NPC Sidney Lust Leader Theater, Washington, DC 1920

The last steps up for the yen?

• Asian Stocks Sink to Four-Week Low as Yen, Dollar Gain (BBG)

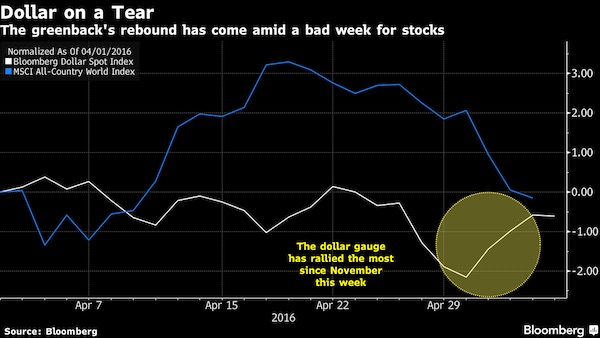

Global stocks dropped, set for the biggest weekly loss since February, and the yen rose before key American jobs data that will help shape the U.S. interest-rate outlook. Australia’s currency slumped and its bonds surged after the nation’s central bank lowered its inflation forecast. The Stoxx Europe 600 Index and the MSCI Asia Pacific Index both lost ground, as did S&P 500 futures. Shanghai shares tumbled the most since February as raw-materials prices sank in China. The yen rose against all 16 major peers. The Bloomberg Dollar Spot Index gained for a fourth day, buoyed by comments from Federal Reserve officials that a June rate hike is possible. U.S. crude oil sank below $44 a barrel and industrial metals were poised for their biggest weekly loss since 2013. Australia’s three-year bond yield fell to a record.

A retreat in global equities gathered pace in the first week of May as data highlighted the fragile state of the world economy. The Reserve Bank of Australia joined the European Union in trimming inflation projections this week, after the Bank of Japan on April 28 pushed back the target date for meeting its 2% goal for consumer-price gains. Economists predict U.S. non-farm payrolls rose by 200,000 last month, a Bloomberg survey showed before Friday’s report. “With the U.S. jobs report coming up, investors are holding back,” said Masahiro Ichikawa at Sumitomo Mitsui in Tokyo. “They’re watching the yen very closely.” Four regional Fed presidents said Thursday they were open to considering an interest-rate increase in June, something that’s been almost ruled out by derivatives traders. Fed Funds futures put the odds of a hike next month at around 10%, down from 20% a month ago.

Losses in shadow banks are consistently underestimated.

• Broker CLSA Sees China Bad-Loan Epidemic With $1 Trillion of Losses (BBG)

Chinese banks’ bad loans are at least nine times bigger than official numbers indicate, an “epidemic” that points to potential losses of more than $1 trillion, according to an assessment by brokerage CLSA Ltd. Nonperforming loans stood at 15% to 19% of outstanding credit last year, Francis Cheung, the firm’s head of China and Hong Kong strategy, said in Hong Kong on Friday. That compares with the official 1.67%. Potential losses could range from 6.9 trillion yuan ($1.1 trillion) to 9.1 trillion yuan, according to a report by the brokerage. The estimates are based on public data on listed companies’ debt-servicing abilities and make assumptions about potential recovery rates for bad loans. Cheung’s assessment adds to warnings from hedge-fund manager Kyle Bass, Autonomous Research analyst Charlene Chu and the IMF on China’s likely levels of troubled credit.

The IMF said last month that the nation may have $1.3 trillion of risky loans, with potential losses equivalent to 7% of GDP. CLSA estimates bad credit in shadow banking – a category including banks’ off-balance-sheet lending such as entrusted loans and trust loans – could amount to 4.6 trillion yuan and yield a loss of 2.8 trillion yuan. CLSA cites a diminishing economic return on stimulus pumped into the economy as among the reasons for a worsening outlook, with Cheung saying at a briefing that bad loans had the potential to rise to 20% to 25%. “China’s banking system has reached a point where it needs a comprehensive solution for the bad-debt problem, but there is no plan yet,” he said in the report.

