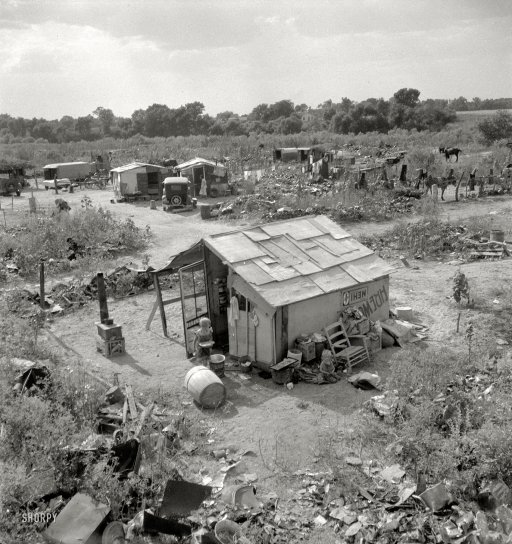

Dorothea Lange Country filling station, Granville County, NC July 1939

“The world is one recession away from a period of stagnation and prolonged deflation in which the challenge would be to avoid a re-run of the Great Depression of the 1930s.”

• The Golden Age Of Central Banks Is At An End – Time To Tax And Spend? (Guardian)

Turn those machines back on. So demands the unscrupulous banker, Mortimer Duke, when he finds he and his brother Randolph have been ruined by their speculative scam in the film Trading Places. Having lost all his money betting wrongly on orange juice futures, Mortimer demands that trading be restarted so that he can win it back. It’s not known whether Christine Lagarde is a secret fan of John Landis movies. As a French citizen, François Truffaut might be more her taste. There is, though, more than a hint of Trading Places about the advice being handed out by Lagarde’s IMF to global policymakers. To Europe and Japan, the message is to print some more money. Keep those machines turned on, in other words.

To the US and the UK, there was a warning that raising interest – something central banks in both countries are contemplating – could have nasty spillover effects around the rest of the world. Think long and hard before turning those machines off because you may have to turn them back on again before very long, Lagarde is saying, because the big risk to the global economy is not that six years of unprecedented stimulus has caused inflation but that the recovery is faltering. These are indeed weird times. Share prices are rising and so is the cost of crude oil, but the sense in financial markets is that the next crisis is just around the corner. The world is one recession away from a period of stagnation and prolonged deflation in which the challenge would be to avoid a re-run of the Great Depression of the 1930s.

That fate was avoided in 2008-09 by strong and co-ordinated policy action: deep cuts in interest rates, printing money, tax cuts, higher public spending, wage subsidies and selective support for strategically important industries. But what would policymakers do in the event of a fresh crisis? Would they double down on measures that have already been found wanting or go for something more radical? Ideas are already being floated, such as negative interest rates that would penalise people for holding cash, or the creation of money by central banks that would either be handed straight to consumers or used to finance public infrastructure, also known as “people’s QE”.

Time people understood this. “QE is deflationary because it shrinks net interest margins for banks via depressing treasury bond yields. It also enriches the already wealthy via asset price inflation but they do not raise their consumption in response..”

• QE Causes Deflation, Not Inflation (Josh Brown)

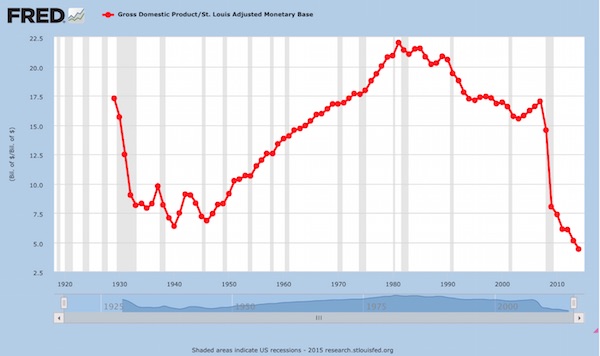

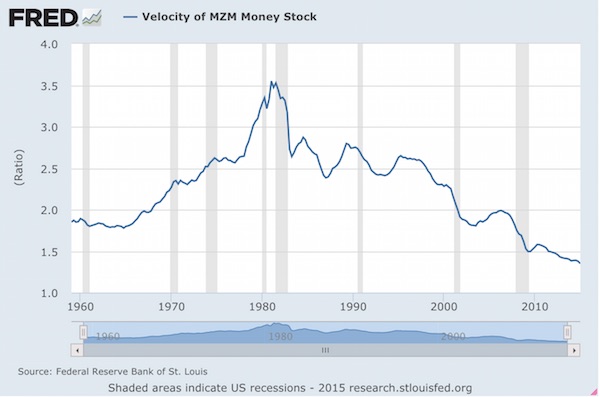

Why were the inflation hawks so wrong about quantitative easing? Why didn’t all the money printing lead to commodity prices skyrocketing? One answer is that, while bank reserves were boosted, lending didn’t take off and there was no uptick in the velocity of money the speed at which capital zooms through the economy and turns over. Absent velocity of money, QE could be looked at as either ineffective or actually causing a deflationary environment, where capital is hoarded and everyone is too petrified to risk it on productive endeavors. Christopher Wood (CLSA) explains further in his new GREED & fear note:

