Lewis Wickes Hine Boys working in Phoenix American Cob Pipe Factory 1910

A truce that never stood a chance. Some may have believed in it, though.

• Foreign-Exchange Market Truce Looks Increasingly Fragile (BBG)

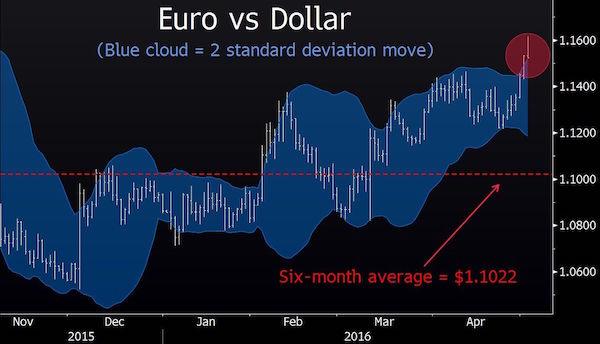

The foreign exchange market is notorious for overshooting. A currency that starts moving in a particular direction as economic fundamentals change will often end up at a rate that can’t be justified by the data. So trying to nudge the matrix of currency values is akin to policy makers attempting to steer a Ouija board pointer – which is exactly what seems to have happened since their February Group of 20 meeting in Shanghai produced a tacit truce in the currency war. Suspicions that finance ministers had agreed in February to stop talking their currencies down seemed confirmed by the dollar’s decline of more than 6% from its Jan. 20 peak.

China’s recent moves to boost the yuan’s reference rate to its highest levels this year also backed the impression of a suspension of hostilities. But while U.S. manufacturers worried that a too-strong dollar would threaten their exports and profits, the recent reversal, and gains for the euro and the yen, pose bigger risks to the struggling economies of Europe, and Japan. The euro, for example, pierced $1.16 on Tuesday, reaching its highest level since August:

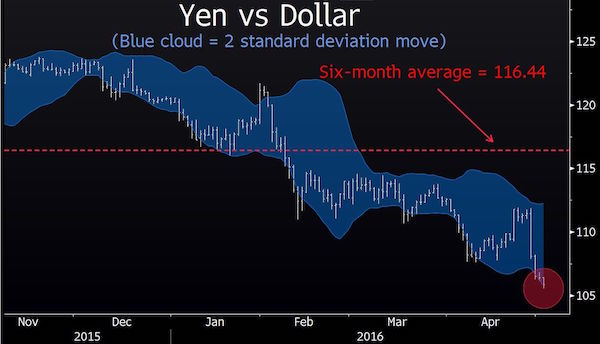

The yen, meanwhile, has breached 106 to the dollar, down from as weak as 122 in January:

Those are the kinds of moves that make central banks uncomfortable – especially when, like the ECB and the BOJ, they’re already struggling to avert deflation. Australia’s surprise decision to cut interest rates overnight, driving its currency lower against all 31 of its major trading peers, is a sign that skirmishes might be breaking out again. Marcus Ashworth, a strategist at Haitong Securities in London, said in a research note: The rumor mill has been incessant (despite official denials) that the so-called Shanghai G-20 accord to pacify markets and quell unrest between the members has actually served to make international relations as toxic as they have been for many years.

The Shanghai deal was to stop the negative feedback loop and thereby prevent a sharp devaluation of the yuan; however, it was meant to curtail the rise of the dollar, not sharply reverse it. [..] It’s clear the Treasury doesn’t want the dollar to resume its ascent. But it’s also clear that trying to steer the currency market into stasis has failed, and that the inflation outlooks in both the euro zone and Japan are deteriorating. The environment looks ripe for hostilities to break out again, providing yet another reason to be pessimistic about the prospects for a global economic recovery.

Much more in the article.

