Banksy Bataclan emergency door 2018 (was stolen in 2019, recovered yesterday)

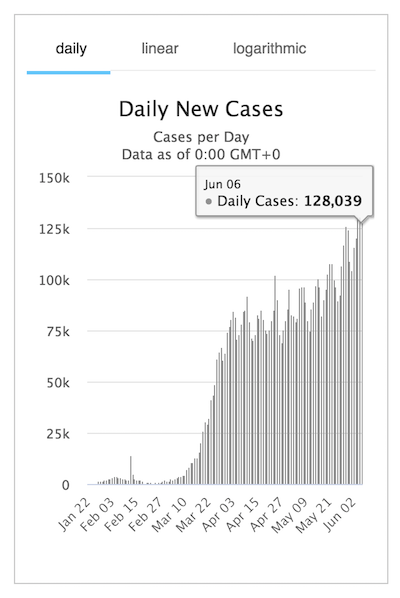

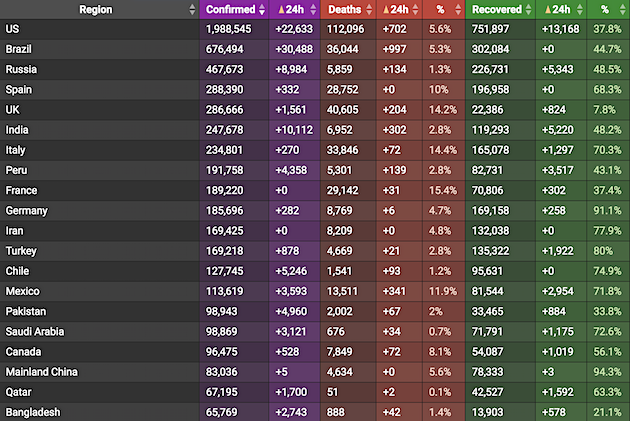

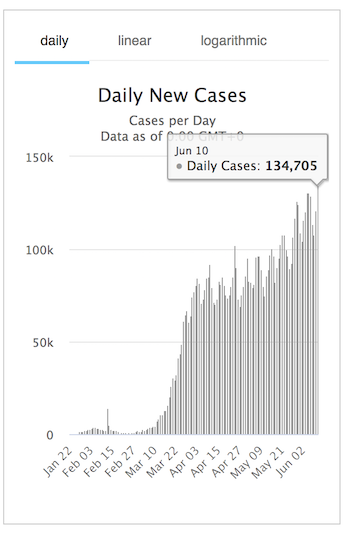

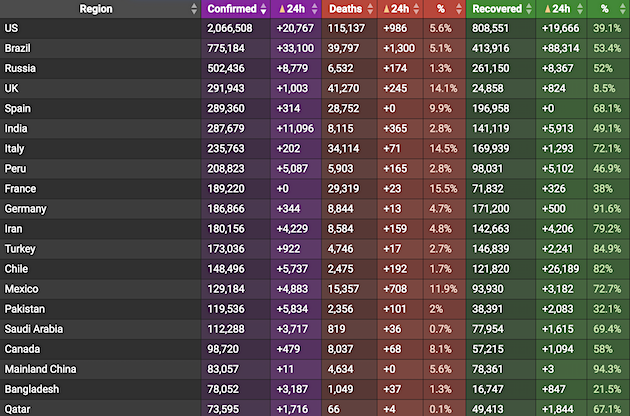

Worldometer reports new cases for June 9 (midnight to midnight GMT+0) at + 134,705. A new record.

My count from about 6 am EDT to 6 am EDT is about + 138,341 cases.

New deaths also rose from + 5,032 to + 5,165 (my count + 5,348)

US passed 2,000,000 cases.

New cases past 24 hours in:

• US + 20,852

• Brazil + 33,100

• Russia + 8,779

• India + 12,375

• Pakistan + 5,834

• Chile + 5,737

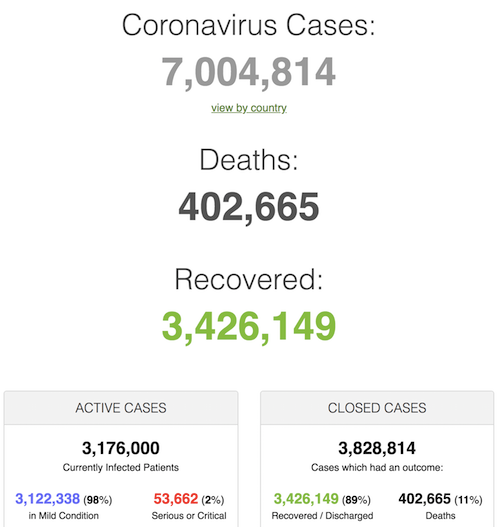

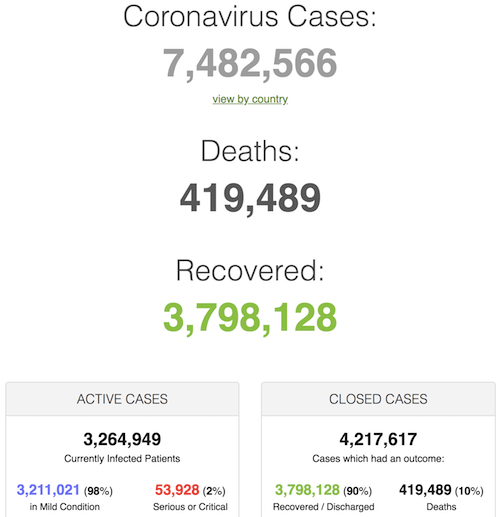

• Cases 7,482,561 (+ 138,341 from yesterday’s 7,344,220)

