M.C. Escher Gravitation 1952

Travel day yesterday, back to Athens. So timing’s a bit skewed. And the content. Just the essentials today. And there was raki last night, and friends. Lots of both. In a city that is fast turning, like Barcelona, Amsterdam et al, into Disneyland. Because of Airbnb. Stories of Greek people getting evicted from their apartments because the Greek owner sold the building to a Chinese who will Airbnb it, not rent out to locals. And then a good friend saying that’s good because renting out his apartment this way is the only way to pay for his aunt’s health care bills. Apartment prices have tripled in 2 years, but you can’t even find one.

A city is nice because of the people who live there. Airbnb chases them out. And then you wind up with an empty shell. Disneyland.

Saw a sign held up in a demo concerning Christchurch that said: “We won’t tolerate hate”. And I thought: maybe you should. Maybe, if you protest intolerance, the response is not more intolerance. Like Martin Luther King could have said: You can hate me, but I refuse to hate you back.

It’s Alice and the looking glass. The entire Mueller probe was based on a dossier based on nothing but a bunch of nutcase comments at a CNN site. And this is CNN commenting on that. The dossier was paid for by the losing Democrat party, and there are close links to FBI and DOJ. And you think Trump’s the bad guy in this story.

On top of that, Steele hadn’t been in Russia in many years, and used equally unverified ‘info’ from Moscow. And the US hunts its own president for 2 years based on it.

“Steele says he used unverified information to support details about web company in dossier..”

• Steele Admits He Used Unverified Information In Dossier (CNN)

A newly released snippet of a deposition with the ex-British spy behind the Trump-Russia dossier describes some of the steps he took to verify information he collected for it in 2016, including pulling from a user-generated citizen journalism initiative by CNN, iReport, which no longer operates. Christopher Steele admitted during a lawsuit deposition that he used internet searches and unverified information to support details he had gathered about a web company mentioned in the dossier, according to select pages of his deposition transcript that a federal court unsealed this week.

But Steele limited his answers about how he verified information about the web companies who claimed they were defamed. He would not explain, for instance, what else he did or sources he used to verify information in the dossier about Webzilla, its parent company XBT and their Russian founder Aleksej Gubarev, who were named in the dossier. He did not have to describe during the deposition all the steps he took to collect or check the information because of terms set by the court.

But he could talk about web searches — and how he didn’t realize one article he found in his research was a submission from a “random person,” as an attorney pointed out, rather than a news report. Steele testified that he used a 2009 article from the crowdsourced news site CNN iReport, for instance, to check information he learned about Webzilla, one of the three related entities that had sued BuzzFeed for defamation. BuzzFeed published the dossier in full — explaining they hadn’t verified it — on January 10, 2017, after CNN reported that President Barack Obama and President-elect Donald Trump had been briefed about it.

Yes, that Stephen Cohen. Who is still America’s no. 1 expert on Russia, professor emeritus of Russian studies, history, and politics at New York University and Princeton University. That Stephen Cohen

• Even A Vacuous Mueller Report Won’t End ‘Russiagate’ (Stephen Cohen)

Too many reputations and other interests are vested in the legend for it to vanish from American politics anytime soon. Russiagate allegations that the Kremlin has a subversive hold over President Trump, and even put him in the White House, have poisoned American political life for almost three years. Among other afflictions, it has inspired an array of media malpractices, virtually criminalized anti–Cold War thinking about Russia, and distorted the priorities of the Democratic Party. And this leaves aside the woeful impact Russiagate has had in Moscow—on its policymakers’ perception of the US as a reliable partner on mutually vital strategic issues and on Russian democrats who once looked to the American political system as one to be emulated, a loss of “illusions” I previously reported.

• The story of a “Kremlin puppet” in the White House is so fabulous and unprecedented it is certain to become a tenacious political legend, as have others in American history despite the absence of any supporting evidence.

• The careers of many previously semi-obscure Democratic members of Congress have been greatly enhanced—if that is the right word—by their aggressive promotion of Russiagate. (Think, for example, of the ubiquitous media coverage and cable-television appearances awarded to Representatives Adam Schiff, Eric Swalwell, and Maxine Walters, and to Senators Mark Warner and Richard Blumenthal.) If Mueller fails to report “collusion” of real political substance, these and other Russiagate zealots, as well as their supporters in the media, will need to reinterpret run-of-the-mill (and bipartisan) financial corruption and mundane “contacts with Russia” as somehow treasonous. (The financial-corruption convictions of Paul Manafort, Mueller’s single “big win” to date, did not charge “collusion” and had to do mainly with Ukraine, not Russia.) Having done so already, there is every reason to think Democrats will politicize these charges again, if only for the sake of their own careers. Witness, for example, the scores of summonses promised by Jerrold Nadler, the new Democratic chair of the House Judiciary Committee.

