Salvador Dali Eggs on the plate (without the plate) 1932

Fresco in Prague, dedicated to the children of Ukraine

Hungry people are dangerous

Rickards

Safe and effective

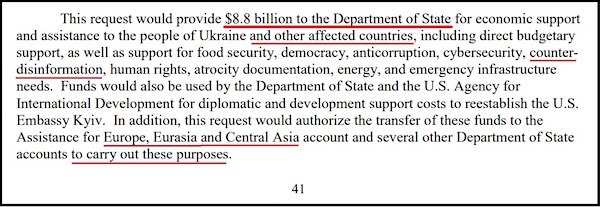

“How do we propose to get these things into Ukraine? Fly the stuff in on USAF C-17 Globemaster transport planes? To what airfield, exactly?”

• Shadows Within Shadows (Jim Kunstler)

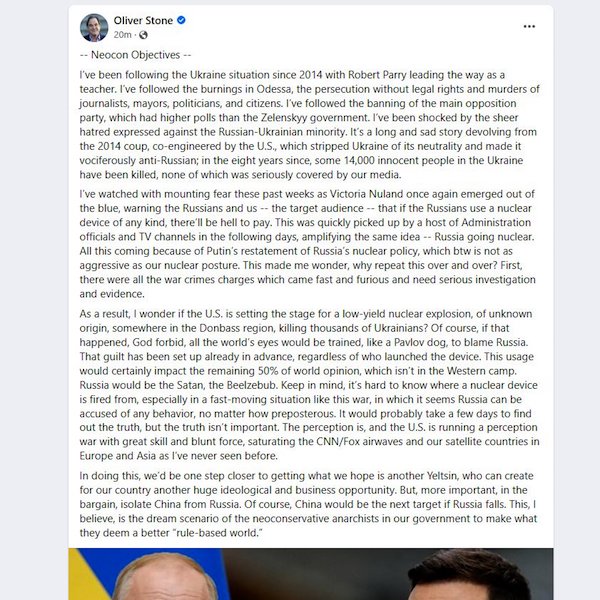

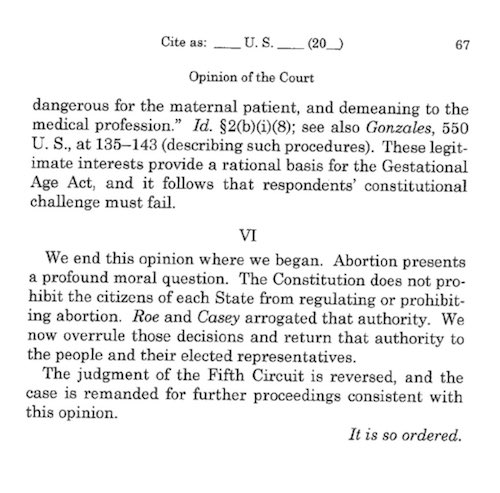

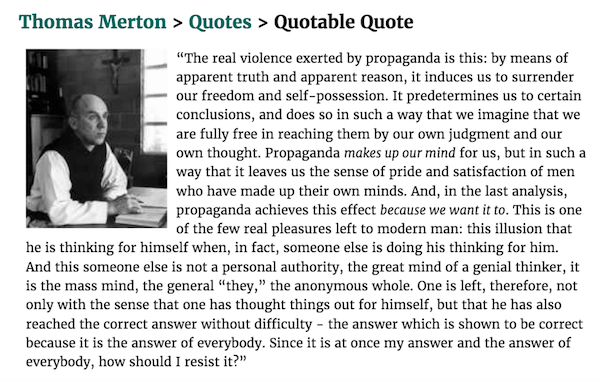

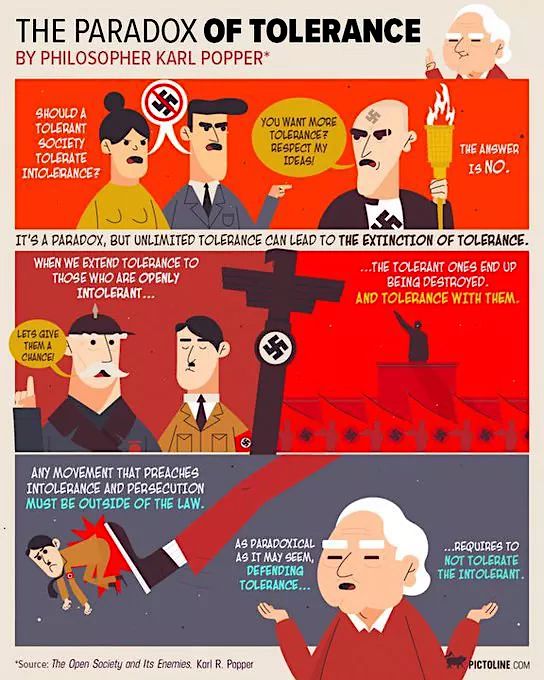

The regime behind “Joe Biden” appears to relish the prospect of dragging out this crisis as long as possible, despite the fact that we have about zero national interest in the fate of Ukraine, except perhaps for our fears about the dark secrets that reside there…. Amid an all-out campaign of contrived World War Three hysteria, our country aims to send about $14-billion in aid to Ukraine post-haste, including more javelin anti-tank missiles and weapons described as “kamikaze drones,” posing some thorny questions for curious observers. How do we propose to get these things into Ukraine? Fly the stuff in on USAF C-17 Globemaster transport planes? To what airfield, exactly? And with what assurance that they can make delivery without encountering, shall we say, induced mechanical failure before landing?

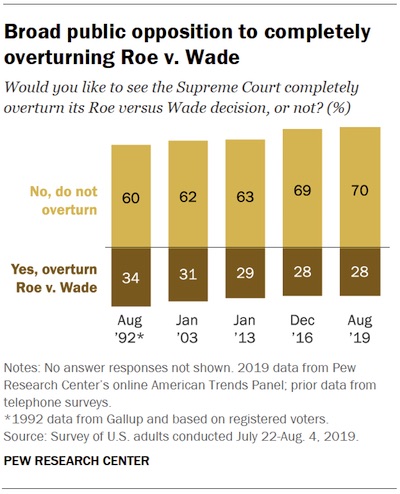

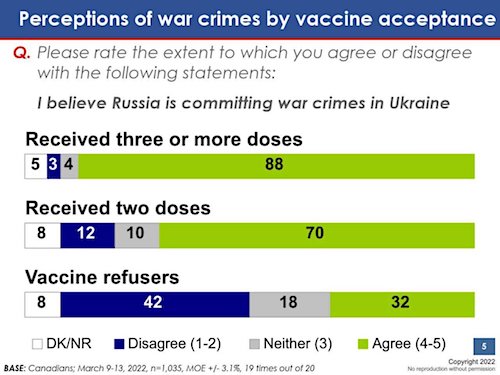

Drive the weapons across the border from Poland, Slovakia, Hungary, Romania, or Moldova? Do you not suppose that Russia has satellite surveillance of the limited number of road crossings along that frontier, and will be watching for truck convoys. More likely, that dollar number and the weaponry talk are fantasies intended to propitiate the roughly thirty percent of Americans whom, pollsters report, are avid for an apocalyptic nuclear showdown with Russia. Thirty percent, by the way, is the estimate by psychologists of any given population susceptible to mass formation psychosis — the transfiguration of anxiety-and-anomie-driven persons from something like harmless grasshoppers into ravaging human locusts.

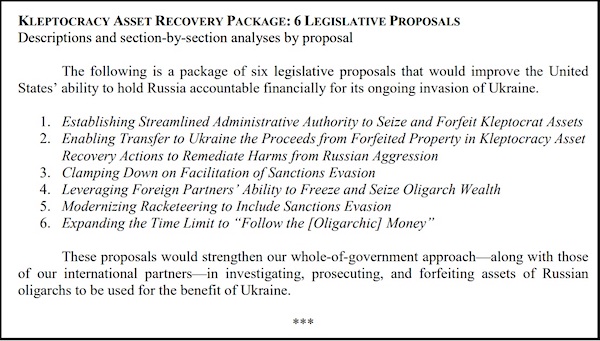

That group derangement phenomenon has been managed artfully by America’s Deep State in recent years starting with the Russia Collusion hoax against the alleged monsterdom of Mr. Trump, then shifted to the frenzy around Covid-19 virus, with all its sickening rituals of obedience and submission, and now segued seamlessly to the melodrama of Vladimir Putin cast as King Kong manhandling Fay Wray as personified by Ukraine. Readers assure me that Russia is “getting its ass kicked” in that sore-beset, yawning expanse of wheat and mud that has been, one way or another, a domain of Russia longer than the USA has been nation — except the past thirty-odd years when it has been a playground for homegrown oligarch-looters, US State Department and CIA gamesters, and grift-seeking rogues such as Mr. Hunter R. Biden and the relatives of John Kerry and Nancy Pelosi.

