Édouard Manet Woman with a jug 1858-60

2 Zels

So – here’s the video.

Zelensky with Biden and…Zelensky?

Seems there is a glitch in the Matrix pic.twitter.com/fEOBBIeQ6F

— Stew Peters (@realstewpeters) February 26, 2023

Putin Oliver Stone

https://twitter.com/i/status/1629705190566776832

Oliver Stone

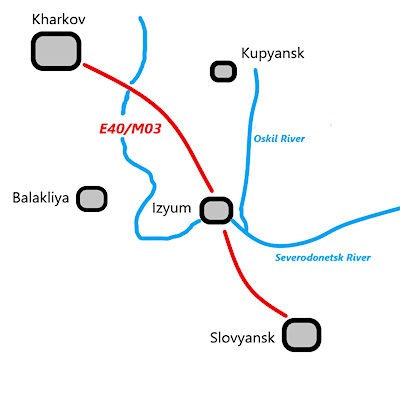

Who really started the Ukraine war?

May 2022

Oliver Stone to Lex Fridman: What the western press hasn't said is that on the days before 24 February, there was heavier & heavier artillery fire going into Donbass. Ukraine had 110,000 troops on the border. They were about to invade pic.twitter.com/r6dfGANVby— the Lemniscat (@theLemniscat) February 24, 2023

Tucker Macgregor

https://twitter.com/i/status/1629739970184507392

Maher Woody

"Ivermectin got made into a horse tranquilizer. Hydroxychloroquine got made ridiculous, and there was only one thing that could work, and that's the vaccine, and ultimately, because of that, billions of dollars were made."pic.twitter.com/tddrtXSySu

— aussie17 (@_aussie17) February 26, 2023

Jimmy Dore

https://twitter.com/i/status/1630038638661861379

History also demonstrates something else: any collapsed empire buries half the world under its rubble.”

– Dmitry Medvedev, February 2023

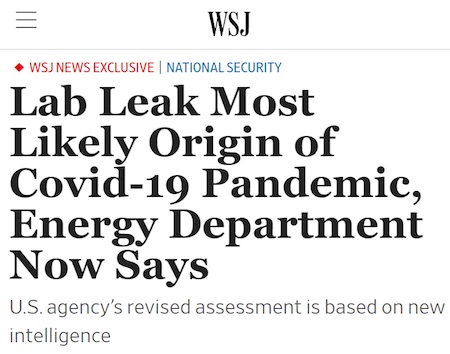

US Department of Energy says: lab leak. White House says: we have so many departments… We must study for years more.