• The ‘Ostrich Approach’ Ignores Real Global and National Debt Figures (SM)

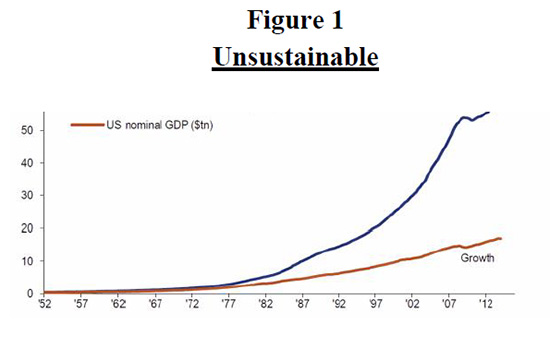

According to Hoisington and Hunt, the ratio of nonfinancial debt-to-GDP rose to 248.6% at the end of 2015, higher than the previous record of 245.5% set in 2009 and well above the average of 167.5% since this figure started to be tracked in 1952. They also point out that since 2000 it has taken $3.30 of debt to generate $1.00 of GDP compared with $1.70 in the 45 years prior to 2000. This points to the fact that a greater proportion of new debt is devoted to unproductive uses. Debt drains away vital resources from economic growth. Fighting a debt crisis with more debt is doomed to failure, yet that is not only what global central banks did during the crisis but long after markets stabilized (though the crisis never truly ended, just slowed). This was an epic policy failure that continues today.

U.S. government debt is growing to unsustainable levels. Gross debt (excluding off-balance sheet items) reached $18.9 trillion at the end of 2015, equal to 104% of GDP (considerably higher than the 63-year average of 55.2%). Government debt increased by $780.7 billion in 2015, or $230 billion more than the nominal or dollar rise in GDP. This actual debt increase is considerably larger than the budget deficit of $478 billion reported by the government because many spending items were shifted off-budget. Readers should remember this the next time The WSJ editorial page trumpets that the deficit dropped significantly from the four consecutive years of $1 trillion+ deficits between 2009 and 2012. And these figures don’t even touch upon the $60 trillion of unfunded liabilities (calculated on a net present value basis) for Social Security and other entitlement programs.

Globally, the debt picture is more disturbing. Total public and private debt/GDP is 350% in China, 370% in the U.S., 457% in Europe and 615% in Japan, respectively. Those numbers should speak for themselves.

It isn’t the answer for anyone, certainly not today when everyone’s debts are through the roof.

• Easy Money Isn’t the Answer for Japan (BBG)

Strolling through Tokyo on a Sunday afternoon, it’s hard to tell Japan’s economy is a mess. Deflation has returned, while growth hasn’t. But Shibuya Crossing remains as packed with diners, bag-toting shoppers and gawking tourists as ever. Nearby, a line of more than 50 people stretches outside a restaurant selling overpriced burgers. Lost decades be damned! Japan had the good fortune to have become wealthy before entering its years of stagnation. Some Japanese are now suffering in an economy that’s endured four recessions in eight years; the poverty rate has reached 16%, its highest level on record. But for many, especially in big cities such as Tokyo, life hasn’t so much deteriorated as frozen in time. GDP per capita, on a nominal basis, is little different now than in 1992.

And though the quality of many jobs has waned due to the increase of temporary work, joblessness remains a rarity. The unemployment rate is an enviable 3.2%. The Shibuya crowds raise serious and uncomfortable questions about the direction of Tokyo’s economic policy. Even as some analysts urge the Bank of Japan to double down on its monetary easing program and the government to ramp up its own spending in an effort to boost inflation, there’s a good argument to be made that the approach of Japan’s policymakers has been dead wrong, and for a very long time. The thrust of Japanese policies since the bursting of its gargantuan asset-price bubble in the early 1990s has been to spur growth with lots and lots of cash, whether from the government or the BOJ.

Since 2013, Prime Minister Shinzo Abe has dramatically pumped up that strategy – running large budget deficits, delaying taxes and encouraging the BOJ to print money on an ever grander scale. Arguably, however, Japan’s main focus should be to preserve the wealth it’s already accumulated. With a population that’s aging and shrinking, Japan can get richer on a per capita basis even if GDP remains perfectly flat. In that sense, deflation – long considered the scourge of Japan’s economy – is actually a boon: Falling prices raise the future value of savings, helping the elderly and others on fixed incomes. In constant terms, Japan’s GDP per capita is 17% higher than in 1992, thanks to deflation.