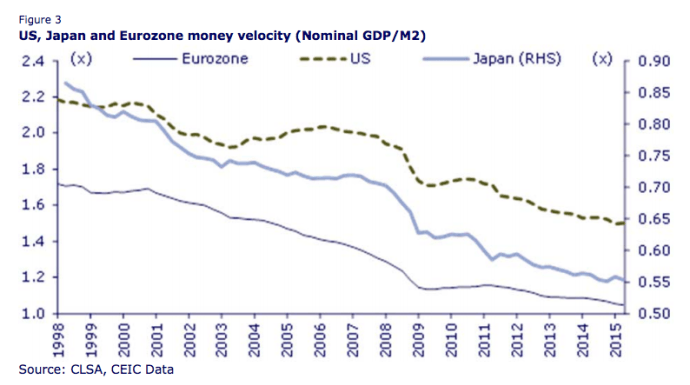

To GREED & fear the best way to illustrate that quantitative easing is not working is the continuing decline in velocity and the resulting lack of a credit multiplier since the unorthodox monetary regime was introduced. In America, Japan and the Eurozone velocity has continued to decline since the financial crisis in 2008. Thus, US, Japan and Eurozone money velocity, measured as the nominal GDP to M2 ratio, has declined from 1.94x, 0.7x and 1.29x respectively in 1Q98 to 1.5x, 0.55x and 1.05x in 2Q15 (see Figure 3).

Indeed, US money velocity is now at a six-decade low. This is why those who have predicted a surge in inflation in recent years caused by the Fed printing money have so far been proven wrong. For inflation, as defined by conventional economists like Bernanke in the narrow sense of consumer prices and the like, will not pick up unless the turnover of money increases. This is the problem with the narrow form of mechanical monetarism associated with the likes of American economist Milton Friedman.

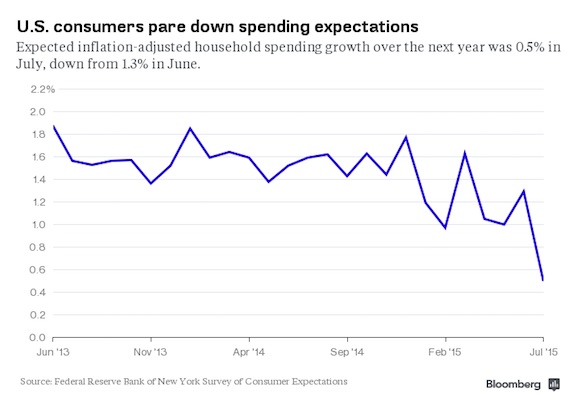

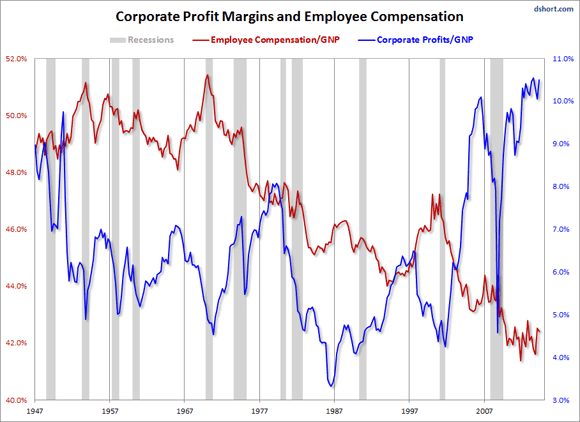

Wood goes on to make the point that QE is deflationary because it shrinks net interest margins for banks via depressing treasury bond yields. It also enriches the already wealthy via asset price inflation but they do not raise their consumption in response, because how much more shit can they possibly buy? Finally, it leads to a preference of share buybacks vs investment spending because the payback from financial engineering is so much easier and more immediate.

And China too.

• Western Economies Still Too Weak To Handle Fed Rate Rise, Says China (Guardian)

The slow recovery of western economies means the US Federal Reserve should not raise interest rates yet, according to the Chinese finance minister. Speaking on the sidelines of the annual meeting of the World Bank and International Monetary Fund in Lima, Lou Jiwei said developed economies were to blame for the global economic malaise because their slow recoveries were not creating enough demand. “The United States isn’t at the point of raising interest rates yet and under its global responsibilities it can’t raise rates,” Lou said in an interview published in the China Business News on Monday. The minister said the US “should assume global responsibilities” because of the dollar’s status as a global currency.

Lou’s comments were published hours after Fed vice-chairman Stanley Fischer said policymakers were likely to raise interest rates this year, but that that was “an expectation, not a commitment”. Asked about the global economic situation, Lou said the problem was not with developing countries. “Rather, it is the continued weak recovery of developed countries” that’s hindering the global economy, he said. “Developed countries should now have faster recoveries to give developing countries some external demand.” Lou welcomed the structural reforms in Europe as a positive development, but said geopolitics and the Syrian refugee crisis would have an impact on its economy. He described the slowdown in China’s economy as a healthy process, but said policy makers needed to manage it carefully.

“The slowing of China’s economic growth is a healthy process, but it is a sensitive period. The Chinese government must make accurate adjustments, keeping the economy within a predictable space while continuing to promote internal structural reforms,” he said.

Stop issuing it?!