Beijing can’t regulate shadow banking, since it let it grow far too big, but it can try to pick favorites. It’s relevant to ask who has the power in China these days. Local governments are neck deep in shadow loans, and Xi can’t afford, politically, to let them go bust. But can he afford to support them, financially?

• China Regulator Tries Again To Rein In Banks’ Shadow Assets (WSJ)

In the pursuit of order in its financial markets, China’s banking regulator has tended to be one step behind in keeping up with a decade-long dalliance between commercial banks and the country’s non-bank lenders, called the shadow banking sector. Its latest directive suggests the government might finally be trying to get ahead. Bankers and analysts say the China Banking Regulatory Commission issued a notice to commercial lenders last week, taking aim at a shadow-banking product that has allowed banks to hide loans, including bad ones, from their books. The watchdog has tried cracking down on similar arrangements in the past. But this time, it appears to have taken a more nuanced approach in order to more effectively get at banks that originate the loans underlying these products.

In its crosshairs is a relatively obscure instrument called credit beneficiary rights, a product that is derived from shadow-banking deals and can then be sold between banks. The CBRC’s new directive in part takes aim at this practice by calling for banks to stop investing in credit beneficiary rights using funds raised from their own wealth management products. In China, shadow banks’ dexterity and relentlessness at product innovation have regularly pushed them right to the edge of what their regulators can tolerate. The CBRC directive, known as Notice No. 82, is the latest in a cat-and-mouse game that banks have played with regulators for years. Beneficiary rights are themselves an innovation to circumvent a CBRC clampdown in 2013 and 2014 on banks directly buying trust products in a similar arrangement to disguise loans, and then developing a lively interbank market for these rights transfers.

There have been regulatory interventions on variations of the practice every year since 2009. The commission hasn’t publicly released the directive. Analysts say the regulator is likely now huddled with banks to gauge how hard they will push back and how thoroughly the regulator can implement the requirements. Beneficiary rights confer on the buyer the right to a stream of income without ceding actual ownership of the underlying asset. That asset is often a corporate loan, which may or may not have already soured, though it could also be anything that generates an income stream, such as a trust, a wealth management product or a margin financing deal.

When one bank sells credit beneficiary rights to another, the transaction allows the first bank to use the accounting change to turn the underlying loan on its books into an “investment receivable.” The rules require banks to set aside about 25% of the receivable’s value in capital provisions, compared with 100% had it been a loan. The deals get more complex as layers are added to further disguise the loan. Banks will have third-party shadow financiers extend the actual loan to the company, in exchange for the bank’s purchase of beneficiary rights to the loan’s income stream.

And where would you think steel prices are going?

• China Produces Most Steel Ever After Price Surge (BBG)

China, maker of half the world’s steel, probably boosted production to a record in April as mills fired up furnaces and domestic prices surged to 19-month highs, according to Sanford C. Bernstein. Average daily output may have eclipsed the previous high of about 2.31 million metric tons in June 2014, said Paul Gait, a senior analyst in London. Producers ramped up supply as demand rebounded and prices jumped as much as 69% from their November low, generating the best margins since 2009.

1970 is a reasonable guess for peak of prosperity. It’s not the only one, but it’s right up there.

• Wages’ Share of US GDP Has Fallen for 46 Years (CH Smith)

The majority of American households feel poorer because they are poorer. Real (i.e. adjusted for inflation) median household income has declined for decades, and income gains are concentrated in the top 5%:

Even more devastating, wages’ share of GDP has been declining (with brief interruptions during asset bubbles) for 46 years. That means that as GDP has expanded, the gains have flowed to corporate and owners’ profits and to the state, which is delighted to collect higher taxes at every level of government, from property taxes to income taxes.

