DPC Market Street from Montgomery Street, San Francisco, after the earthquake 1906

“My forecast today: the stock market will start to crash by early February, if not sooner..”

• The Deadly Truth About the Great Boom and This “Recovery” (Dent)

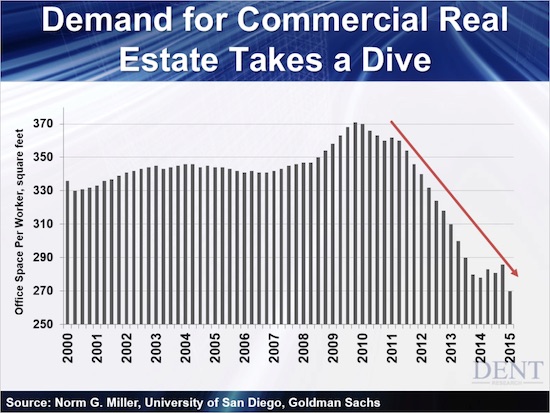

Below is a chart that shows the office space per worker in square feet. It shows a rise into the height of the financial crisis, after which it’s fallen like a rock! At first this could seem counterintuitive. Why did the square footage per worker go up into the worst of the recession into mid- to late-2009? That’s because companies were laying off workers going into that recession, meaning there were more workers per square feet. But the real story comes in the recovery from late 2009 forward.

Square footage per worker has declined very sharply from 371 square feet to 270, down a whopping one-third in just over six years as businesses have rehired a large portion of the laid-off workers – which means largely NOT creating new jobs. You should not look at this chart and assume that because less square footage per worker means more workers than in the past that everything is hunky dory. What’s more important is that the sharp decrease in square footage implies a lack of demand in commercial real estate. And that’s because commercial real estate is already way over-expanded! We overbuilt it in the great boom of 1983 to 2007, so even these hires have not filled up the available space.

Which means businesses aren’t expanding their office or industrial space! So while hiring more workers sounds fine out of context… it’s masking much more severe, deeper-set issues in our capacity to build for the future. This is the hard truth that no one is looking at: businesses are merely re-employing their past capacity, and not creating new plants and offices for future employment. All the 200,000-plus jobs numbers per month, if they are even fully real, are just catching up with the past. And we shouldn’t be investing in such new work space as we already have all we need for decades ahead. This is the reality of demographics that clueless economists just don’t get.

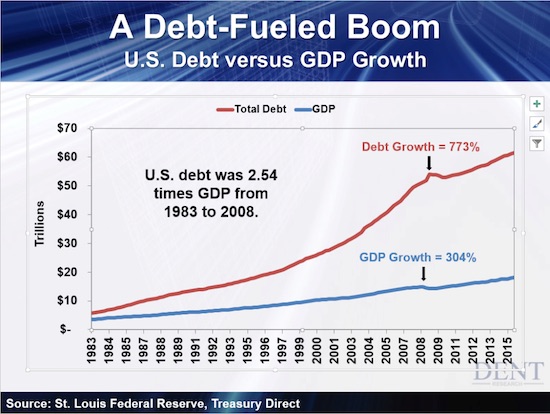

[..] Folks, this “recovery” isn’t working! And no one has expected it to given the over-expansion in the greatest debt bubble in U.S. history from 1983 to 2008. Inflation hasn’t risen due to excess capacity here and around the world, especially China… Money velocity continues to drop without lending and productive investment to expand it… Businesses are struggling with stagnant earnings because we already hit the peak of debt capacity and demographic spending growth in the great boom that finally peaked in late 2007, as I forecast two decades before. Debt was running at 2.54 times GDP for 26 years. It doesn’t take a rocket scientist or nuclear physicist to tell you that pretty much guarantees a massive period of deleveraging and depression – not continued expansion.

So since growth is all but impossible, corporations have resorted to financial engineering to keep the wagon rolling – all courtesy of the Fed, with near-zero short- and long-term interest rates. They’ve had two options: either increase stock buybacks to leverage their stagnant earnings with rising earnings-per-share on fewer shares, or increase dividends to compete with lower and lower yielding bonds (also courtesy of the Fed). And they’ve been milking both options for all they’re worth! But financial engineering does not result in real growth. And speculation does not expand the money supply. It is only a sign of decreasing money velocity, and a bubble that will only burst – like in 1929, 2000, and now again! [..] My forecast today: the stock market will start to crash by early February, if not sooner [..].

There will be no recovery in commodities until the overcapacity is drained.

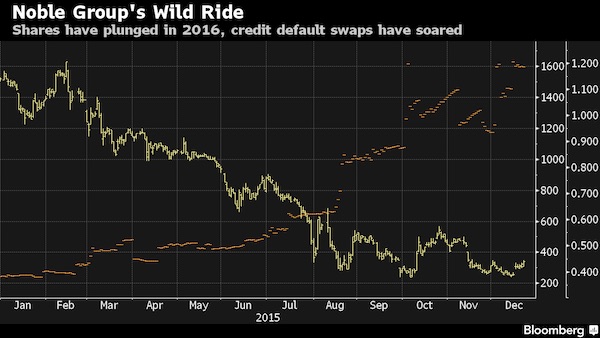

• Asia’s Top Commodity Trader Ends a Turbulent Year With Cut To Junk (BBG)

Asia’s top commodity trader exits 2015 in very different shape to how it began the year. Noble Group has lost almost two-thirds of its value, with its stock trading near the lowest since 2008, after a year of attacks on its finances by critics including the anonymous Iceberg Research and short-seller Muddy Waters LLC. The latest blow, amid a rout in raw materials, was the cut in its credit rating to junk by Moody’s Investors Service on concerns over its liquidity. It’s a downgrade that will test Chief Executive Officer Yusuf Alireza’s view that while an investment-grade rating is desirable, it isn’t required for the business, as Standard & Poor’s also reviews its assessment. Moody’s decision comes a week after the Hong Kong-based company agreed to sell the rest of its agriculture unit to Cofco for at least $750 million.

