NPC Newsstand with Out-of-Town Papers, Washington DC 1925

“If China does decelerate well below 7% in 2015, an oil price target in the $30 to $40 range is completely realistic.”

• Cheap Oil May Be A Sign Of Bigger Problems (MarketWatch)

While there is no instant replay in the markets, if commodities raised more red flags over the summer, at this point they are doing the equivalent of the football coach screaming in the referee’s face as he has been completely ignoring the flags being thrown on the field. Looking at oil dispassionately, one has to admit that for all intents and purposes, WTI crude oil has been down for seven straight weeks. The glass-half-full crowd will note that consumers get more money to spend for the holidays, and this is true. The glass-half-empty crowd will say that oil price weakness indicates weak global demand and consumers cannot possibly make up for that. This does not necessarily have to be the case, although it is certainly a possibility with rising probabilities at the moment. Brent crude oil futures (the European benchmark) are much weaker from a trading perspective as they have taken out key support levels with rather persistent selling that indicates weak demand at a time when oil markets have ample supply.

European economic data signifies what is in effect an economic rarity — a triple-dip recession — as the eurozone never really recovered from its sovereign-debt crisis. Shrinking eurozone bank lending over the past two years already told us with a high degree of certainty that this was coming, but now that it is here, we are starting to see repercussions in key commodities. One thing that strikes me about this oil-price decline is how persistent and methodical it has been. Commodities trend much differently than stocks as strong trends sometimes seem almost linear in nature with very shallow countertrend moves. I have used the analogy that the zigs and zags of stocks are typically much better defined than those for key commodities in strong trends. The other asset class that tends to show such “zagless” strong trends at times is currencies. This can easily be seen in the yen’s USD/JPY cross rate upward move. The euro is also showing a weakening trend, where the EUR/USD downward move has been accelerating as deposit rates at the ECB have sunk further into negative territory.

Strong declines in commodity prices signify a supply-demand imbalance. You can’t quickly shut off supply, as there are many already-spent budgets and projects that need to be completed, so weakening demand can carry the oil price much further. I think this oil situation has little to do with the U.S. and much more to do with Europe and China, much the same way in which commodity-price weakness in 1997-1998 was due to the Asian Crisis and not U.S. demand. How low can the oil price go? [..] we know that the cash cost of shale oil is about $60 per barrel, varying among different producers, and that historically, commodity producers have been known to produce their respective commodities at a loss to keep personnel and equipment going, as well a service debts that have financed their recent expansion. In that regard, it would be interesting to note that energy junk bonds comprise 16% of the junk-bond market, and their issuance is up 148% to $211 billion according to Fitch. So, yes, I think the oil price can decline below $60.

2015 will be a bloody year for the shale industry. Money looks certain to stop flowing in, and then reality fills the freed up space.

• Drilling Slowdown on Sub-$80 Oil Creeps Into Biggest US Fields (Bloomberg)

The slowdown in the U.S. oil-drilling boom spread to two of the nation’s largest fields this week. The Permian Basin of Texas and New Mexico, the country’s biggest oil play, lost four rigs targeting crude, dropping to 558, Baker Hughes aid on its website today. Those in North Dakota’s Williston Basin, the third-largest and home to the Bakken shale formation, slid to the lowest level since August, according to the Houston-based field services company’s website. It was the first time in four weeks that oil rigs dropped in the Williston. Oil prices have tumbled 29% from this year’s peak, pausing a surge in drilling in U.S. shale plays that has propelled domestic crude production to the most in three decades and brought retail gasoline prices below $3 a gallon for the first time since 2010. Drillers from Apache to Hess have announced plans to cut their rig counts in some North American oil fields as crude futures trade under $80 a barrel.

U.S. benchmark West Texas Intermediate crude for January delivery gained 66 cents to settle at $76.51 a barrel on the New York Mercantile Exchange. “We’ll start to see really big drops early next year if oil prices stay the same,” James Williams, president of WTRG Economics in London, Arkansas, said by telephone. Nineteen shale regions in the U.S. are no longer profitable with oil at $75 a barrel, data compiled by Bloomberg New Energy Finance show. Those areas, including parts of the Eaglebine and Eagle Ford in Texas, pumped about 413,000 barrels a day, according to the latest data available from Drillinginfo and company presentations.

