�Dorothea Lange Farm family fleeing OK drought for CA, car broken down, abandoned Aug 1936

Since the new year will bring yuuge and bigly changes to us all (I truly hope both the year and the changes will leave you happy), I thought I’d start off by ‘reduxing’ two articles that contain further ‘reduxes’, Russian doll style. I do this because the man the articles are about is set to play a large role in those changes, certainly where Europe is concerned. And since the changes in Europe will be weally weally bigly, they will impact the entire world.

That is to say, we must seriously doubt if the EU -or rather, what’s left of it post-Brexit-, will live to see January 1 2018 in one piece. This is hardly an exaggeration, as you may be inclined to think. As I said recently, in Europe it’s not and-and, it’s if-or: with elections in Germany, France, Holland and probably Italy coming up, they don’t all have to turn out ‘badly’ for the pro-EU camp, if just one of them goes against the EU, it may well be game over.

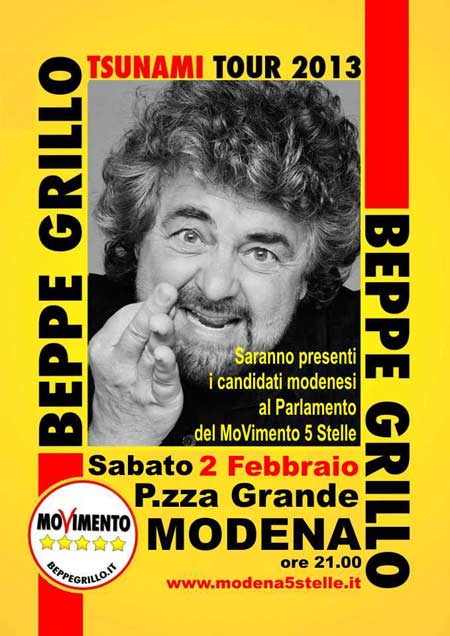

Therefore Beppe Grillo, leader of the Five Star movement, is a man to keep an eye on. And not just for that. The first item below, a 1998 video, is an addition to my original article from November 14 2014, and it makes clear, once more, that Beppe is no fool. Nor is he a right wing nut, or anything remotely like that. Beppe actually understands what money is, much much better than any of the politicians and economists that rule the old continent. That makes him a threat to them.

Below that video from 1998, my November 14 2014 article, which in turn cites a 2013 article. I know some things will look dated, but you’ll get it, I’m sure. I hope you also get why I repost it all: 2017 has begun.

Beppe Grillo: Whom does the money belong to? Who does its ownership belong to? To the State, fine, so to us, we are the State.

You know that the State doesn’t exist, it is only a legal entity. WE are the state, the money is ours.

Then tell me one thing: if the money belongs to us, why do they lend it to us?

From November 14 2014: That says quite something, that title. And it’s probably not entirely true, it’s just that I can’t think of any others. And also, I’m in Europe myself right now, and I still have a European passport too. So there’s two of us at least. Moreover, I visited Beppe Grillo three years ago, before his 5-Star Movement (M5S) became a solid force in Italian politics. So we have a connection too.

Just now, I noticed via the BBC and Zero Hedge that Beppe not only expects to gather far more signatures than he said he would recently (1 million before vs 4 million today) for his plan to hold a referendum on the euro, he also claims to have a 2/3 majority in the Italian parliament. Well done. But he can’t do it alone.

Martin Armstrong thinks the EU may have him murdered for this before they allow it to take place. Which is a very good reason for everyone, certainly Europeans, to come out in support for the only man in Europe who makes any sense. I know many Italians find Beppe too coarse, but they need to understand he’s their only way out of this mess.

The smear campaigns against him are endless. The easier ones put him at the same level as Nigel Farage and Marine Le Pen, the more insidious ones paint him off as a George Soros patsy. There’ll be a lot more of that. And given the success of this year’s anti-Putin campaign in Europe, and the ongoing pro-Euro one, it’s going to take a lot not to have people believe whatever they are told to.

