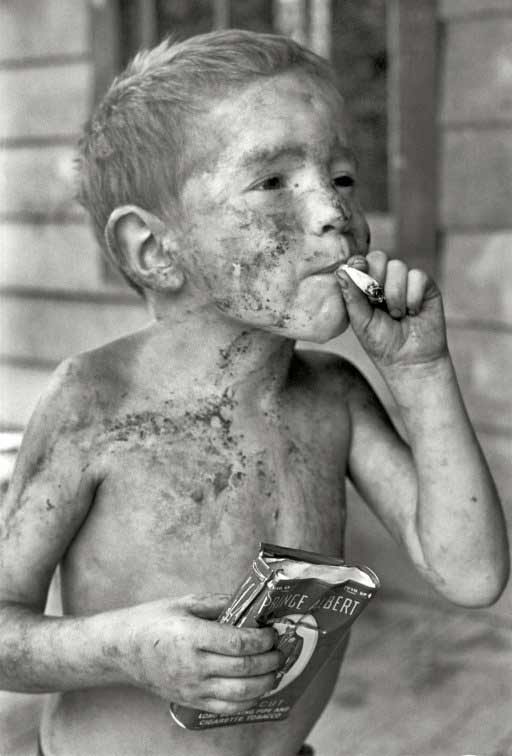

William Gedney Cornett family, Kentucky. Boy covered in dirt smoking cigarette 1964

Here’s part 2 (actually it’s part 1, I inadvertently mixed them up, sorry!, see first part here.) of Nicole’s interview at Vancouver’s PeakmomentTV, along with Laurence Boomert, about the practical aspects of decentralization and alternative currencies, issues that everyone, in our opinion, should at least give some very serious thought.

Because whatever happens, and whether you think that the economy will crash or you don’t, communities can make themselves much wealthier from an -increased – localization of their economies.

Money spent locally is simply worth a lot more than that spent in big box stores, where profits disappear to some unspecified location like the Caymans, a process that forces the locals to bring in ever more money from outside their communities, just to play even. That’s truly and simply a vicious circle process.

Somebody recently estimated that the value to a local economy of US foodstamps is about $1.70 for every dollar’s worth. And foodstamps are far from an ideal example, because they are to a large extent still spent in box stores and fast food chains. I’ve seen estimates of $4 as the actual worth per dollar spent, and spent again, and kept, inside a local economy.

That means we could spend twice what we do today on for instance a pair of shoes, and, provided they are produced locally and the shoemaker spends what we pay, in the local economy, still come out twice as rich. Which would allow us to “subsidize” opening a local shoe “factory”, create jobs, and create wealth for everyone in the process. And so on and so forth.

I realize very well that this is largely theoretical (unfortunately), and that there are many intricacies and questions, but that doesn’t make the principle any less true. Yes, it’s true that we can’t produce everything in our community, but it’s just as true that we can produce a whole lot more locally than we do today, and certainly in basic necessities.

It’s in essence just a matter of preventing the fruits of local labor from being relentlessly drained out of a community.

Which is such an insidious cycle that the more you think about it, the harder it gets to see why we insist on engaging in this behavior. From a purely rational – let alone emotional – point of view, it makes no sense at all. Buying items on the cheap at box stores makes us poorer, it creates unemployment, and we increasingly lose control over our own communities, and hence our own lives.

You don’t need a crisis to see why that this is not the way to go, and that, moreover, if you do go that way, – more – crises are inevitable. You can’t constantly suck wealth from a community and expect it to still continue to do well all the time, year after year. Localization provides a cushion against crises in the larger economy, while centralization and globalization inevitably induce crises.

With the interview below, I included an article from Nicole dated January 3, 2012, entitled: The Storm Surge of Decentralization, that fits in very well with the topic.

Once again, I’d like to point out that much more of this material, and much more in depth, is available in our 4-hour video download series Facing the Future, which you can order from the TAE Store (click here). The Automatic Earth truly and badly needs your support at this point in time, so please keep your orders and donations coming in order to allow us to continue bringing you the biggest possible picture. Thank you.

