Russell Lee “Yreka, California. Magazine stand” 1942

“We are perfectly prepared to refrain from any moves that would jeopardize financial stability or Greek competitiveness..”

• German-Led Bloc Willing to Let Greece Leave Euro: Malta (Bloomberg)

Germany and its allies are ready to let Greece leave the euro unless Prime Minister Alexis Tsipras accepts the conditions required to extend his country’s financial support, according to Malta’s finance minister, Edward Scicluna. Greece’s creditors are cranking up the pressure on Tsipras as he seeks a deal to prevent his country defaulting on its obligations as early as next month. By bowing to German demands, the premier risks a domestic backlash from voters and party members whom he’s promised an end to austerity. “Germany, the Netherlands and others will be hard and they will insist that Greece repays back the solidarity shown by the member states by respecting the conditions,” Scicluna said in an interview. “They’ve now reached a point where they will tell Greece ‘if you really want to leave, leave.’”

Talks between euro-region finance ministers in Brussels Friday aimed at agreeing an extension of Greece’s aid program were pushed back by an hour and a half, the group’s chairman, Dutch Finance Minister Jeroen Dijsselbloem, said on Twitter. The meeting will begin at 4:30 p.m. Brussels time and Dijsselbloem will make a statement at 3 p.m.nIn a formal request on Thursday to extend Greece’s euro-area backed rescue beyond its end-of-February expiry for another six months, Greek Finance Minister Yanis Varoufakis said he would accept the financial and procedural conditions of the Germany’s Finance Ministry almost immediately rebuffed the latest Greek formula, saying the country needs to make a firmer commitment to austerity. A “positive” conversation between Tsipras and German Chancellor Angela Merkel later on Thursday sparked investor optimism for a deal.

“We are perfectly prepared to refrain from any moves that would jeopardize financial stability or Greek competitiveness,” Varoufakis said in an interview Friday with The Telegraph. “But what we cannot accept is that the fiscal adjustment, agreed by the last government, be carried through just because the rules say so.” Investors are pricing in a positive outcome to the Eurogroup meeting with Greek bonds and stocks rising for a third day.

“..is there a way to frame the Greek case in a way that a lawyer might understand?”

• A Lawyer’s Mindset Where An Economist’s Is Needed? (Steve Keen)

A Twitter correspondent pointed out a simple fact that makes Schäuble’s inflexibility in negotiations with Varoufakis explicable: though he is a Minister of Finance, his PhD is in law. So is he implicitly approaching these negotiations as a lawyer would? Because from that point of view, what the Greeks are trying to do is to renege on a contract. And for a lawyer, changing the terms of a contract after you have signed it is a no deal. It’s either carry out the contract, or I’ll sue. Varoufakis, of course, is approaching the negotiations as an economist. From his point of view, the terms of the Troika’s package are a set of economic policies that have failed. And if policies have failed, the sensible economist tries different ones.

So did Greece sign a legal document, whose principles have to be adhered to, even if they have consequences the Greeks didn’t foresee when they signed? Or did Greece accept a set of economic policies, whose continuance should depend on whether those policies are achieving their intended objectives? There’s no doubt that the latter is the case. But if Schäuble is treating it as a legal treaty, then the fact that this is actually a set of failed economic policies, and not a legally binding treaty, won’t matter. He will refuse to “renegotiate the terms of the contract”. The negotiations will be such in name only.

So is there a way to frame the Greek case in a way that a lawyer might understand? Any contract involves consideration by each party to the other. In a contract of sale, the object being sold is the consideration from the seller; the money for the sale is the consideration from the buyer. So what is the consideration in this case? It is a combination of two things: the loans that were extended to the Greeks, and the Greeks carrying out an economic program which promised a set of economic outcomes—the key components of which are shown in Figure 1. These included that real economic growth would commence in 2012, and that unemployment would peak at 15.3% in 2012, and fall to 14.6% by 2014. [..]

Schäuble could then find himself repeating the whole process all over again, but this time with an opposite party who will delight in breaking agreements. He clearly hasn’t enjoyed negotiating with a leftwing academic economist who wears a leather jacket and wears his shirt outside his trousers. How, I wonder, will he enjoy negotiating with someone who prefers to wear jackboots?