Here’s a look at GDP per capita (per person) and median household income. Typically, if GDP per capita is rising, some of that flows to household incomes. In the 1990s boom, both GDP per capita and household income rose together. Since then, GDP per capita has marched higher while household income has declined. Household income saw a slight rise in the housing bubble, but has since collapsed in the “recovery” since 2009.

These are non-trivial trends. What these charts show is the share of the GDP going to wages/salaries is in a long-term decline: gains in GDP are flowing not to wage-earners but to shareholders and owners, and through their higher taxes, to the government. The top 5% of wage earners has garnered virtually all the gains in income. The sums are non-trivial as well. America’s GDP in 2015 was about $18 trillion. Wages’ share -about 42.5%- is $7.65 trillion. If wage’s share was 50%, as it was in the early 1970s, its share would be $9 trillion. That’s $1.35 trillion more that would be flowing to wage earners. That works out to $13,500 per household for 100 million households.

When you start with statements like this, what’s left to talk about? “The Bundesbank and Federal Reserve, for example, are respected for achieving monetary stability..”

• Deutsche Chief Economist: ECB Should Change Course Before It Is Too Late (FT)

Over the past century central banks have become the guardians of our economic and financial security. The Bundesbank and Federal Reserve, for example, are respected for achieving monetary stability, often in the face of political opposition. But central bankers can also lose the plot, usually by following the economic dogma of the day. When they do, their mistakes can be catastrophic. In the 1920s the German Reichsbank thought it a clever idea to have 2,000 printing presses running day and night to finance government spending. Hyperinflation was the result. Around the same time, the Federal Reserve stood by as more than a third of US bank deposits were destroyed, in the belief that banking crises were self-correcting. The Great Depression followed. Today the behaviour of the ECB suggests that it too has gone awry.

When reducing interest rates to historically low levels did not stimulate growth and inflation, the ECB embarked on a massive programme of purchasing eurozone sovereign debt. But the sellers did not spend or invest the proceeds. Instead, they placed the money on deposit. So the ECB went to the logical extreme: it imposed negative interest rates. Currently almost half of eurozone sovereign debt is trading with a negative yield. If this fails to stimulate growth and inflation, “helicopter money” will be next on the agenda. Future students of monetary policy will shake their heads in disbelief. What is more, as purchaser-of-last-resort of sovereign debt, the ECB is underwriting the solvency of its over-indebted members. Countries no longer fear that failure to reform their economies or reduce debt will raise the cost of borrowing.

Six years after the onset of the European debt crisis, total indebtedness in the eurozone keeps on rising. Badly needed reforms have been abandoned. As a result the eurozone is as fragile as ever. Safe keepers of our wealth, such as insurance companies, pension funds and savings banks barely earn a positive spread. Inflation is just above zero, well below the ECB’s defined target. And with growth anaemic, debt levels in some countries, such as Italy, are not sustainable. Worse still, the ECB is failing in its other mandated duty – to promote stability. Popular opposition to low and negative interest rates, when combined with continuing high unemployment, is fomenting anger with the European project. Even if current policy eventually results in an overdue recovery, political pressure is unlikely to abate.

It’s like one of those oracle-type questions: ‘how can something be on its knees that doesn’t exist’?

• UK Economic Recovery Is ‘On Its Knees’ (Ind.)

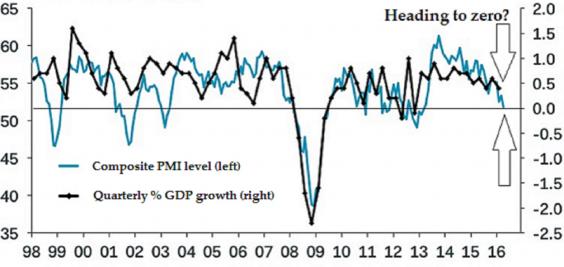

The latest survey of the UK’s dominant services sector has today rounded off a dismal hat-trick of disappointment for the British economy. The Markit/CIPs PMI Index for April came in at 52.3. That’s above the 50 point that separates contraction from growth. But it’s also the weakest reading since February 2013, when the economy’s recovery was just starting. And it follows two pretty desperate readings this week from the equivalent PMIs for the manufacturing and construction sectors, which both showed the feeblest levels of activity in around three years. Put all these three readings together and one gets the “composite” PMI which can be used to roughly approximate to GDP growth in the overall economy. And combine these two metrics in the chart below (from Pantheon Macroeconomics) and you get this grim picture:

The blue line (left hand scale) shows the level of the composite PMI. The black line (right hand scale) shows the % quarterly rate of GDP growth. They track reasonably well over time. And the decline in the composite reading suggests GDP growth, which weakened to 0.4% in the first quarter of 2016, could be heading down to zero in the second quarter. What’s going on? Samuel Tombs of Pantheon says business and consumer jitters emanating from uncertainty about the outcome of the Brexit referendum has “brought the recovery to its knees”. More economists are now seriously talking of the possibile need for macroeconomic stimulus to get the recovery back on track. “The deterioration in April pushes the surveys into territory which has in the past seen the Bank of England start to worry about the need to revive growth either by cutting interest rates or through non-standard measures such as QE” said Chris Williamson of Markit.

Lewis paints King a tad too much like a cross between Einstein and Mother Theresa, if you ask me. He presided over a period when debt was already rising like there’s no tomorrow.

• The Book That Will Save Banking From Itself (Michael Lewis)

One of my favorite memories of my brief life on Wall Street in the late 1980s is of Mervyn King’s visit. A year after Professor King – as I still think of him – had been my tutor at the London School of Economics, he was tapped to advise some new British financial regulator. As he had no direct experience of financial markets, either he or they thought he’d benefit from exposure to real, live American financiers. I’d been working at the London office of Salomon Brothers for maybe six months when one of my bosses came to me with a big eye roll and said, “We have this academic who wants to sit in with a salesman for a day: Can we stick him with you?” And in walked Professor King. I should say here that King’s students, including me, often came away from encounters with him feeling humored.

He was gentle with people less clever than himself (basically everyone) and found interest in what others had to say when there was no apparent reason to. He really wanted you to feel as if the two of you were engaged in a genuine exchange of ideas, even though the only ideas with any exchange value were his. Still, he had his limits. The man who a year before had handed me a gentleman’s B and probably assumed I would vanish into the bowels of the American economy never to be heard from again saw me smiling and dialing at my Salomon Brothers desk and did a double take. He took the seat next to me and the spare phone that allowed him to listen in on my sales calls. After an hour or so, he put down the phone. “So, Michael, how much are they paying you to do this?” he asked, or something like it.

When I told him, he said something like, “This really should be against the law.” Roughly 15 years later, King was named governor of the Bank of England. In his decade-long tenure, which ended in 2013, the Bank of England became, and remains, the most trustworthy institutional narrator of events in global finance. It’s the one place on the inside of global finance where employees don’t appear to be spending half their time wondering when Goldman Sachs is going to call with a job offer. For various reasons, they don’t play scared. One of those reasons, I’ll bet, is King.

They’re all very nervous. What happens when oil prices start falling again?

• Shift In Saudi Oil Thinking Deepens OPEC Split (R.)

As OPEC officials gathered this week to formulate a long-term strategy, few in the room expected the discussions would end without a clash. But even the most jaded delegates got more than they had bargained with. “OPEC is dead,” declared one frustrated official, according to two sources who were present or briefed about the Vienna meeting. This was far from the first time that OPEC’s demise has been proclaimed in its 56-year history, and the oil exporters’ group itself may yet enjoy a long life in the era of cheap crude. Saudi Arabia, OPEC’s most powerful member, still maintains that collective action by all producers is the best solution for an oil market that has dived since mid-2014.