“When you fly to Australia, you land in 2000, to China you land in 2016, Japan you land in 1989.”

• Japan’s Coma Economy Is A Preview For The World (GS)

The 1980s were the apex of Japanese culture and economic might. Back then, Japan’s economy was growing so fast, it was thought they would overtake the US. But that all came to a screeching halt. Truth is, Japan’s meteoric rise was fueled by an epic lending bubble. Similar to the Roaring 20s in America. And when the bubble popped, the government launched massive and misguided measures that set Japan back decades. Their economy hasn’t expanded since. They are stuck in the 1980s. There’s been no growth for 30 years. And as you’ll hear about this in this special bonus video, the United States could be going down the same path. Imagine, if we are stuck in the 2000s for the next couple decades. How will you ever be able to retire?

Deflation.

• Eurozone Retail Sales Fall More Than Expected In March (R.)

Euro zone retail sales fell more than expected in March against February as consumers cut purchases of food, drinks and tobacco, the EU’s statistics office said on Wednesday. Retail sales, a proxy for household spending, decreased 0.5% in March month-on-month in the 19-country currency union, Eurostat said. Economists polled by Reuters had forecast a much smaller decrease of 0.1%. Yearly figures were also lower than expected, with sales up 2.1%, below market forecasts of a 2.5% rise. The fall in March sales was partly offset by an upward revision of data for February.

Eurostat said on Wednesday that in February sales rose 0.3% on a monthly basis and 2.7% year-on-year. It had previously estimated an increase of 0.2% monthly and 2.4% yearly. On a monthly basis, retail sales of food, drinks and tobacco products dropped 1.3% in March, the biggest fall among all the categories. Sales of non-food products, excluding automotive fuels, went down 0.5% month-on-month. Purchases of fuel for cars also dropped 0.4% on a monthly basis. Among the largest euro zone economies, Germany posted a 1.1% monthly drop of retail sales and France recorded a decrease of 0.7%. In Spain, sales increased 0.4% on a monthly basis in March.

Conservative.

• Kyle Bass Sees 30% To 40% Losses On Chinese Investments (BBG)

Kyle Bass, founder of Hayman Capital Management, said investors wouldn’t be investing in China if they realized how vulnerable its banking system is. “Common sense will tell you that they are going to have a loss cycle,” he said at the Milken Institute Global Conference in Beverly Hills, California, on Wednesday. “So if you think about how precarious that system is, you wouldn’t be allocating money to China.” Bass, a hedge fund manager famed for betting against U.S. subprime mortgages, is predicting losses for China’s banks and raising money to start a dedicated fund for bets in the nation. Bass said investors putting money in Asia should ask if they can handle 30 to 40% writedowns in Chinese investments.

Or so we’re supposed to think.

• Hong Kong Cracks Down On Fake Trade Invoices From China (R.)

Hong Kong is conducting a multi-pronged customs, shipping and financial sector crackdown against so-called fake trade invoicing that allows billions of dollars of capital to leave China illegally. Hong Kong’s central bank told Reuters it has beefed up its scrutiny of banks’ trade financing operations, while customs officials are doing more random checks on shipments crossing border posts and conducting raids on warehouses to ensure the authenticity of goods, senior officials working in shipping, logistics and banking said. The head of a logistics company said surprise customs inspections at Hong Kong border posts had doubled. The sources[..] said the increased efforts began this year and reflected concerns about billions of dollars in illicit cash authorities suspect are being channeled through Hong Kong following a stock market crash in China last year.

“Examinations and investigations reflect one of the strongest trends we are seeing now in the financial sector,” said Urszula McCormack, a partner at law firm King & Wood Mallesons, which helped co-author a report published by The Hong Kong Association of Banks in February that highlighted shipping as a sector where fake invoicing can thrive. “(Hong Kong) regulators are now in enforcement mode.” China has become increasingly concerned about capital outflows since the middle of last year when Chinese rushed to get money offshore for safekeeping or to invest following the stock market slump and unexpected yuan devaluation. Hong Kong is the most popular route, analysts say, because of its proximity to China.

Until counterparties start raising their voices?!

