Lewis Wickes Hine Drift Mouth, Sand Lick Mine, near Grafton, West Virginia 1908

A planted rumor. “..if the number was correct, under German capital market rules Deutsche Bank would be required to confirm the amount by now..”

• Why You Should Be Skeptical Of That $5.4 Billion Deutsche Settlement (CNBC)

Shares of Deutsche Bank were leaping in New York trade Friday on a report that it was near a settlement with the U.S. Department of Justice, but there’s reason to be skeptical about the number being cited. Shares of Deutsche Bank have extended their gains, up about 14% in afternoon trading, after an AFP report that Germany’s biggest bank is close to a $5.4-billion dollar settlement with the Justice Department over mortgage bonds. […] But if the number was correct, under German capital market rules Deutsche Bank would be required to confirm the amount by now. Its failure to do so indicates the number is not correct.

Any eventual settlement, however, would almost certainly be well below the reported $14-billion opening bid by the Department of Justice in its talks with Deutsche. Deutsche Bank is not publicly commenting on the supposed $5.4-billion figure. The capital market rules say the bank would have to react almost immediately to a report on such a settlement. That’s why two weeks ago, after The Wall Street Journal reported on the initial $14-billion figure, Deutsche Bank quickly put out a release confirming the news. “The negotiations are only just beginning,” Deutsche Bank said at the time. “The bank expects that they will lead to an outcome similar to those of peer banks which have settled at materially lower amounts.”

Read more …

Far from over: “Once they come to some resolution on the difference between what they are charged, $14 billion, and what they are going to pay, call it $5 or $6 billion, the market is going to be afraid there is a problem..”

• A Deutsche Bank Settlement Rumor Overshadows US Equities (R.)

Deutsche Bank will likely cast a pall over equity markets next week as the largest German lender navigates a possible multi-billion dollar settlement with the U.S. Department of Justice over the sale of mortgage-backed bonds. Deutsche shares traded in the United States hit a record low on Thursday, falling as much as 24% since the DOJ asked the bank to pay $14 billion to settle charges related to its sale of toxic mortgage bonds before the financial crisis. But the stock had its best day in five years Friday, on record volume, after news agency AFP reported that Deutsche was nearing a much-lower $5.4 billion settlement with the DOJ. Analysts at Morgan Stanley estimated Deutsche could pay about $6 billion to settle with the DOJ. Stocks on Wall Street broadly tracked Deutsche over the past few days and will likely continue to do so, analysts say.

“While it is in the headlines, it is an overhang,” said Art Hogan at Wunderlich Securities in New York. “Once they come to some resolution on the difference between what they are charged, $14 billion, and what they are going to pay, call it $5 or $6 billion, the market is going to be afraid there is a problem,” Hogan said. Deutsche’s market capitalization of near $18 billion makes it much smaller than its U.S. peers like Bank of America, at $155 billion, or Citi, at $133 billion. However its trading relationships with the world’s largest financial institutions make a potential breakdown at Deutsche a bigger risk to the wider financial system than any other global bank, the International Monetary Fund said in June. “Its world print and eurocentric role are unrivaled, so it is going to drive the narrative next week,” said Peter Kenny at Global Markets Advisory Group in New York.

Read more …

Merkel’s room to move is shrinking.

• Deutsche Bank Takes a Lashing From the German Public (WSJ)

Deutsche Bank is getting rough treatment in the market. It is also having a hard time with its own public. The lender, founded in 1870, has turned from an object of patriotic pride into what critics on both sides of the political spectrum openly deride as a national embarrassment. Multibillion-dollar losses last year, investigations into misconduct around the world, concerns about its capital cushion and rich pay have made Deutsche Bank a handy target for left-leaning critics that accuse it of short-term thinking and greed. Many on the far right, meanwhile, regard Deutsche Bank as German in name only. Three out of its past four chief executives have been foreigners, including current CEO John Cryan, helping detractors tar it as the embodiment of out-of-control stateless capitalism.

