation. Collapsing demand drives down prices and profits; there is nothing for banks to invest in. The Chinese are laughing. Greece and some other Mediterranean economies are facing poverty not seen in half a century. A return to normal growth means they must declare themselves bankrupt, restructure past debts, leave the eurozone and devalue. Don’t bury money in their banks. Bury it in their wallet. The eurozone may still look great from the top of a Swiss mountain; it looks terrible from the foot of the Acropolis.

Read more …

“There is one large untapped source of triple-A credit, and that is the European Union itself – that has practically no debt, but it has taxing power..”

• Eurozone Stimulus Will ‘Reinforce Inequality’, Warns Soros (BBC)

Billionaire investor George Soros has warned that the aggressive stimulus policy rolled-out by the ECB could “reinforce inequality” in the EU. The ECB committed to injecting at least €1.1 trillion into the ailing eurozone economy. Mr Soros added that the measures could have “serious political repercussions”. But he emphasised that he expected the ECB’s policy to drive economic growth in the European Union. Speaking at a dinner at the World Economic Forum in Davos, the 84-year-old, who was born in Hungary, voiced concerns that an “excessive reliance on monetary policy tends to enrich the owners of property and at the same time will not relieve the downward pressure on wages.” The ECB’s favoured method, known as quantitative easing, amounted to a “very powerful set of measures,” said the financier, and had “exceeded the very high expectations of the markets.”

However he twice cautioned that quantitative easing would “increase inequality between rich and poor, both in regards of the countries and people”. Asked if he worried that the newest round of quantitative easing, which essentially pumps more money into the eurozone, would lead some EU states to delay economic reforms, Mr Soros said that if there were growth, it would actually make it easier for countries like France to change their financial systems. He also said there was another powerful way of boosting the Eurozone economy. “There is one large untapped source of triple-A credit, and that is the European Union itself – that has practically no debt, but it has taxing power,” he said, urging the EU to spend more on financing infrastructure projects, such as energy pipelines, electricity networks and even roads.

Read more …

“It will work because it is big, because it’s strong, and because it’s open-ended.”

• Why We Were Right On QE: ECB Board Member (CNBC)

Even before the ECB’s decision to launch a quantitative easing program was announced on Thursday, it was controversial. However, Benoit Coeuere, one of the bank’s key decision-makers, insisted to CNBC that the trillion-euro launch had been the right move. The slightly larger-than-expected program, which will see the ECB buy 60 billion euros ($69 billion) worth of corporate and government bonds a month for at least 18 months, was welcomed in global stock markets, with US and European equity markets rising after its announcement Thursday afternoon. “It shows that the program is credible for market participants,” Benoit Coeure, the French economist who has served as part of the ECB’s executive board since 2011, told CNBC at the World Economic Forum in Davos.

“It will work because it is big, because it’s strong, and because it’s open-ended.” Spooked by the specter of looming deflation and slowing economic growth, the ECB is now planning to provide a fillip to the euro zone’s economy by buying sovereign bonds from March until at least September 2016, or until inflation shows signs of picking up pace. “Lights were blinking red across our dashboard and we had to do something. The only question was what was the right instrument?” Coeure said Coeure admitted that there had been divisions on the board over the program in recent months, with some thinking it was too early and some too late. However, this month there was an “overwhelming majority” in favor of launching it, he added.

Read more …

Ray Dalio: “Back then we could lower interest rates. If we hadn’t done so, it would have been disastrous. We can’t lower interest rates now,”

• Larry Summers Warns Of Epochal Deflationary Crisis If Fed Tightens Too Soon (AEP)

The United States risks a deflationary spiral and a depression-trap that would engulf the world if the Federal Reserve tightens monetary policy too soon, a top panel of experts has warned. “Deflation and secular stagnation are the threats of our time. The risks are enormously asymmetric,” said Larry Summers, the former US Treasury Secretary. “There is no confident basis for tightening. The Fed should not be fighting against inflation until it sees the whites of its eyes. That is a long way off,” he said, speaking at the World Economic Forum in Davos. Mr Summers said the world economy is entering treacherous waters as the US expansion enters its seventh year, reaching the typical life-expectancy of recoveries. “Nobody over the last fifty years, not the IMF, not the US Treasury, has predicted any of the recessions a year in advance, never.” When the recessions did strike, the US needed rate cuts of three or four percentage points on average to combat the downturn. This time the Fed has no such ammunition left.