“Greece must be bled dry to service its foreign creditors in the name of European solidarity..”

• Greece Should Not Give In to Germany’s Bullying (Legrain – Foreign Policy)

Ever since the initial bargain in the 1950s between post-Nazi West Germany and its wartime victims, European integration has been built on compromise. So there is huge pressure on Greece’s new Syriza government to be “good Europeans” and compromise on their demands for debt justice from their European partners – also known as creditors. But sometimes compromise is the wrong course of action. Sometimes you need to take a stand. Let’s face it: no advanced economies in living memory have been as catastrophically mismanaged as the eurozone has been in recent years, as I document at length in my book, European Spring.

Seven years into the crisis, the eurozone economy is doing much worse than the United States, worse than Japan during its lost decade in the 1990s and worse even than Europe in the 1930s: GDP is still 2% lower than seven years ago and the unemployment rate is in double digits. The policy stance set by Angela Merkel’s government in Berlin, implemented by the European Commission in Brussels, and sometimes tempered – but more often enforced – by the ECB in Frankfurt, remains disastrous. Continuing with current policies — austerity and wage cuts, forbearance for banks, no debt restructuring or adjustment to Germany’s mercantilism — is leading Europe into the ditch; the launch of quantitative easing is unlikely to change that. So settling for a “compromise” that shifts Merkel’s line by a millimeter would be a mistake; it must be challenged and dismantled.

While Greece alone may not be able to change the entire monetary union, it could act as a catalyst for the growing political backlash against the eurozone’s stagnation policies. For the first time in years, there is hope that the dead hand of Merkelism can be unclasped, not just fear of the consequences and nationalist loathing. More immediately, Greece can save itself. Left in the clutches of its EU creditors, it is not destined for the sunlit uplands of recovery, but for the enduring misery of debt bondage. So the four-point plan put forward by its dashing new finance minister, Yanis Varoufakis, is eminently sensible.

This involves running a smaller primary surplus – that is a budget surplus, excluding interest payments – of 1.5% of GDP a year, instead of 3% this year and 4.5% thereafter. Some of the spare funds would be used to alleviate Greece’s humanitarian emergency. The crushing debts of more than 175% of GDP would be relieved by swapping the loans from eurozone governments for less burdensome obligations with payments tied to Greece’s GDP growth. Last but not least, Syriza wants to genuinely reform the economy, with the help of the Organization for Economic Cooperation and Development (OECD), notably by tackling the corrupt, clientelist political system, cracking down on tax evasion, and breaking the power of the oligarchs who have a stranglehold over the Greek economy.

Had the Varoufakis plan been put forward by an investment banker, it would have been perceived as perfectly reasonable. Yet in the parallel universe inhabited by Germany’s Finance Minister Wolfgang Schäuble, such demands are seen as “irresponsible”: Greece must be bled dry to service its foreign creditors in the name of European solidarity.

“Only approval of the conclusion of the review of the extended arrangement by the institutions in turn will allow for any disbursement of the outstanding tranche of the current EFSF program..”

• Tentative Deal For Extension Agreed At Eurogroup (Kathimerini)

Greece and the Eurogroup agreed on Friday a deal to extend the country’s loan agreement for another four months, pending on lenders approving reform proposals due to be submitted by the Greek side on Monday. The terms of the agreement reached after many hours of talks in Brussels Friday means that the country’s lenders – the European Central Bank, the European Commission and the International Monetary Fund – must approve the reforms proposed by Greece on Monday. “The Greek authorities will present a first list of reform measures, based on the current arrangement, by the end of Monday, February 23,” the statement said. “The institutions will provide a first view whether this is sufficiently comprehensive to be a valid starting point for a successful conclusion of the review. This list will be further specified and then agreed with the institutions by the end of April.”

Greece has yet to receive €7.2 billion in bailout installments that the previous government failed to secure. But the country’s creditors will only disburse these funds once the implementation of the measures has taken place by the end of April. “Only approval of the conclusion of the review of the extended arrangement by the institutions in turn will allow for any disbursement of the outstanding tranche of the current EFSF program and the transfer of the 2014 SMP profits,“ said the statement. Greek Finance Minister Yanis Varoufakis stressed the importance of Greece being able to submit its own reforms and vowed to “work night and day between now and Monday” to produce a “fresh list of reforms.”