Read more …

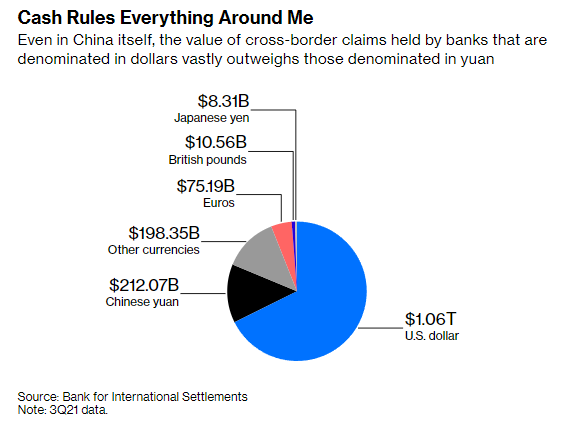

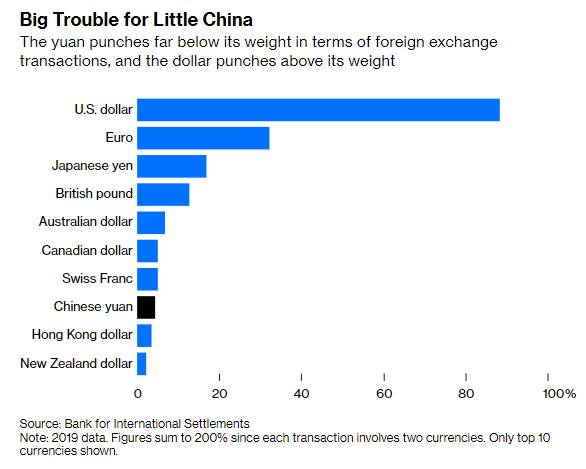

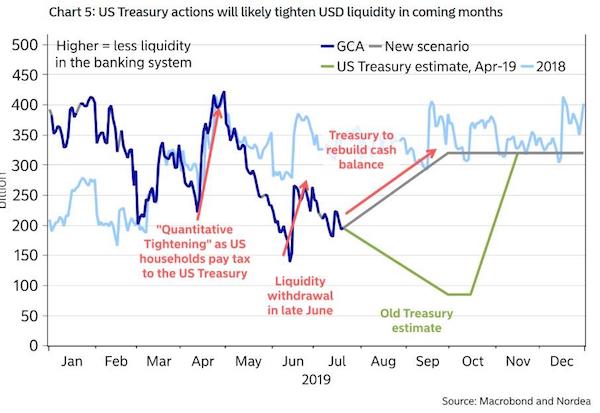

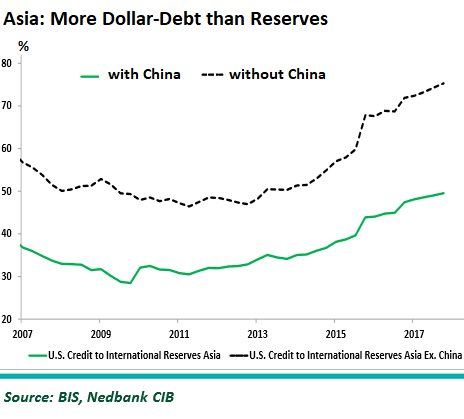

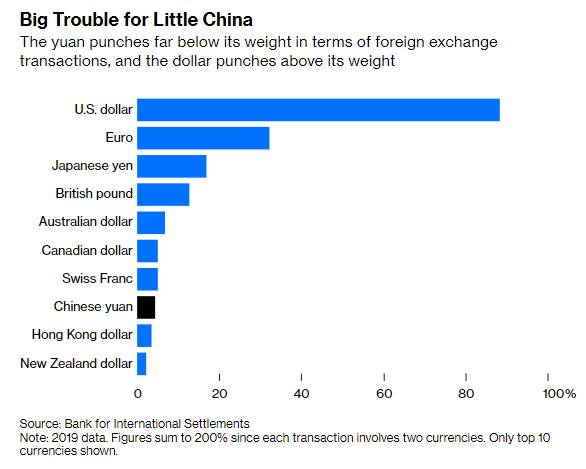

Three articles on the USD. I still tend to side with No. 3, I don’t see what could replace the dollar. Certainly not the yuan, not as long as Xi demands full control of it.. There’s gold, and bitcoin, and SDR, and then maybe a fiat basket of currencies. Whatever comes, it will take a long time.

• The Dominance Of The US Dollar Is Fading Right Before Our Eyes (QTR)

Saudi Arabia, which is a nation of major consequence economically due to its significant oil and gas reserves, has reportedly embraced the idea of accepting Yuan instead of dollars for Chinese oil sales. Not unlike Russia and China’s plans to de-dollarize, that date back nearly a decade, the Saudis have been considering this idea for six years already. And not unlike Russia and China’s new economic tie-up, the catalyst for speeding up the process has been U.S. foreign policy: Saudi Arabia is in active talks with Beijing to price some of its oil sales to China in yuan, people familiar with the matter said, a move that would dent the U.S. dollar’s dominance of the global petroleum market and mark another shift by the world’s top crude exporter toward Asia.

The talks with China over yuan-priced oil contracts have been off and on for six years but have accelerated this year as the Saudis have grown increasingly unhappy with decades-old U.S. security commitments to defend the kingdom, the people said. The consideration by Saudi Arabia is consequential. It shows that other nations, when forced to choose sides between the U.S. and its foes, don’t feel obligated to commit to the U.S. dollar, further undermining the world’s perception about the dollar’s strength. Not unlike Russia, Saudi Arabia is a country that, regardless of how much its currency may “devalue” versus a fiat basket of currencies, is still backed by finite resources. This gives the country and its currency intrinsic strength. Russia seems to understand this. In fact, just this morning, Russian Foreign Minister Sergei Lavrov, likely alluding to this fact, said that economic sanctions against Russia make the country “stronger”.

Saudi Arabia is now another serious name on the list of contenders who have the currency bite to back up the economic rhetoric bark of challenging the dollar. As The Wall Street Journal notes, the Saudis have “traded oil exclusively in dollars since 1974, in a deal with the Nixon administration that included security guarantees for the kingdom.” The U.S. dollar’s ties to oil have been crucial in helping prop up the currency’s demand globally. These ties have also helped drum up the psychological buy-in necessary for the world to collectively accept that “the next guy” is going to want their U.S. dollars. But given the alliance between Russia and China – and the newfound alliance between Saudi Arabia and China – it looks as though that confidence game might be coming to an end right before our very eyes.

Read more …

Love Pepe, but this does’t sound credible.

• All That Glitters Is Not Necessarily Russian Gold (Escobar)

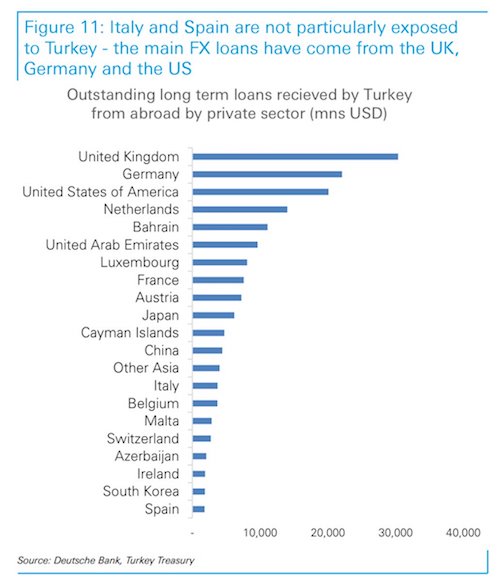

The Eurasia Economic Union (EAEU) and China are starting to design a new monetary and financial system bypassing the U.S. dollar, supervised by Sergei Glazyev and intended to compete with the Bretton Woods system. Saudi Arabia – perpetrator of bombing, famine and genocide in Yemen, weaponized by U.S., UK and EU – is advancing the coming of the petroyuan. India – third largest importer of oil in the world – is about to sign a mega-contract to buy oil from Russia with a huge discount and using a ruble-rupee mechanism. Riyadh’s oil exports amount to roughly $170 billion a year. China buys 17% of it, compared to 21% for Japan, 15% for the U.S., 12% for India and roughly 10% for the EU. The U.S. and its vassals – Japan, South Korea, EU – will remain within the petrodollar sphere. India, just like China, may not.

