Dorothea Lange American River camp, Sacramento, CA. Destitute family. 5 children, aged 2 to 17 years 1936

Well, I now know Taleb read my essay. And he likes it. Shame he linked to Yves’ repost, not the original at the Automatic Earth.

HITS THE SPOT:

"What is happening right now is not because all the epidemiologists & virologists around the world are wrong, but because they’re asked to make decisons and construct models about something they don’t know nearly enough about."https://t.co/3ZYBlKefbe

— Nassim Nicholas Taleb (@nntaleb) April 17, 2020

OK, OK.

Thanks @yvessmith https://t.co/3ZYBlKefbe— Nassim Nicholas Taleb (@nntaleb) April 16, 2020

• US new cases 29,567

• US new deaths 2,174

• Revised COVID-19 death toll for New York City: 10,367

• Total US military death toll for Iraq War: 4,424.

Note: both cases and deaths jump by a lot today. It’s not just the Wuhan deaths number revised up by 1,290.

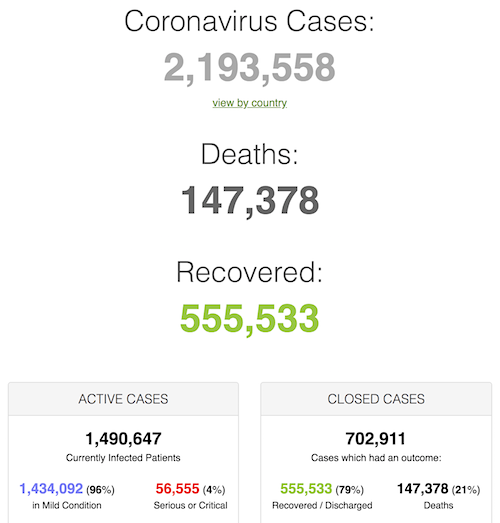

• Cases 2,193,558 (+ 98,674 from yesterday’s 2,094,884)

• Deaths 147,378 (+ 11,809 from yesterday’s 135,569)

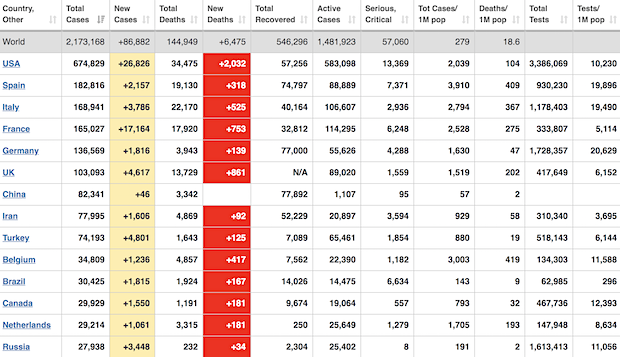

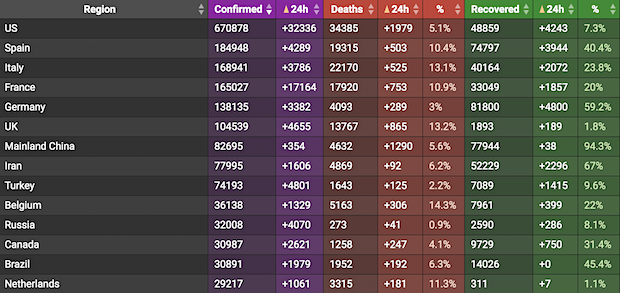

From Worldometer yesterday evening -before their day’s close- (Note: Brazil and Russia keep climbing fast)

From Worldometer – NOTE: mortality rate for closed cases remains at 21% –

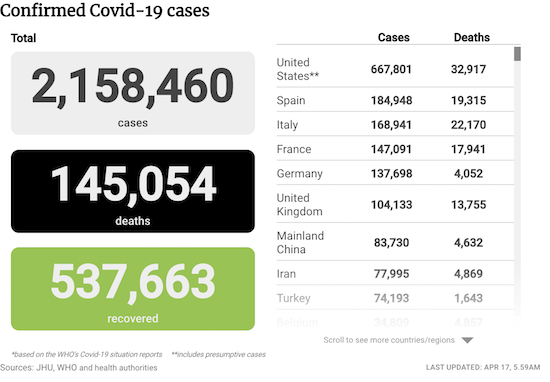

From SCMP:

From COVID19Info.live: (Belgium in first place worldwide of deaths per million at 445, 14.3% CFR, before Spain, Italy, France and UK.)

Jan. 14 to Jan. 20 was already late in the game.