The sentiment isn’t confined to political circles. A TNS Emnid poll for news magazine Focus conducted on Wednesday and released on Friday showed that 69% of respondents opposed any kind of state aid for Deutsche Bank, with only 24% in favor. “People feel it’s simply unacceptable that banks should be exempted from business risks,” said Frank Decker, politics professor at Rheinische Friedrich-Wilhelms-University in Bonn. [..] the lack of support at home, along with strict bailout rules Germany has backed for banks in the European Union, could limit the government’s room for maneuver should Deutsche Bank end up in a position that it does need help.

Despite the trauma of the financial crisis, large institutions such as Deutsche Bank haven’t learned any lessons, said Manfred Güllner, head of the Forsa polling group, making any bailout a tougher sell than in 2008. “While the returns on savings keep falling in a bottomless pit—and now into negative territory—the banks, as always, keep conducting their risky speculative businesses,” the populist Alternative for Germany party said in a Facebook post Thursday. “Whenever they get in trouble, the politicians are always there to help with taxpayers’ money.”

Read more …

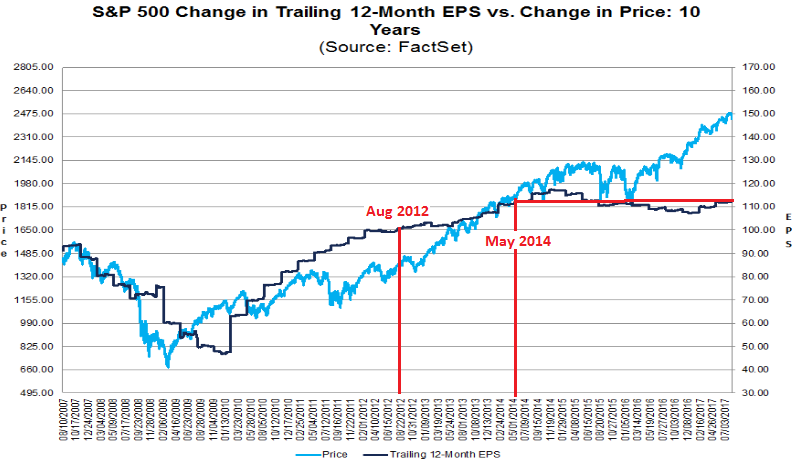

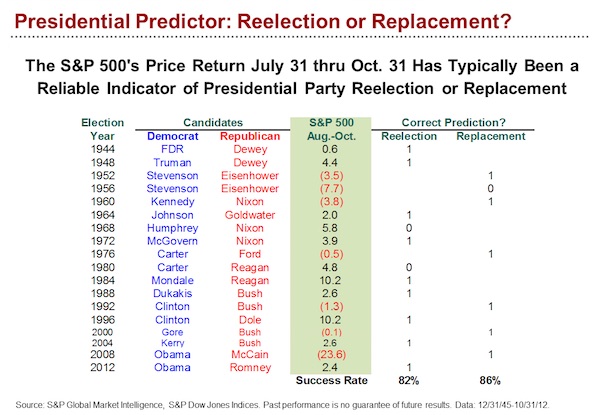

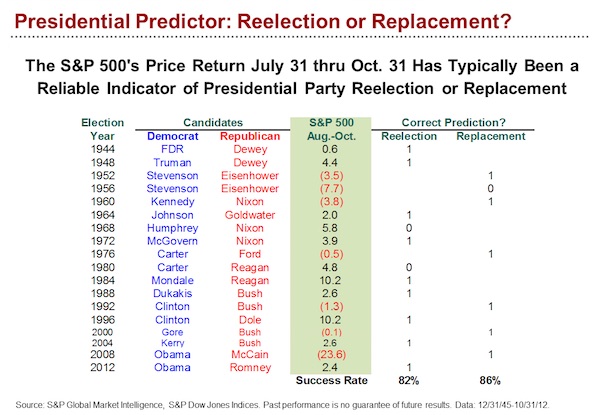

“When the stock market ends up for the three-month period, the Democrat wins. When it’s negative, the Republican wins.”