• Deaths 419,488 (+ 5,348 from yesterday’s 414,140)

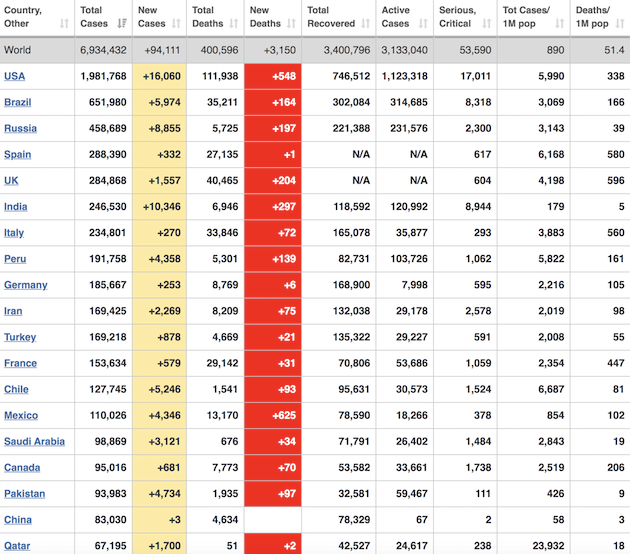

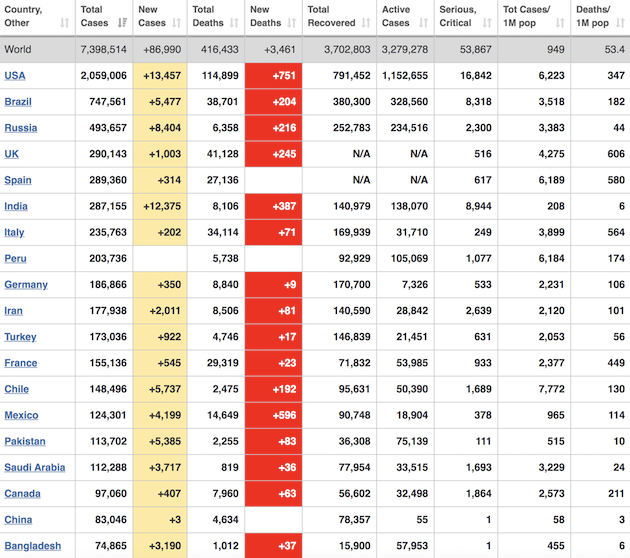

From Worldometer yesterday evening -before their day’s close-:

From Worldometer:

From COVID19Info.live:

Pelosi’s Box. She has no idea. She’s only focused on beating Trump.

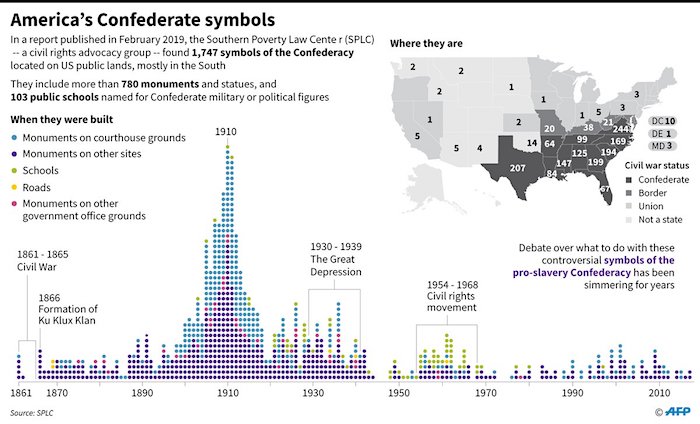

• Pelosi Urges Confederate Statues Be Removed From Capitol (AP)

House Speaker Nancy Pelosi is demanding that [11] statues of Confederate figures such as Jefferson Davis be removed from the U.S. Capitol. In a letter, Pelosi told a House-Senate committee with jurisdiction over the controversial topic that Confederate statues “pay homage to hate, not heritage. They must be removed.” The California Democrat made the announcement on the very day President Donald Trump vowed on Twitter that he would not rename military bases honoring Confederate generals. Only a short time before Pelosi’s statement, NASCAR announced it would ban displays of the Confederate flag at its races. Confederate monuments have reemerged as a national flash point since the death of George Floyd [..]

