DPC Madison Avenue, Memphis, Tennessee 1906

It’ll take a long time for production levels to fall. Inertia is a major factor. And producers will be inclined to increase output, not cut it.

• America’s Going to Lose the Oil Price War (Bloomberg)

The financial debacle that has befallen Russia as the price of Brent crude dropped 50% in the last four months has overshadowed the one that potentially awaits the U.S. shale industry in 2015. It’s time to heed it, because Saudi Arabia and other major Middle Eastern oil producers are unlikely to blink and cut output, and the price is now approaching a level where U.S. production will begin shutting down. Representatives of the leading OPEC countries have been saying for weeks they would not pump less oil no matter how low its price goes. Saudi Oil Minister Ali Al-Naimi has said even $20 per barrel wouldn’t trigger a change of heart. Initial reactions in the U.S. were confident: U.S. oil producers were resilient enough; they would keep producing even at very low sale prices because the marginal cost of pumping from existing wells was even lower; OPEC would lose because its members’ social safety nets depends on the oil price; and anyway, OPEC was dead.

That optimism was reminiscent of the cavalier Russian reaction at the beginning of the price slide: In October, Russian President Vladimir Putin said “none of the serious players” was interested in an oil price below $80. This complacency has taken Russia to the brink: On Friday, Fitch downgraded its credit rating to a notch above junk, and it’ll probably go lower as the ruble continues to devalue in line with the oil slump. It’s generally a bad idea to act cocky in a price war. By definition, everybody is going to get hurt, and any victory can only be relative. The winner is he who can take the most pain. My tentative bet so far is on the Saudis – and, though it might seem counterintuitive, the Russians. For now, the only sign that U.S. crude oil production may shrink is the falling number of operational oil rigs in the U.S. It was down to 1750 last week, 61 less than the week before and four less than a year ago.

Oil output, however, is still at a record level. In the week that ended on Jan. 2, when the number of rigs also dropped, it reached 9.13 million barrels a day, more than ever before. Oil companies are only stopping production at their worst wells, which only produce a few barrels a day – at current prices, those wells aren’t worth the lease payments on the equipment. All this will eventually have an impact. According to a fresh analysis by Wood Mackenzie, “a Brent price of $40 a barrel or below would see producers shutting-in production at a level where there is a significant reduction in global oil supply. At $40 Brent, 1.5 million barrels per day is cash negative with the largest contribution coming from several oil sands projects in Canada, followed by the U.S.A. and then Colombia.”

That doesn’t mean that once Brent hits $40 – and that is the level Goldman Sachs now expects, after giving up on its forecast that OPEC would blink – shale production will automatically drop by 1.5 million barrels per day. Many U.S. frackers will keep pumping at a loss because they have debts to service: about $200 billion in total debt, comparable to the financing needs of Russia’s state energy companies. The problem for U.S. frackers is that it’s impossible to refinance those debts if you’re bleeding cash. At some point, if prices stay low, the most leveraged of the companies will go belly up, and the more successful ones won’t be able to take them over because they will have neither the cash nor the investor confidence that would help them secure debt financing.

Best name ever for an analyst firm: Fat Prophets.

• Oil Extends Drop Below $45 as US Supplies Seen Speeding Collapse (Bloomberg)

Oil extended losses to trade below $45 a barrel since amid speculation that U.S. crude stockpiles will increase, exacerbating a global supply glut that’s driven prices to the lowest in more than 5 1/2 years. Futures fell as much as 2.6% in New York, declining for a third day. Crude inventories probably gained by 1.75 million barrels last week, a Bloomberg News survey shows before government data tomorrow. The United Arab Emirates, a member of OPEC, will stand by its plan to expand output capacity even with “unstable oil prices,” according to Energy Minister Suhail Al Mazrouei.

Oil slumped almost 50% last year, the most since the 2008 financial crisis, as the U.S. pumped at the fastest rate in more than three decades and OPEC resisted calls to cut production. Goldman Sachs said crude needs to drop to $40 a barrel to “re-balance” the market, while SocGen also reduced its price forecasts. “There’s adequate supply,” David Lennox, a resource analyst at Fat Prophets in Sydney, said by phone today. “It’s really going to take someone from the supply side to step up and cut, and the only organization capable of doing something substantial is OPEC. I can’t see the U.S. reducing output.”

“Energy is $7.7 billion/$9.1 billion = 84% of the decline in the dollar value of the earnings decline we have seen in the past five weeks. See why the market is so focused on oil for the moment?”

• Here’s Why Oil Is Such A Problem For Corporate Earnings (CNBC)

Oil and natural gas are sliding again to multi-year lows, and once again it is having an influence on stocks.What’s important is to understand the outsized influence this near-daily drop in oil (six months and running!) is having on corporate earnings. Even though the energy sector is only roughly 8% of the market capitalization of the S&P 500, the decline in earnings in that sector has been so dramatic that it is affecting earnings estimate for the entire S&P 500. On December 1st, analyst anticipated that Energy earnings for Q1 2015 would decline 13.8% compared to Q1 2014, according to S&P Capital IQ. As of Monday, analysts expect Energy earnings for Q1 2015 to decline 41.0%. Think about that: in 5 weeks, earnings expectations for the entire Energy group have gone from down 13.8% to down 41.0%.