• White House Distances Itself From Covid ‘Lab-Leak’ Theory

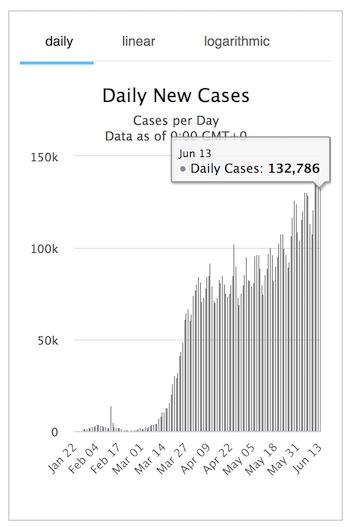

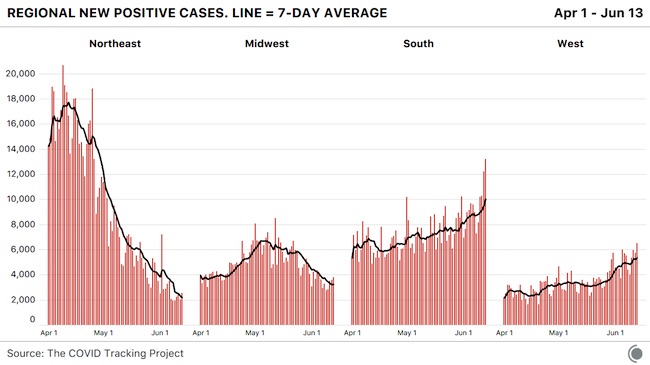

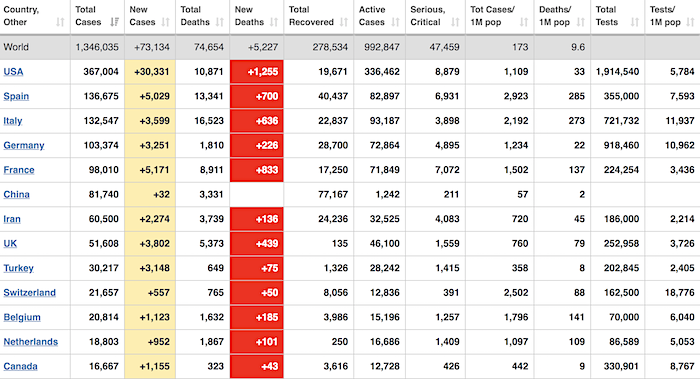

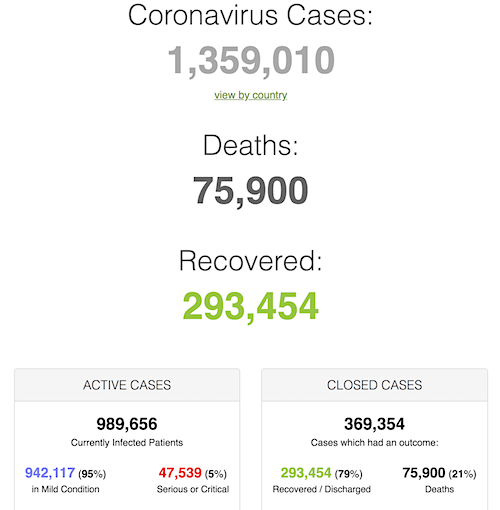

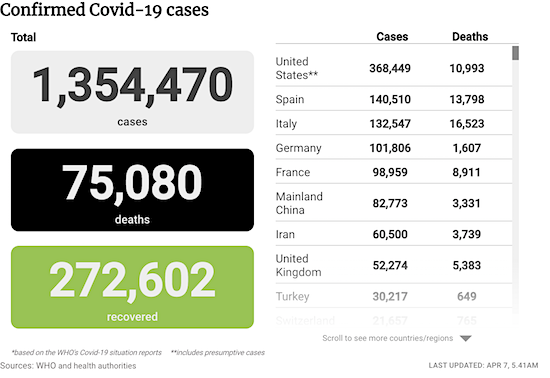

White House national security adviser Jake Sullivan has dissented against a Wall Street Journal report which stated that a US Department of Energy study concluded that the Covid-19 pandemic was likely the result of a failure of safety practices at a laboratory in China, stating that there is “not a definitive answer” as to the true origins of the virus. The WSJ published a report on Sunday which said that the Department of Energy had viewed “new intelligence” which led them to believe that Covid-19 wasn’t naturally produced in the environment, but rather the result of a so-called ‘lab-leak’ – but it added that it has “low confidence” in its findings.

Responding to the WSJ report, Sullivan said that President Joe Biden has ordered a full investigation into the potential origins of Covid-19 but he stressed the various governmental bodies looking into the matter have yet to reach a unanimous verdict. “President Biden has directed, repeatedly, every element of our intelligence community to put effort and resources behind getting to the bottom of this question,” Sullivan told CNN on Sunday. “If we gain any further insight or information, we will share it with Congress, and we will share it with the American people. But right now, there is not a definitive answer that has emerged from the intelligence community on this question.” The virus was first reported to have been discovered in Wuhan, the capital of China’s Hubei province, an area which also features a prominent virology institute which is an active research center for the study of coronaviruses.

The FBI has also backed the lab-leak theory but four other US agencies have determined that natural transmission was the more likely source of the virus. Two other agencies are currently undecided, according to the WSJ. Last year, extensive studies conducted by the peer-reviewed ‘Science’ journal determined that the initial virus was very likely transmitted to a human from an animal at one of Wuhan’s wet markets. Further studies into the lab-leak theory are expected to take place in the US in the coming weeks and months, after several Republican lawmakers included investigations into the pandemic’s origins among the key pledges on the campaign trail ahead of last November’s midterm elections.

Covid, Trump, Ukraine.

• Covid Lab Leak Is A Scandal Of Media And Government Censorship (Turley)

In early 2020, with little available evidence, two op-eds in The Lancet in February and Nature Medicine went all-in on the denial front. The Lancet op-ed stated, “We stand together to strongly condemn conspiracy theories suggesting that Covid-19 does not have a natural origin.” We were also supposed to forget about massive payments from the Chinese government to American universities and grants of some of these writers to both Chinese interests or even the specific Wuhan lab. No reference to the lab theory was to be tolerated. When Sen. Tom Cotton (R., Ark.) merely mentioned the possibility in 2020, he was set upon by the usual flash media mob. The Washington Post ridiculed him of repeating a “debunked” coronavirus “conspiracy theory.”