But events at Monday’s meeting of OPEC governors suggest that if Saudi Arabia gets its way, then one of the group’s central strategies – of managing global oil prices by regulating supply – will indeed go to the grave. In a major shift in thinking, Riyadh now believes that targeting prices has become pointless as the weak global market reflects structural changes rather than any temporary trend, according to sources familiar with its views. OPEC is already split over how to respond to cheap oil. Last month tensions between Saudi Arabia and its arch-rival Iran ruined the first deal in 15 years to freeze crude output and help to lift global prices. These resurfaced at the long-term strategy meeting of the OPEC governors, officials who report to their countries’ oil ministers.

According to the sources, it was a delegate from a non-Gulf Arab country who pronounced OPEC dead in remarks directed at the Saudi representative as they argued over whether the group should keep targeting prices. Iran, represented by its governor Hossein Kazempour Ardebili, has been arguing that this is precisely what OPEC was created for and hence “effective production management” should be one of its top long-term goals. But Saudi governor Mohammed al-Madi said he believed the world has changed so much in the past few years that it has become a futile exercise to try to do so, sources say. “OPEC should recognize the fact that the market has gone through a structural change, as is evident by the market becoming more competitive rather than monopolistic,” al-Madi told his counterparts inside the meeting, according to sources familiar with the discussions.

And how could prices rise in the face of record reserves?

• US Crude Stockpiles Seen Rising Further to Record (BBG)

U.S. crude inventories will expand to a record 550 million barrels this month before starting their seasonal slide, according to a forecast by Citigroup. Stockpiles rose 2.8 million barrels to 543.4 million last week, the most in more than 86 years, according to data from the Energy Information Administration. Inventories reached the highest ever at 545.2 million barrels in October 1929, according to monthly EIA data.

Record stockpiles with a million barrels missing. Prices are already dropping again.

• Fort McMurray Fires Knock One Million Barrels Offline (FP)

The shut down of energy facilities accelerated Thursday, taking off line about one million barrels – close to 40% – of Alberta’s daily oilsands production, as a wildfire that started near Fort McMurray spread south to new producing areas. Meanwhile, oil companies poured their resources into the firefighting effort — from sheltering evacuees to helping with medical emergencies. Overnight Wednesday, the raging fire forced the evacuation of smaller communities south of Fort McMurray, where many evacuees fleeing the flames this week had taken shelter. They joined residents of Fort McMurray, who were ordered to leave their homes earlier in the week.

“Based on press releases and our discussions with producers, the fires have impacted oilsands production by an estimated 0.9 to 1 million b/d – disproportionately weighted towards synthetic crude oil,” Greg Pardy, co-head of global energy research at RBC Dominion Securities, said in a report. “This would constitute about 35% to 38% of our 2016 oilsands outlook of 2.6 million b/d.” Steve Laut, president of Canadian Natural Resources, said it was difficult to gauge the long-term impacts of the crisis because it was still evolving. “It’s devastating to the city of Fort McMurray,” he said Thursday after addressing the company’s annual meeting. Many production facilities are located away from the fire, but “it’s really the workers at the mines and the plants who live in Fort McMurray who are impacted,” Laut said. Canadian Natural said its operations at the Horizon mining project were stable.

How is it possible that no-one died yet? They must be doing something very right.

• Canada’s Wildfires Grow Tenfold In Size (G.)

A catastrophic wildfire that has forced all 88,000 residents to flee Fort McMurray in western Canada grew tenfold on Thursday, cutting off evacuees in camps north of the city and putting communities to the south in extreme danger. Authorities scrambled to organise an airlift of 8,000 people from the camps on Thursday night and hoped to move thousands more to safer areas as the fast-moving fire threatened to engulf huge areas of the arid western province of Alberta. Officials said 25,000 people had taken shelter in the oilsands work camps when the fires engulfed the city. The remaining 17,000 would have to wait until fuel reserves were refilled and the opening of a main highway to drive themselves south. The out-of-control blaze has burned down whole neighborhoods of Fort McMurray in Canada’s energy heartland and forced a precautionary shutdown of some oil production, driving up global oil prices.

