Caravaggio The calling of St. Matthew 1599-1600

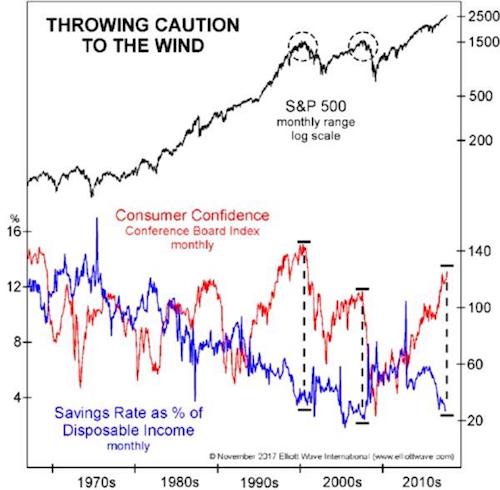

Consumer feelings

“This is the worst consumer sentiment EVER measured.” Biden is toast. pic.twitter.com/NeKO77PHyK

— Ian Miles Cheong (@stillgray) June 16, 2022

Blink

When you smoke some of that good shit before a press conference and totally forget to blink… pic.twitter.com/DujqpoJUqz

— Tim Young (@TimRunsHisMouth) June 14, 2022

DeSantis Musk

Elon Musk is rumored to be supporting Ron Desantis for president in 2024. Asked about it, Desantis says he’s focused on 2022, but always appreciates the support of African-Americans. This is gold. pic.twitter.com/gr0b6fHVCT

— Clay Travis (@ClayTravis) June 15, 2022

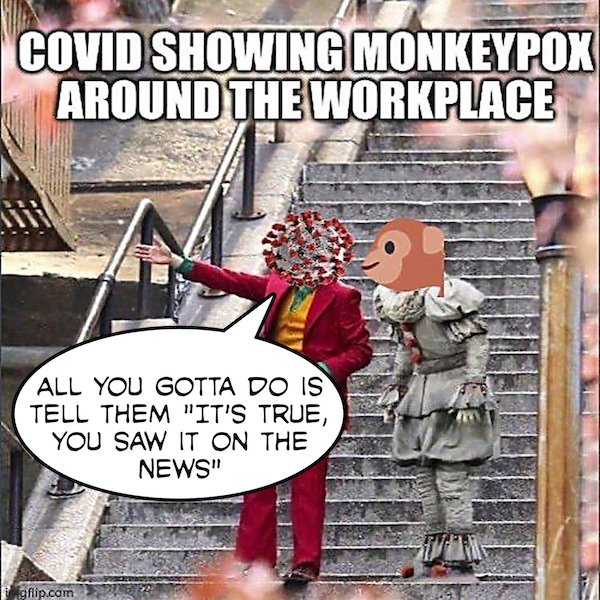

We’ve known for a while that the vaccines don’t protect against infection or transmission. The last thing they had left was protection against severe disease. That is now gone too. It’s over.

• Severe COVID-19 ‘Rare’ In Unvaccinated People (MD)

A survey has found that people who did not get the vaccine had a lower rate of suffering severe COVID-19 amid the pandemic. The survey uploaded to the preprint server ResearchGate presented data from more than 18,500 respondents from the “Control Group” project with more than 300,000 overall participants. An analysis revealed that compared to those who got jabbed, unvaccinated people reported fewer hospitalizations. The international survey also found that the unvaccinated people from more than 175 countries were more likely to self-care to prevent and manage COVID-19 infection. They used natural products like vitamin D, vitamin C, zinc, quercetin, and drugs, such as ivermectin and hydroxychloroquine.

Many participants experienced discrimination for refusing the administration of “genetic vaccines” and struggled with mental health burdens due to the stigma in the mostly “vaccinated” society. Since the participants were self-selected and self-reported, the survey findings had to be interpreted with care compared to statistics or studies based on randomly selected populations, according to the Alliance for Natural Health International. The participants admitted to avoiding vaccines due to their preference for natural medicine interventions and skepticism of pharmaceutical interventions. They also voiced distrust of government information and fear of the possible adverse effects of the vaccines in the long run.