Sanction blowback is on the offense. Even a market/casino capitalism darling such as uber-nerd Credit Suisse strategist Zoltan Poznar, formerly with the NY Fed, IMF and Treasury Dept., has been forced to admit, in an analytical note: “If you think that the West can develop sanctions that will maximize the pain for Russia by minimizing the risks of financial stability and price stability for the West, then you can also trust unicorns.” Unicorns are a trademark of the massive NATOstan psyops apparatus, lavishly illustrated by the staged, completely fake “summit” in Kiev between Comedian Ze and the Prime Ministers of Poland, Slovenia and the Czech Republic, thoroughly debunked by John Helmer and Polish sources.

Poznar, a realist, hinted in fact at the ritual burial of the financial chapter of the “rules-based international order” in place since the early Cold War years: “After the end of this war ‘money’ “will never be the same”. Especially when the Hegemon demonstrates its “rules” by encroaching on other people’s money. And that configures the central tenet of 21st century martial geopolitics as monetary/ideological. The world, especially the Global South, will have to decide whether “money” is represented by the virtual, turbo-charged casino privileged by the Americans or by real, tangible assets such as energy sources. A bipolar financial world – U.S. dollar vs. yuan – is at hand.

There’s no surefire evidence – yet. But the Kremlin may have certainly gamed that by using Russia’s foreign reserves as bait, likely to be frozen by sanctions, the end result could be the smashing of the petrodollar. After all the overwhelming majority of the Global South by now has fully understood that the backed-by-nothing U.S. dollar as “money” – according to Poznar – is absolutely untrustworthy. If that’s the case, talk about a Putin ippon from hell.

Read more …

Thread.

“..would take decades to come to fruition. And that only gets you to the point where the yuan is as important as, say, the euro or the yen.”

• Dollar Dominance Is Going To Be With Us For Decades To Come (Fickling)

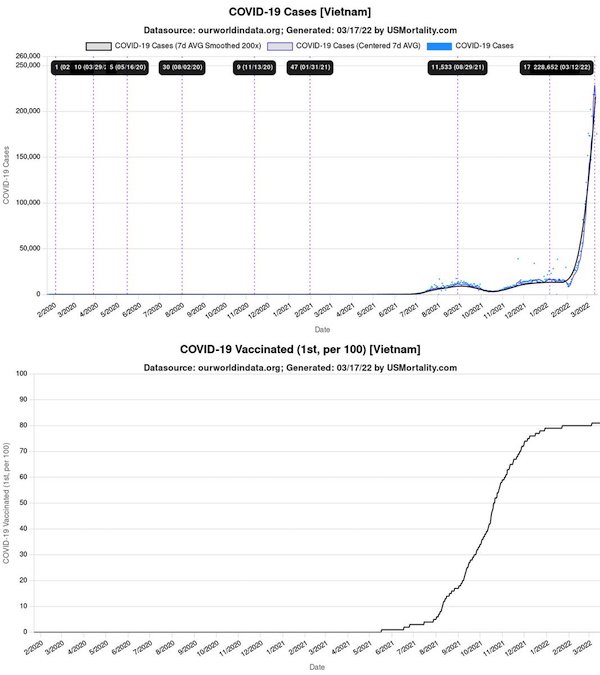

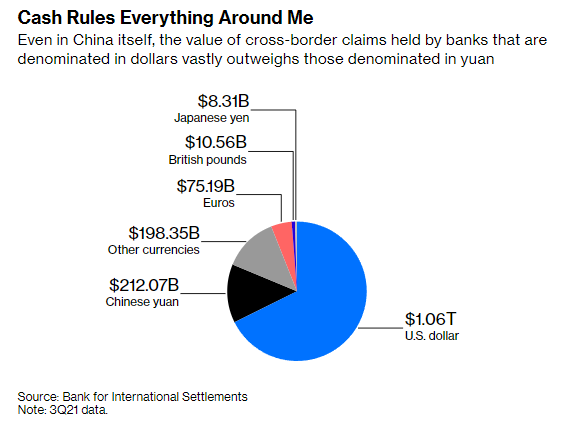

I regularly scoff about the wild claims about the yuan replacing the dollar as a global currency. But every time I look at the data I’m still *amazed* at just how irrelevant the yuan is: Banks *in China itself* still use the greenback for more than two-thirds of their cross-border claims. Just 14% are denominated in yuan.

As is often pointed out, the Swiss Franc and Canadian and Australian dollars are used in more FX transactions than the Chinese yuan. It’s likely the yuan is more used down than in this 2019 data, but also consider that much of those flows will be with the Hong Kong dollar.

Which however you look at it is not exactly a global monetary transaction. The key thing that I think people fail to understand about the dollar’s global importance is that it’s founded not so much on the U.S. dollar regulated by the U.S. Federal Reserve, but the eurodollar, an instrument that few people know about and fewer understand. Are eurodollars money? Well, kinda. They owe their value to the fact that they’re freely convertible with U.S. dollars, on the balance sheets of banks in the U.S. But they are created on the balance sheets of banks outside the U.S. and not subject to Federal Reserve regulation. Eurodollars were the crypto of their day — a way to create money out of sight of government regulation. Their origin was in the dollar deposits of Communist countries after World War II, which the kept in Europe so that the Fed wouldn’t be able to freeze their assets.

It’s absolutely true that the Fed’s post-2008 swap lines, and the growing use of the dollar to extend the reach of Washington’s secondary sanctions, and the action against the central bank of Russia last month, start eroding the eurodollar’s autonomy. But compare it to assets in a country like China with a closed capital account and sweeping asset forfeiture rules like China’s so-called anti-sanctions law last year, and money based on the eurodollar is still the closest thing the world has to unregulated global finance.

If China opens up its capital account, starts running up huge budget deficits to provide more of a supply of safe assets, and establishes a solid reputation for rule of law, it might start to chip away at the edges of this edifice. But any one of those conditions on its own would be an epic, extraordinary policy change, and would take decades to come to fruition. And that only gets you to the point where the yuan is as important as, say, the euro or the yen.

Read more …

WEF AND crypto?!

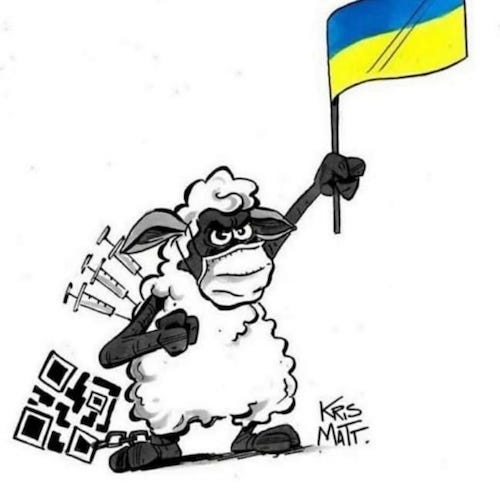

• Ukraine Adopts WEF Proposals (Armstrong)

Zelensky has just signed into law the first steps of Schwab’s Great Reset. He announced he is introducing a Social Credit Application combining Universal Basic Income (UBI), a Digital Identity & a Vaccine Passport all within their Diia app. He also says that because so much money is coming into Ukraine as he has become an international celebrity, he has legalized cryptocurrencies in Ukraine. He will allow foreign and Ukrainian cryptocurrencies exchanges to operate legally, according to the country’s Ministry of Digital Transformation. So far, he has taken in over $63 million in cryptocurrency donations.

Read more …

100,000 US troops sent to Europe to NOT start a war.

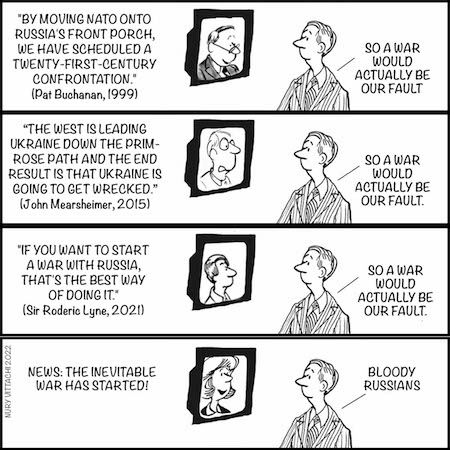

• NATO Calls up 100s of 1000s of Troops Ready to Begin WWIII (Armstrong)

The pressure to start World War III is on. NATO now expects that there will be a major war with Russia and the confrontation may come even in a few weeks. The NATO Secretary-General announced an increased war alert for hundreds of thousands of soldiers. Stoltenberg issued a joint statement with US Secretary of Defense Lloyd Austin, stating that hundreds of thousands of NATO troops were placed on high alert along with 100,000 US troops. The problem with war is that BOTH sides lie and twist the facts to support their own agenda. They paint their adversary as evil to stir up the troops to go fight and risk their lives typically for fake stories and agendas.