While the deal may help the company to cut debt, its liquidity will remain constrained, according to Moody’s, which expects a prolonged commodity slump. “They have had a really difficult year, not only fighting the commodity slump but also various allegations,” Bernard Aw at IG Asia said by e-mail. “Entering 2016, the performance of Noble will clearly hinge on the recovery in the commodity complex. Noble may continue to offload non-profitable assets, to improve its balance sheet and creditworthiness. These should help it better navigate the challenging landscape.” Noble Group stock fell 9.1% to end at 40 Singapore cents on Wednesday, and traded unchanged early Thursday. The shares are 65% lower this year and are the biggest losers in the Straits Times Index.

The company’s dollar bonds due in 2020, its most liquid, dropped on Wednesday to the lowest since they were issued in 2009. After the Noble Agri deal closes, Noble Group’s rating metrics will substantially exceed those required of an investment-grade credit, the company said in a statement on Tuesday. Noble Group still has its investment-grade ratings from S&P and Fitch Ratings, spokesman Stephen Brown said, referring to comments made on the company’s last earnings call. He added that its bank covenants aren’t ratings-dependent. “We are confident that the deal will be approved by our shareholders and will close before the end of February,” Noble Group said in a statement to the Singapore Exchange late on Wednesday. “The current environment is opportunity-rich and plays to our strengths.”

Question is, what keeps markets at their high levels?

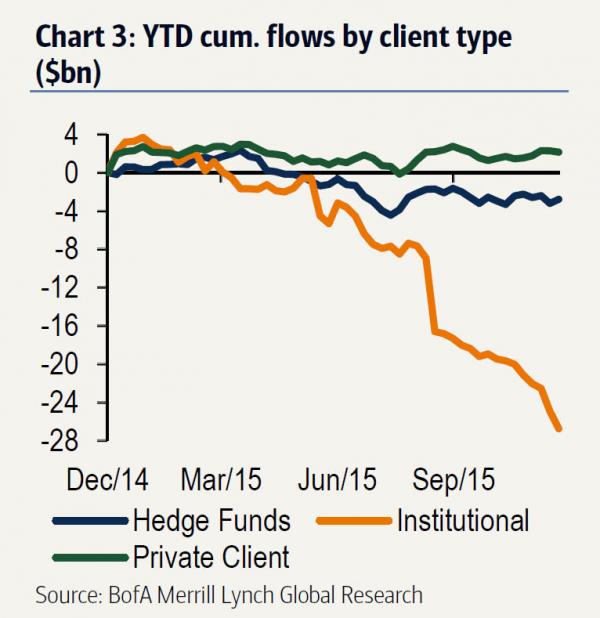

• Mom And Pop Are The Greater Fools (ZH)

[..] while the market was surging last week, the smart money was selling. This comes at the same time as ICI reported major redemptions from both stock ($3.9 billion) and bond ($4.5 billion) mutual funds, even as corporate buybacks were decelerating, leading to the question of just who was buying stocks during the Santa rally of the past two weeks. But something even more surprising emerged when looking at the detailed breakdown of how the “smart money” has been flowing. As Bank of America clarifies, when explaining where its $0.7 billion in weekly outflows came from, “net sales were chiefly due to institutional clients last week” and adds that institutionals “have sold stocks for eight consecutive weeks”!

And then something even more surprising emerges when looking at the YTD breakdown of flows: while hedge funds and private clients (retail) have largely offset each other over the past year, the former selling $2.8BN and the latter buying $2.2BN in 2015, something odd has taken place at the institutional level: starting in early January, the largest financial institutions – mutual funds and various other asset managers – have unleashed an unprecedented selling spree for 11 consecutive months, which has brought their total outflow to $26.8 billion. Which leads to another question: if institutions are actively dumping stocks, perhaps mom and pop investors should show the following chart to their financial advisors, who directly or indirectly work for these institutions, and ask them: why should they be buying, when the counterparty they are buying from is, most likely, this very same financial advisor?

“..global crude production exceeds demand by anywhere between half a million and 2 million barrels every day..”

• Oil Ends 2015 In Downbeat Mood; Hangover To Be Long, Painful (Reuters)

Oil prices remained in a downbeat mood during their final Asian-hours trading session of 2015 after record U.S. crude inventories reinforced concerns about a global supply glut that has pulled down prices by a third over the past year. Crude inventories in the United States rose 2.6 million barrels last week, the U.S. Energy Information Administration said. Analysts polled by Reuters had expected a draw of 2.5 million barrels. Crude prices held losses after falling more than 3% in the previous session, with U.S. West Texas Intermediate (WTI) crude futures trading around $36.70 per barrel at 0300 GMT on Thursday and Brent around $36.60 per barrel. Both benchmarks are down by around a third over 2015.

The immediate outlook for oil prices remains bleak, with some analysts like Goldman Sachs saying prices as low as $20 per barrel might be necessary to push enough production out of business and allow a rebalancing of the market. U.S. bank Morgan Stanley said in its outlook for next year that “headwinds (are) growing for 2016 oil.” The bank cites ongoing increases in available global supplies, despite some cuts by U.S. shale drillers in particular, as well as a slowdown in demand as the main reasons. “The imbalance in the global oil market has been diminishing in 2H15, but the hope for a rebalancing in 2016 continues to suffer serious setbacks,” the bank said, reflecting a market consensus that meaningfully higher prices are not expected before late 2016.

Traders expect some U.S. oil to be taken out of America and supplied into global markets, following the surprise lifting of a decades-old U.S. crude export ban in December, which ended a years-old discount in U.S. crude prices to international Brent. “At a time when U.S. shale is facing headwinds due to the collapse in crude oil prices… U.S. crude oil exports are likely to help reduce congestion concerns in the U.S.,” ING bank said. [..] Analysts estimate global crude production exceeds demand by anywhere between half a million and 2 million barrels every day. This means that even the most aggressive estimates of expected U.S. production cuts of 500,000 bpd for 2016 would be unlikely to fully rebalance the market.