The survey was conducted from September 2021 through February 2022. During the period, participants experienced mild to moderate COVID-19 infection and were infrequently hospitalized. A number of female participants suffered menstrual and bleeding abnormalities, prompting the researchers who analyzed the data to surmise that the issues might have been caused by spike protein exposure and shedding, as per The Epoch Times.

Well, no

Read the article above and then explain this.

• FDA Advisors Unanimously Endorse COVID Shots for Infants and Young Kids (CHD)

The U.S. Food and Drug Administration’s (FDA) vaccine advisory panel today unanimously voted 21-0 to recommend Pfizer and Moderna’s COVID-19 vaccines for infants and young children, stating the totality of the evidence available shows the benefits of the vaccines outweigh the risks of use. Pfizer’s three-dose vaccine would cover children 6 months to 5 years old, while Moderna’s two-dose vaccine covers children 6 months to 6 years old. States have already ordered millions of doses made available prior to FDA authorization by the Biden administration. Depending on whether the FDA and Centers for Disease Control and Prevention (CDC) accept the recommendations of their advisory panels, White House officials have said the administration of vaccines for these age groups could start as early as June 21.

The Vaccines and Related Biological Products Advisory Committee (VRBPAC) ignored pleas from experts, the vaccine injured and a congressman representing 17 other lawmakers to halt authorization until questions about the safety and efficacy of COVID-19 vaccines for the nation’s youngest children could be properly addressed. Many of the committee members, including pediatrician Dr. Ofer Levy, said the decision to authorize the shots was about providing a choice to parents who wanted access to COVID-19 vaccines, despite concerns by public commenters the panel was not adhering to the requirements for Emergency Use Authorization (EUA) and that authorization would eventually lead to mandates — as it did with adult vaccines.

“..the eyes of the freedom-loving world are turned to the Russian Federation..”

• The World Is Looking At You (Batiushka)

As a result of this first War atheist Bolsheviks seized power in the former Russian Empire. Although well over 600,000 Russian troops had died in the two and half years up until February 1917, as they, unlike the Allies on the Western Front, had faced the vast majority of the forces of Germany, Austro-Hungary and Turkey, far worse was to come. Foreign-sponsored foreigners, like the brain-fevered Blank-Lenin and the evil genius Bronstein-Trotsky, killed millions in a civil war, including the Imperial Family, and through deliberate starvation. Many more would later die in concentration camps. And unlike in the First War when the enemy never even entered Russia, in the Second War the enemy reached the very gates of Moscow, Leningrad and the banks of the Volga, slaughtering 27 million, mainly civilians.

But then there was the American flu (called for propaganda reasons ‘Spanish flu’). Beginning in Kansas, it was brought to Europe in 1917 by American troops, who had entered the First War, as arranged, as soon as the treacherous ‘Allies’ (not Germany) had succeeded in overthrowing Imperial Russia. The Americans had come to conquer Europe. After the Great European Suicide of the First War, this flu may have killed another 50 million, though some say far more. But above all, exactly as the French Marshal Foch foretold at Versailles, the ‘Peace’ of 1919 led directly to the Second Great War that broke out twenty years later. And that murdered tens of millions and in 1945 made Western Europe into a conquered and occupied province of the USA, which then set about creating a USE (United States of Europe) in its own image.

And so came the Cold War, with its MAD (mutually assured destruction) phobia, bunker-building, wasteful spending on arms, and the new generation’s social revolution of the 1960s. In turn came the next generation of 1989, 75 years after 1914 and 50 years after 1939, and the occupation of Eastern Europe by the same US colonists, sending out their proconsul-ambassadors to the client states of the ‘New Europe’. In 1991, 50 years after Operation Barbarossa of Nazi Imperialism ravaged the USSR but was defeated, the latter fell to Nato Imperialism. And in turn, 100 years after the Great European Suicide began, the Evil Empire began its occupation of the Ukraine in 2014, turning it into a dependent vassal. The whole pattern of the hundred years, 1914-2014, had the same source.

