George N. Barnard Federal picket post near Atlanta, Georgia 1864

Everyhting around you has been borrowed. You just don’t recognize it.

• World Corporate Debt Far Exceeds Pre-Lehman Financial Bubble (IBT)

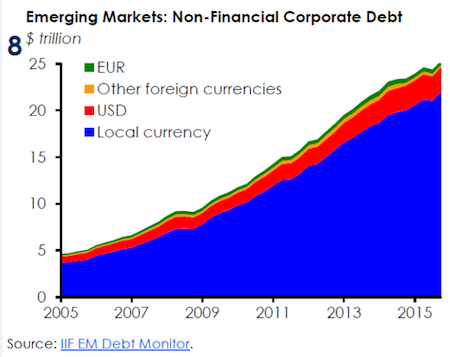

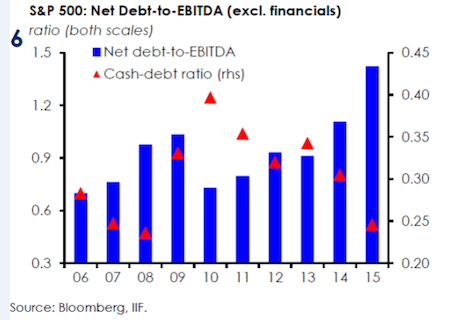

Corporate debt across the world has reached extreme levels, warned the Institute of International Finance (IIF), a trade group of financial institutions. The global banking watchdog added that it far exceeded the pre-Lehman financial bubble. “As the credit cycle ages, following years of record-setting bond issuance, there are growing concerns about signs of stress in corporate balance sheets,” the IIF said. It said there was a double threat. While emerging markets had seen a five-fold increase in corporate debt to $25tn over the last 10 years, developed markets such as the US and Europe were seeing record junk bond issuance. Referring to the US, the IIF said companies were borrowing as if there was no tomorrow even though their profits began to decline in 2014.

It said the ratio of net debt to earnings (EBITDA) for companies was at 1.4. This had doubled since the 2007 subprime bubble, according to The Telegraph. “For the most part, this very significant amount of debt has been used to pay dividends, buy back shares and fund M&A transactions, rather than financing capital spending, which has been on a declining trend since 2012 (and fell 3.5pc in the first quarter on 2016),” the IIF explained. On junk bonds, a high-yielding high-risk security, typically issued by a company seeking to raise capital quickly, Europe and the US put together are reported to have issued them at double the pace when compared to the pre-Lehman period. “Of particular concern is that since US high-yield companies have increased their debt relative to assets, the recovery rate on defaulted bonds has declined sharply,” the IIF said.

It added that corporate defaults were at the highest levels since the financial crisis and it was “not restricted to the energy sector.” The IIF said the situation was complex as on the one hand there were cash-rich companies, on the other there very many smaller companies which had huge amounts of debt on their books. Cash that large businesses were holding onto was estimated at $1.6tn in the US, $2.2tn in Europe, and $2tn in Japan. The warning coincided with warnings issued by the Hong Kong Monetary Authority, the country’s currency board and de facto central bank. It said giving companies access to easy money over years had put the global systems in danger. Howard Lee, the executive director at the board said: “We are far from out of the woods, given new risks and headwinds on multiple fronts. There is the threat of a disorderly pullback in capital out of the region.”

The world has but one answer to warnings like this: borrow more.

• Warnings Mount On World’s Corporate Debt, China Crisis (AEP)

Corporate debt has reached extreme levels across much of the world and now far exceeds the pre-Lehman financial bubble by a host of measures, the global banking watchdog has warned in a deeply-disturbing report. “As the credit cycle ages, following years of record-setting bond issuance, there are growing concerns about signs of stress in corporate balance sheets,” said the Institute of International Finance in Washington. The body flagged a double threat: a five-fold rise in company debt to $25 trillion in emerging markets over the past decade; and record junk bond issuance in US and Europe, along with shockingly-irresponsible levels of US borrowing to buy back shares and pay dividends. The warning came as the Hong Kong Monetary Authority aired its own grim concerns that the global system is dangerously over-stretched after years of easy money, with Asia’s entire financial edifice potentially in danger.