In September 2020, Dr. Li-Meng Yan, a virologist and former postdoctoral fellow at the University of Hong Kong, dared to repeat the theory on Fox News, saying, “I can present solid scientific evidence . . . [that] it is a man-made virus created in the lab.” The left-leaning PolitiFact slammed her and gave her a “pants on fire rating.” President Joe Biden accused Trump of fanning racism in his criticism of the Chinese government over the pandemic and his Administration reportedly shutdown the State Department investigation into the possible lab origins of the virus. When Biden later revived an investigation into the origins, he was denounced as “sugar-coating Trump’s racism.” The categorical rejection of the lab theory is only the latest media narrative proven to be false.

The Russian collusion scandal, the Hunter Biden “Russian Disinformation,” the Lafayette Park “Photo Op” conspiracy, the Nick Sandmann controversy, the Jussie Smollett case, the Migrant Whipping scandal. On the lab theory, media like the Washington Post piled on senators like Cruz and Cotton for mentioning the lab theory only later to admit that it could be legitimate. All of those experts and writers who were called racists or suspended by social media were simply forgotten in media coverage. That is why this is really about censorship. The media guaranteed that we did not have a full debate over the origins of the virus and attacked those who had the temerity to state the obvious that there was a plausible basis for suspecting the Wuhan lab. None of this has diminished demands for more censorship. Even after Twitter admitted that it wrongly blocked The New York Post story before the 2020 election, Democratic senators responded by warning the company not to cut back on censorship and even demanded more censorship.

“Musk’s fiery accusation came in response to a tweet that aggregated the multiple occurrences where Fauci denied any gain-of-function research..”

• Elon Musk Accuses Fauci Of Funding Gain-Of-Function Research (TP)

Elon Musk accused Dr. Anthony Fauci of funding gain-of-function research at the Wuhan, China lab where COVID-19 is believed to have originated from. Musk said Fauci funded gain-of-function research “via a pass-through organization (EcoHealth)” on Twitter Sunday. Musk’s fiery accusation came in response to a tweet that aggregated the multiple occurrences where Fauci denied any gain-of-function research and counter-signaled the idea that COVID-19 originated from a 2019 Wuhan lab leak. “Dr. Anthony Fauci funded gain-of-function research at the Wuhan lab, lied to Congress about it, and now both the FBI & the Department of Energy have concluded that the coronavirus originated at the Wuhan lab. Does that mean Dr. Anthony Fauci funded the development of COVID-19?” the video’s caption reads.

Hours earlier the Wall Street Journal released a bombshell report which revealed the U.S. Energy Department is now considering it likely COVID originated from a Wuhan, China lab leak. The Energy Department’s update came in a classified intelligence report shared with the WSJ. Previously, the Energy Department was undecided on COVID’s origin and numerous public health officials like Fauci disregarded a lab leak theory. On Feb. 13 House Republicans formally requested Fauci, the former Chief Medical Advisor to President Biden, and the president of EcoHealth Alliance, Dr. Peter Daszak, come before Congress for an interview. Fauci and Daszak were cited by thousands of media outlets as truth-sayers when they claimed “the evidence shows that SARS-CoV-2 is not a purposefully manipulated virus” and “we do not believe that any type of laboratory-based scenario is plausible.”

Musk’s tweet referenced Daszak’s company. Daszak’s EcoHealth Alliance is a U.S. National Institutes of Health grantee that “passed taxpayer funds to the Wuhan lab to conduct gain of function research on bat coronaviruses – research that may have started the pandemic,” the House Republicans’ request stated. Throughout the 117th Congress, Reps. James Comer (R-KY) and Jim Jordan (R-OH) have “sent numerous letters to the U.S. National Institute of Allergy and Infectious Diseases, the U.S. National Institutes of Health, and the U.S. Department of Health and Human Services.”

“Well, it could have been us, and it could have been Ukraine, and it could have been some third-party country that wants to see trouble. The one group it wasn’t is Russia…”

• Ukraine Has ‘Total Dominance’ Over US – Trump (RT)

Ukraine has asserted “total dominance” over the US, former President Donald Trump said Friday during an interview with Glenn Beck. The ex-president also suggested that Kiev might be the real culprit behind the destruction of Russia’s Nord Stream pipelines last October. Commenting on the recent report by veteran American journalist Seymour Hersh, who suggested the pipelines were targeted by Washington in a clandestine operation ordered directly by President Joe Biden, Trump did not rule out US involvement but rubbished allegations that Moscow destroyed the installation itself.

