B-25s fly past erupting Vesuvius, Italy 1944

Caitlin Johnstone: “A beautiful continent where the Aboriginal Dreamtime has been paved over with suburbs and shopping centers.”

• Why Bringing Assange Home Would Be The Best Possible Thing For Australia (CJ)

Well I’ll be damned, it’s about time. According to a new report by the Sydney Morning Herald, officials from Australia’s High Commission have just been spotted leaving the Ecuadorian embassy in London, accompanied by Julian Assange’s lawyer Jennifer Robinson. Robinson confirmed that a meeting had taken place, but declined to say what it was about “given the delicate diplomatic situation.” So, forgive me if I squee a bit. I am aware how subservient Australia has historically been to US interests, I am aware that those US interests entail the arrest of Assange and the destruction of WikiLeaks, and I am aware that things don’t often work out against the interests of the US-centralized empire. But there is a glimmer of hope now, coming from a direction we’ve never seen before. A certain southerly direction.

If the Australian government stepped in to protect one of its own journalists from being persecuted by the powerful empire that has dragged us into war after war and turned us into an asset of the US war/intelligence machine… well, as an Australian it makes me tear up just thinking about it. It has been absolutely humiliating watching my beloved country being degraded and exploited by the sociopathic agendas of America’s ruling elites, up to and including the imprisonment and isolation of one of our own, all because he helped share authentic, truthful documents exposing the depraved behaviors of those same ruling elites. I have had very few reasons to feel anything remotely resembling patriotism lately. If Australia brought Assange home, this would change.

We Australians do not have a very clear sense of ourselves; if we did we would never have stood for Assange’s persecution in the first place. We tend to form our national identity in terms of negatives, by the fact that we are not British and are not American, without any clear image about what we are. A bunch of white prisoners got thrown onto a gigantic island rich with ancient indigenous culture, we killed most of the continent’s inhabitants and degraded and exploited the survivors [..] That’s pretty much our entire nation right now. A beautiful continent where the Aboriginal Dreamtime has been paved over with suburbs and shopping centers.

[..] Bringing Julian Assange home could be the first step to giving ourselves a bright, shining image of who we are and what we stand for. At the moment, Australia is a lifeless vassal state hooked up to the US power establishment with our every orifice and resource being used to feed the corporatist empire. Anesthetized to the eyeballs and in a state of total submission, the return of Julian might just be the little spark we need to get the old ticker pumping for itself again. Finally standing up for ourselves, for what’s right, and for the things that Julian stands for might just be the very thing we need as a nation to discover who we really are again.

Bring him home. It’s time.

It must have been so strange for him. How can he trust these people?

• Julian Assange Gets Embassy Visit From Australian Officials (ITV)

WikiLeaks founder Julian Assange has been visited by officials from the Australian High Commission. Two officials went to the Ecuadorian Embassy in London where Mr Assange has been living for almost six years. His internet and phone connections were cut off by the Ecuadorian government six weeks ago and he was denied visitors. The Australian-born campaigner fears being extradited to the US if he leaves the embassy and being questioned about the activities of WikiLeaks. It is believed to be the first time officials from the Australian High Commission in London have visited him.

Jennifer Robinson, a member of Mr Assange’s legal team, said: “I can confirm we met with Australian government representatives in the embassy today. “Julian Assange is in a very serious situation, detained without charge for seven-and-a-half years. “He remains in the embassy because of the risk of extradition to the US. “That risk is undeniable after numerous statements by Trump administration officials, including the Director of the CIA and the US attorney-general. “Given the delicate diplomatic situation we cannot comment further at this time.”

He probably doesn’t get the irony in contradicting himself.