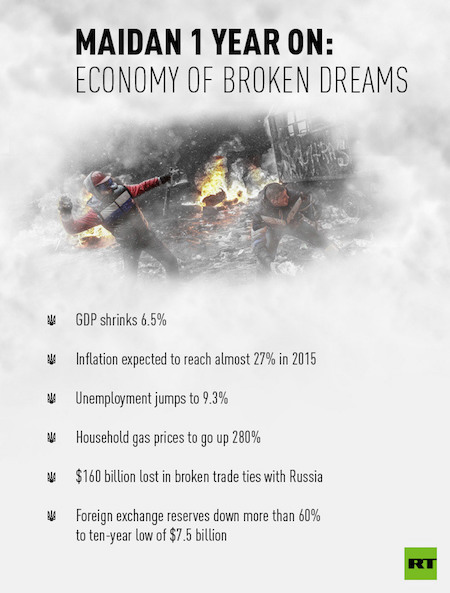

Just take this to heart: since Italy joined the euro, its industrial production has fallen by 25%. How is that not a disaster? Meanwhile, the eurozone economy is in awful shape, and the longer that lasts, the more countries like Italy will be disproportionally affected and dragged down further. There’s a reason for that numbers such as that: it’s not like Germany and Holland lost 25% of their production.

The eurozone must end before it starts to do irreversible damage, and before it turns Europe into a warzone, a far more real and imminent risk than anyone dares suggest.

The first bit here is from Zero Hedge, and then after that I will repost a lengthy piece about Beppe that I first published on February 12, 2013.

Italy’s Grillo Rages “We Are Not At War With ISIS Or Russia, We Are At War With The ECB”

Next week, Italy’s Beppe Grillo – the leader of the Italian Five Star Movement – will start collecting signatures with the aim of getting a referendum in Italy on leaving the euro “as soon as possible,” just as was done in 1989. As Grillo tells The BBC in this brief but stunning clip, “we will leave the Euro and bring down this system of bankers, of scum.” With two-thirds of Parliament apparently behind the plan, Grillo exclaims “we are dying, we need a Plan B to this Europe that has become a nightmare – and we are implementing it,” raging that “we are not at war with ISIS or Russia! We are at war with the European Central Bank,” that has stripped us of our sovereignty.

Beppe Grillo also said today:

It is high time for me and for the Italian people, to do something that should have been done a long time ago: to put an end to your sitting in this place, you who have dishonoured and substituted the governments and the democracies without any right. Ye are a factious crew, and enemies to all good government; ye are a pack of mercenary wretches, and would like Esau sell your country for a mess of pottage, and like Judas betray your God for a few pieces of money. Is there a single virtue now remaining amongst you? A crumb of humanity? Is there one vice you do not possess? Gold and the “spread” are your gods. GDP is you golden calf.

We’ll send you packing at the same time as Italy leaves the Euro. It can be done! You well know that the M5S will collect the signatures for the popular initiative law – and then – thanks to our presence in parliament, we will set up an advisory referendum as happened for the entry into the Euro in 1989. It can be done! I know that you are terrified about this. You will collapse like a house of cards. You will smash into tiny fragments like a crystal vase.

Without Italy in the Euro, there’ll be an end to this expropriation of national sovereignty all over Europe. Sovereignty belongs to the people not to the ECB and nor does it belong to the Troika or the Bundesbank. National budgets and currencies have to be returned to State control. They should not be controlled by commercial banks. We will not allow our economy to be strangled and Italian workers to become slaves to pay exorbitant interest rates to European banks.

The Euro is destroying the Italian economy. Since 1997, when Italy adjusted the value of the lira to connect it to the ECU (a condition imposed on us so that we could come into the euro), Italian industrial production has gone down by 25%. Hundreds of Italian companies have been sold abroad. These are the companies that have made our history and the image of “Made in Italy”.

As Martin Armstrong asks rather pointedly…

Since the introduction of the euro, all economic parameters have deteriorated, the founder of the five-star movement in Italy is absolutely correct. The design or the Euro was a disaster. There is no fixing this any more. We have crossed the line of no return. Beppe is now calling for referendum on leaving euro. Will he be assassinated by Brussels? It is unlikely that the EU Commission will allow such a vote.

And then here’s my February 2013 article; it seems silly to try and rewrite it. There is nobody in Europe other than him who understands what is going on, and is willing to fight for it. Grillo is a very smart man, a trained accountant and an avid reader of anything he can get his hands on. The image of him as a populist loud mouthed good for little comedian is just plain false. It was Grillo who exposed the Parmalat scandal, and the Monte Dei Paschi one.

Never forget what political and behind the veil powers he’s up against in his country, and how they seek to define the image the world has of him. What Beppe Grillo does takes a lot of courage. Not a lot of people volunteer to be smeared and insulted this way, let alone run the risk of being murdered. Those who do deserve our support.