We give you bang for your buck, even as we understand the irony, given the above, in not being in your community. You’ll have to get the ideas and the knowledge somewhere. Facing the Future, or its 2013 “sister”, A World of Change, may well be the best money you have ever spent, dollar for dollar. You can even burn the files onto DVDs and share them with your neighbors. Though we would prefer, of course, that everyone order their own copies, if only as a token of appreciation for our work.

Smart Choices for Meeting the Coming Bust, part 2

“How do we cooperate and build a collaborative culture now?” asks Laurence Boomert, founder of The Bank of Real Solutions in New Zealand. Local currencies, barter cards, and Time Banks not only create alternatives when money systems collapse, they allow people to get entrepreneurial and innovative. He gives examples of people sharing physical spaces equipped with tools and project materials, as well as people sharing their time.

One example is a story of idle young people doing weekly projects, even taking wheelchair-bound folks for a day of surfing! Everyone was a winner, feeling good about themselves and more connected to their community. “It’s vital to get young people involved,” concurs Nicole Foss, senior editor of The Automatic Earth, “No more throw-away people.”

Nicole Foss : The Storm Surge of Decentralization (from January 3, 2012 )

Nicole: One of our consistent themes at TAE has been not expecting solutions to come from the top down. Existing centralized systems depend on dwindling tax revenues, which will dry up to a tremendous extent over the next few years as economic activity falls off a cliff and property prices plummet.

We have already seen cuts to services and increases in taxes and user fees, and we can expect a great deal more of that dynamic as central authorities emulate hypothermic bodies. In other words, they will cut off the circulation to the fingers and toes in order to preserve the body temperature of the core. This is, of course, a survival strategy, from the point of view of the core. But it does nothing good for the prospects of ordinary people, who represent the fingers and toes.

Centralized systems also depend on the political legitimacy that has been conferred upon them as a result of public trust in them to serve the common interest. This trust is rapidly breaking down in an ever-expanding list of places, as ordinary people realize that their interests have been betrayed in favour of the well connected.

Those who played fraudulent ponzi games with other people’s money, and were in the best position to know what could result, have been bailed out time and time again, while the little guy has been told to expect more austerity measures. Protest is inevitable as political legitimacy fades. We are already seeing it spread like wildfire, which is exactly what one would expect given that human beings internalize, reflect and act on the emotions of others. Collective social mood that turns on a dime is very much part of what it means to be human.

The job of national and international politicians in contractionary times is typically to make a bad situation worse as expensively as possible, as they attempt to rescue the dying paradigm that has conveyed so much personal advantage in their direction. That paradigm is one of centralization – the accumulation of surpluses from a broad periphery at the centre of power.

However, the wealth conveyors of the past are breaking down, meaning that the periphery that can be drawn upon is shrinking. As the periphery shrinks, the remaining region within the grip of power can expect to be squeezed harder and harder. ‘Twas ever thus. Rome did the same thing, squeezing the peasants for tithes until they abandoned their land and threw in their lot with the surrounding barbarians.

Even if politicians were informed of what is unfolding on their watch, understood it, and were minded to act in favour of the common man as a result (which is itself unlikely), there would be nothing they could do. They are too deeply embedded in a system which is thoroughly hostage to vested interests and characterized by an extreme inertia that would drastically limit their freedom of action.

Such systems cannot be responsive within the timeframe that would actually matter in a financial crisis, where the risk is cascading system failure, potentially in a short period of time. Everything they might do would be too complex, too expensive and too slow to do much good. If we expect top-down solutions we will be disappointed, and more to the point, we will be unprepared to face a period of rapid change. By the time we realize that the cavalry is not coming, it may well be too late to do anything useful.

This is disheartening only to the extent that we see no other way to address our predicament. Fortunately, other strategies exist beyond attempting to preserve the unpreservable. What we must do is to decentralize – to build parallel systems to deliver the most basic goods and services in ways that are simple, cheap and responsive to rapidly changing circumstance.

We will not, of course, be able to provide for the level of wants our societies were previously able to cater to, but we can provide the most basic necessities if we prepare in advance. The key aspect is to align our expectations with reality, because the essence of our psychological conundrum is our sense that business as usual is a non-negotiable state of affairs that must continue.

It will not continue because it cannot. Business as usual is only non-negotiable in the sense that reality will not negotiate, it will dictate, and we will have to live within its parameters.