“The Greek authorities have expressed their strong commitment to a broader and deeper structural reform process aimed at durably improving growth and employment prospects, ensuring stability and resilience of the financial sector and enhancing social fairness,” said the Eurogroup statement. “The authorities commit to implementing long overdue reforms to tackle corruption and tax evasion, and improving the efficiency of the public sector. In this context, the Greek authorities undertake to make best use of the continued provision of technical assistance.” In the meantime, though, some €11 billion left in Greece’s bank recapitalization fund, the HFSF, will return to the European Financial Stability Facility (EFSF) but will be available for use should banks require it.

“..to sell and lend to the countries on the periphery of Europe was always Germany’s preferred economic activity..”

• The Euro’s Up In Smoke (Beppe Grillo)

“The Eurozone chess game has entered its third and final stage. Germany wins in three moves – Euro, deflation and purchase of public debt by the ECB (QE) – and in the last few years it has found a way to maximise its profits and reduce to zero its risks as Europe’s creditor.

Germany’s risks Let’s try analysing the problems of the Eurozone as they really are: problems of conflicting interests of creditors and debtors regulated by demand and supply. If you agree to make a loan to your neighbour, you open yourself up to three risks:

• that he’ll pay you back in a different currency that has perhaps been devalued unless you had a prior agreement about the repayment currency (currency risk);

• that with the amount you get back, you can buy fewer goods or property (inflation risk);

• that you don’t even have either of the first two problems because your neighbour simply goes bust and thus you lose everything (capital risk).How Germany gains Germany is the Eurozone’s only big creditor with about €600 billion loaned to various countries, most of which are on the periphery of the Eurozone, including Italy. The Euro has given it this enviable status. If you produce lots and you consume and invest very little and you keep domestic wages and prices low, then you’ll always have cheap unconsumed goods to sell to your neighbours. And you might also be able to make money by providing credit that they will probably ask you for so that they can buy your goods that are so cheap and so good. This is Germany’s situation. It has always had this approach to the market economy in European affairs ever since 1870 with its roots in Calvinism. Thus to sell and lend to the countries on the periphery of Europe was always Germany’s preferred economic activity when everything was going well, before the crisis in 2008. Since then its only objective has been to get that credit returned and to protect its purchasing power.

“We are going to write our own script on the reforms that need to be enacted..”

• Eurozone Chiefs Strike Deal To Extend Greek Bailout For Four Months (Guardian)

Greece has stepped back from the prospect of a disorderly eurozone exit after reaching a last-ditch deal to resolve the impasse over its €240bn bailout. The outline agreement between Athens and its creditors in the single currency bloc to extend Greece’s rescue loans should help ease concerns that it was heading for the exit door from the euro. In return, the country’s leftwing government has pledged not to roll back austerity measures attached to the rescue, and must submit, before the end of Monday, a list of reforms that it plans to make. The chairman of the eurozone finance chiefs’ group, Jeroen Dijsselbloem, said Athens had given its “unequivocal commitment to honour their financial obligations” to creditors.

He said that the agreement was a “first step in this process of rebuilding trust” between Greece and its eurozone partners which would provide a strategy to get the country back on track. A senior Greek government official welcomed the agreement, saying it gave Athens time to negotiate a new deal. “Greece has turned a page,” the official added. Greece’s finance minister, Yanis Varoufakis, claimed victory, insisting there was “no substantive difference” between the deal and a Greek compromise text that had been dismissed by Germany’s finance ministry as a Trojan horse for Athens to throw off austerity. “We are going to write our own script on the reforms that need to be enacted,” he said

But the Greek prime minister, Alexis Tsipras, will almost certainly face fierce reaction over the deal, both from hardliners in his radical left Syriza party and from the populist right-wing Anel – his junior partner in the governing coalition – for agreeing to continue with austerity measures as part of the deal, given that he was elected on an anti-austerity programme. “Very heavy concessions have been made, politically poisonous concessions for the government,” Pavlos Tzimas, the veteran political commentator, told SKAI news.

“The Greek authorities commit to refrain from any rollback of measures and unilateral changes to the policies and structural reforms that would negatively impact fiscal targets, economic recovery or financial stability, as assessed by the institutions.”