“If OPEC wants to reduce output, it only makes sense if other oil producers outside of OPEC do the same .. ”

• Russia to Cooperate With Saudis on Oil, Avoiding Output Cuts (Bloomberg)

Russia said it’s willing to cooperate with Saudi Arabia on the oil market, while avoiding a commitment to limit output to reverse plunging prices. The two countries also sought to overcome differences on Syria during the first ever talks in Moscow between their foreign ministers, marking a thawing of ties between the world’s two biggest oil exporters. Oil has collapsed into a bear market this year as the U.S. pumps crude at the fastest rate in more than three decades and demand shows signs of weakening. Russia, which depends on oil and gas for about half its revenue, is on the brink of recession amid U.S. and European sanctions targeting its energy and financial industries.

Saudi Arabia and Russia, which together produce 25% of global oil, agreed the market “must be free of attempts to influence it for political and geopolitical reasons,” Russian Foreign Minister Sergei Lavrov said after the talks today. Where supply and demand are “artificially distorted,” oil exporters “have a right to take measures to correct these non-objective factors.” Lavrov and Saudi Arabian Foreign Minister Prince Saud Al-Faisal said in a joint statement that they’ll coordinate on “issues” affecting the energy and oil markets, without giving more detail. [..] “If OPEC wants to reduce output, it only makes sense if other oil producers outside of OPEC do the same,” said Elena Suponina, a Middle East expert and adviser to the director of Moscow’s Institute for Strategic Studies. “Otherwise you just lose market share.”

“Japan is going down for the count, China’s house of cards is truly collapsing, Europe is plunging into a triple dip and Wall Street’s spurious claim that 3% “escape velocity” has finally arrived in the US is soon to be discredited for the 5th year running.”

• Sell, Sell, Sell .. The Central Bank Madmen Are Raging (David Stockman)

The global financial system has come unglued. Everywhere the real world evidence points to cooling growth, faltering investment, slowing trade, vast excess industrial capacity, peak private debt, public fiscal exhaustion, currency wars, intensified politico-military conflict and an unprecedented disconnect between debt-saturated real economies and irrationally exuberant financial markets. Yet overnight two central banks promised what amounts to more monetary heroin and, presto, the S&P 500 index jerked up to 2070. That is, the robo-traders inflated the PE multiple for S&P’s basket of US-based global companies to a nose bleed 20X their reported LTM earnings. And those earnings surely embody a high water mark in a world where Japan is going down for the count, China’s house of cards is truly collapsing, Europe is plunging into a triple dip and Wall Street’s spurious claim that 3% “escape velocity” has finally arrived in the US is soon to be discredited for the 5th year running.

So it goes without saying that if “price discovery” actually existed in the Wall Street casino, the capitalization rate on these blatantly engineered earnings (i.e. inflated EPS owing to massive buybacks) would be decidedly less exuberant. In truth, nothing has changed about the precarious state of the world since yesterday. Except .. except the Great Bloviator at the ECB made another fatuous and undeliverable promise – this time that he would do whatever he “must to raise inflation and inflation expectations as fast as possible”; and, at nearly the same hour, the desperate comrades in Beijing administered another sharp poke in the eye to China’s savers by lowering the deposit rate to by 25 bps to 2.75%.

Let’s see. Can it possibly be true that European growth is faltering because it does not have enough inflation? Or that China’s fantastic borrowing and building boom is cooling rapidly because the People Bank of China (PBOC) has been too stingy? The answer is not on your life, of course. So why would stocks soar based on two overnight announcements that can not possibly alleviate Europe’s slide into recession or the collapse of China’s out-of-control investment and construction bubble?

There is no growth.