“Well, it could have been us, and it could have been Ukraine, and it could have been some third-party country that wants to see trouble. The one group it wasn’t is Russia… This is a main source of massive income for them. They didn’t blow it up to make a point. That’s the one thing I can tell you for sure,” Trump stated, adding that “everything gets blamed on Russia” by the “sick” people. The US might have been “working in conjunction” with Ukraine to target the pipelines, the ex-president suggested, since Kiev has already asserted “total dominance” over Washington. “We’ve given them probably $150 billion, and Europe has given them almost nothing,” he added.

Earlier this week, Trump, who is seeking to get elected back into the White House in 2024, already vowed to end the Ukraine conflict within hours should he make it to the office again. “I would literally start calling, not from the day I took over, but from the night I won,” he told a campaign rally in Florida this week. The ex-president has also blamed the “warmongers and ‘America Last’ globalists” entrenched at the State Department, the Pentagon, and the “national security industrial complex” for pushing the hostilities forward. “I was the only president who rejected the catastrophic advice of many of Washington’s generals, bureaucrats and so-called diplomats who only knew how to get us into conflicts,” he said in a campaign video released Tuesday.

Most of it Russia territory.

• Wall Street Has Its Eyes Set On Ukraine (Charles Gasparino)

Wall Street really wants to invest in Ukraine, and some of the top players are doing more than sniffing around at the prospects. The world’s largest money-management firm BlackRock continues to hold high-level meetings with the government, including President Volodymyr Zelensky. JPMorgan recently had bankers on the ground scoping the situation as they dodged Russian missiles, I am told. The country is ripe for massive private US investment to rebuild infrastructure destroyed in its conflict with Vladimir Putin. Zelensky is a rock star in the American media; the country is valiantly fighting off a foreign invader. The people are educated and resilient, which means returns could be as good there as any place on the planet. Banker talk has a private investment fund at between $20 billion and $100 billion at some point in the future.

So what s stopping the private money from coming in now? A war that shows no signs of ending anytime soon. Plus, for all of Zelensky’s obvious talents as a leader, he still hasn’t demonstrated an understanding or possibly a willingness to fight corruption on the scale necessary to make investors comfortable, bankers tell me. The meetings between some of Wall Street’s top executives (think Jamie Dimon of JPMorgan and Larry Fink of BlackRock) and Ukraine officials over the past month didn’t garner the same attention as President Biden’s surprise visit last week. The discussions have been going down mostly in private and without much fanfare when they conclude.But they are revealing. The perilous nature of our continued engagement with this country doesn’t just involve a possible nuclear war with Russia but also an economic sinkhole if we’re not careful.

For starters, in these meetings, Zelensky seemed unabashed in his request for billions of dollars in private capital to begin rebuilding his economy immediately. Yet he doesn’t seem to fully grasp what will prevent such an investment. First, money won’t flow to Ukraine (or any country) if it seeds the pockets of a Russian-style oligarchy. In Ukraine, that brand of crony capitalism goes by the names “systema” or “oligarkhiya.” It’s an alliance of government and big business that undermines the free-market forces of competition. Payoffs and graft are part of the systema, and that’s always a dead end for significant private capital. Zelensky said he understood the economic stakes of ending corruption. But deeds go further than words, which is why one banker involved in the process told me: “There are no guarantees here.”

Then there’s the war, and Zelensky’s so-far unyielding determination to keep fighting in order to retake all territory occupied by Putin’s forces. It’s a noble effort, to be sure, but it comes at a steep price. Bankers say private investment money won’t really flow until the war is over. They would love Zelensky to compromise on land to make that happen; maybe give up on retaking Crimea or allow Putin to save face and keep a few parts of the Donbas region in the east, which are nominally controlled by Russian separatists anyway. There was some talk on Wall Street about a Ukrainian spring offensive and, if it’s successful in reclaiming some Russian-held territory, then Zelensky offering a possible deal with Putin so the reconstruction can begin. For now at least, that was described as a likely no-go by Ukrainian officials; Zelensky’s approval rating is at 90%, the bankers were told. It sinks to 40% with a land compromise.

“It is difficult for them to believe that two-thirds of the world’s population is not siding with the West..”