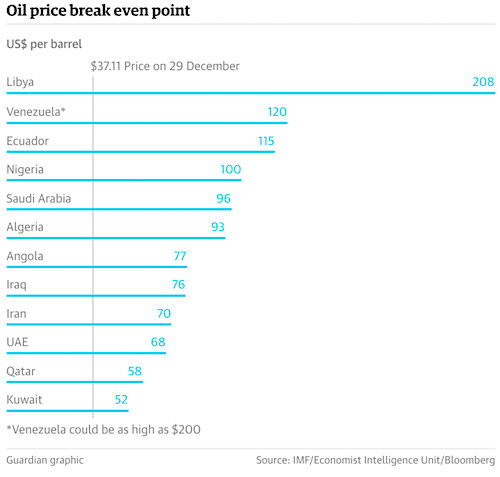

A painful graph. We smell unrest.

• Impact Of Low Crude Prices On Oil Powers (Guardian)

A glut of oil, the demise of Opec and weakening global demand combined to make 2015 the year of crashing oil prices. The cost of crude fell to levels not seen for 11 years – and the decline may have further to go. There have been four sharp increases in the price of oil in the past four decades – in 1973, 1979, 1990 and 2008 – and each has led to a global recession. By that measure, a lower oil price should be positive for the world economy, with lower fuel costs for consumers and businesses in those countries that import crude outweighing the losses to producing nations. But the evidence since oil prices started falling from their peak of $115 a barrel in August 2014 has not supported that thesis – or not yet.

Oil producers have certainly felt the impact of the lower prices on their growth rates, their trade figures and their public finances butthere has been no surge in consumer spending or business investment elsewhere. Economist still reckon there will be a boost from a lower oil price particularly if it looks as if the lower cost of crude will be sustained. Dhaval Joshi, an economist at BCA, a London-based research company, said: “A commodity bubble has deflated three times in the past 100 years: the first was after world war one; the second was after the 1980s oil shock; the third is happening right now.” For the big producer countries, this is a major headache, the ramifications of which are only starting to be felt. Oil powers base their spending plans on an assumed crude price. The graphic below shows just how far below water their budgets are.

How long before IMF starts complaining on behalf of US?

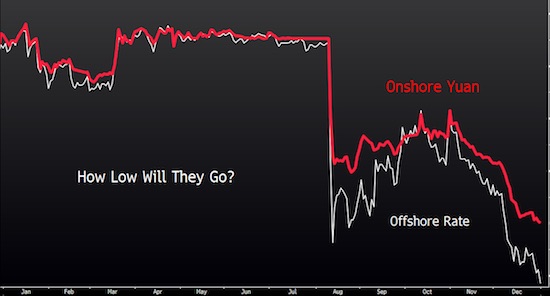

• China’s Yuan Posts Biggest Annual Loss In 21 Years (BBG)

There’s no need to panic, according to the yuan’s top forecaster, even as the currency posted the biggest annual loss in more than two decades and a majority of economists predicted a further depreciation in 2016. “While a weaker yuan could create fear initially, the market will realize it’s a natural consequence of a more flexible yuan and divergent U.S.-China monetary policy,” said Ju Wang at HSBC, which had the best estimates for the onshore yuan over the last four quarters as measured by Bloomberg Rankings. A more adjustable policy will allow for swift reactions to domestic conditions, which “would be structurally positive for China’s economy,” she said. The nation overhauled its foreign-exchange system in 2015, giving market forces greater say in setting the yuan’s reference rate, allowing more foreign participants onshore and doubling trading hours.

The central bank kept investors guessing as it supported the exchange rate from March to August, shocked global markets with an Aug. 11 devaluation, and then spent billions of dollars to prop up the yuan before winning reserve status at the IMF on Nov. 30. The currency tumbled 4.5% in 2015 to close at 6.4936 a dollar in Shanghai on Dec. 31, according to China Foreign Exchange Trade System prices. That’s the biggest decline in data going back to 1994. The central bank cut its daily fixing, which limits onshore moves to a maximum 2% on either side, by 6.1% for the year. The reduction was the most since 2005, when China unpegged its currency from the greenback and allowed it to fluctuate against a basket of exchange rates.

Beijing is feeding speculation with its constant manipulations.

• China Fires a Warning Shot at Yuan Speculators With Bank Bans (BBG)

China has a message for currency speculators: the free lunch is over. The People’s Bank of China has suspended at least two foreign banks from conducting some cross-border yuan business until late March, according to people with direct knowledge of the matter. The clampdown comes as the growing offshore-onshore spread makes it profitable for those who skirt capital controls to buy the currency at a discount in Hong Kong and sell it in Shanghai. By closing loopholes in its regulations, China is trying to stabilize the yuan after a surprising revamp of its currency-valuation system in August led to capital outflows and prompted policy makers to tap $213 billion of foreign reserves to support the yuan. The risk is that discouraging arbitrage will cause the exchange rates to diverge further, undermining the goal of unifying the two markets.

“The market should see this as a warning shot across the bow,” said Douglas Borthwick at Chapdelaine, a unit of the British inter-dealer brokerage Tullet Prebon. Chinese regulators don’t want onshore trades to be speculative in nature and “in the short term this will likely lead to further widening of the spread,” he said. A three-month ban on settling offshore clients’ yuan transactions in the onshore market was imposed Tuesday, the people said. The central bank didn’t immediately respond to questions on the matter, and it was unclear how widely the ban has applied among foreign banks or which institutions are suspended. Spokespeople for Citigroup, HSBC and Standard Chartered, which are among the largest foreign dealers allowed in China’s interbank foreign-exchange markets, declined to comment on the ban and whether their operations were affected.

