Arthur Rothstein Steam shovels on flatcars, Cherokee County, Kansas 1936

“The problem is that the banking sector in China has been pushing out new lending aggressively, but with slowing economic growth many loans have not gone to create more factories and jobs but to financial assets that have been leveraged to boost returns..”

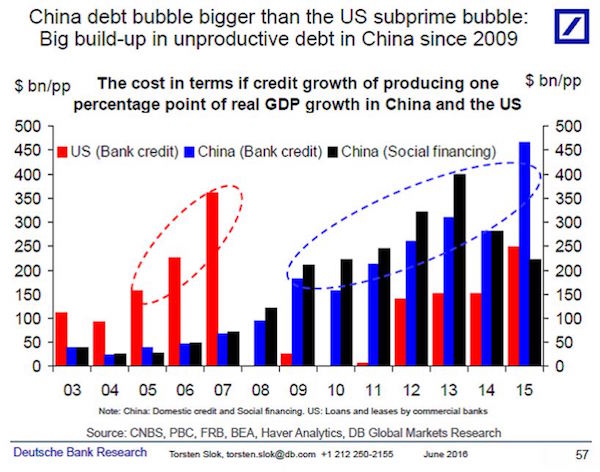

• China’s Debt Bubble Bigger Than Subprime Bubble (MW)

Unproductive debt in China—that is, debt that’s used to drive up asset prices—swelled in 2015, eclipsing the level seen in the U.S. in the run-up to the Great Financial Crisis, said Torsten Slok, chief international economist at Deutsche Bank, in a note to clients published Tuesday. Slok’s findings are illustrated in the chart below, where he compares the level of credit growth required in the U.S. and China to generate 1percentage point of GDP growth. (He notes that the red bar for 2015 also grew, suggesting more credit growth is now required in the U.S. to produce onepercentage point of GDP growth).

Chinese officials are partly responsible for the expansion of credit last year, analysts say, as the People’s Bank of China lessened requirements regarding the collateral lenders put up to borrow funds from the central bank, among other stimulus measures. The move was meant to spur economic growth, the pace of which slowed last year, stoking fears that it could precipitate a sharp global downturn. The world’s second-largest economy saw growth slow to 6.8% in 2015—missing the government’s target for 7% growth by a hair. In the first quarter of 2016, the country’s economy grew at an annual rate of 6.7%, its slowest pace since 2009.

It’s important to note, however, that many economists believe Chinese data overstates the strength of its economy. Over the past year, Chinese stocks, and more recently commodities like iron ore and steel rebar traded in China, have seen a series of dizzying rallies and frightening crashes as investors, emboldened by easy credit engage in speculation. “The problem is that the banking sector in China has been pushing out new lending aggressively, but with slowing economic growth many loans have not gone to create more factories and jobs but to financial assets that have been leveraged to boost returns,” Slok said.

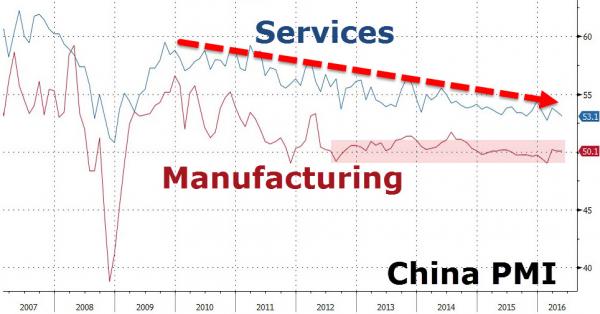

Everyone, US, Japan and EU too, needs that services PMI to flourish, but…

• Yuan Tumbles As China PMI Miraculously Hugs Flatline (ZH)

