Dorothea Lange Salvation Army, Minna Street, San Francisco, California. Apr 1939

When I think about what an American president should do, and should be, the first thing that pops into my mind is (s)he should be a peacemaker. It would seem to be the no. 1 requirement for someone who’s the leader of the most powerful nation on the planet, and therefore the leader of the free world.

If that person is not a peacemaker, if (s)he is not focused on diffusing trouble and violence when and where they rear their ugly heads, how could the entire world possibly not be in a state of perpetual warfare? But here we are, there’s no such American leader in sight, and the prospects of one appearing anytime soon are zero.

Despite what anyone might say or claim, and many will do just that, today America makes war, not peace. A lot of people tell a lot of stories of how and why the American Empire is winding down, but they’re usually talking about the US dollar or energy resources or the rise of China.

For me, it’s the failure of the strongest power in the hood to maintain peace and calm, that tells the story in the clearest terms. If the leader doesn’t just not keep the peace, but actively ignites battles, all the rest are doomed to fight amongst each other until either the end of time, or the end of the leader’s prominence, whichever comes first.

Today, as we look at what goes on in Ukraine, Iraq, Syria, the Gaza Strip, there’s no way we can say the US hasn’t had a stoke-the-fire role in each of these conflicts, and in most cases has even been the main instigator. If you’re the biggest bully on the block, and you keep on bullying people, your days are numbered. It’s the law of the jungle.

Once you’re on top, expectations and responsibilities change. You just went from conquering the fort to holding the fort. And that change is very hard to make. Then again, it’s not as if no-one in 20th century American history ever had an idea of how it works. Robert Kennedy. Ron Paul.

But today American policy is made in the headquarters of Big Oil, the military-industrial complex and Wall Street. All of whom stand to profit hugely from chaos and bloodshed in foreign countries, and won’t shy away, never have, from putting American boots on the ground if they feel that will boost their profits. Boots worn by kids who know the army is their only chance at ever getting a real education, but never make it back home.

This was inevitable from the moment money was allowed to enter US politics, and it inevitably got stronger over time, until it culminated in the recent Supreme Court decision that there should be no effective limits to how much influence the rich can purchase themselves in Washington.

And if you’ve got the cash to buy yourselves the best writers and spin doctors in the world, you can maintain the illusion of democracy, of one man one vote, for a very long time. We all witness that principle on a daily basis. It can be done. People can be made to believe they live in a democracy, that they live in a nation and a political system where their voice counts and has real meaning, for long after they stopped having any voice at all.

It takes those same spin doctors, it takes control over all relevant media (and you decide what’s relevant), and it takes the best speech writers, but since money is no object, why worry, you can always buy better spinners and media and writers than anyone else.

You can’t lose. You have complete control. You can buy the government, the media, and what’s more, through the advertizing industry, you can buy the picture people have of them, and of you.

No matter what harm bankers and oil drillers and gunmakers engage in, they can make sure the public sees them in a favorable light. It may not seem that way at first blush, but remember, the banking/oil/military complex doesn’t need you to love them, only to not hate them, to not demand their downfall. And they’re very successful in that.

Who calls for Exxon to be swept from the face of the earth, or JPMorgan, or Boeing? Nobody. That’s all these firms need, given what’s left of the democracy we once aspired to be. As long as they have that, they can continue to manipulate prices for oil and gold and American homes and jobs as much as they want, for their own benefit and at the cost of everyone else.

America’s role as instigator in theaters like Ukraine – which can be blamed on Putin -, in Iraq – plenty of potential bad guys there – remains hidden thanks to the usual suspects, NY Times, WSJ, Bloomberg etc, let alone CNN and Fox, all of which claim independence, and all were long since purchased hook, line, sinker and fishing pond.

Even inside America, how are things different exactly? The first black president prefers Martha’s Vineyard to a visit to the first serious racial riots since he got the job. Not exactly hands on, to say the least. Or a peacemaker. More like just another neighborhood bully, or a ‘representative’ of that bully. Even worse.

Obama should have been in Ferguson at least a week ago. The fact that he didn’t go has me worried about all those places just like Ferguson, where jobs and conditions and prospects have gotten much worse for so many young black – and white – people, and where “authorities” seem only too eager to show of their power and their new federal government issued toys, which scream ‘overkill’ from all angles, and were purchased with borrowed money.