Protesters decrying racism have targeted Confederate monuments in multiple cities, and some state officials are considering taking them down. Pelosi lacks the authority to order the removal of the 11 Capitol statues honoring Confederates but is urging the little-noticed Joint Committee on the Library to vote to remove them. Senate Republicans share jurisdiction. “The statues in the Capitol should embody our highest ideals as Americans, expressing who we are and who we aspire to be as a nation,” Pelosi wrote. “Monuments to men who advocated cruelty and barbarism to achieve such a plainly racist end are a grotesque affront to these ideals.” The presence of statues of generals and other figures of the Confederacy in Capitol locations such as Statuary Hall — the original House chamber — has been offensive to African American lawmakers for many years.

https://twitter.com/i/status/1270150850380521475

Former Rep. Jesse Jackson Jr., D-Ill., was known to give tours pointing out the numerous statues. But it’s up to the states to determine which of their historical figures to display. Jefferson Davis, a former U.S. senator from Mississippi who was president of the Confederate States of America, is represented by one of two statues from that state. Pelosi noted that Davis and Confederate Vice President Alexander Stephens, whose statue comes from Georgia, “were charged with treason against the United States.” “Several states have moved toward replacing statues and others appear headed in the same direction. This process is ongoing and encouraging,” said Sen. Roy Blunt, R-Mo., chairman of the Library Committee. “As Speaker Pelosi is undoubtedly aware, the law does not permit the Architect of the Capitol or the Joint Committee of Congress on the Library to remove a statue from the Capitol once it has been received.”

Well, let’s see…who’s uncomfortably like Columbus?

• Statues of Christopher Columbus Toppled Across The US (CNN)

As racial reckoning occurs across the country following the death of George Floyd, many Confederate statues — which some consider racist symbols of America’s dark legacy of slavery — have been removed. Now, statues of Christopher Columbus, another controversial figure in US history, are also being taken down. There have been three reports of Christopher Columbus statues being tampered with — one thrown into a lake, one beheaded, and another pulled to the ground. Columbus has long been a contentious figure in history for his treatment of the Indigenous communities he encountered and for his role in the violent colonization at their expense. In recent years, many cities and states have replaced Columbus Day with Indigenous Peoples’ Day, in recognition of the pain and terror caused by Columbus and other European explorers.

[..] Elsewhere in the US, about 1,000 people gathered at Byrd Park in Richmond, Virginia on Tuesday, according to CNN affiliate WTVR. The Richmond Indigenous Society said in a tweet ahead of the rally that “we are gathering at Byrd Park to protest yet another racist monument. Christopher Columbus was a murderer of Indigenous people, mainstreaming the genocidal culture against Indigenous people that we still see today. Bring your sage, drum, jingle dress, and mask!”

[..] in Boston, officials removed the Columbus statue located in the city’s North End after it was beheaded Tuesday evening. The statue, which was erected in 1979, had been previously vandalized in 2015, when it was doused in red paint and the words “Black Lives Matter” were spray-painted on the back, CNN affiliate WBZ reported “This particular statue has been subject to repeated vandalism here in Boston, and given the conversations that we’re certainly having right now in our city of Boston and throughout the country, we’re also going to take time to assess the historic meaning of this action,” Mayor Marty Walsh said, according to WBZ.

Oh, the webs we weave: “Many companies have issued statements in support of the black community..”

• Walmart To Stop Keeping ‘Multicutural’ Beauty Products In Locked Displays (R.)

Walmart Inc will stop keeping personal care products designed for people of color in locked display cases, the retailer said, after the practice drew flak online with many saying it suggested customers for these products cannot be trusted. “We have made the decision to discontinue placing multicultural hair care and beauty products in locked cases,” the company said in an email statement on Wednesday. Walmart said the practice was in place in about a dozen of its 4,700 stores in the United States and the cases were in place to deter shoplifters from products such as electronics, automotive, cosmetics and other personal care products.

[..] The change in Walmart’s policy was prompted by a June 8 CBS News report cbsloc.al/37iJZxv that a Walmart customer had complained of the practice being discriminatory against people of color, while visiting a store in the city of Denver. “The multi-cultural hair care is all locked behind the glass. That’s so ridiculous,” Lauren Epps, a black woman was quoted as saying in the report. Many companies have issued statements in support of the black community, in addition to setting up funds to fight systematic racism. Walmart Chief Executive Doug McMillon has said the company, along with Walmart Foundation, will commit $100 million to create a new center on racial equity.

Columbus opened the doors for the conquistadores. 500+ years later, the population still lives that.

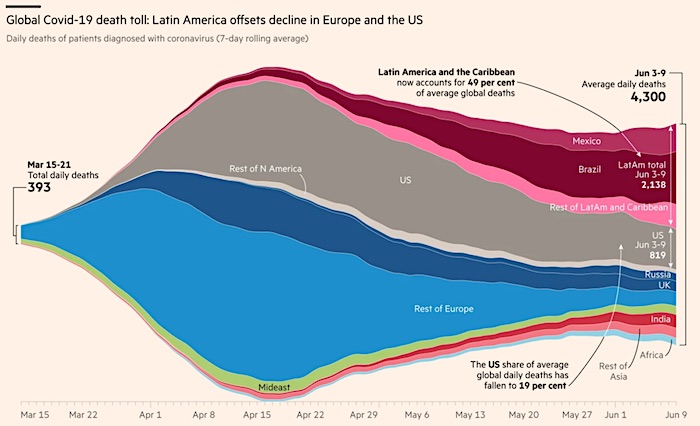

• Latin America Hits 70,000 Pandemic Deaths, Daily Record In Mexico (R.)