• The World Still Needs A Way To Stop Hot Money Scalding Us All (Guardian)

Bill Gross, America’s “bond king”, who made his fortune betting on IOUs from companies and governments, is suing his erstwhile employer for $200m, we learned last week. He says his colleagues were driven by greed and “a lust for power”. His chutzpah was a timely reminder of the vast sums won and lost in the world of globalised capital, but also of the power that still lies in the hands of men (they are mostly men) like Gross, who sit atop a system that remains largely untamed despite the lessons of the past seven years. To those caught up in it, America’s sub-prime crash and its aftermath felt like a unique – and uniquely dreadful – chain of events, a financial and human disaster on an unprecedented scale. Yet it was just the latest in a series of periodic convulsions in modern capitalism, from the east Asia crisis to the Argentine default, to Greece’s humiliation at the hands of its creditors.

The first tremors of the next earthquake could be sensed by the central bankers and finance ministers gathered in Lima for the IMF’s annual meetings this weekend. Many were fretting about the knock-on effects of the downturn in emerging economies – led by China. Take a step back, though, and both the emerging market slowdown and the boom that preceded it are just the latest symptom of the ongoing malaise afflicting the global financial system. Seven years on from the Lehman collapse in September 2008, there has been some re-regulation – the Bank of England will soon announce details of the Vickers reforms, which will make banks split their retail arms from the riskier parts of their business – but many elements of the financial architecture remain unchallenged.

Capital swills unchecked around the world; governments feel compelled to prioritise the whims of international investors such as Gross – who tend to have a neoliberal bent – over the needs of domestic businesses; and credit ratings agencies remain all-powerful, despite their dismal record. The theory behind free-flowing capital is that it allows the world’s savings to find the most profitable opportunities – even far from home – and provides the impetus for investment and entrepreneurialism, aids economic development and boosts growth. Yet as Unctad, the UN’s trade and development arm, detailed in its annual report last week, the reality is very different. Capital flows are often driven more by the global financial weather than by the investment prospects in emerging economies; they can be disproportionately large; and they can change abruptly with the market mood, overwhelming domestic efforts to promote stable development.

Not a good sign: “The company is seeking to raise more than $1 billion by selling future production of gold and silver”

• Glencore Shares Halted Pending Statement On Proposed Asset Sales (Bloomberg)

Glencore, which has flagged divestments as part of a plan to cut debt by about $10 billion after commodity prices plunged, halted trading in Hong Kong Monday pending an announcement on proposed asset sales in Australia and Chile. The Swiss trader and miner said last month it’s planning to raise about $2 billion from the sale of stakes in its agricultural assets and precious metals streaming transactions. While the company didn’t identify specific assets in the statement requesting the trading halt, it has copper operations in Chile and coal, zinc and copper mines in Australia. The potential sales are part of the debt-cutting program that Glencore CEO Ivan Glasenberg announced in early September. The plan includes selling $2.5 billion of new stock, asset sales, spending cuts and suspending the dividend. Taken together, the measures aim to reduce debt from $30 billion nearer to $20 billion.

The company is seeking to raise more than $1 billion by selling future production of gold and silver, two people familiar with the situation said Oct. 1. The company produced 35 million ounces of silver last year and 955,000 ounces of gold from mines in South America, Australia and Kazakhstan. Investors including Qatar Holding, the direct investment arm of the Gulf state’s sovereign wealth fund, have expressed an interest in buying a minority stake in Glencore’s agriculture business, according to three people familiar with the conversations. Citigroup, one of the banks hired to run the sale alongside Credit Suisse, said earlier this month that the whole business could be worth as much as $10.5 billion. The company has also announced cuts to copper and zinc output in an effort to support metal markets.

“Without the oxygen of cheap debt, commodity trading houses are finished. Each trade in oil or iron ore might generate only 1pc to 2pc in margin – but this greatly increases when magnified by debt. The only limit on profits is then how much you can borrow. Greed drives returns. ”

• Commodity Contagion Sparks Second Credit Crisis As Investors Panic (Telegraph)

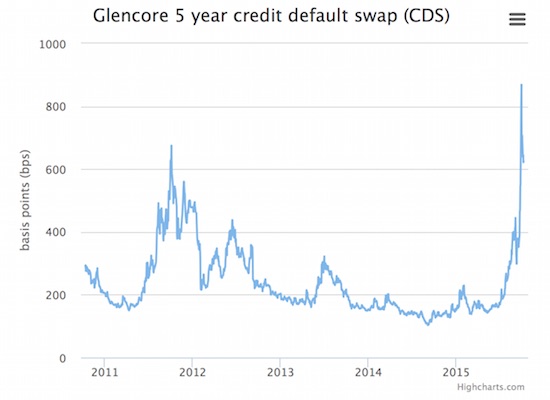

The collapse in commodity prices has sparked a second credit crisis as investors dump high-yield bonds, shattering the fragile confidence necessary to support global markets. Those calling it a Lehman moment forget their history. Current events have chilling similarities to the Bear Stearns collapse and mark the start of a new crisis, not the end. The world of commodity trading has been thrown into chaos as the cost of borrowing to fund operations soars. Glencore has become the poster child for the sector’s woes as its shares have more than halved in value during the past six months. More worrying has been the impact on the group’s credit profile. Glencore’s US bonds due for repayment in 2022 have collapsed to around 82 cents in the dollar. Only four months earlier, they had been stable at around 100 cents, implying that those who lent money would get it back plus interest.

