Henri Matisse Laurette in a green robe 1916

What comes next? Cohen’s lawyer has said he will prove collusion, which is Mueller’s mandate, but that lawyer is a bit of a shady character too.

• Cohen Pleads Guilty, Says Violated Campaign Law At Direction Of Candidate (ZH)

President Donald Trump’s former personal lawyer, Michael Cohen, pleaded guilty on Tuesday to campaign finance violations and other charges, saying he made payments to influence the 2016 election at the direction of a candidate for federal office, potentially delivering a legal blow to the president. Cohen, 51, who agreed to a plea bargain with federal prosecutors earlier in the day, pleaded guilty to eight counts total, including five counts of tax evasion and one count of making a false statement to a financial institution. He also pleaded guilty to one count of making an excessive campaign contribution on Oct. 27, 2016, which is the same date Cohen finalized a payment to adult-film star Stormy Daniels as part of a nondisclosure agreement over an affair Daniels alleges she had with Trump.

The most damaging statement by Michael Cohen was made when, acknowledging the charges against him, Cohen said he was directed to violate campaign law at the direction of an unnamed candidate for federal office, whom he did not name. At the same candidate’s direction, Cohen said he paid $130,000 in violation of campaign finance laws to “somebody” to keep them quiet, which was later repaid by the candidate. He said he arranged to make payments “for (the) principal purpose of influencing (the) election” at the direction of a candidate for federal office; Cohen did not give the candidate’s name, but those facts match Cohen’s payment to Clifford and Trump’s repayment. Cohen’s exact words: “I have donated the money that was in the account in coordination with and at the direction of a federal candidate.”

Cohen also tells the federal court he evaded substantial taxes on his income, with Bloomberg noting that the sentencing guideline calls for 46 to 63 months in prison. The prosecutor told the judge the purpose of the payments was to ensure that the individuals did not disclose “alleged affairs with the candidate.” Besides the $130,000 payment, Cohen admitted to making an illegal contribution of $150,000, which was how much McDougal received from the National Enquirer’s publisher to quash her story. As Bloomberg explicitly adds, “at no time was the candidate’s name mentioned.” The prosecutor also said Cohen failed to report $4 million on taxes and lied about debts and banking details on loan applications.

His voice cracked as he answered questions from Judge William Pauley III. As Bloomberg notes, Cohen was shaking head and appeared to be holding back emotions as judge reviews possible sentence. Cohen faces a likely prison sentence of 46 to 63 months, the judge said.

A mover and a shaker. Can’t help thinking we’re reading a real bad novel. Can’t wait for the movie.

• Paul Manafort Found Guilty On 8 Counts, Mistrial Declared On Other Ten (ZH)

Jurors in the trial of former Paul Manafort have reached a verdict on eight of the 18 counts against the former Trump aide. After a day of passing notes to the Judge, they said they were unable to reach a decision on the other 10. Manafort was found guilty on all five tax fraud counts, while the other three are related to his failure to disclose foreign bank accounts and bank fraud. The verdict comes at the end of two and a half weeks of testimony, which included 27 witnesses and 88 documents submitted into evidence. Earlier, the jury asked Judge T.S. Ellis earlier in the day what would happen if they couldn’t reach a verdict on a count, and Ellis told them to keep working on it.

“If we cannot come to a consensus for a single count, how can we fill in the verdict sheet?” the jurors asked in the note. “It is your duty to agree upon a verdict if you can do so,” said Ellis, who encouraged each juror to make their own decisions on each count. If some were in the minority on a decision, however, they could think about the other jurors’ conclusions. Give “deference” to each other and “listen to each others’ arguments,” said Ellis, adding “You’re the exclusive judges … Take all the time which you feel is necessary.” Manafort stands accused of 18 counts of tax evasion, bank fraud and obfuscating foreign bank counts in the first trial brought against him by special counsel Robert Mueller as part of his investigation into Russian meddling in the 2016 election – despite the charges stemming from his work for the then-Ukrainian governing party.

“The declaration that the Greek crisis is over is merely a statement that there is nothing left to extract from the Greek people for the interest of the foreign banks.”

• Genocide of the Greek Nation (Paul Craig Roberts)

Traditionally, when a sovereign country, whether by corruption, mismanagement, bad luck, or unexpected events, found itself unable to repay its debts, the country’s creditors wrote down the debts to the level that the indebted country could service. With Greece there was a game change. The ECB, led by Jean-Claude Trichet, and the IMF ruled that Greece had to pay the full amount of interest and principal on its government bonds held by German, Dutch, French, and Italian banks. How was this to be achieved? In two ways, both of which greatly worsened the crisis, leaving Greece today in a far worst position that it was in at the beginning of the crisis almost a decade ago.