“We are far from out of the woods, given new risks and headwinds on multiple fronts,” said Howard Lee, the body’s executive director. “There is the threat of a disorderly pullback in capital out of the region.” Mr Lee said the exodus of capital at the beginning of the year – mostly driven by fears of a Chinese devaluation – may be a foretaste of what is to come. “The next episode may be even more damaging given the financial imbalances built up over the past few years,” he told a forum in Hong Kong. “While the region has become a key driver of growth globally, this has come at the price of a pretty dramatic rise in debt fueled by easy global liquidity,” he said. “As we have witnessed in advanced economies, disorderly deleveraging may weigh heavily on the economy and may even risk the financial system.”

The IIF said the ratio of net debt to earnings (EBITDA) for US companies has doubled to 1.4 from 0.7 at the top of the subprime bubble in 2007. Firms continued to borrow as if there were no tomorrow even after their profits began to crumble in 2014. “For the most part, this very significant amount of debt has been used to pay dividends, buy back shares and fund M&A transactions, rather than financing capital spending, which has been on a declining trend since 2012 (and fell 3.5pc in the first quarter on 2016),” it said. Companies on both sides of the Atlantic have issued $1.9 trillion of junk bonds over this cycle, with volumes running at double the pre-Lehman pace. The weakest CCC-rated debt has grown in share and is already under stress, with yields spiking to 20pc in February. “The number of corporate defaults has reached the highest level since the financial crisis. It is not restricted to the energy sector,” said the report.

“Of particular concern is that since US high-yield companies have increased their debt relative to assets, the recovery rate on defaulted bonds has declined sharply,” it said. The recovery value has dropped to 29pc from 44pc two years ago. It is a complex picture because large corporations are also sitting on record levels of cash, estimated at $1.6 trillion in the US, $2.2 trillion in Europe, and $2 trillion in Japan. What emerges is a split market, divided into cash-rich giants and an army of smaller companies up to their necks in debt. Total corporate leverage is 70pc of GDP in the US and 100pc in Europe. Excesses in emerging markets are even greater, concentrated in Turkey, Brazil, Russia, and Indonesia, and above all in China where it has reached 175pc of GDP “This is the highest ratio in the world,” said the IIF.

Debt slavery next.

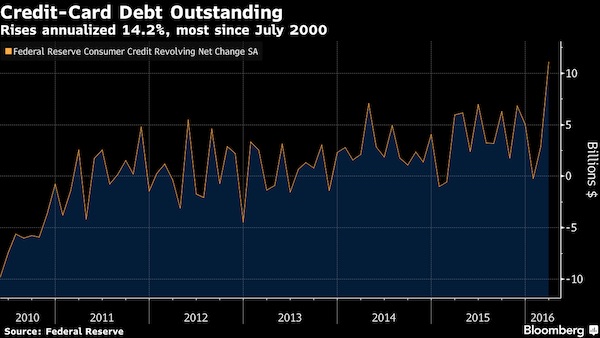

• US Consumer Borrowing Increases at Fastest Pace Since 2001 (BBG)

Household borrowing surged in March at the fastest pace since November 2001 as financing for automobiles picked up and Americans’ outstanding credit-card debt soared. The $29.7 billion increase, or an annualized 10%, exceeded the highest estimate in a Bloomberg survey and followed a revised $14.1 billion gain the prior month, Federal Reserve figures showed Friday. Revolving credit, which includes credit-card spending, posted the biggest annualized advance since July 2000. With employers still hiring at a decent clip, consumers may be growing more comfortable carrying bigger credit-card balances and taking out car loans.

The pickup in March helped drive up household borrowing in the first quarter to a 6.4 annualized pace, compared with a 6.2% rate in the final three months of 2015. Revolving debt jumped by $11.1 billion in March, or an annualized 14.2%, after a $2.9 billion increase, the Fed’s report showed. Non-revolving debt, which includes loans for education and automobile and mobile home purchases, increased $18.6 billion, the most since September. In the first quarter, student loans outstanding climbed $31.7 billion and lending for auto purchases increased $13.5 billion.

What I see when I read this kind of thing is the media creating a story where there is none: “Mr. Trump was clear in saying that he was not going to renegotiate U.S. debt, despite being asked multiple times, and that he would not default on U.S. debt, despite being asked multiple times,” said the adviser.”