• China Didn’t Warn Public Of Likely Pandemic For 6 Key Days (AP)

In the six days after top Chinese officials secretly determined they likely were facing a pandemic from a new coronavirus, the city of Wuhan at the epicenter of the disease hosted a mass banquet for tens of thousands of people; millions began traveling through for Lunar New Year celebrations. President Xi Jinping warned the public on the seventh day, Jan. 20. But by that time, more than 3,000 people had been infected during almost a week of public silence, according to internal documents obtained by AP and expert estimates based on retrospective infection data. Six days. That delay from Jan. 14 to Jan. 20 was neither the first mistake made by Chinese officials at all levels in confronting the outbreak, nor the longest lag, as governments around the world have dragged their feet for weeks and even months in addressing the virus.

But the delay by the first country to face the new coronavirus came at a critical time — the beginning of the outbreak. China’s attempt to walk a line between alerting the public and avoiding panic set the stage for a pandemic that has infected more than 2 million people and taken more than 133,000 lives. “This is tremendous,” said Zuo-Feng Zhang, an epidemiologist at the University of California, Los Angeles. “If they took action six days earlier, there would have been much fewer patients and medical facilities would have been sufficient. We might have avoided the collapse of Wuhan’s medical system.” Other experts noted that the Chinese government may have waited on warning the public to stave off hysteria, and that it did act quickly in private during that time.

But the six-day delay by China’s leaders in Beijing came on top of almost two weeks during which the national Center for Disease Control did not register any cases from local officials, internal bulletins obtained by the AP confirm. Yet during that time, from Jan. 5 to Jan. 17, hundreds of patients were appearing in hospitals not just in Wuhan but across the country. [..] The punishment of eight doctors for “rumor-mongering,” broadcast on national television on Jan. 2, sent a chill through the city’s hospitals. “Doctors in Wuhan were afraid,” said Dali Yang, a professor of Chinese politics at the University of Chicago. “It was truly intimidation of an entire profession.”

May not be coronavirus, though. In November, Beijing hospitals reported three instances of pneumonic plague (transmitted by fleas, not a virus) in people coming from Inner Mongolia:

• US Alerted Israel, NATO To Disease Outbreak In China In November (ToI )

US intelligence agencies alerted Israel to the coronavirus outbreak in China already in November, Israeli television reported Thursday. According to Channel 12 news, the US intelligence community became aware of the emerging disease in Wuhan in the second week of that month and drew up a classified document. Information on the disease outbreak was not in the public domain at that stage — and was known only apparently to the Chinese government. US intelligence informed the Trump administration, “which did not deem it of interest,” but the report said the Americans also decided to update two allies with the classified document: NATO and Israel, specifically the IDF.

The network said Israeli military officials later in November discussed the possibility of the spread of the virus to the region and how it would affect Israel and neighboring countries. The intelligence also reached Israel’s decision makers and the Health Ministry, where “nothing was done,” according to the report. Last week, ABC News reported that US intelligence officials were warning about the coronavirus in a report prepared in December by the American military’s National Center for Medical Intelligence. It was unclear if that was the same report that was said to have been shared with Israel. In its first major step to prevent the spread of the coronavirus, Israel announced on January 30 it was barring all flights from China, ten days after Chinese leader Xi Jinping issued his first public comments on the virus and the Asian country’s top epidemiologist said for the first time it could be spread from person to person.

An Associated Press report on Wednesday said Xi’s warning came seven days after Chinese officials secretly determined that they were likely facing a pandemic, potentially costing China and other countries valuable time to prepare for the outbreak. Doctors in Wuhan, the city at the center of the outbreak in China, are reported to have first tried to have warn about the virus in December, but were censored.

Many countries should follow suit. Hidden deaths are everywhere, and the incentive to report them is mostly lacking.

Holland just reported the 2nd week in a row with 2,000 more deaths than usual, but their testing is still terribly deficient.

• Wuhan Death Toll Up By 50% As 1,290 ‘Delayed & Omitted’ Fatalities Added (RT)

The Chinese city of Wuhan – ground zero for the coronavirus pandemic – has revised its fatality count, increasing the total by just shy of 1,300 deaths, which officials say went unreported due to “delays” and “omissions.” Authorities in Wuhan added another 1,290 deaths to the city’s death toll on Friday, putting the overall figures at 50,333 infections and 3,869 fatalities in the virus’ first epicenter. The revision was necessary to “address incorrect reporting, delays and omissions of cases,” city officials said, with the new numbers increasing Wuhan’s death tally by some 50%. “In the early stage of the epidemic, due to insufficient capacity for admission and treatment, a small number of medical institutions failed to connect with the disease prevention and control information system in a timely manner,” Wuhan health officials said, adding that a “statistical investigation” had been conducted to correct the figures.

More things we don’t know.