Since May 2012, China Manufacturing PMI has miraculously stayed within a 1 point range of the knife-edge 50 level between contraction and expansion. May 2015 just printed 50.1, the same as April with New Orders weaker and business activity expectations (hope) tumbling to 4 month lows. The Steel Industry PMI collapsed from 57.3 to 50.9 with New Steel Orders collapsing from 65.6 to 52.7 – the biggest monthly drop in record. And while non-manufacturing PMI remained in ‘expansion territory at 53.1, it fell back from a brief bounce in April with employment and business expectations both weaker. For now, equity markets are unreactive but offshore Yuan is tumbling on the news, not helped by a sizable devaluation in the official fix. The magic of manufacturing data… as non-manufacturing slowly catches down…

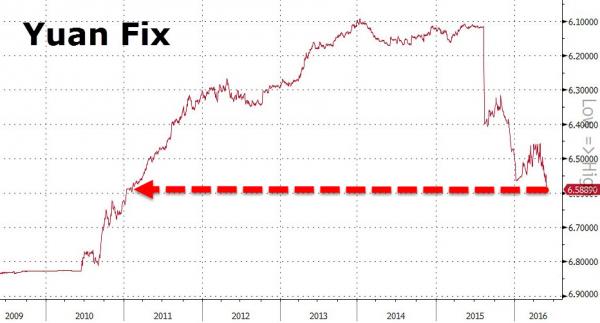

Disappointment triggering more offshore Yuan selling… Not helped by yet another devaluation by PBOC…

*CHINA SETS YUAN FIXING AT 6.5889 VS 6.5790 DAY EARLIER

*PBOC CUTS YUAN FIXING TO LOWEST LEVEL SINCE 2011 FOR THIRD DAY

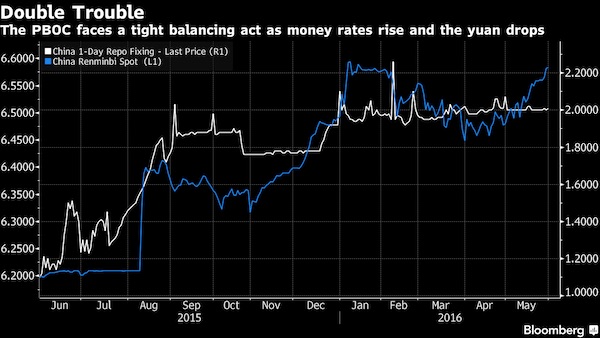

Refinancing is becoming a major problem.

• Double Blow for China Banks as Fed Worry Meets June Cash Crunch (BBG)

Shanghai’s money market is braced for higher borrowing costs as a credit-fueled economic recovery coincides with the prospect of higher U.S. interest rates in June, a month that has historically seen funding crunches in China. The overnight interbank lending rate averaged 1.99% in May, up from 1.18% a year ago, as Federal Reserve tightening weakened the yuan, spurring capital outflow pressures. That borrowing cost has climbed every June since 2011, as lenders hoard deposits ahead of quarter-end regulatory checks. The cost of fixing rates in the swap market is surging as data showed property leading a rebound in investment in the world’s second-biggest economy.

“The internal and external factors combined will certainly add pressure to the money market in June, driving interest rates higher,” said Liu Dongliang at China Merchants Bank, the nation’s sixth-largest lender. “We’re not optimistic about the bond market in the short term.” Any cash crunch would aggravate a rout in bonds that led to 190.6 billion yuan ($28.9 billion) in canceled sales this quarter, making it harder for issuers to refinance a record amount of maturing debt. The overnight money rate has been moving in tandem with the weakening currency in the past year after touching a six-year low, as estimated outflows reached $1 trillion in the past year, according to a gauge compiled by Bloomberg.

The yuan declined 1.5% in May as Federal Reserve Chair Janet Yellen said that evidence of strength in the U.S. economy means there could be an increase in borrowing costs in the coming months. The probability of Fed action in June has surged to 24% from 12% at the end of April, while the premium for China’s one-year sovereign yield over U.S. Treasuries has narrowed to a seven-week low. The People’s Bank of China has an incentive to keep monetary conditions relatively tight as it looks to control the yuan’s decline, rein in excessive lending by banks and keep a lid on inflation. The authority will create a neutral and appropriate monetary environment, it said in an article published in China Business News last week. The comments came after data showed the nation’s consumer price index maintained a 2.3% acceleration for the third month in April, a pace not seen since mid-2014.