These topics and many others are discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

There are many forms of decentralization – of opting out of the herd before it goes over the cliff. What they have in common is local resilience, a focus on local self-reliance and a thorough grounding in relationships of trust. As economies contract, so does the trust horizon.

Where there is no trust, systems cease to function effectively. Local initiatives work because they operate within the social space where trust still exists, and as they function, they reinforce those foundational relationships.

We need to be thinking in terms of local currencies, time banking (ie bartering skills), small transport networks, basic local healthcare, neighbourhood watch programs, adapting properties to multiple dwellings and permaculture initiatives that can rebuild soil fertility over time.

Also: rediscovery of local knowledge as to life conditions in the absence of current creature comforts, removing obstructive bylaws, small-scale food production free from structural dependencies on expensive and energy-intensive inputs, community power initiatives, communal water access, basic water treatment (like aid agencies employ in the third world), and perhaps intentional communities.

This is not meant to be an exhaustive list. There are many possibilities, and their relative importance will vary according to location and circumstances. So will their chance of success in a world that is path-dependent (ie where a society has collectively come from will shape how that society will respond to external stressors). The more we know about our region and our neighbours, the better our chances.

It is important to realize, however, that we are not going to be left in peace to do that which needs to be done. Solutions do not come from the top down, but interference does, because decentralization represents a threat to wealth concentration at the centre, and that is the goal of all human political systems.

Wealth is extracted from the periphery in favour of the centre, and the centre has an inexhaustible appetite. We are expected to pay our dues to that system, however onerous, not to try to reduce our own burden or that of our community.

As the centre seeks continually to solve the problems raised by excess complexity with more complexity, it also raises the cost (in terms of money and resources) of doing everything it touches. The periphery is then expected to cover the cost of the regulation that makes its own existence more precarious.

That regulation may even make life so expensive and difficult that parts of the periphery are driven towards a very marginal existence or out of an area altogether. Cumbersome, impenetrable and poorly communicated regulations are a recipe for raising revenues through fines for non-compliance, therefore we can expect worse governance to be implemented in the interests of the centre.

Fines may be completely disproportionate to the scale of the ‘offence’. Where such regulations are devised with no transparency or accountability, but plenty of discretion on behalf of enforcement personnel, they may also become an engine of corruption. This is a very common circumstance in many parts of the world.

I wanted to explore some examples of central authorities attempting to preserve wealth conveyance at the expense of attempts to adapt to a new reality, so that we might better understand what we are up against. See, for instance, the case of the desert dwellers of Los Angeles County, many of whom have been living self-reliant lives for decades.

They are being pursued by distant authorities for supposed nuisance violations, yet they are disturbing no one. Their ‘crime’ is the very self-sufficiency that allows them to exist independent of centralized systems, and therefore affordably. They are being told to connect to services such as mains power, at a cost of tens of thousands of dollars, or to destroy their own property and leave with nothing.

Local organic food initiatives are often more contentious. Industrial agriculture and food processing corporations are very powerful, to the point of having subverted regulatory mechanisms ostensibly geared towards the public good, but which now serve to safe-guard corporate profits and market share.

If groups of people are allowed to assert their independence by opting out of the corporate food machine, then they are less subject to external control, as well as ceasing to be profit providers. Organic agriculture therefore faces substantial regulatory barriers, and, increasingly, extreme over-reactions by central authorities.

See, by way of example, the case of Rawesome Foods in California. The cooperative had become a private club in order to be allowed to provide raw milk to those who choose to avoid the over-processed commercial variety. Nevertheless, they were subjected to a raid by armed police officers with guns drawn. Opting out of the system in order to share resources constitutes a threat, and that threat is being targeted.

Heavy-handed food regulation has descended on many small farmers in recent years. They face an uphill battle against the centralizing impulse. A regulatory regime that imposes huge costs on small operations makes it very difficult for them to compete. Some of the enforcement incidents are outrageous.

See for instance the film Farmageddon. Jim Puplava at Financial Sense Newshour did a Must Listen interview recently with its creator, which makes eye-opening listening to put it mildly.

Simply put, it is getting more and more difficult to operate outside of the corporate structure, particularly in relation to food. As Joel Salatin observed in a classic article on the subject of organic farming – Everything I Want to Do Is Illegal.