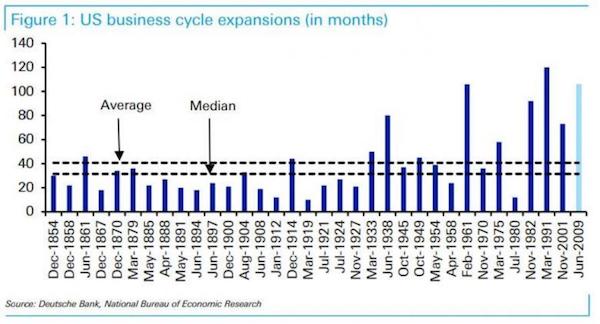

• Ben Bernanke: US Economy To Go Off The Cliff In 2020 (ZH)

Speaking at the American Enterprise Institute, Bernanke echoed Bridgewater’s biggest concern about the sugar high facing the US economy for the next 18 months, saying that the stimulative impact from Trump’s $1+ trillion fiscal stimulus “makes the Fed’s job more difficult all around” because it’s happening at a time of very low unemployment; it also means that the more supercharged the economy gets thanks to the fiscal stimulus, the greater the fall will be when the hangover hits. “What you are getting is a stimulus at the very wrong moment,” Bernanke said Thursday during a policy discussion at the American Enterprise Institute, a Washington think tank. “The economy is already at full employment.”

Stealing further from the Bridgewater note, Bernanke said that while the stimulus “is going to hit the economy in a big way this year and next year and then in 2020 Wile E. Coyote is going to go off the cliff, and it’s going to look down” just when the US economy collides head on with what Bridgewater called “an unsustainable set of conditions.” The irony here is delightful: after all it was Ben Bernanke who consistently blamed Congress for not doing enough to jumpstart the economy during his time in office – a core topic of his 2015 memoir “The Courage to Act: A Memoir of a Crisis and Its Aftermath”; it is the same Bernanke who three years later is now blaming the President and Congress for doing too much. Here is the NYT on the very topic:

“Congress is largely responsible for the incomplete recovery from the 2008 financial crisis, Ben S. Bernanke, the former Federal Reserve chairman, writes in a memoir published on Monday. Mr. Bernanke, who left the Fed in January 2014 after eight years as chairman, says the Fed’s response to the crisis was bold and effective but insufficient. “I often said that monetary policy was not a panacea — we needed Congress to do its part,” he says. “After the crisis calmed, that help was not forthcoming.” And now that Congress has more than done its part, Bernanke predicts collapse in under 2 years.

It’s starting to feel that way.

• The Return Of King Dollar Could Create A Feeding Frenzy For US Stocks (MW)

While Wall Street stocks may well be on their way to fresh highs, the dollar has been taking hits from all comers. That buck weakness is largely due to speculation the ECB may be nearing its own quantitative-easing unwind. The dollar is also sagging a bit as investors fret about the upcoming G-7 and Trump-Kim Jong Un meetings next week. But try to imagine a not-so-distant future, where King Dollar sits on the Iron Throne, while the world burns in chaos. That’s the vision laid out in our call of the day from Santiago Capital CEO Brent Johnson, who predicts the dollar will go “much, much higher” over the next one to two years. That in turn should trigger a global currency crisis and drive investors into U.S. stocks, he argues.

“What it means is we haven’t seen the blowoff top yet. I think equities are going a lot higher. This isn’t a Polyanna view — I’m not saying to go out and buy equities because things are good. I’m saying buy equities because things are bad,” says Johnson in a recent interview with Real Vision . Johnson sees big blowback from the Fed’s unwinding of quantitative easing, already underway and well ahead of the rest of the world’s central banks. That will leave fewer dollars sloshing around the global financial system, even as the world still has a big need for them. He estimates demand for the buck tops $1 trillion a year, just to pay interest on dollar-based debt.

As the Fed tightens and injects less liquidity into the system, it will cause the dollar to go higher and higher, driving more investors toward the buck and then U.S. stocks as well. And a super strong dollar will just cause chaos elsewhere, as other currencies crumble. Just ask emerging-market central bankers how hot it’s getting in the kitchen right now. In Johnson’s opinion, global financial trade revolves around the dollar, which is why it matters so much if it decides to take off in a big way. “And when that money flows into the dollar, it eventually goes into U.S. assets, and I think it is going to push equities to all-time highs,” he says.

