Vincent van Gogh Self-portrait with dark felt hat at the easel 1886

If a crisis next year is seen as the only way to derail Trump, don’t be surprised if one is fabricated.

• Recession Likely Years Away Due To Bullish Trump Effect – Shiller (CNBC)

Nobel-prize winning economist Robert Shiller believes a recession may be years away due to a bullish Trump effect in the market. According to the Yale University professor, President Donald Trump is creating an environment that’s conducive to strong consumer spending, and it’s a major force that should hold off a recession. “Consumers are hanging in there. You might wonder why that would be at this time so late into the cycle. This is the longest expansion ever. Now, you can say the expansion was partly [President Barack] Obama,” he told CNBC’s “Trading Nation” on Friday. “But lingering on this long needs an explanation.”

Shiller, a behavioral finance expert who’s out with the new book “Narrative Economics,” believes Americans are still opening their wallets wide based on what President Trump exemplifies: Consumption. “I think that [strong spending] has to do with the inspiration for many people provided by our motivational speaker president who models luxurious living,” said Shiller. Shiller emphasizes there’s still uncertainty and risk surrounding Wall Street. Before the markets can take-off, Shiller stresses President Trump needs to get past the impeachment inquiry. He sees this as the biggest threat to his optimistic forecast.

From last week, but pretty timeless.

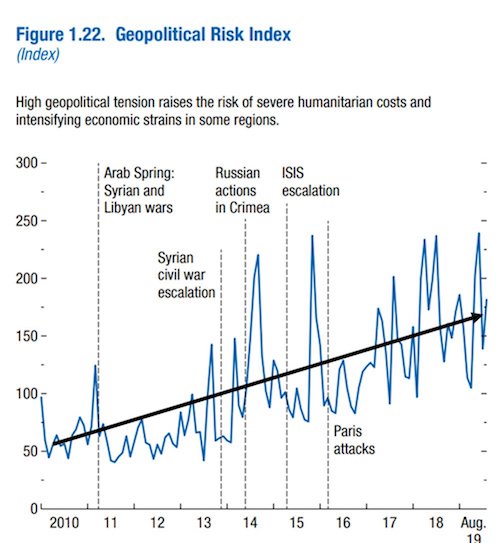

• Global Economy Faces $19 Trillion Corporate Debt Timebomb – IMF (G.)

Low interest rates are encouraging companies to take on a level of debt that risks becoming a $19tn (£15tn) timebomb in the event of another global recession, the International Monetary Fund has said. In its half-yearly update on the state of the world’s financial markets, the IMF said that almost 40% of the corporate debt in eight leading countries – the US, China, Japan, Germany, Britain, France, Italy and Spain – would be impossible to service if there was a downturn half as serious as that of a decade ago.

The IMF noted that the stimulus provided by central banks in both developed and developing countries had the side-effect of encouraging firms to borrow more, even though many would have trouble paying it back. Officials at the Washington-based organisation fear that the buildup of debt makes the global financial system highly vulnerable and are telling member states not to repeat the mistake of the early 2000s, when warning signs of a possible market meltdown were ignored.

The IMF said share prices in the US and Japan appeared to be overvalued, while the credit spreads in bond markets – the compensation demanded by investors against risk – seemed to be too low, given the state of the global economy. Tobias Adrian and Fabio Natalucci, two senior IMF officials responsible for the Global Financial Stability Report, said: “A sharp, sudden tightening in financial conditions could unmask these vulnerabilities and put pressures on asset price valuations.” In a blogpost published alongside the GFSR, Adrian and Natalucci noted: “Corporations in eight major economies are taking on more debt and their ability to service it is weakening.

Let’s see how nasty Hillary will get.

• “Toe The Line Or Be Destroyed”: Tulsi Gabbard (ZH)

Tulsi Gabbard unleashed her latest counterattack to the establishment hit-job against her, after Hillary Clinton suggested she’s an Russian asset. “If you stand up to the rich and powerful elite and the war machine, they will destroy you and discredit your message…,” says Gabbard, who said she’s suffered smears “from day one of this campaign.” In a Sunday tweet accompanied by a video which has nearly 450,000 views on Twitter (and 18,000 on YouTube) as of this writing, Gabbard writes “Hillary & her gang of rich, powerful elite are going after me to send a msg to YOU: “Shut up, toe the line, or be destroyed.” But we, the people, will NOT be silenced.”

Hillary & her gang of rich, powerful elite are going after me to send a msg to YOU: “Shut up, toe the line, or be destroyed.” But we, the people, will NOT be silenced. Join me in taking our Democratic Party back & leading a govt of, by & for the people! https://t.co/TOcAOPrxye pic.twitter.com/TahfE2XOek

— Tulsi Gabbard (@TulsiGabbard) October 20, 2019

Durham’s probe has just been widened again.