I wish I could say this is not going anywhere. It is going somewhere though. Just not anywhere you or I should want to go. But we have been pre-empted, what we think or feel no longer matters. The system decides, fully independent from what we as participants in this democracy are legally entitled to, and are supposed to do: guide our nations’ policies towards what we want, not what a handful of corporate interests want.

We lost that. We no longer have any influence on what Obama decides, or Congress, or the next president. It’s gone.

• Uh-oh: Stock Buybacks Are On The Decline (MarketWatch)

Everyone knows the stock market has skyrocketed in the past few years, but far too few understand why. No, it hasn’t been magic. It hasn’t been levitation. It hasn’t been the natural state of affairs. It’s been supply and demand. U.S. corporations have been spending hundreds of billions of dollars a year buying in their own stock, simultaneously increasing the demand for the stock and reducing the supply. And this matters right now because…er…they just stopped. The amount spent on share buybacks plunged by more than 20% last quarter, strategists at SG Securities calculate. Even though stock prices in the Standard & Poor’s 500 were on average 25% higher than they were a year ago, the amount spent on share buybacks actually fell. As SG notes, “US corporates (have) been the major net buyer of US equity in recent years, purchasing over $500 billion of stock last year alone.” But, notes the bank, this happy trend may be drawing to a close.

There are two reasons. The first is that the federal deficit is falling. Without getting too technical, economists note that there is an historical and mathematical connection between federal deficits and corporate profits. The booming deficits around the financial crisis were followed by booming corporate profits. And corporations used a lot of that money to buy up stock. As deficits decline as a share of the economy, so, it is likely, will corporate profits. The second reason has to do with the winding down of the Federal Reserve’s “quantitative easing” policy. From 2009 through 2013, the Fed effectively printed money and used it to buy up long-term government bonds. Bonds work like seesaws: When the price rises, the yield falls. The Fed’s actions drove up the price of Treasury bonds, and drove down the yield — or interest rate. As the interest rate on Treasury bonds fell, the interest rate that investors demanded on long-term corporate bonds also fell. It became cheaper and cheaper for corporations to borrow money.

The average yield on Moody’s-rated BAA corporate bonds — meaning those at the bottom rung of investment grade — is now below 5%, levels not seen for any length of time since before the Vietnam War. Drop hamburger on the kitchen floor and your golden retriever will eat it. Drop free money on the bond market and corporations will behave about the same. And so they have.

How sad would you like it? How much can you bear?

• A True Picture of What’s Dragging on the American Economy (WolfStreet)

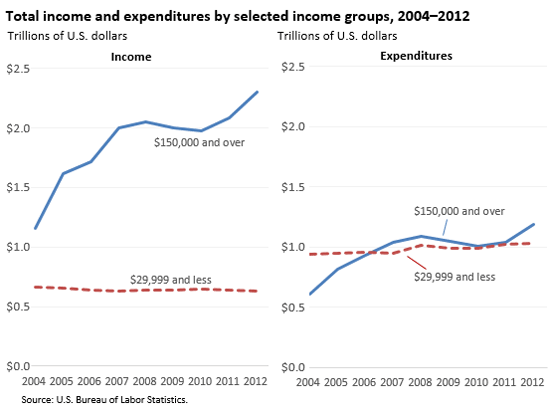

The Bureau of Labor Statistics released a study to confirm what has become the biggest economic problem in the US: those at the lower-income levels, those who’ve gotten ripped off by inflation and wages, have become terrible consumers in an economy dependent on consumer spending. The report found that the average income of households in the top 20% grew by $8,358 per year from 2008 through 2012. But the lowest 20% saw their already minimal incomes get whittled down by $275 per year. The earnings of the second and third quintiles increased only $143 and $69 per year. So for the bottom 60% combined, there really wasn’t any improvement. And their spending patterns? The lowest quintile cut their spending by $150 per year in total. They cut where they could: in seven categories, totaling $490 per year, mostly on apparel, entertainment, housing, and personal care.

And they increased spending where they had to: in seven other categories totaling $340, topped by “cash contributions” such as alimony, “miscellaneous,” and healthcare. This principle of cutting back where they can and spending more where they have to, in order to make their shrinking ends meet, has been dissected by Gallup, which found that consumers are “straining against rising prices on daily essentials” and are cutting back on things they want to buy. But not everyone has this problem. The top two quintiles raised their expenditures by $1,348 and $2,365 respectively. And that’s where the entire increase in consumer spending since 2008 has come from. But over the long run – and that’s now – the math just doesn’t work out. This is the picture of that distortion, the one that is dragging down the American economy:

Twouble in the house!

