Warner Bros Lauren Bacall publicity still from To Have and Have Not 1944

If you put all the pieces in a jigsaw puzzle in their proper places, a picture emerges. An easy enough principle. But how do you get the pieces, and where do they go? That’s often not so easy at all.

Oil prices are low, and falling, in the face of Iraq and Ukraine. But what does that mean, and how does it fit into the puzzle?

In a report issued on Tuesday, the IEA cut its forecast for worldwide oil consumption growth to 1 million bpd (barrels per day), 180,000 bpd less than previously predicted, while supplies have risen by 300,000 bpd above the forecast output.

Now, the IEA and its US sister, the EIA, are notoriously as unreliable in their numbers as the US government is in jobs and growth numbers, and as China is in all economic numbers. But the trend looks believable.

And to think that only in March the IEA predicted increasing demand and said: “Growth momentum is expected to benefit from a more robust global economic backdrop”.

One thing from the IEA report makes sense; it says the oil market seemed “eerily calm in the face of mounting geopolitical risks spanning an unusually large swathe of the oil-producing world”.

Russia Vulnerable As Oil Prices Hit Nine-Month Low On IEA ‘Glut’ Warnings

Oil prices have fallen to a nine-month low as surging supply from Opec and the US floods the market and fresh demand wilts [..] OECD inventories rose by 88m barrels in the second quarter, the most since 2006. Stocks are still below their five-year average but are no longer as dangerously thin as they were last winter.

[..] Saudi Arabia cranked up its production to more than 10m b/d, the highest since last September. Oil demand fell by 440,000 b/d in Europe and the US over the period [..] The big surprise has been a “sharp contraction” in German demand for oil products, down 3.9pc over the past year. It is much the same picture in Italy and Japan.

I find it curious that Saudi Arabia would raise its production in times when there is an oil ‘glut’. What would they be trying to achieve? Lower prices? For political reasons perhaps? It gets more curious when the EIA says OPEC will reduce production, as per the Wall Street Journal:

EIA Lowers Global Oil Demand Forecast for 2014, 2015

The EIA said it expects the Organization of the Petroleum Exporting Countries to reduce output in 2014 [..] The agency called for 35.84 million bpd of OPEC production in 2014[ ..] OPEC produced 36.12 million bpd last year, according to the EIA. In the U.S., production hit 8.5 million bpd in July, the highest monthly level since April 1987 [..] its forecast total U.S. crude production at 8.46 million bpd in 2015 However, the agency cut its forecast for production in the lower 48 states.

The EIA maintained its forecast for U.S. average daily oil consumption at 18.88 million bpd in 2014 but raised its 2015 forecast to 18.98 million bpd.

The glut can come from either one of two directions: more supply or less demand. Since demand fell by 440,000 b/d in Europe and the US since September, and the IEA says production will rise by 300,000 bpd, there is some wiggle room. But.

US oil consumption never recovered. It’s now at about the same level as in 1997, when there were about 45 million fewer people living in America. That is a huge drop. While there have been advances in efficiency etc., there’s no denying that the economy never recovered either, not by a very long shot. No matter that it supposedly grew at a 4% annualized rate in Q2…

And please don’t forget that this happened at a time when stock markets set records, the Fed balance sheet rose to $4+ trillion and overall debt went to the moon and never looked back. What is that, a quadruple whammy?

Worst Retail Sales Showing in Six Months in Slow Start to Third Quarter

Retail sales were little changed in July, the worst performance in six months, as car demand slowed and tepid wage growth restrained U.S. consumers. The slowdown in purchases followed a 0.2% advance in June [..]

Retailers such as Macy’s are relying on promotions and discounts to entice customers. “There’s no sign of momentum or enthusiasm out of the consumer right now,” said Stephen Stanley, chief economist at Pierpont Securities [..] I don’t think people have the wherewithal, not to mention the inclination, to ramp it up.”

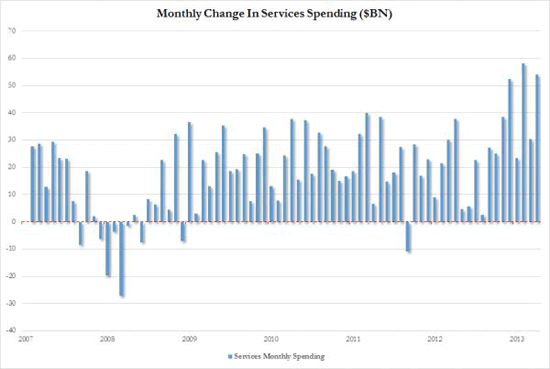

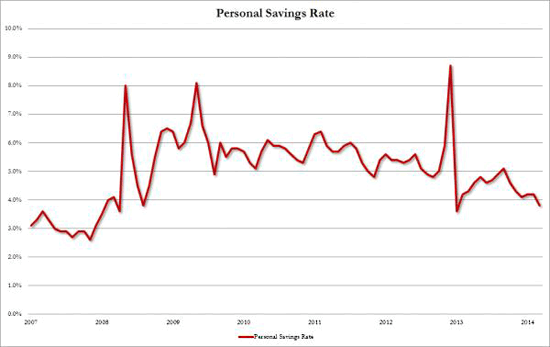

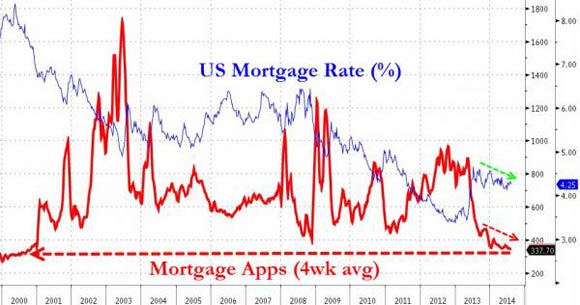

Not even subprime car loans can do the trick anymore. Let alone housing:

Not that that’s a typical American problem:

Home sales in China fell 10.5% in the first seven months of the year to 2.98 trillion yuan ($484 billion) [..] To lure home buyers back to the market, around 30 local governments have loosened property restrictions such as limits on second home purchases. But there has yet to be any meaningful pickup in sales [..] Average home prices in 100 Chinese cities fell for the third straight month in July on a month over month basis, according to data tracker China Real Estate Index System. New construction starts in the January-July period measured by area fell 12.8%

Nor is the US the only country with a retails sales problem:

Japanese GDP Plunges 6.8%, Record Drop in Consumer Spending

Compared to the 3.6% drop in GDP when Japan last hiked its consumption tax in 1997, today’s Q2 GDP collapse of 6.8% annualized is an utter disaster. Consumer Spending collapsed 5.2% QoQ – the most on record.