• Greece Bends To Eurozone Will To Find Short-term Agreement (Open Europe)

Immediately after SYRIZA’s election victory in Greece, we predicted that:” While a compromise could still be possible, it will be quite painful to reach and will imply someone taking big steps back from their previous stance.” Tonight that looks to have been proven true – at least in the short term.

What does this agreement do and why? Tonight’s deal extends the current Master Financial Assistance Facility Agreement (MFAFA) by four months in order to allow Greece to fund itself in the short term and to allow time for negotiations over what happens afterwards.+ The purpose of the extension is the successful completion of the review on the basis of the conditions in the current arrangement, making best use of the given flexibility which will be considered jointly with the Greek authorities and the institutions (European Commission, ECB and IMF – formerly known as ‘the Troika’).+ Tonight’s agreement seems to essentially extend the existing agreement and the tied-in conditionality of the current Memorandum of Understanding.

What points has Greece capitulated on? Completion of the current review – Greece has basically agreed to conclude the current bailout. Any funding is conditional on such a process: “Only approval of the conclusion of the review of the extended arrangement by the institutions in turn will allow for any disbursement of the outstanding tranche of the current EFSF programme and the transfer of the 2014 SMP profits. Both are again subject to approval by the Eurogroup.” This is a clear capitulation for Greek Prime Minister Alexis Tsipras, who said the previous bailout was “dead” and the EU/IMF/ECB Troika is “over”.

Remaining bank recapitalisation funds – Greece wanted this money to be held by the Hellenic Financial Stabilisation Fund (HFSF) over the extension period, and possibly be open for use outside the banking sector. However, this has been denied and the bonds will return to the EFSF, although they will remain available for any bank recapitalisation needs. Role of the IMF – The Eurogroup statement says, “We also agreed that the IMF would continue to play its role”. Again, Greece has given in on this point and the Troika continues to exist and be strongly involved in all but name.

No unilateral action – According to the statement, “The Greek authorities commit to refrain from any rollback of measures and unilateral changes to the policies and structural reforms that would negatively impact fiscal targets, economic recovery or financial stability, as assessed by the institutions.” In light of this, a large number of promises that SYRIZA made in its election campaign will now be hard to fulfil. In the press conference given by Eurogroup Chairman Jeroen Dijsselbloem and EU Economics Commissioner Pierre Moscovici, it was suggested that this pledge also applied to the measures which were announced by Tsipras in his speech to the Greek parliament earlier this week – when he announced plans to roll back some labour market reforms passed by the previous Greek government.

“You’ll get to go through it again in four months..”

• Greece’s Debt Deal Isn’t The End Of Eurozone Drama (MarketWatch)

Rejoicing over the tentative resolution of the latest round of eurozone debt drama? Good for you. You’ll get to go through it again in four months. That is assuming Greece’s weekend exercise in picking its own austerity poison somehow proves mortifying enough to appease the “institutions” (don’t call them the troika anymore) overseeing the country’s bailouts while not enraging Greek voters who elected the new government on the promise it would stop Berlin and Brussels from imposing unrelenting austerity. That could prove to be a tall order. Failure on the latter front could mean new elections. Greek voters in January supported Greek Prime Minister Alexis Tsipras and his Syriza party on the idea that Greece didn’t want to leave the euro, but could no longer abide harsh austerity measures dictated by the dreaded troika..

Greek Finance Minister Yannis Varoufakis says Greece won a victory in that it will now be a “co-author” of its reforms, rather than having measures imposed by fiat by its creditors. Meanwhile, German Finance Minister Wolfgang Schaeuble was attempting to soothe German taxpayers. He emphasized to reporters that Athens won’t see any aid until it completes a satisfactory proposal, Reuters reported. And perhaps just to rub it in a little, he offered that the Greeks “certainly will have a difficult time to explain the deal to their voters, “ the report said. If Greek voters feel they got a raw deal, another election could be in the offing. If so, it would likely turn not on the question of austerity, but on a so-called Grexit.

So now Greece must submit a list of reforms to the institutions by the end of the day Monday. The institutions will review pore over it. There is scope for the process to break down between now and then. Varoufakis said Athens will craft its proposals in consultation with its partners, albeit at “arms length.” But even if everything goes smoothly, the question of what happens next for Greece, which will likely require a third bailout, will need to be answered in four months time.