• BOE Split On Interest Rates Reopens Prospect Of A Rise In 2014 (Guardian)

The first increase in interest rates from the Bank of England since 2007 has moved a decisive step closer after two members of Threadneedle Street’s key policy committee broke ranks and voted for dearer borrowing. Minutes of the meeting of the Bank’s monetary policy committee meeting show that two of the nine members – Martin Weale and Ian McCafferty – called for rates to be pushed up by a quarter point to 0.75%. Although the other seven members of the MPC said weak earnings growth, below-target inflation, and the fragile finances of some households warranted keeping rates unchanged, the August meeting was the first time since 2011 that the MPC has not voted unanimously on rates.

The City had been expecting another 9-0 vote in favour of keeping borrowing costs at 0.5% and the pound rose by half a cent against the dollar shortly after the minutes were published, as dealers anticipated more MPC members joining Weale and McCafferty over the coming months. According to the minutes, the two dissenting MPC members said the state of the economy justified an immediate rise in the bank rate. “These members noted that the continuing rapid fall in unemployment alongside survey evidence of tightening in the labour market created a prospect that wage growth would pick up. They noted that it was possible that wages were lagging developments in the labour market to some extent. If that were true, wages might not start to rise until spare capacity in the labour market were fully used up. Since monetary policy, too, could be expected to operate only with a lag, it was desirable to anticipate labour market pressures by raising Bank Rate in advance of them.”

Simple, to the point.

• How Your Pension Fund Became a Casino (Yves Smith/Bloomberg)

In September 1974, Congress passed a law aimed at ensuring that U.S. companies could fulfill the vast pension promises they had made to millions of employees. Forty years later, that law is greatly in need of reinterpretation. Known as the Employee Retirement Income Security Act, the law has been widely hailed as a success. It created standards for managing private pension funds that professionalized their operations — and that public pension funds, which invest on behalf of government employees, have also chosen to adopt. In 1978, though, the Labor Department made an adjustment that has had vast consequences. Responding to political pressure and influenced by new academic thinking on portfolio theory, it reinterpreted the so-called prudent-man rule of fiduciary duty. Fund managers would be judged not on the risk of their individual investments, but on the risk profile of their investment portfolio as a whole.

The result was that the pension funds, which had long been limited to safe assets such as corporate bonds and Treasury securities, could put some money into riskier investments such as stocks and venture capital — on the assumption that diversification, both by asset class and within each asset class, would reduce risk in the broader portfolio. Unfortunately, over-reliance on the power of diversification has led fund managers to be less attentive to the hazards of particular investments. Consider two examples: private-label mortgage securities, which are issued without government guarantees, and private-equity partnerships, which acquire public companies with the aim of restructuring them and selling at a profit. Seduced by AAA ratings, fund managers often ignored the extraordinary complexity of mortgage securitizations, which typically involve hundreds of pages of documents defining the circumstances under which different investors get paid or suffer losses. As a result, they failed to notice some significant pitfalls.

• Fannie Mae Sledgehammers Housing Forecasts To Smithereens (WolfStreet)

The National Association of Home Builders just released its Housing Market Index [..] Home builders have become an optimistic bunch in 2012. As housing starts were ticking up a smidgen, builder optimism as measured by the HMI began to surge, and except for a couple of dives, including during the harsh winter this year, has continued to surge. The HMI has soared even as the puny growth in housings starts petered out in 2013. And they remain mired down at about one-third of the level where they’d been during the bouts of peak optimism. But the NAHB’s electronic ink wasn’t even dry, so to speak, when the ever optimistic Fannie Mae, the bailed-out government mortgage giant, came out with its August 2014 forecast, in which it took a sledgehammer to its prior forecasts. Home sales have been plunging for months, after post-crisis optimism peaked mid last year. And Fannie Mae is adjusting to an ugly reality.

It slashed its 2014 forecast for construction starts for single-family homes to 642,000 units, down 8% from its July forecast of 696,000. But it has been slashing its forecasts all along: in January, it had still seen 768,000 single-family housing starts in 2014. And in August last year, it had forecast 876,000 starts. It has now chopped 27% off that forecast. Same thing with home sales. Fannie Mae cut its forecast for new single-family home sales to 431,000 units, down 11% from last month, down 21% from its forecast in January. August last year, it still believed that 588,000 new single-family homes could be sold in 2014. Now it has axed that by a brutal 36%. The current forecast is about flat with the 429,000 units actually sold last year. But this is only August. There are four more months to go, and at the current rate of slashing forecasts to bring them in line with reality, it doesn’t look good for the year.