And there’s something else too: “.. his campaign moves [..] to a general election competition where the media and members of the public expect more policy details from the candidates.” That line contains 2 false claims in one: 1) it paints the media as being on the side of the public, and 2) it denies that the media are part of the political machinery.

Actually, there’s a third implied yet unsubstantiated claim: that the media’s reporters are knowledgable when it comes to finance, economics, debt.

• Trump Dips Toe Into Delicate US Debt Discussion (R.)

Would Donald Trump really consider not paying portions of the U.S. debt? The prospect riled economists on Friday as stories in the New York Times and the conservative website The Blaze cast fresh scrutiny on comments Trump made a day earlier. Responding to a question about the national debt, the likely Republican presidential nominee said in an interview on CNBC on Thursday he would “borrow knowing that if the economy crashed you could make a deal.” When asked if that meant he had taken a page from his own playbook as a businessman and try to get U.S. creditors to accept less than the full value of the bonds they hold, he said “No,” but added: “I could see long-term renegotiations where we borrow long-term at very low rates.”

The reaction to his words on Friday offered the first-time political candidate a taste of how delicate the prospect of discussing economic and fiscal policy can be. It also highlighted a danger for Trump as his campaign moves from a crowded, personality-fueled contest for the Republican nomination to a general election competition where the media and members of the public expect more policy details from the candidates. “Such remarks by a major presidential candidate have no modern precedent,” the New York Times wrote in a story saying Trump’s plan implied he would “negotiate a partial repayment” of U.S. debt.

“It’s beyond ludicrous and irresponsible unless you’re, say, an emerging market country,” wrote the U.S. debt analyst David Ader, the head of rates strategy at CRT Capital, in a note to clients early Friday morning. A senior campaign adviser said Trump had not meant to suggest he would demur on any U.S. debt payments. “Mr. Trump was clear in saying that he was not going to renegotiate U.S. debt, despite being asked multiple times, and that he would not default on U.S. debt, despite being asked multiple times,” said the adviser. “All he said is that he believes that long term low interest Treasuries would be a better deal for the U.S. taxpayer.”

It’s moments like this when one must wonder if Beijing perhaps really doesn’t understand how things work.

• China Commodities Selloff Deepens, Steel Has Worst Week Since 2009 (R.)

Chinese commodities prices spiraled lower on Friday, with steel futures suffering their worst week since 2009, as more money flowed out of markets whose surge two weeks ago unnerved global investors and forced regulators to step in to restore calm. Indicating how authorities may now be alarmed after a collapse in volumes and prices, the Dalian Commodity Exchange on Friday said it will cut some trading fees on contracts such as iron ore and coking coal. The commodities slide spilled over into stocks, with the Shanghai Composite Index ending down 2.8%, its worst day since February, as commodity producers fell. Commodities linked to China’s steel sector, which led the mid-April rally, were the hardest hit on Friday, on worries that demand in the world’s biggest steel consumer could soon wane.

The selloff spread to agricultural products including soybeans, eggs and cotton. Some traders were concerned that China’s interest rate easing cycle could be over even as optimism about prospects for the world’s No.2 economy faded. The retreat pulled prices of many of the commodities below levels in mid-April, when a buying frenzy, pinned on retail investors, bloated volumes and drew comparison with the boom-and-bust cycle in China’s stock markets last year. “It’s panic now and capital is flowing out of commodities markets amid a cautious outlook on the economy,” said a trader at a fund in Shanghai. The price declines suggest that Chinese exchanges have more than succeeded in popping the bubble, after commodity platforms in Dalian, Shanghai and Zhengzhou launched measures to curb speculative buying.

Investors have been losing faith in Chinese steel demand for May and June.A tighter steel market following shutdowns of Chinese mills in the past year and a seasonal pickup in demand helped spur prices in the past two months. But producers have since ramped up output and once-shut plants have also resumed production. “The steel mills have started to become cautious towards the market after the really crazy rally. At the same time they don’t think demand will be sustainable,” said Wang Di, an analyst at CRU consultancy in Beijing.