Latin America’s coronavirus crisis reached a grim new milestone on Wednesday with total deaths exceeding 70,000, according to a Reuters count, as Mexico hit a daily record for confirmed infections. Brazil, with the largest economy in the region, remains Latin America’s most affected country as total fatalities are just shy of 40,000, the world’s third highest death toll after the United States and Britain. In the region’s second biggest country Mexico, a new daily record of 4,883 confirmed cases was reported by the health ministry, along with 708 additional fatalities.

The daily totals bring Mexico’s overall official count to 129,184 infections and 15,357 deaths. The World Health Organization has determined that Latin America is the new hotspot for the pandemic, which began around the beginning of the year in China and quickly spread to Europe and beyond. Governments across the globe acknowledge that the real number of infected people is significantly higher than the official counts. Latin American fatalities attributed to the highly-contagious Covid-19 respiratory illness caused by the virus stand at 70,972, while total infections are at 1.45 million.

And talking about slavery and the mistreatment of indigenous people…

• BHP To Destroy At Least 40 Aboriginal Sites, Up To 15,000 Years Old (G.)

Mining giant BHP Billiton is poised to destroy at least 40 – and possibly as many as 86 – significant Aboriginal sites in the central Pilbara to expand its $4.5bn South Flank iron ore mining operation, even though its own reports show it is aware that the traditional owners are deeply opposed to the move. In documents seen by Guardian Australia, a BHP archaeological survey identified rock shelters that were occupied between 10,000 and 15,000 years ago and noted that evidence in the broader area showed “occupation of the surrounding landscape has been ongoing for approximately 40,000 years”. BHP’s report in September 2019 identified 22 sites of artefacts scatters, culturally modified trees, rock shelters with painted rock art, stone arrangements, and 40 “built structures … believed to be potential archaeological sites”.

Under section 18 of the Western Australian Aboriginal Heritage Act, the traditional owners – in this case the Banjima people – are unable to lodge objections or to prevent their sacred sites from being damaged. They are also unable to raise concerns publicly about the expansion, having signed comprehensive agreements with BHP as part of a native title settlement. BHP agreed to financial and other benefits for the Banjima people, while the Banjima made commitments to support the South Flank project. But the Banjima native title holders told the WA government in April they did not want any of the 86 archaeological sites within the project area to be damaged, saying the “impending harm” to the area “is a further significant cumulative loss to the cultural values of the Banjima people”.

“There was no slavery in Australia.” Scott Morrison, 11.06.2020.

What would you call this, then ? pic.twitter.com/gUfFnQbskj

— Mike Carlton (@MikeCarlton01) June 11, 2020

Autralia is built on its own unique legacy of destruction.

• Rio Tinto Destroys 46,000-Year-Old Aboriginal Site: ‘Misunderstanding’ (G.)

The head of Rio Tinto’s iron ore division said he has “taken accountability” for the destruction of a 46,000-year-old Aboriginal heritage site but refused to give a direct answer when asked if the company knew traditional owners did not want the rock shelter destroyed, saying: “clearly, there was a misunderstanding”. In an interview on Radio National on Friday, the chief executive of Rio Tinto iron ore, Chris Salisbury, said it it had “taken accountability” for the destruction of the site, which was one of two destroyed in a blast to expand the Brockman 4 iron ore mine last month. The two sites were located in Juukan Gorge in the Hamersley Ranges, about 300km inland from Karratha in Western Australia’s iron ore rich Pilbara region.

Traditional owners the Puutu Kunti Kurrama and Pinikura people only learned of the planned detonation on 15 May, nine days before it took place. They said the loss was “soul destroying”. Salisbury said the company “regrettably … thought we had a shared understanding with the PKKP about the future of the sites” and would conduct a review to learn “how did this go wrong from our point of view”. He also refused to provide a direct answer when asked if a statement released by the company last week, which suggested the PKKP had only “recently expressed concerns” about the site, was incorrect. It released another statement apologising “for the distress we caused” but not the destruction, on Sunday.

No testing, no quarantines. More people than this arrived by air. No testing. Now that they’ve all landed and had the chance to infect Britons, there’s a quarentine.

• Arrival Of Million By Sea Adds To UK Quarantine Doubts (Times)

More than 1.1 million people have arrived in the UK by sea since the start of the year without being forced to self-isolate as concerns mount over the government’s quarantine policy. Official figures show that there were 346,000 arrivals in the UK in March and April alone despite concerns over the transmission of coronavirus, casting further doubt over the government’s quarantine policy which was introduced for arrivals this week. The figures include HGV drivers, who are exempt from the quarantine measures, although it is not known how many fell into the category. Since Monday, anyone arriving in the UK by air, sea and through the Channel Tunnel rail link has been forced to spend two weeks in isolation. This includes Britons returning from abroad. The scheme does not apply to people from Ireland.