Fannie Mae then took its sledgehammer to its forecast of existing home sales. Only 4.91 million units will change hands this year, it said, down from 4.97 million in July, down from 5.18 million in January, and down from 5.26 million in August last year. The current forecast is already 3.5% below actual sales last year. And total home sales? Fannie cut its forecast for 2014 to 5.34 million units, from 5.45 million last month, from 5.70 million in January. The forecast is now down 9% from the 5.85 million it forecast in August 2013, and it’s 3.4% below last year’s actual sales.

Germany never had a housing boom. Now they do.

• Germany Sees Dizzying Rise In Housing Prices (CNBC)

As soon as someone mutters the words London property, the word “bubble” is never far away. London house prices displayed a jaw-dropping 20% growth year-on-year in July– even though last week’s RICS indicator showed that the housing market is pausing for breath. Bank of England (BoE) Governor Mark Carney has sounded a warning on tougher mortgage rates and the expectation of higher rates. But London isn’t the only place which is seeing a dizzying increase in property prices. Look no further than across the channel – to the euro zone’s economic powerhouse – Germany. Major cities like Frankfurt, the financial capital, Munich with its famous beer gardens and proximity to the Alps and Stuttgart, the home of Mercedes and Porsche, are becoming increasingly attractive as a place to live and work. Germans from rural settings and immigrants are flocking to the cities.

But like in London, an equally potent driver of the property market in Germany is the good old “search for yield”. “Near zero interest rates in the euro zone make sense for the region but not for Germany. The economy has been relatively strong and the interest rate policy is disjointed from economic reality,” Patrick Armstrong from Plurimi Global Macro Fund told CNBC. “With 10-year Bund yields at 1%, free money will have to flow towards property at some point. Rental yields of 4-5% are attractive with current interest rates, and German property is the least expensive per square meter in Western Europe.” Rolf Buch, CEO of Deutsche Annington, Germany’s largest private-sector residential real estate company, echoed these comments when he told CNBC the German housing market is in a “sweet spot” because of stable incomes and the benefit from low interest rates.

Dodges US court order. Pariah?

• Argentina To Bring Defaulted Debt Under National Law (Reuters)

President Cristina Fernandez said on Tuesday her government will move to service its defaulted debt in Argentina or allow bondholders to swap their bonds for new bonds governed by national law in order to get around a U.S. court order. Argentina slid into default last month after a New York court blocked an interest payment owed to holders of debt that was restructured after the country’s record 2002 default. The judge said Argentina could not pay that debt until it had also settled with a group of funds that had rejected the restructuring deal and were demanding full payment.

Fernandez’s announcement killed hopes that Argentina might soon reach a deal with holdouts, enabling it to exit default. In a televised speech, Fernandez said her government would send a bill to Congress to remove Bank of New York Mellon as the exchange bondholders’ trustee and replace it with Argentina’s Banco Nacion. Banco Nacion would open up an account at the country’s central bank to enable Argentina to service its exchange debt there. Under the proposal, holders of bonds resulting from the 2005 and 2010 debt restructurings could also choose to swap their bonds for notes with “identical terms and financial conditions, and with equal nominal value” under Argentine law.

Ha!

• Bank of China Doubles Money for Bad Loans as Growth Slows (Bloomberg)

Bank of China Ltd. more than doubled its money set aside for bad loans as profit growth cooled to the slowest pace in five quarters on weakness in the economy. Provisions for potential soured debt climbed to 12.7 billion yuan ($2.1 billion) in the second quarter, up 116% from a year earlier, based on half-year figures released by the Beijing-based company yesterday. Net income rose 8.5% to 44.4 billion yuan, the earnings statement showed. The nonperforming loans of China’s fourth-largest bank surged to 85.9 billion yuan, the highest in more than five years, as companies struggled with repayments in an economy at risk of the weakest full-year growth since 1990.

The nation’s lenders are already trading at the cheapest price-to-earnings valuations of global banks. “The biggest concern for Bank of China is their asset quality,” Chen Xingyu, a Shanghai-based analyst at Phillip Securities Research, said by phone. “The trend is very obvious. We expect nonperforming loans to continue rising in the next two quarters.” The bank’s net income compared with the 44.9 billion-yuan median of 10 estimates in a Bloomberg News survey. Its net interest margin, a measure of lending profitability.

Sanity.