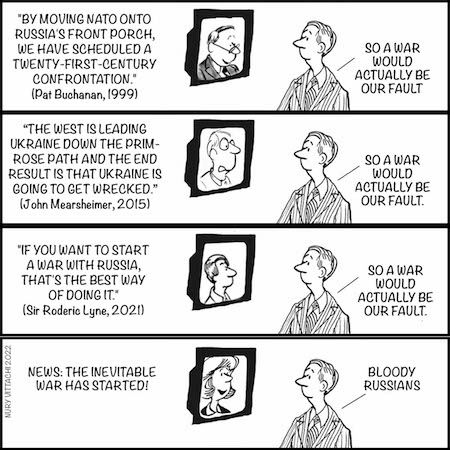

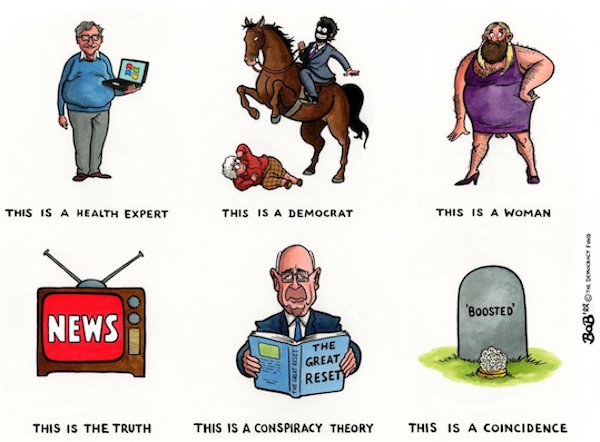

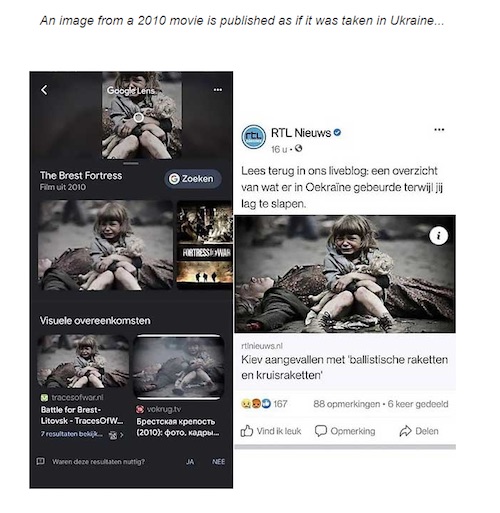

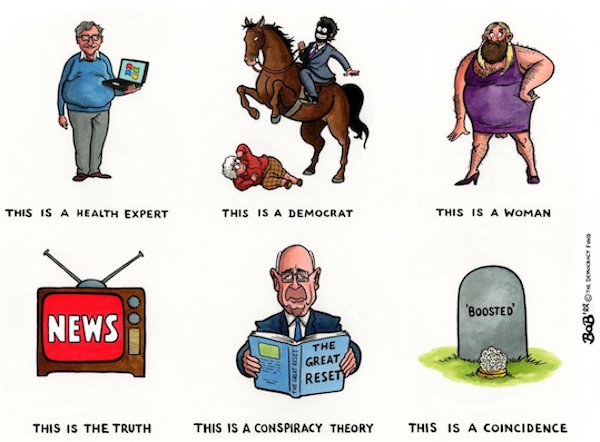

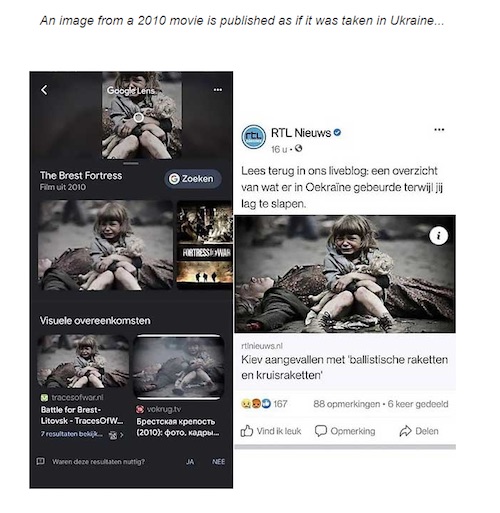

The Press is deliberately trying to create World War III and is engaged in using photos of children hurt and others from events unrelated to Ukraine. This is all to beat the war drums to create World War III without any honest understanding of what that will mean. Despite the hatred and demonization of Putin, he has been trying to take the high road. Zelensky has been following his orders and refusing to compromise on anything. As a WEF Young Global Leader, he is showing the same authoritarian approach as Trudeau in Canada as well as Australia and New Zealand who are all on board with this Great Reset. We may see this crisis turn into a confrontation as soon as the week of April 18th going into the first week of May based upon our computer models.

But the real crisis may come in August and turn global in 2023. I am glad I spent a fair portion of my life in Europe to see all the historical monuments before these people feel the need to destroy the world over two provinces in Ukraine. I fear this time, the monuments will not survive. Pray for civilization for we have madmen leading the West into World War III all so they can Build Back Better as they did following World War II with Bretton Woods II, but this time we are facing a completely different war with biological and nuclear weapons.

Unfortunately, the press will NEVER tell us the truth or explain just why people are expected to lose their lives for some noble cause that is always some propaganda to support a political agenda. This time, the bombs will be wiping out American cities unlike World War I and II not to mention Korea, Vietnam, Iraq, Afghanistan, or other clandestine operations. You may not be watching it on TV but out your own window. Well, we get what we deserve. America voted for Biden, Britain for Johnson, Canada for Trudeau, and Ukraine for Zelensky. There is no peacemaker and certainly no statesman among the crop of world leaders today. To even question what is going on they cancel you now as a Putin supporter to once more not have to explain the truth. There is NEVER truth to be found in the propaganda of war for either side.