The quarantine is part of measures aimed at avoiding a second outbreak of Covid-19 but critics have questioned its value months after such curbs were introduced elsewhere. Giving evidence to MPs yesterday, Sir David Skeggs, 72, emeritus professor of epidemiology at the University of Otago in New Zealand, told the home affairs committee: “These border measures would be most effective if they were done very early.” Scientists also told MPs that summer holidays abroad risked a fresh wave of coronavirus infections across Europe. Gabriel Leung, 47, a dean of medicine at the University of Hong Kong, said it would be safest if mass-market tourism was discouraged. “I can’t imagine anybody going on holiday in any kind of destination where you go to enjoy the sun and actually doing very good hand hygiene and putting on a mask,” he said.

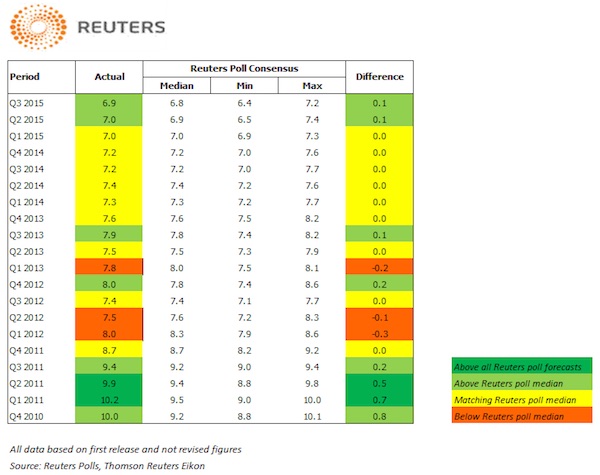

Forget these predictions. Nobody has a single clue.

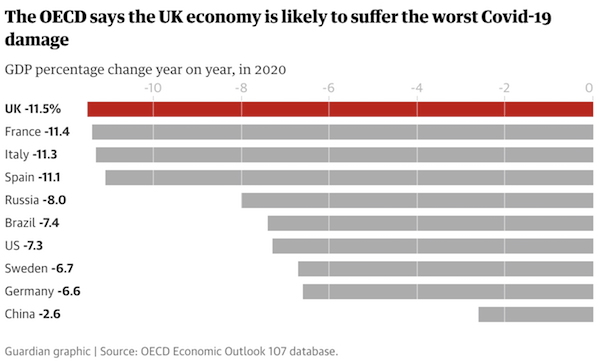

• UK Economy Likely To Suffer Worst COVID19 Damage – OECD (G.)

Britain’s economy is likely to suffer the worst damage from the Covid-19 crisis of any country in the developed world, according to a report by the Organisation for Economic Cooperation and Development. A slump in the UK’s national income of 11.5% during 2020 will outstrip the falls in France, Italy, Spain, Germany and the US, the Paris-based thinktank said. Germany’s decline in GDP is forecast to be 6.6% this year while Spain’s GDP will fall by 11.1%, Italy’s by 11.3 and France’s by 11.4%. The US, the world’s largest economy, is expected to take a hit of 7.3%. Highlighting the task awaiting the UK government as it seeks to ease the lockdown, the OECD warned that countries forced to impose the most draconian restrictions faced a long haul back to previous levels of activity.

Anneliese Dodds, Labour’s shadow chancellor, blamed the “deeply worrying” OECD forecast on the government’s “failure to get on top of the health crisis, delay going into lockdown and chaotic mismanagement of the exit from lockdown”, which she argued made the economic impact of the crisis worse. Responding to the report, the chancellor, Rishi Sunak, said the UK was suffering “in common with many other economies around the world” and the priority was to “support people, jobs and businesses through this crisis – and this is what we’ve done”.

Britain, which is forecast to post an increase in unemployment to around 9%, could make its situation more difficult if it failed to secure a lasting agreement with the EU on trade and access to the single market, the OECD said. “The failure to conclude a trade deal with the European Union by the end of 2020 or put in place alternative arrangements would have a strongly negative effect on trade and jobs,” it said. Adding to pressure on No 10 to agree concessions with Brussels to secure a Brexit deal amid the economic damage caused by the pandemic, the credit ratings agency Moody’s warned that a no-deal Brexit would “significantly damage the UK’s potentially fragile recovery from its deepest recession in almost a century”.

OECD says the global economy will suffer the deepest peace-time slump in a century, urges governments not to shy away from debt-financed spending to support low-paid workers and investment https://t.co/V28WLFA8nu pic.twitter.com/S7wS3uwLEs

— Reuters (@Reuters) June 11, 2020

The Fed supports only banks. But Powell can still spout this insulting nonsense. No journalist ever openly disagrees.

• Fed Vows To Support US Economy’s ‘Long Road’ To Recovery After Dire 2020 (R.)