“The U.S. will need to borrow over $3 trillion of new money in the next three years in addition to rolling over the existing $21 trillion in U.S. Treasury debt.”

• Trouble Brewing in Emerging Markets (Rickards)

Hot money has been heading out of stocks and moving in the direction of government bonds, where higher risk-adjusted returns await. With this market backdrop in mind, what are the prospects for emerging markets in the months ahead? Outflows from EM stocks have just begun and are set to accelerate dramatically in the months ahead. This could lead to a full-blown emerging-market debt crisis with some potential to morph into a global liquidity crisis of the kind last seen in 2008, possibly worse. Some of the main drivers of this outflow from EMs are:

• China has begun cracking down on excessive leverage, zombie companies and shadow banking. The result will be a slowdown in growth in the world’s second- largest economy as the Communist Party tries to bring a credit bubble in for a soft landing. If they fail, the result will be worse than a slowdown; it could be a made- in-China credit crisis

• President Trump has launched a trade war. Major U.S. trading partners such as China, Canada and Mexico are in the cross hairs. Retaliation by those trading partners will be quick in coming. This trade war is another head wind for world growth and will put added stress on EM exports to developed economies

• The U.S. budget deficit is out of control. The U.S. will need to borrow over $3 trillion of new money in the next three years in addition to rolling over the existing $21 trillion in U.S. Treasury debt. The Federal Reserve is no longer monetizing this debt and is actually reducing its holdings of U.S. Treasuries by shrinking the base money supply and deleveraging its balance sheet. This debt will find buyers at progressively higher interest rates. Since central banks are no longer buyers, private parties will have to buy this debt. Those private buyers will have to sell stocks in developed and emerging markets to have the liquidity to buy government bonds

This is an extremely potent combination. Slower growth in China, a global trade war and an epic portfolio rebalancing from stocks to government bonds will sink U.S. and emerging-market stocks. The best case will be a 30% drawdown in stocks. The worst case will be a new global liquidity crisis that makes 2008 look like a warm-up for the main event.

The most desperate bank in the world.

• Deutsche Bank’s Junk Bond Firesale (ZH)

Deutsche Bank is seeking to sell its portfolio of non-investment grade energy loans, worth about $3 billion, according to people with knowledge of the matter.

The potential firesale comes as Deutsche’s short-dated CDS (counterparty risk) is soaring..

And comes as European HY Energy debt is weakening notably and US HY Energy is as good as it gets… Bloomberg reports that Deutsche is planning to sell the loan book as a whole and has marketed it to North American and European peers, said one of the people. The portfolio is expected to sell for par value, said the people, who asked not to be identified because they weren’t authorized to speak publicly; good luck with that! The bank’s energy business is expected to wrap up on June 30, one of the people said. The bank has been an active lender in the energy space in the past year, participating in the financing of companies including Peabody Energy Corp. and Coronado Australian Holdings Pty., according to data compiled by Bloomberg.

So to summarize: Moody’s is warning that when the economy weakens we will see an avalanche of defaults like we haven’t seen before; Corporate debt-to-GDP and investor risk appetite is reminding a lot of veterans of previous credit peaks; and now the most desperate bank in the world is offering its whole junk energy debt book in a firesale… just as high yield issuance starts to slump. All of which raises more than a single hair on the back of our previous lives in credit necks… and reminds us of this…

Thank you all for coming in a little early this morning. I know yesterday was pretty bad and I wish I could say that today is gonna be less so, but that isn’t gonna be the case. Now I’m supposed to read this statement to you all here, but why don’t you just read it on your own time and I’ll just tell you what the fuck is going on here. I’ve been here all night… meeting with the Executive Committee. And the decision has been made to unwind a considerable position of the firm’s holdings in several key asset classes. The crux of it is… in the firms thinking, the party’s over as of this morning. “For those of you who’ve never been through this before, this is what the beginning of a fire sale looks like.” – Sam Rogers, Margin Call

“Concerns about more tariffs ahead likely caused some companies to front-load shipments..”