• Much Of Global South Isn’t Automatically Supporting The West In Ukraine (Mehta)

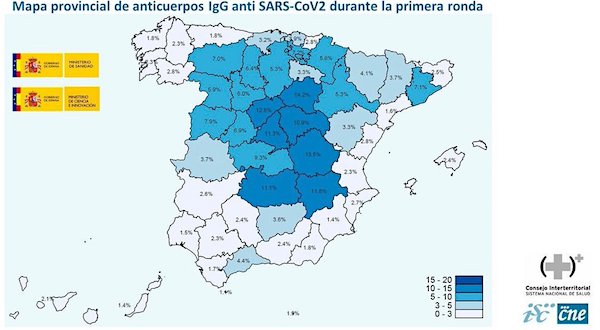

In October 2022, about eight months after the war in Ukraine started, the University of Cambridge in the UK harmonized surveys conducted in 137 countries about their attitudes towards the West and towards Russia and China. The findings in the study, while not free of a margin of error, are robust enough to take seriously. These are: For the 6.3 billion people who live outside of the West, 66 percent feel positively towards Russia and 70 percent feel positively towards China, and, Among the 66 percent who feel positively about Russia the breakdown is 75 percent in South Asia, 68 percent in Francophone Africa, and 62 percent in Southeast Asia. Public opinion of Russia remains positive in Saudi Arabia, Malaysia, India, Pakistan, and Vietnam.

Sentiments of this nature have caused some ire, surprise, and even anger in the West. It is difficult for them to believe that two-thirds of the world’s population is not siding with the West. What are some of the reasons or causes for this? I believe there are five reasons as explained in this brief essay. 1. The Global South does not believe that the West understands or empathizes with their problems. India’s foreign minister, S. Jaishankar, summed it up succinctly in a recent interview: “Europe has to grow out of the mindset that Europe’s problems are the world’s problems, but the world’s problems are not Europe’s problems.” He is referring to the many challenges that developing countries face whether they relate to the aftermath of the pandemic, the high cost of debt service, the climate crisis that is ravaging their lives, the pain of poverty, food shortages, droughts, and high energy prices. The West has barely given lip service to the Global South on many of these problems. Yet the West is insisting that the Global South join it in sanctioning Russia.

The Covid pandemic is a perfect example—despite the Global South’s repeated pleas to share intellectual property on the vaccines, with the goal of saving lives, no Western nation was willing to do so. Africa remains to this day the most unvaccinated continent in the world. Africa had the capability to make the vaccines but without the intellectual property they could not do it. But help did come from Russia, China, and India. Algeria launched a vaccination program in January 2021 after it received its first batch of Russia’s Sputnik V vaccines. Egypt started vaccinations after it got China’s Sinopharm vaccine at about the same time. South Africa procured a million doses of AstraZeneca from the Serum Institute of India. In Argentina, Sputnik became the backbone of their vaccine program. All of this was happening while the West was using its financial resources to buy millions of doses in advance, and often destroying them when they became outdated. The message to the Global South was clear—your problems are your problems, they are not our problems.

“If a cargo is 51% from Morocco, 49% from Russia, how would you referee that?”

• North African Nations Voracious Buyers Of Russian Oil Products – WSJ (RT)

North African nations have sharply increased imports of Russian diesel and other refined oil products, while petrochemical exports from the region have seen a significant uptick, the Wall Street Journal reported on Saturday, citing trading analysts. Industry experts are reportedly raising concerns that Russian sanctioned cargoes are being blended with other oil products and re-sold. The procedure effectively disguises the ultimate origin of the products, undermining Western states’ efforts to oust Russian fossil fuels from their economies. Imports of Russian diesel by Morocco soared to two million barrels in January compared with some 600,000 barrels recorded during the whole of 2021, according to analysts from commodities market data firm Kpler, who stress that a further 1.2 million barrels will be shipped to the country this month.

Tunisia boosted purchases of Russian diesel, gas oil, gasoline and naphtha, which is traditionally used to make chemicals and plastics, to 2.8 million barrels in January and is projected to import another 3.1 million barrels in February. Kpler also recorded an uptick in imports by Algeria, Egypt and Libya. The volumes absorbed by North African countries are too much for them to take on their own, according to Viktor Katona, Kpler senior oil analyst, who predicts that some of the Russian products will make their way to Europe. “Trust me, we are not witnessing some renaissance in Maghrebi refining,” Katona told the Wall Street Journal, referring to the region of North Africa

North African ports are seen as convenient for Russian cargoes sailing from the Baltic Sea, as voyages are not much longer than the pre-sanctions trips to European ports. This allows Russia to keep shipping costs low, and prevents its limited fleet of tankers from getting tied up in lengthy voyages to Asia or elsewhere. “Even if you wanted to regulate that, how would you?” Andreas Economou, head of oil research at The Oxford Institute for Energy Studies, was quoted by the paper as saying. “If a cargo is 51% from Morocco, 49% from Russia, how would you referee that?” Some of North Africa’s increased diesel imports from Russia have displaced the region’s typical suppliers in the Middle East and North America, suggesting some of the activity was bargain hunting, Jorge Leon, senior vice president at Rystad Energy, told the newspaper.