• Will the Democratic Party Exist after 2020 Election? (OffG)

As a result of the corrupt foundation of the Russiagate allegations, Attorney General Bob Barr and Special Investigator John Durham appear hot on the trail with law enforcement in Italy as they have apparently scared the bejesus out of what little common sense remains among the Democratic hierarchy as if Barr/Durham might be headed for Obama’s Oval Office. Barr’s earlier comment before the Senate that “spying did occur’ and that ‘it’s a big deal’ when an incumbent administration (ie the Obama Administration) authorizes a counter-Intelligence operation on an opposing candidate (ie Donald Trump) has the Dems in panic-stricken overdrive – and that is what is driving the current Impeachment Inquiry.

With the stark realization that none of the DNC’s favored top tier candidates has the mojo to go the distance, the Democrats have now focused on a July 25th phone call between Trump and Ukraine President Volodymyr Zelenskyy in which Trump allegedly ‘pressured’ Zelenskyy to investigate Joe Biden’s relationship with Burisma, the country’s largest natural gas provider. At issue is any hanky panky involving Burisma payments to Rosemont Seneca Partners, an equity firm owned by Joe’s errant son, Hunter, who served on Burisma’s Board for a modest $50,000 a month. Zelenskyy, who defeated the US-endorsed incumbent President Petro Poroshenko in a landslide victory, speaks Russian, was elected to clean up corruption and end the conflict in eastern Ukraine.

The war in the Donbass began as a result of the US State Department’s role in the overthrow of democratically elected Ukrainian President Viktor Yanukovych in 2014. Trump’s first priority on July 25th was Crowd Strike, a cybersecurity firm with links to the HRC campaign which was hired by the DNC to investigate Russian hacking of its server. The Dems have reason to be concerned since it is worth contemplating why the FBI did not legally mandate that the DNC turn its server over to them for an official Federal forensic inspection. One can only speculate…those chickens may be coming home to roost.

And why the Democratic party will survive: the funneling of government money to donors.

• Why 97% Of Congress Get Re-Elected Each Year (F.)

How is 97 percent of Congress able to get re-elected each year even though only 17 percent of the American people believe our representatives are doing a good job? It’s called an incumbent protection system. Taxpayers have a right to know how it works. Recently, our auditors at OpenTheBooks.com, mashed up the federal checkbook with the congressional campaign donor database. We found powerful members of Congress soliciting campaign donations from federal contractors based in their districts. We followed the money and found a culture of conflict-of-interest.

The confluence of federal money, campaign cash, private employment, investments, prestigious committee appointments, political power, nepotism, and other conflicts are a fact pattern. Furthermore, members of Congress own investment stock in, are employed by, and receive retirement pensions from federal contractors to whom they direct billions of taxpayer dollars. Moreover, members sponsor legislation that affects these contractors. The contractor’s lobbyists then advocate for the legislation that helps the member and the contractor. Oftentimes, the contractor’s lobbyist also donates campaign cash to the member.

[..] Nothing we discovered is illegal. At arms-length, all of the transactions are legal. And that’s the problem. We polled our subscribers and 1,900 people responded: 96 percent thought it was unethical for a member of Congress to solicit campaign donations from federal contractors based in their districts. Furthermore, 92 percent said it was an important or very important issue. The American people get it. Members should refuse to accept campaign donations from federal contractors and their affiliates.

Ongoing.

• Scottish Court Asked To Delay Ruling On Johnson’s Brexit Extension Request (R.)

Anti-Brexit campaigners said they would ask a Scottish court on Monday to delay its ruling on a legal challenge that sought to force Prime Minister Boris Johnson to comply with a law requiring him to request a delay to Brexit. The so-called Benn Act compelled Johnson to write a letter to the EU asking for a Brexit extension if parliament had not approved either a deal or a no-deal exit by Saturday. Johnson had repeatedly said he would not ask for a delay. The group asked the court earlier this month either to issue an order forcing Johnson to ask for a delay or instruct that a letter be sent to the EU on his behalf if he refused to.

Johnson sent an unsigned letter to the EU on Saturday requesting a delay but added another note in which he said he did not want a “deeply corrosive” Brexit extension, prompting some lawmakers to say he was seeking to frustrate the law. Johnson’s plan to put his Brexit withdrawal deal to the UK parliament on Saturday was derailed after lawmakers voted to withhold a decision on the deal, a move that forced him to seek a third postponement of Britain’s departure from the bloc. The exit is currently due to take place on Oct. 31. Scotland’s highest court, the Court of Session, has been waiting to rule on the matter pending developments up to Oct. 19. It is due to consider the challenge again on Monday.

