Édouard Vuillard In bed 1891

Reason. The mother and child reunion is only a motion away.

• Judge Orders Families Reunited Within 30 Days (AP)

A judge in California has ordered U.S. border authorities to reunite separated families within 30 days. If the children are younger than 5, they must be reunified within 14 days of the order, issued Tuesday. U.S. District Judge Dana Sabraw in San Diego issued the order in a lawsuit by the American Civil Liberties Union. The lawsuit involves a 7-year-old girl who was separated from her Congolese mother and a 14-year-old boy who was separated from his Brazilian mother.

Sabraw also issued a nationwide injunction on future family separations, unless the parent is deemed unfit. More than 2,000 children have been separated from their parents in recent weeks and placed in government-contracted shelters. President Donald Trump last week issued an executive order to stop the separation of families and said parents and children will instead be detained together.

The ruling above seems to cover this?

• 17 US States Sue Trump Administration Over Family Separation (Ind.)

Seventeen US states and Washington DC are suing Donald Trump’s administration over its family separation policy at the US border. The lawsuit was filed by 18 Democratic Attorneys General and attempts to force the administration to reunite the approximately 2,000 separated children with their families. California Attorney General Xavier Becerra said in a statement that the policy to detain children away from parents was a “heartless political manoeuvre”. Though Mr Trump signed an executive order last week declaring that families would no longer be separated upon illegal entry into the US, the lawsuit stated the executive order is “so vague and equivocal that it is unclear when or if any changes will actually be made”.

The order did not reverse or end the underlying “zero tolerance” policy announced by US Attorney General Jeff Sessions was not ended. Families can also now be indefinitely detained and the policy still makes seeking asylum in the US a crime. Per US immigration law, people wanting the protected status must enter the US before applying for it. It stated that “family unity” will be maintained “where appropriate and consistent with law and available resources”. “Child internment camps in America…the Trump Administration has hit a new low. President Trump’s indifference towards the human rights of the children and parents who have been ripped away from one another is chilling,” Mr Becerra said.

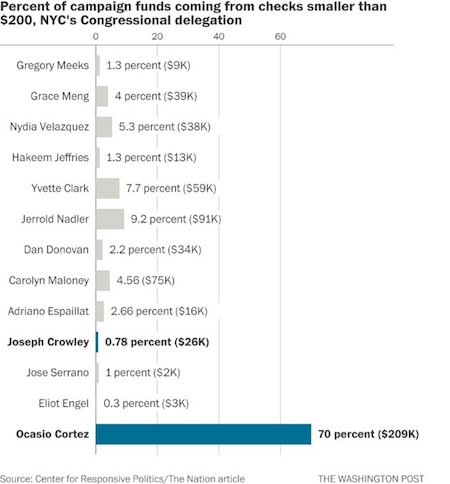

The choice of headlines I’ve seen for this looks weird. Someone tweeted a list of corporations that donate to Crowley. Needed a dozen tweets to cover them. Ocasio beat the system. But watch out: the system has now woken up. They never expected to lose. The big guns will now step in. Next up: Cynthia Nixon vs Cuomo. If she can pull that off, we’re in business.

• Democrats See Major Upset As Socialist Beats Top-Ranking US Congressman (G.)

Joe Crowley, a 10-term Democrat pegged as his party’s next leader in Congress, lost his party’s New York congressional primary to a 28-year-old socialist, in one of the biggest upsets in recent American political history. With 98% reporting, Alexandria Ocasio-Cortez had 57.5% and Crowley had 42.5%, in a majority minority district that included parts of Queens and the Bronx Ocasio-Cortez, a Puerto-Rican American and former Bernie Sanders volunteer, defeated Crowley in his re-election bid Tuesday night, after hitting the incumbent on his ties to Wall Street and accusing him of being out of touch with his increasingly diverse district.

Crowley, head of the Queens county Democratic party and the fourth-ranking Democrat in the House of Representatives, was considered to be Nancy Pelosi’s likely successor as House speaker if she stepped down. [..] Ocasio-Cortez ran a grassroots campaign and made a surprise visit to the Mexican border on the eve of the election to emphasize her call to abolish the Immigration and Customs Enforcement agency (ICE). In contrast, Crowley was unwilling to go that far, simply calling the agency “fascist”.