• Latvia Evokes 1914, Urges End To ‘War Of Sanctions’ Before Economies Ruined (RT)

The “right steps” politicians in the West and Russia are now taking against each other are very similar to what was happening before World War I, Latvian MEP Andrejs Mamikinsh warned EC President Jose Manuel Barroso in a letter Tuesday. It’s crucial to stop reciprocal sanctions before they throw people into poverty and ruin the economies altogether, the European Parliament member wrote. “In 2014 exactly 100 years have passed since the beginning of World War I that killed millions of people and left Europe in ruins. On the eve of that war similar processes occurred when countries took “the right” steps against each other and eventually were not able to stop. It is doubtful that in the end of that war anyone remembered for what good intentions it had started,” Mamikinsh wrote in his letter.

These would be ordinary people, not politicians, who’ll be hit first and hardest by a so called “risky poker” played by politicians in the West and Russia, the Latvian MEP, added. Latvia is expected to suffer the most from the tit for tat sanctions imposed by the West and Russia, Mamikinsh said. Further escalation of a “sanctions war” would erode about 10% of Latvian GDP, which means thousands of people could be left out of work with shrinking living standards.

Everyone seems to want Ukraine to fail. It’s a power game.

• Ukrainian Steel, Coal Producers Facing Shutdown as Result of Conflict (MM)

We have viewed the unfolding violence in eastern Ukraine on our TV screens as a humanitarian disaster in the making. An estimated three quarters of a million Ukrainians have fled across the border into Russia, many living in tents in 95 temporary refugee camps. A further 175,000 are said to be displaced westward into Ukraine. Economically, the damage to Ukraine will take much longer to evaluate. For the steel and coal industries, the situation is deteriorating as the conflict intensifies. This week Reuters reported that after months of fighting, extensive damage has been sustained to the infrastructure of Ukraine’s industrial heartland and considerable disruption to supply networks, leading to a 12% year-on-year fall in industrial output in July.

Last week, it emerged that around half of the 115 coalmines in Ukraine, Europe’s second-largest coal producer, had halted production entirely. Shelling of power stations and transmission lines has halted production at Avdiivka coke plant, which produces 40% of Ukraine’s coke. The same loss of power has led to the full shut down of production at Yenakiieve Steel, a leading producer of steel billet. Enakievskiy Koksohimprom and Khartsyzsk Pipe is one of Europe’s largest large-diameter pipe mills according to the owners Metinvest. Metinvest controls about 50% of Ukraine’s steel market and steel makes up about 15% of the Ukrainian economy, which last year was the fifth-largest exporter in the world, according to a separate Reuters report. Tensions in eastern Ukraine have led to outright production disruptions as the year has gone on resulting in a 7% fall in output in the first half of 2014.

How many black people on the jury?

• Ferguson Police Shooting Grand Jury Probe Starts Today (Bloomberg)

A grand jury will begin hearing evidence tomorrow in the police shooting death of Ferguson, Missouri, teenager Michael Brown, as violent clashes continued in the St. Louis suburb. Witnesses are scheduled to appear before the grand jury, Ed Magee, a spokesman for St. Louis County Prosecuting Attorney Bob McCulloch, said in a telephone interview today. The shooting sparked more than a week of violent protests in Ferguson. The state grand-jury probe comes as federal officials are starting a civil-rights’ investigation into the death of the unarmed black teenager. President Barack Obama has ordered U.S. Attorney General Eric Holder to go to Ferguson and meet with FBI agents and Justice Department lawyers handling the probe into the circumstances of Brown’s death. Police fired tear gas at protesters and 31 people were arrested in Ferguson last night after demonstrators refused to leave a section of the city that has been the epicenter of protests.

Brown, 18, was killed Aug. 9 by Darren Wilson, a white Ferguson police officer, after being stopped on a city street, Police Chief Thomas Jackson said earlier. Wilson has the right to testify before the grand jury, Magee said. It’s not clear how long the proceedings will take or how many witnesses will be called, he said. Greg Kloeppel, Wilson’s lawyer, declined in a telephone interview to comment on the grand jury. Kloeppel is chief legal counsel for a local chapter of the Missouri Fraternal Order of Police. Evidence is still being collected and the probe is “far from being finished,” so there’s no timeline for the case, Magee said yesterday. The grand jury must decide whether Wilson violated the law by shooting the teenager and whether he should face charges ranging from manslaughter to murder, said Gordon Ankney, a former assistant county prosecutor who now does criminal defense work in St. Louis.

That’s what I said yesterday.