Gotta be the (‘Cool spring) weather’…

• UK Stores Post Steepest Sales Decline Since Financial Crisis (BBG)

U.K. stores had their steepest sales decline since 2008 last month as British consumers shunned the country’s shopping streets. Like-for-like sales fell 6.1% compared with April last year, business advisory firm BDO said in its monthly report. Fashion retailers were hardest hit, with sales dropping 9.2% as stores ended seasonal discounting toward the end of the month. The figures confirm recent evidence of difficult trading for U.K. retailers. Clothing merchant Next cut its sales forecast for a second time this week, shortly after the collapses of department-store chain BHS and formalwear retailer Austin Reed. Cool spring weather, muted wage gains and uncertainty surrounding the upcoming EU referendum have caused consumers to defer purchases.

“Retailers are concerned that consumers aren’t inclined to spend at the moment because of the overall economy,” Charles Allen, an analyst at Bloomberg Intelligence, said by phone.

Obviously, the press is in that bed too.

• When Wall Street and Washington Got in Bed Together (Arnade)

My first evening of my first Wall Street business trip was spent in a Brazilian brothel. I was with a salesman from my firm who was entertaining his clients. I was brought there unexpectedly, and told to talk about markets when things got slow. Buying women for clients and then expensing it as a 10-bottle dinner wasn’t every salesperson’s thing, but in certain countries, with certain clients, it was pretty common on Wall Street. It also worked; the clients ended up buying a lot of bonds from us. The next morning I expressed my surprise to a senior trader. He laughed, “You think that’s bad? Did you look at the other guys around you? Did you see the Brazilian bankers entertaining politicians? That is the way it works here. Bankers buy the politicians.”

That was in Brazil in the 90s. On Wall Street outright corruption, like buying escorts for politicians, is exceedingly rare. The far more common, lucrative, and nuanced method of influencing politicians is to offer them high-paying jobs -or pay them for speeches. It’s such an ingrained part of the political culture that Hillary Clinton s speeches to banks after leaving the State Department, which earned her $2.9 million, isn’t odd. She did it because everyone in the political establishment does it. She doesn’t see it as wrong, because being part of that political establishment means being supported by, and supporting, the Wall Street establishment. Wall Street has always hired former government officials, mostly Republicans, and mostly for show. The jobs were ceremonial, used to wow clients and provide a firm a sheen of importance.

Bill Clinton’s first administration dramatically changed the practice, when as part of New Democrats rebranding, and to ride the popular support generated by Reagan, he pivoted towards Wall Street, embracing free trades and free markets. Wall Street was being deregulated, and rules of the game being rewritten, and so value of connections became all the higher. With both parties now aligned with bankers, prior checks on the process started dissolving. With both parties behind it, Wall Street fully embraced the political class. The embrace was mutual. Bankers also started going to work in D.C., taking central roles in writing banking regulations. It turned into a personally profitable merging of interest, with D.C. favoring Wall Street, and Wall Street rewarding D.C..

The model for the new “revolving door” was Robert Rubin, the CEO of Goldman Sachs. Determined to show Wall Street that he was a different type of Democrat, Bill Clinton hired Rubin as his second Treasury Secretary. Rubin’s four years in the administration were very good to Wall Street; the regulatory environment, with his support, swung aggressively in their favor, punctuated by the repeal of Glass-Steagall. Rubin left the administration to go back to a booming Wall Street, taking a high paying job at Citigroup, whose expansion to the world’s largest financial company was made possible by the repeal of Glass-Steagall. It was, even by Wall Street’s standards, an audacious move.

They can be a lot worse than that. We see it on a daily basis.

• Central Banking Can Become An Opaque Creator Of Insider Deals (FT)

Sed quis custodiet ipsos custodes? -Juvenal

Financial people are being given more good reasons to wonder, as Juvenal, the Roman poet, put it, who is guarding the guardians? This has not been a good week or two for anyone concerned about the honesty and independence of central bankers. One has to wonder how many times we can blame Goldman Sachs and JPMorgan, the US banks, for all the wrongdoing in the financial world while overlooking the regulators and central banks themselves. I have been saving bits of questionable-central-bank-behaviour string over the past couple of months, and it has become a giant ball. Consider the ECB’s report last week on “pre-announcement price drift” for US data releases. In plain language, the ECB pointed to the apparent use of inside information, including Federal Open Market Committee policy announcements, to trade instruments such as stock index futures.