Earlier this week, EU sanctions envoy David O’Sullivan told the Financial Times that the bloc and its allies had begun investigating a surge in exports to countries in Russia’s neighbourhood. They suspected sanctioned products were entering Russia via the back door. The EU has introduced 10 rounds of anti-Russia sanctions since the beginning of Moscow’s military operation in Ukraine. Kremlin has repeatedly said that the measures, supported by the US and its allies, are illegitimate and ineffective, and that the restrictions are causing cause more damage to the initiators. Russian President Vladimir Putin called the penalties “crazy and thoughtless,” saying that no country had previously changed its political course due to sanctions pressure.

“If you look around in Europe, 98% of media is liberal, and the rest are the others..”

[..] in Hungary, the media is split roughly into two halves, between liberal and conservative outlets, but the West and the liberal media consider that to show a lack of press freedom.”

• Hungarian FM Explains What Puzzles Him About EU (RT)

The EU’s declared support for media freedom clashes with its actions in a “confusing” way, Hungarian Foreign Minister Peter Szijjarto has said, commenting on the blacklisting of Russian journalists in the latest round of sanctions. In an interview with RIA Novosti news agency published on Monday, the diplomat also said the Hungarian government is criticized by Brussels for allegedly not protecting the media. “The only reason for this criticism is that unlike in every other part of Europe, in Hungary the media is really colorful. If you look around in Europe, 98% of media is liberal, and the rest are the others,” he claimed, while acknowledging that his words may be “a small exaggeration.” The foreign minister noted that in Hungary, the media is split roughly into two halves, between liberal and conservative outlets, but the West and the liberal media consider that to show a lack of press freedom.

“So those who are judging us for media freedom, those are [the people] putting journalists on a sanctions list. For me it’s a bit confusing,” he concluded. The 10th package of anti-Russian sanctions was adopted by the EU last week. It blacklisted Russian media organizations and individuals, in what the bloc described as targeting “disinformation outlets.” Among other things, Brussels added RT Arabic to the list of channels banned from broadcasting in the EU. In the interview, Szijjarto also reiterated Hungary’s commitment to vetoing any attempts to sanction the Russian nuclear industry, and urged a thorough investigation into last year’s sabotage of the Nord Stream pipelines, which he called a “terrorist attack” against EU energy infrastructure.

We need a lot more of this.

• Anti-NATO Protests Hit France (RT)

Multiple mass protests against France’s NATO membership and its continued support of Kiev were held on Sunday in the capital Paris and at other locations across the country. The demonstrations, taking place for the second consecutive weekend, were organized by the right-wing Les Patriotes party, led by Florian Philippot, who personally attended the rally in Paris. The politician claimed the event on Sunday, dubbed National March for Peace, attracted even more participants than last week, when some 10,000 showed up for a rally in the French capital. According to Philippot, smaller-scale anti-NATO protests were held at some 30 other locations across France as well.

Protesters marched through the streets of Paris, carrying a large banner reading “For Peace.” The marchers called for the withdrawal of France from both the US-led NATO and from the EU, and urged a halt to supplying Ukraine with weaponry. The protesters also took jabs at the incumbent French President Emmanuel Macron, chanting “Macron get out!” – a slogan commonly used by assorted anti-government protesters throughout his presidency. Following the march, the protesters held a rally led by Philippot, who was filmed defacing NATO and EU flags alongside his supporters. Footage of the event was shared by the politician himself on social media.

The politician has been actively staging protests against French membership in NATO and the EU since last fall, while arguing against the supply of weapons to Ukraine. Between 2012 and 2017, Philippot was the deputy head of the biggest opposition party in France, the National Rally, led until last year by Marine Le Pen. After leaving the National Rally, the 41-year-old politician established his own right-wing party, Les Patriotes. France has been among the top supporters of Kiev in the ongoing conflict with Russia, which broke out a year ago. While Macron has repeatedly called for a diplomatic settlement of the hostilities, Paris has actively supplied assorted weaponry to Ukraine, including armored vehicles and advanced self-propelled howitzers.