• Men Are Much More Likely To Die From Coronavirus. Why? (G.)

Early on, smoking was suggested as a likely explanation. In China, nearly 50% of men but only about 2% of women smoke, and so underlying differences in lung health were assumed to contribute to men suffering worse symptoms and outcomes. The smoking hypothesis was backed by a paper, published last month, that found smokers made up about 12% of those with less severe symptoms, but 26% of those who ended up in intensive care or died. Smoking might also act as an avenue for getting infected in the first place: smokers touch their lips more and may share contaminated cigarettes. Behavioural factors that differ across genders may also have a role. Some studies have shown that men are less likely to wash their hands, less likely to use soap, less likely to seek medical care and more likely to ignore public health advice.

These are sweeping generalisations, but across a population could place men at greater risk. However, there is a growing belief among experts that more fundamental biological factors are also at play. While there are higher proportions of male smokers in many countries – in the UK, 16.5% of men smoke compared with 13% of women – the differences are nowhere near as extreme as in China. But men continue to be overrepresented in Covid-19 statistics. “The growing observation of increased mortality in men is holding true across China, Italy, Spain. We’re seeing this across very diverse countries and cultures,” said Sabra Klein, a professor at Johns Hopkins Bloomberg School of Public Health. “When I see that, it makes me think that there must be something universal that’s contributing to this. I don’t think smoking is the leading factor.”

Previous research, including by Klein, has revealed that men have lower innate antiviral immune responses to a range of infections including hepatitis C and HIV. Studies in mice suggest this may also be true for coronaviruses, though Covid-19 specifically has not been studied. “Their immune system may not initiate an appropriate response when it initially sees the virus,” Klein said. Hormones can also play a role – oestrogen has been shown to increase antiviral responses of immune cells. And many genes that regulate the immune system are encoded on the X chromosome (of which men have one, and women have two) and so it is possible that some genes involved in the immune response are more active in women than in men.

The embassy talked about France leaving elderly patients “to die of hunger and disease.”

• France Summons Chinese Envoy Over Criticism Of COVID19 response (RT)

Paris has summoned its Chinese envoy after the embassy published a blistering critique of the West’s response to the Covid-19 crisis, accusing leaders of failing to act and abandoning vulnerable citizens to death and starvation. “Certain publicly voiced opinions by representatives of the Chinese Embassy in France are not in line with the quality of the bilateral relations between our two countries,” Foreign Minister Jean-Yves Le Drian said in a statement late on Tuesday, calling on Ambassador Lu Shaye to answer for an article published on the Chinese Embassy website over the weekend.

Entitled ‘Restoring distorted facts,’ the lengthy post – which listed no author – tore into the US and European governments for their handling of the pandemic, while defending Beijing from accusations of concealing information and of a sluggish response. “In the West, we have seen politicians tearing themselves apart to recover votes; advocate herd immunity, thus abandoning their citizens alone in the face of the viral massacre.” The article claimed that some nursing homes had been “deserted,” leaving elderly patients “to die of hunger and disease.”

The post also took aim at Western news outlets, “which take themselves for paragons of impartiality and objectivity,” yet appear to care more about “slandering, stigmatizing and attacking China” than covering the raging health crises in their own countries. “Do these media and these experts, so fond of objectivity and impartiality, have a conscience? Do they have ethics?” Responding to the blustery article, the French FM insisted “there is no room for polemics” amid the Covid-19 pandemic, stating he made his “disapproval” clear to Lu and that France and other nations must pursue “unity, solidarity and the greatest international cooperation.”

What a surprise.

• Chinese Economy Shrank For The First Time Since 1976 In Q1 (SCMP)

China’s economy shrank by 6.8 per cent in the first quarter of 2020, the first contraction since the end of the Cultural Revolution in 1976, confirming the economic damage done by the coronavirus pandemic. Over the first three months of the year, the world’s second largest economy faced an extensive shutdown as it battled to contain the spread of the coronavirus, and has subsequently struggled to fully reopen. New data released by the National Bureau of Statistics (NBS) on Friday confirmed the slump, which was worse than predictions of minus 6.0 per cent from a survey of analysts’ forecasts by Bloomberg. NBS data also showed that over the single month of March the economy remained under huge pressure, with the industrial sectors, retail and fixed asset investment all shrinking again, following a dramatic collapse over the first two months of the year.