• Regulators Want to Slow Runs on Derivatives (BBG)

Nobody quite knows what it means for a bank to be “too big to fail,” so the regulators in charge of solving the problem have an understandable focus on tidiness. A bank that fails tidily, sensibly, in neat little compartments, probably won’t do much damage to anyone else. A bank whose failure is sprawling and incomprehensible might well turn out to be catastrophic. So the preferred mechanism for winding up a possibly too-big-to-fail bank these days is largely about compartmentalization. You put all of the important, messy stuff into subsidiaries – put the deposits in a bank subsidiary, the repurchase agreements and derivatives in a broker-dealer subsidiary, etc. – and put those subsidiaries under a “clean” bank holding company with a fairly large amount of capital and long-term debt.

Then if things go horribly wrong, the holding company’s shareholders and bondholders are the ones who lose money, shielding the people who have messier and more systemic claims on the subsidiaries. The regulators swoop in and recapitalize the holding company, or just sell the subsidiaries to other, healthier banks, in any case without ever interrupting service at the systemic subsidiaries. All the bad stuff happens at the holding company, all the important stuff happens at the subsidiaries, and you try to avoid mixing the two. Then all you have to do is make sure that the holding company has enough equity and long-term debt to shield the subsidiaries against any plausible bad outcome. But to make this work you really need to keep things in their boxes. Derivatives have a tendency to want to jump out of their boxes.

In particular, if bad things are happening at a large and systemically important bank holding company, there isn’t a lot of reason for the bank’s derivatives counterparties and repo creditors to stick around. Repo is meant to be a super-safe place to park your money overnight; if it looks like a repo counterparty might default, then you look for a different counterparty. And derivatives are just supposed to work: If Bank A owes you money under an interest-rate swap, and you owe Bank B money under an offsetting swap, and Bank A defaults, then all of a sudden you have an unanticipated unhedged risk. So if your derivatives or repo counterparty gets in trouble, you bail immediately to protect yourself. (Also there is always the possibility of making a lot of money on the unwind.) But while this is individually rational, it is systemically bad. As Janet Yellen put it yesterday:

“The crisis underscored that when a large financial institution gets into trouble, its failure can destabilize other firms. This is because large banking organizations are connected with each other by the business they do together and through the contracts that result from that business. Indeed, in the 21st century, a run on a failing banking organization may begin with the mass cancellation of the derivatives and repo contracts that govern the everyday course of financial transactions. When these contracts, known collectively as Qualified Financial Contracts or QFCs, unravel all at once at a failed large banking organization, an orderly resolution of the bank may become far more difficult, sparking asset firesales that may consume many firms.”

So yesterday U.S. banking regulators proposed new rules to prevent that from happening. The rules basically say that a bank subsidiary’s derivatives and repo contracts can’t be cancelled for 48 hours after the bank’s holding company files for bankruptcy or otherwise enters resolution proceedings. This gives the regulators two days to swoop in and conduct the neat resolution of the bank before its derivatives spill out everywhere and create a mess.

Not only about economics. But if the economy were growing like crazy, the Brexit risk would be much more subdued.

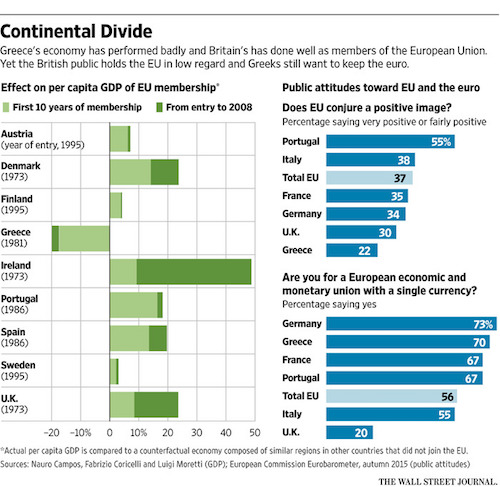

• Brexit, Like Grexit, Is Not About Economics (WSJ)

Britain’s flirtation with leaving the European Union is as puzzling as Greece’s stubborn desire to stay. After all, Britain’s economy has done quite well inside the bloc while Greece’s has been decimated. What explains both sentiments is that the European project has always been about more than economics. It also seeks “an ever closer union among the peoples of Europe,” as the Treaty of Rome, its founding charter, declared in 1957. “Closer union” with Europe deeply appeals to Greeks, whose own state has failed them so badly. But it repels many Britons, whose state works just fine and who want no part of a European political union. For them, the quagmire of the euro, which Britain hasn’t adopted, is a cautionary tale of what such a union could bring.

