Jack Delano Engineer at AT&SF railroad yard, Clovis, NM 1943

Make it easier to pay off debt and we’ll all go deeper into debt.

• ‘Miracle’ Needed To Save The World, Because Central Banks Can’t (SMH)

The Bank of Japan and the ECB are printing billions in a “useless” attempt at stimulating demand as a “crisis of confidence” erupts over central banks and their diminishing influence. And for the same reason, the Reserve Bank of Australia may find itself powerless in trying to defeat low inflation by cutting interest rates to fresh record lows. That is the view of Vimal Gor, who is head of income and fixed interest at BT Investment Management. Mr Gor is the latest expert to question the wisdom of RBA rate cuts. “The theory says yes, but in practice it’s unclear as RBA monetary policy has no influence over commodity prices or overcapacity in Chinese and Japanese markets. This takes us back to the question of central bank credibility in being able to deliver on their objectives,” he said.

“Take negative rates any further and central banks risk putting the financial system at risk.” Inflation expectations implied by long-dated inflation swaps suggest markets are not convinced that central banks can lift prices through easy policy settings. “It is clear markets are giving up on central banks to fulfil their mandate in the inflation fighting arena.” Helicopter money, which Mr Gor agrees is a “ridiculous” idea, might be tested, but there is another idea worth exploring. “The other option is to abandon the inflation targeting mantra which has been pervasive over the last 25 years,” he says. Instead, central banks could come up with “a per capita measure of economic activity”. This would limit the pressure to keep lowering interest rates.

“The reality remains that the world is overwhelmed with debt, so that would suggest that we would need to have low rates to make repayment easier, and to discourage saving. “Ironically low rates spur further adoption of debt because of asset prices that are shooting skywards, and actually encourage more saving because income levels from the existing savings pile are too small to live on.”

Xi doesn’t have the guts to come out and say it.

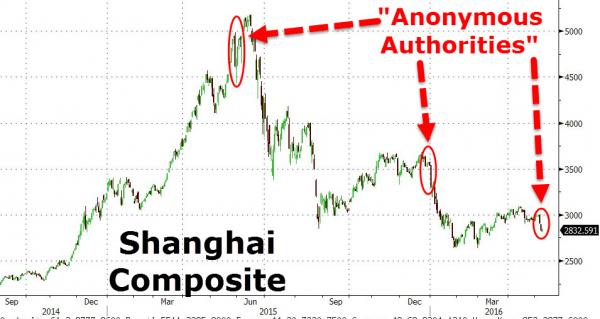

• “Anonymous Voice” Signals Big Policy Change In China (ZH)

Overnight the People’s Daily published an interview with “anonymous authorities” on the topic of China’s economy. It’s a very important article as the “anonymous authorities” is considered to be Mr. Liu He, who is the economy brain of President Xi Jinping. The interview sends strong signals that China policy will shift from its aggressive easing in Q1 to a conservative position which focus on structural reforms. People’s Daily also published the “anonymous authorities” interviews in May 2015 and Jan 2016, which led to the subsequent collapse in the China A share market, because Mr. Liu (and President Xi’s camp) has been promoting structure reforms and risk controls.

For a credit driven China economy and the associated highly leveraged equities/commodities/properties markets, these’re the bad news. The A share market and China domestic commodities market had a big fall last night. Many overseas investors may think last night’s chaos is driven by the weak April import/export data announced during the weekend. I can tell you that it’s not. The local Chinese take the “anonymous authorities” article seriously and his opinion will have much deeper impact for China in the coming quarters. In general, the interview denied the “demand driven” stimulus policy adopted by China in Q1. Like other governments in the world, the CCP party and Chinese government have different sub-parties internally holding different views of the economy.

They believe their own claims are the best for China and advocate their ideas when the reality cling to them. For example, when the economy is really bad, the pro-growth camp will have upper hands and is able to push for their demand driven policies. That’s why we see China swings between structural reform and demand stimulus in the last two years. China pumped $1tn credit in Q1 to stop the falling knife, and this really cross the line of structural reform camp, so that’s why we see the article comes out right now. As the Politburo economy meeting just finished in the end of April, I believe the article delivers the consensus message agreed in the meeting.

One overriding trigger: debt.