At the beginning of the “crisis,” which would have easily been resolved by writing down part of the debt, the Greek debt was 129% of Greek GDP. Today Greek debt is 180% of GDP. Why? Greece was lent more money to pay interest to Greece’s creditors, so that they would not have to lose one cent. The additonal lending, called a “bailout” by the presstitute financial media, was not a bailout of Greece. It was a bailout of Greece’s creditors. The Obama regime encouraged this bailout, because the American banks, expecting a bailout, had sold credit default swaps on Greek debt. Without a bailout the US banks would have lost their bet and paid default insurance on Greek Bonds.

Additionally, Greece was required to sell its public assets to foreigners and to decimate the Greek social safety net, reducing pensions, for example, to below subsistance incomes and so radically reducing medical care that people die before they can get treatment. If memory serves, China bought the Greek seaports. Germay bought the airport. Various German and European entities bought the Greek municipal water companies. Real estate speculators bought protected Greek Islands for real estate development. This plunder of Greek public property did not go toward reducing the debt that Greek owed. It went, along with the new loans, to paying the interest. The debt, larger than ever, still stands. The economy is smaller than ever as is the Greek population that bears the debt.

The declaration that the Greek crisis is over is merely a statement that there is nothing left to extract from the Greek people for the interest of the foreign banks. Greece is sinking fast. All of the income associated with sea ports, airport, municipal utilities, and the rest of public property that was forcibly privatized now belongs to foreigners who take the money out of the country, thus further driving down the Greek economy.

Shifting goal posts, rearranging deck chairs.

• Call For Two Years Further Freedom Of Movement After Brexit (G.)

Britain would face labour shortages in London and the south-east from a no-deal Brexit, according to a report calling for the government to extend freedom of movement for EU migrants to protect the wider economy. The Centre for Cities thinktank urged the government to extend freedom of movement for two years after the UK leaves the EU on 29 March 2019, in the event of no deal on the terms of exit and future relations with the union. Publishing a report on EU citizens working in British towns and cities across the country, the Centre for Cities warned cities such as Oxford, Cambridge and London, where the vote was in favour of remaining in the EU, are reliant on EU migrants, making them particularly vulnerable to tougher immigration rules should Britain crash out without a deal.

The report said about one in 10 employees in major southern cities were from the EU. It said they had brought with them “significant economic benefits” to the wider British economy, which could be put at risk from a no-deal Brexit. Andrew Carter, chief executive of Centre for Cities, said: “[The government] should continue to allow EU migrants to come and work in UK cities for at least the next two years, even if there is no Brexit deal in place. This will be crucial in helping cities avoid a cliff edge in terms of recruiting the workers they need.” The report comes ahead of the government’s publication of a series of technical notices detailing the impact of a no-deal Brexit.

How far removed the City is from the country.

• Britain Extends Lead As King Of Currencies Despite Brexit Vote (R.)

Britain has extended its lead in the global currency trading business in the two years since it voted to leave the European Union, in another sign London is likely to continue to be one of the world’s top two financial centres even after Brexit. Leaving the European Union was supposed to deal a crippling blow to London’s position in global finance, prompting a mass exodus of jobs and business. But with eight months to go, London has tightened rather than weakened its grip on foreign exchange trading, a Reuters analysis shows. Foreign exchange – the largest and most interconnected of global markets, used by everyone from global airlines to money managers in transactions worth trillions of dollars a day – is the crowning jewel of London’s financial services industry.

Reuters’ analysis, based on surveys released by central banks in the five biggest trading centres, shows forex trading volumes in Britain had grown by 23 percent to a record daily average of $2.7 trillion (£2.1 trillion) in April compared to April 2016. That was double the pace of its nearest rival, the United States, which was up 11 percent to $994 billion, mostly out of New York. That means about two-fifths of all trades are handled in Britain, nearly all of them in London – a daily volume almost equivalent to the annual economic output of the United Kingdom. The next three biggest markets are Singapore, which fell by 5 percent to $523 billion; Hong Kong, which grew 10 percent to $482 billion; and Japan, which increased by 2 percent to $415 billion.

Time for a new Karl Marx?!

• Bank of England Chief Economist Warns On AI Jobs Threat (BBC)

The chief economist of the Bank of England has warned that the UK will need a skills revolution to avoid “large swathes” of people becoming “technologically unemployed” as artificial intelligence makes many jobs obsolete. Andy Haldane said the possible disruption of what is known as the Fourth Industrial Revolution could be “on a much greater scale” than anything felt during the First Industrial Revolution of the Victorian era. He said that he had seen a widespread “hollowing out” of the jobs market, rising inequality, social tension and many people struggling to make a living. It was important to learn the “lessons of history”, he argued, and ensure that people were given the training to take advantage of the new jobs that would become available.