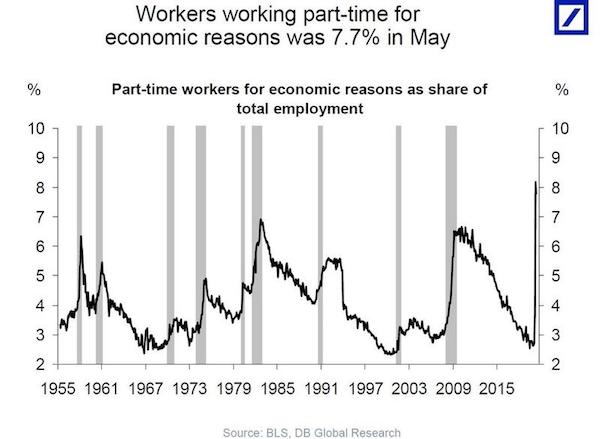

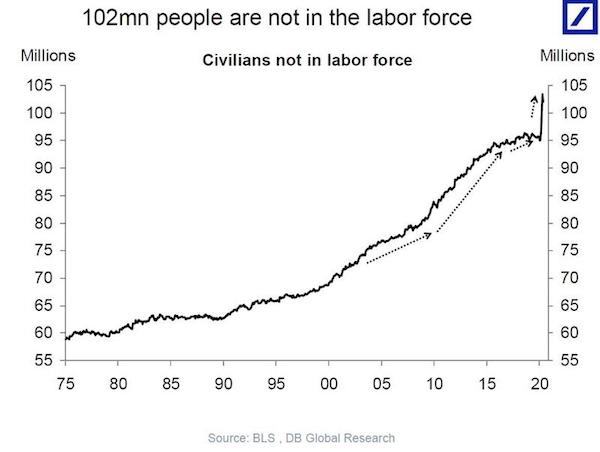

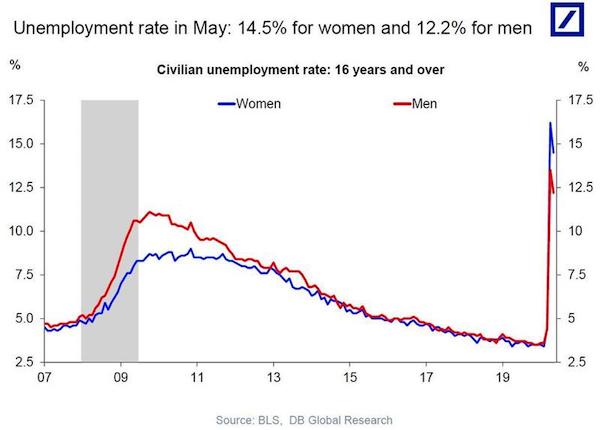

The U.S. Federal Reserve on Wednesday signaled it plans years of extraordinary support for an economy facing a torturous slog back from the coronavirus pandemic, with policymakers projecting the economy to shrink 6.5% in 2020 and the unemployment rate to be 9.3% at year’s end. In the first economic projections of the pandemic era, U.S. central bank policymakers put into numbers what has been an emerging narrative: that the shutdowns, restrictions and other measures used to battle a health crisis will echo through the economy for years to come rather than be quickly reversed as commerce reopens.

Fed's Powell: Many differences between now and the great depression. pic.twitter.com/2gcXUNhO96

— Holger Zschaepitz (@Schuldensuehner) June 10, 2020

Some 20 million or more people have been thrown out of work since February, and Fed Chair Jerome Powell acknowledged it could take years for them to all reacquire jobs – an economic blow that is falling heaviest on minority communities at a time when mass protests over police brutality have thrown a new spotlight on racial inequality in the United States. Powell, acknowledging the nationwide demonstrations in his opening remarks at a news briefing, said it was now the Fed’s single-minded mission to bring the job market back to where it was at the end of last year, with the unemployment rate at a record low 3.5% and wage gains accumulating for some of the very same lower-paid workers in the service sector that have suffered most during the recent collapse.

[..] At the median, officials see the unemployment rate falling to 6.5% at the end of 2021 and 5.5% at the end of 2022 – still a full 2 percentage points above where it was at the end of last year, representing millions of lost years of work and wages. “The ongoing public health crisis will weigh heavily on economic activity, employment and inflation in the near term and poses considerable risks to the economic outlook over the medium term,” the Fed said in its policy statement. The response has been an unparalleled level of unanimity in the outlook for monetary policy. All 17 current Fed policymakers see the key overnight interest rate, or federal funds rate, remaining near zero through next year, and 15 of 17 see no change through 2022.

'We're not thinking about raising rates. We're not even thinking about thinking about raising rates,' Fed Chair Jerome Powell said https://t.co/PLbXkBYujf pic.twitter.com/PlWQZOQscw

— Reuters (@Reuters) June 11, 2020

2 million evictions in the pipeline even before COVID19.

• US Housing ‘Apocalypse’ Coming As Coronavirus Protections Expire (CNBC)

Even before the coronavirus pandemic, the U.S. was experiencing what housing experts and advocates deemed an eviction crisis. More than 2 million people face eviction each year, far more than the number of people who faced foreclosure at the height of the 2008 mortgage crisis. Experts expect the eviction crisis to get far worse in the coming months. The Covid-19 economic recession has hit renters especially hard. They make up a disproportionate share of service sector jobs, an industry that has been decimated as a result of the coronavirus shutdowns. In fact, between March 25 and April 10 of this year, nearly half of renters aged 18 to 64 reported that they were having trouble paying their rent or utilities, were food insecure or couldn’t afford needed medical care, according to the Urban Institute.