Until 2022 there had never been any hope of justice and restitution for any of this. Then on 24 February began the Special Operation to liberate the Ukraine and denazify the world. This is the last throw of the dice and the eyes of the freedom-loving world are turned to the Russian Federation. Even with all its troubles, imperfections and treacheries, we have no other hope. The world is looking at you.

“The traditional end result for captured mercenaries is execution; however, Russian President Vladimir Putin may not want to hang these two State Dept. conscripts.”

• First American Mercenary Contractors Captured in Ukraine (CTH)

A contracted mercenary has no legal recognition or protection as a prisoner of war. Two American mercenary soldiers have been captured by Russian forces and now present a rather unique issue for the Biden administration. The traditional end result for captured mercenaries is execution; however, Russian President Vladimir Putin may not want to hang these two State Dept. conscripts. (Via Telegraph) – “Two former US servicemen have been captured during fighting with Russian forces in Ukraine, The Telegraph has been told. The pair were taken prisoner during a fierce battle outside the north-east city of Kharkiv last week, according to comrades who were fighting alongside them.

Alexander Drueke, 39, and Andy Huynh, 27, had been serving as volunteers with a regular Ukrainian army unit. They are believed to be the first US servicemen to end up as Russian prisoners of war. They join a growing number of Western military volunteers captured by Russian forces, including at least two Britons. Aiden Aslin and Shaun Pinner have already been told they face the death penalty as “mercenaries”. The capture of the two Americans will be diplomatically sensitive as the Kremlin may seek to use it as proof that America is becoming directly involved in the war. Vladimir Putin, the Russian president, is likely to demand significant concessions to release them.”

“The new G8, instead, “does not impose anything on anyone, but tries to find common solutions.”

• The ‘New G8’ Meets China’s ‘Three Rings’ (Escobar)

The speaker of the Duma, Vyacheslav Volodin, may have created the defining acronym for the emerging multipolar world: “the new G8”. As Volodin noted, “the United States has created conditions with its own hands so that countries wishing to build an equal dialogue and mutually beneficial relations will actually form a ‘new G8’ together with Russia.” This non Russia-sanctioning G8, he added, is 24.4% ahead of the old one, which is in fact the G7, in terms of GDP in purchasing power parity (PPP), as G7 economies are on the verge of collapsing and the U.S. registers record inflation.

The power of the acronym was confirmed by one of the researchers on Europe at the Russian Academy of Sciences, Sergei Fedorov: three BRICS members (Brazil, China and India) alongside Russia, plus Indonesia, Iran, Turkey and Mexico, all non adherents to the all-out Western economic war against Russia, will soon dominate global markets. Fedorov stressed the power of the new G8 in population as well as economically: “If the West, which restricted all international organizations, follows its own policies, and pressures everyone, then why are these organizations necessary? Russia does not follow these rules.” The new G8, instead, “does not impose anything on anyone, but tries to find common solutions.”

The coming of the new G8 points to the inevitable advent of BRICS +, one of the key themes to be discussed in the upcoming BRICS summit in China. Argentina is very much interested in becoming part of the extended BRICS and those (informal) members of the new G8 – Indonesia, Iran, Turkey, Mexico – are all likely candidates. The intersection of the new G8 and BRICS + will lead Beijing to turbo-charge what has already been conceptualized as the Three Rings strategy by Cheng Yawen, from the Institute of International Relations and Public Affairs at the Shanghai International Studies University.

