Rembrandt van Rijn Abraham and the angels 1646

Ritter: “[Commander-in-Chief of the Armed Forces of Ukraine Valery] Zaluzhny, in a conversation with Mark Milley, Chairman of the Joint Chiefs of Staff of the Pentagon, said that 250,000 Ukrainian soldiers were killed. About 83,000 are missing, of which about 60,000 are most likely dead. This gives an approximate number of 315,000 dead.”

Scott Ritter:“Bakhmut has fallen. Ukraine has lost the war.“

This is the quintessential turning point of the war. Yes, the fighting will continue and it will be bloody and messy but this was the case for 2 horrible years after Gettysburg & Kursk as well.pic.twitter.com/pl2LEF99ab

— Kaiser (@eagleeye2805) April 8, 2023

Macgregor

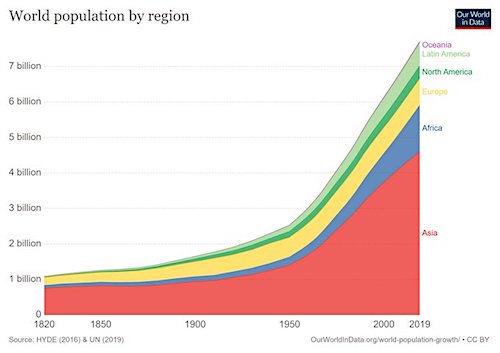

Just start in 1950

Ukr batallion

https://twitter.com/i/status/1644650854702538758

Odessa 2014

https://twitter.com/i/status/1644687154436505600

MAGS

Wanted to put one of my favorite songs on Trump's campaign ad. I made a few edits, but their team already made it great. pic.twitter.com/gKZtY4sz7S

— MAGS (@TAftermath2020) April 8, 2023

Country 404.

“..those who stayed want to leave for any place: the hated Poland, EU, NATO, to be America’s 51nd state. Joining the Antarctic with its pinguins will also be fine.”

• Why Will Ukraine Disappear? Because Nobody Needs It (Medvedev)

1. Europe doesn’t need Ukraine. The forced support of the Nazi regime, by the American mentor’s order, has put Europeans into a financial and political inferno. All for the sake of bandera’s unterukraine, that even the snobby, insolent Polacks don’t take for a valid country, and time and again toss in the issue of its western areas anschluss. There’s a nice perspective ahead: to permanently put the nouveau-Ukrainian blood-sucking parasites on the decrepit EU’s arthritis-crippled neck. That’ll be the final fall of Europe, once majestic, but robbed off by degeneration.

2. The US doesn’t need Ukraine. True, the military and sanction campaigns are attempted for PR by political blabbermouths, who long ago attested to their impotence and imbecility. Average Americans don’t understand what “Ukraine” is, and where “it” is. Most of them won’t show this “power” on the map on the first take. Why won’t the US establishment focus on inflation and job issues, or emergencies in their home States, instead of a country 404, unbeknownst to them? Why does so much dough go across the ocean? Sooner or later, they’ll ask for that. Then, storming of the Capitol in January 2021 would seem like scout games.

3. Africa and Latin America don’t need Ukraine. The hundreds of millions spent by US on pointless fights in Ukraine, could finance many development programmes for Latin American and African states. Latin America is gringos’ backyard – that’s what they’ve been rubbing in for decades. Africa’s had its share of suffering from the genocide, and colonial dependence, imposed by former western slave traders. That’s why the people of African huts and Latin American favelas ask a very reasonable question: for their former suffering and present-day loyalty, why is somebody else rewarded – very, very far away?

4. Asia doesn’t need Ukraine. By Russia’s example, they see “colour” technologies at work to eradicate the largest competing powers. They understand what scenario the America-led collective West has for them if they disobey. “Help us to overcome Russia, and we’ll soon come to you”, the utterly brazen Western leaders tell them. Such gigantic countries as India, China, and other Asia-Pacific states face the big enough challenge of post-pandemic economic recovery, let aside the drugged clowns, with their whining for aid. “We are not interested in you”, Asia tells their messengers, responding to the calls to support Ukraine and confine Russia. The country, geopolitically many times closer to Asian powers, the one that historically has proven itself a reliable strategic partner. Do Asian giants need such headache coming from former colonisers?

5. Russia doesn’t need Ukraine. A threadbare quilt, torn, shaggy, and greasy. The new Malorossiya of 1991 is made up of the artificially cut territories, many of which are indigenously Russian, separated by accident in the 20th century. Millions of our compatriots live there, harassed for years by the Nazi Kiev regime. It is them who we defend in our special military operation, relentlessly eradicating the enemy. We don’t need unterukraine. We need Big Great Russia.