• Still worse, the top Democratic congressional leadership evidently has concluded that promoting the new Cold War, of which Russiagate has become an integral part, is a winning issue in 2020. How else to explain Nancy Pelosi’s proposal—subsequently endorsed by the equally unstatesmanlike Senate Republican leader Mitch McConnell, and adopted—to invite the secretary general of NATO, a not-very-distinguished Norwegian politician named Jens Stoltenberg, to address a joint session of Congress? The honor was once bestowed on figures such as Winston Churchill and at the very least leaders of actual countries.

Trump has reasonably questioned NATO’s mission and costs nearly 30 years after the Soviet Union disappeared, as did many Washington think tanks and pundits back in the 1990s. But for Pelosi and other Democratic leaders, there can be no such discussion, only valorization of NATO, even though the military alliance’s eastward expansion has brought the West to the brink of war with nuclear Russia. Anything Trump suggests must be opposed, regardless of the cost to US national security. Will the Democrats go to the country in 2020 as the party of investigations, subpoenas, Russophobia, and escalating cold war – and win?

“..a Democratic Party Bereavement Ritual..”

• The Blind Leading the Deaf and Dumb (Kunstler)

In his new book, Peak Trump, David Stockman called the RussiaGate affair “a Democratic Party Bereavement Ritual,” an excellent diagnosis. The breast-beating and garment-rending has gone on for more than two years, inducing a generalized hysteria that has made it impossible for this country to govern itself, and opening the door to some really serious mischief as the party’s new Jacobin wing sets up for the advent of an American failed state.

All of this is a prelude to equally serious tribulation roaring down the two-lane pike of finance and economy that will combine with the engineered destruction of institutional authority from RussiaGate to bring on the greatest crisis since the Civil War. The money is not there to perform any of the miracles of redistribution promised by AOC and Bernie Sanders — unless the Federal Reserve is coerced into printing a whole lot more money out of thin air, in which case the consequence will be that everybody gets to have a lot of worthless money that has lost its value.

If congress wants to play committee games, it might want to investigate how the USA is going to rack up another $2 trillion in debt to finance its operations before the 2020 election. They’re the ones who will have to vote to allow that to happen. The disorders of money coming down in the months ahead, RussiaGate aside, are sure to discredit both political parties. I doubt that Mr. Trump will survive it politically and the revenant Republican Party behind him is so devoid of credible leadership that it could dissolve altogether like an evening mist preceding the cold darkness of night. By then, the whole American political establishment will be, as Mencken quipped, like a blind man stumbling around a dark cellar looking for a black cat that isn’t there.

If war-gaming is the same as preparing, sure. Maybe May should war-game a bit more.

• EU War-Gaming For Fall Of May’s Government (O.)

The EU is war-gaming for the fall of Theresa May amid a complete collapse in confidence in the prime minister after a week of chaos over Brexit, a leaked document seen by the Observer reveals. In the run-up to a crucial summit of EU leaders where May will ask for a delay to Brexit, Brussels fears there is little hope that she will succeed in passing her deal this week and is preparing itself for a change of the guard in Downing Street. A diplomatic note of a meeting of EU ambassadors and senior officials reveals an attempt to ensure that any new prime minister cannot immediately unpick the withdrawal agreement should May be replaced in the months ahead. Some hardline Brexiters want to replace her with a leader who will back a harder split with Brussels.

According to the minutes, the European commission’s secretary general, Martin Selmayr, who is known as a master of strategy, asked: “Imagine that they have a new Brexit secretary or prime minister – what then? Article 50 has been agreed and the process has ended. It must be clear that the starting point is not a renegotiation of the withdrawal agreement.” The moves in Brussels come before another critical and highly unpredictable week in the Brexit process in which May is expected to launch her third attempt to secure support for her beleaguered deal. The Observer understands that Labour will use the opportunity to offer its most strident support yet for a second referendum, by voting for a plan drawn up by two Labour backbenchers to put May’s deal to a public vote.

Cabinet ministers remained locked in talks this weekend with the Northern Irish Democratic Unionist party, who are seen as vital in building a narrow majority for May’s deal and who said on Saturday that there were “still issues to be addressed”. And more Tory MPs currently opposing May’s Brexit deal have told party whips they would back it if the prime minister announced she would quit this summer.

They are way past disbelief.

• Disbelief In Europe At Another Lost Brexit Week (G.)