Cheng argues that since the beginning of the 2018 U.S.-China trade war the Empire of Lies and its vassals have aimed to “decouple”; thus the Middle Kingdom should strategically downgrade its relations with the West and promote a new international system based on South-South cooperation. Looks like if it walks and talks like the new G8, that’s because it’s the real deal.

Schiff himself “Engaged in Likely Multiple Criminal Acts”.

• Schiff: Evidence That Trump “Engaged in Likely Multiple Criminal Acts (Turley)

Representative Adam Schiff (D-CA) went on CNN’s “Don Lemon Tonight” to tout the work of the House Select Committee investigating the Jan. 6th riot. In that interview, Schiff declared that the Committee has enough evidence showing former President Donald Trump “engaged in likely multiple criminal acts.” While vague on the specific crimes, Schiff emphasized that the Justice Department did not have to wait any further to launch a criminal investigation based on what has already been disclosed. While the Committee has disclosed new evidence in the form of videotapes and testimony, it has not presented new material evidence of criminal acts in my view. That could still come but the first two hearings largely focused on a “conspiracy” to challenge the election certification and allegations that Trump knew the there was no compelling evidence of widespread election fraud.

If there is evidence of criminal conduct by former president Trump or others, most of us would support the calls for prosecution. It is also possible that the Justice Department is investigating such crimes or has undisclosed evidence. The hearings, however, have not established such a foundation. That can still come but these crimes have elements that have not been addressed in hearings that have lacked any opposing views or adversarial elements. The decision of Speaker Nancy Pelosi to abandon the long tradition of bipartisan members on such selection committee has robbed the investigation of credibility and legitimacy for many Americans.

Indeed, Schiff’s reference to evidence held by the Committee is likely to bring up memories of his highly controversial public statements that the House Intelligence Committee, which he chairs, had direct evidence of Russian collusion despite the countervailing findings of Special Counsel Robert Mueller. He never produced the evidence and later it was revealed that Justice officials and FBI agents had told his Committee that they did not find such evidence. Now, Schiff is maintaining that:

“I certainly believe there’s enough evidence for them to open an investigation of several people, and so did Judge David Carter of California believes the former president and others were engaged in likely multiple criminal acts. So if the Justice Department concurs with Judge Carter, let alone my own view or others, they should be pursuing that. So, yes, I think there is sufficient evidence to open an investigation. It would be of you up to the Justice Department ultimately to decide does that evidence rise to proof beyond a reasonable doubt such that they’re comfortable indicting someone. But there’s certainly, in my view, enough evidence to open up investigations.”

The reference to the Carter opinion has become a mainstay on cable news. I was critical of Judge Carter’s opinion when it was released. Much of the Jan. 6th hearings seem to be structured along the same lines as the Carter decision which was, in my view, strikingly conclusory and unsupported in critical parts of the analysis. Judge Carter simply declares that Trump knew that the election was not stolen and thus “the illegality of the plan was obvious.” Putting aside the court’s assumption of what Trump secretly concluded on the election, a sizable number of Americans still do not view Biden as legitimately elected. The court is not simply saying that they are wrong in that view but, because they are wrong, legislative challenges amounted to criminal obstruction of Congress.

First Japan, then Europe, then the US. Russia and China will remain standing.

• ECB Holds Emergency Meeting To Discuss Market Turmoil (ZH)

Last week, shortly after the ECB’s latest meeting disappointed markets and concluded without a discussion of Europe’s growing bond market fragmentation which has since sent Italian bond yields soaring above 4%, we joked that “at this rate the ECB would make an emergency rate cut” just hours after announcing an end to QT and guiding to a July rate hike. Once again, our jokes was not too far from the truth because on Wednesday morning, just hours before the Fed’s first 75bps rate hike sine 1994, and with Italian bonds in freefall, European Central Bank unexpectedly announced it would hold an emergency , ad hoc meeting of its rate-setters starting 11am CET in which it would “discuss current market conditions.”