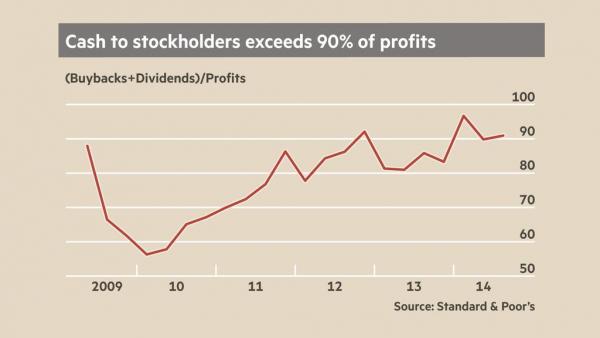

• What Record Stock Buybacks Say About Economic Growth (Zero Hedge)

For all the obfuscation surrounding the topic of stock buybacks and corporations returning record amounts of cash to their shareholders, the bottom line is as simple as it gets. This is what you are taught in CFO 101 class:

if you see organic growth opportunities for your business, or if you want to maintain the asset quality generating your cash flows, you invest in (either maintenance or growth) capex.

if there are no such opportunities, you return cash to investors (or, maybe spend a little on M&A unless you are Valeant in which case you spend everything and then much more).That’s it. Well, based on this shocking chart from the FT’s John Authers, does it seem that America’s corporations – who are returning over a record 90% of Net Income to shareholders – are seeing (m)any growth opportunities?

The Chinese housing sector is in deep doodoo.

• Is China Building a Mortgage Bomb? (Bloomberg)

The first Chinese interest-rate cut in more than two years is a stark recognition that the world’s second-biggest economy is in trouble. After years of piling ever more public debt onto the national balance sheet, it makes sense to have the People’s Bank of China take the lead in propping up gross domestic product. Yet while today’s benchmark rate cut should help stabilize growth, the move also adds to worries about looser credit that could pose risks to the global economy. Case in point: mortgages. Earlier this year, Chinese officials took several stealthy steps aimed at stabilizing the property sector and bolstering GDP growth. The China Banking Regulatory Commission loosened lending policies. Even before cutting the one-year lending rate to 5.6% and the one-year deposit rate to 2.75% today, the central bank had cut payment ratios and mortgage rates, while prodding loan officers to ease up on their reluctance to approve borrowers without local household registrations.

Pilot programs for mortgage-backed securities and real-estate investment trusts got more support. Incentives were rolled out to encourage high-end buyers to upgrade properties. There’s good news and bad in all this. The good: It marks progress for President Xi Jinping’s efforts to recalibrate China’s growth engines. In highly developed economies like the U.S., the quest for homeownership feeds myriad growth ecosystems and offers the masses ways to leverage their equity for other financial pursuits. And China’s debt problems are in the public sphere, not among consumers. The bad: If ramped-up mortgage borrowing isn’t accompanied by bold and steady progress in modernizing the economy, China will merely be creating another giant asset bubble. “Expanding the underdeveloped mortgage market is not bad news,” says Diana Choyleva of Lombard Street Research. “But if China relies on household credit to power the economy and pulls back from much-needed financial reforms, the omens are not good.”

As I’ve said a hundred times.

• ‘China’s Economy Is Slowing Faster Than You Think’ (CNBC)

The Chinese economy is slowing even faster than indicated by the People’s Bank of China’s surprise interest rate cut on Friday, said Peter Baum, a former Asian sourcing executive. China has too much manufacturing capacity for current levels of global demand, which has not adequately recovered from the financial crisis, the COO and CFO of Essex Manufacturing told CNBC’s “Power Lunch” on Friday. “As an example, I was just back. We have plants that we run where they used to have 500, 1,000 workers. They’re down to 200,” Baum said.

Labor costs for factories are rising because working age Chinese have been educated and don’t want to toil in such positions, he said. At the same time, the managers must amortize the fixed costs of the facilities over lower productivity. On top of that, the Chinese renminbi has appreciated 25% since 2004, putting pressure on producers to raise prices, Baum said. Debt levels could be problematic because many Chinese factory owners plan to sell their property to developers if the business fails, but the real estate market is on the rocks, he said. “If real estate is tanking, if there’s no demand for manufacturing, somebody is carrying all the debt, whether it’s banks, whether it’s their shadow banking system,” Baum said.

Roach is more of a religious man, or I can’t explain the 7% limit. It’s as if he’s saying China can set its own growth level.