The ECB’s methodology was quite interesting, and well thought out, as far as it went. It did not, of course, go to the measurement of any such “price drift” for its own announcements, or for the data released by any group under its own supervision. Anyone who has contact with the management of the upper reaches of regulated financial institutions will have noticed the increasing level of paranoia among them about the appearance of wrongdoing. Actually, it is not paranoia. If there is not a regulation that can be used to blame them for the next financial crisis, one will be written, retroactively if that is necessary. Who, though, is exempt from the web of capital ratios, counterparty risk controls and compliance officer full-employment requirements? That would be the central banks of the 189 member states of the IMF.

So, for example, there is not much in the way of treaty obligations or shared philosophy to prevent President Recep Tayyip Erdogan from taking closer control over the Central Bank of the Republic of Turkey in the coming days. The German government and ECB will not like that, but what are they going to say or do about it? As Robert Klitgaard, one of the founders of the sad discipline of corruption research put it back in 1988, “corruption equals monopoly plus discretion minus accountability”. The wonder is why we have not detected or measured more corruption in central banks than we have.

My own belief is that the natural tendency for administrative institutions to become corrupt was tempered in central banks by the original simplicity of their tasks and the immediate evidence of the results. They used to buy and sell a short list of assets against the short-term trends in the market. Their regulatory role was limited to specifying the assets they would buy, and their risk appetite was, proportionately, the smallest in the financial markets. The functions of “lender of last resort”, ie funder of politicians’ projects, and “cop on the beat” or micromanaging regulator, were not the day-to-day purposes of central banking.

Always a useful discussion provided people are prepared to prepare.

• Why Garbagemen Should Earn More Than Bankers (Evon.)

Thick fog envelops City Hall Park at daybreak on February 2, 1968. Seven thousand New York City sanitation workers stand crowded together, their mood rebellious. Union spokesman John DeLury addresses the multitude from the roof of a truck. When he announces that the mayor has refused further concessions, the crowd’s anger threatens to boil over. As the first rotten eggs sail overhead, DeLury realizes the time for compromise is over. It’s time to take the illegal route, the path prohibited to sanitation workers for the simple reason that the job they do is too important. It’s time to strike. The next day, trash goes uncollected throughout the Big Apple. Nearly all the city’s garbage crews have stayed home. “We’ve never had prestige, and it never bothered me before,” one garbageman is quoted in a local newspaper. “But it does now. People treat us like dirt.”

When the mayor goes out to survey the situation two days later, the city is already knee-deep in refuse, with another 10,000 tons added every day. A rank stench begins to percolate through the city’s streets, and rats have been sighted in even the swankiest parts of town. In the space of just a few days, one of the world’s most iconic cities has started to look like a slum. And for the first time since the polio epidemic of 1931, city authorities declare a state of emergency. Still the mayor refuses to budge. He has the local press on his side, which portrays the strikers as greedy narcissists. It takes a week before the realization begins to kick in: The garbagemen are actually going to win. “New York is helpless before them,” the editors of The New York Times despair. “This greatest of cities must surrender or see itself sink in filth.”

Nine days into the strike, when the trash has piled up to 100,000 tons, the sanitation workers get their way. “The moral of the story,” Time Magazine later reported, “is that it pays to strike.” Perhaps, but not in every profession. Imagine, for instance, that all of Washington’s 100,000 lobbyists were to go on strike tomorrow. Or that every tax accountant in Manhattan decided to stay home. It seems unlikely the mayor would announce a state of emergency. In fact, it’s unlikely that either of these scenarios would do much damage. A strike by, say, social media consultants, telemarketers, or high-frequency traders might never even make the news at all. When it comes to garbage collectors, though, it’s different. Any way you look at it, they do a job we can’t do without. And the harsh truth is that an increasing number of people do jobs that we can do just fine without.