How they decide between the economic benefits and political risks of staying could determine whether Britain votes to leave the EU in a June 23 referendum. Greece joined the European Economic Community, the EU’s predecessor, in 1981, in search of shelter from foreign invaders, domestic coups, and its own dysfunctional government. Economics actually argued against membership: EEC technocrats said Greece wasn’t ready, but were overruled by political leaders worried about geopolitical instability on the Continent’s southern flank. The same logic brought Greece into the euro in 2001 when its debts and deficits should have disqualified it. Greece’s underdeveloped, overprotected economy was poorly prepared for life inside the EU.

A study led by Nauro Campos of Brunel University concluded only Greece was poorer in 2008 for having joined the EU; Britain, they reckon, was 24% richer. Eurozone membership initially brought down Greek interest rates and unleashed a borrowing binge but resulted in crisis and a six-year depression. Yet Greeks still don’t want to give up the euro. “Anglo Saxons think the euro is only an economic and financial project,” said Yannis Stournaras, governor of the Greek central bank, in an interview. “It’s political as well. It’s a means to an identity. We feel safer in the euro.” British considerations were just the opposite. A Conservative government took Britain into the EEC in 1973 largely for its trade benefits, a decision voters overwhelmingly approved in a 1975 referendum.

You don’t say.

• Even ‘Small Crisis’ Enough To Tear EU Apart, Moody’s Warns (Tel.)

Fresh turmoil in the EU risks triggering the disintegration of the entire bloc, according to Moody’s. In a stark warning, the rating agency said the “painful adjustment” faced by some countries in the eurozone meant the collapse of the single currency area and wider EU was believed by some to be a question of “when” not “if”. Moody’s said that even a “small crisis” threatened to set off an uncontrollable chain of events that would “threaten the sustainability” of the EU and its institutions. The rating agency praised the “significant political progress” made since the crisis in putting the foundations in place for a banking union and creating a eurozone rescue fund. However, it said endless austerity demands in return for bail-outs had fuelled deep resentment across the region, especially in countries weighed down by sky-high unemployment.

“Significant vulnerabilities” facing the bloc such as a British exit from the EU also remained, which would fuel support for “anti-establishment and anti-EU parties elsewhere”, it warned in a report. Colin Ellis, Moody’s chief credit officer for Europe, said a British exit could spark an “existential moment” for the bloc. “Even if the EU survives its current challenges largely unscathed, even a ‘small’ future crisis could threaten the sustainability of current institutional frameworks, if it coincided with negative public sentiment and populist political developments,” the report said. “This can create the impression that the question is when the system breaks, rather than if.”

It came as Mervyn King, the former governor of the Bank of England, warned that the eurozone faced four “unpalatable choices” as policymakers struggle to lift the bloc out of its economic malaise. Lord King said the single currency area would have to choose between an economic “depression” in the south, higher inflation in northern states like Germany, permanent fiscal transfers or a “change of composition of the euro area”. However, he told an audience in Frankfurt that there was “a limit to the economic pain that can be imposed in pursuit of a federal Europe without risking a political reaction. “There are no empires in Europe any more and our leaders would do well not to try to recreate one.”

Ambrose votes Brexit?!

• Let The TTIP Die If It Threatens Parliamentary Democracy (AEP)

Unloved, untimely, and unnecessary, the putative free trade pact between Europe and America is dying a slow death. The Dutch people have amassed 100,000 signatures calling for a referendum on this Transatlantic Trade and Investment Partnership, or TTIP. The number is likely to soar after Greenpeace leaked 248 pages of negotiation papers over the weekend. The documents do not exactly show a “race to the bottom in environmental, consumer protection and public health standards” – as Greenpeace alleges – but they do raise red flags over who sets our laws and who holds the whip hand over our eviscerated parliaments. Dutch voters have already rebuked Brussels once this year, throwing out an association agreement with Ukraine in what was really a protest against the wider conduct of European affairs by an EU priesthood that long ago lost touch with economic and political reality.