• Go to Ferguson, Mr. President (Bloomberg Ed.)

Once upon a time, there was a man who gave moving and important speeches about race. He was careful to respect history, to call out injustice, to acknowledge competing anxieties — and, crucially, to elucidate a path forward. His speeches touched Americans of every color and background and gave them hope that it is possible to make progress in their great national project of creating a more just and equal society. That man was Barack Obama. As a little-known Senate candidate a decade ago, he offered a grand vision of a united America; four years later, as the Democrats’ leading presidential candidate, he offered a more personal reflection. Obama’s unique ability to both articulate and embody the equal-opportunity ideal of America helped him become the country’s first biracial president. Since he has taken office, however, this Obama has mostly gone missing. It has never been more manifest, or painful, than these past weeks in Ferguson, Missouri.

As local and state authorities bumble their way through the crisis that erupted over the police shooting of 18-year-old Michael Brown, Obama has said little of note. Yesterday he held a news conference in which he checked all the necessary boxes: He condemned violence and looting, endorsed the rights of protesters, acknowledged racial grievances with the criminal justice system, and suggested that Americans “use this moment to seek out our shared humanity.” Then he hopped on Air Force One to resume his vacation. Obama was right to recognize the magnitude of this moment. But he seems not to realize that he himself has to be the one to seize it. It is his job as president, of course, and it also happens to be a task that almost perfectly matches his talents and demeanor. Attorney General Eric Holder will be in Ferguson [today]. But the president should go, too – if not tomorrow then in the days or weeks ahead.

Yikes!

• Under What Conditions Can The US Army Engage Citizens (Zero Hedge)

With events in Ferguson deteriorating from day to day, despite the arrival of the Missouri National Guard, some have asked what further escalation steps are possible.

As a reminder, the reason Missouri governor Jay Nixon resorted to the aid of the National Guard is due to the limitations imposed by the Posse Comitatus Act which, broadly, seeks to limit the powers of Federal government in using federal military personnel, i.e., the Armed Forces of the United States, to enforce state laws. The Act does not apply to the National Guard, nor to the US Coast Guard, although the former will likely not see much practical use in Missouri.

However, as usually happens, there are loopholes and the best place to uncover these is in a 132-page primer conveniently released by none other than the US Army back on April 21, known simply as ATP 3-39.33 “Civil Disturbances.” The primer begins with the umbrella statement:

Civil unrest may range from simple, nonviolent protests that address specific issues, to events that turn into full-scale riots. Gathering in protest may be a recognized right of any person or group, regardless of where U.S. forces may be operating. In the United States, this fundamental right is protected under the Constitution of the United States…

“Protected” it may be, but as usual, the interpretation of the Constitution is in the eye of the beholder, or more appropriately, gun holder. Because shortly thereafter we further read the following:

The Constitution of the United States, laws, regulations, policies, and other legal issues limit the use of federal military personnel in domestic support operations. Any Army involvement in civil disturbance operations involves many legal issues requiring comprehensive legal reviews. However, federal forces are authorized for use in civil disturbance operations under certain circumstances.

What circumstances? For the answer we turn to section, 2-8, whose provisions may soon become applicable to Ferguson and/or other municipal regions, should the rioting in the St. Louis suburb escalate further.

• US Spends Millions To Blow Up Its Own War Machines (Reuters)

Last week was a weird one for American military hardware. In the United States, Mine-Resistant Ambush Protected vehicles (MRAPs), AR-15s and camouflage body armor all made an appearance on the streets of a suburb in the heartland, helping to give a tense situation the push needed to turn into a week of riots. American citizens in Ferguson, Missouri, feeling they were being occupied by a foreign army, rather than their friendly neighborhood cop on the beat. Riot police stand guard as demonstrators protest the shooting death of teenager Michael Brown in Ferguson, Missouri.

MRAPs didn’t get a better rap overseas, either. In what’s still being called Iraq — at least for the sake of convenience — the U.S. Air Force has resumed bombing missions in the northern part of the “country.” The aim of the missions is stated as being the defense of a minority group known as the Yazidis, who practice a religion unique to themselves and are under threat by the Islamic State, a jihadi group that controls a large chunk of territory in Syria and Iraq. The extremist cadre Islamic State — which has declared itself to be the new caliphate, representing God’s will on earth — has had an incredible string of military successes over the last few months. They’ve taken a lot of territory. They’ve slaughtered a lot of people, including civilians. They’ve imposed what they say is Islamic law — though many Islamic scholars would beg to disagree. And Islamic State’s captured an enormous amount of U.S. weaponry, originally intended for the rebuilt Iraqi Army.