Read more …

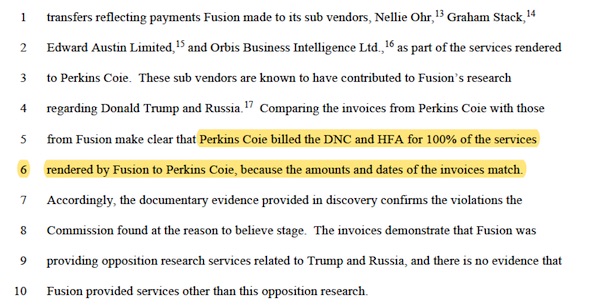

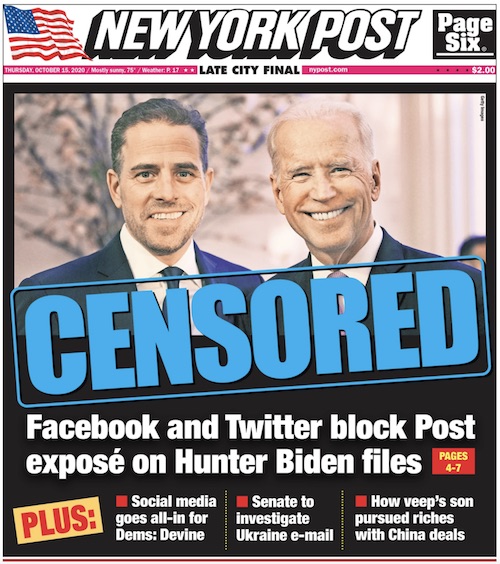

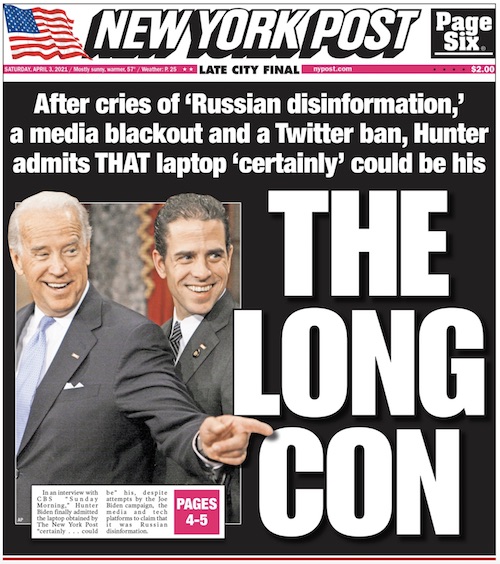

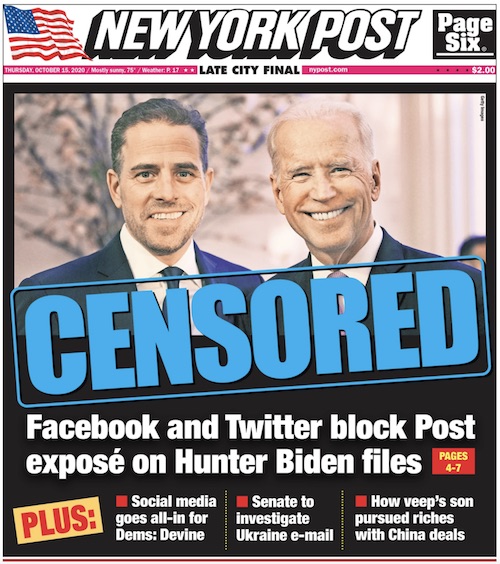

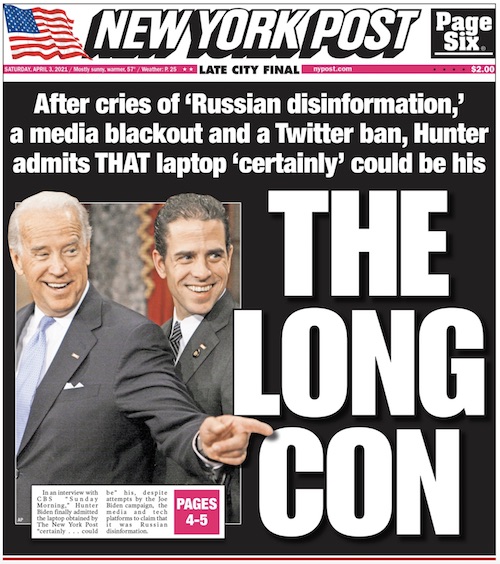

Censoring the laptop story was for domestic consumption. But Russia, China, India watch this unfold and see a corrupt rogue state that cannot be trusted.

• The Times Finally Admits: Hunter’s Laptop Is Real (NYP op-ed)

Now we’re 16 months away from the 2020 election, Joe Biden’s safely in the White House, and the Times finally decides to report on the news rather than carry the Biden campaign’s water. And they find that hey, Hunter Biden’s business interests benefited from Joe Biden’s political status to a suspicious degree. Perhaps this is a topic worthy of examination. How did the Times “authenticate” the laptop? It doesn’t say. Unlike The Post’s reporting, which detailed exactly how we got the files and where they came from, the Times does a hand wave to anonymous sources. No facts have changed since fall 2020. They knew the laptop was real from the start. They just didn’t want to say so.

There’s never any shame with these 180s. Sorry that we wrote a “fact check” that turned out to be bull! Sorry we wrote a piece claiming something wasn’t a story and you were stupid for thinking so! Twitter banned us for supposedly publishing “hacked materials” that weren’t hacked. The company’s CEO apologized, but by that point, they had accomplished what they wanted. Like the Times, they cast enough doubt to avoid making their preferred candidate look bad. Readers of the Times have discovered in March 2022 that Hunter Biden pursued business deals in Europe and Asia, and may have leveraged his father’s position as vice president to do it. Hunter also may not have properly registered with the government or declared all his income. All legitimate topics of discussion about a presidential candidate’s family, no?

Readers of The Post have known this since October 2020. We also have a much better sports section. We’ve authenticated it.

Read more …

Special counsel. It’s the only approach.

• How Dem Officials, The Media And Big Tech Buried The Hunter Biden Story (NYP)

Everlasting, undying, soul-rending shame be upon you, Facebook and Twitter and Politico and all the others who covered up, denied and suppressed this newspaper’s true and accurate reporting about Hunter Biden’s laptop in 2020. You should be hurling yourselves at the feet of the American people, begging forgiveness. You should be renting billboards saying, “WE LIED.” But most importantly, you should be hauled before Congress to answer humiliating questions. These and other information purveyors owe us — not just this paper, but this country — restitution for what now looks like the most egregious and willful fake-news scam of our time. This paper’s scoops on Hunter Biden’s laptop in 2020 were labeled “Russian misinformation” (Politico), a “hoax” (Steven Brill of “fact-check” site NewsGuard), discredited by “many, many red flags” (NPR) and a “hack and leak” operation that had to be throttled (Facebook’s Mark Zuckerberg).

It was infamously snuffed out on Twitter, as was The Post’s Twitter account, because of a policy about hacked materials that only seemed to apply to this one case. Twitter didn’t bar the New York Times’s stories about Donald Trump’s tax returns, which could have come from hacked materials for all we know, and almost certainly were the product of a criminal act (leaking tax returns is against the law), but the Times never even told us how it got the returns, so we don’t know. The Post acted with transparency in explaining to readers how it got the Laptop from Hell. Moreover, nobody on Team Biden denied The Post’s report, because they knew or suspected it was true. Every news outlet in the country should have fronted the story at that point: “Biden team refuses to deny Hunter Biden laptop story.” A few months later, Hunter himself said the laptop “certainly” could be his, and the media shrugged instead of apologizing.

Even in the presidential debate where the matter came up, Joe Biden’s comments were not a denial but simply a deflection, and everybody who reported that he denied the laptop story was guilty of propagating fake news all over again. What he actually said was, “There are 50 former national intelligence folks who said that what he’s accusing me of is a Russian plant. Five former heads of the CIA, both parties, say what he’s saying is a bunch of garbage. Nobody believes it except his good friend Rudy Giuliani.” Joe (who later said “Yes, yes, yes” when a reporter asked him if he “believed” the laptop was Russian disinfo — the question allowed him all the wiggle room in the world) pointedly wasn’t denying the laptop belonged to Hunter, and wasn’t denying the material on it was genuine.

He was simply referring to the now-infamous Politico whitewash of October 19, 2020, which was fake news about fake news: The headline “Hunter Biden Story is Russian Disinfo, Dozens of Former Intelligence Officials Say” didn’t even accurately relate what was in the story. Those officials simply said they were “suspicious” about Russian involvement, admitted they had no evidence for this and pointed out (this was buried in the 10th paragraph of Politico’s story), “We want to emphasize that we do not know if the emails … are genuine or not.” In other words, the notorious liar James Clapper et al. (as far as I can tell, every signatory who made his opinion known about the election was a Biden supporter) were simply peeing in the dark. Their rank speculation was unworthy of being published.

Read more …

Watch Africa.

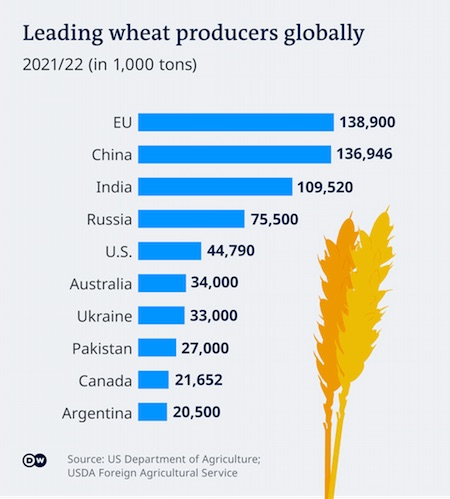

• Food Supply Chains “Falling Apart” In Ukraine (ZH)

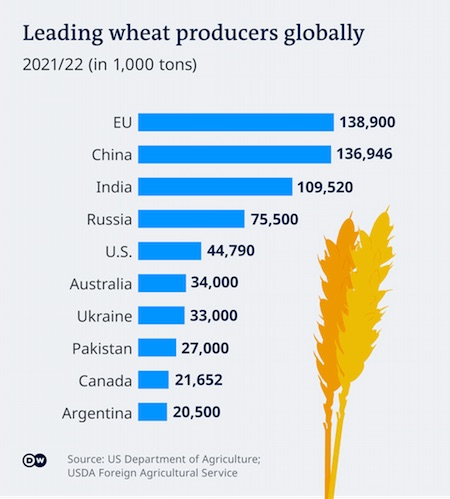

On Friday, Jakob Kern, an emergency coordinator at the United Nations (UN) World Food Programme (WFP), warned Ukraine’s food supply chains were collapsing as Russia bombed key infrastructures such as roads, bridges, and trains. “The country’s food supply chain is falling apart. Movements of goods have slowed down due to insecurity and the reluctance of drivers,” Kern told a Geneva during a video conference from Krakow, Poland. “Inside Ukraine our job is in effect, to replace the broken commercial food supply chains,” he added, describing the rebuilding task as a “mammoth” one. Ukraine’s top agricultural export products are corn and wheat. Before the invasion, Ukraine was the second-largest supplier of grains for the European Union and one of the largest suppliers for emerging markets in Asia and Africa.