Mainland Chinese fail to appear.

• Hong Kong April Retail Sales Fall 7.5%, 14th Straight Month (R.)

Hong Kong’s retail sales fell for the 14th successive month in April, as a drop in tourists and weak local consumption deepened the pain for retailers in the city. Retail sales in April slid 7.5% from a year earlier to HK$35.2 billion ($4.5 billion) in value terms, less than a 9.8% slump in March. In volume terms, April sales dropped 7.6%, government data showed on Tuesday. “Many types of retail outlet still recorded notable falls in sales, reflecting the continued drag from the slowdown in inbound tourism as well as the more cautious local consumer sentiment amid subpar economic conditions,” the government said in a statement.

Hong Kong is struggling with mounting economic challenges from the prospect of rising U.S. interest rates, which has stepped up capital outflows, and from China’s economic slowdown. Mainland tourists are avoiding the city amid political tensions with China and growing calls from radical activists for greater autonomy from Beijing. “The near-term outlook for retail sales will continue to depend on the performance of inbound tourism,” the government added.

“Output tumbled at the fastest pace in 25 months and new orders are the worst since Jan 2013. This is the death cross for Abenomics..”

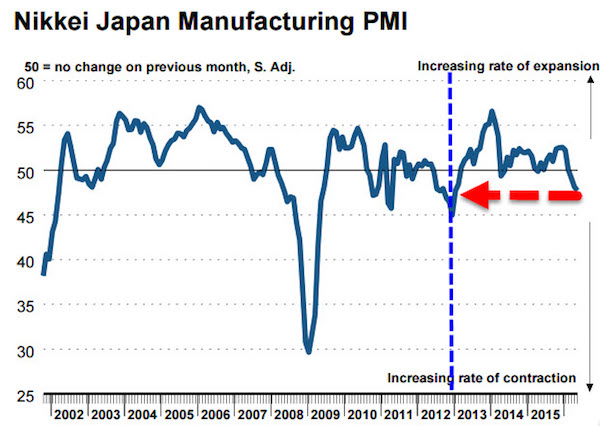

• Abenomics “Death Cross” Strikes As Japan PMI Plunges To 40-Month Lows (ZH)

Since Abenomics was unleashed on the world (with QQE starting in April 2013), things have not worked out as the smartest men in the Japanese rooms predicted. In fact, with April’s final manufacturing PMI printing at 47.7, operating conditions in Japan worsened at the sharpest pace in 40 months… since Abe began his three arrows. Output tumbled at the fastest pace in 25 months and new orders are the worst since Jan 2013. This is the death cross for Abenomics… The weakest Japanese manufacturing PMI since the start of Abenomics…

Commenting on the Japanese Manufacturing PMI survey data, Amy Brownbill, economist at Markit, which compiles the survey, said: “The aftermaths of the earthquakes in one of Japan’s key manufacturing regions continued to weigh heavily on the manufacturing sector. Both production and new orders declined sharply midway through the second quarter of 2016. A marked fall in international demand also contributed to the drop in total new orders, as exports declined at the fastest rate since January 2013.” Flashing the “death cross” of Abenomics three arrows… As it is now clear that the massive expansion of the Bank of Japan balance sheet has done nothing… in fact worse than nothing… for the Japanese economy.

Talk about a death cross…

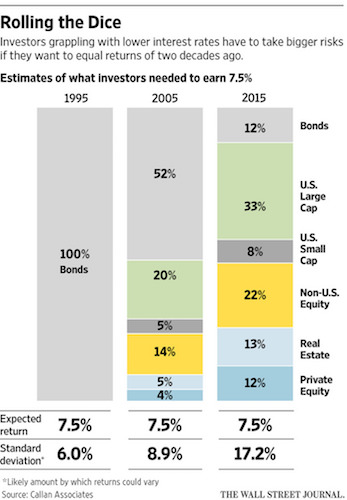

• Pension Funds Pile on Risk Just to Get a Reasonable Return (WSJ)

What it means to be a successful investor in 2016 can be summed up in four words: bigger gambles, lower returns. Thanks to rock-bottom interest rates in the U.S., negative rates in other parts of the world, and lackluster growth, investors are becoming increasingly creative—and embracing increasing risk—to bolster their performances. To even come close these days to what is considered a reasonably strong return of 7.5%, pension funds and other large endowments are reaching ever further into riskier investments: adding big dollops of global stocks, real estate and private-equity investments to the once-standard investment of high-grade bonds. Two decades ago, it was possible to make that kind of return just by buying and holding investment-grade bonds, according to new research.