On the streets of Paris, France today: Another huge anti-NATO protest that Western corporate media are trying very hard to ignore. pic.twitter.com/gqJB7pLUx4

— sarah (@sahouraxo) February 26, 2023

Thousands won’t change a thing. Try millions.

• Thousands Rally For Peace In Italy (RT)

Several thousand people turned up for peace demonstrations in the Italian cities of Genoa and Milan on Saturday. Union members and left-wing activists claimed, among other things, that authorities in Rome have breached national law by sending weapons to Ukraine. The rally in Genoa drew nearly 4,000 participants from across the country as well as from Switzerland and France, local media reported. Organized by the Collective Autonomous Port Workers (CALP) group with the support of the Italian communist party, the protest took place under the slogan “Lower weapons, raise wages.” CALP’s Riccardo Rudino was cited in the media as saying that the “conflict in Ukraine did not begin last year” but rather “in 2014, with the massacre of the Russian-speaking population in Donbass.

The demonstrators filed through the port of Genoa, demanding an end to the use of the facility for arms shipments destined for Ukraine. CALP spokesperson Jose Nivoi accused the Italian government of violating law 185 of 1990, which “imposed a ban on the import, export and transit of weapons from Italy to states at war.” The group’s representatives also described how they had been networking with like-minded “associations and activists in various European cities.” The procession went off without serious incidents, marred only by a few acts of vandalism at the hands of anarchists, who smeared and damaged several vehicles and broke windows in a bank.

A protest was also held on Saturday in Milan. Ruptly video news agency filmed several hundred people chanting slogans and waving flags, including those of Russia and the Donetsk People’s Republic. The demonstrations in Italy coincided with one in the German capital, Berlin. There, tens of thousands of people heeded the call of prominent Left Party politician Sahra Wagenknecht and author Alice Schwarzer. Named the ‘Uprising for Peace,’ the protest called for peace talks to end hostilities in Ukraine. The participants also urged the German government to stop shipping weapons to Kiev. Addressing her supporters, Wagenknecht criticized Chancellor Olaf Scholz’s government for allegedly trying to “ruin Russia,” and described Saturday’s protest as the start of a new peace movement in Germany.

In Ramstein, the largest US Airbase (and drone centre) ,activists demonstrate with Russian flags in their hands. Drones were sent from here, activists demonstrate: they protest against further arms deliveries to Ukraine and demand peace negotiations. pic.twitter.com/XThh92JYNq

— sonja van den ende (@SonjaEnde) February 26, 2023

Not the UN but the west.

• UN To Discuss Investigation Into War Crimes In Ukraine (Az.)

Days after the United Nations General Assembly in New York voted overwhelmingly to demand Russia immediately withdraw from Ukraine, Moscow’s war is expected to dominate the opening of the top UN rights body’s main annual session in Geneva. “We’re looking for this session to show, as the UN General Assembly showed… that the world stands side-by-side with Ukraine,” British ambassador Simon Manley said at an event Friday marking the one-year anniversary of Russia’s full-scale invasion. The meeting, which is due to last a record six weeks, will be the first presided over by new UN rights chief Volker Turk, who kicks the session off early Monday.

UN chief Antonio Guterres will also address the council on the first day, while nearly 150 ministers and heads of state and government will speak, virtually or in person, during the four-day high-level segment. Moscow will send Deputy Foreign Minister Sergey Ryabkov to address the council in person on Thursday. Despite calls from NGOs, observers said it was unlikely there would be a walkout like the one many diplomats took part in when Russian Foreign Minister Sergei Lavrov’s video played in the council last year.

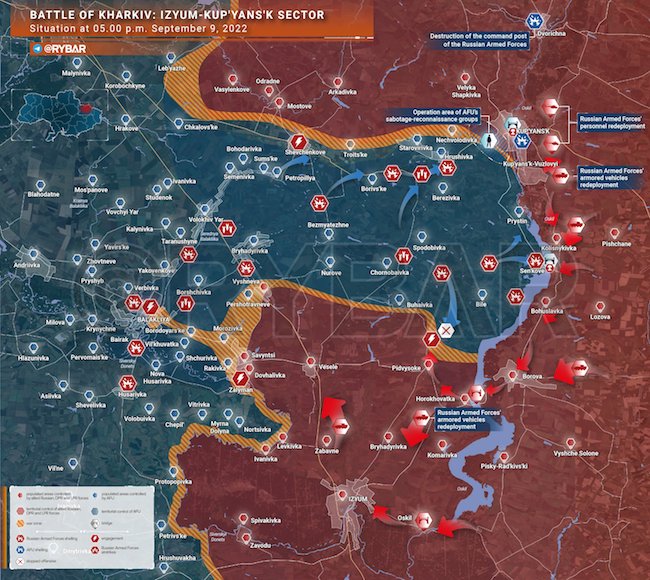

“We’re investigating the Biden crime-family operations. They’ve moved a lot of very suspicious money,” Higgins said. “‘Selling’ Hunter Biden art is just a method they’ve employed.”