Now for every dollar lent to Glencore, banks face losses, and as the price of bonds falls the yield has risen to 7.4pc. Without the oxygen of cheap debt, commodity trading houses are finished. Each trade in oil or iron ore might generate only 1pc to 2pc in margin – but this greatly increases when magnified by debt. The only limit on profits is then how much you can borrow. Greed drives returns. Glencore is a profitable business when it can borrow at around 4pc, but if it has to refinance at 7pc to 10pc those slim profit margins evaporate. The fear of those holding Glencore debt can be seen in the soaring price for the insurance against a default, or credit default swaps (CDS). Glencore five-year CDS has soared to 625, from about 280 just a month ago. A rule of thumb is that a CDS above 400 means a serious risk of a default, or about a 25pc chance in the next five years.

Glencore has taken drastic action to reduce its $50bn debts, or $30bn if all its stocks of metals are deducted, which it reported at the end of September. A $2.5bn equity raising has been completed, the dividend has been axed and assets sold as part of a $10bn debt reduction plan. However, if borrowing costs remain where they are, the game may already be over. If Glencore itself were to fold, it would be a huge problem with its $221bn in annual revenues, but when combined with the other commodity trading houses, Trafigura, Vitol and Noble, the fallout would be disastrous. Trafigura is not listed but its debt is publicly traded and the bonds have collapsed to 86 cents in the dollar, or a yield of 8.9pc. Noble, the Singapore trading house, has also seen its shares collapse as commodity prices slump. First-half profits from Noble’s metals trading have fallen 98pc to just $3m. This has been offset by strong results in oil trading, but the problems remain.

Deflation.

• Japan Inc. Sounds Alarm On Consumer Spending (Reuters)

Do not believe in official statistics, Japanese retailers seem to be saying, as they cut earnings forecasts and warn of lackluster consumer spending, a key growth engine for Japan at a time when exports and factory output are stalling. If you go by the larger-than-expected 2.9% gain in household spending in August – the first year-on-year rise in three months – then consumption looks like it is finally alive and well again, after a sales tax hike last year stifled the economy. But profits of retailers suggest the spending data, which has a small sample size, has not captured the full picture. Restrained household consumption raises the stakes for a central bank policy meeting on Oct. 30, and for the government’s plan to flesh out new economic policies before the year-end.

“Consumer spending has ground to a halt,” said Noritoshi Murata, president of Seven & i Holdings (3382.T). “There are a lot of concerns about the global economy and not many positives for consumption. Weak spending could continue into the second half of the fiscal year.” Seven & i, which operates Japan’s ubiquitous 7-Eleven convenience stores, on Oct. 8 trimmed its full-year profit forecast by 1.6% to 367 billion yen ($3.05 billion) and cut its revenue forecast by 3.9% to 6.15 trillion yen, triggering a fall in its shares in Tokyo. The main problem is wages are not rising fast enough to keep pace with rising food prices, and consumers are starting to cut back on other goods. Real wages, adjusted for inflation, rose 0.5% in July from a year earlier. That was the first gain in 27 months.

But wage growth subsequently slowed to 0.2% in August, and summer bonuses fell from last year, government data shows. Another problem is more and more workers are getting stuck in jobs with low pay. Part-time and irregular workers comprised a record 37.4% of the workforce last year, according to the National Tax Bureau. Irregular workers earn on average less than half of what regular full-time workers earn, tax data show. The third problem is the government plans to raise the nationwide sales tax again, to 10% in 2017 from 8%, and households are already changing their behavior.

Structural changes for the OECD means opening stores on Sundays. It doesn’t get more clueless.

• World Cannot Spend Its Way Out Of A Slump, Warns OECD Chief (Telegraph)

Countries that try to spend their way out of crisis risk becoming stuck in a permanent malaise, according to the head of the Organisation for Economic Co-operation and Development (OECD). Angel Gurria said central banks were running out of firepower to boost economies in the event of another sharp slowdown, while governments had limited space to ramp up spending. The secretary general said structural reforms and more international co-operation were badly needed in a world of deteriorating growth. “Countries that say: I’ll spend my way out of this third slump. I say: no you won’t, because you’ve already done that, and you ran out of space,” Mr Gurria said on the sidelines of the IMF’s annual meeting in Lima, Peru.

“Now countries are trying to reduce the deficit and debt because that’s a sign of vulnerability and the rating agencies are breathing down their neck – they’ve already downgraded Brazil and France. “We don’t have room to inflate our way out of this one. So we go back to the same issue: it’s structural, structural, structural.” The OECD has been working with countries such as Greece to liberalise product markets, which deal with competitiveness issues and labour laws. Mr Gurria, who has urged countries for years to implement structural reforms, said he was frustrated at the lack of progress: “If you listen to the conversations we have on opening on Sundays you wouldn’t believe it. Or the debates we have about [the] 35 hour [working week]. These are the real issues.

“The people, the trade unions, they all have a stake and their arguments are strong. But where countries have room is to make structural changes, and central banks can help by continuing to ease. “[With quantitative easing] there is a question of whether we’re entering a territory of diminishing returns. Of course we must use it, but there’s not a lot of room left.” Mr Gurria conceded that the benefits of reform were gradual. “Germany modified its labour laws 12 years ago, and it’s reaping the benefits brilliantly and gallantly because of much better performance during the crsis. Spain did it three years ago, and they’re reaping the benefits now. Italy did it last month, and it will take a couple of years.”