• China Trade Surplus Falls, But US Gap Widens (MW)

China’s trade surplus narrowed in May on strong imports, through the gap with the U.S. widened–in part, some economists said, because of concerns that trade tensions could worsen in the months ahead. China reported a trade surplus of $24.92 billion last month, according to customs data released Friday, narrower than April’s $28.78 billion and the $32.6 billion forecast in a poll of economists. Imports were up 26% from a year earlier–driven by rising oil prices and bigger purchases of factory inputs, some economists said–accelerating from April’s 21.5% and beating forecasts. The higher-than-expected figure came after Beijing pledged to its trading partners to increase purchases and narrow trade gaps.

Stripping out price effects, Julian Evans-Pritchard, an economist with Capital Economics, estimated that import volumes in May were still up a seasonally adjusted 5.2% from April, reversing most of the decline since the start of 2018. The increase suggests that industrial activity remains strong following the easing of wintertime pollution controls, he said. Washington and Beijing have skirmished over trade this year, increasing tariffs on some products and threatening to do so on tens of billions of dollars in other goods. Beijing in recent weeks extended an olive branch, announcing plans to increase purchases from abroad and reduce tariffs on automobiles and some consumer products ranging from food and cosmetics.

Even so, China’s trade surplus with the U.S. in May was up 11% from April, at $24.58 billion, according to Friday’s data. Concerns about more tariffs ahead likely caused some companies to front-load shipments, said Liu Xuezhi, an economist with Bank of Communications.

Shackles.

• Argentina Clinches $50 Billion IMF Financing Deal (R.)

Argentina and the International Monetary Fund said on Thursday they reached an agreement for a three-year, $50 billion standby lending arrangement, which the government said it sought to provide a safety net and avoid the frequent crises of the country’s past. Argentina requested IMF assistance on May 8 after its peso currency weakened sharply in an investor exodus from emerging markets. As part of the deal, which is subject to IMF board approval, the government pledged to speed up plans to reduce the fiscal deficit even as authorities now foresee lower growth and higher inflation in the coming years.

The deal marks a turning point for Argentina, which for years shunned the IMF after a devastating 2001-2002 economic crisis that many Argentines blamed on IMF-imposed austerity measures. President Mauricio Macri’s turn to the lender has led to protests in the country. “There is no magic, the IMF can help but Argentines need to resolve our own problems,” Treasury Minister Nicolas Dujovne said at a news conference. Dujovne said he expected the IMF’s board to approve the deal during a June 20 meeting. After that, he said he expects an immediate disbursement of 30% of the funding, or about $15 billion. Argentina will seek to reduce its fiscal deficit to 1.3% of GDP in 2019, down from 2.2% previously, Dujovne said. The deal calls for fiscal balance in 2020 and a fiscal surplus of 0.5% of GDP in 2020.

Overview of all initiatives to move away from western dominance.

• Welcome To The Post-Westphalian World (Escobar)

In his latest, avowedly “provocative” slim volume, Has the West Lost It? former Singaporean ambassador to the UN and current Professor in the Practice of Public Policy at the National University, Kishore Mahbubani frames the key question: “Viewed against the backdrop of the past 1,800 years, the recent period of Western relative over-performance against other civilizations is a major historical aberration. All such aberrations come to a natural end, and that is happening now.” It is enlightening to remember that at the Shangri-la Dialogue two years ago, Professor Xiang Lanxin, director of the Centre of One Belt and One Road Studies at the China National Institute for SCO International Exchange and Judicial Cooperation, described BRI as an avenue to a ‘post-Westphalian world.’

That’s where we are now. Western elites cannot but worry when central banks in China, Russia, India and Turkey actively increase their physical gold stash; when Moscow and Beijing discuss launching a gold-backed currency system to replace the US dollar; when the IMF warns that the debt burden of the global economy has reached $237 trillion; when the Bank for International Settlements (BIS) warns that, on top of that there is also an ungraspable $750 trillion in additional debt outstanding in derivatives. Mahbubani states the obvious: “The era of Western domination is coming to an end.” Western elites, he adds, “should lift their sights from their domestic civil wars and focus on the larger global challenges. Instead, they are, in various ways, accelerating their irrelevance and disintegration.”