Industrial production, a gauge of manufacturing, mining and utilities, fell by 1.1 per cent last month, after a 13.5 per cent decline over January and February, when the data was combined. This was much better than expectations of a 6.2 per cent decline, according to the Bloomberg survey. Within that, however, manufacturing contracted by 10.2 per cent, suggesting that even as factories reopen, headwinds remain. Retail sales, a key measurement of consumption in the world s most populous nation, fell by 15.8 per cent, following a record 20.5 per cent collapse in the first two months, much worse than forecasts of a 10.0 per cent slump. Fixed asset investment, a gauge of expenditure over the year to date on items including infrastructure, property, machinery and equipment, fell by 16.1 per cent over the first three months, from an all-time low of minus 20.5 per cent in January-February. Analysts had forecast a 15.1 per cent slump.

Terrible headline, but interesting concept: ..how many jobs can society do without? The answer, it would appear, is an awful lot. David Graeber, pay attention.

• Biophysical Economics and the Coronavirus Pandemic (Fix)

[..] there are two constraints on our ability to deal with the coronavirus pandemic. The first constraint is money. This gets all the press right now — and rightly so. To slow the spread of the coronavirus, millions of people are staying home from work. Since we don’t want these people to starve, we need to somehow give them money. But where should this money come from? While this appears like a monetary constraint, it’s actually a social constraint. Money is a social fiction that we can create and destroy at will. So at the societal level, ‘not having enough money’ isn’t a real constraint. No, the real constraint is about who has the power to create and distribute money. We usually give most of this power to the private sector. (Banks create the majority of money when they issue credit.) We forget that the government can also create money. Fortunately, many governments of the world are rediscovering this power, and are paying their citizens to stay at home.

While this (apparent) monetary constraint is on the top of our minds, there are also biophysical constraints on how we can deal with the coronavirus pandemic. These biophysical constraints are little discussed, but they’re more fundamental than the lack of money. [..] Two hundred years ago, most people lived in rural areas. This made it easy to keep your distance from other people (if you had to). Now the vast majority of us live in cities, making it hard to stay away from other people. So urbanization has made it more difficult to fight pandemics.

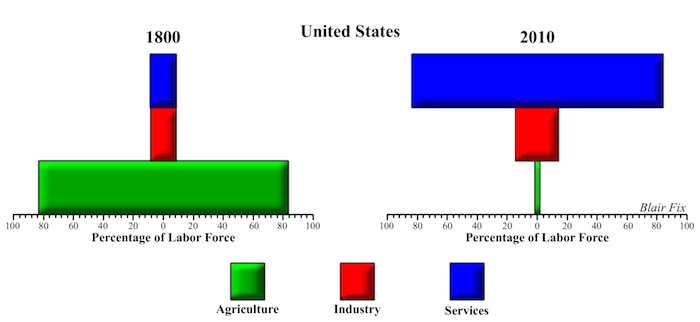

Fortunately, another demographic change offsets the affects of urbanization. To slow the spread of the virus, many of us are being paid to sit at home and do nothing. Two hundred years ago this would have been impossible. Why? Because at the time, most people were farmers. If they didn’t go to work, the population would starve. So a sweeping ‘stay-at-home’ order would have been impossible. Now things are different. As Figure 1 shows, the US has undergone an astonishing

demographic inversion. The vast majority of people now work in the service sector. This means that many of us can simply not work. Sure, without a large service sector we can’t get our lattes or our manicures. But we won’t starve. So the coronavirus pandemic is forcing us to run a vast social experiment. The research question is this: in the short run, how many jobs can society do without? The answer, it would appear, is an awful lot.

Figure 1: The demographic inversion in the US. The sector composition of the US in 1800 (left) and in 2010 (right). [Source: Rethinking Economic Growth Theory from a Biophysical Perspective]

Millions losing health care in a pandemic….

• 22 Million New Jobless Claims, 9.2 Million Lost Health Care In Past Month (NBC)

The number of unemployed Americans continues to climb with another 5 million people filing jobless claims last week, bringing the total number of people applying for unemployment to 22 million in the last month. But an unsettling undercurrent of that number is the amount of people who are also losing access to health insurance because they lost their job. Approximately 9.2 million workers have likely lost their employer-provided health care coverage in the past four weeks, an analysis from the Economic Policy Institute concluded.

Two weeks ago, the nonprofit think tank concluded that nearly 3.5 million among the 8.7 million claims likely lost their employer coverage. An additional 11.4 million people have since applied for unemployment, with the biggest losses of insurance coming from the health care/social assistance, manufacturing and retail sectors. NBC News previously reported that states are bracing for an increase in the number of people who have applied for Medicaid, the public health care coverage option, since the coronavirus pandemic caused states to shutter businesses and caused workers to lose access to their insurance.