6. Finally, its own citizens don’t need the Nazi-headed Ukraine. That’s why out of 45 million people there’re only some 20 million remaining. That’s why those who stayed want to leave for any place: the hated Poland, EU, NATO, to be America’s 51nd state. Joining the Antarctic with its pinguins will also be fine. As long as it’s quiet, and the food’s good. The ruling junta’s criminal ambitions forced Ukrainians to beg and roam around the countries and continents, searching for a better life. All that is for an obscure European perspective. Or rather, to let the harlequin in a khaki tricot and his band of thievish Nazi clowns to put the money stolen from the West into their offshore accounts. Would ordinary Ukrainians need that? Nobody on this planet needs such a Ukraine. That’s why it will disappear

“The strengthening of [Ukraine’s] military power alongside powerful fortifications erected near Donbass indicates the U.S. intention to initiate a conflict in the region.”

• Human Destiny In Ukraine (Eve Ottenberg)

The deficiencies in the American character have rotted the world. And that’s without discussion of the abyss of human wickedness of senators who, like Lindsay Graham or Tom Cotton, call for war which would end in nuclear winter and five billion starving, then dead humans, or Joe Manchin, who wanted a no-fly zone – with, of course, the same radioactive results. But these character deficiencies at the top also have had unintended consequences that could spell a swerve off the U.S.-caused fatal trajectory of human destiny. American bullying and relentless aggression has created problems for itself, namely the tremendous Russia/China alliance and the eagerness and support that union receives from the Global South. Washington elites would like nothing better than to splinter that alliance, and thus perhaps succeed at destroying first Russia then China, separately. But Beijing and Moscow have caught on. So has the Global South, whose members pile as fast as they can into Russian and Chinese-led groups like the Shanghai Cooperation Organization and BRICS, which has now outstripped the G-7 in how much wealth – and certainly population – it represents.

Humanity stands at a crossroads. The American Empire’s hubris has brought our fate to a point where the two most heavily nuclear-armed nations could get into a shooting war. If nuclear war erupts, we’re not just talking about the incineration of American and Russian cities, but more – to repeat, those five billion people who starve to death due to nuclear winter. But this was the atrocious risk American elites were prepared to take when they provoked Russia. As John Ross writes in a new book, Waging the New Cold War, coauthored with Deborah Veneziale and John Bellamy Foster, since the U.S.-backed coup in Kiev in 2014, Washington has prepared for war against Russia in Ukraine, thrusting the human future into a crucible for superpower conflict centered on Kiev. “The strengthening of [Ukraine’s] military power alongside powerful fortifications erected near Donbass indicates the U.S. intention to initiate a conflict in the region.”

That’s nothing yet. Pepe Escobar talks of BRIICSS, adding Iran and Saudi Arabia. And then there’s Algeria, Argentina, Bahrain, Bangladesh, Indonesia, Iran, Egypt, Mexico, Nigeria, Pakistan, Sudan, Syria, Türkiye, the United Arab Emirates and Venezuela, all of whom want in.

• BRICS Carries Greater Economic Weight Than G7 – Study (RT)

The BRICS group, comprising the world’s five major developing economies, has overtaken the Group of Seven (G7) by making up a larger share of the global gross domestic product (GDP) based on purchasing power parity, data compiled by Acorn Macro Consulting, a UK-based macroeconomic research firm, shows. According to the findings, the bloc of BRICS countries, Brazil, Russia, India, China and South Africa, contributes 31.5% of the world’s GDP. Meanwhile, the G7, consisting of the US, Canada, France, Germany, Italy, Japan and the UK, and considered the most advanced economic bloc of countries on the planet, add up to 30.7%. The gap between the two groups is expected to continue to grow, analysts say, as China and India are experiencing robust economic growth, and more countries are interested in joining BRICS.

Earlier this year, Russian Foreign Minister Sergey Lavrov said that “more than a dozen” nations have expressed an interest in joining BRICS, including Algeria, Argentina, Bahrain, Bangladesh, Indonesia, Iran, Egypt, Mexico, Nigeria, Pakistan, Sudan, Syria, Türkiye, the United Arab Emirates and Venezuela. Meanwhile, Saudi Arabia, Egypt and Bangladesh have acquired equity in the New Development Bank, BRICS’ funding organization. Last year, BRICS countries proposed creating their own currency in order to move away from the US dollar and the euro in mutual transactions. International settlements in those currencies were made difficult for Russia, a BRICS founding member, by Ukraine-related sanctions. More recently, Russian President Vladimir Putin suggested the use of the Chinese yuan in transactions with BRICS allies and other international partners in Asia, Africa and Latin America.

Malaysia

https://twitter.com/i/status/1644672070117097472

McCaul is the quintessential American idiot.

• US Ready For War With China – Congressman (RT)

US Congress would authorize a direct military confrontation with China if Beijing launched an attack against Taiwan, House Foreign Affairs Committee Chairman Michael McCaul told Fox News on Friday evening. The Texas Republican representative was talking from Taipei during a three-day bipartisan delegation visit to the self-governing island. American lawmakers would consent to putting boots on the ground if people in the US support the measure, McCaul said, without elaborating on how exactly such support would be measured. “If communist China invaded Taiwan, it would certainly be on the table and something that would be discussed by Congress and with the American people,” he said, adding that “if the American people support this, the Congress will follow.”