The offshore yuan, which is freely traded overseas, touched a five-year low on Wednesday before erasing losses on speculation the government was intervening to support the currency. It traded at 6.5810 a dollar as of 12:32 p.m. in Hong Kong, leaving it about 1.3% cheaper than the rate in mainland China. The gap between the two rates has widened since August when China’s devaluation, part of the move to a more market-determined currency regime, fueled expectations among overseas investors for further yuan weakness. The divergence is undesirable because it means companies cannot use hedging tools tied to overseas rates to protect their onshore exposure. By imposing the ban, China is seeking to prevent speculators from bringing money in illegally to arbitrage, even though it helps narrow the difference.

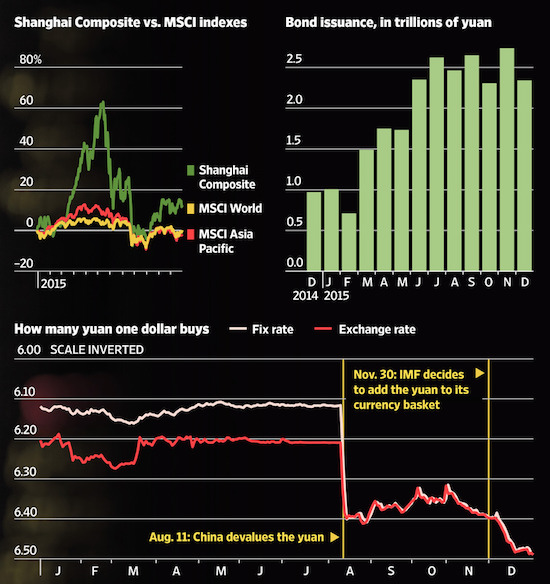

It’s all in the choice of words, isn’t it? Growing pains sounds so much better than bursting bubble.

• China’s Financial Growing Pains Caused World of Hurt in 2015 (WSJ)

China’s long history of tempestuous trading spilled over its borders this year, signaling that a once-isolated market is moving to the center of global finance. Chinese volatility upended markets from Tokyo to London, and helped send some emerging-market currencies to their weakest levels in nearly two decades. Commodities including copper and aluminum plumbed six-year lows as China, one of the world’s biggest metals consumers, reined in buying. While a summer stock crash and the surprise devaluation of China’s yuan spooked investors world-wide, the repercussions also exposed the growing pains of a maturing financial market. With one trading day left in 2015, Shanghai’s stock market is still up 10.5% this year, despite losing more than 40% of its value over the summer.

That gain outpaces the 1% rise in the S&P 500 through Tuesday, and the 9.6% advance in Germany’s DAX and 7.35% gain in the Stoxx Europe 600 index through Wednesday. China’s smaller Shenzhen stock market is up 66%, one of the best-performing benchmarks globally. Japan’s Nikkei Stock Average is up 9.1% for the year, as the central bank’s two-year easing campaign weakened the yen. A weaker currency can help exporters by boosting profits repatriated from abroad. Meanwhile, China’s yuan is on track for its largest annual fall on record, down more than 4% so far this year. Goldman Sachs economists say China was “arguably the prime mover in global markets” this year, though foreigners hold less than 2% of the mainland’s $8 trillion stock market and less than 3% of the onshore bond market.

On Aug. 24, dubbed “Black Monday” by Chinese government media, the Shanghai Composite’s 8.5% fall sparked a global selloff that dragged U.S. stocks to an 18-month low. Yet the struggles have been felt most acutely in markets of China’s regional trading partners, where slackening demand from the world’s second-largest economy has put a chill on exports of commodities and gadgets, dimmed the corporate outlook and sent currencies into a tailspin. Investors have pulled money out of Asia’s emerging-market equities every month since July, with the exception of October, according to the Institute of International Finance. Investors put $47 billion into emerging-market Asia stocks and bonds this year through November, compared with $107.9 billion for the whole of 2014.

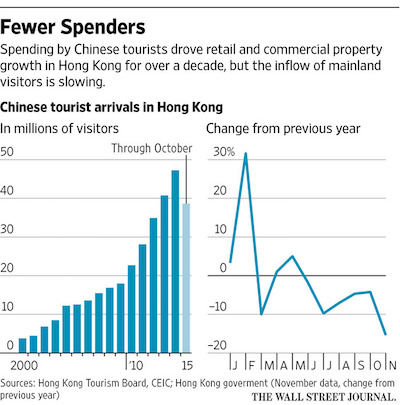

Confidence in China is sagging.

• Hong Kong Retail Slows as Mainland Tourists Stay Away (WSJ)

Hong Kong, once a shopping mecca for mainland Chinese seeking Swiss watches and luxury handbags, is expected to record its biggest annual decline in retail sales since the outbreak of severe acute respiratory syndrome, or SARS, in 2003. The city may also post the first annual decline in mainland tourists since visa relaxations allowed individual visitors from China, also in 2003, prompting calls for extensive diversification of tourism—a pillar of the city’s economy. Spending by Chinese tourists has been the main driver of retail and commercial property sectors in Hong Kong in recent years, as the number of mainland tourists rose. During the boom, long lines outside the city’s numerous Louis Vuitton, Chanel and Gucci shops were commonplace, as luxury goods sold in Hong Kong were up to 40% cheaper than in China.

Those lines have largely disappeared as inflows of Chinese tourists slowed. The number of Chinese tourist arrivals was 15.4% lower in November compared with a year ago, the steepest decline all year, extending the year-to-date fall in Chinese visitors. Hong Kong’s tourism commission says the city’s tourism industry has “entered a consolidation period” after a decade of growth, and says it is now targeting “high-spending overnight visitors” from other markets to help fill the city’s myriad shopping malls and hotel rooms. Meanwhile, retail sales in the formerly bustling shopping hub have fallen for eight straight months on lower tourist spending, with total retail sales down 2.7% year-over-year for the first 10 months of 2015. That is steeper than the 2.6% decline recorded in 2003, when tourists shunned Hong Kong for several months during the SARS outbreak.