“If we were to sell bonds, we would make huge capital gains, but we will then have to reinvest that money at a yield of 0.5%, set against liabilities at 3.50-3.75 (percent),”

• ECB’s Draghi Wants To Buy Bonds, But Who Will Sell? (Reuters)

At the height of the euro zone debt crisis in 2012, ECB President Mario Draghi’s problem was how to convince investors to hold on to European bonds. Now he faces a struggle to make them sell. Weeks before the European Central Bank begins a program to buy about 1 trillion euros of euro zone government bonds, banks, pension funds and insurers across the continent are hoarding them for regulatory or accounting reasons. That may complicate implementation of the quantitative easing program, aimed at reviving growth and inflation in the euro zone. The ECB might have to pay way above market prices, or take additional measures to encourage investors to sell. “We prefer to hold on to them,” said Antoine Lissowski at French insurer CNP Assurances. “The ECB’s policy … is reaching its limits now.”

Banks, which buy mainly short-term bonds, use government debt as a liquidity buffer. Selling would force them to invest in other assets, for which – unlike government bonds – regulators ask banks to set cash aside as a precaution. Alternatively, they can deposit money with the ECB, at a discouraging interest rate of minus 0.20%. Insurers and pension funds typically buy long-term debt. They could make hefty profits selling to the ECB. But the money would have to be re-invested in other bonds whose yields would be much lower than their long-term commitments to clients – a regulatory no-no. In 2012, many euro zone bonds offered double-digit yields. Today, Greece aside, the bloc’s highest yielding debt is a 30-year Portuguese bond offering 3.30%.

Between a quarter and a third of the market carries negative yields, meaning investors pay governments to park their money in debt. In Belgium, a country whose rates are taken as indicative of the euro zone average, benchmark 10-year bonds BE10YT=TWEB yield 0.7%, just above record lows around 0.5%. “If we were to sell bonds, we would make huge capital gains, but we will then have to reinvest that money at a yield of 0.5%, set against liabilities at 3.50-3.75 (percent),” said Bart de Smet, the CEO of Belgian insurer Ageas. Dutch banks ING and Rabobank, Spain’s Bankinter and rescued lender Bankia and France’s BNP Paribas said they were unlikely to sell when the ECB comes knocking. “The volume of sovereign bonds we own at the moment is not linked to monetary policy,” BNP Paribas deputy CEO Philippe Bordenave said. “It’s linked to the regulation.”

“It is hard to imagine how Ireland, Portugal, Spain or even Italy could have stayed in the euro area in 2011-2012 had there been a worked-out exit route.”

• It’s Up To Germany To End The Game Of Chicken With Greece (Guardian)

At the heart of the rift that runs through Europe at the moment lies a technocratic debate drowned in emotion. Germany has rejected Greece’s bailout request on the basis of the semantic difference between a programme extension (acceptable) and a loan extension (unacceptable). True, words are substance. But when the German finance minister, Wolfgang Schäuble, or his allies take the floor to explain their critical stance, the underlying reasons become evident: they quickly shift to moral and emotional grounds, invoking trust, values and cultural differences. The Greek side of the debate is not better. Opening the negotiations with a ridiculous request for war reparations, tolerating for several days caricatures of Schäuble as a Nazi in government-friendly newspapers, and comparing Eurogroup methods with waterboarding, the new Greek government went for a strategy of emotional alienation, rather than trust-building.

In a game of chicken, stubbornness leads to catastrophe. And stubbornness based on pride and prejudice is hard to abandon. This is why I have started to get seriously worried about where these negotiations are heading. We urgently need to bring back in some simple economic and political considerations to show that a compromise is not only a good solution; it’s the only solution. First, we need to make it absolutely clear that Grexit would be devastating for Greece, for Europe and for Germany. For Greece, because it would cause the banking system to collapse, import prices to skyrocket and growth prospects to disappear for several years, with horrifying prospects for the Greek population. For Europe because the euro area would be turned from an “irrevocable” currency union into some kind of fixed-exchange rate regime where countries can leave as soon as they come under market pressure.

