Théodore Géricault Prancing Grey Horse 1812

19 reasons

Michael Capuzzo, famous journalist and writer, started looking into ivermectin when his daughter fell ill with Covid. But even Capuzzo couldn’t get his paper published. It’s time to start talking about the untold number of deaths caused by the ban, by politics, media, medical field, social media, of mentioning anything related to ivermectin. This has gone too far.

When my daughter Grace, a vice president at a New York advertising agency, came down with COVID-19 recently, she was quarantined in a “COVID hotel” in Times Square with homeless people and quarantining travelers. The locks on her room door were removed. Nurses prowled the halls to keep her in her room and wake her up every night to check her vitals—not to treat her, because there is no approved treatment for COVID-19; only, if her oxygen plummeted, to move her to the hospital, where there is only a single effective approved treatment for COVID-19, steroids that may keep the lungs from failing.

• I Don’t Know Of A Bigger Story In The World (NC)

Michael Capuzzo, a New York Times best-selling author , has just published an article titled “The Drug That Cracked Covid”. The 15-page article chronicles the gargantuan struggle being waged by frontline doctors on all continents to get ivermectin approved as a Covid-19 treatment, as well as the tireless efforts by reporters, media outlets and social media companies to thwart them. Because of ivermectin, Capuzzo says, there are “hundreds of thousands, actually millions, of people around the world, from Uttar Pradesh in India to Peru to Brazil, who are living and not dying.” Yet media outlets have done all they can to “debunk” the notion that ivermectin may serve as an effective, easily accessible and affordable treatment for Covid-19. They have parroted the arguments laid out by health regulators around the world that there just isn’t enough evidence to justify its use.

For his part, Capuzzo, as a reporter, “saw with [his] own eyes the other side [of the story]” that has gone unreported, of the many patients in the US whose lives have been saved by ivermectin and of five of the doctors that have led the battle to save lives around the world, Paul Marik, Umberto Meduri, José Iglesias, Pierre Kory and Joe Varon. These are all highly decorated doctors. Through their leadership of the Front Line COVID-19 Critical Care (FLCCC) Alliance, they have already enhanced our treatment of Covid-19 by discovering and promoting the use of Corticoid steroids against the virus. But their calls for ivermectin to also be used have met with a wall of resistance from healthcare regulators and a wall of silence from media outlets.

“I really wish the world could see both sides,” Capuzzo laments. But unfortunately most reporters are not interested in telling the other side of the story. Even if they were, their publishers would probably refuse to publish it. That may explain why Capuzzo, a six-time Pulitzer-nominated journalist best known for his New York Times-bestselling nonfiction books Close to Shore and Murder Room, ended up publishing his article on ivermectin in Mountain Home, a monthly local magazine for the of the Pennsylvania mountains and New York Finger Lakes region, of which Capuzzo’s wife is the editor. It’s also the reason why I decided to dedicate today’s post to Capuzzo’s article. Put simply, as many people as possible –particularly journalists — need to read his story. As Capuzzo himself says, “I don’t know of a bigger story in the world.”

“A news blackout by the world’s leading media came down on Ivermectin like an iron curtain.”

• The Drug That Cracked Covid (Michael Capuzzo)

Marik had been keeping tabs on Ivermectin but hadn’t included it in his protocols. He knew the drug as a core medicine on the WHO Model List of Essential Medicines, and it is wellestablished in the literature as a “wonder drug” that won the 2015 Nobel Prize for its discoverer, Japanese microbiologist Satoshi Omura, for nearly eradicating two of the “most dis guring and devastating diseases” in history, river blindness and elephantiasis, that had plagued millions of people in Africa countries, one of the great achievements in the history of medicine. The drug was also well known as a standard treatment for scabies and lice, from nurseries to nursing homes. A veterinary version keeps millions of family dogs and cats, farm animals, and cattle safe from worms and parasitic diseases.

An over-the-counter medicine in France, Ivermectin is safer than Tylenol and “one of the safest drugs ever given to humanity,” Dr. Marik said, with “3.7 billion doses administered in forty years, that’s B for billion, and only extremely rare serious side e ects.” An earlier Australian study, reported in the journal Antiviral Research, showed that Ivermectin, which blocked other RNA viruses like Dengue virus, yellow fever virus, Zika virus, West Nile virus, influenza, the Avian fu, and HIV1/AIDS in vitro, decimated the coronavirus in vitro, wiping out “essentially all viral material by 48 hours.” But more research was needed in human beings. But by October Marik’s concerns were answered. ¬e studies were well-designed university trials that showed amazing anti-COVID-19 activity at the normal doses used to treat parasites.