Thousands of tenants have been missing rent payments over the past few months. People of color have fared worse than white renters due to the disproportionate job loss in their communities, the Urban Institute reports. About 25% of black and Latino renters reported not paying or deferring rent in May, compared to 14% of white renters. To keep people in their homes, the federal government banned evictions in federally assisted properties through July 25, and some cities and states, including Massachusetts, New York and Michigan, put their own temporary eviction moratoriums in place. But many of those bans begin expiring this month depending on the state, according to Princeton University’s Eviction Lab, which tracks evictions across the country.

Plus, the extra $600 per week in federal unemployment benefits is set to expire at the end of July. That extra money is “what has been allowing many people who have lost their jobs to continue paying rent,” Solomon Greene, a senior fellow in housing policy at the Urban Institute, tells CNBC Make It. Coupled with the end of eviction moratoriums, the U.S. is likely to experience an uptick in evictions nationwide in the coming weeks. Evicting people in the middle of a global health crisis puts them at greater risk of contracting and spreading Covid-19, turning “a catastrophe into an apocalypse,” Aaron Carr, founder and executive director of the Housing Rights Initiative, tells CNBC Make It. “A lot of people could be on the streets,” says Carr. “Especially in places like New York City that already have a homeless problem, it could turn into a homeless nightmare.”

For a year. That’s all you need to know. About a company that has rich contracts with US intelligence,

• Amazon Bans Police Use Of Facial Recognition Tech – For A Year (BBC)

Technology giant Amazon has banned the police from using its controversial facial recognition software for a year. It comes after civil rights advocates raised concerns about potential racial bias in surveillance technology. This week IBM also said it would stop offering its facial recognition software for “mass surveillance or racial profiling”. The decisions follow growing pressure on firms to respond to the death in police custody of George Floyd. Amazon said the suspension of law enforcement use of its Rekognition software was to give US lawmakers the opportunity to enact legislation to regulate how the technology is employed.

“We’ve advocated that governments should put in place stronger regulations to govern the ethical use of facial recognition technology, and in recent days, Congress appears ready to take on this challenge,” Amazon said in a statement. “We hope this one-year moratorium might give Congress enough time to implement appropriate rules, and we stand ready to help if requested.” However, the company said that it would still allow organisations that deal with human trafficking to use the technology. Like other facial recognition products, Amazon’s Rekognition can use Artificial Intelligence (AI) to very quickly compare a picture from, for example, an officer’s phone camera and try to match it with mugshots held on police databases that can hold hundreds of thousands of photos.

You mean, that wasn’t obvious yet? Sometimes you guys surprise me.

• The Elevator Arises As The Latest Logjam In Getting Back To Work (KHN)

When the American Medical Association moved its headquarters to a famous Chicago skyscraper in 2013, the floor-to-ceiling views from the 47th-floor conference space were a spectacular selling point. But now, those glimpses of the Chicago River at the Ludwig Mies van der Rohe-designed landmark, now known as AMA Plaza, come with a trade-off: navigating the elevator in the time of COVID-19. Once the epitome of efficiency for moving masses of people quickly to where they needed to go, the elevator is the antithesis of social distancing and a risk-multiplying bottleneck. As America begins to open up, the newest conundrum for employers in cities is how to safely transport people in elevators and manage the crowd of people waiting for them.

If office tower workers want to stay safe, elevator experts think they have advice, some practical, some not: Stay in your corner, face the walls and carry toothpicks (for pushing the buttons). Not only have those experts gone back to studying mathematical models for moving people, but they are also creating technology like ultraviolet-light disinfection tools and voice-activated panels. “When there is risk of disease spreading from human to human, continuing to maintain a clean and safe vertical transportation system is critical to help people return to work and safe living,” said Jon Clarine, head of digital services at Thyssenkrupp Elevator, in an email.

After all, most elevators are inherently cramped, enclosed spaces that can barely fit two people safely spaced 6 feet apart, much less the dozen or more that elevators in commercial and residential buildings were designed to hold. They’re a minefield of buttons and surfaces tempting to touch. Air circulation is limited to what a few vents and the opening doors can manage. Plus, they’re usually mobbed during the morning, lunchtime and evening rushes.

If news agencies write this sort of thing, while there are hundreds such products being touted, how is that not stealth advertizing and promotion?

• Lilly COVID19 Treatment Could Be Authorized For Use As Soon As September (R.)

Eli Lilly and Co could have a drug specifically designed to treat COVID-19 authorized for use as early as September if all goes well with either of two antibody therapies it is testing, its chief scientist told Reuters on Wednesday. Lilly is also doing preclinical studies of a third antibody treatment for the illness caused by the new coronavirus that could enter human clinical trials in the coming weeks, Chief Scientific Officer Daniel Skovronsky said in an interview. Lilly has already launched human trials with two of the experimental therapies. The drugs belong to a class of biotech medicines called monoclonal antibodies widely used to treat cancer, rheumatoid arthritis and many other conditions. A monoclonal antibody drug developed against COVID-19 is likely to be more effective than repurposed medicines currently being tested against the virus.