Beppe Grillo Wants To Give Italy Democracy

In the fall of 2011, The Automatic Earth was on another European lecture tour. Nicole Foss had done a series of talks in Italy the previous year, and there was demand for more. This was remarkable, really, since a knowledge of the English language sufficient to understand Nicole’s lectures is not obvious in Italy, so we had to work with translators. Certainly none of this would have happened if not for the limitless drive and energy of Transition Italy’s Ellen Bermann.

In the run-up to the tour I had asked if Ellen could perhaps set up a meeting with an Italian I found very intriguing ever since I read he had organized meetings which drew as many as a million people at a time for a new – political – movement. Other than that, I didn’t know much about him. We were to find out, however, that every single Italian did, and was in awe of the man. A few weeks before arriving, we got word that he was gracious enough to agree to a meeting; gracious, because he’d never heard of us either and his agenda was overloaded as it was.

So in late October we drove the crazy 100+ tunnel road from the French border to Genoa to meet with Beppe Grillo in what turned out to be his unbelievable villa in Genoa Nervi, high on the mountain ridge, overlooking – with a stunning view – the Mediterranean, and set in a lovely and comfortable sunny afternoon. I think the first thing we noticed was that Beppe is a wealthy man; it had been a long time since I had been in a home where the maids wear uniforms. The grand piano was stacked with piles of books on all sorts of weighty topics, politics, environment, energy, finance. The house said: I’m a man of wealth and taste.

Eugenio Belgeri, Raúl Ilargi Meijer, Beppe Grillo, Nicole Foss and Ellen Bermann in Genoa Nervi, October 2011

I don’t speak Italian, and Beppe doesn’t speak much English (or French, German, Dutch), so it was at times a bit difficult to communicate. Not that it mattered much, though; Beppe Grillo has been a super charged Duracell bunny of an entertainer and performer all his life, and he will be the center of any conversation and any gathering he’s a part of no matter what the setting. Moreover, our Italian friends who were with us – and couldn’t believe they were there – could do a bit of translating. And so we spent a wonderful afternoon in Genoa, and managed to find out a lot about our very entertaining host and his ideas and activities.

Beppe had set up his Five Star movement (MoVimento Cinque Stelle, M5S) a few years prior. He had been organizing V-day “happenings” since 2007, and they drew those huge crowds. The V stands for “Vaffanculo”, which can really only be translated as “F**k off” or “Go f**k yourself”: the driving idea was to get rid of the corruption so rampant in Italian politics, and for all sitting politicians to go “Vaffanculo”.

At the time we met, the movement was focusing on local elections – they have since won many seats, have become the biggest party on Sicily (after Beppe swam there across the Straits of Messina from the mainland) and got one of their own installed as mayor of the city of Parma.

Grillo explained that M5S is not a political party, and he himself doesn’t run for office. He wants young people to step forward, and he’s already in his sixties. Anyone can become a candidate for M5S, provided they have no ties to other parties, no criminal record (Beppe does have one through a 1980 traffic accident); they can’t serve more than two terms (no career politicians) and they have to give back 75% of what they get paid for a public function (you can’t get rich off of politics).

I found it surprising that our friends at Transition Italy and the general left were reluctant to endorse Grillo politically; many even wanted nothing to do with him, they seemed to find him too coarse, too loud and too angry. At the same time, they were in absolute awe of him, openly or not, since he had always been such a big star, a hugely popular comedian when they grew up. Grillo offered to appear through a video link at Nicole’s next talk near Milan, but the organizers refused. It was only the first sign of a lot of mistrust among Italians even if they all share the same discontent with corrupt politics. Which have made trust a major issue in Italy.

This may have to do with the fact that Grillo is a comedian in the vein of perhaps people like George Carlin or Richard Pryor in the US. On steroids, and with a much wider appeal. Rough language, no holds barred comedy turns a lot of people off. Still, I was thinking that they could all use the visibility and popularity of the man to get their ideas across; they preferred anonymity, however.

By the way, the Five Stars, perhaps somewhat loosely translated, stand for energy, information, economy, transport and health. What we found during our conversation is that Beppe Grillo’s views on several topics were a little naive and unrealistic. For instance, like so many others, he saw a transition to alternative energy sources as much easier than it would realistically be. That said, energy and environment issues are important for him and the movement, and in that regard his focus on decentralization could carry real benefits.