In October, Hong Kong saw a 38.5% drop in sales of Swiss watches, said the Federation of the Swiss Watch Industry. Other brands, like Chanel, went the unusual route of slashing the price of an iconic bag by over 24% in Hong Kong, among other rare discount offers, in a sign of the trying times. [..] Luxury sales began to decline in late 2013 after Beijing started cracking down on corruption and conspicuous consumption. The slump spread to mass-market retailers this year as the Chinese economy slowed. Milan Station, a vendor of secondhand handbags, said revenue in its Hong Kong shops fell over 28% in the first half of the year, while cosmetic retailers Sa Sa and Bonjour reported revenue declines of 10.6% and 14.4% in the six months ended September and June, respectively.

Washington needs to get out of the housing market.

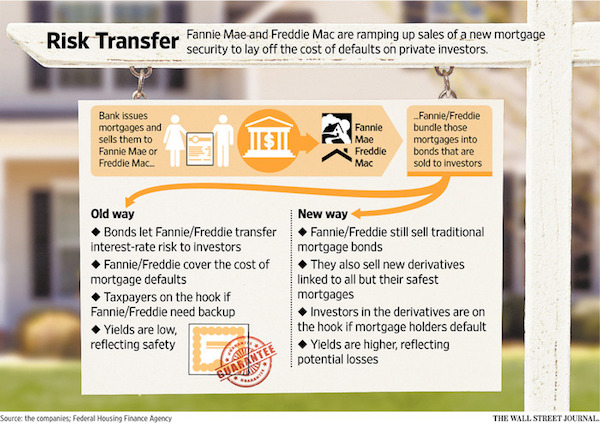

• Fannie and Freddie Give Birth to New Mortgage Bond (WSJ)

Fannie Mae and Freddie Mac are turning to crisis-era tools to reduce their exposure to mortgage losses and spark a new market for financing home buyers. Beginning in 2016, the two government-controlled housing giants will ramp up sales of a new type of security that will transfer most of the cost of defaults on all but their safest mortgages to private investors. The securities will be based on the value of a pool of underlying mortgages—but only indirectly, making them a derivative similar to those that figured in the financial crisis seven years ago. The insurance-like products are called Connecticut Avenue Securities by Fannie Mae and Structured Agency Credit Risk by Freddie Mac. Standard-issue bonds from the housing giants protect investors from the risk that home buyers will stop making payments on their loans.

With the new securities, however, investors could lose some or all of their principal if the underlying mortgages default. The effort marks a notable return to financial engineering in housing finance—elements of which served useful purposes before bloating in the years leading to the crisis. The new securities ultimately could help reduce the government’s role in mortgages by persuading investors to take on the risk of default. Right now, the U.S. housing market relies almost entirely on guarantees from Fannie, Freddie or other government-backed entities. The companies, along with government agency Ginnie Mae, back most mortgages and issued 96% of all mortgage bonds in the first 10 months of the year, according to trade publication Inside Mortgage Finance.

Banks used to issue hundreds of millions of dollars worth of mortgage bonds that didn’t carry Fannie or Freddie’s guarantees, but that market dried up after the financial crisis. Proponents hope the new securities could help restore investors’ appetite for mortgage risk. If it works, backers think the securities could become a mainstay of the bond and housing markets over time, perhaps even getting included in the major indexes tracked by bond funds.

Ambrose’s history lesson dissolves into confusion. Still worth reading, though. “Yes, the world is a mess, but it has always been a mess, forever climbing the proverbial wall of political worry even in its halcyon days. So let us drink a new year’s toast with a glass at least half full.”

• The World’s Political And Economic Order Is Stronger Than It Looks (AEP)

Readers have scolded me gently for too much optimism over the past year, wondering why I refuse to see that the world economy is in dire trouble and that the international order is coming apart at the seams. So for Christmas reading I have retreated to the “World of Yesterday”, the poignant account of Europe’s civilisational suicide in the early 20th century by the Austrian writer Stefan Zweig – the top-selling author of the inter-war years. From there it is a natural progression to Zweig’s equally poignant biography of Erasmus, who saw his own tolerant Latin civilization smothered by fanatics four centuries earlier. Zweig’s description of Europe in the years leading up to 1914 is intoxicating. Everything seemed to be getting better: wealth was spreading, people were healthier, women were breaking free.

He could travel anywhere without a passport, received with open arms in Paris, Milan or Stockholm by a fraternity of writers and artists. It was a cheerful, peaceful world that seemed almost untainted by tribal animosities. It was not an illusion, but it was only half the story. A handful of staff officers at the apex of the German high command under Helmuth von Moltke were already looking for their chance to crush France and Russia, waiting for a spark in the Balkans – it could only be the Balkans – that would lock the Austro-Hungarian empire into the fight as an ally. What is striking in Zweig’s account is that even during the slaughter of the First World War, Europe still had a moral conscience. All sides still bridled at any accusation that they were violating humanitarian principles.

Two decades later, even that had disappeared. Zweig lived to see his country amputated, cut off from its economic lifelines, and reduced to a half-starved rump. He saw Hitler take power and burn his books in Berlin’s Bebelplatz in 1933, then in stages extend the ban to France and Italy. He saw what remained of Austria extinguished in 1938, and his friends sent to concentration camps. As a Jewish refugee in England he slipped from stateless alien to enemy alien. He committed suicide with his wife in February 1942 in Brazil, too heart-broken to keep going after his spiritual homeland – Europe – had “destroyed itself”. Erasmus was also the best-selling author of his day, attaining a dominance that has probably never been challenged by any other author in history, expect perhaps Karl Marx posthumously.

More than 1m copies of his works had been printed by the early 16th century, devoured by a Latin intelligentsia in the free-thinking heyday of the Renaissance, chortling at his satires on clerical pedantry and the rent-farming of holy relics. But after lighting the fire of evangelical reform, he watched in horror as the ideologues took over and swept aside his plea that the New Testament message of love and forgiveness is the heart of Christianity. They charged headlong into the Augustinian cul-de-sac of original sin and predestination, led by Martin Luther, a rough, volcanic force of nature, or the “Goth” as Erasmus called him. Luther preferred to see the whole world burn and Christian Europe split into armed camps rather than yield an inch on abstruse points of doctrine. And burn they did. The killing did not end until the Treaty of Westphalia in 1648. By then the Thirty Years War had left a fifth of Germany dead.