However, McCaul insisted that a “conflict is always a last resort” and described the US delegation’s visit as a way to “provide deterrence to China.” US-Chinese relations have previously been strained by the visits of American delegations to Taiwan, which China considers an inalienable part of its sovereign territory. The representative also maintained that discussions about a potential use of force by America in the Indo-Pacific region serve as a “deterrent for peace” since “you don’t have NATO in the Pacific.” Doing otherwise would mean inviting “aggression and war,” McCaul claimed. Beijing has repeatedly opposed Taiwan’s contacts with the US. The Chinese Foreign Ministry warned on Wednesday that the Taiwan issue is “the first red line that must not be crossed in China-US relations.” Washington formally adheres to the One China policy, by which Taiwan is considered an integral part of China. At the same time, the US enjoys close informal relations with the self-governing island and supplies it with weapons.

Washington has ramped up military support for Taiwan in recent months. In the Wall Street Journal, it was reported that the US was planning to increase its troop presence on the island from 30 to between 100 and 200 soldiers as it seeks to help Taiwan make the island “harder to assault.” In early March, the US State Department also announced that it was approving arms sales to Taipei, including $619 million worth of munitions for F-16 fighter jets. On Saturday, the Chinese military announced the launch of three days of exercises in the Taiwan Strait. The drills, held at the same time as McCaul’s visit to Taipei and just a day after Taiwanese leader Tsai Ing-wen returned from the US, was designed as a warning to Taiwan and “external forces,” the Chinese military said.

"WW3 is on the table, it's worth it to trade American lives and cities for Taiwan" confirms US Chairman of the House Committee on Foreign Affairs Michael McCaul pic.twitter.com/aBZGtqEjoG

— Carl Zha (@CarlZha) April 8, 2023

“Brazilian journalist Jamil Chade reports that China and Brazil have already begun working on a joint peace proposal for the Russia/Ukraine conflict, which will be finalized and presented to the public during Lula’s visit to China (April 11-15).”

“The Saudis have had enough of U.S. interference in their region. They are looking for development and development requires peace.”

Ending the war on Yemen is the deal clincher.

• ‘Peace In The Middle East? That’s A Threat.’ (MoA)

Thanks to China’s and Russia’s mediation peace is breaking out in the Middle East. Elijah J. Magnier @ejmalrai – 4:14 UTC · Apr 8, 2023 #BreakingNews: “The United Arab Emirates has begun withdrawing its forces from #Yemen. The Saudi-Emirati-Yemenite agreement will be announced soon.” The Middle East is solving its conflicts without the #US negative impact. Elijah J. Magnier @ejmalrai · Apr 7 Great news: “#SaudiArabia will announce the end of the war in #Yemen after the Eid al-Fitr. Saudi is ending all its (high/low) conflicts in the Middle East with #Iran, #Syria, #Iraq, #Yemen & #Lebanon (not interested in the country for now) to turn towards its own development. …” Peace will also come to Syria. The foreign minister of Saudi Arabia will soon visit Damascus. He will invite Syria to rejoin the Arab League. An Arab League summit will be held next month in Saudi Arabia and the Syrian president Bashar al Assad is expected to be there.

This comes after agreements between Iran and Saudi Arabia to bury the hatchet and after agreements between Iraq and Iran to reign in a Kurdish uprising in Iran that was controlled by Kurdish forces in Iraq. ‘We can’t have that’, says U.S. president Joe Biden. He sent CIA director Bill Burns to Saudi Arabia to threaten consequences: “CIA Director Bill Burns made an unannounced trip to Saudi Arabia this week where he reportedly aired Washington’s frustrations over Riyadh’s opening to Iran and Syria through mediation brokered by US rivals China and Russia. Speaking on condition of anonymity, a US official confirmed the trip to Al-Monitor. “Director Burns traveled to Saudi Arabia where he met with intelligence counterparts and country leaders on issues of shared interest,” the US official said.”

The official did not disclose the exact day of the trip but said that Burns discussed intelligence cooperation, especially in the area of counterterrorism. The CIA director met the country’s Crown Prince Mohammed bin Salman, The Wall Street Journal reported on Thursday. Burns likely threatened to withhold U.S. intelligence on terrorist groups from the Saudis. The CIA could additionally push some of its ISIS assets to make some nasty appearances in Saudi Arabia to then offer ‘help’ to ‘fight terrorism’. I do not think that this will work. The Saudis have had enough of U.S. interference in their region. They are looking for development and development requires peace.

It is simple: “..the more countries the US sanctions, the more these targeted nations may cooperate as trading partners..”