That is the biggest drop in earnings for any sector since the bank stocks collapsed in Q4 2008. What does this mean for earnings for the overall S&P 500? On December 1, analysts were expecting Q1 earnings for the entire S&P 500 to be up 8.6%. As of Monday, they’re expecting earnings to be up only 4.6%. From up 8.6% to up 4.6%. That is a drop of 4 percentage points in just 5 weeks. That is a lot, and most of it is due to the decline in Energy. Here’s another way to look at it: Q1 earnings for the Energy sector were cut by $7.7 billion from December 1 through today. The S&P 500 as a whole saw a cut of $9.1 billion during the same period. So Energy is $7.7 billion/$9.1 billion = 84% of the decline in the dollar value of the earnings decline we have seen in the past five weeks. See why the market is so focused on oil for the moment? If oil keeps dropping, estimates will be lowered even more.

This is turning into a game of whack-a-mole.

• Oil Crash May Whack Earnings Of Top US Home Builders In Texas (MarketWatch)

Crashing oil prices will hurt housing demand in key Texas markets this year, shaving profits for national builders, according to a Monday analyst note. As energy companies cut spending on jobs and exploration-and-production projects because of tumbling oil, U.S.home builders will see housing demand drop, RBC Capital Markets analysts wrote. The slump will lead builders to start 5% fewer single-family homes this year in the Lone Star State, according to RBC analysts, who lowered earnings estimates for the country’s top home-construction companies. “We believe that this assumption fairly balances the effect of a decline in oil production on state employment levels with our view that improved productivity should limit vast swings in production-related employment,” according to RBC analysts. Under one scenario, Texas housing starts could fall by as much as 10%, RBC added.

“We expect that layoffs and the ripple effect on support services will have a decidedly negative impact on housing demand in Texas,” RBC analysts wrote. While Texas is just one state, here’s why real estate trends there could hit national builders’ earnings. Texas markets, led by Houston, Dallas and Austin, make up about 16% of total U.S. home-construction plans among builders. That’s true for both single-family and multi-family home-building permits, data show. When it comes to real estate, oil’s impact won’t be limited this year to new-home building. Dropping energy prices are also expected to hit home-price appreciation. The shock from dropping oil may take some time to show up in companies’ earnings. Later this week, KB Home and Lennar, two of the country’s largest home builders, could both report fourth-quarter earnings that at least meet Wall Street consensus estimates. But forward-looking investors should listen specifically to executives’ comments about how the energy crash is hitting housing demand in Texas.

Or you could just read my The Price Of Oil Exposes The True State Of The Economy from November 27.

• Falling Oil Reveals The Truth About The Market (MarketWatch)

It seems like every day some pundit is on air arguing that falling oil is a net long-term positive for the U.S. economy. The cheaper energy gets, the more consumers have to spend elsewhere, serving as a tax cut for the average American. There is a lot of logic to that, assuming that oil’s price movement is not indicative of a major breakdown in economic and growth expectations. What’s not to love about cheap oil? The problem with this argument, of course, is that it assumes follow through to end users. If oil gets cheaper but is not fully reflected in the price of goods, the consumer does not benefit, or at least only partially does and less so than one might otherwise think. I believe this is a nuance not fully understood by those making the bull argument. Falling oil may actually be a precursor to higher volatility as investors begin to question speed’s message.

Given the extent of which oil has fallen, one would think that consumer-sensitive stocks would be skyrocketing. Cheaper oil should mean more demand for stuff sold around the country. Indeed, retail stocks have been strong, but the magnitude of their outperformance is no where near as significant as it should be. Take a look below at the price ratio of the SPDR S&P Retail Index relative to the S&P 500. As at reminder, a rising price ratio means the numerator/XRT is outperforming (up more/down less) the denominator/SPY. Note that the ratio is still below it’s 2013 peak, and that while the trend is up, the speed is not an inverse crash of oil.

Maybe this is because wage growth is faltering and that is offsetting oil’s decline, or maybe it’s because oil is a signal of some kind of economic slowdown ahead. Regardless, oil is revealing the truth about the current state of markets, as junk debt falters, long-duration Treasurys counter Fed hope for reflation, and defensive sectors actually act as defense as opposed to offense starting 2015. Our alternative inflation rotation and equity-beta rotation mutual funds and separate accounts are positioned in the near term in their respective defensive positions given our quantitative models. If oil’s crash isn’t enough to cause consumer stocks to skyrocket, one needs to indeed question the narrative against inter-market movement. I welcome volatility, which is not fear, but rather doubt about current prices relative to changing growth and inflation expectations. Truth be told.

They have no more choice than the Saudis, or anyone really. With the possible exception of the US.

• U.A.E. Sticks With Oil Output Boost Even as Prices Drop (Bloomberg)

The United Arab Emirates will stick with a plan to increase oil-production capacity to 3.5 million barrels a day in 2017 even as an oversupply pushed prices to the lowest in more than five years. “In this time of unstable oil prices, we are showing in Abu Dhabi and across the country that we remain dedicated to reach our long-term production goals,” Energy Minister Suhail Al Mazrouei said in a presentation in Abu Dhabi yesterday. “Our investments remain there.”