In 1995, a portfolio made up wholly of bonds would return 7.5% a year with a likelihood that returns could vary by about 6%, according to research by Callan Associates, which advises large investors. To make a 7.5% return in 2015, Callan found, investors needed to spread money across risky assets, shrinking bonds to just 12% of the portfolio. Private equity and stocks needed to take up some three-quarters of the entire investment pool. But with the added risk, returns could vary by more than 17%. Nominal returns were used for the projections, but substituting in assumptions about real returns, adjusted for inflation, would have produced similar findings, said Jay Kloepfer, Callan’s head of capital markets research.

The amplified bets carry potential pitfalls and heftier management fees. Global stocks and private equity represent among the riskiest bets investors can make today, Mr. Kloepfer said. “Stocks are just ownership, and they can go to zero. Private equity can also go to zero,” said Mr. Kloepfer, noting bonds will almost always pay back what was borrowed, plus a coupon. “The perverse result is you need more of that to get the extra oomph.”

How to destroy the euro from within.

• Germany: Draghi v the Banks (FT)

In Dillingen an der Donau, a small town in rural Bavaria, the local Sparkasse savings bank is providing an unusual service. For customers who live a long way from a branch, it is giving out free bus tickets. And for those who cannot get to the bank at all — the old or sick, for example — it offers to send a member of staff directly to their homes to deliver small sums of cash. The Sparkasse came up with the idea to compensate for the fact that it was closing several branches as revenues dwindled due to interest rates being at a record low and customers visiting less frequently. “If your revenues are shrinking, then you have to do something about your costs,” says an official at the bank. “You have to economise.” The pressure on Germany’s army of savings banks is just one example of the increasing strains on the country’s financial system caused by the ultra-loose monetary policy of the Frankfurt-based ECB.

In a bid to jolt the eurozone’s lacklustre economy back to life , the central bank has, over the past five years, slashed interest rates to record lows and even pushed its deposit rate into negative territory. On top of this, it has launched a €1.7tn asset purchase programme, which has driven down bond yields across the continent. The measures have bought time for reform in the battered economies of southern Europe. Yet in Germany, they have met a blizzard of opposition. The country’s hawkish monetary policy establishment has always nurtured a degree of scepticism about the institution that succeeded the Bundesbank as the custodian of Germany’s monetary stability. But as savers, banks and insurers have been increasingly hurt by low interest rates — nominal yields on 10-year German bonds have fallen from about 4% in 2008 to less than 0.2% today — the criticism of the ECB has intensified.

The media has accused the central bank of fuelling a “social disaster”, while one bank has claimed that low interest rates will have deprived German households of €200bn between 2010 and the end of this year. Germany’s financial watchdog, BaFin, branded low rates a “seeping poison” for the country’s financial system. The most dramatic intervention, however, came from Wolfgang Schäuble, the hawkish finance minister, who blamed ECB president Mario Draghi for “half” the rise in support for Alternative for Germany, the rightwing, anti-immigration, anti-euro party. Mr Draghi hit back, archly noting that the ECB has a mandate “to pursue price stability for the whole of the eurozone, not only for Germany”, and argued that low borrowing costs were symptomatic of a glut in global savings for which Germany was partly to blame.

“He’s judge and jury and everything else..”