That means it is also getting more and more difficult in some places to purchase healthy food, as opposed to industrial food-like substances genetically-modified, tainted with all manner of chemicals, stuffed with addictive fillers such as high-fructose corn syrup, and vastly over-processed. The option to eat simple, wholesome, unprocessed, unadulterated, nutritious food is being whittled away, ironically on health grounds, just as demand for real food is skyrocketing.

It is also falling foul of spurious ordinances to protect the uniformity of neighbourhoods by defending them from vegetables growing where anyone can see them. Jail terms can be threatened for the crime of seeking seeking to be more independent. Occasionally the corporate world will explicitly complain that eating unprocessed food kills jobs, but it is more common to approach the issue tangentially rather than head on.

Although not yet a reality, direct taxation of home-produced food has been floated. Unfortunately this idea is all too plausible. States are indeed desperate for revenue, and the connections politicians have with large corporations gives them a direct incentive to protect the profit margins of those who feather their nests:

I heard a state legislator today on the radio talking about taxing home gardens that grow vegetables and other produce. This state is in serious economic trouble and they are looking at every possible source of revenue. The legislator stated that many home gardeners sell their produce at flea markets and do not pay any sales tax, that the produce grown even if not sold amounts to income and should be taxed.

In 2006, Britain was already contemplating taxing gardens, not yet for the vegetables they produce, but simply for the property tax revenue stream government could extract for any distinguishable positive feature of a property.

It is not that much of a stretch to imagine an attempt at taxing produce, although this would obviously be very difficult to enforce. Fortunately, there do exist places where the opposite approach is gaining a foothold. Long may they continue. And spread.

At an even more basic level, seed control threatens both independence and biodiversity:

Two thirds of the 1.2 billion poorest people in the world live in rural areas and are dependent on traditional agriculture. They do not have the financial means to buy commercially available seed or the input factors needed to cultivate them.

However, they often have long experience with, and a profound understanding of, local plant diversity within crops such as grains, potatoes, vegetables and fruit. By cultivating and developing these crops they are contributing to the preservation and development of global plant genetic diversity, which constitutes the basis for the world’s food production.

Legislation ostensibly aimed at food safety is being written vaguely and broadly enough to confer unaccountable discretion on enforcement agencies already in a state of regulatory capture. The very necessary processes of seed saving from year to year, and seed banking, are well on the way to being criminalized, for the sake of protecting profit margins:

But now the effort is to take over the whole game, going after even these small sources of biodiversity – by simply defining seeds as food and then all farmers’ affordable mechanisms for harvesting (collecting), sorting (seed cleaning) and storing (seed banking or saving) as too dirty to be safe for food.

Set the standard for “food safety” and certification high enough that no one can afford it and punish anyone who tries to save seed in ways that have worked fine for thousands of years, with a million dollar a day fine and/or ten years in prison, and presto, you have just criminalized seed banking.

The penalties are tremendous, the better to protect us from nothing dangerous whatsoever, but to make monopoly over seed absolutely absolute.One is left with control over farmers, an end to seed exchanges, an end to organic seed companies, an end to university programs developing nice normal hybrids, and an end to democracy – reducing us to abject dependence on corporations for food and gratitude even for genetically engineered food and at any price.

These topics and many others are discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

On the other side of the Atlantic, EU seed control regulations are also making it difficult, and potentially expensive, to protect biodiversity:

[In February 2008], in France, the independent seed-saving and selling Association Kokopelli were fined €35,000 after being taken to court by corporate seed merchant Baumaux. Their crime was selling traditional and rare seed varieties which weren’t on the official EU-approved list – and, therefore, illegal to sell – thus giving them an ‘unfair trading advantage’.

As the European Commission met this week to prepare new legislation for seed control, due in 2009, which will further restrict the geographic movement and range of crop varieties, this ruling will set a dangerous precedent.

Kokopelli, the non-profit French group set up in 1999 to safeguard endangered seed strains, may be driven out of existence by the fine. Their focus is biodiversity, food security, and the development of sustainable organic agriculture and seed networks in the ‘global south’.

They have created one of the largest independent collections in Europe – with over 2500 sorts of vegetable, flower and cereals. Other non-government seedbanks are held by large agro-industrial companies like Limagrain, Syngenta and Pioneer – and guess what their main interest is money rather than starving subsistence farmers.