And Europe fares no better:

Crisis Stalks Europe Again As Deflation Deepens, Germany Stalls

Portugal has crashed into deep deflation and Italy’s inflation rate has fallen to zero as the eurozone flirts with recession, automatically pushing these countries further towards a debt compound spiral. The slide comes amid signs of a deepening slowdown in the eurozone core, with even Germany flirting with possible recession. Germany’s ZEW index of investor confidence plunged from 27.1 to 8.6 in July, the sharpest fall since June 2012 [..]

Markets were stunned by the sudden fall in Portugal’s HICP inflation to -0.7% in July, from -0.2% the month before. Spain’s provisional estimate is for a fall of -0.3%. The risk is that this will cause inflation expectations to become unhinged and extremely difficult to reverse.

“The latest inflation figures call for the ultimate bazooka from the ECB. We’re seeing the Japanification of Europe,” said Lena Komileva from G+ Economics. “Deflation pushes up the debt ratios in the southern countries and makes their task even more insurmountable.”

Morgan Stanley warned that Germany’s economy contracted by 0.1% in the second quarter [..] Hans Redeker, the bank’s currency chief said: “It is very difficult to keep recovery going in the eurozone without credit. Companies are just eating up their cash flow.”

Germany’s factory orders from the rest of the eurozone dropped by 10.4% in June [..] The DAX index of stocks in Frankfurt has plummeted 10% over the past month, while yields on 10-year German Bunds have dropped to historic lows of 1.06%.

For Italy, it is already becoming a fresh crisis. The country is caught in a vice, squeezed by a triple-dip recession and zero inflation at the same time. Italy’s €2.1 trillion public debt is rising on a shrinking base of nominal GDP despite austerity policies. The debt ratio has surged five percentage points to 135.6% of GDP over the past year, despite austerity. Portugal is close behind. Its debt has jumped from 127.4% to 132.9% [..] Deflation is pushing both nations into a textbook debt trap.

And then we haven’t even talked about France. Or fresh sanctions that will bite a piece out of GDP both in Russia and in Europe.

Without the markets, or economies, collapsing outright yet, it’s starting to look like while oil cannot save us from economic mayhem, the downfall of our economies is indeed keeping the lack-of-energy monster at bay.

Not that that’s something we should be too happy about, for obvious reasons.

But that’s not the whole story, or the end of the story, and it’s not where the jigsaw pieces fall neatly into place.

What we tend to label geopolitical risks, which will come in very handy to mask economic problems we would have had anyway, are already leading to other events and consequences.

That is to say, the world has started fighting over oil for real. It’s no longer just about dominance, it’s about survival. Of societies, of values, political systems, religions.

Islamist State Funds Caliphate With Mosul Dam, Oil and Gas

Islamic State militants who last week captured the Mosul Dam, Iraq’s largest, had one demand for workers: Keep it going. [..] militants from the al-Qaeda breakaway group told workers hiding in management offices they would get their salaries as long as the dam continued to produce electricity for the region under their control.

[IS] fighters are capturing the strategic assets needed to fund the Islamic caliphate [..] “These extremists are not just mad,” said Salman Shaikh, director of the Brookings Institution’s Doha Center in Qatar. [..] “It’s been a big mistake for some people to think that these guys are some ragtag outfit .. ” [..] “There’s a method to their madness, because they’ve managed to amass cash and natural resources, both oil and water, the two most important things. And of course they are going to use those as a way of continuing to grow and strengthen.”

The dam is the most important asset the group captured since taking Nineveh province in June. The group controls several oil and gas fields in western Iraq and eastern Syria, generating millions of dollars in daily revenue. The group is using the dam as a hideout because it knows it wouldn’t be bombed, he said [..] The dam was completed in 1986 and its generators can produce as much as 1010 megawatts of electricity, according to the website of the Iraqi State Commission for Dams and Reservoirs.

Aziz Alwash, an environmental adviser to the Water Resources Ministry, said the dam needs cement injections as part of its maintenance. “Mosul city would drown within three hours” if the dam broke, he said Aug. 10 in a telephone interview. Other cities down the road to Baghdad would also be inundated while the capital would be under water within four hours.

While you were sleeping, the world changed. Our economies are no longer growing. But some things are. The Islamist State for one. International tension in general. And “We” are actively causing these things to grow as much as anyone else.

It should be crystal clear that oil prices can shoot up at any given moment. One wrong move, one faulty calculation, one missed shot or one stray bullet, that’s all it takes. We like to think of ourselves as being in control, that’s how we grew up. But we no longer are, if we ever were.

Someone at CNBC found a few pieces that fit together:

Are Weaker Oil Prices Signaling Doom For Stocks?

The price of Brent crude slipped to a 13-month low on Wednesday, pushed lower by reports of oversupply in the markets. However, some market watchers believe that this softness could be signaling something more sinister in the global economy, with a risk that the weakness could spread to other assets. [..] Michael Hewson, analyst at CMC Markets, agrees that current global growth forecasts may be too optimistic and depressed demand in Europe and China, along with the anticipated normalization of interest rates in the U.S. and the U.K., could be about to bring investors back down to earth.

[..[ he has felt the market has been too upbeat for most of 2014. “Far be it from me to get in front of a runaway train … but I think that train is a bit crowded.”

“Far be it from me to get in front of a runaway train … but I think that train is a bit crowded,”

• Are Weaker Oil Prices Signaling Doom For Stocks? (CNBC)

The price of Brent crude slipped to a 13-month low on Wednesday, pushed lower by reports of oversupply in the markets. However, some market watchers believe that this softness could be signaling something more sinister in the global economy, with a risk that the weakness could spread to other assets. “At the end of the day it’s all about demand,” Michael Hewson, the chief market analyst at brokerage firm CMC Markets told CNBC via telephone. The oil price is simply a leading indicator for demand across the globe, according to Hewson, who predicts the price has more downside risk than upside, barring any unexpected geopolitical event. He agrees that current global growth forecasts may be too optimistic and depressed demand in Europe and China, along with the anticipated normalization of interest rates in the U.S. and the U.K., could be about to bring investors back down to earth.