…vs the other side of America…

• 43,000 US Millionaires Will Get ‘Stimulus’ Averaging $1.6 Million Each (NYP)

At least 43,000 American millionaires who are too rich to get coronavirus stimulus checks are getting a far bigger boost — averaging $1.6 million each, according to a congressional committee. The Coronavirus Aid, Relief, and Economic Security (CARES) Act trumpeted its assistance for working families and small businesses, but it apparently contains an even bigger benefit for wealthy business owners, the committee found. The act allows pass-through businesses — ones taxed under individual income, rather than corporate — an unlimited amount of deductions against their non-business income, such as capital gains, the Washington Post said. They can also use losses to avoid paying taxes in other years.

That gives the roughly 43,000 individual tax filers who make at least $1 million a year a savings of $70.3 billion — or about $1.6 million apiece, according to the Joint Committee on Taxation. Hedge-fund investors and real estate business owners are “far and away” the ones who will benefit the most, tax expert Steve Rosenthal told the Washington Post. Sen. Sheldon Whitehouse (D-RI) called it a “scandal” to “loot American taxpayers in the midst of an economic and human tragedy.” Sen. Lloyd Doggett (D-Texas) claimed that “someone wrongly seized on this health emergency to reward ultrarich beneficiaries.” “For those earning $1 million annually, a tax break buried in the recent coronavirus relief legislation is so generous that its total cost is more than total new funding for all hospitals in America and more than the total provided to all state and local governments,” he stressed in a statement.

And there are the dollar-denominated debts again…

• Fed Just Jawboning, Massively Tapered QE-4, Hasn’t Bought Any Junk Bonds (WS)

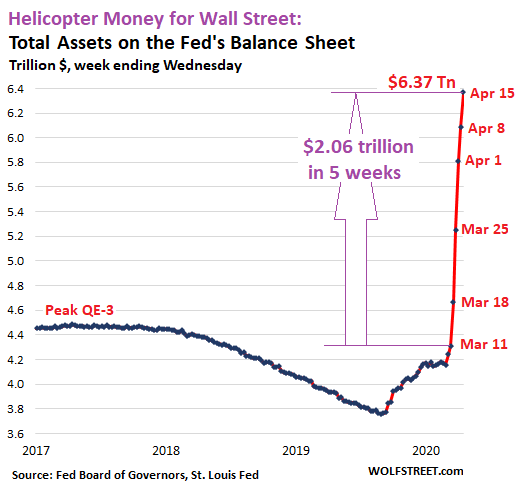

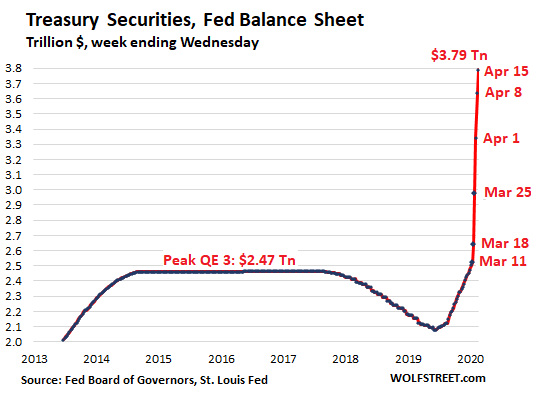

Since the Fed announced its market bailouts and interventions on March 15, it has printed and handed to Wall Street $2.06 trillion. But here is the thing: This was front-loaded, and over the past two weeks, it has cut its bailouts in half, and it has stopped lending new funds to its SPVs that were expected to buy all manner of securities, including equities, junk bonds, and old bicycles. But those loan amounts haven’t moved in four weeks. What it has bought were Treasury securities and mortgage-backed securities – and it’s cutting back on those too. Total assets on the Fed’s balance sheet rose by $285 billion during the week through April 15, reported Thursday afternoon, to $6.37 trillion.

Over the past five weeks, including the partial bailout-week which started March 16 and ended March 18, total assets increased by these amounts. Note the big taper from $586 billion and $557 billion early on to $287 billion in the latest week: • $356 billion (Mar 18, partial bailout week started Mar 16) • $586 billion (Mar 25) • $557 billion (Apr 1) • $272 billion (Apr 8) • $285 billion (Apr 15).

The $6.37 trillion of assets on the Fed’s balance sheet are mostly composed of Treasury securities, mortgage-backed securities (MBS), repurchase agreements (repos), “foreign central bank liquidity swaps,” and “loans” to its Special Purpose Vehicles (SPVs). We’ll go through them one at a time. The Fed added $154 billion in Treasury securities during the week, down 47% from the $293 billion it had added the week before, and down 57% from the $362 billion it had added two week ago. This is a major factor in the Big Taper of QE-4.