• The Triggers For A New Financial Crisis (Das)

There are a number of potential triggers to a new crisis. The first potential trigger may be equity prices. The US stock market runs into trouble. A stronger dollar affects US exports and foreign earnings. Emerging market weakness affects businesses in the technology, aerospace, automobile, consumer products and luxury product industries. Currency devaluations combined with excess capacity, driven by debt fuelled over-investment in China, maintain deflationary pressures reducing pricing power. Lower oil prices reduce earnings, cash flow and asset values of energy producers. Overinflated technology and bio-tech stocks disappoint. Earnings and liquidity pressures reduce merger activity and stock buybacks which have supported equity values. US equity weakness flows into global equity markets.

The second potential trigger may be debt markets. Heavily indebted energy companies and emerging market borrowers face increased risk of financial distress. According to the Bank of International Settlements, total borrowing by the global oil and gas industry reached US$2.5 trillion in 2014, up 250% from US$1 trillion in 2008. The initial stress will be focused in the US shale oil and gas industry which is highly levered with borrowings that are over three times gross operating profits. Many firms were cash flow negative even when prices were high, needing to constantly raise capital to sink new wells to maintain production. If the firms have difficulty meeting existing commitments, then decreased available funding and higher costs will create a toxic negative spiral.

A number of large emerging market borrowers, such as Brazil’s Petrobras, Mexico’s Pemex and Russia’s Gazprom and Rosneft, are also vulnerable. These companies increased leverage in recent years, in part due to low interest rates to finance significant operational expansion on the assumption of high oil prices. These borrowers have, in recent years, used capital markets rather than bank loans to raise funds, cashing in on demand from yield hungry investors. Since 2009, Petrobras, Pemex and Gazprom (along with its eponymous bank) have issued US$140 billion in debt. Petrobras alone has US$170 billion in outstanding debt. Russian companies such as Gazprom, Rosneft and major banks have sold US$244 billion of bonds. The risk of contagion is high as institutional and retail bond investors worldwide are exposed.

A nation on its way to becoming a sinkhole.

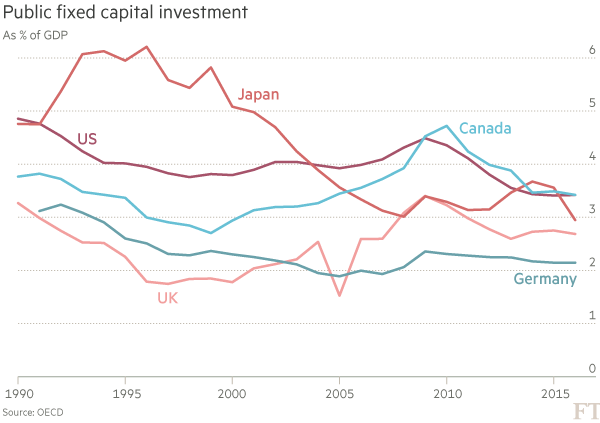

The American Society of Civil Engineers yesterday projected a $1.44tn investment funding gap between 2016 and 2025, warning of a mounting drag on business activity, exports and incomes. Politicians are demanding action. Hillary Clinton, the Democratic frontrunner, has called for a $275bn spending blitz, including the creation of an infrastructure bank, recalling past glories such as the interstate highway system and Hoover Dam. Donald Trump, the presumptive Republican presidential nominee, is bucking anti-spending dogma within the party by promising major programmes to renew infrastructure and create jobs — albeit without putting forward any detail on how to pay for them.

Without radical surgery, the decay in tunnels, railways and waterways will cost the US economy nearly $4tn in lost GDP by 2025 as costs rise and productivity is impeded, according to estimates from the ASCE, dragging on a recovery in output that is the shallowest since the end of the second world war. Faced with crimped public resources, President Barack Obama’s administration and some states have tried to fill infrastructure gaps by luring in private investment, including from public-private partnerships or P3s. A number of states and municipalities have lifted petrol taxes to pay for roads and bridges, even as the federal petrol tax that serves as the backbone of transport spending nationwide has remained frozen since 1993. Many argue that the recent fall in oil prices presented the perfect moment to raise petrol taxes.

Even in the heart of Washington, Memorial Bridge, a symbolic link between the north and the south of the US, might have to be closed to traffic early in the next decade if major repairs are not carried out. Around the country more than 61,000 bridges were deemed structurally deficient in 2014. Last year US public capital investment, which includes infrastructure, was just 3.4% of GDP, or $611bn, according to the president’s Council of Economic Advisers — the lowest in more than 60 years. In the White House, the inability to do more to improve roads, bridges and other infrastructure is seen as one of the major policy failures since the crisis. Mr Obama last month bemoaned the absence of a major infrastructure programme from 2012 to 2014, when borrowing costs were low and the construction industry was short of jobs.