Oil fell to the lowest level since March 2009 yesterday after Goldman Sachs and Societe Generale cut their price forecasts. Venezuela called on OPEC producers to work together to lift prices back toward $100 a barrel. The U.A.E., the fifth-largest OPEC member, produced 2.7 million barrels a day last month and has a current capacity of 3 million barrels a day, according to data compiled by Bloomberg. Oil slumped almost 50% last year, the most since the 2008 financial crisis, amid a supply surplus estimated by Qatar at 2 million barrels a day. OPEC is battling a U.S. shale boom by resisting production cuts, signaling it’s prepared to let prices fall to a level that slows American output, which has surged to a three-decade high.

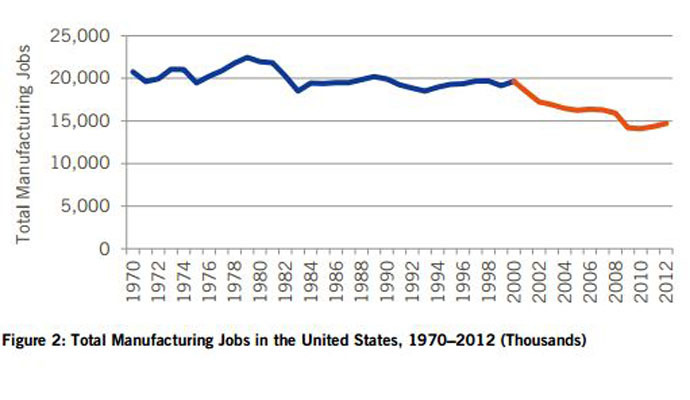

“.. we’ve added 520,000 jobs in manufacturing in the last three years .. But that compares to 2.5 million jobs lost between 2007 and 2009.”

• US Manufacturing Comeback Myth ‘Tortures The Data’ (RT)

The ‘rosy scenario’ of so-called recovery in US manufacturing is a hyped media myth, and is more fiction than reality. A new study says it offers a dangerous sense of complacency to business and the public, as America faces a $458 billion trade deficit. “A lot of people are desperate for positive economic news, so articles suggesting that there’s a revival of manufacturing get a lot of traction,” Adams Nager and Robert Atkinson, from the Information Technology & Innovation Foundation, said in Monday’s report.The Washington DC-based think tank is non-partisan and not for profit, according to the group’s website. The authors claim that many reports “torture the data” by masking the decline in manufacturing output between 2007 and 2013 in order to claim a miraculous ‘recovery’.

Though employment and output are both growing, they are not at a fast enough rate to declare a US manufacturing renaissance, the report says. “Much of the growth since the recession’s lows was just a cyclical recovery instead of real structural growth that will improve long-term conditions, and there is a strong possibility that manufacturing will once again decline once domestic demand recovers,” it says. American manufacturing has lost over a million jobs net and over 15,000 manufacturers since the beginning the recession, which took hold in 2008. Based on these numbers, the US only added one new manufacturing job for every five that were lost. “It’s true that we’ve had four straight years of growth, and that we’ve added 520,000 jobs in manufacturing in the last three years,” says Nager.

But that compares to 2.5 million jobs lost between 2007 and 2009. These figures can be accounted for due to the big turnaround in the automobile industry. The study focuses on hard numbers instead of anecdotal evidence, outlining five main myths of the US manufacturing narrative, including rising Chinese wages and the gas shale revolution, “We have stretched six cool examples [of the rebirth of manufacturing] into a whole news trend,” the authors of the report wrote. By the end of 2013, real manufacturing value added was still 3.2% below 2007 levels, even though GDP grew 5.6%. The study argues that the best measure of the health of US manufacturing is real value added. “In short, it is unwise to assume that US manufacturing will continue to rebound without significant changes in national policy,” the authors conclude in warning.

Chapter 826 in the narrative for rate hikes.

• US Wages Will Rise This Year Toward Yellen’s View of Normal (Bloomberg)

The bigger wage gains that have so far eluded American workers probably will begin to materialize this year as the job market tightens, according to economists polled by Bloomberg. Hourly earnings for employees on company payrolls will advance 2% to 3% on average, according to 61 of 69 economists surveyed Jan. 5-7. They climbed 1.7% in the year through December. While still short of the 3% to 4% increases Federal Reserve Chair Janet Yellen has said she considers “normal” with 2% inflation, it would be another sign that the labor market is making headway. A jobless rate that’s quickly approaching the range policy makers say is consistent with full employment will mean employers will need to pay up to attract and keep talent.

“By mid-year we should start to see more meaningful wage gains,” said Ryan Sweet, a senior economist at Moody’s Analytics Inc. in West Chester, Pennsylvania, whose firm projects wage growth just below 3% this year. “We’re absorbing a lot of this slack quickly.” Wages were one disappointing element in an otherwise brightening jobs market last year. Employers added an average 246,000 workers a month to payrolls, the best performance since 1999. The jobless rate sank to 5.6% in December, the lowest since June 2008 and just shy of the 5.2% to 5.5% that the Fed has defined as full employment.