“I think the (growth forecasts) have been over egging the pudding,” he said, adding that he has felt the market has been too upbeat for most of 2014. “Far be it from me to get in front of a runaway train … but I think that train is a bit crowded,” he said. The price of Brent and WTI has been relatively stable for the last two years as the expansive monetary policy by central banks has coincided with a bull run in the equities market. The commodity saw a brief spike in June with fears over an Islamist militant group taking over large parts of northern Iraq. But markets have slipped since that price move, with Brent crude sliding to $102.45 a barrel on Wednesday to trade near its lowest level since June 2013. U.S. crude fell to $97.16 on Wednesday morning, near levels not seen since February this year.

Oil prices have been in this trend in recent weeks despite tensions in Iraq, Libya and Ukraine, however, it was a new report by the International Energy Agency that weighed on markets Wednesday. On Tuesday, the IEA said that oil has seen weak demand in the last few months and an oil glut has helped to keep a lid on prices. It added that markets were “eerily calm” in the face of the mounting geopolitical risks. Commenting on the report Marshall Gittler, a currency market strategist at IronFX, said that U.S. intervention in Iraq – with targeted airstrikes and militarily advisers entering the country – would only mean a further price fall as the risk premium diminishes.

• Brent Trades Near 13-Month Low Amid Signs China Is Slowing (Bloomberg)

Brent crude traded near its lowest intraday level in 13 months on speculation that supplies are excessive as Libyan output recovers and economic activity in China slows. West Texas Intermediate was steady. Futures slipped as much as 0.6% in London in a fourth daily decline. Libya exported the first oil cargo from Ras Lanuf port since it was closed by rebels a year ago. China’s broadest measure of new credit plunged to the lowest since the global financial crisis, while the National Bureau of Statistics in Beijing said growth in factory production slowed. The IEA said yesterday a supply glut was shielding the market against threats to output in the Middle East. “On the supply side, there’s been positive news from Libya even as the fighting worsens, giving a better situation in the physical market,” said Frank Klumpp, an analyst at Landesbank Baden-Wuerttemberg in Stuttgart, Germany. “The demand side has potential for a bearish surprise as we have growing uncertainty” over China’s economy, he said.

• Japanese GDP Plunges 6.8%, Record Drop in Consumer Spending (Zero Hedge)

Compared to the 3.6% drop in GDP when Japan last hiked its consumption tax in 1997, today’s Q2 GDP collapse of 6.8% annualized is an utter disaster (even if it is slightly better than the expected -7.0% expectations thanks to a surge in the deflator). Inventory additions added 1.0% growth. Consumer Spending collapsed 5.2% QoQ – the most on record. Of course, in the tradition of Keynesian hockey-sticks, this XX% collapse in Q2 is expected to surge back to a 2.5% growth figure in Q3 and lead Japan to the holy grail once more.. only it didn’t quite work out that way last time for Japan. Simply put this is the worst posible outcome for bulls, small beat not enough to rejuice QQE.

Here come the hockeysticks …

• Chinese Home Sales Fall 10.5% (WSJ)

Home sales in China fell 10.5% in the first seven months of the year to 2.98 trillion yuan ($484 billion), data released by the National Bureau of Statistics on Wednesday showed, as potential buyers wait for prices to slide further. Sales were 2.56 trillion yuan in the first half of the year – down 9.2% from the same period of 2013. To lure home buyers back to the market, around 30 local governments have loosened property restrictions such as limits on second home purchases. But there has yet to be any meaningful pickup in sales, as home buyers stay away due to expectations of further price falls and rising inventories. Average home prices in 100 Chinese cities fell for the third straight month in July on a month over month basis, according to data tracker China Real Estate Index System. New construction starts in the January-July period measured by area fell 12.8% to 982.3 million square meters. This compared with a decline of 16.4% to 801.3 million square meters in the first six months.

Property investment in the first seven months of this year rose 13.7% to 5.04 trillion yuan, slowing from 14.1% growth in the first six months of the year. The investment figures are a lagging indicator, and reflect continuing activity in projects that started last year. New construction starts grew 13.5% in 2013. Analysts however, noted that they are awaiting sales data in August and September, rather than July, for cues on whether a turnaround is in the works. More property developers plan new home launches for sale during the two months. The statistics bureau doesn’t give data for individual months. Earlier Wednesday, China’s central bank issued data showing that new lending in July fell sharply from June, dashing hopes of a widespread pickup in mortgage loans and housing sales amid some property policy easing. Many economists have said that the downturn in the property sector poses the biggest risk to China’s economy.

• Crisis Stalks Europe Again As Deflation Deepens, Germany Stalls (AEP)

Portugal has crashed into deep deflation and Italy’s inflation rate has fallen to zero as the eurozone flirts with recession, automatically pushing these countries further towards a debt compound spiral. The slide comes amid signs of a deepening slowdown in the eurozone core, with even Germany flirting with possible recession. Germany’s ZEW index of investor confidence plunged from 27.1 to 8.6 in July, the sharpest fall since June 2012, during the European sovereign debt crisis. “The European Central Bank has to act now,” said Andrew Roberts, credit chief at RBS. Markets were stunned by the sudden fall in Portugal’s HICP inflation to -0.7% in July, from -0.2% the month before. Spain’s provisional estimate is for a fall of -0.3%. The risk is that this will cause inflation expectations to become unhinged and extremely difficult to reverse.

“The latest inflation figures call for the ultimate bazooka from the ECB. We’re seeing the Japanification of Europe,” said Lena Komileva from G+ Economics. “Deflation pushes up the debt ratios in the southern countries and makes their task even more insurmountable.” The ECB is waiting to see whether its new four-year loans for banks (TLTROs) will stop the relentless contraction of credit and stave off the threat of a Japanese-style deflation trap, but the auctions will not take place until September and December. “Europe could be in deflation before the TLTROs have even begun. They cannot wait until February or March to start thinking about quantitative easing,” said Mr Roberts. Morgan Stanley warned that Germany’s economy contracted by 0.1% in the second quarter, raising the risk of outright recession as the Russia crisis starts to bite. “Momentum really stalled in May and June,” said Hans Redeker, the bank’s currency chief. “It is very difficult to keep recovery going in the eurozone without credit. Companies are just eating up their cash flow.”

Germany’s factory orders from the rest of the eurozone dropped by 10.4% in June, a fall not seen since the white heat of the Lehman crisis in late 2008. The DAX index of stocks in Frankfurt has plummeted 10% over the past month, while yields on 10-year German Bunds have dropped to historic lows of 1.06%. A sudden drop in yields typically signals a recession risk. Ingo Kramer, head of the BDI, the German industry federation, said German companies are struggling but it has not yet reached crisis level. “We are not at risk of recession,” he said. Brussels expects sanctions against Russia to cut eurozone growth by 0.3% this year.

