John La Farge Girls Carrying a Canoe, Vaiala in Samoa 1891

Feels like China’s just going through the motions.

• China Announces New Tariffs On 128 US Products (CNBC)

China is implementing new tariffs on meat, fruit and other products from the U.S. as retaliation for American duties, heightening fears of a potential trade war between the world’s two largest economies. Beijing’s latest move, announced by its finance ministry in a statement dated April 1, is direct retaliation against taxes approved by President Donald Trump on imported steel and aluminum. Chinese officials had been warning over the last few weeks that their country would take action against the U.S. The tariffs begin on Monday, the finance ministry statement said. China’s Customs Tariff Commission is increasing the tariff rate on pork products and aluminum scrap by 25 percent. It’s also imposing a new 15 percent tariff on 120 other imported U.S. commodities, from almonds to apples and berries.

All told, the extra tariffs will hit 128 kinds of U.S. products, multiple outlets reported. The list of new duties matches the proposed list released by the government on March 23, according to Reuters. At that time, China said the affected U.S. goods had an import value of $3 billion in 2017 and included wine, fresh fruit, dried fruit and nuts, steel pipes, modified ethanol and ginseng. The decision to target $3 billion in U.S. imports is significant, but it’s widely seen as a drop in the ocean given the size of the bilateral trading relationship. U.S. goods exported to China in 2016 totaled $115.6 billion, according to official data. China’s retaliation is “a statement of intent … but it’s not an escalation in our opinion,” Steve Brice, chief investment strategist at Standard Chartered Private Bank, told CNBC on Monday.

One of many, really.

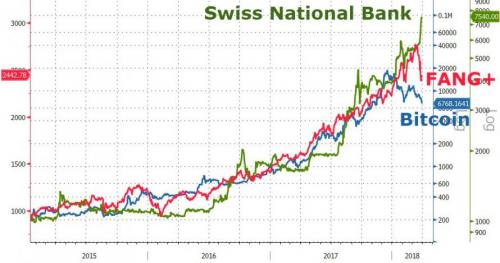

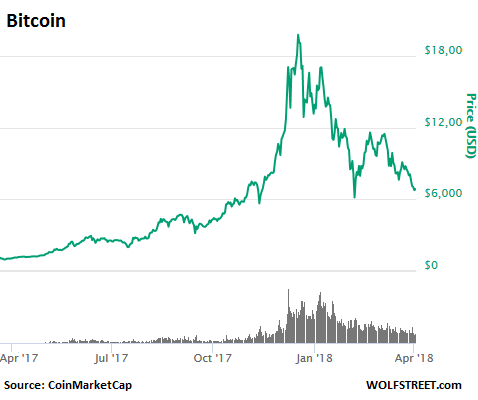

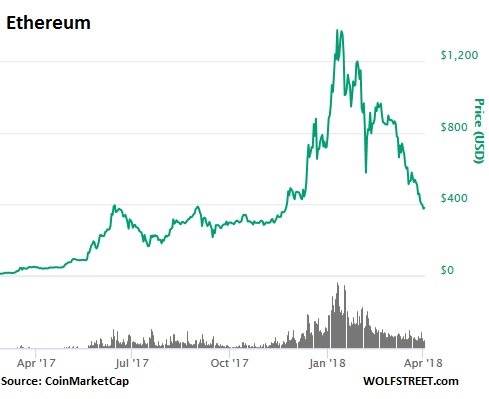

After a seemingly unstoppable surge higher for years, March was a tough one for tech stocks, as the curtain was lifted exposing Oz-like machinations behind the scenes that spooked investors enough to pop the bubble of delusion so many were living in. After a magnificent 2017, Cryptocurrencies also started 2018 off poorly as yet another ‘bubble’ popped. However, there was one ‘asset’ that had a tremendous 2017, and has gone on to greater and bubblier things in 2018. Spot the real bubble in financial markets… Bitcoin has bust, FANG stocks are FUBAR, but The SNB is accelerating.

As we noted previously, The SNB made 32 times more than 85 Swiss private banks… and owns a record $100 billion-plus of American stocks… $11,589.01. – That’s the US dollar amount of American stocks the Swiss National Bank owns on behalf of every man, woman and child in Switzerland. Let that sink in. A Central Bank has taken on itself to expand its balance sheet and invest in the proceeds, not in gold, nor sovereign debt – heck not even in corporate bonds. Nope, the SNB has taken it upon itself to “invest” that money in another country’s most risky part of the capital structure – equity. And don’t think it’s a small number. It’s almost $100 billion US dollars.