The meeting, which comes less than a week after the rate-setting governing council’s last vote, raised investor expectations that the central bank is preparing to announce a policy instrument to stave-off another debt crisis in the region, which can only come in the form of more QE… which is ironic at a time when the ECB just announced it was phasing out all QE! Italian government bonds rallied in price following news of the planned meeting, reversing some of the recent sell-off that analysts said brought the country’s borrowing costs towards the “danger zone”. Gilles Moec, chief economist at Axa, an insurer, said the “stakes are high” for the ECB “now that everyone is dusting off their debt sustainability spreadsheets for Italy, they probably need to go up an extra notch”.

[..] ECB executive board member Isabel Schnabel indicated in a speech on Tuesday evening that the central bank was getting closer to the point where it would intervene in bond markets, saying “some borrowers have seen significantly larger changes in financing conditions than others since the start of the year”. She added: “Such changes in financing conditions may constitute an impairment in the transmission of monetary policy that requires close monitoring.” Schnabel, the ECB executive who oversees its market operations and one of the most influential voices on its board, said the central bank’s commitment to the euro had no limits. “And our track record of stepping in when needed backs up this commitment,” she added. But wait, this means… more QE at a time when the ECB just vowed… less QE!!??

”Choose one and only one: Feel good or be able to afford food and basically everything else.”

• PPI: Smoking -AGAIN- (Denninger)

Oh my look what we have here! “The Producer Price Index for final demand increased 0.8 percent in May, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This rise followed advances of 0.4 percent in April and 1.6 percent in March. (See table A.) On an unadjusted basis, final demand prices moved up 10.8 percent for the 12 months ended in May.” So…. two points, more or less, higher than CPI. PPI leads, I remind you, so the consumer inflation level has not peaked. Let’s look inside. “Final demand goods: The index for final demand goods moved up 1.4 percent in May, the fifth consecutive rise. Over 70 percent of the increase in May can be traced to a 5.0-percent advance in prices for final demand energy. The index for final demand goods less foods and energy moved up 0.7 percent, while prices for final demand foods were unchanged.”

Oh really? Only 5% eh? Well, don’t look at June, because gasoline, for example, has risen by more than 10% in the last two weeks which is all in June. Oops. “Product detail: Nearly 30 percent of the May increase in the index for final demand services can be attributed to prices for truck transportation of freight, which rose 2.9 percent.” No kidding? You mean $6+ diesel fuel turns directly into higher shipping prices? I just got back from a cross-country trip and saw lots of dead dinosaurs coming out of the stack of 18 wheelers and every one of them had better keep moving or you’re not eating, never mind being able to buy and consume anything else. The current Administration’s war on fossil fuels might make you feel good but it is also directly responsible for this insanity. Choose one and only one: Feel good or be able to afford food and basically everything else.

The really nasty is that the 12 month trend is unbroken and, as I noted, it all started right after Biden was inaugurated. He said he was going to do this during the campaign and he has. It takes time for the PPI to reflect down into the final shelf price and it has. But the 12 month final demand number, less food, energy and trade from 12 months prior stands at 6% which it has run at or above since August of last year. Shut it off now and it will be next summer before that has all worked its way through and there’s nothing you can do about the time requirement.

“At the core what The Fed does is not the question. It’s what Congress does.”

• Today’s The Day…. (Denninger)

….. we “celebrate” The Fed decision on rates. Well, yeah, ok. The 13 week bill says the FFR should be 1.5% now. As has almost-always been the case historically (go look at FRED if you don’t believe me) the market leads and The Fed is not actually in charge of rates. Of course this runs counter to the “all-powerful Fed” which suits everyone on all sides. The politicians and conspiracy nuts get to blame someone else for an agency that follows what the market demands because if it doesn’t it is proved impotent and takes a huge loss on top of it. Unfortunately 50 bips will do nothing to cool inflation; to do that short-term rates must be higher than the inflation rate so that the real cost of borrowing is positive. That would mean putting about 700bips on the FFR right here and now – which we know won’t happen.