For Italy, it is already becoming a fresh crisis. The country is caught in a vice, squeezed by a triple-dip recession and zero inflation at the same time. Italy’s €2.1 trillion public debt is rising on a shrinking base of nominal GDP despite austerity policies. The debt ratio has surged five percentage points to 135.6% of GDP over the past year, despite austerity. Portugal is close behind. Its debt has jumped from 127.4% to 132.9%, and is certain to move higher after the recovery collapsed earlier this year. There are growing concerns that the Portuguese state will end up footing the bill for the rescue of Banco Espirito Santo after senior bondholders were protected. Deflation is pushing both nations into a textbook debt trap.

• Europe’s Crash-and-Burn Economy (Bloomberg)

As the euro-region economy struggled to emerge from recession in recent years, officials could at least comfort themselves with the performance of the German economy: “We’ll always have Frankfurt,” to miscoin a phrase. That’s no longer true. German investor confidence has worsened for eight consecutive months; today, it collapsed to its lowest level in two years. The euro-region economy is in flames. Here ends the argument that the world of finance and economics is shrugging off Ukraine and Iraq and Ebola and Gaza and all the other geopolitical risks currently assailing the headlines. A sentiment index measuring faith in the six-month economic outlook dropped to 8.6 this month, according to the ZEW Center for European Economic Research in Mannheim. The index has slumped from a seven-year high of 62 reached in December. ZEW explained the situation thus:

The decline in economic sentiment is likely connected to the ongoing geopolitical tensions that have affected the German economy. Since the economy in the euro zone is not gaining momentum either, the signs are that economic growth in Germany will be weaker in 2014 than expected.

Figures scheduled for release on Aug. 14 are likely to show that the German economy, Europe’s biggest, contracted by 0.1% in the second quarter, according to the median forecast of economists surveyed by Bloomberg News. The euro zone as a whole will be lucky to manage growth of 0.1%, based on data scheduled for release that same day. So just one slip and the region will be flatlining; two slips, as it were, and recession will be just one quarter away: The specter of deflation, meantime, looms ever larger. In Portugal, consumer prices fell at an annual pace of 0.9% last month, their sixth consecutive decline, figures today showed. In Italy, already mired in recession, prices were unchanged as companies presumably decided their prospects are too gloomy for customers to endure increases. The euro-zone economy is heading for a crash; what will it take for European Central Bank President Mario Draghi to see that?

• Sliding German Output Bodes Ill For Eurozone (NY Times)

An important reading on the health of the eurozone economy is expected to show this week that growth stagnated in the most recent quarter as German output faltered, confirming the assessment of many analysts that a lasting recovery remains out of reach for the region. Economists are expecting that in the 18-nation currency bloc, gross domestic product expanded 0.1%in the second quarter compared with the first quarter, equivalent to an annual rate of growth of 0.4%. The eurozone eked out quarterly growth of 0.2%in the first three months of the year. The eurozone GDP report, to be released Thursday by the European Union statistical agency, Eurostat, is based on data from before the latest tensions about Ukraine and before the sanctions against Russia for its involvement in the crisis began to be felt. That means there are plenty of questions hanging over the second half of the year.

Most worrying are the indications that Germany is beginning to struggle, including a steep drop in economic sentiment reported Tuesday. Germany, which accounts for more than one-fourth of the overall eurozone economy, had been propping up the rest of the area for much of the last few years. On Tuesday, a report from the ZEW economic research institute in Mannheim, Germany, showed German economic sentiment fell this month to the lowest level since December 2012. The drop, the report said, “is likely connected to the ongoing geopolitical tensions that have affected the German economy.” The setback followed a warning from the OECD on Monday that its analysis showed “growth losing momentum” in Germany and an official report last week that showed German factories produced far less than expected in June. The gloomy sentiment in Germany is a “signal that the growth performance in the second quarter could suddenly morph from a one-off into an undesired trend,” said Carsten Brzeski, an economist with ING Group in Brussels.

• Eurozone Industrial Production Fell Again in June (WSJ)

Industrial production in the 18 countries that share the euro fell for a second straight month in June, an indication that the currency area’s economic recovery may have faltered again in the second quarter. The European Union’s statistics agency Wednesday said output from factories, mines and utilities fell 0.3% from May, and was unchanged compared with June 2013. That was a surprise, with 21 economists surveyed by The Wall Street Journal last week estimating the production rose by 0.3% during the month. Eurostat will Thursday release its measure of economic growth during the second quarter. Economists expect the agency to record a second straight quarter of slowing growth, with gross domestic product having risen by just 0.1% from the three months to March. The weakness of industrial production will likely cement those expectations. The euro zone’s economy has struggled to grow in the years since the 2008 financial crisis, and in particular has lagged behind other parts of the world economy since its interlinked government debt and banking crises erupted in late 2009.

But with the worst appearing to have passed last year, policy makers had hoped for a gradual acceleration in the rate of growth as 2014 advanced. Instead, the first quarter marked a slowdown from the final three months of 2013, and hopes for a significant rebound in gross domestic product during the second quarter have faded with every data release. Without higher rates of growth, the currency area will struggle to reduce its high levels of debt and unemployment. Weak demand and high joblessness across much of Europe’s economy is reflected in inflation rates far below the European Central Bank’s target of just under 2%. Spain’s statistics agency Wednesday said consumer prices were 0.4% lower in July than a year earlier, having previously estimated prices were down 0.3%. Portugal’s statistics agency Tuesday said consumer prices were down 0.7% on the year in July, a sixth straight month of deflation.

• Eurozone GDP: Brace Yourself (CNBC)

Complacency about the state of the euro zone’s economy could get a serious shaking Thursday, with the latest growth figures not expected to paint a pretty picture. The gross domestic product figures for the second quarter of 2014, following on from a paltry 0.2% increase in the first three months of the year, are unlikely to banish the looming specter of deflation and economic stagnation. Between April and June, the single currency region’s economy is expected to grow by just 0.1% from the previous quarter – or 0.4% from the same time in 2013. By contrast, the U.S. announced last month that its economy grew 4% on an annual basis.

Most importantly, Germany, long the engine room of Europe, and the region’s largest economy, is expected to show faltering or even declining growth. This can partly be accounted for by an unusually strong first quarter, powered by unseasonably high construction figures. Still, German investors are increasingly sceptical about the country’s economic potential, according to the ZEW figures released on Tuesday. Neighboring France is also unlikely to provide much of a fillip to growth, as pressure grows on its government to enact economic reforms more quickly. “Growth in the euro area is perilously low, and vulnerable to even slight setbacks in sentiment,” according to Claus Vistesen, chief euro zone economist at Pantheon Macroeconomics. “At the current rate, growth is far too low and uncertain to make a meaningful difference to a still high unemployment rate and too high debt levels.”