In a strange twist of fate, the Swiss National Bank is not only Switzerland’s Central Bank, but also a publicly traded security. And that ‘security’ has had a great year so far – up a stunning 93%…

However, as Holger Zschaepitz notes, the market cap of the Swiss National Bank remains below CHF1bn amidst a profit of CHF54.4bn. But that didn’t stop investors piling in to The SNB in March as a ‘safe haven’ as the rest of the world collapsed… As Macro Tourist’s Kevin Muir concluded previously, I worry that right now, Central Banks are being rewarded for keeping their balance sheets as big and risky as they can stomach. It appears to be a trade with no cost, and in fact, helps out by both keeping their currency weak, and in the meantime, making some money. It encourages them to be extremely slow easing off the accelerator. The idiocy of Central Banks taking this sort of risk is beyond description, but no sense arguing about it – it is what it is.

65%.

• Cryptocurrencies: Nothing Goes To Heck In A Straight Line (WS)

I don’t think there has ever been an entire sector that skyrocketed as much and collapsed as quickly as the cryptocurrency space. The skyrocketing phase culminated at the turn of the year. Then the collapse phase set in, with different cryptos choosing different points in time. It doesn’t help that regulators around the world have caught on to these schemes called initial coin offerings (ICOs), where anyone, even the government of Venezuela, can try to sell homemade digital tokens to the gullible and take their “fiat” money from them and run away with it. There are now 1,596 cryptocurrencies and tokens out there, up from a handful a few years ago. And the gullible are getting cleaned out.

And it doesn’t help that the ways to promote these schemes are being closed off, one after the other. At the end of January, Facebook announced that, suddenly, “misleading or deceptive ads have no place on Facebook,” and it prohibited ads about ICOs and cryptos. On March 14, Google announced that it will block ads with “cryptocurrencies and related content,” including ICOs, cryptocurrency exchanges, cryptocurrency wallets, and cryptocurrency trading advice. Its crackdown begins in June. On March 26, Twitter announced that it would ban ads of ICOs, cryptocurrency exchanges, and cryptocurrency wallet services, unless they are by public companies traded on major stock markets. It will roll out its policy over the next 30 days.

On March 29, MailChimp, a major email mass-distribution service, announced that it will block email promos from businesses that are “involved in any aspect of the sale, transaction, exchange, storage, marketing or production of cryptocurrencies, virtual currencies, and any digital assets related to an Initial Coin Offering.” This broadened and tightened its policy announced in February that promised to shut down any account related to promos of ICOs or blockchain activity. The overall cryptocurrency space, in terms of market capitalization, peaked on January 4, when market cap reached $707 billion, according to CoinMarketCap. Less than three months later, market cap has now plunged by 65% to $245 billion. $462 billion went up in smoke.

It’s hard to accept that your entire country is pushing up daisies. But you got to sell your paper. So you get a real heavy headline, and then quote someone saying: “..the numbers were “generally pretty good news for retailers”..

• Easter Shoppers Desert UK High Streets, Spreading Retail Gloom (G.)

The gloom on Britain’s high streets deepened over the Easter bank holiday weekend as heavy rain in many areas drove people to seek the shelter of shopping centres or simply stay at home. The number of shoppers on UK high streets on Easter Sunday morning slumped by over 12% compared with 2017, according to retail intelligence firm Springboard. That followed a disappointing Good Friday, when high street footfall fell by 9.6%. Saturday was little better, with footfall down 6.9% year-on-year. This weekend had been billed as the most anticipated weekend for retail since Christmas, but Springboard said bad weather in some parts of the country had “definitely hit high streets”, and pulled the overall result for all UK shopping destinations down into minus figures.

A week ago Springboard predicted that this Easter weekend’s UK retail footfall could end up 2.4% higher than last year’s, though it had said this assumed “normal weather”. It added that if freezing conditions similar to those caused by the “beast from the east” returned, all bets were off. In the event wet weather sent a chill through the high streets, meaning footfall across all shopping destinations was down 2.4% on Good Friday and 3% lower on Saturday. However, retail parks and shopping centres typically enjoyed better fortunes than they did last year. Diane Wehrle, Springboard’s marketing and insights director, said the rain kept many people away from their local high street shops. But “at the same time, people did go shopping” rather than staying at home and browsing the web.

She said the numbers were “generally pretty good news for retailers”, many of whom would be quite heartened by the numbers of shoppers out on Good Friday and Holy Saturday. With predictions of snow in some parts of the country for Easter Monday, many retailers will be crossing their fingers and hoping that conditions are not too challenging. Last week it emerged that high street sales had slumped at the fastest rate for early spring in at least five years, as cold and snowy weather kept people away from the shops. Wehrle said of Easter Monday: “If it starts off dry in the morning, that will shape the day. If people wake up and it’s snowing, that will be it.”

“..for shareholders and pension plans, the tarnishing of tech could have serious consequences.”

• Trouble For Big Tech As Consumers Sour On Amazon, Facebook And Co (G.)