• China Cut Pegs Growth Floor At 7%, Says Stephen Roach (CNBC)

After unexpectedly cutting interest rates for the first time in two years, Chinese leaders have revealed their floor for economic growth is around 7%, said Stephen Roach, senior fellow at Yale’s Global Affairs Institute. The move also signals investors can expect further moves if China fears the growth rate will go appreciably below 7%, the former chairman of Morgan Stanley Asia said Friday on CNBC’s “Squawk Box.” In a surprise announcement Friday, the People’s Bank of China said it was cutting one-year benchmark lending rates by 40 basis points to 5.6%. It also lowered one-year benchmark deposit rates by 25 basis points. The changes take effect Saturday. The rate cut is seen as addressing slowing factory growth and a stalled property market, which have dragged down the broader economy.

China is addressing cyclical changes while also fixing big structural issues in its economy, something that no other economy is doing right now, Roach said. “There are headwinds associated with that when you try to shift the mix of economic growth from your hyper-growth sectors of investment—debt-intensive investments and exports—to services and internal private consumption,” he said. “There’s some slowing associated with that, and when that occurs in the context of much weaker external environment, which is obviously the case given what’s going on in the world, China’s got downside pressures to contend with,” Roach added. The hyperbole about China being an ever-ticking debt bomb stacked with excesses and nonperforming loans is based on emotion rather than empirical data, he said.

And China needs to keep up with the yen devaluation too.

• Yen Weakens to Seven-Year Low as Japan Will Vote on Abenomics (Bloomberg)

The yen slid to its lowest level in seven years versus the dollar after Japan’s Prime Minister Shinzo Abe called early elections seeking to renew his mandate for economic stimulus as the nation entered a recession. The 18-nation euro declined versus most of its 31 major peers as European Central Bank President Mario Draghi said officials “will do what we must” to raise inflation. The Swiss franc tested its cap versus the weakening shared currency as a central bank official vowed to defend it. The yen fell for a sixth week against the euro, the longest streak since December 2013, as the Bank of Japan warned inflation may slip below 1% before a consumer prices report Nov. 27.

“We have uncertainty on the political front and we have weaker domestic data combined with very aggressive policy coming from the central bank, all of which should be driving a weaker yen,” said Camilla Sutton, chief foreign-exchange strategist at Bank of Nova Scotia in Toronto. The yen tumbled 1.3% against the dollar this week in New York, touching 118.98 on Nov. 20, the weakest level since August 2007. The currency lost 0.2% versus the euro, which fell 1.2% to $1.2391 per dollar. The Bloomberg Dollar Spot Index, which tracks the U.S. currency against 10 major counterparts, rose a fifth week, adding 0.2% to close at the highest level since March 2009.

“By the end of this year or by the start of next year, without QE, the market is going down”.

• ‘We Are Living in an Aberrational World’ (Finanz und Wirtschaft)

The editor of the influential investment newsletter ‘The High-Tech Strategist’ warns of trouble in semiconductor stocks and spots bright investment opportunities in gold miners. It’s unchartered territory: For the first time since more than half a decade the global financial markets are supposed to live without the constant liquidity infusions of the Federal Reserve. Fred Hickey, the outspoken editor of the widely-read investing newsletter ‘The High-Tech Strategist’, says this won’t work well for long. “By the end of this year or by the start of next year, without QE, the market is going down”, says the sharply thinking contrarian. In his view, especially the outlook for semiconductor makers like Intel is gloomy. As protection against the upcoming crash he recommends investments in gold and in gold mining stocks.

Mr. Hickey, after the short setback in October the hunt for new records at the stock market is on once again. What’s your take on the current situation?

We are living in an aberrational world. It’s all driven by an orgy of money printing. All the major central banks are engaged in this. From the Federal Reserve in the United States to the ECB, to the Bank of England and the National Bank of Switzerland to the Bank of Japan and the People’s Bank of China. It’s been tried ever since there was money, but in thousands of years of history it has never worked. When the Roman empire was unraveling the Caesars would shave the silver from the coins in order to be able to make a lot more of them. And in Weimar Germany, Reichsbank president Rudolf Havenstein ran the printing presses day and night, seven days a week. And here we are now, repeating the same mistake.Yet, the markets love cheap money. The S&P 500 just climbed to another record high this Monday.