Then again this has been the problem for the last 30ish years. The slope of the interest rate curve has gone from the upper left to the lower right and thus serial refinancing at the corporate and government level, say much less at the personal level, has looked “free.” That’s the sneaky part of inflation which I explained back when I wrote Leverage with a nice graph. When you run a deliberate inflationary policy over decades the first years look like a free lunch because the apparent “wealth” initially goes up faster than the debt service (which is on a smaller base) and thus produces a “belly” (an area of expansion of the space between the two lines of available spending power and debt service.) This is a chimera and to intentionally run such a policy as a business or government is fraud because all exponential expansions eventually go vertical, and the debt service will eventually cross available funds at which point you’re screwed since you cannot spend 110% of what you have — ever — no matter what you do.

It’s happening now. At the core what The Fed does is not the question. It’s what Congress does. The Fed is constrained to use only Federal Government backed securities for its monetary operations and policy. Yes, it has shaved that repeatedly, most-egregiously with Fannie and Freddie paper during the housing crash which at the time was wildly illegal yet not one person in Congress called them on it nor did anyone from the Executive (e.g. DOJ) stop it despite its blatant illegality. Then Congress went even further and, for all intents and purposes, explicitly backstopped said paper on a retroactive basis which is also illegal, but heh, nobody cared because it was “too big to fail.”

Total control is the goal.

• “Red Flag” Laws Put a Target on the Back of Every American (Whitehead)

What we do not need is yet another pretext by which government officials can violate the Fourth Amendment at will under the guise of public health and safety. Indeed, at a time when red flag gun laws (which authorize government officials to seize guns from individuals viewed as a danger to themselves or others) are gaining traction as a legislative means by which to allow police to remove guns from people suspected of being threats, it wouldn’t take much for police to be given the green light to enter a home without a warrant in order to seize lawfully-possessed firearms based on concerns that the guns might pose a danger. Frankly, a person wouldn’t even need to own a gun to be subjected to such a home invasion.

SWAT teams have crashed through doors on lesser pretexts based on false information, mistaken identities and wrong addresses. Nineteen states and the District of Columbia have adopted laws allowing the police to remove guns from people suspected of being threats. If Congress succeeds in passing the Federal Extreme Risk Protection Order, which would nationalize red flag laws, that number will grow. As The Washington Post reports, these red flag gun laws…”allow a family member, roommate, beau, law enforcement officer or any type of medical professional to file a petition [with a court] asking that a person’s home be temporarily cleared of firearms. It doesn’t require a mental-health diagnosis or an arrest.”

In the wake of yet another round of mass shootings, these gun confiscation laws—extreme risk protection order (ERPO) laws—may appease the fears of those who believe that fewer guns in the hands of the general populace will make our society safer. Of course, it doesn’t always work that way. Anything—knives, vehicles, planes, pressure cookers—can become a weapon when wielded with deadly intentions. With these red flag gun laws, the stated intention is to disarm individuals who are potential threats… to “stop dangerous people before they act.”

I think he has elections coming up.

• Erdogan Issues Fresh Threats Against Greece (K.)

Turkish President Recep Tayyip Erdogan has issued fresh threats against Greece, this time accusing the country of supporting an international campaign directed against his country. “We have sent a clear message to everyone concerned about developments in the Aegean,” Erdogan told MPs of his AK Party in the wake of the EFES-2022 military exercise near the Aegean port city of Izmir. “We have seen through the game being played at the expense of our country. They are allowing Greece to behave like a spoiled child as they have done in the past,” he said. “The problem is that Greece is not aware of this game, or it has voluntarily adopted a supporting role,” he said, adding that the country would pay a hefty price for “making the same mistake.”

Joshua Schulte. Treated like an animal.