But .. But .. Cheap gas gave them all that extra cash!

• UK Retailers Have Worst December Since 2008 (Guardian)

Britain’s retailers have suffered their toughest Christmas since the financial crisis struck, according to industry figures that showed sharp discounting continuing to take its toll. Capping a tough year on the high street, the value of December sales dropped by 0.4% on a year earlier in like-for-like terms, according to the British Retail Consortium (BRC) – the worst December performance since 2008, when sales had tumbled 3.3% in the aftermath of Lehman Brothers collapse. However, the trade group noted that food sales picked up in December, rising for the first time since April. There was also some support for non-food items in end-of-season sales. The figures came after mixed trading reports so far for the industry’s most crucial month. Marks & Spencer has admitted to a dismal Christmas, while Next and John Lewis saw strong sales. Debenhams and Morrisons update investors on Tuesday.

The BRC director general, Helen Dickinson, talked about a “positive performance” overall in December. “It’s clear that targeted discounting has worked for the UK’s retailers – prices have been cut just enough to encourage customers through the doors, but not so much that sales growth has been completely choked off,” she said. The BRC-KPMG retail sales monitor showed there was a 1% rise in total sales, which are not adjusted to strip out the effect of changes in floor space as shops open and close. That was also the weakest December performance since 2008. David McCorquodale, head of retail at the report’s co-authors, KPMG, highlighted the growing role discounting has played in the runup to Christmas. He said the US-inspired Black Friday of flash sales was followed by a “challenging lull in spending” as consumers waited for future bargains. “This difficult stop/start sales environment has been undoubtedly challenging, but most retailers have managed to achieve a flat, but respectable, sales performance this Christmas. Time will tell on margins,” he said.

Back in character?

• ECB Threatens to Choke Off Funding to Greece Prior to Election (Bloomberg)

The European Central Bank is threatening to choke off funding to Greece’s lenders in the hope it won’t actually need to. Parliamentary elections on Jan. 25 hinge on whether Greek voters are willing to accept a strings-attached successor to the country’s international bailout package. Under President Mario Draghi, the Frankfurt-based ECB has made its position clear: No program means no guarantee of cash from us. Draghi is reprising an ECB tactic honed in the Irish and Cypriot stages of Europe’s debt crisis, where the prospect of vanishing central-bank funds helped prod politicians into action. Amid anti-austerity promises by the Syriza party, which leads in polls, the ECB is signaling a willingness to withdraw 30 billion euros ($35 billion) of finance even if it tips Greece into a crisis that ultimately sees it leave the single currency.

“While these things might be threatened, bandied around, it would be remarkable if such a step were actually taken,” said James Nixon, chief European economist at Oxford Economics Ltd. in London. “The negotiation starts off with the threat of mutually assured destruction. But to actually withdraw funding from Greek banks is the sort of thing that would mean Greece is well on the road to exiting the euro.” Since 2010, the ECB has accepted Greece’s junk-rated government debt and state-backed securities as collateral in its refinancing operations as long as the administration complies with austerity measures and reform pledges in its international aid agreements.

This could become an even bigger threat to the EU than the Greek elections.

• RBS Bets ECB Blitz To Reach €4.5 Trillion And Reignite Asset Boom (AEP)

The European Central Bank will be forced to boost its balance sheet to €4.5 trillion in a colossal monetary blitz to prevent deflation engulfing the eurozone, economists at RBS have warned. The figure is the most aggressive forecast issued so far by any major bank and implies quantitative easing (QE) of at least €2.3 trillion, two or even three times the level suggested so far by ECB officials. It comes amid a blizzard of leaks from Frankfurt over the size and shape of QE as the ECB prepares for a pivotal decision next week. Most analysts say sovereign bond purchases are almost certain after the currency bloc slumped into deflation in December, though legal and political barriers complicate the picture.

The RBS report, entitled “Deflation Motel: you can check in, but you can’t check out”, said the buying spree will drive 10-year yields to near zero or even lower in the core countries. The German Bund yield will continue to smash historic records, dropping to 0.13% by the end of this quarter, pulling Italian yields down to 1%. “It is very easy to make a case over coming months for negative 10-year Bund yields. We are increasingly asking ourselves the question, who on Earth is the ECB going to be buying them from,” said Andrew Roberts, the bank’s credit chief. “It is Japanification no longer. It goes even further.” Germany plans a budget surplus this year that will cause Bund issuance to dry up. The report said Germany’s debt agency will cancel a net €18bn of bonds next year with maturities from five to 30 years.

This scarcity of new debt will continue since a constitutional amendment is coming into force that makes a balanced budget obligatory. The Bundesbank may have to find other ways of conducting QE, opting instead to buy the debt of the German Lander or the state development bank KfW. The report said the first blast of QE to be unveiled next week – though not necessarily enacted immediately – will fail to stop the slide towards debt-deflation as powerful deflationary pressures from Asia and the global effects of China’s excess capacity overwhelm Europe’s defences.

“Quantitative easing “would give the ECB the function of lender of last resort toward individual states” in the euro area ..” Eh, I don’t think that’s legal.