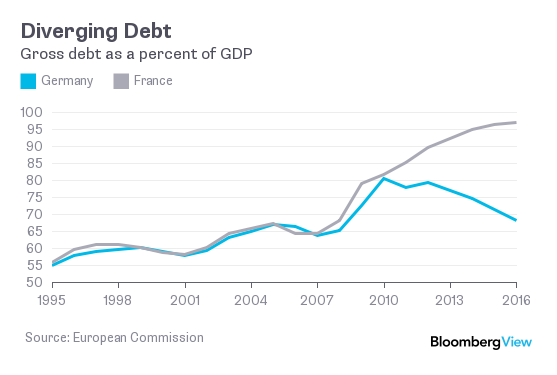

France as the black shhep. But Germany’s recent woes should not be underestimated.

• Growing Government Debt Will Test Euro-Zone Solidarity (Paul)

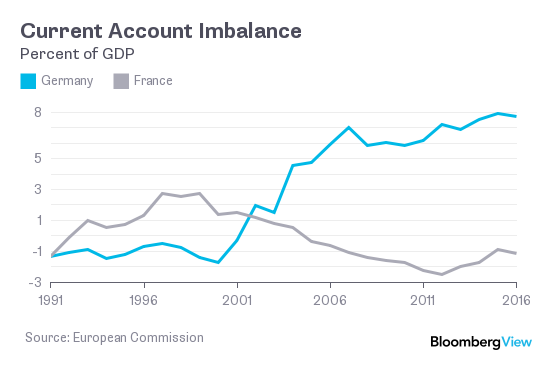

The German chancellor and the French president stood side by side last Wednesday to address the European Parliament. But beneath that show of solidarity lies a story of two diverging economies at the heart of the euro zone. At the time the euro was born, Germany’s economy – bearing close to $2 trillion in reunification costs – looked not too dissimilar to France’s. Today, however, the gap between the two countries is the widest since the reunification. Not only is the debt-to-gross-domestic-product ratio of France and Germany the widest in 20 years, but – more importantly in a currency union without a federal state – the latter has a huge and increasing current surplus, while the former is in deficit.

This is not surprising. Germany, while benefiting greatly from the opened markets of its fixed exchange rate partners, undertook a series of reforms to improve its economic position. France was not only unable to reform but indulged in the 35-hour workweek. If we were still living under the European Monetary System that predated the euro, France would simply have had to devalue, as it did many times before the euro. Under the euro, helped by its trade surplus, Germany kept a tighter budget, while the French state kept spending an ever-higher percentage of its GDP in repeated attempts to support its faltering economy. As a result, its debt is now close to the symbolic 100% of GDP level, not accounting for unfunded pension liabilities, and the rating agencies have stripped it of its AAA rating and continue to downgrade it. The European Commission, in its last assessment, speaks of France facing “high sustainability risk” in the medium term.

This is not just a French problem though; it’s a euro-zone one. According to Eurostat, in the first quarter of 2015, the euro-zone debt-to-GDP ratio was 92.9% — the highest it has been since the creation of the euro. Never has the zone been so far away from its own Maastricht fiscal sustainability criteria. Huge differences between countries exist, but the only country of the original 12 euro-zone members still respecting the debt and deficit levels is tiny Luxembourg. What does this say for the future of the euro?

More billions to slide out of VW coffers.

• EU Bank Chief ‘Could Recall Volkswagen Loans’ (BBC)

The European Investment Bank (EIB) could recall loans it gave to Volkswagen, its president told a German newspaper. Werner Hoyer told Sueddeutsche Zeitung that the EIB gave loans to the German carmaker for things like the development of low emissions engines. He said they could be recalled in the wake of VW’s emissions cheating. The paper reported that about €1.8bn of those loans are still outstanding. Mr Hoyer is quoted as saying that the EIB had granted loans worth around €4.6bn to Volkswagen since 1990. “The EIB could have taken a hit [from the emissions scandal] because we have to fulfil certain climate targets with our loans,” the Sueddeutsche Zeitung quoted Mr Hoyer as saying. Mr Hoyer was attending the IMFs meeting in Lima, Peru. He added that the EIB would conduct “very thorough investigations” into what VW used the funds for.

Mr Hoyer told reporters that if he found that the loans were used for purposes other than intended, the EU bank would have to “ask ourselves whether we have to demand loans back”. He also said he was “very disappointed” by Volkswagen, adding the EIB’s relationship with the carmaker would be damaged by the scandal. Volkswagen admitted that about 11 million of its vehicles had been fitted with a “defeat device” – a piece of software that duped tests into showing that VW engines emitted fewer emissions than they really did. Mr Hoyer’s comments come days after VW’s US chief Michael Horn faced a Congress panel to answer questions about the scandal, which has prompted several countries to launch their own investigations into the carmaker. On Monday, VW’s UK managing director Paul Willis is due to appear before members of parliament at an informal hearing.