• Trump Will Win, Unless the S&P Rallies in October (BBG)

October is the bad boy of the stock market. The Panic of 1907, the Crash of 1929, Black Monday in 1987. It’s notable for another reason, too. The performance of Standard & Poor’s 500-stock index from July 31 to Oct. 31 has a curious way of predicting the winner of the presidential election. As with every prediction, take it with a giant grain of salt. But the pattern is solid, as shown in this chart by Sam Stovall, equity strategist for S&P Global Market Intelligence1. When the stock market ends up for the three-month period, the Democrat wins.

When it’s negative, the Republican wins. Since this July 31, the S&P is in slightly negative territory. Two times the pattern didn’t hold were in 1968 and 1980, when influential third-party candidates were in race, including George Wallace, who took about 14% of the popular vote in ’68. The pattern also failed in 1956, which Stovall says could be attributed to geopolitical events putting the markets on edge. That was the year of the Suez Crisis and the Hungarian Uprising, he noted.

Read more …

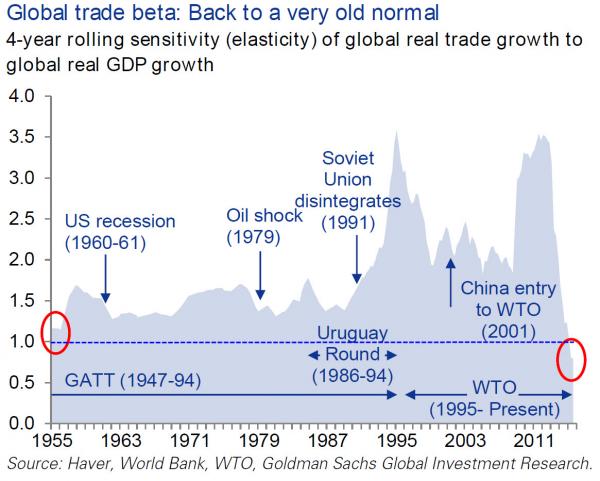

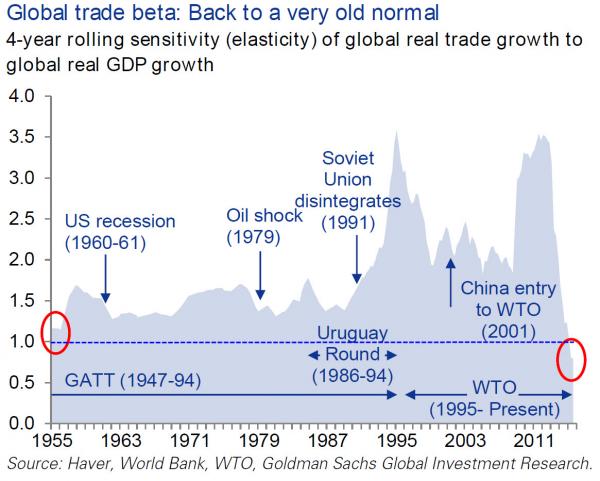

“What if the last 30 years of exuberant world trade growth was the ‘outlier’..”

• Global Trade Crashes Back To “Very Old Normal” (ZH)

“Get used to it” is the message from Goldman Sachs when it comes to the collapse in global trade… What if the last 30 years of exuberant world trade growth was the ‘outlier’ and we are now reverting to the pre-Greenspan normal? As Goldman’s Goohoon Kwon explains, a low trade beta may be normal:

“Finally, another explanation for the trade slowdown is that it simply represents a return to normal. Historical trade data show that the global trade beta was slightly higher than 1 in the early 1950s before rising gradually due to a series of extraordinary events. In the 1960s-1980s, it rose to around 1.5, boosted by multilateral efforts for trade reforms, which reduced average tariffs from 35% in 1947 to 6.4% at the start of the of the Uruguay Round (1986-94) of global trade negotiations. Thereafter, the breakup of the Soviet Union enabled global trade to expand rapidly in the 1990s, and the WTO entry of China in 2001 helped sustain the trade beta at around 2 in the 2000s. There is therefore an argument that a series of largely one-off factors drove the trade beta to unusually high levels.”