It is hard to imagine how Ireland, Portugal, Spain or even Italy could have stayed in the euro area in 2011-2012 had there been a worked-out exit route. Finally, it would be devastating for Germany, not only because it would lose billions of euros from a Greek devaluation but even more so because it would put at risk Germany’s recent prosperity: a currency union is to the benefit of the largest export nation in Europe. Secondly, we need to remember that some of the Greek requests are economically reasonable. The country urgently needs to shift from a contractionary to a more neutral fiscal stance. Structural reforms were necessary but put additional pressure on domestic demand. The bailout money hasn’t benefitted the Greek population, but in its largest parts has gone straight from European bank accounts, through Athens, and back to the ECB or the IMF.

“These are uncharted waters and founding fathers never envisaged or made provision for a nation leaving the euro.”

• Is Greek PM Alexis Tsipras Going To Be Russia’s ‘Trojan Donkey’? (NewsCorp)

As newly elected Greek leader Alexis Tsipras earlier this month made a much heralded visit to mainland Europe to shore up support to end austerity measures in his country, he made a largely unreported transit stop in Cyprus. The stopover lasted only a few hours but in that time he received first-hand briefings of not only the dire financial precipice upon which the island also stood but equally the potentially huge oil and gas reserves waiting to be explored off its turquoise coastline. Symbolically the Leftist prime minister met not only with Greek Cyprus counterparts but also leading members of the Turkish Cypriot community, to declare his desire for reunification of the island, split in two between Greece and Turkey for more than 40 years but now largely divided over rights to those offshore hydrocarbon reserves.

Turk Cypriots applauded the significant move. It was the first time a Greek leader had visited the island and met them but for eurozone leaders the trip bore two other less obvious outcomes — Greece was prepared to break from tradition in a bid to find friends in the face of its financial crisis and more crucially was perhaps seeking those friendships to forge new ties with others like Russia. And there lies the issue at hand this week. Greece’s almost inevitable exit from the EU has less to do with its own economic predicament and the effect its collapse or exit or both would have on the broader 19 nation euro-using money markets, but its where and to whom it would then turn in a post Europe landscape.

There are other issues too including if Greece did finally leave the bloc, where would it leave the likes of Spain, Ireland and Portugal that all have upcoming national elections with governments wading through their respective austerity quagmires against huge domestic oppositions. It is conceivable they too may like or be forced to abandon their multi-billion dollar loans. Greece had a $270 billion bailout in 2010 and 2012 that it has sought to renegotiate to remove pegging the payback to austerity measures. The current bailout expires on February 28 hence the urgency to find a solution now. These are uncharted waters and founding fathers never envisaged or made provision for a nation leaving the euro.

Nobody has a clue. They’re just pretending.

• Has Greece’s ‘Lehman Moment’ Finally Arrived? (CNBC)

A key week for Greece’s economic future drew to a close on Friday with the country facing the very real threat that it’s running out of money and key analysts warming to the idea that it could be on its way out of the euro zone. Euro zone finance ministers are set to meet Friday to discuss Greece’s latest proposals to extend its loan agreement. But with Germany already rejecting the plan, there is very little hope that an agreement will be announced. Another meeting in Brussels for next week was already being touted before Friday’s meeting even began. The main problem for the fiscally disciplined countries like Germany is that, despite the ground Greece has given up in the last week, it is still asking for the bailout loan without all of the strict austerity conditions that come with the money.

Greek economist Elena Panaritis, former member of the Greek Parliament and the World Bank, drew comparisons with the collapse of the Lehman Brothers in 2008. As with the fall of the big U.S. bank, market-watchers feel euro zone policymakers want to show the world they will only be pushed so far — with the result being Greece would be allowed to exit the euro zone. Panaritis thought there was a “political statement as well as economic statement” being made during the negotiations. Randy Kroszner, a former U.S. Federal Reserve governor and the professor of economics at the University of Chicago Booth School of Business, agreed that there were comparisons between the two events.

“I think there a parallel, but the tools exist if the European Union wants to keep Greece in and if Greece is willing to stay in,” he told CNBC Friday. “Even though it may be quite ugly, the likelihood of complete chaos is much lower. So that gives policymakers more willingness to say ‘Hey, we’ll take that risk’.”

Damning.