“In principle, depositors are the most senior creditors in a bank. However, that was changed in the 2005 bankruptcy law, which made derivatives liabilities most senior.”

• Derivatives vs Bank Deposits: Let the Bail-Ins Begin (Ellen Brown)

Dodd-Frank states in its preamble that it will “protect the American taxpayer by ending bailouts.” But it does this under Title II by imposing the losses of insolvent financial companies on their common and preferred stockholders, debtholders, and other unsecured creditors. That includes depositors, the largest class of unsecured creditor of any bank. Title II is aimed at “ensuring that payout to claimants is at least as much as the claimants would have received under bankruptcy liquidation.” But here’s the catch: under both the Dodd Frank Act and the 2005 Bankruptcy Act, derivative claims have super-priority over all other claims, secured and unsecured, insured and uninsured. The over-the-counter (OTC) derivative market (the largest market for derivatives) is made up of banks and other highly sophisticated players such as hedge funds.

OTC derivatives are the bets of these financial players against each other. Derivative claims are considered “secured” because collateral is posted by the parties. For some inexplicable reason, the hard-earned money you deposit in the bank is not considered “security” or “collateral.” It is just a loan to the bank, and you must stand in line along with the other creditors in hopes of getting it back. State and local governments must also stand in line, although their deposits are considered “secured,” since they remain junior to the derivative claims with “super-priority.” Under the old liquidation rules, an insolvent bank was actually “liquidated” – its assets were sold off to repay depositors and creditors. Under an “orderly resolution,” the accounts of depositors and creditors are emptied to keep the insolvent bank in business.

The point of an “orderly resolution” is not to make depositors and creditors whole but to prevent another system-wide “disorderly resolution” of the sort that followed the collapse of Lehman Brothers in 2008. The concern is that pulling a few of the dominoes from the fragile edifice that is our derivatives-laden global banking system will collapse the entire scheme. The sufferings of depositors and investors are just the sacrifices to be borne to maintain this highly lucrative edifice. In a May 2013 article in Forbes titled “The Cyprus Bank ‘Bail-In’ Is Another Crony Bankster Scam,” Nathan Lewis explained the scheme like this:

At first glance, the “bail-in” resembles the normal capitalist process of liabilities restructuring that should occur when a bank becomes insolvent. . . . The difference with the “bail-in” is that the order of creditor seniority is changed. In the end, it amounts to the cronies (other banks and government) and non-cronies. The cronies get 100% or more; the non-cronies, including non-interest-bearing depositors who should be super-senior, get a kick in the guts instead. . . .

In principle, depositors are the most senior creditors in a bank. However, that was changed in the 2005 bankruptcy law, which made derivatives liabilities most senior. Considering the extreme levels of derivatives liabilities that many large banks have, and the opportunity to stuff any bank with derivatives liabilities in the last moment, other creditors could easily find there is nothing left for them at all. As of September 2014, US derivatives had a notional value of nearly $280 trillion.

A study involving the cost to taxpayers of the Dodd-Frank rollback slipped by Citibank into the “cromnibus” spending bill last December found that the rule reversal allowed banks to keep $10 trillion in swaps trades on their books. This is money that taxpayers could be on the hook for in another bailout; and since Dodd-Frank replaces bailouts with bail-ins, it is money that creditors and depositors could now be on the hook for. Citibank is particularly vulnerable to swaps on the price of oil. Brent crude dropped from a high of $114 per barrel in June 2014 to a low of $36 in December 2015.

What a story Brazil will be in 2016…

• It’s Every Snitch For Himself In Brazil’s Petrobras Scandal (BBG)

[..] all hail 2015, Brazil’s year of the snitch. Investigators in the city of Curitiba, where the so-called Operation Car Wash probe into corruption at Petrobras is based, have struck 40 such plea bargains, turning criminals into strategic witnesses for the prosecution. Negotiating reduced sentences is not new in Brazil. But until recently, most criminals preferred to gamble on the feeble court system and take their secrets to jail. Everything changed after 2012, when Brazil’s Supreme Federal Court sent two dozen moguls and political bosses to jail in a sweeping vote-buying scam. A rigorous anti-corruption law followed in 2013, and now criminals and cronies are lining up to cop their pleas.

Thanks largely to dishonor among thieves — not to mention financial trackers skilled in sniffing out hidden money — prosecutors have since secured 80 convictions of seemingly untouchable moguls and politicians, whose jail sentences total 782 years. So many criminals have been repurposed as state witnesses that police are running short on ankle bracelets. Brazilians would be forgiven for thinking that little has changed. By cutting deals with prosecutors, confessed criminals have managed to convert harsh jail terms into suspended sentences and house arrest. Yes, Fernando “Baiano” Soares, a lobbyist at the heart of the Car Wash cabal, had to forfeit a bundle of cash and two fancy vacation homes as part of his plea deal.

But when he left jail in November after agreeing to finger accomplices in the Petrobras scheme, he went home to his luxury apartment in one of Rio’s toniest beach districts. Pedro Jose Barusco Filho, sentenced last year to 18 years for turning his second-tier job at Petrobras into a bribe-collection counter, quickly signed an agreement with prosecutors and promised to return $615 million he’d skimmed from supply contracts. By Christmas, he was spotted kicking back at a luxury spa in the Rio hills. Two other guests reportedly left on the spot. Then there is Alberto Youssef, a shadowy money dealer who has been in and out of custody since 2005, when he first agreed to help authorities take down a money-laundering ring at a state-owned regional bank.