Though small and endlessly diverse by large, Western big pharma “one-size-fits all” random control trials, the Ivermectin studies were a mosaic of hundreds of scientists and many thousands of patients in trials all over the world, all showing the same remarkable efficacy against all phases of COVID-19 no matter what dose or age or severity of the patient. “Penicillin never was randomized,” Marik says. “It just obviously worked. Ivermectin obviously works.” Marik was astonished. “If you were to say, tell me the characteristics of a perfect drug to treat COVID-19, what would you ask for?” he said. “I think you would ask rstly for something that’s safe, that’s cheap, that’s readily available, and has anti-viral and anti-inflammatory properties. People would say, “That’s ridiculous. There could not possibly be a drug that has all of those characteristics. That’s just unreasonable. But we do have such a drug. The drug is called Ivermectin.”

———––

A news blackout by the world’s leading media came down on Ivermectin like an iron curtain. Reporters who trumpeted the COVID-19 terror in India and Brazil didn’t report that Ivermectin was crushing the P-1 variant in the Brazilian rain forest and killing COVID-19 and all variants in India. That Ivermectin was saving tens of thousands of lives in South America wasn’t news, but mocking the continent’s peasants for taking horse paste was. Journalists denied the world knowledge of the most effective life-saving therapies in the pandemic, Kory said, especially among the elderly, people of color, and the poor, while wringing their hands at the tragedy of their disparate rates of death.

Three days after Kory’s testimony, an Associated Press “fact-check reporter” interviewed Kory “for twenty minutes in which I recounted all of the existing trials evidence (over fifteen randomized and multiple observational trials) all showing dramatic benefits of Ivermectin,” he said. Then she wrote: “AP’S ASSESSMENT: False. There’s no evidence Ivermectin has been proven a safe or effective treatment against COVID-19.” Like many critics, she didn’t explore the Ivermectin data or evidence in any detail, but merely dismissed its “insufficient evidence,” quoting instead the lack of a recommendation by the NIH or WHO. To describe the real evidence in any detail would put the AP and public health agencies in the difficult position of explaining how the lives of thousands of poor people in developing countries don’t count in these matters.

Not just in media but in social media, Ivermectin has inspired a strange new form of Western and pharmaceutical imperialism. On January 12, 2021, the Brazilian Ministry of Health tweeted to its 1.2 million followers not to wait with COVID-19 until it’s too late but “go to a Health Unit and request early treatment,” only to have Twitter take down the official public health pronouncement of the sovereign fifth largest nation in the world for “spreading misleading and potentially harmful information.” (Early treatment is code for Ivermectin.) On January 31, the Slovak Ministry of Health announced its decision on Facebook to allow use of Ivermectin, causing Facebook to take down that post and removed the entire page it was on, the Ivermectin for MDs Team, with 10,200 members from more than 100 countries.

In Argentina, Professor and doctor Hector Carvallo, whose prophylactic studies are renowned by other researchers, says all his scientific documentation for Ivermectin is quickly scrubbed from the Internet. “I am afraid,” he wrote to Marik and his colleagues, “we have affected the most sensitive organ on humans: the wallet…” As Kory’s testimony was climbing toward nine million views, YouTube, owned by Google, erased his official Senate testimony, saying it endangered the community. Kory’s biggest voice was silenced.

Nasal spray.

• Finnish Firm Earns US Patent For Covid Drug Containing Ivermectin, HCQ (Yle)

A coronavirus drug developed by Therapeutica Borealis, a pharmaceutical firm in Turku, has been granted a patent by the United States Patent and Trademark Office (USPTO). The nasal spray contains hydroxychloroquine, among other ingredients. Earlier in May, the company said it had received approval for a patent application, based on which it expected a final patent this month. “The final patent is an important milestone for us on our way to the market. Our next goal is to find an established pharmaceutical industry company with an international business scale,” says Professor Kalervo Väänänen, one of the three inventors and founders of Therapeutica Borealis, in a press release on Monday. Väänänen is a cell biologist and former rector of the University of Turku.

The co-inventors of the drug and co-founders of Therapeutica Borealis are Lauri Kangas, an adjunct professor of science at the University of Turku, and Matti Rihko, a psychologist, and board chair of the Turku Chamber of Commerce and of the University of Turku. He is also a former CEO of the Raisio food corporation, known for its cholesterol-lowering Benecol products. According to the company, the nasal spray acts on cell function in nasal mucous in three ways, impairing the ability of the virus to penetrate the body and multiply, thus reducing the risk of serious illness. [..] The firm said that the drug’s active ingredients – aprotinin, hydroxychloroquine and ivermectin – are well-known and widely used drugs, but in this product are used in a new, targeted manner on the upper respiratory mucous membrane.