Oh mon Dieu.

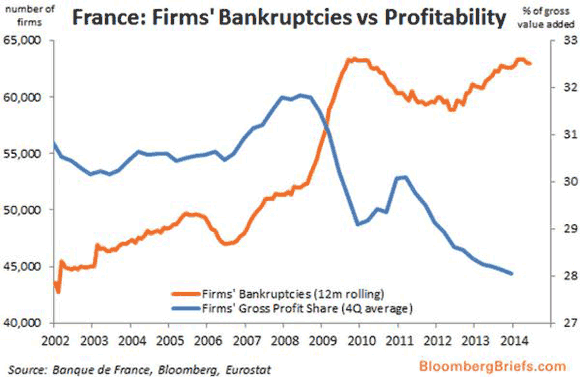

• France’s ‘Recovery’ In 1 Hard-To-Believe Chart (Zero Hedge)

With French government bonds trading at record low yields under 1.5%, it is hard to argue that the troubled socialist nation is ‘priced’ for either recovery or credit risk… but then again, thanks to Draghi’s promise and domestic banks’ largesse, none of that matters. With joblessness at record highs, the following chart of France’s “recovery” shows near-record high bankruptcies and record-low profitability. Oh the beauty of socialism…as Europe’s core diverges dramatically. “Recovery”?

China money supply is waning.

• China Credit Gauge Plunges as Expansion in Money Supply Slows (Bloomberg)

China’s broadest measure of new credit unexpectedly plunged to the lowest level since the global financial crisis, adding risks to economic growth already headed for the weakest annual pace in 24 years. Aggregate financing was 273.1 billion yuan ($44.3 billion) in July, the People’s Bank of China said today in Beijing, compared with the 1.5 trillion yuan median estimate of analysts surveyed by Bloomberg News. New local-currency loans of 385.2 billion yuan were half of projections, while M2 money supply grew a less-than-anticipated 13.5% from a year earlier.

Chinese stocks fell after the credit slowdown joined a property slump in testing Premier Li Keqiang’s economic-expansion target of about 7.5%this year, spurring speculation the government will ease policy. The PBOC said the drop in financing resulted from recent regulation and financial institutions’ enhanced control of risks. n“The numbers reflect both tightened regulation over certain financing activities and an underlying weak economy,” said Zhang Bin, an economist in Beijing with the state-run Chinese Academy of Social Sciences. “There’s still no real recovery in growth – at best, we can say that economic performance is stabilizing at a low level.”

China is teetering.

• China Trust Asset Growth Slows in Shadow Banking Campaign (Bloomberg)

China’s trust assets expanded at the slowest pace in two years as the government cracks down on shadow banking and investors reassess the risks of the high-yield investments. Trust companies’ assets under management climbed 6.4% to 12.5 trillion yuan ($2 trillion) as of June 30 from three months earlier, the China Trustee Association said in a statement yesterday. That’s the slowest growth since the first quarter of 2012 and compares with an average annual gain of 50% since 2008. Premier Li Keqiang is grappling with sustaining economic growth while containing financial risks after shadow banking exploded in China from 2010.

A “day of reckoning” is approaching for the trust industry with repayments to peak this quarter and next, and banks are set to bear the bulk of losses as defaults rise, Haitong International Securities Co. economist Hu Yifan wrote in a July 25 report. “Regulators, banks and local governments are all trying to contain the trust risks but things will only really improve if the economy picks up and borrowers get back on their feet,” Zeng Yu, a Beijing-based analyst at China Securities Co., said today by phone. “Chinese investors are becoming more risk averse and increasingly will go for lower-yield but less risky products.” Trust assets under management fell 240 billion yuan in June from May. That was the first monthly decline, the statement said, without specifying a time period.

We’ll all be rich!

• JPMorgan Joins Goldman in Designing New Generation Derivatives (Bloomberg)

Derivatives that helped inflate the 2007 credit bubble are being remade for a new generation. JPMorgan Chase is offering a swap contract tied to a speculative-grade loan index that makes it easier for investors to wager on the debt. Goldman Sachs Group Inc. is planning as much as €10 billion ($13.4 billion) of structured investments that bundle debt into top-rated securities, while ProShares last week started offering exchange-traded funds backed by credit-default swaps on company debt. Wall Street is starting to return to the financial innovation that helped extend the debt rally seven years ago before exacerbating the worst financial crisis since the Great Depression.

The instruments are springing back to life as investors seek new ways to boost returns that are being suppressed by central bank stimulus. At the same time, they’re allowing hedge funds and other investors to bet more cheaply on a plunge after a 145%rally in junk bonds since 2008. “The true sign of a top is when you have these new structures piling up,” said Lawrence McDonald, a chief strategist at Newedge USA LLC, and author of the book “A Colossal Failure of Common Sense” about the 2008 demise of Lehman Brothers Holdings Inc. “At the top of the market in 2007, there were these types of innovation and many investors didn’t realize about it at that time. These products are a clear risk indicator.”

• New York Prosecutors Charge Payday Loan Firms With Usury (NY Times)

A trail of money that began with triple-digit loans to troubled New Yorkers and wound through companies owned by a former used-car salesman in Tennessee led New York prosecutors on a yearlong hunt through the shadowy world of payday lending. On Monday, that investigation culminated with state prosecutors in Manhattan bringing criminal charges against a dozen companies and their owner, Carey Vaughn Brown, accusing them of enabling payday loans that flouted the state’s limits on interest rates in loans to New Yorkers. Such charges are rare. The case is a harbinger of others that may be brought to rein in payday lenders that offer quick cash, backed by borrowers’ paychecks, to people desperate for money, according to several people with knowledge of the investigations. “The exploitative practices — including exorbitant interest rates and automatic payments from borrowers’ bank accounts, as charged in the indictment — are sadly typical of this industry as a whole,” Cyrus R. Vance Jr., the Manhattan district attorney, said on Monday.