He added that in the past a safety net such as new welfare benefits had also been provided. Mr Haldane’s points were echoed by the new head of the government’s advisory council on artificial intelligence, who also warned there was a “huge risk” of people being left behind as computers and robots changed the world of work. Tabitha Goldstaub, chair of the newly formed Artificial Intelligence Council, said that the challenge was ensuring that people were ready for change and that the focus was on creating the new jobs of the future to replace those that would disappear. “Each of those [industrial revolutions] had a wrenching and lengthy impact on the jobs market, on the lives and livelihoods of large swathes of society,” Mr Haldane told me for the Today Programme.

“Jobs were effectively taken by machines of various types, there was a hollowing out of the jobs market, and that left a lot of people for a lengthy period out of work and struggling to make a living. “That heightened social tensions, it heightened financial tensions, it led to a rise in inequality. “This is the dark side of technological revolutions and that dark-side has always been there. “That hollowing out is going to be potentially on a much greater scale in the future, when we have machines both thinking and doing – replacing both the cognitive and the technical skills of humans.”

“The shocks to our current system that arrive early are better than the ones that come too late.”

• Our Economic System Was Designed To Burn Everything In Its Path (NO)

Boom and bust cycles in the extraction economy have always brought incredible destruction and pain, especially to those closest to the land. Not by accident but by design – billions of dollars of wealth has been stripped from the land for the benefit of mostly outside investors who never intended a long term sustainable plan for rural or Indigenous communities, much less the ecosystems they rely on. But with accelerating climate change, we now have boom, bust and burn (this burn has many forms, fire is just one). And it affects everyone. The truth is this economic system has always been on fire. The terrifying object at the end of the extraction economy is the devastating and total incineration of almost everything we know and love.

This is the only endgame in the extraction economy — it is what happens when a model dependent on infinite growth is played out on a planet with finite resources. The extraction economy is an extinction economy, or maybe more accurately an extinction machine. It has always burnt everything in its path. That is what it’s designed to do. The people and living things on the periphery have always felt it first. But now in a world of global climate disruption, the match has burned down to our fingers. There is no periphery and no centre. Just one interconnected and interdependent world – on fire, together. It is not a bad thing to see this laid bare. We need new models for a sustainable civilization, and this will be a big lift that will require change at every level of social organization. The shocks to our current system that arrive early are better than the ones that come too late.

Free trade requires permanent war.

• The Economy of Permanent War (Connelly)

Dr Kadri says that free trade is ‘a poisonous concept’ that requires a state of permanent war. “In way we are caught in a catch-22 situation,” he says. “War is awful, but it does wonders for the macroeconomy.” “One need only look at what has occurred in Yemen, Gaza, Libya, Syria, Afghanistan and Iraq to discover the new shape of war and what happens to countries that attempt to control their own resources in an age where war and war spending have become all the more necessary to take the market out of its slump.” Syria’s GDP was $73 billion in 2012, a 73% decrease in economic output from 2008, according to Statista. Cumulative GDP loss between 2011–2016 is estimated at $226 billion, according to the World Bank.

“Why would the US be interested in billion dollar trade, when it has made more than a trillion out of war in Syria?,” he says. “If you want cash in against the Syrian government, you spend a trillion dollars mobilising intelligence in the west, another couple of trillion sowing dissent, saying Syria is bad, we have a bad guy in power, we should kill him and free this country, maybe bring in ISIS, al-Qaeda or some other obscurantist group. They’re willing to pay even tens of trillions, because they will earn back every penny.” “If they spend ten trillion on this war, they’re going to earn $10–20 trillion back,” he says.

[..] The former UN economist says that free trade basically dislocates resources and never re-employs them back. “It either drives resources out of business, or it simply destroys them,” he says. “If you force governments in sub-Saharan Africa or the Middle East to subsidise their agriculture, while the EU, for instance, spends a trillion euros a year subsidising its agriculture, you already have an economic imbalance in the way policy occurs.” In many cases, war is actually more profitable than trade.

Make every single part of the travel industry pay for the destruction it causes.