I lean towards the school of Austrian economists and they tell you that you can’t get out of those things. As a reminder, I keep the following quote from the great Austrian economist Ludwig von Mises pinned to the bulletin board in my office: “The final outcome of credit expansion is general impoverishment”. Von Mises also warned that the boom can only last as long as the credit expansion progresses at an ever-accelerating pace. That’s why the Federal Reserve is unable to get out of this. Shortly after QE1 the stock market sold off 13% and the economy tanked. Then they did QE2 and when that ended the market sunk 16% in just a few weeks. That led to Operation Twist and that led to QE3, the biggest money printing operation of them all. Even before QE3 ended the markets started to take a dive and the Fed had to come to the rescue again. James Bullard of the St. Louis Fed came out and said that maybe they shouldn’t stop QE. That led to what they call the «Bullard Bounce» or «Bullard’s Charge». So they gave the green light to speculate once again. But fact of the matter is that money printing does not work.Nevertheless, Fed chief Janet Yellen stopped QE3 at the end of October.

That’s why I expect things to fall apart in the market. I don’t know what’s going to happen between now and the year end because this is a seasonally strong period for stocks. Money managers who have been underperforming all year are under pressure to get into the stock market. And we might see what I call a «Run for the Roses» and the market gets to even more extreme levels. I don’t know how much longer this global money printing experiment can continue. But it sure feels to me that we’re nearing the day that it spins out of control. By the end of this year or by the start of next year without QE the market is going down and we will end up in chaos.

Another stillborn plan. In his latest speech, Draghi was poiting to the emphasis on confidence. His actions must make people feel confident. I guess that shows he doesn’t believe it himself.

• European Central Bank Has Begun Buying Asset-Backed Securities (Reuters)

The European Central Bank has started buying asset-backed securities, it said on Friday, in a move to encourage banks to lend and revive the economy. “Following publication of legal act on the implementation of the ABS purchase programme, the Eurosystem has started the purchases on 21/11/2014,” the ECB said on its Twitter feed. The program is one plank in a strategy which ECB chief Mario Draghi hopes will increase its balance sheet by up to €1 trillion. It already buys covered bonds, a secure form of debt often backed by property.

The ABS and covered bond programs will last for at least two years. The ECB will give a weekly updated on its purchases on its website around 1430 GMT on Mondays, as it is already doing with the covered bond purchases. If it falls short of this overall €1 trillion mark and fails to boost the economy significantly, pressure to print money to buy government bonds, also known as quantitative easing, will reach fever pitch. However, expectations among market experts for the program are muted. To limit its risk, the ECB will buy only the most secure part of such loans in the hope that others pile in behind it to buy riskier credit.

Excuse me, but what use is a stress test if banks can throw out false numbers and the test doesn’t detect them?

• RBS Admits Overstating Financial Strength In Stress Test (Guardian)

Royal Bank of Scotland has admitted it made a mistake that led to it overstating its financial strength to banking regulators. Shares in RBS tumbled by almost 3% at one point on Friday as investors digested the bank’s announcement that it is less able to withstand an economic crisis than previously thought. The bank, which is 80% owned by the British taxpayer, has still passed the stress test exercise designed by European banking regulators, but among UK banks it has the least margin for error. An RBS spokesperson said the stress tests were a “theoretical” exercise that had no impact on its most recent capital position. One in five European banks failed the stress tests that were published last month by the European Banking Authority. The tests were intended to prevent a rerun of the economic crisis, with banks required to show they had enough capital to withstand a series of economic shocks such as a sudden rise in unemployment, a sharp fall in house prices and decline in economic growth.

The banks were asked to model how a slide into recession imposing £20bn of losses would affect their common equity tier 1 ratio – a key measure of financial strength based on its earnings. Under Friday’s revised results, RBS has found that its capital position in a crisis would be weaker than it previously thought: it would have a common equity tier 1 ratio of 5.7%, scraping above the EBA pass rate of 5.5%, but significantly less comfortable than the 6.7% it reported last month. The revised results mean that RBS beat the threshold by the narrowest margin among UK banks: Lloyds came in at 6.2%, followed by Barclays at 7.1% and HSBC at 9.3%. RBS said that if it was repeating the stress-test exercise based on its latest earnings figures, it would have a stronger financial cushion. The bank said it had improved its CET 1 ratio by 220 basis points to 10.8% by 30 September, compared to 8.6% at the end of last year.