You may think that in an era of mass extinction it would be a no-brainer that we need to protect biodiversity and the heritage of the crop varieties which have been build up over centuries… but no.

Since the 1970s, laws in the UK and Europe mean that to sell seeds, the strain needs to be registered and everything else becomes ‘outlaw’ seeds, illegal to sell. In the UK it costs 300 per year to maintain the registration and 2000 to register a ‘new’ one which all disadvantages smaller organisations.

Garden Organic in the UK run a Heritage Seed Library, and they get around the law by not selling ‘outlaw’ seeds, but getting individual gardeners to become ‘seed guardians’ who pass around seeds for free to other members of the Library. Unlike other seedbanks, seeds are not kept in cold storage, but are living species which are continually grown and allowed to adapt to new environmental factors.

Another law-busting approach is seed swaps – which in recent years have sprouted up and down the country. People freely share seeds for another year’s growing – a co-operative way of maintaining genetic diversity.

Controlling the supply of necessities in order to generate monopoly profits is not new and is not limited to food. See for instance the erstwhile Bolivian water privatization that resulted in a requirement to obtain a permit even to capture rainwater. If access to affordable options is limited, people are forced to pay the rentiers their monopoly profits.

Collecting rainwater has been illegal in many western US states as well, since water rights are separate to property rights:

Like many Western states, Colorado employs a complicated system of water use known as prior allocation, which severs water rights from other property rights.

The system preserves an 80-year-old compact Colorado signed with other Western states (as well as a separate federal pact with Mexico) divvying up runoff from the Colorado River. It means you can buy a parcel of land in Colorado, but the right to any precipitation that falls on that land likely belongs to someone two houses over, two counties over, or even in another state.

It might also belong to a state or local government, but it probably doesn’t belong to you. Under Colorado law, then, collecting rainwater or reusing “gray water” from bathtubs or washing machines violates the rights of someone who may not see that water for months.

The recent change to the law to allow small-scale rainwater collection is a belated improvement. Previously it was illegal even to sell rainwater collection equipment.

“I was so willing to go to jail for catching water on my roof and watering my garden,” said Tom Bartels, a video producer here in southwestern Colorado, who has been illegally watering his vegetables and fruit trees from tanks attached to his gutters. “But now I’m not a criminal.”

Ben Elton’s brilliant (Must See) 1990 play Gasping explored the trend towards corporate control of necessities, and illustrated the point, taken to its logical conclusion:

Lockheart Industries are looking for a new product to make them huge sums of money. Their whizz-kid Philip comes up with the superb idea of designer air – Perrier for the lungs, in the form of their patent-pending Suck And Blow machine. For a while, all is well, and the machines are a huge success, as sales massively exceed all projections.

But greed forces up the price of air until the oxygen industry becomes privatised. And if you can’t afford to pay, you have no right to live. Philip’s conscience ultimately wins through at the end of the day, and he takes extreme measures to rectify everything he feels he has destroyed.

The need to move towards a decentralized future, and the hazards that may await the first movers who run into a brick wall of regulation, remind me of a British nature documentary called The Tides of Kirawira.

The scenario is that every year the great migratory herds of the Serengeti must cross seasonal rivers, but these rivers are populated with giant crocodiles. Every year the herd must cross, but it doesn’t pay to be the first or only gazelle, zebra or wildebeest in the river. There is safety in numbers. Once the whole herd is on the move, the vast majority reaches the other side.

One line from this that strikes a chord in relation to the collusion between government and corporations to fleece the little guy is: “The crocs work as a team. It’s easier to tear chunks of flesh from the bone when someone is holding the other end.” Regulations against decentralization immobilize people for corporate interests to extract their pound of flesh.

In this instance, we need to emulate the herd animals and cross the river all at once. This is our best hope of achieving a simpler, decentralized future that might be workable, unlike our current industrial paradigm. We are going to have to live without cheap energy and cheap credit because they are going away. Decentralization is the only real option we have, but if we are to achieve what we need to achieve, we need to mobilize on a large scale rather than take only a few tentative steps into the crocodile infested waters.

These topics and many others are discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Smart Choices for the Coming Bust – Part 2