Breaking down the numbers, Ukraine produced 49.6% of global sunflower oil, 10% of global wheat, 12.6% of global barley, and 15.3% of global maize. Estimates via Black Sea research firm SovEcon show Ukraine’s 2022 corn harvest could plunge as much as 35% from 41.9 million tons last year to 27.7 million tons this year because of all the disruptions. Farmers are already reporting diesel and fertilizer shortages. Wheat harvests are also expected to decline. Some have even pointed total crop output in the country could be halved. “With global food prices at an all-time high, WFP is also concerned about the impact of the Ukraine crisis on food security globally, especially hunger hot spots,” he said, warning of “collateral hunger” in other places like Egypt, Indonesia, Bangladesh, Pakistan, and Turkey that rely heavily on Ukraine imports.

All of this has fueled the UN’s Food and Agriculture Organization to warn global food prices could rise another 8-20% from current levels due to the deteriorating situation in Ukraine. The UN Special Rapporteur on the right to food, Michael Fakhri, also warned today, Russia’s invasion of Ukraine may cause a global surge in malnutrition and famine. “For the last three years, global rates of hunger and famine have been on the rise. With the Russian invasion, we are now facing the risk of imminent famine and starvation in more places around the world,” Fakhri said in a statement.

Read more …

“Russia blames the stoppage on the high risk of mines, which it said had been laid by the Ukrainian Navy.”

• Russia Blocks Ships Carrying Grain Exports (DW)

Wheat exports from Ukraine and Russia, which make up a vital part of the world’s food supply are still being blocked by Russia from leaving the Black Sea, Germany’s largest agricultural trader BayWa said this week. “Zero [grain] is currently being exported from the ports of Ukraine — nothing is leaving the country at all,” Jörg-Simon Immerz, head of the grain trading at BayWa, told dpa news agency. He added that the export activity on the Russian side is “very limited.” Immerz’s assessment was backed up by the Panamanian Maritime Authority, who said on Wednesday that the Russian Navy was preventing 200-300 ships from leaving the Black Sea — most of them were carrying grain. Other reports suggest around 100 vessels are blocked.

Noriel Arauz, the administrator for the authority, said three Panamanian-flagged ships have come under Russian fire since the invasion of Ukraine started. One of the ships sank and two others were damaged, while no one was injured. British newspaper The Guardian reported that several other ships have been struck since the invasion began on February 24, including from Bangladesh and Estonia, which killed one person. Russia blames the stoppage on the high risk of mines, which it said had been laid by the Ukrainian Navy. Questions have been raised about how much grain Ukraine will be able to produce this year due to the conflict. At the same time, Russia has vowed to retaliate against Western sanctions that have crippled its economy.

Curbs on wheat and fertilizer exports are presumed to be high on Moscow’s list, which could have further consequences for the world’s food supply and food price inflation. Russia produces close to 80 million metric tons of wheat a year and exports close to 30 million tons, while Ukraine exports about 20 to 25 million tons a year. BayWa, meanwhile, believes there is no reason to fear a wheat shortage as much more wheat is harvested in the EU than is consumed. “The EU exports about 30 million metric tons of wheat annually, and Germany is also an exporter in normal years,” Immerz said. But that is not true for all types of grain. “We rely on imports for corn,” he added.

[..] Meanwhile, a new report by the United Nations Conference on Trade and Development (UNCTAD) has warned about the impact of the war on the food situation in Africa. Between 2018 and 2020, Russia accounted for nearly a third of wheat imports to the continent, while around 12% come from Ukraine. The UNCTAD report said up to 25 African countries, especially the least developed economies, relied on wheat imports from Russia and Ukraine.

Read more …

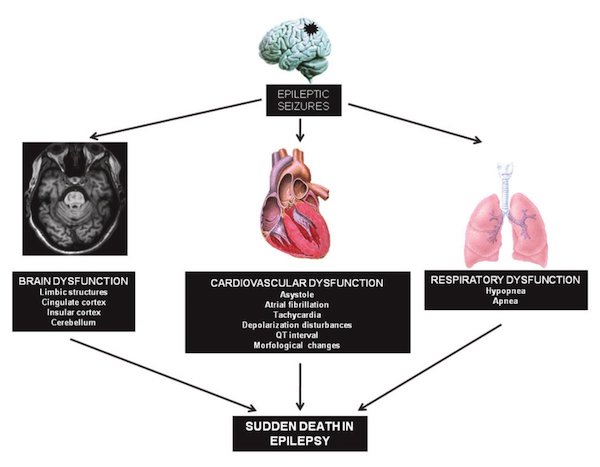

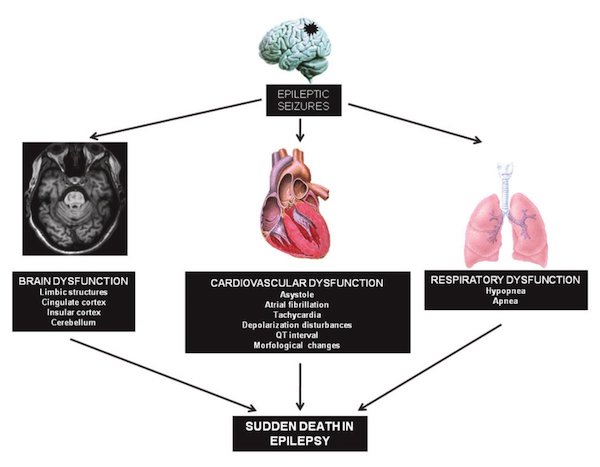

Thread. SUDEP- Sudden Unexpected Death in Epilepsy.

• “Died Suddenly” Solved (Chesnut)

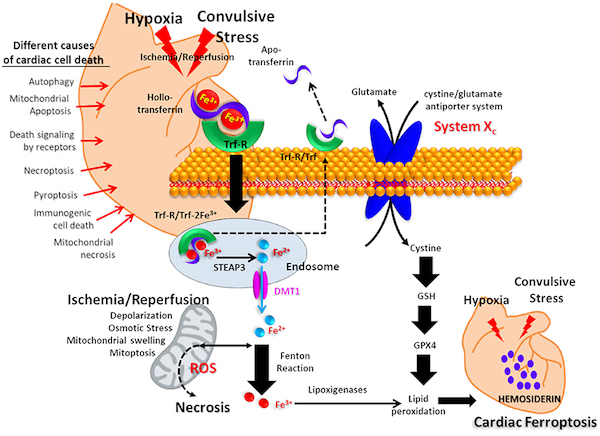

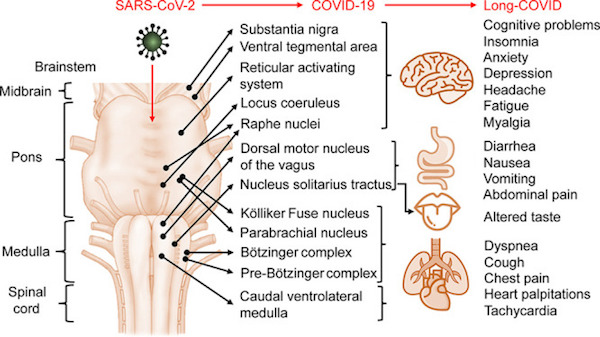

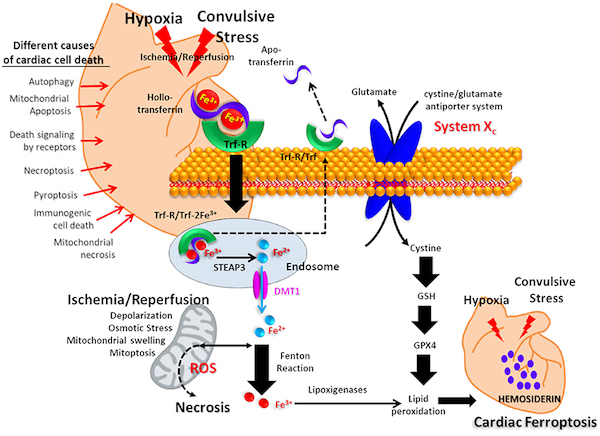

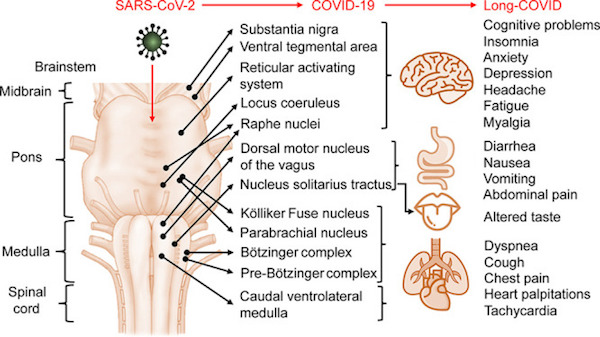

BUILDING: MY MOST IMPORTANT FINDING TO DATE: DIED UNEXPECTEDLY SOLVED. SUDEP AND “DIED UNEXPECTEDLY” – THE SPIKE PROTEIN, FIBROSIS AND THE BRAINSTEM. PART I “A SILENT ENTRANCE”. As you recall, the original spike caused a loss of the sense of smell, the medical term is Anosmia.