• A Whistleblower’s Agony (Kiriakou)

A C.I.A. whistleblower languishes awaiting trial in a federal prison under inhumane conditions and almost nobody is paying attention. Joshua Schulte is a former C.I.A. hacker, one of those computer geniuses whose job it is to work his way into the computer systems of our country’s enemies in support of some of the most highly-classified operations the C.I.A. carries out. The government believes that Schulte was a malcontent who released to WikiLeaks in 2017 the equivalent of 2 billion pages of top secret C.I.A. data with code names like Brutal Kangaroo, AngerQuake and McNugget. These programs, collectively known as Vault 7, were custom-made techniques used to compromise Wifi networks, hack into Skype, defeat anti-virus software and even hack into smart TVs and the guidance systems in cars.

They were the C.I.A.’s modern-day crown jewels. One senior C.I.A. officer likened the revelations to “a modern-day Pearl Harbor.” The C.I.A. accused Schulte of stealing the data in 2016 and of sending it to WikiLeaks in 2017. He was eventually charged with 13 felonies, mostly related to the Espionage Act. He was later charged with a number of additional felonies related to child pornography, accusations that he has adamantly denied. Schulte went to trial in New York in early 2020 with the Justice Department accusing him of “the single biggest leak of classified national defense information in the history of the C.I.A.”

After four weeks of testimony and six days of jury deliberation, he was found guilty of contempt of court and making a false statement, both minor charges for which federal sentencing guidelines call for imprisonment of zero-to-six months. The jury deadlocked on all other counts, and the judge declared a mistrial. Schulte remains in prison awaiting retrial. He has been incarcerated since October 2018.

“This dramatic deterioration of Mr Assange’s health has not yet been considered in his extradition proceedings.”

• Patel Responsible For Assange’s ‘Slow-Motion Execution’ If Extradited (DIss.)

A coalition of over 300 doctors warned UK Home Secretary Priti Patel that she may be responsible for the “slow-motion execution” of WikiLeaks founder Julian Assange if her office approves the United States government’s extradition request. Patel has until June 19, which is ten years after Assange entered Ecuador’s embassy in London and sought political asylum, to decide whether to approve the extradition. Assange faces 18 charges brought against him by the US Justice Department, 17 of which are under the Espionage Act. All the charges relate to documents WikiLeaks released in 2010 and 2011, which were provided by US Army whistleblower Chelsea Manning.

Doctors for Assange” is an international coalition of medical doctors, psychiatrists, and psychologists who have spoken up for Assange because of the toll the US government’s prosecution has taken on his health. Many of the doctors are from the UK and Australia, which is Assange’s home country. The doctors sent a letter to Patel on June 10, 2022, ahead of the Home Office’s extradition decision. “Should [Assange] come to harm in the US,” the group contends Patel “will be left holding the responsibility for that negligent outcome.” They add, “The extradition of a person with such compromised health, moreover, is medically and ethically unacceptable.” As the doctors recall, Assange’s health has deteriorated in UK custody at Belmarsh prison, where he’s been detained since April 11, 2019.

“In October 2021, Mr. Assange suffered a ‘mini-stroke.’” “This dangerous deterioration of Mr Assange’s health underscores the medical concern that the chronic stress caused by his harsh prison conditions, as well as his justified fear of the conditions that he would face in the case of extradition, leaves Mr. Assange vulnerable to cardiovascular events,” the doctors add. “This dramatic deterioration of Mr Assange’s health has not yet been considered in his extradition proceedings.” The doctors argue the basis for accepting US “assurances” was based upon “outdated medical information,” which should render the assurances “obsolete.” “Under conditions in which the UK legal system has failed to take Mr Assange’s current health status into account, no valid decision to approve his extradition may be made, by you, or anyone else.”

Tucker Dore

Jimmy Dore nails it… pic.twitter.com/g6WUgJUi0H

— Wittgenstein (@backtolife_2022) June 16, 2022

Rooster

OK it’s happened. We have the best video ever pic.twitter.com/CpkVpTVueC

— Greg James (@gregjames) June 14, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.