Crowley had expressed confidence about the race in private conversations and as one national Democratic strategist told the Guardian: “The Crowley team did not raise red flags or ask allies for help with his primary.” Prior to 2018, Crowley had not even faced a primary since 2004, years before his opponent was even eligible to vote. He had raised over $3m for his campaign, 10 times the amount his opponent had.

Tariffs on US companies?

• How Long Can The Federal Reserve Stave Off the Inevitable? — PCR

When are America’s global corporations and Wall Street going to sit down with President Trump and explain to him that his trade war is not with China but with them? The biggest chunk of America’s trade deficit with China is the offshored production of America’s global corporations. When the corporations bring the products that they produce in China to the US consumer market, the products are classified as imports from China. Six years ago when I was writing The Failure of Laissez Faire Capitalism, I concluded on the evidence that half of US imports from China consist of the offshored production of US corporations. Offshoring is a substantial benefit to US corporations because of much lower labor and compliance costs.

Profits, executive bonuses, and shareholders’ capital gains receive a large boost from offshoring. The costs of these benefits for a few fall on the many—the former American employees who formerly had a middle class income and expectations for their children. In my book, I cited evidence that during the first decade of the 21st century “the US lost 54,621 factories, and manufacturing employment fell by 5 million employees. Over the decade, the number of larger factories (those employing 1,000 or more employees) declined by 40 percent. US factories employing 500-1,000 workers declined by 44 percent; those employing between 250-500 workers declined by 37 percent, and those employing between 100-250 workers shrunk by 30 percent.

These losses are net of new start-ups. Not all the losses are due to offshoring. Some are the result of business failures” (p. 100). In other words, to put it in the most simple and clear terms, millions of Americans lost their middle class jobs not because China played unfairly, but because American corporations betrayed the American people and exported their jobs. “Making America great again” means dealing with these corporations, not with China. When Trump learns this, assuming anyone will tell him, will he back off China and take on the American global corporations?

Mnuchin wants less agressive policies.

• Market Drop Prompts Trump To Offer China A Trade War “Olive Branch” (ZH)

One day after the market tanked followed media reports that the Trump administration would pursue new initiatives to limit Chinese investments in US tech industries, on Tuesday the president suggested that he will ease off demands for such new restrictions, and will rely instead on a 1988 law being updated by Congress that authorizes the government to review foreign investments for national security problems. Speaking to reporters at the White House, Trump said that “we have the greatest technology in the world, people come and steal it. We have to protect that and that can be done through CFIUS,” or the Committee on Foreign Investment in the U.S., which traditionally has screened foreign investments to see whether they endanger national security.

Trump also said that the recent WSJ article reporting that the administration was planning two further initiatives, in addition to CFIUS, to prevent Beijing from obtaining advanced U.S. technology, “a bad leak…probably just made up.” Why is this stated policy important? Because according to the WSJ it would represent a potential “olive branch” for Trump in the escalating trade war with China, and a signal that the US is willing to break the tit-for-tat escalation: If Mr. Trump’s decision holds through June 30, when the new policies are scheduled to be announced, it would represent a significant backing away from threats the president has made against China and a possible olive branch to Beijing before the July 6 impositon of tariffs on $34 billion of Chinese goods.

Meanwhile, lawmakers who have worked on a CFIUS reform bill have also been arguing in administration meetings that additional investment restrictions weren’t necessary given changes being made to CFIUS. Separately, the report notes that relying mainly on CFIUS — if that is the final decision — would be a big victory for Treasury Secretary Steven Mnuchin, National Economic Council Director Larry Kudlow and others who have tried to tamp down the burgeoning trade battle with China.

Obese tails.

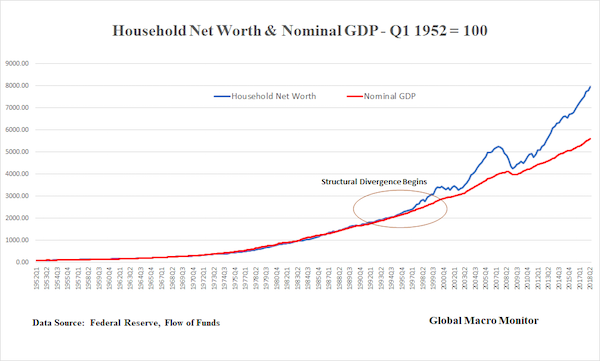

• US Asset Prices Divorced From Economic Reality More Than Ever (GMM)