• US Will Threaten Europe To Implement Sanctions on Russia (Antiwar)

The White House plans to send a clear message to its European partners in the economic war against Russia, “you are either with us or against us.” Two US Treasury officials will visit European and Central Asian partners next month to demand all sanctions on Russia be implemented. Treasury officials Liz Rosenberg and Brian Nelson will meet with leaders of financial institutions in Switzerland, Italy and Germany. The AP reports the officials will have a simple message, “1. Continue to provide Moscow with material support or 2. Keep doing business with countries that represent 50 percent of the global economy.” Rosenberg and Nelson will provide their European counterparts with intelligence on alleged sanctions evaders. If those countries fail to crack down on those still doing business with Russia, then Washington is threatening to issue “penalties.”

It is unclear how far the Joe Biden administration is willing to punish NATO allies for violating sanctions. The policy echoes President George W. Bush’s doctrine that countries must either actively align with Washington in its Middle East wars, or else be judged as working “with the terrorists.” It is unclear how Europe will respond to the Joe Biden administration’s threats. Some EU members were in favor of a plan that would lift sanctions on the Belarusian fertilizer industry. Additionally, stricter sanctions implementation could threaten the Black Sea grain export agreement. The deal, brokered by Turkey and the UN, allows Ukraine’s heavily mined Black Sea ports to export agricultural products. Moscow has been willing to extend the agreement several times but is threatening to terminate it over Western sanctions preventing Russia from reaping the agreement’s benefits. After Russia invaded Ukraine last year, the White House unleashed a series of sanctions that it considered an economic nuclear weapon.

However, the attempt to isolate Moscow’s economy has largely floundered. While the Russian rouble has dipped in recent days, throughout most of the war Moscow has weathered the sanctions by increasing trade with Asia. Washington has only rallied its NATO allies and other close partners to adopt the sanctions. Meanwhile, China has added more countries to its Shanghai Cooperation Organization, and Saudi Arabia and Turkey are two of the latest prospective members. Upon becoming a member of the SCO, Iranian President Ebrahim Raisi observed that the more countries the US sanctions, the more these targeted nations may cooperate as trading partners.”The relationship between countries that are sanctioned by the US, such as Iran, Russia or other countries, can overcome many problems and issues and make them stronger,” he said. “The Americans think whichever country they impose sanctions on, it will be stopped, their perception is a wrong one.”

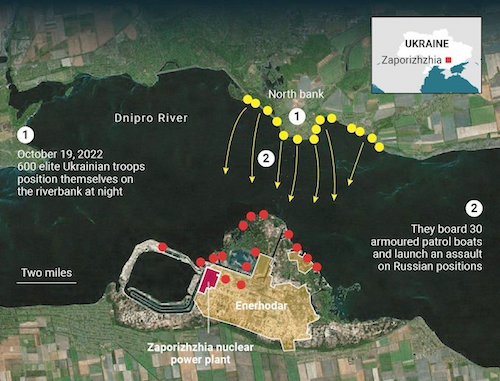

“..the attack involved some 600 elite Ukrainian soldiers who tried to cross the Dnieper River on October 19 by boat..”

• Details Of Kiev’s Botched Assault On Nuclear Plant Emerge – The Times (RT)

Ukraine’s “highly dangerous”operation to capture the Zaporozhye nuclear power plant last year ended in failure due to heavy Russian resistance, The Times reported on Friday, citing its sources. According to Kiev’s military personnel interviewed by the British newspaper, the attack involved some 600 elite Ukrainian soldiers who tried to cross the Dnieper River on October 19 by boat. The operation hinged on the presumption that Moscow’s troops would not be able to fire artillery so close to the nuclear power plant, which is the largest in Europe, one officer told The Times. However, the paper’s sources said the team met unexpected resistance. Moscow’s forces had “mined everything” and “even pulled up tanks and artillery” to fire on Kiev’s forces while they were on the water, the officer added.

The assault was supported by Ukrainian artillery, including US-made HIMARS systems, but Russian resistance resulted in only a fraction of the Ukrainian force coming ashore. After a three-hour firefight on the outskirts of Energodar, the town hosting the plant, the Ukrainian soldiers were forced to retreat, the report says. Some senior Ukrainian officials viewed the offensive as controversial, with the president of Ukraine’s nuclear operator Energoatom, Pyotr Kotin, telling The Times: “it is very dangerous to do such things near nuclear material. Any damage will bring radiation to the people and to the whole world.” The report appears to echo the Russian Defense Ministry’s statement at the time. On October 19, it said Kiev’s forces attempted – without success – to mount an amphibious operation in the area, involving up to two Ukrainian companies and a total of 37 boats.

The military claimed Ukraine lost over 90 soldiers and 14 boats. Russia and Ukraine have repeatedly accused each other of shelling the Zaporozhye NPP, which has been under Moscow’s control since last February. Russian officials have on numerous occasions warned that Kiev’s attacks could trigger a nuclear disaster. The International Atomic Energy Agency (IAEA) has called on both parties to create a safe zone around the facility, but the negotiations on the matter have failed to achieve a breakthrough. In late March, Rafael Grossi, the nuclear watchdog’s chief, said the idea was no longer being considered. Instead of establishing a safe zone, the IAEA now wants Kiev and Moscow to promise not to target the plant, or use it for staging attacks.