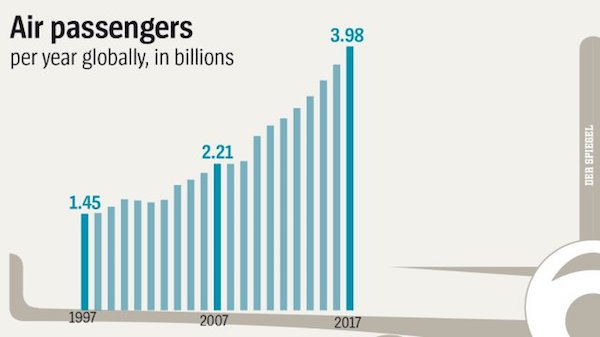

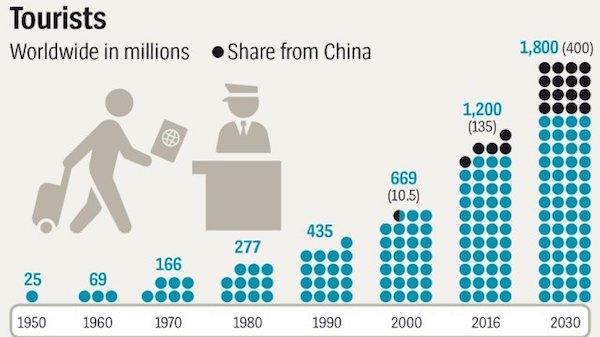

• Tourists Are Destroying the Places They Love (Spiegel)

It’s not just Europeans exploring each others’ countries. The boom is also fueled by people from countries that have benefited handsomely from globalization. Much of the responsibility for the growth in global tourism lies with members of the newly emerging middle classes in Russia and with people from the Far East and Arab countries. They also bear a significant share of the responsibility for the growing problems. The boom, after all, is also producing losers, and many of them have begun revolting, as recently seen in the pilot strikes at European budget carrier Ryanair, whose poor working conditions and low wages are what make the airline’s low-cost strategy possible in the first place.

But residents of the cities and regions affected are perhaps the biggest losers. When, for example, it becomes more lucrative for property owners to rent their apartments out to tourists on a daily or weekly basis than to locals who need an affordable place to live. Or when commuters have to squeeze into overcrowded public transportation because local buses and trains have been filled to capacity by tourists. Or when people no longer feel comfortable in their neighborhood because they have become a minority in the cafés and restaurants they traditionally frequented. That is, assuming they can get in at all or afford the new prices.

The tourism industry suddenly finds itself confronted by a group that it hadn’t previously paid much attention to. Having always focused on the guests, it tended to overlook the hosts. “Tourism is a phenomenon that creates many private profits but also many socialized losses,” says Christian Laesser, a tourism professor at the University of St. Gallen in Switzerland. Often, the profits benefit very few – the landlords and hotel owners primarily, but also, to a much lesser extent, the often poorly paid employees working in the travel sector. The rest are stuck with the noise and the mess, the high rents and the feeling of being a stranger in their own country, like being an extra in some Disney World for tourists.

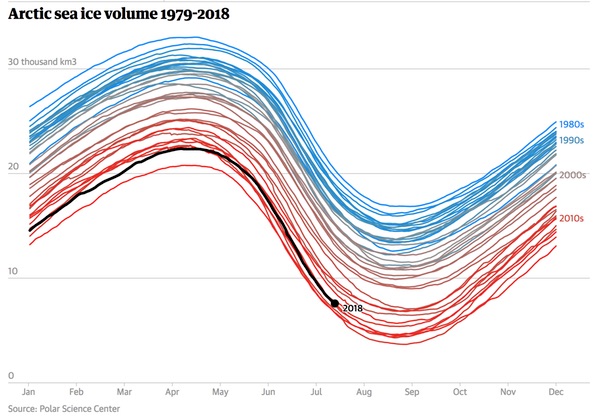

The last ice area. That sounds ominous.

• Arctic’s Strongest Sea Ice Breaks Up For First Time On Record (G.)

The oldest and thickest sea ice in the Arctic has started to break up, opening waters north of Greenland that are normally frozen, even in summer. This phenomenon – which has never been recorded before – has occurred twice this year due to warm winds and a climate-change driven heatwave in the northern hemisphere. One meteorologist described the loss of ice as “scary”. Others said it could force scientists to revise their theories about which part of the Arctic will withstand warming the longest. The sea off the north coast of Greenland is normally so frozen that it was referred to, until recently, as “the last ice area” because it was assumed that this would be the final northern holdout against the melting effects of a hotter planet.

But abnormal temperature spikes in February and earlier this month have left it vulnerable to winds, which have pushed the ice further away from the coast than at any time since satellite records began in the 1970s. “Almost all of the ice to the north of Greenland is quite shattered and broken up and therefore more mobile,” said Ruth Mottram of the Danish Meteorological Institute. “Open water off the north coast of Greenland is unusual. This area has often been called ‘the last ice area’ as it has been suggested that the last perennial sea ice in the Arctic will occur here. The events of the last week suggest that, actually, the last ice area may be further west.”