“Are we anywhere near the point when we have 3pc or 4pc running room to cut rates? This is why I am worried,” he told a Bloomberg forum. Any error at this critical juncture could set off a “spiral to deflation” that would be extremely hard to reverse. The US still faces an intractable unemployment crisis after a full six years of zero rates and quantitative easing, with very high jobless rates even among males aged 25-54 – the cohort usually keenest to work – and despite America’s lean and efficient labour markets. Mr Summers warned that this may be a harbinger of deeper trouble as technological leaps leave more and more people shut out of the work-force, and should be a cautionary warning to those in Europe who imagine that structural reforms alone will solve their unemployment crisis. “If the US is in a bad place, we are short of any engine at the moment, so I hope you are wrong,” said Christine Lagarde, the head of the IMF.

Mrs Lagarde said the IMF expects the Fed to raise rates in the middle of the year, sooner than markets expect. “This is good news in and of itself, but the consequences are a different story: there will be spillovers. One thing for sure is that we are in uncharted territory,” she said. Worries about the underlying weakness of the US economy were echoed by Bridgewater’s Ray Dalio, who said the “central bank supercycle” of ever-lower interest rates and ever-more debt creation has reached its limits. Interest rate spreads are already so compressed that the transmission mechanism of monetary policy has broken down. “We are in a deflationary set of circumstances. This is going to call into question the value of holding money. People may start putting it in their mattress.”

Mr Dalio said the global economy is in a similar situation to the early Reagan-era from 1980-1985 when the dollar was surging, setting off a “short squeeze” for those lenders across the world who borrowed in dollars during the boom. There is one big difference today, and that is what makes it so ominous. “Back then we could lower interest rates. If we hadn’t done so, it would have been disastrous. We can’t lower interest rates now,” he said.

Read more …

“With oil companies staring down the barrel of low prices, they are realising that they have to prepare for ever more drastic scenarios.”

• How We’re Preparing For $25 Oil: Lukoil CEO (CNBC)

With oil companies staring down the barrel of low prices, they are realising that they have to prepare for ever more drastic scenarios. Lukoil, the Russian oil company, has stress tested its business for the oil price falling to $25 a barrel, Vagit Alekperov, the company’s chief executive, told CNBC at the World Economic Forum in Davos. Brent crude was changing hands at close to $110 a barrel just a year ago, but has plummeted in recent months as the global economy performed worse than hoped, but supply continued at previous levels. On Friday, news that Saudi King Abdullah bin Abdulaziz Al Saud passed away sent oil prices sharply higher.

“We think that the current trends in the oil market and the global economy are only pushing the world oil to lower levels. We think the crisis is only at its earliest stages and the demand situation in world market is not really conducive to oil prices going up,” Alekperov warned. Lukoil, like other Russian businesses, has been affected by sanctions imposed by Western governments. A planned joint venture with French oil giant Total was scrapped in September. Lukoil, like other Russian companies, will also find it difficult to raise money internationally, or to repay international loans as the value of the rouble has tumbled. “The sanctions obviously limit our access to locality and financing. And over the past 25 years, we’ve been heavily integrated into the international community in terms of technology and financing,” Alekperov said. “These will have a telling impact on us.”

Read more …

“..a signal that worldwide demand is contracting so quickly that oil prices must quickly decline to reflect that fact.”

• If Oil Drops Below $30 A Barrel, Brace For A Global Recession (MarketWatch)

The price of oil is about $17 a barrel away from signaling that a global recession is inevitable, according to a new survey of investment professionals. The survey from ConvergEx Group polled 306 investment professionals, asking, among other things, what oil price would show that a global recession was inevitable. “The idea behind this question was simple — at some point oil prices aren’t just a nice theoretical tailwind for global economies,” said Nicholas Colas, chief market strategist at ConvergEx, in a note. “Rather, they become a signal that worldwide demand is contracting so quickly that oil prices must quickly decline to reflect that fact.” The most common answer was $30 a barrel, from 26% of respondents, with $35 a barrel being the second most common answer (16% of respondents). All told, 62% of respondents said $30 or lower crude was a global recession’s canary in a coal mine.