Short: you can buy it, but you cannot pay for it.

• Hidden Sanctions On Russian Grain Could Spark Global Famine – Official (RT)

Russian grain exporters have been hit by indirect sanctions, as Western businesses were unable to provide services critical to the industry, the head of the Russian Union of Grain Exporters has said in an interview with RT. Eduard Zernin explained that even though grain is exempt from anti-Russia sanctions imposed by Western powers, firms located or registered in those countries were systemically refusing to work with Russian suppliers. “Among them are banking institutions of this or that country that have been rejecting payments, or vessels flying the flag of this or that country that suddenly stopped entering Russian ports despite all the valid licenses,” Zernin said. “We have seen a wave of individual initiatives, the scale of which was massive.”

Russia accounts for more than 20% of the world’s grain shipments, the official noted, adding that the latest attempts “to erase or cancel Russian produce from global markets has failed,” as the elimination of such a prodigious amount of supplies would inevitably trigger a global food crisis. “Direct pressure is impossible, but if we face another upsurge in disguised sanctions targeting shipments of Russian grain, famine may be inevitable,” he warned. According to Zernin, the hidden sanctions applied to Russian exporters last year sent prices for wheat surging from $300 to $450 per ton. He added that prices began declining only when those restrictions were eased, after the Russian Union of Grain Exporters raised concerns on the international level, having alerted the United Nations to the issue.

“We have faced and are still facing challenges related to banking operations,” Zerin said. “We managed to resolve nearly all the issues relating to fleets, partly arising from increased freight tariffs.” According to the head of the union, Russian grain exporters have also been cut off from the legal regulation platform as part of Western restrictions. “As a result, we are not able to resolve any legal disputes at specialised arbitration platforms,” he said. Zernin noted that the Russian Union of Grain Exporters has had to establish direct contacts with major importers of agricultural produce, to reduce the impact of sanctions. “We have defined our focus markets, such as the Middle East and North African countries, the world’s biggest grain consumers, we have established direct ties with them, and developed new strategies for trading with every nation separately,” he explained. According to the official, Russian exporters now work either under Russian legislation or follow the requirements of domestic laws of partners, staying out of global legislative framework.

“Romania and Bulgaria have seen similar waves of unrest, with farmers staging demonstrations in the capitals and blocking border crossings.”

• Poland Suspends Imports Of Ukrainian Grain (Pol.eu)

Poland will temporarily stop all imports of grain from Ukraine, the two countries’ governments announced Friday. The measure comes after a meeting earlier in the day between Poland’s new Agriculture Minister Robert Telus, who took office Thursday, with his Ukrainian counterpart Mykola Solskyi at a border crossing between the two countries. “The Ukrainian side has proposed to severely restrict, and for the moment even stop completely, grain arrivals to Poland,” Telus said during a joint press conference after the meeting. He added that restrictions would not extend to the transit of grain intended for other countries. Following Russia’s invasion, Ukraine was forced to divert around half of its exports from the blocked Black Sea ports into Poland, Hungary, Romania and other border countries.

The move, facilitated by the European Commission and EU countries, was meant to throw an economic lifeline to Ukraine, one of the world’s largest agricultural producers, and ensure its exports could reach global markets. But, instead of leaving the EU’s eastern member countries, much of the produce has instead flooded local markets. Earlier this week, Telus’ predecessor, Henryk Kowalczyk, resigned amid mass farmers’ protests over the issue. Romania and Bulgaria have seen similar waves of unrest, with farmers staging demonstrations in the capitals and blocking border crossings.

“The situation is difficult for both Ukrainian and Polish farmers. We all understand who is to blame, but we have to solve this problem. The Ukrainian side will refrain from exporting wheat, corn, rapeseed and sunflower to Poland until the new season,” Solskyi said, referring to this summer’s harvest. Solskyi added that the two sides would meet again in the coming days to ensure smooth transit of grain intended for other countries. “We are counting on the most constructive position of the Polish side regarding the transit of Ukrainian grain to Polish ports and ports of other EU countries,” he said.

“..the desire for a sense of security (belonging to a powerful community) overrides the practical considerations of avoiding danger (the prospect of becoming a target or a battlefield)”

• Finland May Come To Regret Joining NATO When Everyone Sobers Up (Lukyanov)

The idea of abandoning the policy of non-alignment has always been present in Finland, as has a public and political consensus that it was inadvisable. Indeed, for 30 years the idea of a new military confrontation in Europe was solely the preserve of the most indomitable ‘Cold Warriors,’ and even the enlargement of NATO was presented primarily in political and ideological, not military, terms. The return of the reality of war has shaken all of Europe. In Sweden and Finland, the decision to abandon non-alignment and join NATO was taken immediately, and public opinion was turned on its head. Remarkably, there was almost no discussion of whether neutral status was a more reliable way of ensuring national security; membership of the military bloc was seen as the only option. Before that, non-participation had long been considered the most sensible approach. So, why the sudden change?