• Ifo’s Sinn Says ECB Using Deflation Risk as Excuse for QE (Bloomberg)

European Central Bank policy makers are using the specter of deflation as an excuse to help the euro area’s weaker nations, said Hans-Werner Sinn, head of Germany’s Ifo economic institute. The argument by central bankers that the ECB needs to act because inflation is below its goal of just under 2% isn’t covered by the treaty governing the currency union, Sinn said in a phone interview. Consumer prices in the euro area posted an annual decline in December for the first time in more than five years, though core inflation rose. “The risk of deflation is just a pretext for quantitative easing, for hammering out a bailout program for southern Europe,” Sinn said. The decline in inflation is due to lower crude prices and “there’s no need for ECB action,” he said.

Buying investment-grade government bonds is among the options that staff presented to ECB policy makers last week before a meeting on Jan. 22 at which they will consider further stimulus, according to a euro-area central bank official. The bank is already buying asset-backed securities and covered bonds, part of unprecedented measures announced by ECB President Mario Draghi since June that include negative deposit rates and four-year loans to banks. To ward off deflation, the ECB intends to expand its balance sheet toward €3 trillion ($3.55 trillion) from €2.2 trillion now. Complicating Draghi’s task are Greek elections on Jan. 25 that polls suggest may be won by the Syriza alliance, which wants to restructure the nation’s debt.

Quantitative easing “would give the ECB the function of lender of last resort toward individual states” in the euro area, said Sinn, who advocates an international conference to write down Greek debt. While Bundesbank head Jens Weidmann, lawmakers in German Chancellor Angela Merkel’s coalition and economists such as Sinn criticize the ECB’s expanding role, Merkel hasn’t opposed Draghi publicly. The chancellor on Jan. 7 backed keeping Greece in the euro area as long as it fulfills its austerity commitments, saying she has “always” sought to keep the euro area from splintering.

Them’s your fighting words?! The Greek government seems reluctant to go after SYRIZA too hard, lest it costs them votes. The EU will have to throw the punches.

• Greece Could Exit the Euro by Accident, Warns Finance Minister (Bloomberg)

Greece could stumble out of the euro by accident if a new government fails to reach an agreement with international creditors soon after this month’s election, Finance Minister Gikas Hardouvelis said. The main challenge facing whichever government emerges from the Jan. 25 vote will be to close the stalled review of Greek progress in meeting the terms of its financial rescue by the euro area and International Monetary Fund, he said. If that government is led by Syriza, it would be “prudent” to reverse its stance and negotiate an extension to the bailout before the aid supporting Greece expires on Feb. 28, Hardouvelis said. The prospect of “leaving the euro area is not necessarily a bluff,” Hardouvelis, 59, said in a Bloomberg Television interview in Athens yesterday. “An accident could happen, and the whole idea is to avoid it.”

Opinion polls show the opposition Syriza party of Alexis Tsipras with a slim though consistent lead over Prime Minister Antonis Samaras’s New Democracy. Tsipras has said he’ll roll back the austerity measures tied to the bailout and seek a write down on some Greek debt, putting him on a collision course with the so-called troika of creditors including the European Central Bank, which have kept the country afloat with €240 billion ($284 billion) of loans pledged since 2010. Tsipras’s commitment to keep the country in the euro area hasn’t stopped New Democracy from stoking concerns during the campaign that a Syriza victory could force Greece out of the currency bloc. The yield on Greece’s benchmark 10-year bond, which breached the 10% mark for the first time in 15 months last week, fell the most since October yesterday, suggesting investor perceptions of Syriza may be shifting.

A bubble popped: “Local government budgets, especially in smaller cities, rely heavily on land sales, which in turn are dependent on strong property demand and prices.”

• Snake Eats Its Tail: China’s Small Cities Buy Up Their Own Land (FT)

Local governments in some of China’s smallest cities are snapping up an increasing amount of their own land at auctions, in a destructive cycle designed to prop up property prices but which is ravaging their own finances. Local government financing vehicles in at least one wealthy province, Jiangsu, which borders Shanghai, accounted for more land purchases than property developers did in 2013 — the last year for which data were available — according to research collated by Deutsche Bank. The data signal that already cash-strapped local governments are switching money from one pocket to another rather than booking real sales.

“China faces a severe fiscal challenge in 2015,” as local governments are forecast to record the first contraction in revenues since 1994 and total government revenues grow by the smallest percentage since 1981, Zhang Zhiwei, Deutsche Bank’s chief Asia economist, said on Monday. Although Deutsche Bank only reviewed data for four provinces, concerns about the health of property markets in third-tier cities across China are mounting. Local government budgets, especially in smaller cities, rely heavily on land sales, which in turn are dependent on strong property demand and prices.

A glut of new building combined with tougher credit markets has cooled interest in all but the largest cities, forcing local governments to step in and prop up their own land prices. and sales account for about a quarter of local government revenues on average across China but there is a “huge range”, said Debra Roane of Moody’s rating agency. “The issue is that land as a source of revenue is highly volatile.” LGFVs appeared about six years ago. Created to fund Beijing-mandated stimulus projects in the wake of the global financial crisis, they quickly exacerbated concerns over rising levels of local government debt. Use of the vehicles to prop up land prices would further stoke those concerns.

Big fight looming between local dealers and global car manufacturers.