More than half those surveyed represented buy-side firms such as asset managers and hedge funds, and about a quarter of them were from sell-side firms such as banks or broker dealers, according to ConvergEx. Crude oil for March delivery settled down $1.47, or 3.1%, at $46.31 a barrel on the New York Mercantile Exchange Thursday, as U.S. inventories for this time of year hit their highest level in eight decades. About 68% of the respondents said oil hasn’t reached a bottom yet, and only 20% think it already has. On Thursday, OPEC Secretary-General Abdalla el-Badri said he thinks oil prices will stay where they are now, setting up for an eventual rebound. Recently, Iran’s oil minister said his country’s oil industry is not threatened by $25 a barrel prices.

While a continued slide in oil prices may seem foreboding, not many of those surveyed think oil will actually drop to such low prices. Only 8% of those polled believe oil will end 2015 at below $40 a barrel, with the vast majority thinking it will settle above that: 43% estimated $40 to $60 a barrel, and 42% expect $60 to $80 a barrel. Those estimates, however, appear to be fluid. A ConvergEx survey conducted in December, when oil was at $63 a barrel, showed 89% of respondents forecasting an end-of-2015 price of more than $60, and 47% estimating oil at $80 a barrel or more. Most are looking for oil prices to rebound while acknowledging that current prices are benefiting the U.S. economy. About 66% said current prices are a positive to the U.S. economy, but if oil prices keep sliding from current levels, the U.S. labor market will take a hit, according to 55% of respondents. “The bottom line here is that investors say the drop in oil prices has been a net positive thus far, but their forecast is less sunny,” said Colas.

Read more …

“When I saw WTI hit $65, I thought we’re going to be really busy with restructurings,” Young said. “When it hit the $40s, I knew we were looking at outright liquidations.”

• Oil Drillers ‘Going to Die’ in 2Q on Crude Price Swoon (Bloomberg)

Oil drillers will begin collapsing under the weight of lower crude prices during the second quarter and energy explorers who employ them will shortly follow, according to Conway Mackenzie Inc., the largest U.S. restructuring firm. Companies that drill wells and manage fields on behalf of oil producers will be the first to fall after the benchmark American crude, West Texas Intermediate, lost 57% of its value in seven months, said John T. Young, whose firm led the city of Detroit through its 2013 bankruptcy. Oil companies have slashed thousands of jobs, delayed billions of dollars in projects and dropped or scaled back expansion plans in response to the prolonged rout in crude prices. For oilfield service providers that test wells and line the holes with steel and cement, the impact of price reductions forced upon them by explorers will start to pinch hard during the second quarter, Young said Thursday.

“The second quarter is going to be devastating for the service companies,” Young said in a telephone interview from Houston. “There are certainly companies that are going to die.” Oilfield-service providers are facing a “double-whammy,” he said. Even as oil companies are demanding 20% to 30% price reductions, they’re also extending wait times before paying their bills, enlarging cash-flow gaps for the drilling and equipment firms, he said. Young, who has restructured more than a dozen energy companies and advised Kirk Kerkorian’s Delta through its 2011 bankruptcy, is warning drillers to monitor whether the oil producers they work for have protected future cash flows with hedging instruments like swaps and collars.

The amount of projected 2015 oil and natural gas output a company has hedged is a strong indicator of whether they’ll be able to pay their bills, he said. Another important metric is how much is drawn on revolver loans, Young said. “I’m telling them they really have to keep an eye on this stuff and you’ve got to be the squeaky wheel,” he said. “You’ve got to start filing liens if you see a company starting to go down.” In the U.S., a lien is a legal claim against a debtor’s property to force payment of a delinquent bill. “When I saw WTI hit $65, I thought we’re going to be really busy with restructurings,” Young said. “When it hit the $40s, I knew we were looking at outright liquidations.”

Read more …

Asia has huge deflation risks.

• Asian Central Banks Under Pressure To Act (Reuters)

Chinese factories were forced to cut prices for the sixth straight month in January to sell their products, while economic growth in South Korea slowed sharply, raising the prospect of more policy easing from major central banks in Asia. The weak manufacturing reading from China added to expectations that Beijing will have to announce fresh stimulus measures soon, and came a day after the European Central Bank took the ultimate leap and launched a huge bond-buying program as it tries to stave off deflation and kick-start growth. China’s manufacturing growth stalled for the second month in a row, the HSBC/Markit Flash Manufacturing Purchasing Managers’ Index (PMI) survey showed on Friday, while the sub-index for input prices fell to the lowest since the global financial crisis, reflecting a tumble in oil prices that is spreading disinflationary pressure throughout the globe.