It was the week in which the EU’s governments had hoped that British common sense might seal the deal, putting a painful first chapter of the Brexit psychodrama to bed. By Wednesday the French daily Le Monde had concluded that the hoarseness of the prime minister’s throat “symbolised the state of a supposedly pragmatic country left voiceless by its incapacity to accept compromise with its neighbours”. For all the forlorn hopes that things might be different this time, leaders across Europe and senior EU officials in their offices in Brussels, watched on with a sinking heart as Theresa May’s deal was rejected again on Tuesday evening, this time by 149 votes, the fourth largest defeat for a sitting government.

The Commons subsequently voted to delay Brexit by at least three months. Mark Rutte, the Dutch prime minister, who has described himself as Britain’s best friend among the 27 EU heads of state and government, was left asking reporters: “What’s the point of whining on for months on end while we have been going around in circles for two years?” There had never been great optimism among the British officials close to the negotiations that things would slot into place, given the EU’s refusal to make changes to the withdrawal agreement, and the over-optimistic goals set by the prime minister in the Commons for the latest talks. But there had been a plan.

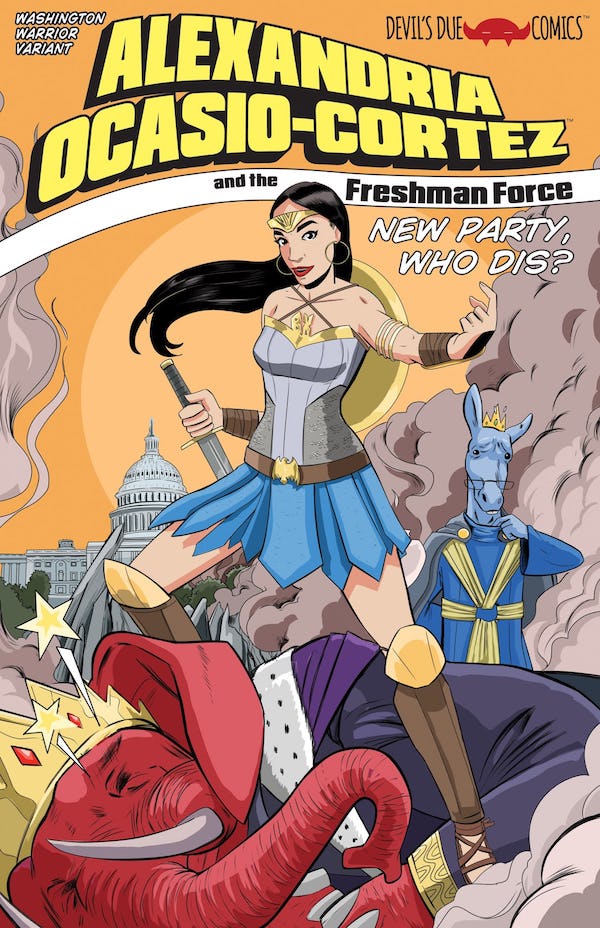

Convince me she’s wrong on this. And I’m a white man. You’ll have a hard time getting rid of her, America. Thing is, you don’t need to agree with Trump, or AOC, to recognize their value and their role in the grander scheme of things.

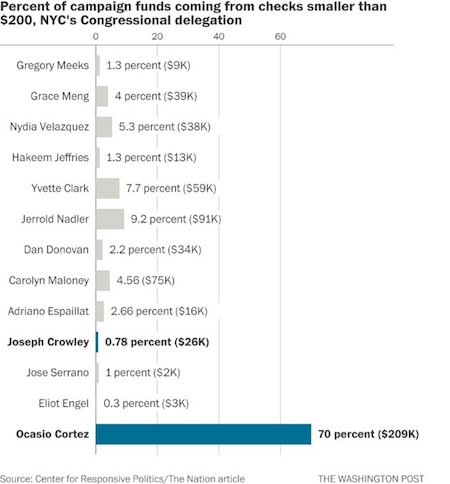

• ‘White Men Are Considered Everyone’: Ocasio-Cortez (G.)

Alexandria Ocasio-Cortez criticized media coverage of her latest polling results on Saturday, noting her net favorability among all women and all non-white Americans, even as some commenters suggested that “Americans” now viewed her negatively. “So older, conservative white men are considered ‘everyone’ and everyone else is discounted as an exception,” the progressive New York congresswoman tweeted. “Cool.” The freshman Democrat blamed Fox News’ round-the-clock negative coverage for increasing the number of Republicans and white Americans who know who she is –and who view her unfavorably.

“The reason people know more is bc Fox News has turned into ‘AOC TMZ’ (no offense to TMZ),” she wrote, referencing the celebrity tabloid site. She also called Fox News a “propaganda machine” that “will be aimed at any Dem[ocrat] they want”. Since September, two months before the 29-year-old was elected, the number of Americans who say they have never heard of her or that they have no opinion has dropped by 21%, according to the Gallup poll results from February. Now, more than two-thirds of respondents have an opinion.But such visibility appears to have brought more negative reactions than positive ones. Overall, Gallup found, 31% of respondents now view Ocasio-Cortez favorably and 41% unfavorably. Her net favorability ratings are down 8%.