French president François Hollande cannot hide from that reality. Faced with approval ratings of 13pc in the latest TNS-Sofres poll, a TTIP mutiny within his own Socialist Party, and electoral annihilation in 2017, he is retreating. “We don’t want unbridled free trade. We will never accept that basic principles are threatened,” he said. In Germany, just 17pc now back the project, and barely half even accept that free trade itself a “good thing”, an astonishing turn for a mercantilist country that has geared its industrial system to exports. The criticisms have struck home. The Dutch, Germans, and French, have come to suspect that TTIP is a secretive stitch-up by corporate lawyers, yet another backroom deal that allows the owners of capital to game the international system at the expense of common people.

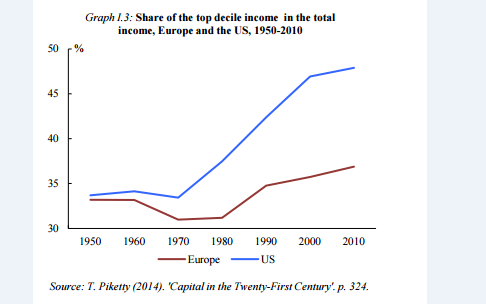

Weighty principles are at stake. The Greenpeace documents show that the EU’s ‘precautionary principle’ is omitted from the texts, while the rival “risk based” doctrine of the US earns a frequent mention. Clearly, the two approaches are fundamentally incompatible. It is a heresy in our liberal age – a sin against Davos orthodoxies – to question to the premises of free trade, but this tissue rejection of the TTIP project in Europe may be a blessing in disguise. You can push societies too far. [..] The European Commission’s Spring forecast this week has an eye-opening section on the rise of inequality. Without succumbing to the fallacy of ‘post hoc, propter hoc’, it is an inescapable fact that the pauperisation of Europe’s blue collar classes corresponds exactly with the advent of globalisation.

Let’s sign another set of deals with them.

• Turkey In Political Freefall As Erdogan Grabs More Power, PM To Resign (MEE)

News that Turkish Prime Minister Ahmet Davutoglu, after meeting President Recep Tayyip Erdogan, is to announce the holding of a party congress on Thursday, effectively signifying his resignation, has sent shockwaves through the country. The value of the Turkish Lira dropped from 2.79 to the dollar earlier in the day to 2.94. Davutoglu is expected to make the announcement at 1100am local time. After 14 years in power, the ruling Justice and Development Party (AKP) may be coming apart at the seams. But far more threatening than the unravelling of a political party are fears about the direction in which the country is headed. Both domestic and international critics have for years pointed to the growing authoritarianism and strong-man tactics employed by Erdogan. The fact that he can so easily dismiss the prime minister, a man he rapidly promoted through the ranks, is sending shivers down the spines of many.

“This is a palace coup,” said Yusuf Kanli, a veteran commentator on Turkish politics. “The president wanted the prime minister to step down and that’s it. Now we will have a party convention in May or early June,” Kanli told Middle East Eye. Rumours of tensions within the party have been rife for almost a year, but not even the AKP’s worst enemies had imagined a split could occur on such a scale. Unconfirmed reports suggest the AKP will convene a party congress within 60 days and that Davutoglu will not stand as a candidate. “Events today show that the AKP will move to consolidate Erdogan’s aspirations of becoming a super president. Whether they will succeed remains to be seen. These are very fine political calculations,” Kanli said. The party congress elects the party chairman, who automatically becomes their choice for prime minister.

Now confirmed by another study.