In the indictment, prosecutors outline how Mr. Brown assembled “a payday syndicate” that controlled every facet of the loan process — from extending the loans to processing payments to collecting from borrowers behind on their bills. The authorities argue that Mr. Brown, along with Ronald Beaver, who was the chief operating officer for several companies within the syndicate, and Joanna Temple, who provided legal advice, “carefully crafted their corporate entities to obscure ownership and secure increasing profits.” Beneath the dizzying corporate structure, prosecutors said, was a simple goal: make expensive loans even in states that outlawed them. To do that, Mr. Brown incorporated the online payday lending arm, MyCashNow.com, in the West Indies, a tactic that prosecutors say was intended to try to put the company beyond the reach of American authorities. Other subsidiaries, owned by Mr. Brown, were incorporated in states like Nevada, which were chosen for their light regulatory touch and modest corporate record-keeping requirements, prosecutors said.

• Islamist State Funds Caliphate With Mosul Dam, Oil and Gas (Bloomberg)

Islamic State militants who last week captured the Mosul Dam, Iraq’s largest, had one demand for workers: Keep it going. Arriving in their Toyota pickup trucks, armed with Kalashnikov assault rifles and wearing a patchwork of military uniforms, robes and turbans, jubilant militants from the al-Qaeda breakaway group told workers hiding in management offices they would get their salaries as long as the dam continued to produce electricity for the region under their control, according to a technician who was at the dam when nearly 500 militants drove off Kurdish troops. Islamic State’s rampage through northern Iraq has inspired terror as stories spread of beheadings and crucifixions. At the same time, its fighters are capturing the strategic assets needed to fund the Islamic caliphate it announced in June and strengthen its grip on the territory already captured. “These extremists are not just mad,” said Salman Shaikh, director of the Brookings Institution’s Doha Center in Qatar.

“There’s a method to their madness, because they’ve managed to amass cash and natural resources, both oil and water, the two most important things. And of course they are going to use those as a way of continuing to grow and strengthen.” The dam is the most important asset the group captured since taking Nineveh province in June. The group controls several oil and gas fields in western Iraq and eastern Syria, generating millions of dollars in daily revenue. U.S. President Barack Obama said the fight against militants in Iraq will be a “long-term project,” tying the prospects for success to whether the nation’s leaders quickly form an inclusive government. The U.S. conducted several strikes last week against Islamic State fighters attacking Yezidi civilians near Sinjar. The group still controls the dam. Fighter jets and drones were flying over it on Aug. 9 without hitting it, said the technician.

The group, which used to call itself Islamic State in Iraq and the Levant, is using the dam as a hideout because it knows it wouldn’t be bombed, he said [..] The dam was completed in 1986 and its generators can produce as much as 1010 megawatts of electricity, according to the website of the Iraqi State Commission for Dams and Reservoirs. Aziz Alwash, an environmental adviser to the Water Resources Ministry, said he’s concerned the militants will use the dam to blackmail the government. The dam needs cement injections as part of its maintenance, he said. “Mosul city would drown within three hours” if the dam broke, he said Aug. 10 in a telephone interview. Other cities down the road to Baghdad would also be inundated while the capital would be under water within four hours. [..] “It’s been a big mistake for some people to think that these guys are some ragtag outfit,” said Shaikh of the Brookings Institution.

Just what we needed.

• Obama Administration Loosens Ban on Lobbyists in Government (Reuters)

President Barack Obama is loosening restrictions on lobbyists who want to serve on federal advisory boards, a White House official said on Tuesday, a setback to the president’s efforts to tamp down special interest influence in Washington. Obama came to office pledging to curtail the sway of lobbyists and banned lobbyists from serving on such panels, which guide government policy on a range of topics ranging from cancer to towing safety. The president said he was doing so because the voices of paid representatives of interest groups were drowning out the views of ordinary citizens.

But many lobbyists felt they were being unfairly tarred by Obama’s campaign to keep them out of public service. A lawsuit challenging the ban was initially dismissed, but a District of Columbia Circuit Court in January reinstated it. A spokesperson for the White House Office of Management and Budget said the administration was revising its earlier guidance on lobbyists serving on federal advisory panels to clarify that lobbyists may now serve on such panels when they are representing the views of a particular group. There are more than 1,000 federal advisory committees. The head of a lobbying industry trade group called the change a positive step that will allow the government to draw on the expertise of people whose experience can be beneficial in making policy.

Get out! There’s no future for your children there.

• Southwest Braces As Lake Mead Water Levels Drop Further (AP)

Once-teeming Lake Mead marinas are idle as a 14-year drought steadily drops water levels to historic lows. Officials from nearby Las Vegas are pushing conservation but also are drilling a new pipeline to keep drawing water from the lake. Hundreds of miles away, farmers who receive water from the lake behind Hoover Dam are preparing for the worst. The receding shoreline at one of the main reservoirs in the vast Colorado River water system is raising concerns about the future of a network serving a perennially parched region home to 40 million people and 4 million acres of farmland. Marina operators, water managers and farmers who for decades have chased every drop of water across the booming Southwest and part of Mexico are closely tracking the reservoir water level already at its lowest point since it was first filled in the 1930s.

“We just hope for snow and rain up in Colorado, so it’ll come our way,” said marina operator Steve Biggs, referring to precipitation in the Rockies that flows down the Colorado River to help fill the reservoir separating Nevada and Arizona. By 2016, continued drought could trigger cuts in water deliveries to both states. [..] The effect of increased demand and diminished supply is visible on Lake Mead’s canyon walls. A white mineral band often compared with a bathtub ring marks the depleted water level. The lake has dropped to 1,080 feet above sea level this year – down almost the width of a football field from a high of 1,225 feet in 1983. A projected level of 1,075 feet in January 2016 would trigger cuts in water deliveries to Arizona and Nevada. At 1,000 feet, drinking water intakes would go dry to Las Vegas, a city of 2 million residents and a destination for 40 million tourists per year that is almost completely dependent on the reservoir. That has the Southern Nevada Water Authority spending more than $800 million to build a 20-foot-diameter pipe so it can keep getting water.

Ouch.

• Worst Drought In Half A Century Hits China’s Bread-Basket (MarketWatch)

China’s worst drought in half a century is sweeping across crucial agricultural regions, devastating harvests in its wake and threatening food security. Part of the area hit by unusually dry weather — the northeastern Manchurian Plain — is known as China’s bread-basket, supplying much of the country’s corn, wheat and soybean production. In a portion of the plain, in Jilin province, 10 major grain producing counties are facing the lowest rainfall since 1951, and many corn fields are facing “zero harvest,” according to report by the state-run Xinhua New Agency, citing Jilin’s provincial weather bureau. Next door in Liaoning province, there has been no rain at all since late July.