The mistake was discovered by officials at the Bank of England, who spotted an anomaly in RBS’s figures after the pan-European results were published in late October. Officials at Threadneedle Street contacted RBS, which amended the figures and filed the results to the EBA on Friday. No errors were uncovered at any other UK bank, although Deutsche Bank amended one of its figures shortly after the stress test results were published.

Investigating yourself. That always works fine.

• Bank Of England Investigates Staff Over Possible Auction Rigging (Reuters)

The Bank of England is investigating whether staff knew or even aided possible manipulation of auctions it held at the onset of the financial crisis to pump liquidity into the banking system, the Financial Times has reported. The newspaper said the formal inquiry began during the summer and the central bank asked the British lawyer who looked into the Bank’s role in a foreign exchange scandal to head the new investigation. “If the bank were conducting an investigation or review of any of its activities, as it does from time to time, it would be wholly inappropriate to provide a running commentary via the press,” a spokesman said. “I can tell you that no actions have been taken or are currently being contemplated against any employee of the bank.“ The FT, quoting people familiar with the situation, said the investigation would look into whether Bank of England money market auctions in late 2007 and early 2008 were rigged, and whether officials were party to any manipulation.

About 10 Bank staff have been interviewed as part of the inquiry and have been provided with defence lawyers at the expense of the Bank, the FT said. The report comes little more than a week after an investigation, headed by lawyer Anthony Grabiner and commissioned by the Bank’s oversight committee, found no evidence that any of its official had been involved in improper behaviour in relation to a foreign exchange trading scandal. The FT said Grabiner had been asked to conduct the new investigation. The Bank dismissed its chief foreign exchange dealer last week, saying it found information about serious misconduct but it stressed the case was unrelated to the foreign exchange scandal.

A dead model. Good riddance.

• The Impossible American Mall Business. ‘We Surrender’ (Bloomberg)

On a crisp Friday evening in late October, Shannon Rich, 33, is standing in a dying American mall. Three customers wander the aisles in a Sears the size of two football fields. The RadioShack is empty. A woman selling smartphone cases watches “Homeland” on a laptop. “It’s the quietest mall I’ve ever been to,” says Rich, who works for an education consulting firm and has been coming to the Steeplegate Mall in Concord, New Hampshire, since she was a kid. “It bums me out.” Built 24 years ago by a former subsidiary of Sears Holdings Corp., Steeplegate is one of about 300 U.S. malls facing a choice between re-invention and oblivion. Most are middle-market shopping centers being squeezed between big-box chains catering to low-income Americans and luxury malls lavishing white-glove service on One%ers.

It’s a time of reckoning for an industry that once expanded pell-mell across the landscape armed with the certainty that if you build it, they will come. Those days are over. Malls like Steeplegate either rethink themselves or disappear. This summer Rouse Properties a real estate investment trust with a long track record of turning around troubled properties, decided Steeplegate wasn’t salvageable and walked away. The mall is now in receivership. As management buys time by renting space to temporary shops selling Christmas stuff, employees fret that if the holiday shopping season goes badly, more stores will close. Should the mall lose one of its anchors – Sears, J.C. Penney and Bon-Ton Stores – the odds of survival lengthen. “Rouse is basically saying ‘We surrender,’” said Rich Moore, an analyst at RBC Capital Markets who has covered mall operators for more than 15 years. “If Rouse couldn’t make it work and that’s their specialty, then that’s a pretty tough sale to keep it as is.”

“Either you need to fix it, Mr. Dudley, or we need to get someone who will.”

• Dudley Defends New York Fed Supervision In Heated Senate Hearing (Bloomberg)

William C. Dudley came under attack today by U.S. senators, who accused the Federal Reserve Bank of New York president of being too cozy with big Wall Street banks. “I wouldn’t accept the premise that there’s been a long list of failures by the New York Fed since my tenure,” Dudley said in response to an assertion by Elizabeth Warren, a Massachusetts Democrat. “Is there a cultural problem at the New York Fed? I think the evidence suggests that there is,” Warren said. “Either you need to fix it, Mr. Dudley, or we need to get someone who will.” The hearing was prompted by allegations by a former New York Fed bank examiner, Carmen Segarra, who said her colleagues were too deferential to Goldman Sachs Group Inc., the Wall Street bank where Dudley was chief economist for a decade.