The Alberta government, which declared a state of emergency, said more than 1,100 firefighters, 145 helicopters, 138 pieces of heavy equipment and 22 air tankers were fighting a total of 49 wildfires, with seven considered out of control. Three days after the residents were ordered to leave Fort McMurray, firefighters were still battling to protect homes, businesses and other structures from the flames. More than 1,600 structures, including hundreds of homes, have been destroyed. “The damage to the community of Fort McMurray is extensive and the city is not safe for residents,” said Alberta premier Rachel Notley in a press briefing on Thursday night, as those left stranded to the north of the city clamoured for answers. “It is simply not possible, nor is it responsible to speculate on a time when citizens will be able to return. We do know that it will not be a matter of days,” she added.

Merkel bet on the wrong horse again. And this one, too, will put people’s well-being in danger. “..It’s time the EU starts to connect the dots and see it for what it is.” Oh, they see it alright.

• Turkish Power Struggle Threatens EU Migrant Deal (FT)

A pivotal deal to staunch the flow of migrants from Turkey into the EU, masterminded by Angela Merkel, German chancellor, is in doubt after Turkey’s pro-European prime minister resigned. Ahmet Davutoglu, who personally negotiated the deal with Ms Merkel, quit on Thursday following a power struggle with President Recep Tayyip Erdogan. The premier’s departure imperils an agreement credited with sharply reducing the influx of asylum-seekers into the EU – and rescuing Ms Merkel from a potentially fatal political backlash. The deal enables the EU to send migrants arriving illegally on the Greek islands back to Turkey in exchange for visa requirements on Turkish visitors being eased and financial aid. However, President Erdogan has responded coolly towards the agreement struck by his premier and has shown increasing hostility towards the EU.

Without reforms to Turkey’s antiterrorism and anti-corruption laws, which Mr Erdogan has angrily resisted, Brussels may be unable to grant some of the most important concessions in the deal — a move that Ankara has already warned would cancel its obligation to curtail refugee crossings into Greece. “We’ve made good progress on the agreement with Turkey,” Ms Merkel said in Rome on Thursday. “The European Union, or at least Germany and Italy, are prepared and stand by the commitments that we’ve agreed to. We hope that’s mutual.” To keep the pact on track, Ankara must still meet several benchmarks, including major revisions to its antiterrorism legislation to ensure civil liberties, that Mr Erdogan has been loath to support.

EU officials are now concerned that Ankara will backtrack on reform commitments. “It’s certainly not good news for us,” said the EU official. “Erdogan would be very ill-advised to throw this out of the window and think this is now a matter of horse-trading. He thinks it’s 50% wriggle room, and the rest is all arm-wrestling.” Sinan Ulgen, a former Turkish diplomat at the Carnegie Europe think-tank, said that Mr Erdogan had been “much more categorical” in resisting changes to the antiterrorism law, adding that, with his AK party and parliament in disarray, the chances of reforms being passed in time for a June deadline was becoming increasingly unlikely. When Ms Merkel set out to persuade sceptical EU countries to back the migrant deal, one of her central arguments, according to diplomats, was that it would shore up the pro-European faction in Ankara, led by Mr Davutoglu.

Instead, the deal hastened the demise of her main Turkish ally and left the pro-Europeans seriously weakened. President Erdogan saw Mr Davutoglu’s increasingly close relationship with the EU as a threat. A rift between the two men turned into a power struggle which the prime minister lost. [..] European lawmakers who must now approve the deal say they are becoming increasingly wary. “If this was an isolated incident, you could say it’s just an internal affair,” said Marietje Schaake, a Dutch liberal who has become a leading voice on Turkey in the European parliament. “But we’ve seen a series of incidents that are clearly a pattern towards authoritarianism. It’s time the EU starts to connect the dots and see it for what it is.”