• The Most Powerful Man in Banking (WSJ)

The most important person in the banking business isn’t a banker. To most Wall Street executives, that title goes to Federal Reserve governor Daniel Tarullo, a brusque, white-haired former law professor who has come to personify Washington’s postcrisis influence over how banks do business. Mr. Tarullo heads the Fed’s Committee on Bank Supervision. On paper—and in practice for most of the previous decades—the post isn’t a hugely powerful one. But the 63-year-old took office at the Fed in 2009 at a moment of broad public support for a more aggressive tack and has pressed that advantage ever since. Financiers privately call Mr. Tarullo “the Wizard of Oz” for his behind-the-scenes sway over everything from corporate strategy to how many billions of dollars banks must maintain in capital.

Through the stress tests he championed to evaluate how banks might fare in another market shock, the Fed wields control over whether banks can raise the dividends they pay to shareholders. For a big bank in 2016, getting a stamp of approval from Mr. Tarullo is an effort consuming thousands of employees. The industry’s lawyers pore over transcripts of Mr. Tarullo’s dense speeches to grasp the meaning of every word. When Citigroup and Bank of America stumbled on the stress tests in recent years, each bank said it spent at least $100 million to correct the problems the Fed had called out. Peter Conti-Brown, a historian and author of “The Power and Independence of the Federal Reserve,” called Mr. Tarullo’s influence extraordinary. One former bank executive put a finer point on it: “He’s judge and jury and everything else,” he said.

Mr. Tarullo in an interview attributed his power to his longevity at the Fed and consensus with other regulators. And, he said, the full impact of the regulatory changes made on his watch have yet to be felt. “I think it likely that firms are going to have to change in some cases their size, in some cases their business model, and in some cases their organization,” he said. Mr. Tarullo’s influence illustrates the outsize role that government regulation now plays for banks. For most of the modern era, regulators took a more hands-off approach, monitoring the industry for abuses but stopping short of injecting themselves into bank operations. But the near collapse of the financial system in 2008 brought widespread criticism of regulators for not being more vigilant and changed the equation.

“..governments try to make finance safer and finance exploits the support to make itself riskier.”

• Central Banks As Pawnbrokers Of Last Resort (M. Wolf)

Will there be another huge financial crisis? As Hamlet said of the fall of a sparrow: “If it be now, ’tis not to come. If it be not to come, it will be now. If it be not now, yet it will come – the readiness is all.” So it is with banks. They are designed to fall. So fall they surely will. A recent book explores not only this reality but also a radical and original solution. What makes attention to this suggestion even more justified is that its author was at the heart of the monetary establishment before and during the crisis. He is Lord Mervyn King, former governor of the Bank of England. His book is called The End of Alchemy . The title is appropriate: alchemy lies at the heart of the financial system; moreover, banking was, like alchemy, a medieval idea, but one we have not as yet discarded. We must, argues Lord King, now do so.

As Lord King remarks, the alchemy is “the belief that money kept in banks can be taken out whenever depositors ask for it”. This is a confidence trick in two senses: it works if, and only if, confidence is strong; and it is fraudulent. Financial institutions make promises that, in likely states of the world, they cannot keep. In good times, this is a lucrative business. In bad times, the authorities have to come to the rescue. It is little wonder, then, that financial institutions have become so large and pay so well. Consider any large bank. It will have a wide range of long-term and risky assets on its books, mortgages and corporate loans prominent among them. It will finance these with deposits (supposedly redeemable on demand), short-term loans and longer-term loans. Perhaps 5% will be financed by equity.

What happens if lenders decide banks might not be solvent? If they are depositors or short-term lenders, they can demand their money back immediately. Without aid from the central bank, the only institution able to create money without limit, banks will fail to meet that demand. Since a generalised collapse would be economically devastating, needed support is forthcoming. Over time, this reality has created a “Red Queen’s race”: governments try to make finance safer and finance exploits the support to make itself riskier. Broadly speaking, two radical solutions are on offer. One is to force banks to fund themselves with far more equity. The other is to make banks match liquid liabilities with liquid and safe assets. The 100% reserve requirements of the “Chicago plan”, proposed during the Great Depression, is such a scheme.