Segarra attended today’s hearing and later released a statement via a spokesman expressing disappointment that she was not given a chance to address the panel. “She looks forward to publicly testifying if and when the Senate moves forward with additional hearings,” said her spokesman, Jamie Diaferia, in an e-mail. Senators questioned Dudley, 61, on issues ranging from whether some banks are too big to regulate to the Fed’s role in overseeing their commodities businesses. Some of the criticism was pointed. Warren, a frequent critic of financial regulators, asked Dudley if he was “holding a mirror to your own behavior.”

Can this be solved without a default? Hard to see.

• Illinois $111 Billion Pension Deficit Fix Struck Down (Bloomberg)

Illinois will have to find a new way to fix the worst pension shortfall in the U.S. after a judge struck down a 2013 law that included raising the retirement age. Yesterday’s ruling that the pension changes would have violated the state’s constitution undoes a signature achievement of outgoing Democratic Governor Pat Quinn and hands responsibility for tackling the state’s $111 billion pension deficit to Republican businessman Bruce Rauner, who defeated him in the Nov. 4 election. State constitutions have been invoked elsewhere to try to prevent cuts to public pensions. In Rhode Island, unions settled with the state over pension cuts before their constitutional challenge could be put to the test. In municipal bankruptcy cases in Detroit and California, judges ruled that federal law overrode state bans on cutting pensions.

Illinois Attorney General Lisa Madigan, a Democrat, said she’ll appeal the ruling by Judge John Belz in Springfield and ask the state Supreme Court to fast-track the review. “Today’s ruling is the first step in a process that should ultimately be decided by the Illinois Supreme Court,” Rauner said yesterday. “It is my hope that the court will take up the case and rule as soon as possible. I look forward to working with the legislature to craft and implement effective, bipartisan pension reform.” Belz concluded that a 1970 constitutional provision barring cuts to public employee retirement benefits trumps the state’s claim that it has the power to trim future cost-of-living adjustments and delay retirement eligibility for some workers. “The court finds there is no police power or reserved sovereign power to diminish pension benefits,” he said, voiding the legislation in its entirety and permanently barring the state from enforcing any part of it.

Unfortunately, only for Windows computers.

• Click Here to See If You’re Under Surveillance (BW)

For more than two years, researchers and rights activists have tracked the proliferation and abuse of computer spyware that can watch people in their homes and intercept their e-mails. Now they’ve built a tool that can help the targets protect themselves. The free, downloadable software, called Detekt, searches computers for the presence of malicious programs that have been built to evade detection. The spyware ranges from government-grade products used by intelligence and police agencies to hacker staples known as RATs—remote administration tools. Detekt, which was developed by security researcher Claudio Guarnieri, is being released in a partnership with advocacy groups Amnesty International, Digitale Gesellschaft, the Electronic Frontier Foundation, and Privacy International.

Guarnieri says his tool finds hidden spy programs by seeking unique patterns on computers that indicate a specific malware is running. He warns users not to expect his program (which is available only for Windows machines) to find all spyware, and notes that the release of Detekt could spur malware developers to further cloak their code. The use of the programs—which can remotely turn on webcams and track keystrokes—gained attention as researchers increasingly found the spyware being used to target political activists and journalists. In Syria, dissidents have been attacked by malware delivered through fake documents sent via Skype. In Washington and London, Bahraini democracy activists received e-mails laced with what was identified as the German-made FinSpy Trojan.

In Ethiopia, another hacking tool made multiple attempts against employees of an independent media company, according to a probe by Guarnieri and security researchers Morgan Marquis-Boire, Bill Marczak, and John Scott-Railton. The new safeguard comes amid fresh reminders of pervasive electronic snooping around the globe. Just this week, London-based Privacy International published a 96-page report detailing surveillance capabilities of Central Asian republics and the companies that supply them.