There are several reasons for this, but one is worth highlighting. There is a term known as ‘securitization’ – where a security dimension is given to everything: economic, cultural and even humanitarian processes. There is now a counter-experience, with the issue of classical security taking on a value-based form. That is, belonging to a particular ideological and ethical group, and being openly opposed to others, is seen as a more effective way of protecting oneself than remaining aloof from confrontation. This is a psychological rather than a military-technical phenomenon. Put simply, the desire for a sense of security (belonging to a powerful community) overrides the practical considerations of avoiding danger (the prospect of becoming a target or a battlefield).

This in itself is a result of the radicalization of values that took place in the West, as part of the wave of euphoria following the Cold War, when the “right side of history” prevailed. Hence the rejection of neutrality and the need to take into consideration the concerns of the “wrong” side, on the basis that those who aren’t in the same moral and ethical boat can’t be trusted. The current attitude to neutrality is the product of two simultaneous concepts: ’the long peace’ and ’the end of history.’ The first is because it has become obvious that delicate balances and safeguards are simply no longer relevant. The second is down to the belief that it’s clear whose side the historical truth is on (the West), so there is no need to flirt with representatives of the “doomed” opponent. Both perspectives are already things of the past. A rethink is inevitable.

Ritter Finland

Scott Ritter explains #Finland's losing gambit in joining #NATO – abandoning neutrality in favour of an expensive military build up and the associated risks. No lesson learned from Finland's Nazi aligned past, it seems. pic.twitter.com/NLcCFiMvnm

— tim anderson (@timand2037) April 8, 2023

” Italy had 12 deaths for every seven births last year..”

• Italy’s Birth Rate At Historic Low (RT)

Fewer than 400,000 babies were born in Italy in 2022, deepening what has been referred to as a “national emergency” as the country’s population declines to historically low levels, according to figures released by the EU nation’s National Institute of Statistics. The total number of newborns dropped about 1.8% from the 400,249 births recorded in Italy in 2021, the lowest such figure since 1861. The newly tallied statistics, released on Friday by Italy’s statistics bureau, mean that Italy had 12 deaths for every seven births last year as the country’s overall population dropped by 179,000. “It’s a demographic crisis,” said Maria Rita Testa, a demographer at Luiss University in Rome, via the Financial Times. “We are going to lose a lot of people in the future,” she said of a situation attributable simply to the fact that “women are just having fewer children.”

The population decline follows the introduction of a financial incentive scheme in 2021 by the former government led by Mario Draghi, which would provide families with monthly financial incentives for each child born, ranging between €50 to €175 ($55 to $192) depending on the family’s income. The leader of Italy’s current right-wing government, Giorgia Meloni, made addressing the population decline a key element of her election campaign last year. This policy pledge came amid concerns that the dwindling populace would put increasing strain on various key public sectors such as the funding of healthcare systems. Italy already has one of the highest debt-to-GDP levels in Europe at 135%.

“Having a low fertility rate is an issue that doesn’t belong to the right or the left-wing political side, it’s a national emergency,” Senator Lavinia Mennuni of the ruling Brothers of Italy party said last year. “We have to put working mothers back at the center of any political decision.” Italy’s population has been falling since 2014, with a total drop of around 1.36 million people during that time – roughly equivalent to the population of Milan, Italy’s second-largest city. However, these numbers have been partially offset by immigration as immigrants exceeded emigrants by 229,000 in 2022.

“The central bank will have the power to enforce dollar limits on our transactions restricting where you can send money, where you can spend it, and when money expires.”

• RFK Jr. Strongly Disapproves Of CBDCs And Digital IDs (IP)

Presidential candidate Robert F. Kennedy Jr. is resisting the notion of centralized control and recently blasted CBDCs and digital IDs. Kennedy, who is an environmental lawyer, has announced his plan to run for the US presidency as a Democrat in 2024. He made this announcement after filing the necessary paperwork with the Federal Election Commission on April 5th. In a separate event, Kennedy shared his views on CBDCs on Twitter. “The Fed just announced it will introduce its ‘FedNow’ Central Bank Digital Currency (CBDC) in July,” he said.

The Fed just announced it will introduce its “FedNow” Central Bank Digital Currency (CBDC) in July. CBDCs grease the slippery slope to financial slavery and political tyranny.

While cash transactions are anonymous, a #CBDC will allow the government to surveil all our private…

— Robert F. Kennedy Jr (@RobertKennedyJr) April 5, 2023

This statement is not entirely accurate. Although the Federal Reserve has revealed its plans to launch the FedNow payment system in July, it is not considered a CBDC. Nevertheless, the implementation of this system could potentially aid in the development of a future CBDC, which the Biden Administration has expressed interest in supporting. “While cash transactions are anonymous, a #CBDC will allow the government to surveil all our private financial affairs,” the environmental lawyer warned. “The central bank will have the power to enforce dollar limits on our transactions restricting where you can send money, where you can spend it, and when money expires.” Kennedy also warned about the possible risks of such technology.