Were they to suddenly stop working the world wouldn’t get any poorer, uglier, or in any way worse. Take the slick Wall Street traders who line their pockets at the expense of another retirement fund. Take the shrewd lawyers who can draw a corporate lawsuit out until the end of days. Or take the brilliant ad writer who pens the slogan of the year and puts the competition right out of business. Instead of creating wealth, these jobs mostly just shift it around.

I’m tempted to change the title into something that makes actual sense, but I’ll leave it. The Shanghai US dollar manipulation accord (a.k.a. sleight of hand) makes it possible for rags like the Economist to write drivel like this. In reality, the EM ‘recovery’ is entirely fake.

• The Emerging Markets Recovery Looks Fragile (Economist)

It is not easy to have faith in the rally in emerging-market currencies that has taken place since February. The ones that have risen most in recent weeks are typically those—the rouble, the real and the rand—that had lost most ground since May 2013, when the emerging-market sell-off began in earnest. What is there to like about Russia, Brazil and South Africa, with their wilting economies and dysfunctional politics? The proximate causes of the rally are clear. One was the fading of fears for China’s economy. At the start of 2016 capital appeared to be fleeing China at a rapid rate, in a vote of no confidence.

The yuan seemed in danger of losing its moorings against the dollar, raising fears of a round of competitive devaluations across Asia and beyond. Views changed around the time of the meeting of the G20, a club of big economies, in Shanghai in February. Informal pledges by the Chinese authorities not to let the economy slide were backed up by stimulus policies, including a big budget deficit and faster credit growth. Tighter capital controls stemmed the outflows from China. Prices of scorned commodities, such as iron ore, surged at the prospect of Chinese construction. Currencies of raw-material exporters rose too. A second trigger was a change of heart by the Federal Reserve. In December it raised its main interest rate for the first time in a decade and suggested four further increases were likely in 2016.

It has since backed away from these hawkish forecasts. Real interest rates, measured by the yield on inflation-proof bonds, have fallen to 0.14%. The dollar has slumped against even rich-world currencies. No wonder the high yields on offer in Brazil, Russia and other emerging markets are so tempting to rich-world investors, says Kit Juckes of Société Générale. The improved conditions for emerging markets may prevail for a while, but not indefinitely. China’s policy of loose credit only adds to its alarming debt pile. The Fed will eventually resume tightening. Even so, there is a bit more to the emerging-market rally than just a favourable backdrop.

Offering to work with authorities requires that one trust those authorities.

• Panama Papers Whistleblower Manifesto (John Doe)

[..] For the record, I do not work for any government or intelligence agency, directly or as a contractor, and I never have. My viewpoint is entirely my own, as was my decision to share the documents with Süddeutsche Zeitung and the International Consortium of Investigative Journalists (ICIJ), not for any specific political purpose, but simply because I understood enough about their contents to realize the scale of the injustices they described. The prevailing media narrative thus far has focused on the scandal of what is legal and allowed in this system. What is allowed is indeed scandalous and must be changed. But we must not lose sight of another important fact: the law firm, its founders, and employees actually did knowingly violate myriad laws worldwide, repeatedly.

Publicly they plead ignorance, but the documents show detailed knowledge and deliberate wrongdoing. At the very least we already know that Mossack personally perjured himself before a federal court in Nevada, and we also know that his information technology staff attempted to cover up the underlying lies. They should all be prosecuted accordingly with no special treatment. In the end, thousands of prosecutions could stem from the Panama Papers, if only law enforcement could access and evaluate the actual documents. ICIJ and its partner publications have rightly stated that they will not provide them to law enforcement agencies. I, however, would be willing to cooperate with law enforcement to the extent that I am able.

That being said, I have watched as one after another, whistleblowers and activists in the United States and Europe have had their lives destroyed by the circumstances they find themselves in after shining a light on obvious wrongdoing. Edward Snowden is stranded in Moscow, exiled due to the Obama administration’s decision to prosecute him under the Espionage Act. For his revelations about the NSA, he deserves a hero’s welcome and a substantial prize, not banishment. Bradley Birkenfeld was awarded millions for his information concerning Swiss bank UBS—and was still given a prison sentence by the Justice Department. Antoine Deltour is presently on trial for providing journalists with information about how Luxembourg granted secret “sweetheart” tax deals to multi-national corporations, effectively stealing billions in tax revenues from its neighbour countries.