You know — the one that collapsed in terror in front of the Islamic State, back when they were just ISIL? The ones who dropped their uniforms, and rifles and ran away? They left behind the bigger equipment, too, including M1 Abrams tanks (about $6 million each), 52 M198 Howitzer cannons ($527,337), and MRAPs (about $1 million) similar to the ones in use in Ferguson. Now, U.S. warplanes are flying sorties, at a cost somewhere between $22,000 to 30,000 per hour for the F-16s, to drop bombs that cost at least $20,000 each, to destroy this captured equipment. That means if an F-16 were to take off from Incirclik Air Force Base in Turkey and fly two hours to Erbil, Iraq, and successfully drop both of its bombs on one target each, it costs the United States somewhere between $84,000 to $104,000 for the sortie and destroys a minimum of $1 million and a maximum of $12 million in U.S.-made equipment.

Why do we do it?

• Earth Overshoot Day: We Already Used Up A Whole Year’s Resources (Guardian)

Humans have used up the natural resources the world can supply in a year in less than eight months, campaigners have warned. The world has now reached “Earth overshoot day”, the point in the year when humans have exhausted supplies such as land, trees and fish and outstripped the planet’s annual capacity to absorb waste products including carbon dioxide. The problem is worsening, with the planet sliding into “ecological debt” earlier and earlier, so that the day on which the world has used up all the natural resources available for the year has shifted from early October in 2000 to August 19 in 2014.

In 1961, humans used only around three-quarters of the capacity Earth has for generating food, timber, fish and absorbing greenhouse gases, with most countries having more resources than they consumed. But now 86% of the world’s population lives in countries where the demands made on nature – the nation’s “ecological footprint” – outstrip what that country’s resources can cope with. The Global Footprint Network, which calculates earth overshoot day, said it would currently take 1.5 Earths to produce the renewable natural resources needed to support human requirements. The network warned that governments that ignore resource limits in decision-making are putting long-term economic security at risk.

repaet of what I’ve said often.

• The Powerful ‘Group Think’ on Ukraine (Robert Parry)

When even smart people like economist Paul Krugman buy into the false narrative about the Ukraine crisis, it’s hard to decide whether to despair over the impossibility of America ever understanding the world’s problems or to marvel at the power of the U.S. political/media propaganda machine to manufacture its own reality. On Monday, Krugman’s New York Times column accepts the storyline that Russia’s President Vladimir Putin instigated the Ukraine crisis and extrapolates from that “fact” the conclusion that perhaps the nefarious Putin did so to engineer a cheap land grab or to distract Russians from their economic problems.

“Delusions of easy winnings still happen,” Krugman wrote. “It’s only a guess, but it seems likely that Vladimir Putin thought that he could overthrow Ukraine’s government, or at least seize a large chunk of its territory, on the cheap — a bit of deniable aid to the rebels, and it would fall into his lap. … “Recently Justin Fox of the Harvard Business Review suggested that the roots of the Ukraine crisis may lie in the faltering performance of the Russian economy. As he noted, Mr. Putin’s hold on power partly reflects a long run of rapid economic growth. But Russian growth has been sputtering — and you could argue that the Putin regime needed a distraction.”

Or you could look at the actual facts of how the Ukraine crisis began and realize that it was the West, not Russia, that instigated this crisis. Putin’s response has been reactive to what he perceives as threats posed by the violent overthrow of elected President Viktor Yanukovych and the imposition of a new Western-oriented regime hostile to Moscow and Ukraine’s ethnic Russians. Last year, it was the European Union that was pushing an economic association agreement with Ukraine, which included the International Monetary Fund’s demands for imposing harsh austerity on Ukraine’s already suffering population. Political and propaganda support for the EU plan was financed, in part, by the U.S. government through such agencies as the National Endowment for Democracy. When Yanukovych recoiled at the IMF’s terms and opted for a more generous $15 billion aid package from Putin, the U.S. government ratcheted up its support for mass demonstrations aimed at overthrowing Yanukovych and replacing him with a new regime that would sign the EU agreement and accept the IMF’s demands.

Sad.