TEXT

• UK Government Emissions Tester Paid £80 Million By Car Firms (Telegraph)

The state agency that carries out emissions tests on new vehicles has been paid more than £80 million by car companies over the last decade, The Daily Telegraph can disclose. The Vehicle Certification Agency, whose chief will appear on Monday before a Commons committee looking at the Volkswagen scandal, has reported a year-on-year rise in profits, receiving almost £13 million in 2014/15 alone. Campaigners claim Europe’s national certification agencies are competing so fiercely for business it is not in their interests to catch out car-makers. Samples of new cars must undergo checks by approval agencies to ensure they meet European performance standards. Once a car has been type-approved by the manufacturer s chosen national agency, it can be sold anywhere in Europe.

“Car makers are able to go type-approval shopping around Europe to get the best deals for them”, said Greg Archer, of campaign group Transport & Environment. “No one is checking that type approval authorities are doing an impartial or good job and this needs to change”, he added. Last month Volkswagen admitted that it had systematically installed software in VW and Audi diesels since 2009 to deceive regulators who were measuring their exhaust fumes. Since 2005 the VCA -an executive agency of the Department for Transport- has received a total of £84million from “product certification/type-approval services”, according to a Greenpeace investigation. It said the VCA’s outgoing CEO Paul Markwick, interim chief executive Paul Higgs and chief operating officer John Bragg had held senior positions with major car manufacturers.

MPs on the Commons select committee on transport will question Volkswagen bosses, Transport Secretary Patrick McLoughlin and the VCA’s acting chief, Mr Higgs, over the emissions violations. A Department for Transport spokesman said the VCA charged car-makers in order to cover its operating costs and to provide value for taxpayers. He added: “Whilst the VCA charges the industry for its services, its governance framework is set by government.” It claimed there was “a conflict of interest” . A Greenpeace spokesman said: The Government s testing regime failed the public. The question is why? “Our evidence suggests it’s not actually in the VCA’s interests to catch out the car-makers. Their business model -and it has become a business- is to attract manufacturers to test their cars with them. It’s a conflict of interest.”

They’re right to be scared.

• Volkswagen’s Home City Enveloped In Fear, Anger And Disbelief (FT)

Few cities are as dependent on one company as Wolfsburg. Situated 200km west of Berlin, it is home not just to the world’s biggest factory and Volkswagen’s headquarters, it also has a VW Arena where Champions League football is played, a VW bank, and even a VW butcher that makes award-winning curried sausage. “VW is God here,” says a Turkish baker on the main shopping street of Porschestrasse. But news of VW’s diesel emissions scandal has hit the city hard, sparking anger and dismay as well as worries of the financial and employment consequences for both the carmaker and Wolfsburg. Some are even invoking the decline of another motor city Detroit in the US.

“I am worried. It’s not good for Wolfsburg. Detroit stands as a negative example for what can happen: the city has collapsed. The same here is also thinkable,” says Uwe Bendorf, who was born and raised in Wolfsburg and now works at a health insurer. VW’s sprawling factory employs about 72,000 in a city with just 120,000 inhabitants. Over an area of more than 6 sq km, three times the size of the principality of Monaco, the plant churns out 840,000 cars a year, including the VW Golf, Tiguan and Touran models. Among workers, the scandal dominates rather like the chimney stacks of the factory’s power station tower over Wolfsburg.

“It was shock. Then anger. How could they be so stupid?” says one worker, describing his emotions on hearing last month that VW had admitted to large scale cheating in tests on its diesel vehicles for harmful emissions of nitrogen oxides. Another worker says: “Everyone is worried. Will we get our bonus still? Will there be job cuts? There is so much uncertainty.” Outside the factory gates, few are keen to be seen speaking to the media. But this is a city in which VW is omnipresent, and a VW worker never far away.

“Total equity sales by Russian companies this year are set to be about 30 times lower than the 2007 peak..”

• The Russians Are Fleeing London’s Stock Market (Bloomberg)

Russian expansionism is going into reverse, at least on the London stock market. Three of Russia’s major commodity-related companies are already preparing to withdraw their listings after the bursting of the raw-materials boom and a slump in share sales by the nation’s companies from more than $30 billion in 2007 to below $1 billion this year. Eurasia Drilling, the country’s largest oil driller, said last week its owners and managers offered to buy shareholders out and take the company private. That follows a move by potash miner Uralkali PJSC to buy back a major part of its free float, saying in August it may delist shares in London as a result. Billionaire Suleiman Kerimov’s family also plans to take Polyus Gold private.

More may follow as their owners’ interest in using foreign shares as a route to expansion wanes in tandem with overseas investors’ appetite for raw-material and emerging-market stocks, said Kirill Chuyko at BCS Financial Group in Moscow. “Each company has a specific reason, but the common one is that investors’ appetite for commodities-related stocks, especially from the emerging markets, is exhausted,” Chuyko said. “At the same time, the owners see that the companies’ valuations don’t reflect their hopes and wishes, while maintaining the listing requires some effort and expenditure.” Total equity sales by Russian companies this year are set to be about 30 times lower than the 2007 peak, when global commodity prices were about 90% higher than current levels.

A gauge of worldwide emerging-market stocks has declined 14% in the past year. Russia has been among the hardest-hit emerging economies as prices of oil and gas, making up half of the national budget, collapsed since last year. The economy shrank 4.6% in the second quarter from a year earlier. That’s a reversal from when oil prices and growth were high and local companies talked up expanding overseas. Polyus planned to merge with a global rival to become one of the world’s top three gold miners, billionaire Mikhail Prokhorov, who controlled the company at the time, said in December 2010. The producer, which redomiciled to the U.K. in 2012 as part of the plan, never achieved his goal.