You would never know it listening to the market cheerleaders but asset prices, both real and financial, are, once again, at extreme valuation levels relative to the trend economy. The valuation reality coupled with the prevailing, but false, “don’t worry” market narrative sets us up for another major financial crisis. A third major crisis in 20 years? These are only supposed to happen once in every 100 or 1,000 or 10,000 years, so say the rocket scientists. Blame it on

fatobese tails. The chart below illustrates that household net worth, as measured by real and financial assets minus liabilities, which just hit a record high at around $102 trillion, is, once again, totally divorced from the economy.Note that one of the reasons why the highest level U.S. policymakers missed the last financial crisis is because they were too focused on this indicator, which also hit a record high in Q3 2007. They failed, or chose not to see, the massive leverage as the root cause driving up assets prices. Their error was twofold: 1) not fully recognizing or believing the risk of asymmetric mark-to-market, where asset prices are variable, while liabilities remain fixed, and 2) not understanding the economy had morphed into a giant asset-driven feedback loop, where the wealth effect drives growth (both consumption and investment confidence), which drives asset prices, which drives the wealth effect. Wash, rinse, repeat.

Well, how timely.

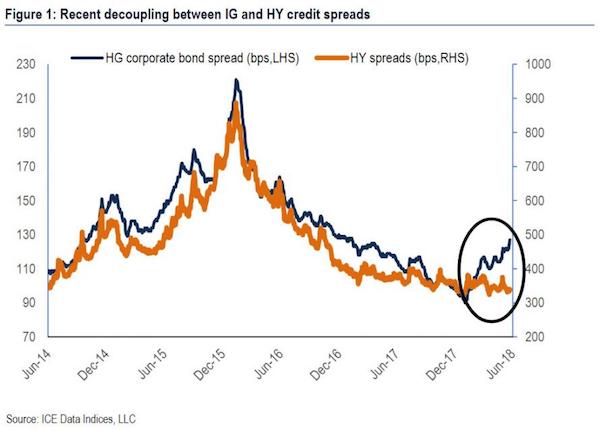

• IMF Sounds The Alarm Over Junk Bonds (ZH)

Ever since the start of 2018, an odd divergence has emerged in credit markets, where Investment Grade bonds have seen their spreads leak progressively wider, hitting levels not seen in 2 years, while the bid for higher yielding, and much more risky, junk bond debt has been seemingly relentless, with high yield spreads near all time lows. To be sure, many reasons have been offered, with Bank of America suggesting that IG weakness is “due to supply pressures in an environment of reduced demand that began in March and extended through last week, plus the Italian situation, which is about systemic risks running through the global IG financial system.”

Meanwhile, it believes the strength in HY is mostly due to the lack of supply of higher yielding paper. Whatever the suggested reasons, however, the underlying causes are two: an environment of artificially low interest rates created by central banks, and unyielding, pardon the pun, investor euphoria. In other words: a multi-year credit boom. And while the Fed’s “macroprudential regulation team” appears to have zero problems with what is going on in the world of junk bonds, the IMF has sounded the alarm on the troubling developments in junk bond land in particular, and capital markets in general.

In its The Chart of the Week, the IMF Blog shows the impact of a bad credit boom – one which the fund defines as followed by slower economic growth or even a recession – on economic growth in the years that follow. But first, it ask a basic question: what makes for a bad boom? The IMF’s answer: it is fueled by excessive optimism among investors. When the economy is doing well and everybody seems to be making money, some investors assume that the good times will never end. They take on more risk than they can reasonably expect to handle.

Really, guys, you should send her packing. The damage accelerates.

• France And Germany Will Block May’s Single Market Plan, Says Spain (G.)

Theresa May’s plan to protect British industry by keeping the UK in a single market for goods without respecting the free movement of people after Brexit will be rejected by an “angry” France and Germany, despite some sympathy within the EU to Downing Street’s cause, Spain’s foreign minister has said. The new Spanish government would also block such a political fix, Josep Borrell told the Guardian, ahead of both a summit of leaders in Brussels and a summer tour by the prime minister of EU capitals during which May hopes to convince leaders of her economic case. Of those member states who might see value in a deal on single market access for goods without free movement, Borrell said: “They will not win the battle. They have not enough power. Germany will say no, France will say no, Spain will say no.”