“A CBDC tied to digital ID and social credit score will allow the government to freeze your assets or limit your spending to approved vendors if you fail to comply with arbitrary diktats, i.e. vaccine mandates. “The Fed will initially limit its CBDC to interbank transactions but we should not be blind to the obvious danger that this is the first step in banning and seizing bitcoin as the Treasury did with gold 90 years ago today in 1933. “Watch as governments, which never let a good crisis go to waste, use Covid-19 and the banking crisis to usher in a new wave of CBDCs as a safe haven from germ-laden paper currencies or as protection against bank runs.” His tweet had 7.3 million views at the time of writing this article.

“Trump still makes news and boosts ratings in a way that no other US political candidate ever has. Which is a problem for anyone running against him.”

• When Trump Sucks All The Oxygen In The Race – Katty Kay (BBC)

“Down in Mar-a-Lago, they’re calling it total dominance,” the Trump associate chuckled as he slid his phone across the desk to show me a photo. The image was of a dozen different TV channels all tuned to Trump’s speech hours after the former president’s historic arrest. It was taken by one of Trump’s aides who was with him down in Florida and then sent around as bragging rights to show how much coverage Trump can still command. “They just give us free airtime,” the associate added, almost perplexed. If American election campaigns are a war, TV is the battlefield and this week team Trump blew all his opponents off the map. [..] The arrest was a big deal and it will change American politics. But hours of coverage of an uneventful journey from Palm Beach to Manhattan gave Mr Trump a lot of TV time that he didn’t have to pay for out of campaign funds.

Back in 2016 the US press was criticised for covering the ever colourful Mr Trump more extensively than his Republican rivals for the presidential nomination. He would famously call into cable news TV shows on his cell phone and get 20 minutes of airtime (full disclosure, I took part in some of those interviews. He once told me I was too negative about his campaign, but added that I shouldn’t worry about it.) Afterwards there was some hand wringing among Democrats who accused the media of helping Mr Trump win the White House just by covering him so much – which is ironic since the American media is often accused of skewing left. But at least when Mr Trump called into TV shows he was talking and saying something and being interviewed by reporters who had often tough questions and he got a lot of push back.

This week he got airtime by just sitting on the tarmac. Total dominance. This is not 2016, and most newsrooms have thought hard about their Trump coverage. On Tuesday night several TV stations, including the BBC, dipped out of Trump’s speech after a couple of minutes in order not to relay what was effectively a campaign rally. MSNBC didn’t run the speech at all. But nearly all stations were glued to his flight up to New York the day before his court appearance – I even saw a tweet that an Italian TV channel was running it live. And of course the reason is clear. Trump still makes news and boosts ratings in a way that no other US political candidate ever has. Which is a problem for anyone running against him. Did you know that Florida Governor Ron DeSantis was in the swing state of Michigan this week, talking to a packed convention hall of Republican voters?

Or that Nikki Haley, one of only three Republicans actually officially running for the presidency, announced this week that she’s raised $11 million in campaign funds? Maybe you missed that news because you were glued instead to President Joe Biden’s speech in Minnesota, touting the benefits of his administration’s manufacturing policy. No? Don’t feel bad, we’re all in the same Trump-powered boat. It is too soon to say whether this week’s arrest is good news for Donald Trump’s candidacy or not. But it did teach us one thing for sure – Mr Trump still dominates headlines. Which means the other Republican candidates, as well as the current president himself, will have to find a way to get media coverage of their own. And the American TV networks will have to decide what is newsworthy in the Trump campaign, and what isn’t. None of that is easy.

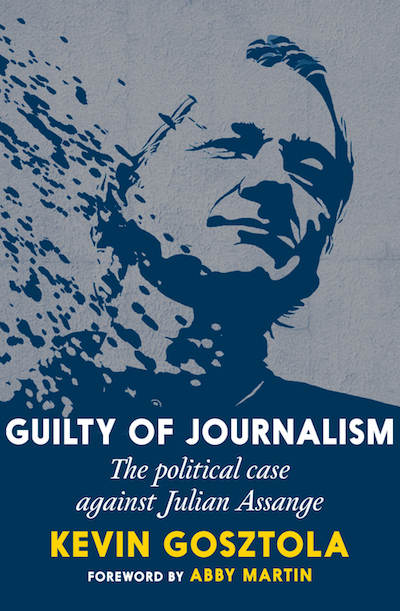

Book review.

• The Case Against the Case Against Julian Assange (Rohde)

Like the Trump administration that preceded it, the Biden administration is seeking the extradition of WikiLeaks founder Julian Assange to stand trial on an indictment under the infamous Espionage Act of 1917. As the unprecedented U.S. prosecution of Assange reaches a critical stage, a growing number of elite media outlets, human rights advocates and press freedom organizations around the world are demanding his release. All have expressed basic agreement with Nils Melzer, former UN Special Rapporteur on Torture, who describes the case against Assange as a scandal that “represents the failure of Western rule of law.”