The Greek court system works.

• Turkey Suspends Migrant Deal With Greece (R.)

Turkey has suspended its migrant readmission deal with Greece, Foreign Minister Mevlut Cavusoglu was quoted as saying by state-run Anadolu agency, days after Greece released from prison four Turkish soldiers who fled there after a 2016 attempted coup. The four soldiers were released on Monday after an order extending their custody expired. A decision on their asylum applications is still pending. “We have a bilateral readmission agreement. We have suspended that readmission agreement,” Cavusoglu was quoted as saying, adding that a separate migrant deal between the EU and Turkey would continue. Under the bilateral deal signed in 2001, 1,209 foreign nationals have been deported to Turkey from Greece in the last two years, data from the Greek citizens’ protection ministry showed.

Cavusoglu was quoted as saying that he believed the Greek government wanted to resolve the issue about the soldiers but that Greek judges were under pressure from the West. “The Greek government wants to resolve this issue. But we also see there is serious pressure on Greece from the West. Especially on Greek judges,” Cavusoglu was quoted as saying. The eight soldiers fled to Greece following the July 2016 failed coup in Turkey. Ankara has demanded they be handed over, accusing them of involvement in the abortive coup. Greek courts have rejected the extradition request and the soldiers have denied wrongdoing and say they fear for their lives. In May, Greece’s top administrative court rejected an appeal by the Greek government against an administrative decision by an asylum board to grant asylum to one of the Turkish soldiers.

Worst offender? Turkey.

• Mediterranean A ‘Sea Of Plastic’ (AFP)

The Mediterranean could become a “sea of plastic”, the WWF warned on Friday (June 8) in a report calling for measures to clean up one of the world’s worst affected bodies of water. The WWF said the Mediterranean had record levels of “micro-plastics,” the tiny pieces of plastic less than 5mm in size which can be found increasingly in the food chain, posing a threat to human health. “The concentration of micro-plastics is nearly four times higher” in the Mediterranean compared with open seas elsewhere in the world, said the report, “Out of the Plastic Trap: Saving the Mediterranean from Plastic Pollution.” The problem, as all over the world, is simply that plastics have become an essential part of our daily lives while recycling only accounts for a third of the waste in Europe.

Plastic represents 95 per cent of the waste floating in the Mediterranean and on its beaches, with most coming from Turkey and Spain, followed by Italy, Egypt and France, the report said. To tackle the problem, there has to be an international agreement to reduce the dumping of plastic waste and to help clear up the mess at sea, the WWF said. All countries around the Mediterranean should boost recycling, ban single-use plastics such as bags and bottles, and phase out the use of micro plastics in detergents or cosmetics by 2025. The plastics industry itself should develop recyclable and compostable products made out of renewable raw materials, not chemicals derived from oil.

Bon appetit.

• All UK Mussels Contain Plastic And Other Contaminants (Ind.)

All mussels sampled from UK coastlines and supermarkets were found to contain tiny shards of plastic and other debris in a new study. The scientists behind the report said microplastic consumption by people eating seafood in Britain was likely “common and widespread”. Though they were less certain about the resulting impact on human health, the research team emphasised the importance of further studies to determine any potential harm as a result of people eating plastic. In samples of wild mussels from eight coastal locations around the UK and eight unnamed supermarkets, 100 per cent were found to contain microplastics or other debris such as cotton and rayon.

Every 100 grams of mussels eaten contains an estimated 70 pieces of debris, according to the researchers, whose study is published in the journal Environmental Pollution. Mussels feed by filtering seawater through their bodies, meaning they ingest small particles of plastic and other materials as well as their food. There was more debris in the wild mussels, which were sampled from Edinburgh, Filey, Hastings, Brighton, Plymouth, Cardiff and Wallasey, than in the farmed mussels bought in shops. But mussels from the supermarkets, which came from various places around the world, had more particles in them if they had been cooked or frozen than if they were freshly caught, the study found.