The olfactory (sense of smell) system happens to be a DIRECT ROUTE TO THE BRAINSTEM. Indeed, when we look at autopsies, the Spike Protein is a very frequent “guest” in the Brainstem. Pathological immune responses or SARS-CoV-2 invasion of the brainstem is suspected. An autopsy study has isolated 32 brain sections from 16 victims of COVID-19 and found concentrated SARS-CoV-2 RNA (>5 copies/mm3) in three sections from the olfactory nerves and the brainstem’s MEDULLA. More convincingly, in another autopsy study of deceased COVID-19 patients, SARS-CoV-2 RNA and proteins (nucleocapsid or SPIKE) were detected in 50% and 40% of brainstem samples, respectively.

Similarly, another autopsy study has found SARS-CoV-2 RNA and SPIKE PROTEINS in the olfactory mucosal-neuronal junction and brainstem’s MEDULLA in 67% and 19% of samples, respectively. In sum, these autopsy studies have provided evidence for SARS-CoV-2 tropism FROM THE OLFACTORY SYSTEM INTO THE BRAINSTEM. OK. We know the Spike Protein invades the Medulla of the Brainstem. So, what does this mean? Well, those who suffer from Epilepsy are prone to sudden death. In fact, it is because of PATHOLOGIC CORRELATIONS IN THE MEDULLA that they suffer what is known as SUDEP- Sudden Unexpected Death in Epilepsy.

Sudden unexpected death in epilepsy (SUDEP) likely arises as a result of AUTONOMIC DYSFUNCTION around the time of a seizure. In vivo MRI studies report volume reduction in the MEDULLA and other brainstem autonomic regions. Rostro-caudal alterations of medullary volume in SUDEP localize with regions containing respiratory regulatory nuclei. They may represent seizure-related alterations, relevant to the pathophysiology of SUDEP. Now, this heretofore rare event is now becoming all too common. The “One-Two Punch” of aberrant spike protein brainstem signaling (remodeling) combined with spike protein cardiac remodeling has virtually recreated the EXACT ENVIRONMENT OF SUDEP!

Read more …

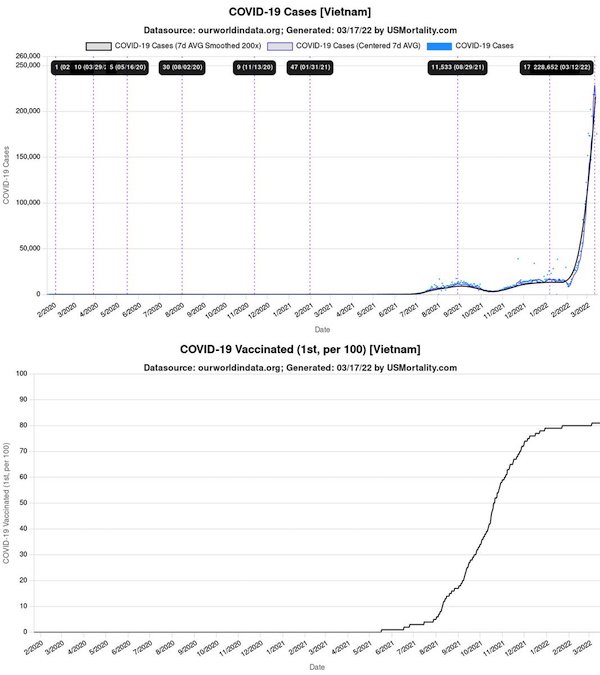

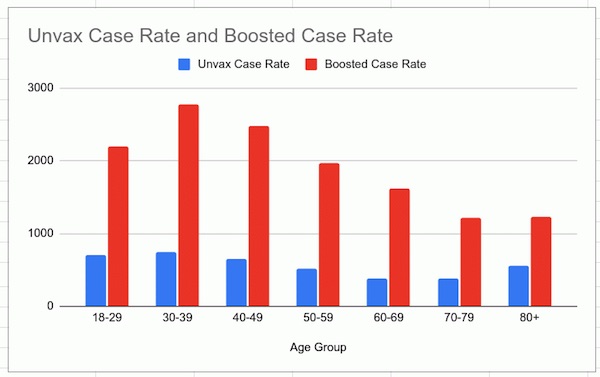

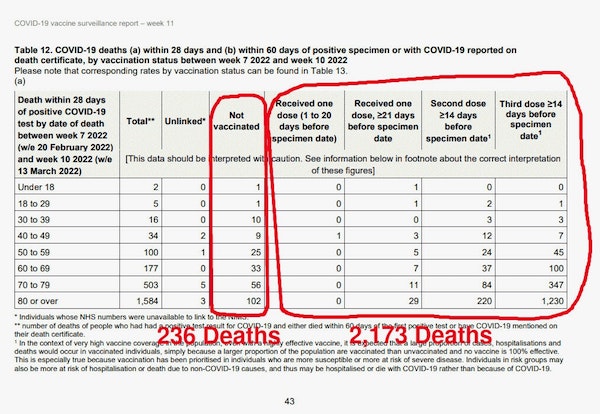

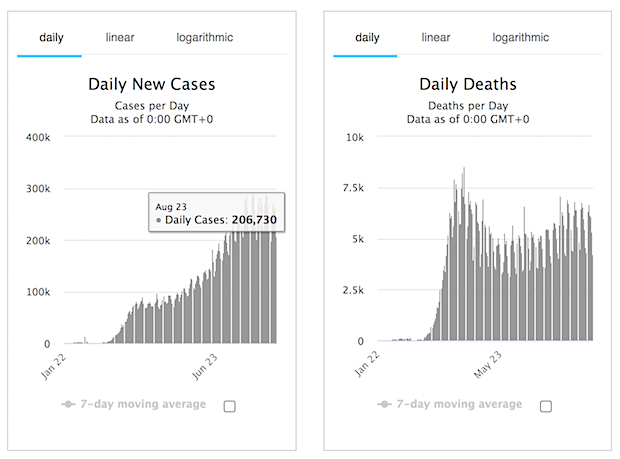

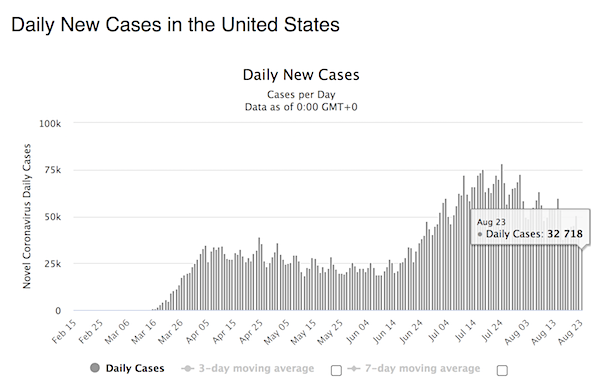

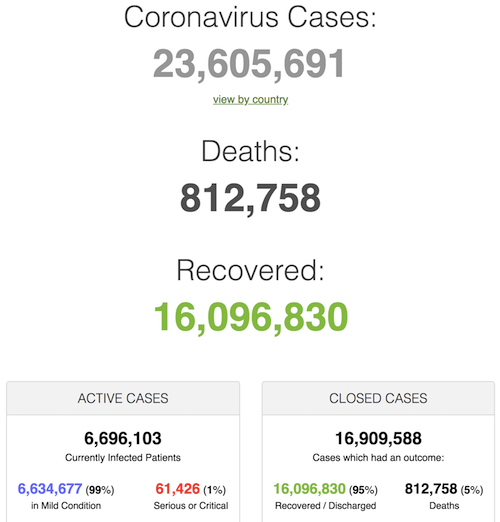

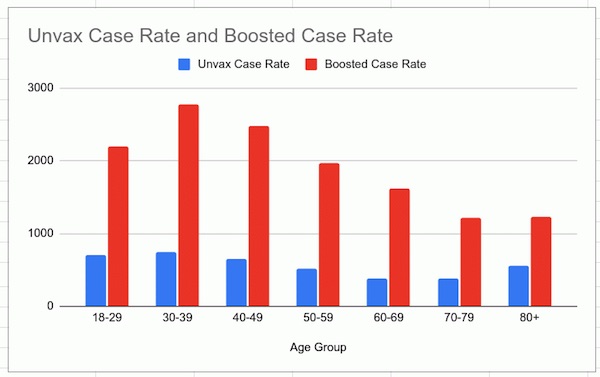

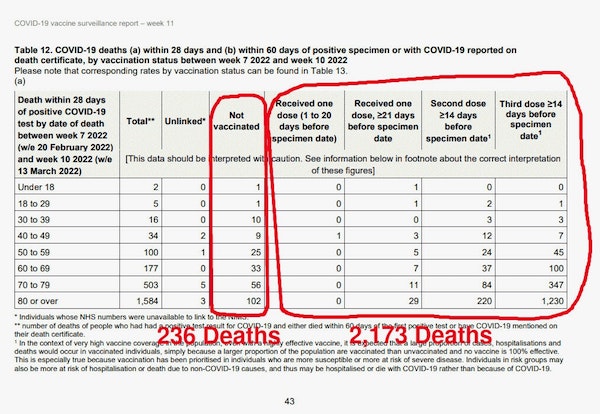

“..cases in week 7-10 among the unvaccinated barely increased by 1%, from 59,904 cases to 60,372. For the boosted, cases increased by 14%..”