• Chinese Car Dealers Find Days of ‘Printing Money’ Ending (Bloomberg)

China’s car dealers are in open revolt over industry practices that have slashed profits, threatening growth prospects for companies such as General Motors and Volkswagen in the world’s biggest auto market. Retailers are banding together under the state-backed China Automobile Dealers Association to demand lower sales targets and a bigger share of profit from vehicle sales. BMW’s agreement last week to pay 5.1 billion yuan ($820 million) to its dealers has emboldened distributors for VW and Toyota to demand similar concessions. The rising tensions means companies like VW and GM will face the choice of narrower profit margins or slower growth in China, a market that increasingly determines the fortunes of global automakers.

China vehicle sales in 2014 rose at half the pace of the preceding year, a “new normal” according to BMW after surging growth in past years triggered by government subsidies. “We can’t just keep on sucking it up,” said Richard Li, 40, a Toyota dealership owner who lost about 300,000 yuan last year after offering markdowns of as much as 16% on some models. “We have to negotiate with them and defend our rights. I will stop buying cars from them unless they step up their financial support.” Total vehicle sales are forecast to rise 7% this year, little changed from 2014, because of cooling growth and as more cities impose purchase restrictions to fight pollution, according to the China Association of Automobile Manufacturers.

Almost all retailers in the country are offering discounts and selling some models at losses to meet sales targets set by automakers, according to a survey by the China Auto Dealers Chamber of Commerce. Sales targets are crucial because dealers must meet them to qualify for year-end bonuses, which account for more than half of their annual profit from selling cars, according to the trade group. “When auto sales were booming in China, dealers would do anything the automakers asked them to do in order to gain their authorization to sell cars,” said Han Weiqi, an analyst with CSC. “With the expected slowdown in demand growth, manufacturers and dealers will have to find a way to make peace and secure their common interests.”

And this won’t help.

• Car Sales Growth Halves In China (BBC)

Growth in vehicle sales in the world’s largest car market, China, halved last year as the country’s economic expansion slowed. The China Association of Automobile Manufacturers (CAAM) said that sales rose by 6.9% in 2014, compared with growth of 13.9% a year earlier. The industry body also expects the market to expand by 7% this year, in line with China’s economic growth. Global carmakers have been grappling with slowing sales in China. On Sunday, Volkswagen, which is Europe’s biggest carmaker and the top selling global brand in China, said its sales in the country rose 12.4% to 3.67 million vehicles last year, compared with growth of 16% in 2013. Japanese carmaker Toyota missed its full-year sales target in China last year, selling 1.03 million cars compared with its aim of 1.1 million. However, despite the cooling of the car market in the world’s second-largest economy, its size is still much bigger than that of its closest competitor – the US. More than 23 million vehicles were sold in China last year, compared with an estimated 16.5 million in the US.

“The banking armature that is the dwelling place of all that debt is coming apart just as surely as the 20th century Muslim nation-states that were largely a creation of the West. The long war underway is a race to the bottom where the human project has to re-set the terms of a life above savagery.”

• The Clash of Civilizations (Jim Kunstler)

The big turnout in Paris was bracing but it also might reveal a sad fallacy of Western idealism: that good intentions will safeguard soft targets. The world war underway is not anything like the last two. Against neo-medieval barbarism, the West looks pretty squishy. All of the West is one big fat soft target. Recriminations are flying – as if this was something like a Dancing with the Stars contest — to the effect that the Charlie Hebdo massacre should not be labeled as “France’s 9/11.” It’s a matter of proportion, they say: only 12 dead versus 2977 dead, plus, don’t forget, the shock of two skyscrapers pancaking into the morning bustle of lower Manhattan. Interesting to see how the West tortures itself psychologically into a state of neurasthenic fecklessness. The automatic cries for “unity,” only beg the question: for or against what? The same cries went up in the USA after the Ferguson, Missouri, riots and the Eric Garner grand jury commotion, pretty much disconnected from the reality of ghetto estrangement, as if unity meant brunch together.

The demonstrators quickly reminded everybody that Homey don’t play brunch. If French politicians think that some magical overnight state of fraternité will congeal between the alienated Islamic masses and the rest of the citizenry, they’re liable to be disappointed. If anything, mutual distrust is only hardening on each side, and, anyway, I think that is not the kind of unity they have in mind. Over in Germany, they don’t have to travel very far psychologically to recall the awful efficiency of Hitler in purifying the social scene according to some dark cthonic principle that remains essentially unexplained even after all these years and ten thousand books on the subject. It happened that he picked on a group that wasn’t disturbing the peace in any way; if anything, the Jews were busier than anyone contributing to Western culture, knowledge, and science.

It is at least well-understood that there are seasons in history, but they seem to have a mysterious, implacable dynamism that mere humans can only hope to ride like great waves, hoping to not get crushed. In the background of the present disturbances are not only the rise of Islamic fundamentalism, but the imminent collapse of the machinery that boosted up the greater Islamic economy of our time: the oil engine. It was oil and oil alone that allowed the populations of the Islamic world to blossom in a forbidding desert in the late 20th century, and that orgy of wealth is coming to an end. So will the ability of that region to support the populations now occupying it. The violent outreach of Islamic wrath is actually a symptom of the region’s death throes, already obvious in the disintegration of one nation-state after another across North Africa and the Middle East. Saudi Arabia will only be one of the last dominoes to fall because it is so stoutly girded by desperate American support.