How on earth has this not been obvious for years now?

• Soaring London House Prices Sucking Cash Out Of Economy (Guardian)

Soaring London house prices are costing the economy more than £1bn a year and preventing the creation of thousands of jobs, as individuals plough money into buying and renting instead of spending their cash elsewhere, a report has claimed. London’s housing market recovered quickly from the financial downturn of 2008-2009 and in recent years rents and house prices have rocketed. House prices are more than 46% above their pre-crisis peak, at an average of £525,000 according to the Office for National Statistics, while rents in the private sector have risen by a third over the past decade. The report, by business group London First and consultancy CEBR, found that workers in many sectors were now priced out of the capital, while companies were being forced to pay more to attract staff and help them meet living expenses.

The report said there was a knock-on effect on consumer spending, with money being spent on expensive mortgages and rents rather than other goods. It said as much as £2.7bn could have been spent elsewhere in 2015 if housing costs had kept in line with inflation over the past decade. This additional spending could have supported almost 11,000 more jobs, and meant a boost to the economy of more than £1bn this year. Workers in shops, cafés and restaurants, and those performing administrative office roles would have to pay their entire pre-tax salary to rent an average private home in London, the report found, while social workers, librarians, and teachers faced rents equivalent to more than half their salaries.

It said only the best-paid workers, including company directors and those working in financial services, earned enough to rent in central London “affordably”; that is paying less than one-third of their salaries on housing. “The housing crisis is making it difficult to attract and retain staff in retail, care and sales occupations,” it said. “Even if they spend a limited amount on other goods and services, they are effectively priced out of living independently in the capital. They need to co-habit with partners, friends or family, or be eligible for social housing in the capital.” To compensate for high housing costs, employees expected higher salaries, which meant firms were paying an average of £1,720 a year more to workers than they would have had accommodation costs risen only in line with inflation since 2005. This meant an extra wage bill for firms of £5bn this year, and the figure was set to grow to £6.1bn by 2020.

No worries, mate, there’ll be loud denials right up to the end.

• Australia Housing Bust Now The Greatest Recession Risk (SMH)

House prices are set for a 7.5% decline from March next year, with the resulting slowdown in housing lending and construction activity set to hit the broader economy, according to a range of investment banks. “Our economics team are forecasting quarter-on-quarter house prices to fall from the March 2016 quarter before beginning to recover from June 2017,” said Macquarie Research in a briefing note entitled: “Australian Banks: What goes up, must come down”. Macquarie said there would be a “7.5% reduction from peak to trough”. Another economist says heavy household debt and softening house prices pose a greater recession risk to the Australian economy than the slowdown in China.

Bank of America Merrill Lynch Australian economist Alex Joiner says high historic indebtedness, coupled with the chance of a downturn in house-building and prices, could further crimp consumer spending and property investment once the Reserve Bank of Australia was forced to tackle inflation by lifting interest rates. He said while the chance of a “hard landing” in the Chinese economy – on which Australia depends heavily for exports and inward investment – was small, a sharp decline in demand for housing in overheated markets such as Melbourne and Sydney was more probable and would drag the broader economy with it. “We are not forecasting collapse or the bursting of any perceived bubble,” Mr Joiner wrote in a note.

“That said, it is not difficult to envisage a more hard landing scenario in the property market. “This would clearly have a greater negative macro-economic impact channelled through households and the residential construction cycle,” he said. His fears are based on current household indebtedness measures, which have soared to the highest ever. These include the dwelling price-to-income ratio, currently at “never before observed” levels of five and a half times, and a household debt-to-gross-domestic-product ratio, which is at a “record high” 133.6%.

I know Joris has read at least some of the many articles I wrote on the topic. Wonder what he took away from that.

• Don’t Let The Nobel Prize Fool You. Economics Is Not A Science (Joris Luyendijk)

Business as usual. That will be the implicit message when the Sveriges Riksbank announces this year’s winner of the “Prize in Economic Sciences in Memory of Alfred Nobel”, to give it its full title. Seven years ago this autumn, practically the entire mainstream economics profession was caught off guard by the global financial crash and the “worst panic since the 1930s” that followed. And yet on Monday the glorification of economics as a scientific field on a par with physics, chemistry and medicine will continue. The problem is not so much that there is a Nobel prize in economics, but that there are no equivalent prizes in psychology, sociology, anthropology. Economics, this seems to say, is not a social science but an exact one, like physics or chemistry – a distinction that not only encourages hubris among economists but also changes the way we think about the economy.

A Nobel prize in economics implies that the human world operates much like the physical world: that it can be described and understood in neutral terms, and that it lends itself to modelling, like chemical reactions or the movement of the stars. It creates the impression that economists are not in the business of constructing inherently imperfect theories, but of discovering timeless truths. To illustrate just how dangerous that kind of belief can be, one only need to consider the fate of Long-Term Capital Management, a hedge fund set up by, among others, the economists Myron Scholes and Robert Merton in 1994. With their work on derivatives, Scholes and Merton seemed to have hit on a formula that yielded a safe but lucrative trading strategy. In 1997 they were awarded the Nobel prize.