The administration included so-called shovel-ready infrastructure projects in its $800bn stimulus bill after Mr Obama took office, but the spending fell short of what was needed for repairs and to galvanise the economy. Critics see it as a squandered opportunity. However, Jason Furman, chairman of the council, says Mr Obama made repeated attempts to get more money into infrastructure and was rebuffed. “Congress has been unwilling to substantially expand infrastructure investment — it is as simple as that,” he says.

Price discovery.

• Big Oil Abandons $2.5 Billion in US Arctic Drilling Rights (BBG)

After plunking down more than $2.5 billion for drilling rights in U.S. Arctic waters, Royal Dutch Shell, ConocoPhillips and other companies have quietly relinquished claims they once hoped would net the next big oil discovery. The pullout comes as crude oil prices have plummeted to less than half their June 2014 levels, forcing oil companies to cut spending. For Shell and ConocoPhillips, the decision to abandon Arctic acreage was formalized just before a May 1 due date to pay the U.S. government millions of dollars in rent to keep holdings in the Chukchi Sea north of Alaska. The U.S. Arctic is estimated to hold 27 billion barrels of oil and 132 trillion cubic feet of natural gas, but energy companies have struggled to tap resources buried below icy waters at the top of the globe.

Shell last year ended a nearly $8 billion, mishap-marred quest for Arctic crude after disappointing results from a test well in the Chukchi Sea. Shell decided the risk is not worth it for now, and other companies have likely come to the same conclusion, said Peter Kiernan, the lead energy analyst at The Economist Intelligence Unit. “Arctic exploration has been put back several years, given the low oil price environment, the significant cost involved in exploration and the environmental risks that it entails,” he said. All told, companies have relinquished 2.2 million acres of drilling rights in the Chukchi Sea – nearly 80% of the leases they bought from the U.S. government in a 2008 auction. Oil companies spent more than $2.6 billion snapping up 2.8 million acres in the Chukchi Sea during that sale, on top of previous purchases in the Beaufort Sea.

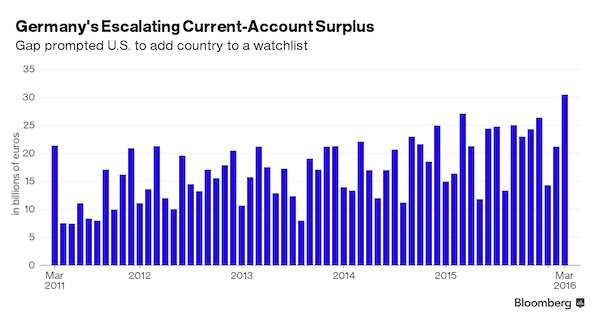

Bloomberg relates this to the US, but that’s not the point. It’s what the surplus does to the rest of the EU that counts.

• Germany Posts Record Current-Account Surplus (BBG)

Germany posted a record current-account surplus just days after being placed on a U.S. watchlist for countries that may have an unfair foreign-exchange advantage. The current-account gap climbed to €30.4 billion in March, up from €21.1 billion the previous month, data from the Federal Statistics Office showed on Tuesday. The nation’s trade surplus, a narrower measure that only counts imports and exports of goods and services, widened to €26 billion, also a record. The U.S. put Germany, China, Japan, South Korea and Taiwan on a new currency watchlist on April 29, saying their foreign-exchange practices bear close monitoring to gauge whether they provide an unfair trade advantage over America. The economies met two of the three criteria used to judge unfair practices under a February law that seeks to enforce U.S. trade interests.

Meeting all three would trigger action by the president to enter discussions and seek potential penalties, including being cut off from some U.S. development financing and exclusion from U.S. government contracts. While Germany has no direct influence over the value of its currency, being just one member of the 19-nation euro area, it was cited because of its current-account and trade surpluses. Taiwan made the list because of its current-account surplus and persistent intervention to weaken the currency, according to the Treasury. Germany’s excess savings could be used to boost growth in the euro area, the Treasury said at the time. A report by the IMF on Monday said the current-account surplus will probably stay near record levels this year.