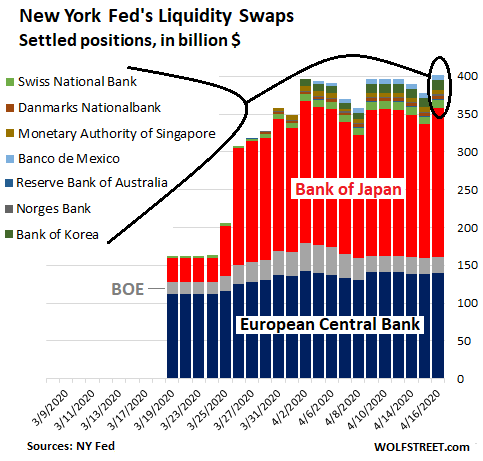

The sharp reduction in purchases of Treasuries confirms for now that the Fed is sticking to its announcement that it would drastically cut QE after the initial blast. Fed Chair Jerome Powell in a webcast on April 10 said that the Fed would pack away its emergency tools once “private markets and institutions are once again able to perform their vital functions of channeling credit and supporting economic growth.” Whatever that means. [..] The Fed has “dollar liquidity swap lines” with [many central banks]. The total on its balance sheet increased by $20 billion from the prior week to $378 billion but has been in the same range all April. Of note: • 83% of outstanding liquidity swaps are with the ECB ($138 billion) and the BOJ ($176 billion). • The Bank of England is far behind ($22 billion). And there no swaps with the central banks of Canada, Brazil, New Zealand, and Sweden.

[..] neither the ECB nor the BOJ need the dollars for trade. They need them to support their banks and companies have large dollar-denominated debts and speculative bets that they need to refinanced with cheap dollars. And those swaps make that possible.

Wisdom.

• Cut Military Spending To Fund Human Security – Gorbachev (RT)

The Covid-19 pandemic shows that governments that think of security in mostly military terms are simply wasting money, Mikhail Gorbachev has said. Defence spending must be cut globally to fund things that humanity actually needs. The former Soviet leader called on the world to move away from hard power in international affairs. He remains especially worried about the kind of military brinkmanship that lately has almost led to a shooting war in the Middle East. “What we urgently need now is a rethinking of the entire concept of security,” he wrote, in an op-ed published by TIME magazine. “Even after the end of the Cold War, it has been envisioned mostly in military terms. Over the past few years, all we’ve been hearing is talk about weapons, missiles and airstrikes.”

The Covid-19 outbreak has highlighted once again that the threats humanity faces today are global in nature and can only be addressed by nations collectively. The resources currently spent on arms need to go into preparation for such crises, Gorbachev said. “The overriding goal must be human security: providing food, water and a clean environment, and caring for people’s health,” he said. The first thing that nations should do after the coronavirus is dealt-with is to make a commitment to a massive demilitarization. “I call upon [world leaders] to cut military spending by 10 percent to 15 percent. This is the least they should do now, as a first step toward a new consciousness, a new civilization.”

Gorbachev, the former leader of the USSR who is credited with de-escalating the Cold War against the US and with negotiating a dramatic reduction in the nuclear arsenals of the two powers, shared his opinions and aspirations as the global number of Covid-19 cases surpassed the two-million benchmark. The pandemic has led to over 130,000 deaths and is projected to plunge the world economy into a recession of a magnitude unseen since the 1920s.

It should be easy for Xi to prevent this.

• Chinese Airlines Poised For Post-Coronavirus ‘Revenge Travelling’ (SCMP)

China’s airlines are poised for a bout of “revenge travelling” in the coming weeks, as soaring reservations ahead of the annual Labour Day holiday and demand by residents returning home from quarantines helped them recover 40 per cent of their traffic. Regional carriers like Guizhou Airlines, Fuzhou Airlines, and China Eastern Airlines’ low-cost unit China United Airlines have added new routes around the country, according to CAAC News, a newspaper run by the Civil Aviation Administration of China (CAAC). United has added 25 routes, eight of which depart from the new Daxing airport in the Chinese capital.

“Chinese carriers are hoping that they could make a breakthrough on the Labour Day holiday,” said the Institute for Aviation Research’s founder and president Lei Zheng, adding that airlines do tend to make seasonal scheduling adjustments. “If they have decent recovery during May, then they can be well-prepared for summer, one of the two most profitable seasons other than the Lunar New Year.” The recovery in air travel, underpinned by an easing coronavirus outbreak in mainland China, is welcomed news for an industry that has suffered 39.82 billion yuan (US$5.6 billion) in first-quarter losses as air passenger traffic shrank 53.9 per cent.

[..] At the height of the outbreak in China a month ago, the aviation regulator grounded most aircraft, limiting each airline to one weekly international route at 75 per cent capacity. As the daily caseload of coronavirus infections fell to single digits, carriers resumed their services, increasing the average aircraft utilisation to 2.8 hours a day, compared with 9 hours per day before the Covid-19 pandemic, according to Flight Master, a Chinese travel intelligence and data company.