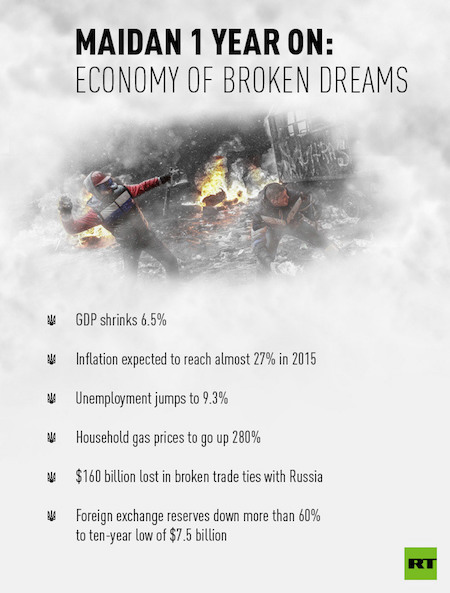

• Expectations And Reality: What Maidan Gave Ukraine’s Economy (RT)

The major expectation of the Maidan protest a year ago was replacing the burden of corruption and mismanagement of the economy with the benefits of EU integration. The reality brought collapse and a debt trap. The protests that ousted President Viktor Yanukovich in February 2014 started after his government postponed the signing of a key EU integration treaty. The EU Association Agreement opens the Ukrainian market to European goods and required that its industries adopt European standards. Both would take a heavy toll on the already ailing economy due to the cost of modernization and the loss of Russian markets. Moscow also warned it would protect its home market from European goods by revoking the tax-free trade deal with Ukraine.

Critics of Yanukovich, most notably Arseny Yatsenyuk, then-leader of a major opposition party, dismissed such concerns. Speaking on political talk shows and from the Maidan stage, Yatsenyuk gave vivid descriptions of how Prime Minister Nikolay Azarov was hurting Ukraine with his policies and how he would do a better job. He promised visa-free travel to Europe for Ukrainian tourists and guest workers, rising wages and social benefits, reining in national debt, lowering utility prices, bringing in billions of dollars of foreign investments, and many other things. Azarov went with Yanukovich and was replaced with Yatsenyuk, but the reality under the new cabinet is nothing like the picture presented a year ago. The Ukrainian economy experienced a deep plunge in 2014.

Its GDP dropped 6.5% last year, according to IMF figures, the only two countries worse were South Sudan and Libya. The unemployment rate reached 9.3% in the third quarter of 2014, as compared to 7.7% in 2013. The figure is expected to rise sharply in 2015. Ukrainian job search websites report a 30 to 50% drop in the number of employment offers over a year. “The country is at war that they cannot afford to fight. There is no economy any longer. When you look at where the industrial base of Ukraine is and the conflict going on in the east there is absolutely no doubt as to why it is happening,” Gerald Celente told RT. “That $160 billion loss of trade with Russia has destroyed the economy when it was already in a severe recession. It went from very bad to worse than depression levels.”

“Both Deutsche Bank and Santander passed ECB stress tests in October.”

• US Units of Deutsche Bank, Santander Likely to Fail Fed Stress Test (WSJ)

Large European banks including Deutsche Bank and Banco Santander are likely to fail the U.S. Federal Reserve’s stress test over shortcomings in how they measure and predict potential losses and risks, according to people familiar with the matter. The expected rebuke would mark the second year large foreign banks, which were drawn into the Fed’s stress test regime in 2014, failed to meet the U.S. regulator’s expectations for risk management. As banks have bulked up their capital cushions to ensure they can withstand losses in periods of turmoil, the Fed has increasingly focused on more “qualitative” issues in its stress tests, including whether banks accurately measure potential losses in credit portfolios, collect risk exposure data accurately and have strong internal controls.

Failing the stress tests would likely subject the U.S. units of Deutsche Bank and Banco Santander to restrictions on paying dividends to their European parent companies or other shareholders. Santander is already under such a restriction after failing its first stress test run last year. Deutsche Bank is undergoing the U.S. stress test process for the first time this year. Both Deutsche Bank and Santander passed ECB stress tests in October. Those tests focused on whether the banks had enough capital to withstand a two-year recession but didn’t assess such things as governance, risk management, and other more subjective factors like the Fed’s test.