If liquid, safe liabilities finance liquid, safe assets — and risk-bearing, illiquid liabilities finance illiquid, unsafe assets — alchemy disappears. Finance would be safe. Unfortunately, the end of alchemy would also end much risk-taking in the system. Lord King offers a novel alternative. Central banks would still act as lenders of last resort. But they would no longer be forced to lend against virtually any asset, since that very possibility must create moral hazard. Instead, they would agree the terms on which they would lend against assets in a crisis, including relevant haircuts, in advance. The size of these haircuts would be a “tax on alchemy”. They would be set at tough levels and could not be altered in a crisis. The central bank would have become a “pawnbroker for all seasons”.

The US will need to pressure a lot harder to keep the sanctions going.

• Germany Considers Easing of Russia Sanctions (Spiegel)

As expected, G-7 leaders reiterated their hardline approach to Moscow in the Japan summit’s closing statement. Chancellor Angela Merkel complained last Thursday that there still isn’t a stable cease-fire in Ukraine and the law pertaining to local elections in eastern Ukraine, as called for by the Minsk Protocol, still hasn’t been passed. That, she said, is why “it is not to be expected” that the West will change its approach to Russia. What Merkel didn’t say, though, is that behind the scenes, her government has long since developed concrete plans for a step-by-step easing of the sanctions against Russia and that the process could begin as early as this year. Thus far, the message has been that the trade and travel restrictions will only be lifted once all the provisions foreseen by the Minsk Protocol have been fulfilled. 100% in return for 100%.

Now, however, Berlin is prepared to make concessions to Moscow – on the condition that progress is made on the Minsk process. “My approach has always been that sanctions are not an end in themselves. When progress is made on the implementation of the Minsk Protocol, we can also then talk about easing sanctions,” says Foreign Minister Frank-Walter Steinmeier. The Chancellery also supports the new approach. Thus far, it was the Social Democrats that were particularly vocal about rapprochement with Russia. Led by Economics Minister Gabriel, the SPD is Merkel’s junior coalition partner. While Steinmeier, also a senior SPD member, has never explicitly demanded the easing of sanctions, he has long supported Russia’s return to the G-7. Merkel, by contrast, had always maintained a hard line. Now, though, the Chancellery also appears to be changing course.

[..] more and more EU member states have begun questioning the strict penalty regime, particularly given that it hasn’t always been the Russians who have blocked the Minsk process. Despite Tusk’s apparent optimism, indications are mounting that getting all 28 EU members to approve the extension of the sanctions at the end of June might not be quite so simple. Berlin has received calls from concerned government officials whose governments have become increasingly skeptical of the penalties against Russia but have thus far declined to take a public stance against them. Members of some governments, though, have very clearly indicated that they are not interested in extending the sanctions in their current stringent form. Austrian Vice Chancellor Reinhold Mitterlehner is among the skeptics as is French Economics Minister Emmanuel Macron. So too are officials from Italy, Spain, Greece and Portugal.

Time for the death penalty?! Time to put our armies to good use?

• Elephants In Tanzania Reserve Could Be Wiped Out By 2022 (AFP)

Elephants in Tanzania’s sprawling Selous Game Reserve could be wiped out within six years if poaching continues at current levels, the World Wildlife Fund warned. Tanzania’s largest nature reserve was in the 1970s home to 110,000 elephants, but today only 15,000 remain and they are threatened by “industrial-scale poaching”. The Selous “could see its elephant population decimated by 2022 if urgent measures are not taken,” the WWF said. More than 30,000 African elephants are killed by poachers every year to supply an illegal trade controlled by criminal gangs that feeds demand in the Far East. Tanzania is among the worst-affected countries with a recent census saying the country’s elephant population fell by 60% in the five years to 2014.