There were sharp partisan and racial divides in this response. Since September, Ocasio-Cortez’s net favorability dropped most sharply among Republicans (-21), white Americans (-15), men (-11) and Americans over 55 (-10). At the same time, net favorability increased among nonwhite Americans (+9) and Democrats (+8). A majority of women and Americans ages 18 to 34 still have a favorable opinion of the congresswoman, Gallup found. Her favorability has dropped slightly among such voters groups since September, but remains net positive. In presenting the poll results, Gallup noted that Republicans were more likely to have an opinion about Ocasio-Cortez than members of her own party, which “helps explain her overall net-negative rating”.

Some headlines announcing the Gallup results did not emphasize the racial and party-line divides reflected in the statistics. “Alexandria Ocasio-Cortez polls like Donald Trump: Poorly,” CNN reported, while US News and World Report summarized the news as: “Alexandria Ocasio-Cortez’s Unfavorable Rating Climbs.” Fox News covered the poll results with the headline: “Ocasio-Cortez’s ‘unfavorable’ rating skyrockets, with most people viewing her negatively.”

https://twitter.com/AOC/status/1106953015804731393

Europe is one of the worst places in air quality. Happy driving.

• Deadly Air In Our Cities: The Invisible Killer (O.)

In 2014, like Kylie and Shazia, I didn’t know much about air pollution. I had just become a father when, living in London at the time, an Evening Standard headline caught my eye: Oxford Street had the worst diesel pollution in the world. This came as a surprise: the shopping street where I took my daughter to pick out her first pram had some of the most polluted air on Earth. Where were the health warnings, the public information signs, the protesters marching? All I could see were happy, oblivious shoppers. Weeks later came another headline: “Oxford Street pollution levels breached EU annual limit just four days into 2015.”

We had sleepwalked into a public health crisis. And not just in the UK, but across the world. The 2015 smog in Beijing was so bad that it was dubbed the “Airpocalypse”. Pictures circulated on social media of Beijing students sitting their exams so couched in smog that they could barely see the neighbouring table. The toxic smog that covers Delhi every Diwali now lasts for months at a time. Eventually, in the summer of 2016, my young family and I left London and moved to semi-rural Oxfordshire. I felt the relief of escape. I could breathe easy. The first time my daughter went out into our new garden at night, she asked what all the lights in the sky were. Twinkle Twinkle Little Star was no longer an abstract concept. But I also felt a sense of defeat. Had I taken the easy way out? Shouldn’t I have stayed and fought for change?

The more food we produce, the worse it gets. Supreme irony. Because with all that food, we could grow our numbers with no limits. So we build in a limit.

• Good Enough To Eat? The Toxic Truth About Modern Food (G.)

For most people across the world, life is getting better but diets are getting worse. This is the bittersweet dilemma of eating in our times. Unhealthy food, eaten in a hurry, seems to be the price we pay for living in liberated modern societies. Even grapes are symptoms of a food supply that is out of control. Millions of us enjoy a freer and more comfortable existence than that of our grandparents, a freedom underpinned by an amazing decline in global hunger. You can measure this life improvement in many ways, whether by the growth of literacy and smartphone ownership, or the rising number of countries where gay couples have the right to marry. Yet our free and comfortable lifestyles are undermined by the fact that our food is killing us, not through lack of it but through its abundance – a hollow kind of abundance.

[..] What we eat now is a greater cause of disease and death in the world than either tobacco or alcohol. In 2015 around 7 million people died from tobacco smoke, and 2.75 million from causes related to alcohol, but 12m deaths could be attributed to “dietary risks” such as diets low in vegetables, nuts and seafood or diets high in processed meats and sugary drinks. This is paradoxical and sad, because good food – good in every sense, from flavour to nutrition – used to be the test by which we judged the quality of life. A good life without good food should be a logical impossibility.

Where humans used to live in fear of plague or tuberculosis, now the leading cause of mortality worldwide is diet. Most of our problems with eating come down to the fact that we have not yet adapted to the new realities of plenty, either biologically or psychologically. Many of the old ways of thinking about diet no longer apply, but it isn’t clear yet what it would mean to adapt our appetites and routines to the new rhythms of life. We take our cues about what to eat from the world around us, which becomes a problem when our food supply starts to send us crazy signals about what is normal. “Everything in moderation” doesn’t quite cut it in a world where the “everything” for sale in the average supermarket has become so sugary and so immoderate.