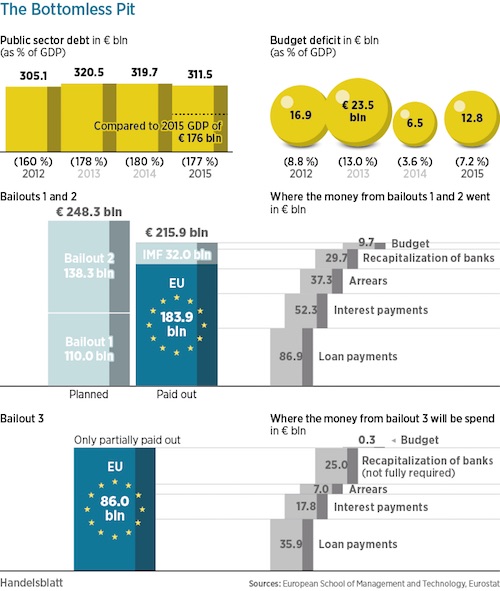

• Study: Bailouts Went To Banks, Only 5% To Greeks (Hand.)

After six years of ongoing bailouts amounting to more than €220 billion, or $253 billion in loans, Greece just cannot get out of crisis mode. It is tempting to blame those who refused to reform the country’s pensions and labor markets for the latest calamity. But a study by the European School of Management and Technology, a copy of which Handelsblatt has obtained exclusively, gives another perspective. The aid programs were badly designed by Greece’s lenders, the ECB, the EU and the IMF. Their priority, the report says, was to save not the Greek people, but its banks and private creditors. This accusation has been around for a long time. But now, for the first time, the Berlin-based ESMT has compiled a detailed calculation over 24 pages.

Their economists looked at every individual loan instalment and examined where the money from the first two aid packages, amounting to €215.9 billion, actually went. Researchers found that only €9.7 billion, or less than 5% of the total, ended up in the Greek state budget, where it could benefit citizens directly. The rest was used to service old debts and interest payments. The report comes as the EU and the Greek government prepare to hold negotiations about further debt relief. E.U. Economics Commissioner Pierre Moscovici said he hoped all sides could reach an agreement at a special meeting of the Eurogroup of euro-zone finance ministers next Monday. Extensions of credit repayment periods, deferments and freezing interest rates are all being discussed. This “debt relief light” would not affect private investors – just the loans from Europeans.

At the moment, German Chancellor Angela Merkel and her colleagues are not inclined to listen to the Greek prime minister, Alexis Tsipras, as he asks for a new multi-billion euro aid package. It is easy to understand why. The chancellor must feel she has seen it all before. She has experienced many near state bankruptcies since early 2010 when she put together the first bailout for Greece. But Jörg Rocholl, president of the European School of Management and Technology said that his institute’s research shows that the biggest problem lies with the way the bailout packages were designed in the first place. “The aid packages served primarily to rescue European banks,” he said. For example, €86.9 billion were used to pay off old debts, €52.3 billion went on interest payments and €37.3 billion were used to recapitalize Greek banks.

Of course, the servicing of debts and interest payments is a major source of expenditure in any state budget – so the Greek state did benefit from it indirectly, as it had also spent the loan money beforehand. But the new calculations do throw doubts on whether the aid programs were sensibly constructed: The loans were used to service debt, although Greece has been de facto bankrupt since 2010.

Apart form the obvious human tragedy, I don’t know why, but nobody talks about this being the end of the tar sands industry. That’s a real possibility, though. Nearly all workers live in the town. And so oil prices are up a bit for the moment.

• The Terrible News From Fort McMurray, And The Hope That Remains (G&M)

On Monday, residents of Fort McMurray watched anxiously as wildfires burned southwest of the northern Alberta city. Fort Mac’s streets are carved out of the boreal forest at the spot where the Clearwater River flows into the Athabasca. Backyards in the residential neighbourhoods in the west and northwest run up against walls of pine and spruce. Forest fire is always a threat, but on Monday the smoke and flames appeared to be far enough away to allow for hope that the city was safe. On Tuesday, the worst happened. The winds came up and the wildfires flanked the city. The two oldest residential developments, Abasands and Beacon Hill, have been decimated. Thickwood, Timberlea and Parsons Creek, the newest and by far the largest residential developments, where there are modern schools and shopping malls and a beautiful ravine park, were on the verge of being overrun by the flames.