And there are plenty more examples. Legitimate whistleblowers who expose unquestionable wrongdoing, whether insiders or outsiders, deserve immunity from government retribution, full stop. Until governments codify legal protections for whistleblowers into law, enforcement agencies will simply have to depend on their own resources or on-going global media coverage for documents.

Oh well, it’s far away. Who cares?

• Sea-Level Rise Claims Five Islands In Solomons (AFP)

Five islands have disappeared in the Pacific’s Solomon Islands due to rising sea levels and coastal erosion, according to an Australian study that could provide valuable insights for future research. A further six reef islands have been severely eroded in the remote area of the Solomons, the study said, with one experiencing some 10 houses being swept into the sea between 2011 and 2014. “At least 11 islands across the northern Solomon Islands have either totally disappeared over recent decades or are currently experiencing severe erosion,” the study published in Environmental Research Letters said. “Shoreline recession at two sites has destroyed villages that have existed since at least 1935, leading to community relocations.”

The scientists said the five that had vanished were all vegetated reef islands up to five hectares (12 acres) that were occasionally used by fishermen but not populated. “They were not just little sand islands,” leader author Simon Albert told AFP. It is feared that the rise in sea levels will cause widespread erosion and inundation of low-lying atolls in the Pacific. Albert, a senior research fellow at the University of Queensland, said the Solomons was considered a sea-level hotspot because rises there are almost three times higher than the global average. The researchers looked at 33 islands using aerial and satellite imagery from 1947 to 2014, combined with historical insight from local knowledge.

They found that rates of shoreline recession were substantially higher in areas exposed to high wave energy, indicating a “synergistic interaction” between sea-level rise and waves, which Albert said could prove useful for future study. Those islands which were exposed to higher wave energy – in addition to sea-level rise – were found to have a greatly accelerated loss compared with the more sheltered islands. “This provides a bit of an insight into the future,” he said. “There’s these global trends that are happening but the local responses can be very, very localised.”

I’m not at all sure the EU and IMF are not merely playing theater here.

• IMF Tells Eurozone To Start Greek Debt Relief Talks (FT)

The IMF has told eurozone finance ministers they must immediately begin negotiations to grant debt relief for Greece despite German opposition, upending carefully orchestrated negotiations ahead of an emergency meeting on Monday. In a letter to all 19 ministers sent on Thursday night and obtained by the Financial Times, Christine Lagarde, the IMF chief, said stalemated talks with Athens to find €3bn in “contingency” budget cuts, which have gone on for a month, had become fruitless and that debt relief must be put on the table immediately, or risk losing IMF participation in the programme. “We believe that specific [economic reform] measures, debt restructuring, and financing must now be discussed contemporaneously,” Ms Lagarde wrote.

“For us to support Greece with a new IMF arrangement, it is essential that the financing and debt relief from Greece’s European partners are based on fiscal targets that are realistic because they are supported by credible measures to reach them.” The IMF has come under intense criticism in Greece, where senior officials in Alexis Tsipras’s government have blamed Poul Thomsen, the IMF’s European chief, for making excessive austerity demands and holding up an agreement on the €86bn bailout’s first review. But Ms Lagarde’s letter makes clear the IMF wants less austerity, arguing that the budget surplus target agreed last year between the EU and Athens — a primary surplus of 3.5% of GDP target by 2018 — is unrealistic and should be drastically reduced. A primary surplus is a country’s budget surplus when debt payments are not included.

“A clarification is needed to clear unfounded allegations that the IMF is being inflexible, calling for unnecessary new fiscal measures and — as a result — causing a delay in negotiations and the disbursement of urgently needed funds,” Ms Lagarde wrote. [..] In her letter, Ms Lagarde wrote that all sides have nearly agreed on a core set of economic reforms that would cut the Greek budget by 2.5% of GDP by 2018. Some officials believe that list could be finalised at Monday’s eurogroup meeting. But Ms Lagarde stuck by the IMF’s assessment that such reforms would only produce a primary surplus of 1.5% in 2018 — not the 3.5% the EU has mandated. Instead, Ms Lagarde urged the EU to change its target to 1.5%, a sign that she believes Brussels is demanding too much austerity of Athens.