The Fed’s Board of Governors in Washington will disclose partial results of the test on March 5 and full results on March 11, including any capital restrictions. Last year, the board met just ahead of releasing the results to vote on whether banks should fail the tests for “qualitative” reasons. It ultimately rejected Citigroup Inc. as well as U.S. units of Santander, HSBC and RBS on such grounds. It cited the foreign banks for “significant deficiencies” in their capital planning process. It hasn’t disclosed such a board meeting yet this year. The Fed declined to comment on specific banks.

Who wants a US passport these days?

• The US Government’s Stupid Tax War On Expatriates (MarketWatch)

The U.S. government’s stupid, hateful and dishonest war on Americans living abroad claimed its latest scalp this week. London Mayor Boris Johnson, a dual British and American national, says he will join the growing lines of Americans overseas who are now being driven to renounce their U.S. citizenship by the federal government for no good reason. Johnson, a possible future British prime minister, was born to British parents in New York. His case is not important individually, but it is illustrative. A record number of Americans abroad renounced their citizenship last year, and the numbers are escalating fast. That’s in response to a growing set of U.S. financial laws that make it nearly impossible for them to keep two passports. Most people don’t understand the government’s war on U.S. expats and dual nationals, so they buy the official spin that it is just “cracking down” on “rich tax cheats.”

It is doing no such thing, and it knows that it is doing no such thing. Indeed some of its most onerous financial rules, while “cracking down” on overseas grandmas with a $30,000 retirement account, specifically and deliberately exempt billionaires with money in hedge funds and private-equity funds. Even National Taxpayer Advocate Nina Olson has pointed out in her official reports to Congress that the war on expats often punishes ordinary middle-class and even poor Americans abroad far more severely than it does the rich. Olson is appointed to her role by the Congress, but she says that when she called up the Treasury to discuss some of the problems, they didn’t bother to respond. Talk to the hand, honey. Oh, and doesn’t it say a bundle that while the U.S. Treasury was “cracking down” on Grandma Moses, it was waiving all penalties on U.S. Treasury Secretary Tim Geithner for failing to pay tens of thousands of dollars in taxes?

What is going on? To put a complicated issue in a nutshell, the federal government is currently ramping up a wide set of bizarre and impossible regulations on all Americans living abroad — and threatening them with the financial equivalent of the death penalty if they don’t comply. As an American expat, you can be arrested, thrown in jail and bankrupted by Uncle Sam for failing to disclose a $15,000 checking account on which you have paid all the taxes owed. You are liable to double taxation, required to spend thousands of dollars a year on professional advice simply to survive — oh yes, and you are effectively barred from investing in either U.S. or non-U.S. based mutual funds. Ha ha! You lose!

That’s a whole extra full size guy…

• NYC Could See 6-Foot Sea Rise By 2100 (NewsMaine)

A new study, published by the New York Panel on Climate Change, has revealed that many regions of New York could be under water by 2100 if the sea level continues to rise due to global warming. The researchers have predicted that the city could experience sea level rise as much as 6 feet in the future. They said that in the next 40 years, the sea level could reach 11 to 12 inches and have demonstrated that New York City’s Central Park’s mean annual precipitation has increased at a rate of approximately 0.8 inches in every 10 years over 1900 to 2013. This has raised the mean annual precipitation to 8 inches over this past decade. During this time period, Central Park has shown an increase in mean annual temperature at a rate of 0.3°F per decade. The researchers have said that this trend has varied ‘considerably’ over shorter periods of time.

The data has suggested that both the precipitation and the New York City’s temperature have shown an increase. It has further disclosed that NYC will face heat waves at a rate 3 times as much as the city does now by the 2080s, decreasing the’ extreme cold events’.The study has called the sea level rise in New York City as a significant hazard and the main risk will be on the ‘coastal communities, infrastructure, and ecosystems’. The new climate change report given by New York City Panel on Climate Change (NPCC) has revealed that New York City might be looking at high sea level rise in the future. According to NBC, the 2015 report has found that the flood damage in the future might exceed that of Hurricane Sandy. In a press release, NYC Mayor Bill de Blasio said, “NPCC’s findings underscore the urgency of not only mitigating our contributions to climate change, but adapting our city to its risks”.