The destruction by fire of an entire Canadian city of more than 80,000 people is suddenly a possibility. Fort McMurray is a remarkable place. People from across Canada and the world have built lives there. In grocery stores, you’ll find halal meats displayed alongside cod tongues. Muslim and Christian children mix easily at the new Roman Catholic high school. Fort Mac is often maligned as a transient, wild west town and a symbol of oil extraction at all costs, but it is in fact a tolerant, diverse and progressive city – a very Canadian boomtown. Not perfect, but doing its best to be a durable home for oil sands workers in spite of the capriciousness of oil prices, the isolation and the long winters.

The focus now is on the logistics of caring for 89,000 evacuees – a staggering challenge. Government officials at all levels and in all provinces, along with private industry and the many native bands around Fort McMurray, are offering aid. Residents are safe and, miraculously, no one has been reported killed or injured. But many, or even perhaps all, may not have homes to return to.

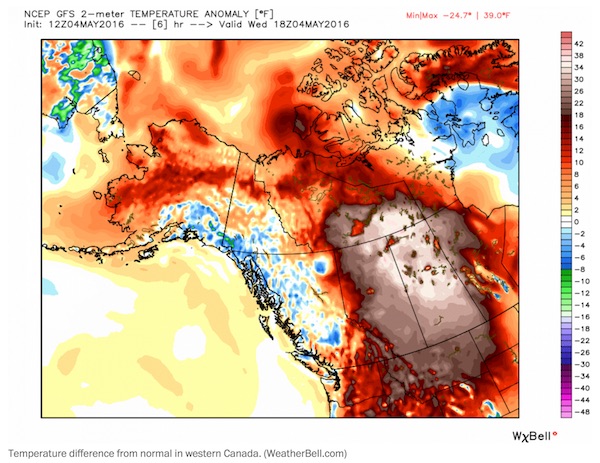

Temperature anomalies keep spreading.

• ‘Omega Block’ Behind Searing Heat Inflaming Fort McMurray Wildfire (WaPo)

Unseasonably hot weather in Alberta, Canada, is fueling the worst wildfire disaster in the country’s history. An extreme weather pattern, known as an omega block, is the source of the heat. An omega block is essentially a stoppage in the atmosphere’s flow in which a sprawling area of high pressure forms. This clog impedes the typical west-to-east progress of storms. The jet stream, along which storms track, is forced to flow around the blockage. At the heart of the block in Canadian’s western provinces, the air is sinking and much warmer than normal. Such a clog can persist for days until the atmosphere’s flow is able to break it down and flush it out.

Centers of storminess form on both sides of the block, and the resulting jet stream configuration takes on the likeness of the Greek letter omega. In this case, cool and unsettled weather is affecting the eastern Pacific Ocean and eastern North America, including much of the U.S. East Coast. As the Fort McMurray wildfire rapidly spread Tuesday, temperatures surged to 90 degrees (32 Celsius), shattering the daily record of 82 degrees set May 3, 1945. Dozens of other locations in Alberta also had record high temperatures. More records are likely to fall today. Temperatures are forecast to climb well into the 80s today at Fort McMurray, about 30 degrees warmer than normal. The average high is in the upper 50s.

This is very far from over.

• UN Envoy Warns of New Wave of 400,000 Refugees From Syria (WSJ)

A top United Nations official warned of a new tide of refugees from Syria if world powers didn’t succeed in calming an outbreak of hostilities in and around the northern Syrian city of Aleppo. Staffan de Mistura, the U.N.’s special envoy for Syria, said after meeting with European diplomats and Syrian opposition officials Wednesday that the priority in moving forward with a peace process for Syria was to stop the fighting around what was once Syria’s most populous city. “The alternative is truly quite catastrophic,” Mr. de Mistura said. “We could see 400,000 people moving toward the Turkish border.” The talks in Berlin centered on ways to return to talks in Geneva on Syria’s political future. The opposition’s High Negotiations Committee, headed by Riad Hijab, pulled out of those talks on April 18 as a cessation of hostilities agreed to in February disintegrated.

Home › Forums › Debt Rattle May 5 2016