“.. the opaque and ponderously bureaucratic nature of Russian governance, which the westerners, who love transparency (if only in others) find so unnerving ..”

• Peculiarities of Russian National Character (Dmitry Orlov)

Recent events, such as the overthrow of the government in Ukraine, the secession of Crimea and its decision to join the Russian Federation, the subsequent military campaign against civilians in Eastern Ukraine, western sanctions against Russia, and, most recently, the attack on the ruble, have caused a certain phase transition to occur within Russian society, which, I believe, is very poorly, if at all, understood in the west. This lack of understanding puts Europe at a significant disadvantage in being able to negotiate an end to this crisis.

Whereas prior to these events the Russians were rather content to consider themselves “just another European country,” they have now remembered that they are a distinct civilization, with different civilizational roots (Byzantium rather than Rome)—one that has been subject to concerted western efforts to destroy it once or twice a century, be it by Sweden, Poland, France, Germany, or some combination of the above. This has conditioned the Russian character in a specific set of ways which, if not adequately understood, is likely to lead to disaster for Europe and the world.

Lest you think that Byzantium is some minor cultural influence on Russia, it is, in fact, rather key. Byzantine cultural influences, which came along with Orthodox Christianity, first through Crimea (the birthplace of Christianity in Russia), then through the Russian capital Kiev (the same Kiev that is now the capital of Ukraine), allowed Russia to leapfrog across a millennium or so of cultural development. Such influences include the opaque and ponderously bureaucratic nature of Russian governance, which the westerners, who love transparency (if only in others) find so unnerving, along with many other things. Russians sometimes like to call Moscow the Third Rome – third after Rome itself and Constantinople – and this is not an entirely empty claim. But this is not to say that Russian civilization is derivative; yes, it has managed to absorb the entire classical heritage, viewed through a distinctly eastern lens, but its vast northern environment has transformed that heritage into something radically different.

The west won’t solve anything in the Arab world, ever, without Russian help.

• Russia Says Paris Terror Acts Show Need for ‘Urgent’ Cooperation (Bloomberg)

France’s worst terror attacks in more than half a century show the need for “urgent” cooperation between Russia and the U.S. and Europe, Russia’s top diplomat said. Russian Foreign Minister Sergei Lavrov criticized a continued freeze in anti-terrorist ties imposed over the Ukraine conflict, telling reporters in Moscow today that such a key matter shouldn’t be based on “personal emotions and grievances.” Lavrov also rejected conditions for a lifting of what he said were “illegitimate” sanctions against his country, including handing joint control of the border between separatist-controlled areas of eastern Ukraine and Russia to Ukrainian forces.

While Russia has condemned the attacks, which started with an assault on the offices of the satirical magazine Charlie Hebdo on Jan. 7 that killed 12 people, its expression of solidarity hasn’t eased tensions with its former Cold war foes. Lavrov was the most senior Russian official to join the largest march in French history yesterday in Paris along with leaders from dozens of countries. He said the militants behind the terror spree had ties to Islamists seeking the overthrow of Syrian President Bashar al-Assad, who’s also a target of the U.S. and its allies. Russia, which says the U.S. and Europe have encouraged the spread of militancy by their efforts to oust Assad, is locked in the worst geopolitical standoff since the Cold War over the fighting in Ukraine that’s killed more than 4,800 people since April.

Russia, a Soviet-era ally of Syria, has supported Assad through weapons sales and by blocking punitive action against him at the United Nations Security Council. Alexei Pushkov, a senior pro-government lawmaker in Moscow, said in comments published today that Europe is guilty of “double standards” in its attitude toward terrorism and Ukraine, where Russia accuses the government in Kiev of using force to suppress Russian speakers. Europe is heading toward a conflict of civilizations through the publication of cartoons mocking the Muslim prophet Muhammad in Charlie Hebdo, Pushkov, head of the foreign affairs committee of the lower house of parliament, said in an interview with Izvestia newspaper.

“.. the US and its allies have deliberately radicalized Muslim fighters in the hopes they would strictly fight those they are told to fight. We learned on 9/11 that sometimes they come back to fight us.”

• Lessons from Paris (Ron Paul)

After the tragic shooting at a provocative magazine in Paris last week, I pointed out that given the foreign policy positions of France we must consider blowback as a factor. Those who do not understand blowback made the ridiculous claim that I was excusing the attack or even blaming the victims. Not at all, as I abhor the initiation of force. The police blaming victims when they search for the motive of a criminal. The mainstream media immediately decided that the shooting was an attack on free speech. Many in the US preferred this version of “they hate us because we are free,” which is the claim that President Bush made after 9/11. They expressed solidarity with the French and vowed to fight for free speech. But have these people not noticed that the First Amendment is routinely violated by the US government? President Obama has used the Espionage Act more than all previous administrations combined to silence and imprison whistleblowers.