Trump is going after Amazon; Congress is after Facebook; Google is too big, and Apple is short of new products. Is it any surprise that sentiment toward the tech industry giants is turning sour? The consequences of such a readjustment, however, may be dire. The past two weeks have been difficult for the tech sector by every measure. Tech stocks have largely driven the year’s stock market decline, the largest quarterly drop since 2015. Facebook saw more than $50bn shaved off its value after the Observer revealed that had harvested millions of people’s user data for political profiling. Now users are deleting accounts, and regulators may seek to limit how the company monetizes data, threatening Facebook’s business model.

On Monday, the Federal Trade Commission confirmed it was investigating the company’s data practices. Additionally, Facebook said it would to London to appear in front of UK lawmakers, but it would not send the chief executive, Mark Zuckerberg, who is increasingly seen as isolated and aloof. Shares of Facebook have declined more than 17% from the close on Friday 16 March to the close on Thursday before the Easter break. Amazon, meanwhile, long the target of President Trump’s ire, saw more than $30bn, or 5%, shaved off its $693bn market capitalization after it was reported that the president was “obsessed” with the company and that he “wondered aloud if there may be any way to go after Amazon with antitrust or competition law”.

Shares of Apple, and Google’s parent company Alphabet, are also down, dropping on concerns that tech firms now face tighter regulation across the board. For Apple, there’s an additional concern that following poor sales of its $1,000 iPhone X. For Google, there’s the prospect not only of tighter regulation on how it sells user date to advertisers, but also the fear of losing an important Android software patent case with Oracle. Big tech’s critics may be forgiven a moment of schadenfreude. But for shareholders and pension plans, the tarnishing of tech could have serious consequences.

More on the article in yesterday’s Debt Rattle.

• Google, Facebook Too Big To Be Governed, Could Be Dismantled – Macron (Ind.)

Emmanuel Macron, the French president, has warned that Google and Facebook are becoming too big to be governed and could face being dismantled. Internet giants could be forced to pay for the disruption they cause in society and submit to French or European privacy regulations, he suggested. In an interview with the magazine Wired, the president warned that artificial intelligence (AI) would challenge democracy and open a Pandora’s box of privacy issues. He was speaking after announcing a €1.5bn (£1.32bn) investment in artificial intelligence research to accelerate innovation and catch up with China and the US.

Mr Macron said companies such as Google and Facebook were welcome in France, brought jobs and were “part of our ecosystem”. But he warned: “They have a very classical issue in a monopoly situation; they are huge players. At a point of time – but I think it will be a US problem, not a European problem – at a point of time, your government, your people, may say, ‘Wake up. They are too big.’ “Not just too big to fail, but too big to be governed. Which is brand new. “So at this point, you may choose to dismantle. That’s what happened at the very beginning of the oil sector when you had these big giants. That’s a competition issue.”

We don’t know nearly enough on ME economies. So this is a real good find.

• The Middle East Is Doomed (Ehsani)

Authored by “Ehsani” – a Middle East expert, Syrian-American banker and financial analyst who visits the region frequently and writes for the influential geopolitical analysis blog, Syria Comment.

* * *

The Mideast is doomed. Egypt alone needs to create 700,000 jobs every single year to absorb the new job seekers out its 98 million population. A third of this population already live below the poverty line (482 Egyptian Pounds a month, which is less than $1 a day). The seeds of the vicious circle that the Mideast region finds itself in today were planted at least 5 decades ago. Excessive public spending without matching revenues were the catalyst to a faulty and dangerous incentive system that helped to balloon populations beyond control. A governance system that was ostensibly put in place to help the poor ended up being a built-in factory for poverty generation. Excessive subsidies helped misallocate resources and mask the true cost of living for households. Correlation between family size and income was lost.

Successive Mideast leaders are often referred to as evil dictators. I see them more as lousy economists and poor users of simple arithmetic and excel spreadsheets that can help demonstrate the simple, yet devastating power of compounding. Unless you are a Gulf-based monarchy enjoying the revenue stream from oil and gas that can postpone your day of reckoning, the numbers in nearly every single Arab country don’t add up. t is important to note that excessive population growth is not fundamental the issue here. Japan and many parts of Europe are suffering from too little population growth. The problem in Arab societies is lack of productivity stemming from weak private sector and overburdened bankrupt public sector. As students of Economics know, “Potential” Economic Growth of a country is derived by adding the growth rate of its labor force to the growth rate of the economy’s productivity.