Skovronsky said the therapies – which may also be used to prevent the disease – could beat a vaccine to widespread use as a COVID-19 treatment, if they prove effective. “For the treatment indication, particularly, this could go pretty fast,” he said in an interview. “If in August or September we’re seeing the people who got treated are not progressing to hospitalization, that would be powerful data and could lead to emergency use authorization.” “So that puts you in the fall time: September, October, November is not unreasonable,” he said. Coronavirus vaccines being developed and tested at unprecedented speed are not likely to be ready before the end of the year at the earliest.

Out of over 5,000, most of whom have been in Greece for much of their entire lives.

• Germany Takes In Another 249 Refugee Children From Greece (K.)

Germany has taken in an additional 249 refugee children from Greece, the country’s interior minister Horst Seehofer said Wednesday, noting that most of the minors are sick or the siblings of migrants that are already in Germany. “As the rates of coronavirus are currently at this low level, we decided as the Interior Ministry… to take in more children from Greece,” Seehofer said, noting that Germany had already received 47 refugee children in April. Seehofer said that some of his associates visited Greece last week to arrange the transfer of the children.

Six of the youngsters who were too sick to travel last week will be transferred on a subsequent trip, he said. “I always said that my migration policy includes order but also humanity,” the German minister said. Luxembourg, Switzerland, Portugal and France are among the countries that have also taken in child refugees from Greece. Many of the children being relocated belong to the ranks of unaccompanied refugee minors in Greece, who number over 5,000.

Tomorrow’s the DC Appeals Court Michael Flynn hearing. Fireworks.

• FBI Knew Steele Dossier Linked To Clinton, Dems From The Start (JTN)

Notes and emails that have been kept so far from Senate investigators show the FBI knew from its earliest interactions with Christopher Steele in July 2016 that his Russia research project on Donald Trump was connected to Hillary Clinton and the Democratic Party. The information, so far mentioned only glancingly and in footnotes of a Justice Department report, could provide the Senate Judiciary Committee with the most powerful evidence yet to confront witnesses about why the bureau concealed the political origins of Steele’s work from the FISA court. “So far the bureau is slow-walking this stuff,” a source familiar with senators’ frustrations told Just the News. “We need to see these sort of documents before we question key witnesses.”

Chairman Lindsay Graham (R-S.C.) is seeking a vote later this week to authorize subpoenas that would compel the Christopher Wray-led FBI to produce witnesses and outstanding documents for the committee’s investigation of the Russia investigators. The effort to acquire the original source materials began last December after DOJ Inspector General Michael Horowitz released his explosive report blaming the FBI for 17 mistakes, omissions and acts of misconduct in seeking a FISA warrant against Trump campaign adviser Carter Page. While the headlines since that report have mostly focused on FISA abuses, Senate investigators have also zeroed in on a handful of little-noticed passages in Horowitz’s narrative that reference original FBI source documents showing what agents and supervisors knew about Steele, the former MI6 agent, and the firm that hired him, Fusion GPS.

It wasn’t until late October 2017 that the public and Congress first learned that the law firm Perkins Coie, on behalf of the Democratic National Committee and Hillary Clinton’s campaign, hired Glenn Simpson’s Fusion GPS research firm to have Steele delve into Trump’s Russia connections. And FBI officials have been vague in their explanations about when they knew Steele’s research was tied to Clinton and the DNC and why they did not explicitly inform the FISA court that the Steele dossier used to secure the warrant was funded by Trump’s election opponent. But one passage and two footnotes in Horowitz’s report that have largely escaped public attention suggest the FBI agent who first interviewed Steele about his anti-Trump research in London on July 5, 2016 was aware immediately of a connection to Clinton and that a separate office of the FBI passed along information from an informant by Aug. 2, 2016 that Simpson’s Fusion GPS was connected to the DNC.

[..] The FBI notes and emails from summer 2016 are consistent with recent testimony that Steele gave in a civil case in London, where he testified he told the bureau his research and the Fusion GPS project was connected to Clinton. “I presumed it was the Clinton campaign, and Glenn Simpson had indicated that. But I was not aware of the technicality of it being the DNC that was actually the client of Perkins Coie,” Steele testified in March under questioning from lawyers for Russian bankers suing over his research. Steele confirmed during that testimony that his notes of a 2016 FBI meeting showed he told agents about the Clinton connection.

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the interaction.

Thank you.

Obama received the Nobel Peace Prize then dropped more bombs than all his predecessors, and barely anyone batted an eyelash because he looked and sounded classy while doing it. https://t.co/v4jaxYMbz0

— Sarah Abdallah (@sahouraxo) June 11, 2020

Little ones relate

— James Hirsen (@thejimjams) June 10, 2020

Support the Automatic Earth in virustime.