Where are the protests? Where are protesters demanding the release of John Kiriakou, who blew the whistle on the CIA use of waterboarding and other torture? The whistleblower went to prison while the torturers will not be prosecuted. No protests. If Islamic extremism is on the rise, the US and French governments are at least partly to blame. The two Paris shooters had reportedly spent the summer in Syria fighting with the rebels seeking to overthrow Syrian President Assad. They were also said to have recruited young French Muslims to go to Syria and fight Assad. But France and the United States have spent nearly four years training and equipping foreign fighters to infiltrate Syria and overthrow Assad! In other words, when it comes to Syria, the two Paris killers were on “our” side. They may have even used French or US weapons while fighting in Syria.

Beginning with Afghanistan in the 1980s, the US and its allies have deliberately radicalized Muslim fighters in the hopes they would strictly fight those they are told to fight. We learned on 9/11 that sometimes they come back to fight us. The French learned the same thing last week. Will they make better decisions knowing the blowback from such risky foreign policy? It is unlikely because they refuse to consider blowback. They prefer to believe the fantasy that they attack us because they hate our freedoms, or that they cannot stand our free speech. Perhaps one way to make us all more safe is for the US and its allies to stop supporting these extremists. Another lesson from the attack is that the surveillance state that has arisen since 9/11 is very good at following, listening to, and harassing the rest of us but is not very good at stopping terrorists.

But what about after this week?

• Charlie Hebdo to Print 3 Million Copies With Muhammad Cover (Bloomberg)

Charlie Hebdo will print 3 million copies of a special issue of the satirical magazine, depicting the Prophet Muhammad on the cover, a week after an attack at its headquarters left a third of its journalists dead. Publishers of the weekly magazine will put the copies on newsstands worldwide in 16 languages on Jan. 14. The issue will feature a cartoon of Muhammad, crying, on a green background, holding a board saying “Je suis Charlie” or “I am Charlie.” Above his image is written “All is Forgiven.” Millions of people in France and across the world rallied in marches in the past week to show support for the Charlie Hebdo victims. The killings by self-proclaimed jihadists are the deadliest attacks in France in half a century. France has been on the highest terrorist alert since the first attack.

More than 15,000 special forces are being deployed to protect sensitive sites across the country, including Jewish schools, tourist landmarks and Charlie Hebdo’s new headquarters in Paris. This week’s magazine will have six or eight pages instead of the usual 16. “This won’t be a tribute issue of some sort,” Richard Malka, Charlie Hebdo’s lawyer and spokesman, told France Info radio Monday. “We will be faithful to the spirit of the newspaper: making people laugh.” mThe magazine’s circulation has dropped over the years. While issues with covers depicting Muhammad sold about 100,000 copies, the magazine often printed 60,000 copies and sales sometimes didn’t exceed 30,000. After the attack, French Culture Minister Fleur Pellerin pledged €1 million ($1.2 million) of state money to help the publication. Google promised to give €250,000, U.K. daily The Guardian €125,000. The French press association opened a bank account which is attracting donations from the public.

“I joke that I drive the bus, but they’re the real rock stars ..”

• The Goats Fighting America’s Plant Invasion (BBC)

Each country has its own invasive species and rampant plants with a tendency to take over. In most, the techniques for dealing with them are similar – a mixture of powerful chemicals and diggers. But in the US a new weapon has joined the toolbox in recent years – the goat. In a field just outside Washington, Andy, a tall goat with long, floppy ears, nuzzles up to his owner, Brian Knox. Standing with Andy are another 70 or so goats, some basking in the low winter sun, and others huddled together around bales of hay. This is holiday time – a chance for the goats to rest and give birth before they start work again in the spring. Originally bought to be butchered – goat meat is increasingly popular in the US – these animals had a lucky escape when Knox and his business partner discovered they had hidden skills. “We got to know the goats well and thought, we can’t sell them for meat,” he says.

“So we started using them around this property on some invasive species. It worked really well, and things grew organically from there.” They are now known as the Eco Goats – a herd much in demand for their ability to clear land of invasive species and other nuisance plants up and down America’s East Coast. Poison ivy, multiflora rose and bittersweet – the goats eat them all with gusto, so Knox now markets their pest-munching services one week at a time from May to November. Over the past seven years, they have become a huge success story, consuming tons of invasive species. “I joke that I drive the bus, but they’re the real rock stars,” says Knox, who also works as a sustainability consultant. Typically, chemicals and/or machinery are used to clear away fast-growing invasive plants, but both methods have their drawbacks. Chemicals can contaminate soil and are not effective in stopping new seeds from sprouting.

Pulling plants out by machine can disturb the soil and cause erosion. Goats, says Knox, are a simple, biological solution to the problem. “This is old technology. I’d love to say I invented it, but it’s been around since time began,” he says. “We just kind of rediscovered it.” One of the reasons goats are so effective is that plant seeds rarely survive the grinding motion of their mouths and their multi-chambered stomachs – this is not always the case with other techniques which leave seeds in the soil to spring back. Unlike machinery, they can access steep and wooded areas. And tall goats, like Andy, can reach plants more than eight feet high. A herd of 35 goats can go through half an acre of dense vegetation in about four days, which, says Knox, is the same amount of time it gets them to become bored of eating the same thing.