The government has been rocked by a series of warnings from industry, from Airbus to BMW, that companies will move out of the UK unless preferential access to the single market can be secured in the negotiations. Ministers have openly squabbled over how seriously they should take the threats. The business secretary, Greg Clark, urged his cabinet colleagues to “listen with respect” and the health secretary, Jeremy Hunt, called Airbus’s warnings “completely inappropriate”. The prime minister is expected to publish a white paper on the UK’s vision of the future relationship, including a proposal for regulatory alignment on goods, for the benefit of UK industry and European-wide supply chains, shortly after a meeting of the cabinet at Chequers, the prime minister’s country retreat, on 6 July.

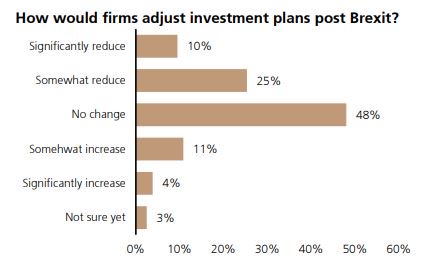

UBS survey of 600 companies spells out Brexit “dividend”:

– 35% of companies plan to reduce UK investment post-Brexit

– 41% plan to move a large amount of capacity out of UK

– 42% plan to shift capacity to euro zone

Too late. No unity.

• Merkel Calls For Direct Deals Between Countries To Fix Migration Crisis (R.)

German Chancellor Angela Merkel said she will seek direct deals with separate EU states on migration, conceding the bloc had so far failed to find a joint solution to the issue threatening her government. Sixteen EU leaders met for emergency talks in Brussels hoping to get a deal for the full summit of all 28 states on 28 to 29 June. Ms Merkel said the meeting produced “a lot of goodwill” to resolve differences, but was clear smaller agreements may produce better results. “There will be bilateral and trilateral agreements, how can we help each other, not always wait for all 28 members,” she said.

Since Mediterranean arrivals spiked in 2015, when more than a million refugees and migrants reached the bloc, EU leaders have been at odds over how to handle them. The feud has weakened their unity and undermined Europe’s Schengen free-travel area. Wealthy Germany is where the newly-arrived mostly end up and Merkel is under pressure to curb the numbers. Her coalition partner is pushing for firmer action that could break her government. The talks were “frank and open,” but “we don’t have any concrete consequences or conclusions,” Spanish Prime Minister Pedro Sanchez said. French President Emmanuel Macron offered his backing for Ms Merkel’s proposal , saying the solution should be “European” but it could just be several states together.

But the profits!

• Misuse Of Opioids Is A ‘Global Epidemic’ -UN (G.)

The misuse of pharmaceutical opioids is fast becoming a “global epidemic”, with the largest quantities being seized in African countries for the second year in a row, according to a UN report. While huge attention has been paid to the opioid crisis in the US – where the misuse of prescription drugs like fentanyl dominates – figures released by the United Nations Office on Drugs and Crime has revealed seizures in Africa of opioids now account for 87% of the global total. Unlike in the US, the seizures – concentrated in west, central and north Africa – have largely consisted of the drug tramadol, followed by codeine.

The figures were disclosed in the latest UN world drug report, which noted that opioids were the most harmful global drug trend, accounting for 76% of deaths where drug-use disorders were implicated. The report said that while fentanyl and its analogues remain a problem in North America, tramadol – used to treat moderate and moderate-to-severe pain – has become a growing concern in parts of Africa and Asia. The report added that the global seizure of pharmaceutical opioids in 2016 was 87 tonnes, roughly the same as the quantities of heroin impounded that year.

The figures on pharmaceutical opioids were rivalled by global cocaine manufacture, which the agency said had reached the highest level ever reported in 2016, with an estimated 1,410 tonnes produced. Most of the world’s cocaine comes from Colombia, but the report also showed Africa and Asia emerging as cocaine trafficking and consumption hubs. From 2016-17, global opium production also jumped by 65% to 10,500 tonnes, the highest estimate recorded by the agency since it started monitoring global opium production nearly 20 years ago.

They convert greenhouse gases into oxygen.

• One Football Pitch Of Forest Lost Every Second In 2017 (G.)

The world lost more than one football pitch of forest every second in 2017, according to new data from a global satellite survey, adding up to an area equivalent to the whole of Italy over the year. The scale of tree destruction, much of it done illegally, poses a grave threat to tackling both climate change and the massive global decline in wildlife. The loss in 2017 recorded by Global Forest Watch was 29.4m hectares, the second highest recorded since the monitoring began in 2001. Global tree cover losses have doubled since 2003, while deforestation in crucial tropical rainforest has doubled since 2008. A falling trend in Brazil has been reversed amid political instability and forest destruction has soared in Colombia.