“What I and … the other petitioners have instructed our lawyers to do is to seek a continuation of the case until the end of the week to keep a watching brief over matters,” Scottish National Party lawmaker Joanna Cherry told ITV on Sunday. “We don’t want the focus to be all on the court case. We want the focus to be on what is happening in Brussels, the negotiation for an extension.” Cherry said the way Johnson had gone about sending the letter, without signing it, was “immensely childish” and was “arguably frustrating the purpose of the act”. “The EU … have overlooked the childish tricks and are taking the extension at face value, taking it seriously,” Cherry said. “It will be for the court to comment or otherwise on whether they think what has occurred is a frustration of the act or a contempt of court.”

There’s the shadow banks again.

• Many Firms In China’s Third-Biggest Province Struggle To Pay Debt – S&P (R.)

Many privately held firms in Shandong, China’s third-biggest province by economic output, are struggling to repay short-term debt due to declining industry fundamentals, entangled cross guarantees and ill-managed investments, S&P Global Ratings said. China’s slowing economy and enforcement of environmental protection rules have pressured the profitability and cash flow of Shandong companies in over-capacity sectors including oil refining, petrochemicals, steel, aluminium and textiles, S&P said. “The Shandong economy is skewed toward gritty smoke-stack industries where companies are typically highly leveraged,” said Chang Li, China country specialist for S&P Global Ratings.

“We view the plight of Shandong POEs (privately owned enterprises) as indicative of China’s wider challenge: the difficulty of transitioning to a higher value-added economy, while managing high debt and slowing growth.” Private firms in Shandong are also frequent users of the cross guarantee, which has the potential to send one company’s liquidity problems reverberating through the credit system, the ratings agency said. Reuters reported in February, citing court rulings, that at least 28 private companies in Dongying, a hub for oil refining and heavy industry in Shandong, are seeking to restructure their debts and avoid bankruptcy, mainly due to souring loans that they guaranteed for other firms.

Places with mass protests in yesterday’s list: Chile, Ecuador, Lebanon, Barcelona, France, London, Puerto Rico, Hong Kong, Iraq.

New additions today: Guinea, Bolivia, Algeria, Haiti, Egypt, Pakistan, Brazil.

• Chile’s Deadly Weekend Of Fire As Youth Anger Ignites (R.)

Chile’s capital Santiago has been singed by fire. In riots sparked by anger over fare hikes, masked and hooded protesters have torched buses, metro stations, supermarkets, banks and the high-rise headquarters of a major energy firm. Around the city, flames and smoke mixed with tear gas and water cannon spray as armed forces mobilized on the streets for the first time in almost 30 years in a country that still shudders at the memory of military rule. Fare-dodging protests largely by school children and students exploded into violent riots on Friday.

Amid the looting, arson and clashes, thousands of residents of rich and poor neighborhoods alike also took to the streets to express a more widespread discontent over rising living costs and patchy public services that is boiling beneath the surface of one of South American’s wealthiest and most liberal economies. The demonstrations spread around the country over the weekend, and there was little sign of tempers cooling. “This is not a simple protest over the rise of metro fares, this is an outpouring for years of oppression that have hit mainly the poorest,” Karina Sepulveda, an anthropology student, told Reuters at a protest in central Santiago on Sunday as she banged a frying pan with a wooden spoon. “The illusion of the model Chile is over. Low wages, lack of healthcare and bad pensions have made people tired.”

Fire them all. And then sue them for wrongful death.

• Boeing Expresses Regret As Text Messages Plunge Company Into New Crisis (R.)

Boeing Co. said on Sunday that it regrets and understands concerns raised by the release of a former Boeing test pilot’s internal instant messages noting erratic software behaviour two years before deadly crashes of its 737 Max jet. The world’s largest plane maker, plunged into a fresh crisis over the safety of the banned 737 Max after Reuters reported the messages on Friday, also said it was investigating the “circumstances of this exchange” and regretted the difficulties that the release of messages presented for the U.S. Federal Aviation Administration (FAA).

The FAA on Friday ordered Boeing chief executive Dennis Muilenburg to give an “immediate” explanation for the delay in turning over the “concerning” document, which Boeing discovered some months ago. In the messages from November, 2016, then-chief technical pilot Mark Forkner tells a colleague that what’s known as the MCAS anti-stall system – the same one linked to deadly crashes in Indonesia and Ethiopia – was “running rampant” in a flight-simulator session. At another point, he says: “I basically lied to the regulators (unknowingly).” The messages prompted a new call in the U.S. Congress for Boeing to shake up its management as it scrambles to rebuild trust and lift an eight-month safety ban of its fastest-selling plane.

“We understand entirely the scrutiny this matter is receiving, and are committed to working with investigative authorities and the U.S. Congress as they continue their investigations,” Boeing said in its statement on Sunday. The instant messages prompted harsh reactions from several Democratic lawmakers in Washington, with Representative Peter DeFazio saying, “This is no isolated incident.” “The outrageous instant-message chain between two Boeing employees” suggests “Boeing withheld damning information from the FAA,” Mr. DeFazio, who chairs the U.S. House transportation committee, said on Friday.