The Selous reserve is a tourist draw contributing an estimated $6 million (5 million euros) a year to Tanzania’s economy, according to a study commissioned by WWF and carried out by advisory firm Dalberg. It is named after Frederick Selous, a British explorer, hunter and real-life inspiration for the H. Rider Haggard character Allan Quatermain in King Solomon’s Mines. “By early 2022 we could see the last of Selous’ elephants gunned down by heavily armed and well trained criminal networks,” the report said. The 55,000-square kilometre (21,000-square mile) reserve in southern Tanzania was named a World Heritage Site by UNESCO in 1982. But it was put on a watch list in 2014 as poaching spiked, with six elephants killed every day and industrial activities including oil and gas exploration, as well as mining, threatening the delicate environment.

The sadness just intensifies.

• Mediterranean Death Toll Soars In First 5 Months Of 2016 (UNHCR)

At least 880 people are believed to have drowned last week in a spate of shipwrecks and boat capsizings on the Mediterranean, the UN Refugee Agency said today. “For so many deaths to have occurred just in a matter of days and months is shocking and shows just how truly perilous these journeys are,” said UN High Commissioner for Refugees Filippo Grandi. UNHCR told a press briefing in Geneva that the latest figures were arrived at following new information received through interviews with survivors brought ashore in Italy.

“As well as three shipwrecks that were known to us as of Sunday, we have received information from people who landed in Augusta over the weekend that 47 people were missing after a raft carrying 125 people from Libya deflated,” UNHCR spokesperson William Spindler detailed. He added that eight others were reported separately to have been lost overboard from another boat, and four deaths were reported after fire on board another. “Thus far 2016 is proving to be particularly deadly. Some 2,510 lives have been lost so far compared to 1,855 in the same period in 2015 and 57 in the first five months of 2014,” Spindler added.

“Everything started after the EU agreement,” he said. “These people are no longer refugees to them [the authorities]. They are prisoners and are being detained. But they have left the humanitarian aspect out of the story.”

• Frontex Denies, Prevents Help To Refugees: Witnesses (MEE)

Frontex denied aid to refugees including a baby and kept them floating in the sea off Greece for nearly two hours, according to aid workers. Eyewitnesses told MEE that Frontex officers prevented aid workers helping 50 people as they landed on the northern shore of the Greek island of Lesbos early on Monday. Their tactic was to take them directly into detention “without any aid, even the injured,” one aid worker said. Witnesses also told MEE that officers from the Maltese branch of the European border control police prevented a doctor tending to a baby that was “unresponsive”. In a written statement to MEE, Frontex said the crew on the Maltese ship had followed a Hellenic Coast Guard officer’s instructions and that none of the volunteers identified themselves as a doctor.

The reports come as the UN says that more than 2,500 people have died trying to make the perilous journey across the Mediterranean to Europe so far in 2016, a sharp jump from the same period last year. In the past week alone, at least 880 people are believed to have died in a series of shipwrecks – but thousands of people have also been rescued in the last seven days, with some 90 rescue operations launched. Frontex, supported by a series of national fleets and coast guards as well as several NGOs and some private volunteers, is charged with carrying out rescue operations in the Mediterranean. However, witnesses told MEE that the boat crammed with refugees was made to float out at sea until Frontex ground units came to take the passengers away in buses, after the Greek coastguard granted permission for the landing at the fishing hamlet of Skala Skiaminias on Lesbos’s north coast.

Esther Camps, from Spanish NGO Proactiva, which provides aid and rescue operations at sea, was at the scene. She said the incident took place at around 01:00 on Monday morning – the arrivals, she said, included around 10 children, as well as women who were crying out for help. “We were told to do nothing and to ‘stay away’,” she told MEE. “As they [the refugees and migrants] were disembarking, we saw there was a baby that was not making any noise. One of the officers said the baby was ‘fine’ and kept us away. We said, ‘how do you know it is OK? You are not doctors.'” Camps, who has been working with Proactiva since December, said that babies normally cry when they are brought ashore, but that in this case the child was not making any noise. MEE understands that a doctor from the aid organisation Waha was also at the scene but was denied access.

Handout photo released as courtesy by German humanitarian NGO Sea-Watch shows a crew member holding a drowned baby as dead bodies were recovered after a wooden boat transporting migrants capsized off the Libyan coast on 27 May, 2016 (AFP)

Home › Forums › Debt Rattle June 1 2016