• UK will HIDE Vaccinated Cases and Deaths (Chudov)

The infamous UKHSA Vaccine Surveillance Report started as a great tool by the vaccinators to showcase incredible successes of Covid Vaxx. But, as time went on, success was no longer in the cards, and the reports displayed grimmer and grimmer failure of vaccines in the UK. As I said many times, the bad news from the UK in no way should be interpreted as the UK being somehow a bad country. To the contrary, the UK had an amazing statistical agency that (up until now) honestly reported the goings in the vaxxed world. Finally, it seems, just as Scotland did, the UK will discontinue case reports by vaccination status. They gave the lamest excuse of “ending free Covid testing” that somehow makes them unable to add up vaccinated vs unvaccinated cases? Come on.

The so called “free Covid testing” is likely ending for similarly sinister reasons, specifically because they want to downplay cases as they keep increasing in the UK. Well, these UKHSA reports were good while it lasted. The truthful cases by vaccination status reports, showing the ignominous ending of the UK vaccination campaign, will be available no more starting April. [..] Before I describe what is it that they are trying to hide, let me mention my methodology: I keep a spreadsheet that I update week by week, with counts of vaccinated vs boosted case rates and death rates. I do NOT include under-18s in my data because they are (were) overtested in schools, do not actually die of Covid, thankfully, and really are not the same population as adults.

What they are trying to hide is that the pandemic among the unvaccinated is essentially over, whereas it is just getting started among the boosted. Look at the numbers: Compared to week 6-9, cases in week 7-10 among the unvaccinated barely increased by 1%, from 59,904 cases to 60,372. For the boosted, cases increased by 14%, from 543,809 to 617,982! For the vulnerable 60-69 year old category, the boosted 60-69 year olds get sick 4.25 TIMES as much as unvaccinated 60-69 year olds. Take a minute to let that sink in. Far from being protective, boosters make 60-69 year olds four times more vulnerable to infections!

Deaths similarly show a sad picture. 90% of Covid deaths in the UK, in weeks 7-10, were among the vaccinated!

Read more …

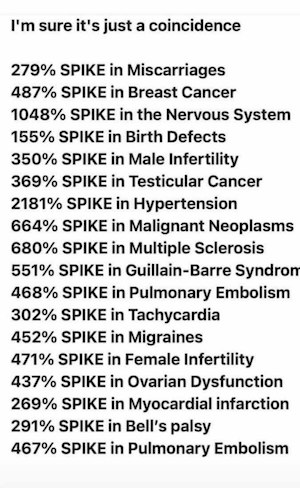

The “potentially fatal blood-clotting issue” was not known, because it was never tested.

• Two UK Residents Died of Blood-Clotting Disorders Linked to AstraZeneca (CHD)

UK coroners in two separate cases this week concluded individuals who received AstraZeneca’s COVID-19 vaccine died from blood-clotting disorders caused by the vaccine. Kim Lockwood, a 34-year-old mother from South Yorkshire, died in March 2021 of a catastrophic brain bleed nine days after getting the AstraZeneca shot. Lockwood complained of an excruciating headache eight days after getting the vaccine. Her condition quickly deteriorated and she was pronounced dead 17 hours after being admitted to the hospital. South Yorkshire Coroner Nicola Mundy, calling Lockwood “extremely unlucky,” recorded the cause of death as vaccine-induced thrombotic thrombocytopenia (VITT).

Separately, a Sheffield County inquest on Monday concluded Tom Dudley, a 31-year old father of two who received the Astra-Zeneca vaccine on April 27, 2021, died of a vaccine-induced brain hemorrhage on May 14, 2021. The UK’s National Health Service on May 7, 2021, changed the guidance for the AstraZeneca vaccine, suggesting healthy individuals under 40 should avoid it due to possible blood-clotting complications. Assistant coroner Tanyka Rawden said that at the time of Dudley’s death the potentially fatal blood-clotting issue “was not a known and recognized complication of this vaccine. It seems to me that the guidelines have been changed,” she said. “They were changed very, very quickly after Tom had his vaccination.”

Read more …

After big decisions had been based on precisely those numbers.

• CDC Removes 24% of Child COVID-19 Deaths, Thousands of Others (ET)

The Centers for Disease Control and Prevention (CDC) has removed tens of thousands of deaths linked to COVID-19, including nearly a quarter of deaths it had listed in those under 18 years old. The health agency quietly made the change on its data tracker website on March 15. “Data on deaths were adjusted after resolving a coding logic error. This resulted in decreased death counts across all demographic categories,” the CDC says on the site. The CDC relies on states and other jurisdictions to report COVID-19 deaths and acknowledges on its website that the data is not complete. But the statistics are often cited by doctors and others when pushing for COVID-19 vaccination, including figures who believe virtually all children should be vaccinated.

Dr. Rochelle Walensky, the CDC’s director, cited the tracker’s death total in November 2021 while pushing for an expert panel to advise her agency to recommend vaccination for all children 5- to 11-years-old. Before the change, the CDC listed 1,755 children as dying from COVID-19 along with approximately 851,000 others, according to Kelley Krohnert, a Georgia resident who has been tracking the updates. The update saw the CDC cut 416 deaths among children and over 71,000 elsewhere, arriving at a total of just under 780,000. The CDC previously adjusted its death count in August 2021 “after the identification of a data discrepancy.”

“The update is an improvement, but it’s at least the third correction to this data, and still does not solve the issue. It just highlights that people have been using a flawed source of data when discussing kids and COVID,” Krohnert told The Epoch Times in an email. Some journalists and doctors have been citing the tracker data while others use a tally that is managed by the CDC’s National Center for Health Statistics (NCHS) has been described by the agency as more reliable. The NCHS tally, which is compiled from death certificates, currently lists 921 deaths involving COVID-19 among children and some 966,000 deaths involving COVID-19 among other age groups.

Read more …

“I have said that I would stay in what I’m doing until we get out of the pandemic phase, and I think we might be there already..”

2 days after he warns of another wave….

• Fauci Says He’s Considering Stepping Down (ET)

Dr. Anthony Fauci said in a new interview that he is considering stepping away from the position he’d held since 1984. Fauci, the longtime director of the National Institute of Allergy and Infectious Diseases (NIAID), was asked during a podcast released March 18 whether he was mulling retirement or transitioning to a less-demanding job. “I certainly am because I’ve got to do it sometime,” Fauci, 81, said. “I can’t stay at this job forever, unless my staff is going to find me slumped over my desk one day. I’d rather not do that,” he added. Fauci was appointed to his position in 1984 during the Reagan administration. Fauci’s comments came after Sen. Rand Paul (R-Ky.) failed in his effort to get support for a measure that would eliminate the NIAID and create three new institutes in its stead.

Paul, who has clashed with Fauci during multiple congressional hearings, said Fauci has become has become a “dictator-in-chief.” “No one person should have unilateral authority to make decisions for millions of Americans,” Paul, a doctor, said. Fauci and his agency had not responded to requests for comment on the measure. Paul and other Fauci critics have taken issue with how the doctor misled the public on his agency’s funding for the Chinese lab located near the first cases of COVID-19 were recorded, his support for harsh measures during the pandemic, and his admission that he lied about the effectiveness of masks because of worries there wouldn’t be enough for health care workers.

Fauci, who has also been preparing for investigations Republicans have pledged into the COVID-19 response, has called Paul a partisan whose accusations aren’t rooted in facts. Without mentioning Paul, the podcast host asked Fauci in the new interview whether he would leave his post soon, noting that besides Dr. Francis Collins, who exited from his position as director of the National Institutes of Health in late 2021, Jeffrey Zients was stepping down as the White House COVID-19 response coordinator. “I have said that I would stay in what I’m doing until we get out of the pandemic phase, and I think we might be there already,” Fauci said. “If we can stay in this, then we’re at a point where I feel that we’ve done well by this. But I don’t have any plans right now to go anywhere, but you never know.”

Read more …

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.