The euro weakened by more than 10% against the dollar in each of 2014 and 2015, though it has strengthened this year. The single currency traded at $1.1383 at 9:04 a.m. Frankfurt time. It was at almost $1.40 in mid-2014, before the European Central Bank started an unprecedented monetary-stimulus drive that includes negative interest rates and bond purchases.

Germany and Holland prey on Europe’s poor.

• Germany is the Eurozone’s Biggest Problem (Wolf)

Why is conventional German thinking on macroeconomics so peculiar? And does it matter? The answer to the second question is that it matters a great deal. A part of the answer to the first is that Germany is a creditor. The financial crisis has given it a dominant voice in eurozone affairs. This is a matter of might, not right. Creditors’ interests are important. But they are partial, not general, interests. Recent complaints have focused on the European Central Bank’s monetary policies, especially negative interest rates and quantitative easing. Wolfgang Schauble, Germany’s finance minister, even claimed that the ECB bore half of the responsibility for the rise of the Alternative for Germany, an anti-euro party. This is an extraordinary attack.

Criticism of ECB policies is wide-ranging: they make it unnecessary for recalcitrant members to reform; they have failed to reduce indebtedness; they undermine the solvency of insurance companies, pension funds and savings banks; they have barely kept inflation above zero; and they foment anger with the European project. In brief, ECB policy has become a big threat to stability. All this accords with a conventional German view. As Peter Bofinger, an heretical member of Germany’s council of economic experts argues, the tradition goes back to Walter Eucken, the influential father of postwar ordoliberalism. In this approach, ideal macroeconomics has three elements: a balanced budget at (almost) all times; price stability (with an asymmetric preference for deflation); and price flexibility.

This is a reasonable approach for a small, open economy. It is workable for a larger country, such as Germany, with highly competitive tradeable industries. But it cannot be generalised to a continental economy, such as the eurozone. What works for Germany cannot work for an economy three times as large and far more closed to external trade. Note that in the last quarter of 2015, real demand in the eurozone was 2% lower than in the first quarter of 2008, while US demand was 10% higher. This severe weakness in demand is missing from most of the German complaints. The ECB is rightly trying to prevent a spiral into deflation in an economy suffering from chronically weak demand. As Mario Draghi, ECB president, insists, the low interest rates set by the bank are not the problem. They are instead “the symptom” of insufficient investment demand.

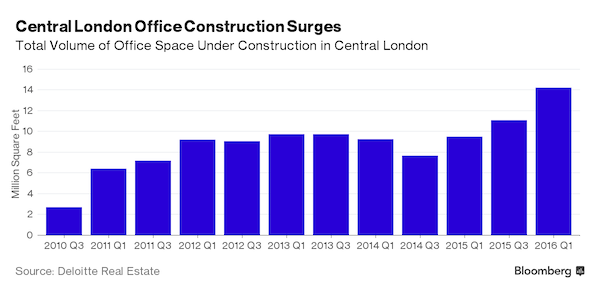

Following the MO of China’s ghost cities.

• London Is Building More Offices Than Ever (BBG)

Developers started a record number of central-London office projects in the six months through March as they tried to capitalize on rising rents. Construction work began on 51 office buildings during the period, Deloitte LLP said in a report on Tuesday. About 14 million square feet (1.3 million square meters) of space is now under construction, 28% more than the previous six months and the highest since March 2008, according to the report. “In just 18 months, we have seen activity nearly double,” Deloitte said in the report, which it started publishing in 1996. “This is perhaps the first survey in a long time where we are able to point to the pendulum swinging away from landlords and back toward tenants.”

About 42% of the space under construction has already been leased and vacancy rates remain at a record low of less than 4%, Deloitte said. The “tight market conditions” are likely to continue for a few more years, according to Tim Leckie at JP Morgan. “There is a risk of the cycle turning first in the City from 2018 as new supply comes online,” he said in an e-mail.

It’s war machine.

• NATO Is Much Worse Than A Cold War Relic (FFF.Org)

Whatever else might be said about Donald Trump, the fact is that he has provided a valuable service in producing a national and international discussion of NATO, the old Cold War organization whose mission was to protect Western Europe from an attack from the Soviet Union, which had been America’s partner and ally during World War II. The obvious question arises: Given that NATO was a Cold War institution, why didn’t it go out of existence when the Cold War ended, as its counterpart, the Warsaw Pact, did? Indeed, let’s not forget that that’s precisely what U.S. officials assured Soviet officials would happen as the Cold War was ending. Shut down the Warsaw Pact and we’ll shut down NATO. But U.S. officials double-crossed the Russians. Even though the Warsaw Pact, which consisted of the Soviet Union and Eastern European countries, dismantled, NATO didn’t.