China’s Labour Day holiday begins on May 1 and lasts until May 5, an annual weeklong break that usually marks the first peak for travelling and shopping in calendar following the Lunar New Year. Flights are resuming to destinations with lighter caseloads of the coronavirus infections, and where local authorities have either lifted, or are implementing less draconian isolation and quarantine measures than some of the most severely afflicted cities.

I see people say that Greece was very early in its response. It wasn’t, the second half of March was not ‘very early’. What they did right was to be rigorous when they finally got going.

• Greece to Celebrate Easter Under Coronavirus Lockdown (GR)

Greece will celebrate Easter on Sunday, the most important religious holiday of the Orthodox Church, behind closed doors this year after the authorities strictly forbade the traditional spirited celebrations of mass church attendance, firecrackers and large family gatherings. Authorities are desperate to avoid the traditional mass exodus of city dwellers, when hundreds of thousands of Greeks traditionally flock to churches and to their ancestral homes to celebrate Christ’s resurrection, in order to prevent the spread of coronavirus. As of Friday, officials reported 2,207 cased and the death toll at 105, one of the lowest rates in Europe. But compliance will be tested over the long Easter weekend.

The government has doubled fines and included removal or car plates for anyone who travels without reason for Greek Orthodox Easter, Civil Protection Deputy Minister for Crisis Management Nikos Hardalias said on Thursday. Extra controls will be in place at toll posts and ports, and only those with a permanent residency in the area will be allowed to travel to prevent trips to visit relatives or second homes in the countryside. “This virus doesn’t distinguish days, whether it’s a celebration or not,” said Hardalias, who spoke extensively of the great majority of Greek citizens who have observed faithfully the lockdown restrictions, and explained the introduction of additional ones, particularly for Easter. As he said, “One in ten Greeks has said directly or explicitly that they will not follow directions. They do not want to change their habits for one day, as if nothing is going on.”

If anything, RT has been surprisingly calm in its responses. But sometimes there’s a column that is a bit less that. And c’mon, Biden…

• Russiagate Godfather Obama Promotes NYTimes’ “Putin + Covid-19” (RT)

What does Joe Biden have in common with a New York Times article even critics of Russian President Vladimir Putin have described as “incompetent”? Both have received ringing endorsements from former US President Barack Obama. “Democracy depends on an informed citizenry and social cohesion. Here’s a look at how misinformation can spread through social media, and why it can hurt our ability to respond to crises,” Obama tweeted on Wednesday – linking to an article published three days prior. Written by William S. Broad, the top science journalist at the New York Times, the piece contains no actual science – merely a laundry list of conspiracy theories blaming Russia and Putin personally for wanting to “discredit the West and destroy his enemies from within.” “Analysts say” that Putin personally “played a principal role in the spread of false information” about vaccines, the coronavirus, and just about anything really, Broad argues.

Which analysts? Well, Broad cites only three professional Russia-baiters by name, uses two entirely unrelated stories from years ago that were in the general “blame Russia for disinformation” ballpark, and cites “sources” such as the infamous “Intelligence Community Assessment” blaming Russia for the 2016 presidential election. Remember that one? The “Trump-Russia collusion” claim that Russia “hacked our democracy” (whatever that means) that the Democrats flogged for four years to explain losing to Donald Trump and attempt to oust him from office – until it imploded last May and they had to scramble to invent a bogus “Ukrainegate” conspiracy to actually impeach him – and the outlets like the Times and the Washington Post leveraged to get Pulitzers?

Or has all this vanished in the mists of time, due to the month-long brain scrambling induced by the coronavirus lockdowns? May 2019, incidentally, is when Broad wrote another hit piece along the exact same lines, only narrower in scope: he accused RT America of doing Putin’s bidding by reporting on theories that 5G wireless networks could be dangerous. No matter that mainstream US news outlets have reported on the issue in the exact same way – Broad saw “RUSSIA” and had to jump in. Then, too, he chose not to interview actual scientists but Russiagate-pushers such as Ryan Fox, CEO of New Knowledge – the notorious outfit that blamed Russia for its own bot campaign in the 2017 Senate election in Alabama. In other words, a literal false-flag perpetrator.

By way of illustration, one of the “experts” Broad quotes has a line about “a cloud of Russian influencers,” which the NY Times journalist then describes thusly: The players, he said, probably include state actors, intelligence operatives, former RT staff members and the digital teams of Yevgeny Prigozhin, a secretive oligarch and confident [sic] of Mr. Putin’s who financed the St. Petersburg troll farm. “Probably!” Also, you left out the kitchen sink.