• A Time To Cull? The Battle Over Australia’s Wild Horses (Guardian)

The last mare in Dead Horse Gap lies dying on a pure-white bed of snow. Her ears twitch as we approach, but she’s too weak to lift her head. Her rib bones are a scaffold now for her chocolate brown coat. About her, her fellow mob lie in various stages of decay, food for fat, shiny foxes. Crows line the pretty snow gums above. This mare, like her mates, has starved here in Australia’s alpine winter landscape for the unhappy chance of being in the wrong place at the wrong time. She was caught in a mountain pass when the late snow arrived, and nothing can save her now. And by her eye, she knows it. This scene is, as the poet Tennyson put it, “nature, red in tooth and claw”. In another life, a mare like her could have been petted and cosseted and dressed in a pink rug by a teenage girl who would have whispered love-torn secrets into that twitching ear. In this story, the foxes will have it.

It’s a bad year for Australia’s wild horses caught in the upper reaches of the Australian Alps. This mountain pass between New South Wales and Victoria is not called Dead Horse Gap for nothing. But it could get worse for the wild horses as national parks in Victoria and NSW decide how to manage brumby numbers, which they describe as out of control. Both states are considering “wild horse management plans” for the next five years. Both will address how to cull brumbies with all methods on the table, in an effort to protect Australian habitats and species. They may be dying up top, but down the mountain, on the open plains of the now-deserted gold mining village of Kiandra, a mob of 24 fat and shiny brumbies tramps through the appropriately named Racecourse creek. The creek forms part of the Eucumbene catchment, delivering water to 2.1 million people downstream.

These animals are magnificent as they run through the snow against a pink evening sky. When we follow their tracks, they run along a watercourse, leaving deep prints in a spongy, unstable wetland, before escaping from us to higher ground. As we follow, the scene resembles a Lord of the Rings landscape of soft grassland studded by pools fringed with the “super moss”, sphagnum. Problem is, this swampy stuff is heritage-listed. Sphagnum is highly prized for holding a lot of water and carbon. It is the breeding ground for the endangered corroboree frog, a black and fluoro smudge that would fit on the end of a teaspoon. The surrounding environment is habitat for other endangered species such as the pygmy possum, the broad-toothed rat, the mountain she-oak skink and the guthega skink.

Sad.

• Lions Hunted to Preserve Rhinos in South African Circle of Life (Bloomberg)

When U.S. television host Melissa Bachman posted a photo on Facebook of herself smiling and holding a rifle above the head of a lion she had shot, the response was instant. Users of the social network vilified Bachman, 30, who also killed a Nyala antelope last year on a trip to South Africa, as “evil,” a “low-life” and a “disgusting excuse for a human being.” The hunting trip was part of South Africa’s 12 billion rand ($1.1 billion) per year game ranching industry, which is growing at 10% annually, according to Barclays Africa Group. The industry also responsible for boosting the country’s large mammal population, a measure that excludes animals such as rodents, to 24 million, the most since the 19th century, and up from 575,000 in the early 1960s, Wouter van Hoven, an emeritus professor at the University of Pretoria, said in an interview last month. By contrast animal numbers in Kenya, which bans hunting, have plunged.

“We’re made out to be the bad guys,” said Peter Oberem, 60, a veterinarian turned game rancher, as he pointed to three adolescent rhinos being raised on his farm in northern South Africa, funded by hunting. “We put everything we earn back into conservation. Hunters pay us to save the rhino and repopulate Africa with native species.” Game ranching, the private-ownership of wildlife for hunting, tourism and meat production that’s been allowed by law since 1991, has split conservation groups. Some, such as London-based Save the Rhino, say the money raised from hunting is vital in the fight against poaching. The Massachusetts-based International Fund for Animal Welfare, says it’s hypocritical to conserve animals by killing them, and that turning wildlife into a commodity is bad for natural ecosystems.

Kenya, which focuses on eco-tourism, has lost 80% of its wildlife since it banned hunting almost 30 years ago, said Mike Norton-Griffiths, an academic writing for London’s Institute of Economic Affairs, a social policy research group. The country’s elephant population has dropped 76% since the 1970s while rhinos are down 95%, said Stephen Manegene, Director Wildlife Conservation in Kenya’s Department of Environment and Natural Resources. Foreign hunters, about 60% of whom came from the U.S., spent $118.1 million on licenses to hunt in South Africa in 2012, figures from the Pretoria-based Professional Hunters’ Association of South Africa, known as PHASA, show. Hunters target animals ranging from the Big Five — rhino, lion, leopard, elephant and buffalo — to plains game, a term for antelopes. The hunting of endangered animal species, such as the black rhino, is subject to quotas.

Home › Forums › Debt Rattle Aug 20 2014: Obama Fails As Schoolyard Bully