Still, I don’t see the present naive ideas as being all that bad. After all, there are limits to what people can do and learn in a given amount of time. And Beppe certainly has a lot to do, he’s leading a revolution, so it’s fine if the learning process takes some time. Ideally, he would take a crash Automatic Earth primer course, but language will be a barrier there. I hope he finds a way, he’s certainly smart and curious enough.

When his career took off in the late 70’s, early 80’s, Beppe Grillo was just a funny man, who even appeared on Silvio Berlusconi’s TV channels. Only later did he become more political; but then he did it with a vengeance.

Grillo was first banned from Italian TV as early as 1987, when he quipped about then Prime Minister Bettino Craxi and his Socialist Party that if all Chinese are indeed socialists, who do they steal from? The ban was later made permanent. In the early 90’s, Operation Clean Hands was supposed to have cleaned up corruption in politics. Just 15 years later, Beppe Grillo started the Five Star movement. That’s how deeply engrained corruption is in Italy, stretching across politics, business and media.

We are- almost – all of us living in non-functioning democracies, but in Italy it’s all far more rampant and obvious. There’s a long history of deep-seated corruption, through the mafia, through lodges like P5 and Opus Dei, through many successive governments, and through the collaboration between all of the above, so much so that many Italians just see it as a fact of life. And that’s what Beppe Grillo wants to fight.

Ironically, he himself gets called a neo-nazi and a fascist these days. To which he replies that perhaps he’s the only thing standing between Italy and a next bout of fascism. I’ve read a whole bunch of articles the past few days, the international press discovers the man in the wake of the general elections scheduled for February 24-25, and a lot of it is quite negative, starting with the all too obvious notion that a clown shouldn’t enter politics. I don’t know, but I think Berlusconi is much more of a clown in that regard than Grillo is. A whole lot more of a clown and a whole lot less funny.

Beppe is called a populist for rejecting both right and left wing parties, a neo-nazi for refusing to block members of a right wing group from M5S, a Jew hater in connection with the fact that his beautiful wife was born in Iran, and a dictator because he’s very strict in demanding potential M5S candidates adhere to the rules he has set. Oh, and there are the inevitable right wing people calling him a communist.

There are of course tons of details that I don’t know, backgrounds, I’m largely an outsider, willing to be informed and corrected. And this would always be much more about the ideas than about the man. Then again, I did talk to the man in his own home and I don’t have the impression that Grillo is a fraud, or part of the same system he purports to fight as some allege, that he is somehow just the existing system’s court jester. He strikes me as being too loud and too embarrassing for that. And too genuinely angry.

Moreover, I think Italy is a perfect place for a nasty smear campaign, and since they can’t very well murder the man – he’s too popular – what better option than to make him look bad?! If anything, it would be strange if nobody did try to paint him off as a demagogue, a nazi or a sad old clown.

Photo: AFP: Marcello Paternostro

After being banned from TV, Grillo went on the build one of the most visited blogs/websites in the world, and the number one in Europe. Ironically, he is now in some media labeled something of a coward for not appearing in televised election debates. But Beppe doesn’t do TV, or – domestic – newspapers. For more than one reason.

Because he was banned from TV, because of the success of the internet campaign, and because Silvio Berlusconi incessantly used “lewd” talk shows on his own TV channels to conduct politics, Beppe Grillo insists his councilors and candidates stay off TV too, and he has his own unique way of making clear why and how: When a female Five Star member recently ignored this and appeared on a talk show anyway, Grillo said “the lure of television is like the G-spot, which gives you an orgasm in talk-show studios. It is Andy Warhol’s 15 minutes of fame. At home, your friends and relations applaud emotionally as they share the excitement of a brief moment of celebrity.”. Of course Beppe was labeled a sexist for saying this.

The internet is central to Grillo’s ideas. Not only as a tool to reach out to people, but even more as a way to conduct direct democracy. Because that is what he seeks to create: a system where people can participate directly. Grillo wants to bring (back) democracy, the real thing, and he’s long since understood that the internet is a brilliant tool with which to achieve that goal. One of his spear points is free internet access for all Italians. Which can then be used to let people vote on any issue that can be voted on. Not elections once every four years or so, but votes on any topic anytime people demand to vote on it. Because we can.