Time is running out to correct this failure. Last August, Assange filed an appeal before the U.K. High Court of Justice Administrative Court arguing that his extradition would violate U.K. law because he is being prosecuted for his political opinions and protected speech; that the request itself violates the U.S.-UK Extradition Treaty and international law because it is based on “political offenses;” that the U.S. government has misrepresented the core facts of the case to the British courts; and that the extradition request and its surrounding circumstances constitute an abuse of process. If Assange loses this appeal, his last resort is the European Court of Human Rights.

No one has covered the Assange case more tenaciously, as well as the broader attack on whistleblowers, than journalist Kevin Gosztola. In “Guilty of Journalism: The Political Case Against Julian Assange,” Gosztola expands upon his reports of Assange’s extradition hearings in London during September and October 2020, and in a clear and compelling style, recounts the key events in the case. But he also does more than that. “Guilty of Journalism” offers revelations of egregious conduct by the U.S., including the use of knowingly false testimony, illegal surveillance of Assange and his lawyers and CIA plans to kidnap and assassinate him. These disclosures compound an already shocking tale of injustice at the hands of the U.S. government.

Opening his first chapter with the unequivocal declaration, “Julian Assange is a journalist,” Kosztola never loses sight of the extraordinary contributions WikiLeaks has made through its public disclosures since its founding in 2006. He includes an informative Appendix entitled, “Thirty WikiLeaks Files the Government Doesn’t Want You to Read,” covering climate change and the environment, corporate power, human rights abuses, regime change, foreign policy and U.S. politics. These files, he writes, “reflect the positive impact that WikiLeaks has had by boosting our shared knowledge of a government that rules the most powerful country in the world.”

“I can confirm we are continuing our efforts to seek the extradition of Julian Assange..”

• Biden Admin Has No Plans To Drop Charges Against Assange (Maynard)

In a week when the Biden administration worked to free a truth teller arrested in Russia, it doubled down on its commitment to punish another truth teller arrested in Western Europe. “I can confirm we are continuing our efforts to seek the extradition of Julian Assange,” Justice Department spokesperson Nicole Navas Oxman told Poynter on Monday. The statement was released in a period when pressure to release the WikiLeaks founder has come from many directions, with members of Congress, the British press and a Russian state official all chiming in on Assange’s continued detention in Britain at the behest of American authorities.

[..] The U.S. government’s push to punish Assange is a matter of the public’s right to know, Morinière said, with his case setting “a dangerous precedent that any member of the media, in any country, can now be targeted by governments, anywhere in the world, to answer for publishing information in the public interest.” “Debating whether he is a journalist is a distraction from the indisputable fact that he’s being (prosecuted) for committing acts of journalism,” said Seth Stern, director of advocacy for the Freedom of the Press Foundation, in an email. “The First Amendment doesn’t limit itself to protecting card-carrying journalists,” he said. “It says ‘Congress shall make no law … abridging the freedom of speech, or of the press.’ Assange is being prosecuted under a law that not only abridges freedom of the press but criminalizes essentially the dictionary definition of investigative journalism. If that’s permitted by the First Amendment then the First Amendment does not mean much.”

[..] Much of the debate over WikiLeaks during the Obama administration — which used the constitutionally dubious Espionage Act of 1917 more than all past administrations combined, but still restrained itself when it came to prosecuting Assange — hinged on what was at the time called the “New York Times problem.” That debate postulated that if the prosecution of Assange set a marker, there would be little to prevent future administrations from prosecuting reporters from The New York Times, as most Times reporters who wrote military and national security stories regularly did most of the actions Assange was accused of doing. Prosecuting such a publication “would obviously be undesirable,” said a representative for Britain’s National Union of Journalists via email. That’s both because the Times is North America’s most established and trusted news organization, the spokesperson said, and also because “when it was tried in 1971 (USA v. NYT) over publication of the Pentagon Papers, the Supreme Court upheld the NYT’s rights under the First Amendment.”

O’Looney funeral director

https://twitter.com/i/status/1644656316173160449

https://twitter.com/i/status/1641600075531968512

Makis

https://twitter.com/i/status/1644670228008239106

Food vaccines

FOOD VACCINES – Last week the U.K. allowed genetically medicines food into your food chain. Even though the public has consistently rejected it.

Vaccinated food will remove your informed consent. But then the public’s consent no longer matters.

Focus!

— Bernie's Tweets (@BernieSpofforth) April 8, 2023

https://twitter.com/i/status/1642910169230381056

Yareta is an evergreen perennial plant with tens of thousands of flowering buds. It is estimated to grow approximately 1.5 centimeters per year and many yaretas are estimated to be over 3,000 years old.

Grandala are deeply sexually dimorphic and this is the difference. While females are brown with white streaks all over the head, males are almost eye-searing blue. This picture captured by Rajesh Panwar in North Sikkim, India

Orca

https://twitter.com/i/status/1644743191596285952

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.