But he went back on his word and left investigators empty-handed. This time, the feds were cleverer. When, in early 2014, police again caught up to Youssef – now for helping high-rolling oil company executives and politicians on the take spirit their off-books earnings to offshore tax havens – they doubled down on the man known as “the black market’s central banker.” Jailed for breaking his earlier plea bargain, and with his name popping up in testimony from other state witnesses, Youssef buckled, agreed again to speak out, and led Brazil’s sleuths to the corner offices of Petrobras and beyond.

Snitch by snitch, the Car Wash case has made its way from the oil rigs to the Brazilian capital, where 54 senior politicians, former politicians and their associates are now under investigation. All eyes are now on Delcidio do Amaral, who is not only the first sitting Brazilian senator to be arrested but also a former Petrobras bureaucrat who served as a key dealmaker to the ruling Workers’ Party for the past 13 years. So far, Amaral hasn’t named any names, but the prospect that he might sing is roiling the political corridors. If anyone knows where the bodies in Brasilia are buried, it’s Amaral.

Money must be separated from political power, or huge trouble lies ahead.

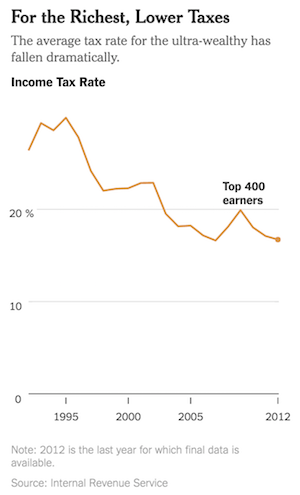

• For the Wealthiest, a Private Tax System That Saves Them Billions (NY Times)

The hedge fund magnates Daniel S. Loeb, Louis Moore Bacon and Steven A. Cohen have much in common. They have managed billions of dollars in capital, earning vast fortunes. They have invested large sums in art — and millions more in political candidates. Moreover, each has exploited an esoteric tax loophole that saved them millions in taxes. The trick? Route the money to Bermuda and back. With inequality at its highest levels in nearly a century and public debate rising over whether the government should respond to it through higher taxes on the wealthy, the very richest Americans have financed a sophisticated and astonishingly effective apparatus for shielding their fortunes. Some call it the “income defense industry,” consisting of a high-priced phalanx of lawyers, estate planners, lobbyists and anti-tax activists who exploit and defend a dizzying array of tax maneuvers, virtually none of them available to taxpayers of more modest means.

In recent years, this apparatus has become one of the most powerful avenues of influence for wealthy Americans of all political stripes, including Mr. Loeb and Mr. Cohen, who give heavily to Republicans, and the liberal billionaire George Soros, who has called for higher levies on the rich while at the same time using tax loopholes to bolster his own fortune. All are among a small group providing much of the early cash for the 2016 presidential campaign. Operating largely out of public view — in tax court, through arcane legislative provisions and in private negotiations with the Internal Revenue Service — the wealthy have used their influence to steadily whittle away at the government’s ability to tax them.

The effect has been to create a kind of private tax system, catering to only several thousand Americans. The impact on their own fortunes has been stark. Two decades ago, when Bill Clinton was elected president, the 400 highest-earning taxpayers in America paid nearly 27% of their income in federal taxes, according to I.R.S. data. By 2012, when President Obama was re-elected, that figure had fallen to less than 17%, which is just slightly more than the typical family making $100,000 annually, when payroll taxes are included for both groups. The ultra-wealthy “literally pay millions of dollars for these services,” said Jeffrey A. Winters, a political scientist at Northwestern University who studies economic elites, “and save in the tens or hundreds of millions in taxes.”

Another example of why choice of words counts. Reform sounds much better than preparing for war.

• China Says Consulted Widely On Army Reform, Xi Closely Involved (Reuters)

China’s military consulted widely on its sweeping reform program, with President Xi Jinping closely involved by speaking with soldiers on the frontlines and hand-writing suggestions, the army’s newspaper said on Thursday. Xi unveiled a broad-brush outline of the reforms last month, seeking further streamlining of the command structure of the world’s largest armed forces, including job losses, to better enable it to win a modern war. He is determined to modernize at the same time as China becomes more assertive in territorial disputes in the East and South China Seas. China’s navy is investing in submarines and aircraft carriers and the air force is developing stealth fighters. The reforms, kicked off in September with Xi’s announcement he would cut service personnel by 300,000, have been controversial.

The military’s newspaper has published almost daily commentaries warning of opposition to the reforms and worries about lost jobs, and warnings that reforms are needed to win wars. In a lengthy front page commentary, the People’s Liberation Army Daily outlined the steps taken to listen to everyone’s opinions on the reforms, including Xi’s involvement. “Chairman Xi went into offices and visited colleges, went to the plateaus, visited the borders, sat in driving seats and cockpits, taking the pulse of reform with soldiers,” the newspaper said. The reform commission took opinions from more than 900 current and former senior officers and experts, issued questionnaires and received thousands of online suggestions, the report said.

There were more than 800 meetings about reform from March to October this year covering almost 700 military bases and units, the newspaper said. The article was also carried in the ruling Communist Party’s official People’s Daily. Xi “found time” to attend meetings on the feedback, saying he wanted to “listen to everyone’s opinion”, it said. “Every line, every word and every character – Chairman Xi earnestly reviewed every draft, putting forward many guiding suggestions, making many important changes with this own hand,” the report said. The enthusiasm for reform and willingness to listen to all sides meant the process was “ardently participated in” by soldiers throughout the ranks, it said.

We still label the PKK terrorists?! Why?

• Turkey ‘One Step Away From A Civil War’ (NY Times)

A major Turkish military operation to eradicate Kurdish militants in Turkey’s restive southeast has turned dozens of urban districts into bloody battlefields, displacing hundreds of thousands of civilians and shattering hopes of reviving peace as an old war reaches its deadliest level in two decades. Over the past week, Turkish tanks and artillery have pounded Kurdish targets across several southeast cities, killing at least 200 militants and more than 150 civilians, according to human rights groups and local officials. Their descriptions of the fighting and mass destruction in populated areas, which are off-limits to journalists, depict war zones not unlike the scenes in neighboring Syria to the south. The Kurds are a geographically dispersed minority whose aspirations for autonomy date back decades.