Since we had our chat in that garden in Genua, Beppe Grillo and M5S have moved on to bigger pastures: they are now set to be a major force in the general elections that will establish a new parliament. Polls differ, but they can hope to gain 15-20% of the vote (Grillo thinks it could be even much more). The leader in the polls is the Socialist Party, and then, depending on which poll you choose to believe, M5S comes in either second or third (behind Berlusconi). What seems certain is that the movement will be a formidable force, carrying 100 seats or more, in the new parliament, and that they could have a lot of say in the formation of any new coalition government.

In the run-up the elections, Beppe has now traded his home for a campaign bus, going from town to town and from one jam-packed campaign event to the next on what he has labeled the Tsunami Tour, in which he, in his own words, brings class action to the people.

As was the case in the local elections, Beppe Grillo says he wants “normal” people (“a mother of three, a 23-year-old college graduate, an engineer [..] those are the people I want to see in parliament”) to be elected, not career politicians who enrich themselves off their status and influence, and who he labels “the walking dead”, and though he acknowledges his candidates have no political experience, he says: “I’d rather take a shot in the dark with these guys than commit assisted suicide with those others.” In the same vein, another one of his lines is:“The average age of our politicians is 70. They’re planning a future they’re never going to see”.

On his immensely popular website beppegrillo.it, which has quite a bit of English language content, Grillo has some nice stats and tools. There is a list of Italian parlimentarians and Italian members of the EU Parliament who have been convicted of crimes. At this moment there are 24; their number has come down, but still. There is also a great little thing named “Map of Power of the Italian Stock Exchange” that graphically shows the links various politicians have with various corporations. I remember when Grillo proudly showed it to us, that after clicking just 2-3 politicians and 2-3 businesses, the screen was so full of lines depicting connections it had become an unreadable blur.

In between all the other activities, Beppe was instrumental 10 years ago in exposing the stunning $10 billion accounting fraud at dairy and food giant Parmalat before it went bankrupt, as well as the recent scandal at the world’s oldest bank, Monte Dei Paschi Di Siena, which will cost a reported $23 billion. Corruption is everywhere in Italy, which has a large political class that is all too eager to share in the spoils. Mr. Grillo was trained as an accountant, and he understands what he’s talking about when it comes to dodgy numbers. What he needs is the power to act.

Apart from the strong stance that Grillo and M5S take against corruption and for direct representation, critics say they have few clear policy objectives, that they don’t even know what they want. Being a movement instead of a party doesn’t help. But then, these critics think inside the very old system that M5S wants to replace with one that is far more transparent and direct. It’s more than obvious that existing powers have no interest in incorporating the possibilities for improvement offered by new technologies, but it should also be obvious that people, wherever they live, could potentially benefit from a better functioning political system.

There will be many who say that no such thing can be achieved, but perhaps it not only can, but is inevitable. All it could take is for an example to show that it can work. One might argue that the only reason our current systems continue to exist in all their opaqueness is that those who stand to profit from them are the ones who get to vote on any changes that could be applied. What Beppe Grillo envisions is a system in which every one can vote directly on all relevant issues, including changes to the system itself. It’s about class action, about taking back power from corrupt existing politics. Italy looks like a good testing ground for that, since its systemic rot is so obvious for all to see. But in other western countries, just like in Italy, it could return the power where it belongs: in the hands of the people.

Radical ideas? Not really, because when you think about it, perhaps it’s the technology itself that’s radical, not the use of it. And maybe it’s the fact that we’re so stuck in our existing systems that keeps us from using our new technologies to their full potential. Just like it keeps us from restructuring our financial systems and our energy systems for that matter. We continue to have systems and institutions guide our lives long after they’ve ceased to be useful for our present day lives, as long as we’re snug and warm and well-fed. And we do so until a real bad crisis of some sort comes along and makes it absolutely untenable, often with a lot of misery and blood thrown into the equation.

Beppe Grillo wants to break that chain. And he’s got a recipe to do it. It may not be perfect or foolproof, but who cares when it’s replacing something that no longer functions at all, that just drags us down and threatens our children’s lives? Who cares? Well, the Monti’s and Berlusconi’s and Merkel’s and Obama’s and Exxon’s and BP’s and Monsanto’s of the world do, because it is the old system that gave them what they have, and they don’t want a new one that might take it away. Our so-called democracies exist to please our leaders and elites, not ourselves. And we’re unlikely to figure that one out until it’s way too late.

Unless the Italians do our work for us and vote for the Cinque Stelle in huge numbers.