Food for thought: Erdogan, too, who’s slowly moving Turkey from secularism to ‘islamism’, will be happy with Sadiq Khan’s election as muslim mayor of London. Therefore Khan will need to distance himself from Turkey. And since Turkey is the EU’s new best friend, that would mean distancing himself from the EU. Something he’s not prepared to do. And his party is not prepared to do.

• Turkish Journalists Jailed For 5 Years, Hours After Courthouse Attack (R.)

Two prominent Turkish journalists were sentenced to at least five years in jail for revealing state secrets on Friday, just hours after a gunman tried to shoot one of them outside the courthouse in Istanbul. Can Dundar, editor-in-chief of the opposition Cumhuriyet newspaper, who was unscathed in the shooting, was given five years and 10 months. Erdem Gul, the newspaper’s Ankara bureau chief, was sentenced to five years. They were acquitted of some other charges, including trying to topple the government. The case, in which President Tayyip Erdogan was named as a complainant, has brought widespread condemnation from global rights groups and increased fears about freedom of the press in Turkey, a NATO member and EU candidate country.

Hours before the verdict was handed down, an assailant attempted to shoot Dundar. In full public view, before a courthouse, the attack marked an alarming development in a country already grappling with bombings by Kurdish insurgents and spillover of violence from neighboring Syria. The man shouted “traitor” before firing at least two shots in quick succession. A reporter covering the trial appeared to have been wounded. A Reuters witness said the assailant was detained by police. Before the shooting, he had approached reporters, saying he had been waiting since early morning and hoped Dundar would be found guilty. His motives and background were not immediately clear.

“We experienced two assassination attempts in two hours: one by firearms, the other by law,” Dundar told reporters following the trial. “There will always be concerns that the orders of the highest office played a role in this ruling.” The two journalists are free pending appeal. The court also decided to postpone a hearing on separate charges of links to a terrorist group until the outcome of a related case. [..] Dundar and Gul had faced up to life in jail on espionage and other charges for publishing footage purporting to show the state intelligence agency taking weapons into Syria in 2014.

Erdogan has acknowledged that the trucks, which were stopped by gendarmerie and police officers en route to the Syrian border in January 2014, belonged to the National Intelligence Organisation and said they were carrying aid to Turkmen battling both Syrian President Bashar al-Assad and Islamic State. He has accused the journalists of undermining Turkey’s international reputation and vowed Dundar would “pay a heavy price”, raising opposition concerns about the fairness of any trial. “We say the incident we covered was a crime, not our coverage,” Dundar said. “And for that we were confronted by the president. He acted like the prosecutor of this case. He threatened us and made us targets.”

A deal with a country that jails its journalists is labeled a ‘success’. 2016 European values. In June the British can vote to be part of this. Or not.

• EU’s Juncker Sees Refugee Crisis At ‘Turning Point’ (R.)

Europe’s migrant crisis is at a “turning point” thanks to a deal with Turkey to stem the number of new arrivals which is showing its first successes, European Commission President Jean-Claude Juncker said in comments published on Saturday. Under an accord struck with the EU, Turkey has agreed to help stop illegal migrants reaching the continent in return for accelerated EU accession talks, visa liberalization, and financial aid. Juncker told the Funke Media Group that the deal, which came into force last month, was already enabling Europe to better manage the flow of migrants. “We at a turning point,” he said. “The deal with Turkey is having an effect and the number of migrants is sinking significantly.”

He added there still needed to be a sustainable drop in the numbers before the “all-clear” could be sounded, but said the deal had given the 28-member bloc room for maneuver to create a fair and efficient asylum system in the medium term. Europe is grappling with its largest migration wave since World War Two, as a traditional flow of migrants from Africa is compounded by refugees fleeing wars and poverty in the Middle East and South Asia. The deal sealed off the main route by which a million migrants crossed the Aegean into Greece last year, but some believe new routes will develop through Bulgaria or Albania as Mediterranean crossings to Italy from Libya resume. Juncker criticized the decision to build a fence between Greece and Macedonia. “I don’t share the view of some that this fence – or building fences in Europe in general – can contribute anything to the long-term solution of the refugee crisis,” he said.

Home › Forums › Debt Rattle May 7 2016