The flaring of their conflict with Turkey represents a dangerous complication in a region already convulsed by the upheavals in Syria, Iraq and Yemen. About half of all Kurds live in Turkey, a NATO member and American ally. Several Turkish cities are under tight lockdown, and many residents have been trapped without food or electricity as clashes between Kurdish militants and Turkish security forces have intensified. Militants of the Kurdistan Workers’ Party have dug trenches and put up barricades and are using heavy weaponry and rocket launchers to repel the Turkish police, according to local officials. Turkey has been fighting a counterinsurgency campaign against the Kurdistan Workers’ Party since the group ended a two-year cease-fire in July.

Analysts said the renewed conflict initially appeared to have been a calculated political strategy by President Recep Tayyip Erdogan to strengthen support for his Justice and Development Party ahead of parliamentary elections in November. When Justice and Development won by a landslide – a result that Mr. Erdogan interpreted as the public’s demand for stability – many had hoped it would lead to the revival of peace talks. Instead, the violence has sharply escalated, stoking fears that it might spread. Mr. Erdogan has vowed to eliminate the Kurdistan Workers’ Party, considered a terrorist organization by Turkey, the United States and the European Union. Having carried out an insurgency against Turkey for three decades, the group, now emboldened by a radicalized youth branch inspired by the war in Syria, has declared autonomous regions and stepped up its fight for self-rule.

One more red line fades.

• Greek Pension Cuts Back On The Table (Kath.)

The government’s proposal to Greece’s creditors for reform of the country’s ailing pension system is likely to foresee 50% of the savings coming from increases to social security contributions and the other half from cuts to pensions, chiefly through supplementary pensions. Though the government has consistently resisted calls by creditors for further cuts to primary pensions, it is likely to make some small concessions. Apart from reductions to supplementary pensions, it is expected that the government’s proposal will foresee reductions to the size of lump sums paid out to retirees. Government sources on Tuesday indicated that there could be some “adjustments” to primary pensions too but that these would only comprise small reductions and would only affect monthly pensions over €2,500 and cases where retirees receive more than one pension.

Authorities are also said to be considering the use of revenue from games of chance and from the state privatization agency to bolster the pension system. Further, ther is the possibility of a tax on bank transactions of more than 1,000 euros which Economy Minister Giorgos Stathakis on Tuesday confirmed was on the table. Members of the Government Council for Economic Policy (KYSOIP) met Tuesday under Deputy Prime Minister Yiannis Dragasakis and discussed the issue of pension reform as well as plans for social welfare initiatives aimed to helping poorer citizens. Sources indicated after the meeting that the government is committed to carry out a series of actions aimed at rebuilding the welfare state and fighting unemployment as well as boosting the health and education systems.

And then the Germans buy them all up?!

• Greek House Price Drop Second To Worst In The World (Kath.)

Greece has the unenviable distinction of having the second to worst performing residential property market in the world this year, according to data up to the end of September. A Global Property Guide survey shows that the annual price decline in Greece came to 6.03%, second only to Dubai in the United Arab Emirates (-10.4%). Compared to the second quarter of the year, Greece’s price slide amounted to 2% in Q3. Among European Union member-states, Cyprus was a distant second behind Greece, with a 2.2% annual decline in home prices, while Spain was in third after seeing a small drop of 0.45%. As Bank of Greece data also show, pressure on the market prices of residential properties continues, albeit to a lesser degree that previously.

However, an Alpha Bank analysis revealed that after seven consecutive quarters of slowdown in the annual price reduction rate, the trend reversed in the second and third quarters of this year, when the decline accelerated again to 5% and 6.1% respectively, against a drop of 3.9% in Q1 on an annual basis. Apartments in particular saw a milder decline this year, suffering a 5% drop in prices in the first nine months against an 8.1% slump in the same period of 2014 and a 7.5% decline in the whole of 2014. Apartment prices have dropped 40.9% from 2008 up to end-September 2015. The central bank forecasts that the slide is unlikely to reverse in the coming quarters, as the factors that have led to it have not been eliminated.

The problems will come in 2016.

• Merkel Urges Germans To See Refugee Arrivals As ‘An Opportunity’ (AFP)

Chancellor Angela Merkel in her New Year’s address on Thursday asked Germans to see refugee arrivals as “an opportunity for tomorrow” and urged doubters not to follow racist hate-mongers. The past year – when the country took in more than a million migrants and refugees – had been unusually challenging, she said in a pre-released text of the speech, also bracing Germans for more hardships ahead. But she stressed that in the end it would all be worth it because “countries have always benefited from successful immigration, both economically and socially”. With a view to right-wing populists and xenophobic street rallies, she said “It’s important we don’t allow ourselves to be divided.”

“It is crucial not to follow those who, with coldness or even hatred in their hearts, lay a sole claim to what it means to be German and seek to exclude others.” Merkel has earned both praise and criticism at home and abroad for her decision to open Germany to a record wave of refugees, about half from war-torn Syria. Germany took in almost 1.1 million asylum seekers this year, five times 2014’s total, the Saechsische Zeitung regional daily reported on Wednesday citing unpublished official figures. Merkel, faced with opposition in her conservative camp and popular concerns about the influx, has vowed steps to reduce numbers in 2016. Her plan involves convincing other European Union members to take in more refugees, so far with little success, and an EU deal with gateway country Turkey to better protect its borders.

Merkel said “there has rarely been a year in which we were challenged so much to follow up our words with deeds”. She thanked volunteers and police, soldiers and administrators for their “outstanding” accomplishments and “doing far, far more than their duty”. Looking to 2016, she said: “There is no question that the influx of so many people will keep demanding much of us. It will take time, effort and money.”

Home › Forums › Debt Rattle December 31 2015