All the drug molecules covered by the patent are approved for the treatment of other diseases, but if used systemically, for instance as pills or infusions swallowed by patients, the amounts of drugs would be high and potentially harmful. For topical use, as in a nasal spray, the concentrations of the active ingredients throughout the body remain very low but are sufficient locally to prevent the passage and replication of the virus, making the drug safer and more effective, says Therapeutica Borealis.

No vaccines needed.

• Mild COVID-19 Induces Lasting Antibody Protection (wustl)

Months after recovering from mild cases of COVID-19, people still have immune cells in their body pumping out antibodies against the virus that causes COVID-19, according to a study from researchers at Washington University School of Medicine in St. Louis. Such cells could persist for a lifetime, churning out antibodies all the while. The findings, published May 24 in the journal Nature, suggest that mild cases of COVID-19 leave those infected with lasting antibody protection and that repeated bouts of illness are likely to be uncommon. “Last fall, there were reports that antibodies wane quickly after infection with the virus that causes COVID-19, and mainstream media interpreted that to mean that immunity was not long-lived,” said senior author Ali Ellebedy, PhD, an associate professor of pathology & immunology, of medicine and of molecular microbiology.

“But that’s a misinterpretation of the data. It’s normal for antibody levels to go down after acute infection, but they don’t go down to zero; they plateau. Here, we found antibody-producing cells in people 11 months after first symptoms. These cells will live and produce antibodies for the rest of people’s lives. That’s strong evidence for long-lasting immunity.” During a viral infection, antibody-producing immune cells rapidly multiply and circulate in the blood, driving antibody levels sky-high. Once the infection is resolved, most such cells die off, and blood antibody levels drop. A small population of antibody-producing cells, called long-lived plasma cells, migrate to the bone marrow and settle in, where they continually secrete low levels of antibodies into the bloodstream to help guard against another encounter with the virus. The key to figuring out whether COVID-19 leads to long-lasting antibody protection, Ellebedy realized, lies in the bone marrow.

Won’t happen. Not now.

• Rand Paul Says Dr. Anthony Fauci Should ‘Be Immediately Fired’ (JTN)

Sen. Rand Paul said Tuesday that National Institute of Allergy and Infectious Diseases Director Dr. Anthony Fauci has repeatedly lied and should be fired. Paul said on Just the News’ “Water Cooler” show that Fauci lied to Congress when he said the National Institutes of Health did not fund gain-of-function research at the Wuhan Institute of Virology. “He oughta be immediately fired,” said Paul, who has repeatedly clashed with Fauci over numerous COVID-19 issues. “He’s been lying to us since the very beginning. He first said no masks work, which wasn’t true. Then he said all masks work and that wasn’t true either. The N95 masks work, the rest of them don’t. But he’s been dishonest from the very beginning.” The Kentucky Republican Paul also said Fauci has lied “so-called with good intentions, noble lies, but he has been dishonest and he should be dismissed.”

And you thought your health care was a mess..

• Inside India’s “Hunger Games” (Bhandari)

I have just returned from a visit to my family in India. It was hard to escape. To get to the US from India, I needed a COVID test. The Indian government has seriously restricted who can provide COVID testing, treatment, and vaccination. Private doctors and hospitals that are not approved face brutal legal consequences if they provide COVID treatment. Emergency powers were centralized early last year in the hands of the Indian Prime Minister, Narendra Modi. He gave himself direct control over the bureaucrats of the states, making local governments largely impotent and dependent on him. In their supreme wisdom, government bureaucrats concluded that because the prefix “COVID-” exists in treatment, vaccination, and testing, they must all be performed at the same place.

For my test, I sat in a petri dish of COVID, with those coming out positive sitting right next to me. Desperate, vulnerable old people, who merely wanted to get their jabs, sat among us. Those who were sick for reasons other than COVID were among us too, for the government has required everyone who is sick to be tested for COVID first . A microcosm of how everything is done in India, the tests were given haphazardly, with samples getting mixed up, nurses spending most of their time fighting among themselves, and — lacking a lineup system — people crowded together, pushing and breathing into the mouths of one another. A few days earlier, the government had given notice of the rate of tests and further restricted where they could be performed.

A bribe-taking system would have been my preference to bypass government restrictions, but no such system has evolved yet. Nevertheless, corruption has exploded, and self-centeredness, apathy, a dog-eat-dog environment has come to the surface. You see this everywhere; the scavengers are out in full force. I went to a private COVID hospital. The situation in government hospitals is far worse, beyond my capacity to cope with it. Yet the story of COVID in India is hardly about COVID as such, which is nothing more than a trigger. More than twice as many people died of fairly easily treatable tuberculosis in 2020 than of COVID. Instead, this is a story of foolish rulers, completely hollowed out institutions, and a pathetically irrational and tribal society.