Chinese companies again cut output prices, but more deeply than in December, eroding their profit margins and pointing to faltering demand. Analysts at Nomura saw more downside pressure on China’s producer prices, “enhancing our concerns over deflation”. “This looks like a trend and it will affect core inflation at some stage. So the PBOC will very likely react to such deflation concerns,” said Chang Chun Hua, an economist at Nomura, adding he expected the central bank to cut commercial banks’ reserve requirement ratio (RRR) in the first quarter to free up more money to lend. News out of South Korea made for uncomfortable reading as well. Asia’s fourth-largest economy grew a seasonally adjusted 0.4% in the October-December period on-quarter, less than half of the 0.9% gain in the third quarter. A senior statistics official from the central bank pointed to the uncertainty facing the trade-reliant economy, not least from the slowdown in China, South Korea’s biggest export market.

Read more …

What credibility?

• Is Bank Of Japan Governor Kuroda Losing Credibility? (CNBC)

Bank of Japan (BOJ) Governor Haruhiko Kuroda has frustrated investors with his habit of surprising markets, and now the central bank’s latest inflation forecast has some questioning his credibility. “Now that the BOJ has admitted to failing to meet its target and put its credibility on the line, the risk is that another round of asset purchases could provoke a negative reaction,” said Hiroaki Hayashi, at Fukokushinrai Life Insurance director of investment management, who expects the BOJ to ease further in April. On Wednesday, the BOJ cut its inflation forecast for the fiscal year starting in April 2015 to 1.0%, half of the 2% target it set nearly two years ago. The central bank cited the around 50% decline in oil prices over the past six months for the updated forecast, which was lower than many analysts had expected.

Officially, the central bank expects to exceed its 2% forecast in fiscal 2016, raising its core inflation forecast to 2.2% from 2.1%. Apparently undeterred, Kuroda insisted the 2% target will be met, just a little later than expected. “Consumer inflation will slow for the time being due to oil price falls,” he said at the press conference following the BOJ’s two-day policy meeting. “On the assumption that oil prices will flatten out at current levels and rise moderately ahead… we expect consumer inflation to reach 2% in a period centered on fiscal 2015.” “Governor Kuroda is being his bullish self – he really does believe his forecasts can be achieved. The point is to raise expectations that inflation will rise,” explained Mizuho Securities market economist Kenta Ishizu. Although he conceded that “most people in the markets don’t think the 2% inflation is going to become a reality.”

Read more …

Without the government, there is no growth left: “More monetary and fiscal easing measures will be needed to support growth in the coming months.”

• Chinese Manufacturing Growth Stalls (BBC)

Activity in China’s vast manufacturing sector contracted for the second consecutive month, according to a preliminary survey on Friday. The HSBC/Markit flash purchasing managers’ index (PMI) was at 49.8 in January, up from 49.6 in December. But the index was still below the 50-point level that separates growth from contraction in the sector. Firms cut prices for six months in a row to sell products, impacting profit margins, said the private survey. Economists had expected factory activity growth to continue to stall, with a Reuter’s poll forecasting a reading of 49.6. News of the contraction comes just days after Chinese authorities said growth in the world’s second largest economy had slowed to its weakest in 24 years. China’s economy expanded 7.4% in 2014 from a year ago, missing its official growth target of 7.5% for the first time in 15 years.

The recent data has stoked fears of deflation in China where producer prices have fallen for nearly three consecutive years. On the back of that, China’s annual consumer inflation hit a near five-year low of 1.5% in December. “Today’s data suggest that the manufacturing slowdown is still ongoing amidst weak domestic demand,” Qu Hongbin, a HSBC economist told Reuters. “More monetary and fiscal easing measures will be needed to support growth in the coming months.” Calls have been growing for more easing in China and the country’s central bank did surprise markets by unexpectedly cutting interest rates in November for the first time in over two years. Meanwhile, Asian markets ignored the weak data with both the Shanghai Composite and Hang Seng index up 1.8% and 1.3% respectively.

Read more …

The Danes would be better off with a dollar peg.