And with Jilin government meteorologist Yang Xueyan warning that the situation will likely get worse in the near future, concern over the drought has sent local corn futures rising more than 4% in less than two week, First Financial Daily reported Friday. But the crisis isn’t confined to the Manchurian Plain alone — according to state broadcaster CCTV, the drought is impacting more than one-third of China. This includes the central Chinese province of Henan, another agriculturally important area, which has seen the weakest flood season in 53 years, leaving some rural communities with no viable drinking water, let alone water needed for irrigation, for as long as three months, CCTV said. In what may be a sign of things to come, the state-owned SDIC Zhonggu Futures brokerage is predicting a 40-million-ton corn deficit this summer.

Brilliant.

• The Privilege Of Watching War (Mises Canada)

The prospect of renewed war has little effect on the public anymore. We have been desensitized to the violence because it seemingly never stops. Material capitalism has created a state of luxury never known to mankind before our current day; yet it renders our sympathy for the plight of others flaccid. We watch movies and play video games and pretend to know what war is like. But in reality, we can’t begin to understand how it feels to live under the threat of bombs and shrapnel every day. As Americans, and Westerners, we are gifted with the option to not partake directly in war, but play the casual observer. It’s a privilege; and not at all like the class privilege egalitarians are constantly harping about. To see explosions go off in foreign lands, destroying homes, mutilating children, killing family members, is a jarring sight. But as long as it’s a pixelated image on a computer screen, it fails to have the same heart-wrenching effect as if it were occurring just a few feet away. It fails to invoke the emotional intensity that is the most potent weapon in battle.

It fails to show the emotional impetus that is behind vindictive combat. How lucky we are to be far removed from the cries of a mother whose child was collateral damage in an air strike. How lucky we are to not have our brothers and sisters disintegrated before our eyes. How lucky we are to not have our parents taken from us by stray bullets. How lucky are we not to have a generation of orphans, angry over the death of their mothers and fathers and wishing to exact revenge. The new Vice News documentary on the growing Islamic State in Syria provides a candid but eerie look into the internal deliberations of West-hating Muslim fanatics. These aren’t ordinary folks happy with careers and raising families. They live for jihad. They feed children propaganda on why American and European infidels must die. What’s discomforting about this mindset is that it’s not completely unjustifiable.

At one point during the mini-series, a pious man dedicated to the cause of the Islamic State declares, “we are going to invade you as you invaded us. We will capture your women as you captured our women. We will orphan your children as you orphaned our children.” Can it really be denied that a century of meddling in the Middle East hasn’t created this sentiment of seething vengefulness? Who are we, as Americans and citizens of militarily-dominant countries, to sit back and ignore this type of anger, when under the same circumstances, we would feel the same way? Such unfettered rage demands reflection: how blessed we are to not live in such a maddening state. And how fortunate we are to have an ocean of distance between us and pit of despair known as the Middle East. It’s truly unfortunate how the suffering of others helps us to understand the blessings wrought by domestic tranquility.

The other day, I shared an elevator with Eli Lake of The Daily Beast. Well-respected as a foreign policy analyst with high-ranking connections, Lake is one of the biggest agitators for war in the media. Seeing him up close was quite a revelation. Clad in nicely-fitted dress clothes, I was struck by Lake’s protruding belly. It was reminiscent of when I ran into Bill Kristol months before in the same elevator. Same clothes, same overweight figure. These men have the benefit of filling their gullets at rubber chicken dinners while begging for death and destruction across the globe. They don’t don military garb, pick up AR-15s and take care of business themselves. They would rather stare into a television camera and make the case for other people’s children to go off and die in war.

Highly recommended read.

• Sovereign Debt For Territory: A New Global Elite Swap Strategy (Salbuchi)

In recent decades, dozens of sovereign nations have fallen into ever-deepening trouble by becoming indebted with the “private megabank over-world” for amounts far, far in excess of what they can ever pay back. Is this due to bankers’ professional malpractice coupled with government mismanagement on a truly grand scale? Or are we seeing global power elite long-term planners slowly achieving their goals? Recurrent sovereign debt crises reflect neither “over-lending mistakes” by bankers and investors, nor “innocence” on the part of successive governments in deeply indebted nations. Rather, it all ties in with a global model for domination driven by a system of perpetual national debt which I have called “The Shylock Model”. [..] Sovereign debts are a major problem in just about every country in the world, including the US, UK and EU nations. So much so, those debts have become a Damocles’ Sword threatening the livelihood of untold billions of workers around the world.

One often wonders why governments indebt themselves for so much more than they can ever hope to pay… Here, Western economists, bankers, traders, Ivy League academics and professors, Nobel laureates and the mainstream media have a quick and monolithic reply: because all nations need “investment and investors” if they wish to build highways, power plants, schools, airports, hospitals, raise armies, service infrastructures and a long list of et ceteras, economic and national activities are all about. But more and more people are starting to ask a fundamental common-sense question: why should governments indebt themselves in hard currencies, decades into the future with global mega-bankers, when they could just as well finance these projects and needs far more safely by issuing the proper amounts of their own local sovereign currency instead?

Here is where all the above “experts” go berserk & ballistic, shouting back: “Issue currency? Are you crazy?? That’s against the “rules & laws” of economics!!! Issuing national sovereign currency to finance the real economy’s monetary needs leads to inflation and lost jobs and chaos and… (puts us nice mega-bankers out of a job…)!!.” That’s when they all gang-up into noisy “The sky is falling! The sky is falling!!” mode. Then you ask them: What happens when countries default on their unpayable sovereign debts – as they invariably and repeatedly do – not just in Argentina, but in Brazil, Spain, Venezuela, France, Costa Rica, Peru, El Salvador, Portugal, Russia, Bolivia, Iceland, Turkey, Greece, Cyprus, Thailand, Nigeria, Mexico, and Indonesia? Again the voice of the “experts”: “Then countries must “restructure” their debts kicking them forwards 20, 40 or more years into the future, so that your great, great, great grandchildren can continue paying them”. Oh, I see!

• Russia Vulnerable As Oil Prices Hit Nine-Month Low On IEA ‘Glut’ Warnings

Oil prices have fallen to a nine-month low as surging supply from Opec and the US floods the market and fresh demand wilts, leading to an “oil glut” in the Atlantic region despite the twin crises in Iraq and Russia. The International Energy Agency (IEA) cut its forecast for the rise in global consumption to just 1m bpd (b/d) this year due to near recession conditions in Europe and as pervasive weakness in the world economy disappoints. This comes as supply rises by a further 300,000 b/d beyond what was already planned. The warning sent Brent crude prices tumbling to $104 a barrel, the lowest this year. The sudden shift in the balance of the market has allowed the OECD club of rich states to build up their oil stocks at the fastest rate in eight years, creating an extra layer of protection against any possible supply shock from Russia and Iraq. The agency said OECD inventories rose by 88m barrels in the second quarter, the most since 2006. Stocks are still below their five-year average but are no longer as dangerously thin as they were last winter.