Merkel has lost it: the EU, in order to survive, needs to start protecting people, especially children, before protecting borders. It’s the only thing that could still save the Union.

• Merkel Warns Of Return To Nationalism Unless EU Protects Borders (AFP)

German Chancellor Angela Merkel on Thursday urged European leaders to protect EU borders or risk a “return to nationalism” as the continent battles its worst migration crisis since World War II. As Italian Prime Minister Matteo Renzi kicked off two days of talks in Rome with Merkel and senior EU officials, the German leader said Europe must defend its borders “from the Mediterranean to the North Pole” or suffer the political consequences. Support for far-right and anti-immigrant parties is on the rise in several countries on the continent which saw more than a million people arrive on its shores last year. In Austria, Norbert Hofer of the far-right Freedom Party is expected to win a presidential run-off on May 22 after romping to victory in the first round on an anti-immigration platform.

Merkel told a press conference with Renzi that Europe’s cherished freedom of movement is at threat, with ramped-up border controls in response to the crisis raising questions over whether the passport-free Schengen zone can survive. With over 28,500 migrants arriving since January 1, Italy has once again become the principal entry point for migrants arriving in Europe, following a controversial EU-Turkey deal and the closure of the Balkan route up from Greece. In previous years, many migrants landing in Italy have headed on to other countries – but with Austria planning to reinstate border controls at the Brenner pass in the Alps, a key transport corridor, Rome fears it could be stuck hosting masses of new arrivals. Renzi lashed out at Austria on Thursday, describing Vienna’s position as “anachronistic”.

Child refugees have to be the no. 1 priority. A Europe with no morals has no future either.

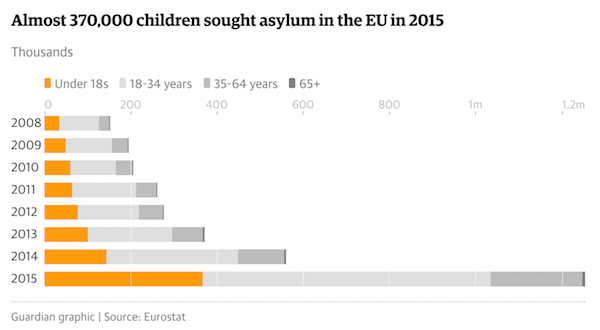

• Quarter Of Child Refugees Arriving In EU Travelled Without Parents (G.)

A quarter of all child refugees who arrived in Europe last year – almost 100,000 under-18s – travelled without parents or guardians and are now “geographically orphaned”, presenting a huge challenge to authorities in their adopted countries. A total of 1.2 million people sought asylum in the EU in 2015, 30% of whom – almost 368,000 – were minors. The number of children arriving in Europe last year was two-and-half times that recorded a year earlier, and almost five times as many as in 2012. But the most staggering statistic is that a quarter of the young arrivals were unaccompanied. In all, 88,695 children completed the dangerous journey without their parents – an average of 10 arriving every hour. The highest proportion of child refugees last year were Syrian, followed by Afghans and Iraqis. Together these three nationalities accounted for 60% of all minors seeking asylum in the EU.

In absolute terms, Germany received the highest number of child refugees, taking in more than 137,000 in 2015. However, as a proportion of population Sweden took in the most. Half of the unaccompanied minors came from Afghanistan, and one in seven were Syrian. More unaccompanied minors hailed from Eritrea (5,140) than from Iraq (4,570). Sweden took the highest number of lone children, 35,000 in total, two-thirds of them from Afghanistan. It also recorded the highest number of unaccompanied minors per head of population, followed by Austria and Hungary. It is not possible to get a full picture of how many children have sought asylum in Europe so far in 2016, as several countries have not yet published figures for the first quarter of the year. But the number of child asylum applicants recorded in Europe in January and February already far exceeds that recorded in the same months of 2015.

Home › Forums › Debt Rattle May 6 2016