A year later, Long-Term Capital Management lost $4.6bn in less than four months; a bailout was required to avert the threat to the global financial system. Markets, it seemed, didn’t always behave like scientific models. In the decade that followed, the same over-confidence in the power and wisdom of financial models bred a disastrous culture of complacency, ending in the 2008 crash. Why should bankers ask themselves if a lucrative new complex financial product is safe when the models tell them it is? Why give regulators real power when models can do their work for them?

Excellent overview by Tyler Durden.

• The Tragic Ending To Obama’s Bay Of Pigs: CIA Hands Over Syria To Russia (ZH)

One week ago, when summarizing the current state of play in Syria, we said that for Obama, “this is shaping up to be the most spectacular US foreign policy debacle since Vietnam.” Yesterday, in tacit confirmation of this assessment, the Obama administration threw in the towel on one of the most contentious programs it has implemented in “fighting ISIS”, when the Defense Department announced it was abandoning the goal of a U.S.-trained Syrian force. But this, so far, partial admission of failure only takes care of one part of Obama’s problem: there is the question of the “other” rebels supported by the US, those who are not part of the officially-disclosed public program with the fake goal of fighting ISIS; we are talking, of course, about the nearly 10,000 CIA-supported “other rebels”, or technically mercenaries, whose only task is to take down Assad.

The same “rebels” whose fate the AP profiles today when it writes that the CIA began a covert operation in 2013 to arm, fund and train a moderate opposition to Assad. Over that time, the CIA has trained an estimated 10,000 fighters, although the number still fighting with so-called moderate forces is unclear.

The effort was separate from the one run by the military, which trained militants willing to promise to take on IS exclusively. That program was widely considered a failure, and on Friday, the Defense Department announced it was abandoning the goal of a U.S.-trained Syrian force, instead opting to equip established groups to fight IS.

It is this effort, too, that in the span of just one month Vladimir Putin has managed to render utterly useless, as it is officially “off the books” and thus the US can’t formally support these thousands of “rebel-fighters” whose only real task was to repeat the “success” of Ukraine and overthrow Syria’s legitimate president: something which runs counter to the US image of a dignified democracy not still resorting to 1960s tactics of government overthrow. That, and coupled with Russia and Iran set to take strategic control of Syria in the coming months, the US simply has no toehold any more in the critical mid-eastern nation. And so another sad chapter in the CIA’s book of failed government overthrows comes to a close, leaving the “rebels” that the CIA had supported for years, to fend for themselves. From AP:

CIA-backed rebels in Syria, who had begun to put serious pressure on President Bashar Assad’s forces, are now under Russian bombardment with little prospect of rescue by their American patrons, U.S. officials say. Over the past week, Russia has directed parts of its air campaign against U.S.-funded groups and other moderate opposition in a concerted effort to weaken them, the officials say. The Obama administration has few options to defend those it had secretly armed and trained.

The Russians “know their targets, and they have a sophisticated capacity to understand the battlefield situation,” said Rep. Mike Pompeo, R-Kan., who serves on the House Intelligence Committee and was careful not to confirm a classified program. “They are bombing in locations that are not connected to the Islamic State” group.

Seems racism is the only way they can barely keep their distribution plans alive.

• EU Must Stop ‘Racist Criteria’ In Refugee Relocation – Greece (Reuters)

The EU must stop countries picking and choosing which refugees they accept in its relocation programme, otherwise it will turn into a shameful “human market”, Greece’s new migration minister said. The EU has approved a plan to share out 160,000 refugees, mostly Syrians and Eritreans, across its 28 states in order to tackle the continent’s worst refugee crisis since World War Two. The first 19 Eritrean asylum seekers were transferred from Italy to Sweden on Friday. Some countries, such as Slovakia and Cyprus, have expressed a preference for Christian refugees and Hungary has said the influx of large numbers of Muslim migrants threatens Europe’s “Christian values”. Migration Minister Yannis Mouzalas said that Greece was having trouble finding refugees to send to certain countries because the receiving nations had set what he called “racist criteria”.

He declined to name the states concerned. “Views such as ‘we want 10 Christians’, or ’75 Muslims’, or ‘we want them tall, blonde, with blue eyes and three children,’ are insulting to the personality and freedom of refugees,” Mouzalas told Reuters. “Europe must be categorically against that.” An EU official said a group of Syrian refugees was due to be relocated from Greece to Luxembourg under the EU scheme around Oct. 18, the first to be officially reassigned from Greece. A gynaecologist and founding member of the Greek branch of aid agency Doctors of the World, Mouzalas urged the EU to enforce strict quotas “otherwise it will turn into a human market and Europe hasn’t got the right to do that”. The refugees are generally not allowed to select the country to which they are assigned.

Greece has seen a record of about 400,000 refugees and migrants – mainly from Syria, Afghanistan and Iraq – arrive on its shores this year from nearby Turkey, hoping to reach wealthier northern Europe. Those who can afford it move on quickly to other countries, sometimes on tour buses taking them straight from the main port of Piraeus, near Athens, to the Macedonian border. But several thousand, mostly Afghans, have ended up trapped in Greece for lack of money. European authorities are reluctant to treat Afghans systematically as refugees, and a result, they are shut out of the relocation process. “It’s absurd to think that Afghans are coming to find better work. There is a long-lasting war, you aren’t safe anywhere, that’s the reality,” Mouzalas said.