The IEA said in its monthly report that the oil market seemed “eerily calm in the face of mounting geopolitical risks spanning an unusually large swathe of the oil-producing world”. Yet so far the rise in supply has overwhelmed any actual disruptions from crisis zones. Libya’s output doubled to 430,000 b/d in July from a month earlier despite the continuing war between rival militias for control of the country’s oil wealth. Saudi Arabia cranked up its production to more than 10m b/d, the highest since last September. Oil demand fell by 440,000 b/d in Europe and the US over the period, a sign of how weak global recovery still is, consistent with a rare fall in the CPB’s index of world trade in May. The big surprise has been a “sharp contraction” in German demand for oil products, down 3.9pc over the past year. It is much the same picture in Italy and Japan.

The supply glut leaves the world economy slightly less vulnerable to a shock if the crisis escalates in Russia. The West has already imposed a funding freeze on Russia’s top oil company, Rosneft. This could ratchet up to Iran-style sanctions on Rosneft deliveries as well if the Kremlin launches a full-blown invasion of eastern Ukraine. Falling prices will ratchet up the pressure on Russia, which needs a price near $110 to balance its budget. While it has a reserve fund to cover any shortfall, this would be depleted fast if oil falls anywhere near $80 and Russia goes into a deep recession. Most of Russia’s energy revenues come from oil, not gas. The crisis in Iraq has yet to pose a serious threat to oil exports, though this could change at any time. The vast majority of Iraqi supply comes from Shia-controlled fields in the south. The most powerful force now holding down global prices is the US fracking industry. Shale will boost US output by a further 1.2m b/d this year to a total of 11.5m, increasing America’s lead as the world’s biggest producer.

• Petrol prices expected to fall after Saudis open the oil taps

Petrol prices are poised to fall further after the cost of a barrel of crude oil reached its lowest level this year. The fall followed the publication of an influential report that showed a glut of crude from Saudi Arabia flowing on to the market and rising stockpiles. The Paris-based International Energy Agency, the leading oil think tank, said yesterday that the world will consume less crude than experts had thought this year. Saudi Arabia’s supplies are running at the highest level since last September and crude from Libya is back on the market. Recent figures from Experian Catalist, a petrol analyst, show the typical price of unleaded petrol is almost unchanged this year at 131.3p a litre and the cost of diesel is down from 138.3p to 135.6p. However, supermarkets are already cutting prices at the pumps in a battle for customers that could be intensified by the slump in crude. The supply glut leaves the world economy slightly less vulnerable to a shock if the crisis over Ukraine escalates.

• EIA Lowers Global Oil Demand Forecast for 2014, 2015 (WSJ)

Government forecasters lowered their forecast for global oil consumption this year and next, the latest sign of weak demand that is pressuring prices. The U.S. Energy Information Administration, in its monthly short-term energy outlook released Tuesday, cut its international consumption forecast to 91.56 million bpd this year and 92.96 million bpd next year. Last month, the EIA called for 91.62 million bpd in 2014 and 93.08 million in 2015. Earlier Tuesday, the International Energy Agency also lowered its global demand forecast for 2014 to 92.7 million bpd. Prices have fallen in recent weeks on concerns about weak demand. Ongoing violence in Iraq, Ukraine and other parts of the world hasn’t disrupted oil production, as investors worried earlier this summer. Brent, the global oil benchmark, traded at nine-month intraday lows Tuesday and appeared on track to close at a 13- month low.

The EIA said it expects the Organization of the Petroleum Exporting Countries to reduce output in 2014, offsetting the production growth from such non-OPEC countries as the U.S. The agency called for 35.84 million bpd of OPEC production in 2014, down from its earlier forecast of 35.93 million bpd. OPEC produced 36.12 million bpd last year, according to the EIA. In the U.S., production hit 8.5 million bpd in July, the highest monthly level since April 1987, the EIA said. The agency maintained its forecasts for total U.S. crude production at 8.46 million bpd in 2015 and 9.28 million bpd, noting it would represent the highest level of annual average oil production since 1972. However, the agency cut its forecast for production in the lower 48 states and raised its expectation for production in the offshore Gulf of Mexico.

The EIA maintained its forecast for U.S. average daily oil consumption at 18.88 million bpd in 2014 but raised its 2015 forecast from 18.95 million bpd to 18.98 million bpd. The EIA cut its forecast of average prices for the global Brent benchmark oil contract this year and raised its estimate for next year. The agency said it expects prices of $108.11 a barrel in 2014 and $105.00 a barrel in 2015, compared to its prior assessment of $109.55 a barrel this year and $104.92 a barrel next year. For the U.S. benchmark, the EIA lowered its estimate to an average price of $100.45 a barrel in 2014, from $100.98 a barrel last month. The gap between the Brent and the U.S. benchmark contracts is likely to average $8 in 2014 and $9 in 2015, the EIA said. As a result of soaring domestic energy production, petroleum imports have declined significantly, the EIA said, with the share of consumption met by net imports expected to fall from 33% in 2013 to 22% in 2015, the lowest level since 1970. The EIA lowered its forecast for average retail gasoline prices this year from $3.54 a gallon to $3.50 a gallon.

The US economy supposedly grew at a 4% annualized rate in Q2.

• Worst Retail Sales Showing in Six Months in Slow Start to Third Quarter (Bloomberg)

Retail sales were little changed in July, the worst performance in six months, as car demand slowed and tepid wage growth restrained U.S. consumers. The slowdown in purchases followed a 0.2% advance in June, the Commerce Department reported today in Washington. The median forecast of 82 economists surveyed by Bloomberg called for a 0.2% gain. Excluding cars, sales rose 0.1%. Job growth has yet to stoke the type of wage gains needed to boost household purchases, a sign the economic expansion will probably not sustain the second-quarter pickup into the end of the year.

Retailers such as Macy’s are relying on promotions and discounts to entice customers, whose spending accounts for about 70 percent of the economy. “There’s no sign of momentum or enthusiasm out of the consumer right now,” said Stephen Stanley, chief economist at Pierpont Securities in Stamford, Connecticut, who accurately forecast today’s sales figure. “Income growth continues to be so-so. Employment has picked up in recent months but you’re not seeing the growth in hours worked that would generate big increases in paychecks. I don’t think people have the wherewithal, not to mention the inclination, to ramp it up.”