• GOP Lawmakers Vow To Unmask Hunter Biden’s Anonymous Art Buyers (NYP)

Republican members of the House Oversight Committee have vowed to reveal the identities of the mysterious buyers of Hunter Biden’s art one day after the first son missed a deadline to provide the panel records about his overseas business interests. Biden’s failure to meet the committee’s Wednesday 11:59 p.m. deadline to produce financial documents and other records dating back to January 2009 mirrors his art dealer’s refusal to provide the panel with the names of his clients. In response to a January request by the committee, William Pittard, a lawyer for Biden’s art dealer Georges Berges, wrote a letter to Chairman Rep. James Comer (R-Ky.) earlier this month raising “concerns” about complying with the committee’s demands to see records about clients who have purchased Biden’s work.

In the Feb. 6 letter, seen by The Post, Pittard argues that complying with the Committee’s request to release the names of the art buyers “would defeat the efforts of Mr. Biden and the White House to avoid the ‘serious ethics concerns’ that you raise.” “If the White House was not aware of those buyers, it would seem impossible for the administration to grant the buyers any favors based on the purchases,” Pittard notes. GOP Oversight Committee members say Berges’ refusal to comply is only adding “fuel to the fire” of the probe. “Hunter Biden’s artwork isn’t worthy of hanging on the walls of a foreclosed motel, so why would anyone buy it?” Rep. Lisa McClain (R-Mich.) told Fox News Digital. “The answer is simple, to curry favor with the corrupt son of the president.”

“We need to know who purchased Hunter’s so-called ‘art’, and Georges Berges refusing to provide that information to Congress only adds fuel to the fire for our investigation,” she added. Rep. Lauren Boebert (R-Colo.) echoed McClain, telling the outlet that all “Hunter’s attorney is doing is delaying the inevitable.” “We will receive this evidence, one way or another,” Boebert said. [..] Rep. Clay Higgins (R-La.), another member of the Oversight Committee, told Fox News Digital that the scope of the panel’s investigation goes beyond Hunter Biden, and that nobody “cares specifically about Hunter.” “We’re investigating the Biden crime-family operations. They’ve moved a lot of very suspicious money,” Higgins said. “‘Selling’ Hunter Biden art is just a method they’ve employed.”

Assange

Julian Assange: media and wars pic.twitter.com/QEMjnzmRaS

— ms (@sundin1967) February 25, 2023

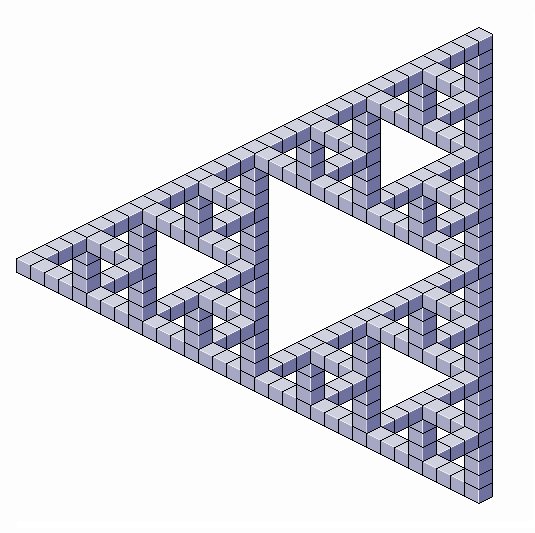

In 2009, Nidhal Selmi combined the Sierpinski triangle with the Penrose triangle to create the M.C. Escher-like Selmi triangle

Clouded leopards live in forests at elevations of up to 3,000 meters and spend much of their lives in trees. Their strong tails help them to balance while perched on tree branches

Kyaiktiyo Pagoda, also known as Golden Rock, is a Buddhist pilgrimage site in Mon State, Burma, famous for its balancing rock which seems to defy gravity, as it perpetually appears to be on the verge of rolling down the hill

The roots of this tree in Hong Kong, photohraphed by Clément Bucco-Lechat in 2010, have grown over the paving stones and seem to follow the patterns that the pavers were laid in

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.