In other key nations, the Democratic Republic of Congo’s vast forests suffered record losses. However, in Indonesia, deforestation dropped 60% in 2017, helped by fewer forest fires and government action. Forest losses are a huge contributor to the carbon emissions driving global warming, about the same as total emissions from the US, which is the world’s second biggest polluter. Deforestation destroys wildlife habitat and is a key reason for populations of wildlife having plunged by half in the last 40 years, starting a sixth mass extinction.

“The main reason tropical forests are disappearing is not a mystery – vast areas continue to be cleared for soy, beef, palm oil, timber, and other globally traded commodities,” said Frances Seymour at the World Resources Institute, which produces Global Forest Watch with its partners. “Much of this clearing is illegal and linked to corruption.” Just 2% of the funding for climate action goes towards forest and land protection, Seymour said, despite the protection of forests having the potential to provide a third of the global emissions cuts needed by 2030. “This is truly an urgent issue that should be getting more attention,” she said. “We are trying to put out a house fire with a teaspoon.”

No, trees are not an industrial resource. They are so much more.

• ‘There Is No Oak Left’: Are Britain’s Trees Disappearing? (G.)

England is running out of oak. The last of the trees planted by the Victorians are now being harvested, and in the intervening century so few have been grown – and fewer still grown in the right conditions for making timber – that imports, mostly from the US and Europe, are the only answer. “We are now using the oaks our ancestors planted, and there has been no oak coming up to replace it,” says Mike Tustin, chartered forester at John Clegg and Co, the woodland arm of estate agents Strutt and Parker. “There is no oak left in England. There just is no more.” Earlier this month, the government appointed the first “tree champion”, who will spearhead its plans to grow 11 million new trees, and conserve existing forests and urban trees.

Sir William Worsley, currently chairman of the National Forest Company, has been given the task of overseeing trees in England and Wales, including England’s iconic national tree, and ensuring that trees are not felled unnecessarily. Worsley is a former chief of the Country Land and Business Association, which represents landowners and rural businesses. Trees were once fundamental to the British economy, from the days of Magna Carta, a large section of which concerned forestry rights, to the “Hearts of Oak” centuries of the empire-building Royal Navy, up to more recent times when millions of homes were needed, and the Forestry Commission was set up immediately after the First World War to grow the material to make them, while providing jobs for returning soldiers.

Today, forestry is a tiny business and only about 13% of the UK is covered in forest, a vast improvement on the 5% after the First World War, but far less than the European average of more than 30%.

That’s the spirit.

• ‘Green Gold’: Pakistan Plants Hundreds Of Millions Of Trees (AFP)

The change is drastic: around the region of Heroshah, previously arid hills are now covered with forest as far as the horizon. In northwestern Pakistan, hundreds of millions of trees have been planted to fight deforestation. In 2015 and 2016 some 16,000 labourers planted more than 900,000 fast-growing eucalyptus trees at regular, geometric intervals in Heroshah – and the titanic task is just a fraction of the effort across the province of Khyber Pakhtunkhwa. “Before it was completely burnt land. Now they have green gold in their hands,” commented forest manager Pervaiz Manan as he displayed pictures of the site previously, when only sparse blades of tall grass interrupted the monotonous landscape.

The new trees will reinvigorate the area’s scenic beauty, act as a control against erosion, help mitigate climate change, decrease the chances of floods and increase the chances of precipitation, says Manan, who oversaw the revegetation of Heroshah. Residents also see them as an economic boost – which, officials hope, will deter them from cutting the new growth down to use as firewood in a region where electricity can be sparse. “Now our hills are useful, our fields became useful,” says driver Ajbir Shah. “It is a huge benefit for us.” Further north, in Khyber Pakhtunkhwa’s Swat, many of the high valleys were denuded by the Pakistani Taliban during their reign from 2006 to 2009.

Now they are covered in pine saplings. “You can’t walk without stepping on a seedling,” smiles Yusufa Khan, another forest department worker. The Heroshah and Swat plantations are part of the “Billion Tree Tsunami”, a provincial government programme that has seen a total of 300 million trees of 42 different species planted across Khyber Pakhtunkhwa.