High labor force growth therefore ought to be a plus for the “Potential Growth”. The Arab World’s problem is that it suffers from shockingly low levels of “productivity”. This may seem like a fancy word but the concept encapsulates everything that Arab economies and societies suffer from. Why does the Arab world have such low productivity? The answer lies in everything from excessive size of public sector, subsidies and overbearing regulatory system leading to corruption. As public sector liabilities grow, education, healthcare & infrastructure funding suffers. Why is the size of the public sector coupled with excessive subsidies the problem? Because what starts as the noble cause of helping the poor ends up masking the true costs of raising family size. Governments soon go broke. Services suffer. Anger rises. We know the drill now.

Dead on, Caitlin.

• This Is How We End Up With John Bolton (CJ)

A GoFundMe for former FBI Deputy Director Andrew McCabe, who was fired two weeks ago by Attorney General Jeff Sessions, has raised over $400,000 in less than a day. Another way to say that would be that a former officer from the US intelligence community, who is married to a successful physician and will surely receive a book deal worth millions of dollars, just had a charity drive which in less than a day raised an amount of money it would take the average American years to earn. Meanwhile, an impoverished American recently died because his GoFundMe failed to raise enough money for his insulin and an FBI whistleblower was just arrested for trying to bring transparency to the Bureau’s secret domestic surveillance practices while banks receive massive bailouts, global fossil fuel subsidies total trillions of dollars, and Amazon paid zero federal taxes last year despite earning billions.

Even leaving aside the reasons for McCabe’s firing and the shady dealings he was accused of, this is a very solid illustration of everything that is sick about the United States of America. In America you have socialism for the rich and capitalism for the poor. You have government secrecy for the powerful and surveillance for the powerless. You have charity for wealthy establishment lackeys and rugged individualism for ordinary human beings. Those at the top are uplifted even further, while those on the bottom are stomped through the floor.

Julian Assange is currently under siege in the Ecuadorian embassy, deprived of mobility, sunlight and healthcare, and now internet, phone calls and visitors, all because he dared to bring some transparency to the powerful. Meanwhile the intelligence and defense agencies who serve as the armed goon squad of the wealthy and the powerful are able to kill, destroy and pillage from behind the opaque walls of near-total government secrecy in the name of “national security”. And instead of defending the single defenseless man who speaks truth to power, mainstream media reporters around the world are spitting on him in near-unanimity because he hurts power’s feelings.

This is how we end up with John Bolton, people. This is the “kiss-up, kick-down” pathway to success that elevates bloodthirsty psychopaths like John Bolton, the worst of the worst, the ones willing to do the most killing on behalf of the powerful and the most stomping on the powerless to get to the top. This has become the unquestioned pathway in every sphere of public life. We have a situation now where the highest echelons of power are not the wisest among us, but the wiliest. The fourth estate is full of everyday people who at one point presumably believed they were there to bring truth to power, stomping on the silvery head of one who does, while sucking up to the very power that he regularly embarrasses with his leak drops.

All the stuff we should do but don’t. Should we instead ask why we don’t? All the ‘it’s not too late’ talk certainly doesn’t help.

• Two Degrees No Longer Seen As Global Warming Guardrail (AFP)

Limiting global warming to two degrees Celsius will not prevent destructive and deadly climate impacts, as once hoped, dozens of experts concluded in a score of scientific studies released Monday. A world that heats up by 2C (3.6 degrees Fahrenheit) – long regarded as the temperature ceiling for a climate-safe planet – could see mass displacement due to rising seas, a drop in per capita income, regional shortages of food and fresh water, and the loss of animal and plant species at an accelerated speed. Poor and emerging countries of Asia, Africa and Latin America will get hit hardest, according to the studies in the British Royal Society’s Philosophical Transactions A.

“We are detecting large changes in climate impacts for a 2C world, and so should take steps to avoid this,” said lead editor Dann Mitchell, an assistant professor at the University of Bristol. The 197-nation Paris climate treaty, inked in 2015, vows to halt warming at “well under” 2C compared to mid-19th century levels, and “pursue efforts” to cap the rise at 1.5C. UN Secretary-General Antonio Guterres on Thursday said climate change was “the most systemic threat to humankind”. With only one degree of warming so far, Earth has seen a crescendo of droughts, heatwaves, and storms ramped up by rising seas. Voluntary national pledges made under the Paris pact to cut CO2 emissions, if fulfilled, would yield a 3C world at best.

The treaty also requires that – by the end of the century – humanity stop adding more greenhouse gases to the atmosphere than oceans and forests can absorb, a threshold known as “net zero emissions”. “How fast we get to a 2C world” is critical, Mitchell told AFP. “If it only takes a couple of decades, we will be in trouble because we won’t have time to adapt to the climate.” [..] Researchers led by Felix Pretis, an economist at the University of Oxford, predict that two degrees of global warming will see GDP per person drop, on average, 13% by 2100, once costly climate change impacts are factored in. A 2ºC world will also “show significant negative impact on the rates of economic growth,” Pretis told AFP.

Home › Forums › Debt Rattle April 2 2018