Hope.

• More Bombshells On Covid And Wuhan Lab Connection Should Come Soon (JTN)

Sen. Mike Braun (R-Ind.) believes that intelligence on COVID-19 originating from the Wuhan Institute of Virology is forthcoming, and will be revealed by force of legislation if it is not released otherwise. Braun told the “John Solomon Reports” podcast about the COVID-19 Origin Act of 2021 that he introduced with Sen. Josh Hawley (R-Mo.): “Something was afoot even a week to two weeks ago — we were just a little ahead of the game when we rolled that out — where I think we’re going to hear more information. “When you got somebody like Dr. Fauci that moves goalposts from one end zone to the other and then back again, and wherever it needs to kind of plop down, when you hear the head of the WHO, when you hear the Biden administration now saying that there needs to be an investigation — of course, they’re still saying WHO needs to do it itself.

“That’s like the fox in the henhouse metaphor. So something is happening. And that’s why, with our bill out there, it’s now very pertinent.” Braun is confident the truth will soon emerge. “I think we’re gonna get to the bottom of it,” he said. “It’s just a question of, will we need a bill to do it? I don’t even think we’re going to need that because I think there’s going to be stuff coming forward that might flush it out without having to force it legislatively. If not, we’re prepared to roll up the support. Sadly, we probably won’t get one Democrat on it, though.” Braun was asked where Congress could get information on COVID and Wuhan. “How about in our own DHS?” he replied. “How about in our own Director of National Intelligence? That’s the essence of declassifying this stuff. And when you’ve got such a political posture that has dominated the dynamic, we just need that — we need the Freedom of Information Act, in essence, to release all this stuff that’s been classified.”

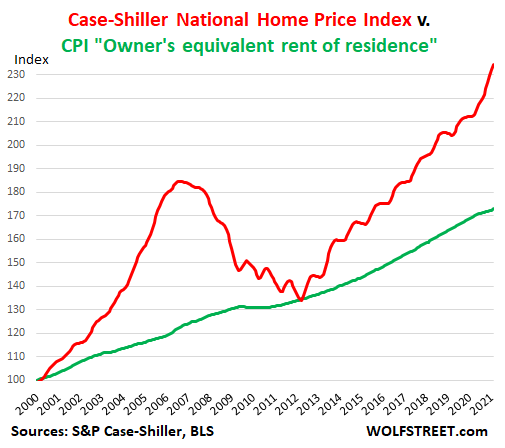

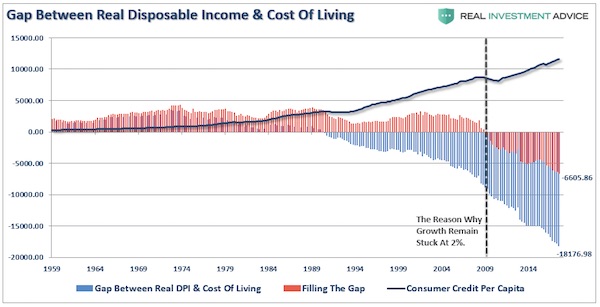

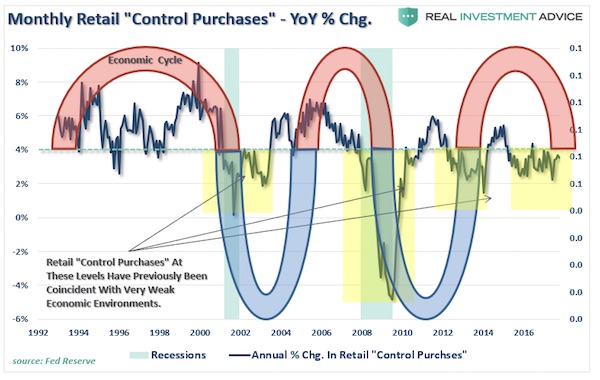

History of CPI.