And Cooper and Gupta sit there listening, serious faces and all, because this is supposed to be their man.

Joe Biden can’t even get a *single* coherent thought out. Seriously. pic.twitter.com/tIwsiM1h8u

— Kyle Kashuv (@KyleKashuv) April 17, 2020

A very biased hudge decides that a jury frontperson is not biased.

• Roger Stone Denied Bid For New Trial (G.)

A federal judge on Thursday denied a bid for a new trial by Donald Trump’s longtime friend and adviser Roger Stone after the veteran Republican operative accused the jury forewoman of being tainted by anti-Trump political bias. Amy Berman Jackson, a US district court judge, rejected Stone’s claim that the forewoman was biased against Trump and therefore could not be impartial in deciding Stone’s guilt or innocence during the trial. “There is zero evidence of ‘explicit bias’ against Stone, and defendant’s attempts to gain a new trial based on implied or inferred bias fail,” Berman Jackson said in an 81-page decision. Stone, a longtime confidant and former aide to Trump, was convicted in November of seven felonies in an attempt to interfere with a congressional inquiry. He was sentenced to 40 months in prison.

In her memorandum, Berman Jackson said the lawyers had not proved the forewoman was biased or that any jurors acted inappropriately. She included details of their juror questionnaires in her explanation. “The assumption underlying the motion – that one can infer from the juror’s opinions about the president that she could not fairly consider the evidence against the defendant – is not supported by any facts or data and it is contrary to controlling legal precedent,” she wrote in denying the new trial. “The motion is a tower of indignation, but at the end of the day, there is little of substance holding it up.” Stone must appear in person “at the institution designated by the Bureau of Prisons” within 14 days to serve out his sentence, Jackson ruled. She also released Stone and his lawyers from a gag order.

“In the cold autumn of 1629, the plague came to Florence, Italy..”.

Notable for the ‘lavish’ provision of food for the poor, backed by the thought that underfed people are more likely to spread a disease.

• Surviving Plague in an Early Modern City (Henderson)

The officials of the Sanità, the city’s health board, wrote anxiously to their colleagues in Milan, Verona, Venice, in the hope that studying the patterns of contagion would help them protect their city. Reports came from Parma that its ‘inhabitants are reduced to such a state that they are jealous of those who are dead’. The Sanità learned that, in Bologna, officials had forbidden people to discuss the peste, as if they feared you could summon death with a word. Plague was thought to spread through corrupt air, on the breath of the sick or trapped in soft materials like cloth or wood, so in June 1630 the Sanità stopped the flow of commerce and implemented a cordon sanitaire across the mountain passes of the Apennines.

But they soon discovered that the boundary was distressingly permeable. Peasants slipped past bored guards as they played cards. In the dog days of the summer, a chicken-seller fell ill and died in Trespiano, a village in the hills above Florence. The city teetered on the brink of calamity. By August, Florentines were dying. The archbishop ordered the bells of all the churches in the city to be rung while men and women fell to their knees and prayed for divine intercession. In September, six hundred people were buried in pits outside the city walls.

[..] The Sanità arranged the delivery of food, wine and firewood to the homes of the quarantined (30,452 of them). Each quarantined person received a daily allowance of two loaves of bread and half a boccale (around a pint) of wine. On Sundays, Mondays and Thursdays, they were given meat. On Tuesdays, they got a sausage seasoned with pepper, fennel and rosemary. On Wednesdays, Fridays and Saturdays, rice and cheese were delivered; on Friday, a salad of sweet and bitter herbs. The Sanità spent an enormous amount of money on food because they thought that the diet of the poor made them especially vulnerable to infection, but not everyone thought it was a good idea. Rondinelli recorded that some elite Florentines worried that quarantine ‘would give [the poor] the opportunity to be lazy and lose the desire to work, having for forty days been provided abundantly for all their needs’.

The provision of medicine was also expensive. Every morning, hundreds of people in the lazaretti were prescribed theriac concoctions, liquors mixed with ground pearls or crushed scorpions, and bitter lemon cordials. The Sanità did devolve some tasks to the city’s confraternities. The brothers of San Michele Arcangelo conducted a housing survey to identify possible sources of contagion; the members of the Archconfraternity of the Misericordia transported the sick in perfumed willow biers from their homes to the lazaretti. But mostly, the city government footed the bill. Historians now interpret this extensive spending on public health as evidence of the state’s benevolence: if tracts like Righi’s brim over with intolerance towards the poor, the account books of the Sanità tell an unflashy story of good intentions.

We would like to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the process.

Thanks everyone for your wonderful donations to date.

Support the Automatic Earth. It’s good for your mental health.