• Denmark Ready to Dump Kroner on Market to Tame Hedge Funds (Bloomberg)

Denmark sent hedge funds and other speculators a clear message yesterday, daring them to test the full force of its monetary arsenal at their own peril. The central bank signaled it is ready to step up currency interventions and continue cutting rates to stamp out any lingering speculation it may be unable to defend its euro peg. “We have plenty of kroner,” Karsten Biltoft, head of communications at the central bank in Copenhagen, said in a phone interview. “We have the necessary tools in terms of interest-rate changes and interventions and we have a sufficient supply of Danish kroner.” The comments follow the central bank’s second rate cut in less than a week, with Governor Lars Rohde lowering the benchmark deposit rate to a record minus 0.35% yesterday.

That was more than expected by economists surveyed by Bloomberg and followed a 15 basis-point cut on Monday. The easing comes as the European Central Bank unveiled an historic bond-purchase program that drove the euro lower. Since Switzerland abandoned its euro peg on Jan. 15, the Danes have fought back conjecture they’ll be next after the krone rose to its strongest against the euro in 2 1/2 years. Denmark sold a record 50 billion kroner ($7.7 billion) from Jan. 15-20 to weaken the currency, Svenska Handelsbanken AB estimates. That’s equivalent to more than 10% of foreign reserves as of the end of December.

Read more …

Want your military to do something good?

• South Africa Rhino Poaching Record Set In 2014 (BBC)

A record 1,215 rhinos were poached in South Africa in 2014, a 21% increase on the previous year, officials have said. More than two-thirds were killed in the famed Kruger National Park. The last few years have all seen new records set, with poaching fuelled by the belief in countries like China and Vietnam that horns have medicinal properties. The lucrative market has attracted criminal gangs who use sophisticated technology to kill their quarry. South Africa’s environment minister Edna Molewa said more than 100 rhinos had been moved to “more secure locations” – some of them in neighbouring countries – in a bid to protect the animals. “Through this method we aim to create rhino strongholds, areas where rhino can be cost-effectively produced,” she said. Despite successes through the re-location programme, Ms Molewa said the figures killed each year remained “worryingly high”.

“The organised transnational illicit trade in rhino horn undermines our efforts,” she explained. “We therefore have to ensure that we continue to work together in stepping up all the measures that we have adopted. The environment minister described poaching as part of an “multi-billion dollar worldwide illicit trade”. Conservationists say they are facing an ever greater challenge to protect animals against poachers who are equipped with sophisticated tools such as night-vision goggles and long-range rifles. “Killing on this scale shows how rhino poaching is being increasingly undertaken by organised criminal syndicates,” said Dr Carlos Drews, WWF’s director of global species programme. “The country’s brave rangers are doing all they can to protect the rhinos but only a concerted global effort can stop this illegal trade. This includes South Africa scaling up its efforts to stop the poaching and Viet Nam taking urgent measures to reduce consumer demand.”

Read more …

Tick tick.

• Clock’s Ticking: Humanity ‘2 Minutes’ Closer To Its Doomsday (RT)

Three minutes to midnight – with midnight being the figurative end of humanity – are left before apocalypse descends upon the planet, scientists announced on Thursday, as the minute hand of the iconic ‘Doomsday Clock’ was adjusted two minutes forward. “World leaders have failed to act with the speed or on the scale required to protect citizens from potential catastrophe,” Kennette Benedict, the executive director of the Bulletin of Atomic Scientists, the organization behind the Doomsday Clock, announced on Thursday. Citing climate change and nuclear tensions, the latest decision to move the minute hand closer to midnight – thus pronouncing the world closer to its doom – was traditionally made by the Bulletin’s board of directors and the sponsors, including a number of Nobel laureates.

“Today, unchecked climate change and a nuclear arms race resulting from modernization of huge arsenals pose extraordinary and undeniable threats to the continued existence of humanity,” said Benedict, while breaking the news at an international conference in Washington. Founded in 1945 by University of Chicago scientists who had helped to develop the first atomic weapons, the Bulletin created the Clock two years later, making midnight and countdown to zero the imagery of apocalypse and nuclear explosion. It was then seven minutes to midnight. This time, the decision to push the Clock forwards was made with the reference to “accelerating climate change coupled with inadequate international action to greenhouse gas emission,” as well as nuclear programs in US, Russia and other countries, and “the stalled reduction of nuclear warheads in Russian and US arsenals.”

Read more …