• The Ghost of Arthur Burns (Stephen S. Roach)

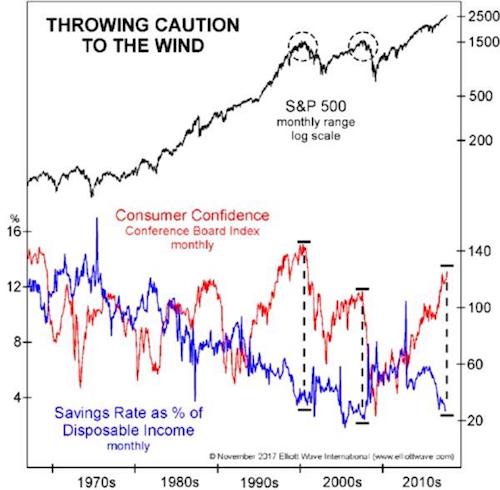

Memories can be tricky. I have long been haunted by the inflation of the 1970s. Fifty years ago, when I had just started my career as a professional economist at the Federal Reserve, I was witness to the birth of the Great Inflation as a Fed insider. That left me with the recurring nightmares of a financial post-traumatic stress disorder. The bad dreams are back.

They center on the Fed’s legendary chairman at the time, Arthur F. Burns, who brought a unique perspective to the US central bank as an expert on the business cycle. In 1946, he co-authored the definitive treatise on the seemingly rhythmic ups and downs of the US economy back to the mid-nineteenth century. Working for him was intimidating, especially for someone in my position. I had been tasked with formal weekly briefings on the very subjects Burns knew best. He used that knowledge to poke holes in staff presentations. I found quickly that you couldn’t tell him anything.

Yet Burns, who ruled the Fed with an iron fist, lacked an analytical framework to assess the interplay between the real economy and inflation, and how that relationship was connected to monetary policy. As a data junkie, he was prone to segment the problems he faced as a policymaker, especially the emergence of what would soon become the Great Inflation. Like business cycles, he believed price trends were heavily influenced by idiosyncratic, or exogenous, factors – “noise” that had nothing to do with monetary policy.

This was a blunder of epic proportions. When US oil prices quadrupled following the OPEC oil embargo in the aftermath of the 1973 Yom Kippur War, Burns argued that, since this had nothing to do with monetary policy, the Fed should exclude oil and energy-related products (such as home heating oil and electricity) from the consumer price index. The staff protested, arguing that it made no sense to ignore such important items, especially because they had a weight of over 11% in the CPI. Burns was adamant: If we on the staff wouldn’t perform the calculation, he would have it done by “someone in New York” – an allusion to his prior affiliations at Columbia University and the National Bureau of Economic Research.

Then came surging food prices, which Burns surmised in 1973 were traceable to unusual weather – specifically, an El Niño event that had decimated Peruvian anchovies in 1972. He insisted that this was the source of rising fertilizer and feedstock prices, in turn driving up beef, poultry, and pork prices. Like good soldiers, we gulped and followed his order to take food – which had a weight of 25% – out of the CPI.

We didn’t know it at the time, but we had just created the first version of what is now fondly known as the core inflation rate – that purified portion of the CPI that purportedly is free of the volatile “special factors” of food and energy, where gyrations were traceable to distant wars and weather. Burns was pleased. Monetary policy needed to focus on more stable underlying inflation trends, he argued, and we had provided him with the perfect tool to sharpen his focus.

Where the big profits are.

• America’s Nuclear Spending Spree (DP)

As Capitol Hill lawmakers continue to insist that initiatives like Medicare for All are too expensive, a new congressional report shows that the United States government is on a path to spend more than a half-trillion dollars on nuclear weapons in just the next decade. The report emerges at the same time a separate analysis shows that a handful of top executives at defense contractors are being wildly enriched by a Pentagon spending spree. The first report from the Congressional Budget Office finds that the federal government is on track to spend $634 billion over the next decade to maintain its nuclear forces, according to a new Congressional Budget Office (CBO). Almost two-thirds of those costs are for the Department of Defense, mostly to maintain ballistic missile submarines and intercontinental ballistic missiles. About one-third is for the Department of Energy.

For comparison that is: • 1.5 times the cost of all of the $1,400 stimulus checks that were sent to people through the American Rescue Plan earlier this year • Nearly 14 times the $47 billion that Congress has spent so far this year helping Americans who are behind on rent. • Over one-third of the cost of cancelling the $1.7 trillion in student debt held by Americans, most of which is never going to be repaid. • More than 7 times the estimated $81 billion of outstanding medical debt in America, as of 2018. The new CBO estimate represents a 28-percent increase over the last 10-year estimate that the CBO made on U.S. nuclear forces two years ago.

The figures were released just a few weeks after a new analysis from the Center for International Policy, a foreign policy think tank in Washington, found that “In 2020 alone, the CEOs of the [Pentagon’s] top five contractors received a total of $105.4 million in compensation.” When accounting for all top corporate officials, these firms paid out more than a quarter billion dollars of total executive compensation in 2020 — and paid out more than $1 billion over the last four years.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.