[Recently], the New York Times said reminded readers that former Defense Secretary Robert Gates had expressed a concern back in 2011 that young Americans would have no memory of the Cold War and would consider NATO to be just an artifact. If only NATO was only an artifact, one in which people just sat around collecting tax-funded paychecks. Instead, after double-crossing the Russians, it continued operating as if the Cold War had never ended, moving ever close to Russia’s border by absorbing former members of the Warsaw Pact. When NATO forces ultimately reached Ukraine, which is on Russia’s border, how could anyone be surprised over Russia’s reaction? The U.S. would have reacted the same way. In fact, it did in 1961, when the Soviets installed defensive missiles in Cuba.

There is no way U.S. national-security state officials could have been shocked over Russia’s reaction to NATO’s plan to absorb Ukraine. U.S. officials had to know from the get-go that Russia would never permit NATO to take control over its longtime military base in Crimea, which is precisely what would have happened if NATO had absorbed Ukraine. The same New York Times article quotes Gen. Philip M. Breedlove, former supreme allied commander for Europe: “The United States absolutely needs NATO — a NATO that is strong, resilient and united.” According to the article, “Five members of the Joint Chiefs of Staff made a similar set of arguments at the Council on Foreign Relations on Tuesday, also avoiding any mention of Mr. Trump’s name.”

Well, duh! Of course, they favor NATO! What better way to ignite more crises and more Cold War than with NATO? After all, what if Americans demand that U.S. troops come home from the Middle East, thereby eliminating any more threat of anti-American terrorism? What better new official enemy than the old Cold War official enemy, Russia? What better way to keep the entire national-security establishment in high cotton with ever-increasing budgets? The Times article also expressed the concern among many that Trump intends to establish good relations with Russian President Vladimir Putin. Heaven forbid! Why, that’s heresy to any advocate of the national-security state! Everyone knows that Putin is a former KGB official. Everyone knows that the KGB was composed of communists. Everyone knows that a communist can never be trusted. The war on communism is on, once again.

Allegedly to make sure the country can rebuild its economy. But there’s nothing left to rebuild with.

• Greece Faces Its Toughest Austerity Measures Yet (G.)

In his tiny shop in downtown Athens, Kostis Nakos sits behind a wooden counter hunched over his German calculator. The 71-year-old might have retired had he been able to make ends meets but that is now simply impossible. “All day I’ve been sitting here doing the maths,” he sighs, surrounded by the undergarments and socks he has sold for the past four decades. “My income tax has just gone up to 29%, my social security payments have gone up 20%, my pension has been cut by 50 euros; they are taxing coffee, fuel, the internet, tavernas, ferries, everything they can, and then there’s Enfia [the country’s much-loathed property levy]. Now that makes me mad. They said they would take that away!” A mild man in milder times, Nakos finds himself becoming increasingly angry.

So, too, do the vast majority of Greeks who walked through his door on Monday. “Everyone’s outraged, they’ve been swearing, insulting the government, calling [prime minister] Alexis Tsipras a liar,” he exclaims after parliament’s decision on Sunday night to pass yet more austerity measures. “And they’re right. Everything he said, everything he promised, was a fairy tale.” Until the debt-stricken country’s financial collapse, shops like this were the lifeblood of Greece. For small-time merchants, the pain has been especially vivid because, like everyone Nakos knows, he voted for Tsipras and his leftist Syriza party. Now the man who was swept to power on a platform to eradicate austerity has passed the toughest reforms to date – overhauling the pension system, raising taxes and increasing social security fund contributions as the price of emergency bailout aid.

As MPs voted inside the red-carpeted 300-seat chamber on Sunday, police who had blocked off a large part of the city centre deployed teargas and water cannon against the thousands of anti-austerity demonstrators amassed outside. It was a world away from the day the tieless, anti-austerity leftists first assumed office, tearing down the barricades outside the sandstone parliament building. The latest measures – worth €5.4bn (£4.3m) in budget savings – mark a new era. After nine months of wrangling with the international creditors keeping the country afloat, Athens must apply policies that until now had been abstract concepts for a populace who have suffered as unemployment and poverty rates have soared.

Home › Forums › Debt Rattle May 11 2016