And as Goldman warns, there is limited upside to global trade from here…

“Given these structural forces, the outlook for global trade remains weak in our view, though it might rebound somewhat in the short term. Asian trade is likely to recover moderately in coming years, helped by the eventual dissipation of capacity overhangs in China and reductions in internal imbalances in the economy. And further trade liberalization, including in services, presents upside for global trade. However, the restructuring of overcapacity sectors seems to be proceeding slowly so far in Asia, as reflected in low and still-falling capacity utilization in China and Korea. Moreover, the current political backdrops in the major economies suggest that another major push for trade liberalization might be off the table, at least for now.”

Read more …

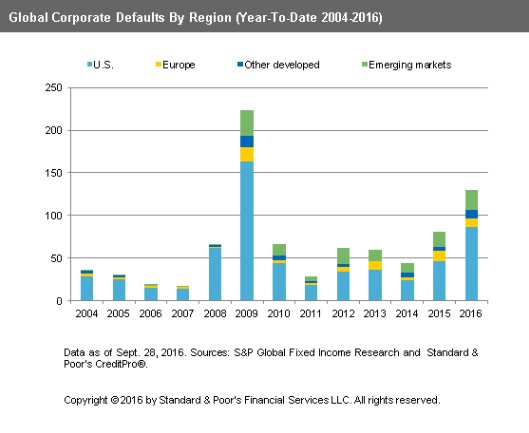

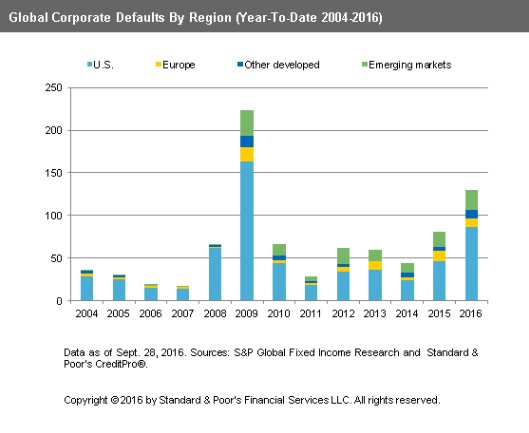

By far the worst year since 2009.

• Global Corporate Default Tally By Far Highest Since 2009 (Barron’s)

Three corporate defaults in the past week, two metals companies and one telecom firm, brought the total number of defaults around the world to 130. That’s a lot more than last year. Diane Vazza, head of S&P Global Fixed Income Research says: “The default tally is 60% higher than the count at this time in 2015 and has surpassed the total number of defaults recorded in full-year 2015, 113 defaults. The last time the global tally was higher at this point in the year was in 2009, when it reached 223 during the financial crisis.” Energy and commodity-related firms make up over half of the defaults; 70% are U.S. companies. Vazza notes: “As of Aug. 31, 2016, the global speculative-grade default rate for the energy and natural resources sector was 17.9%–more than seven times higher than the default rate of all other sectors.”

Read more …

Read more …

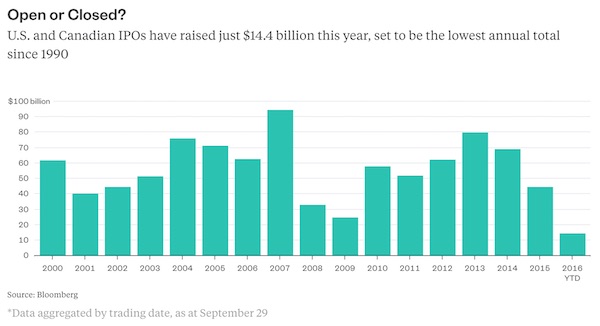

How to make a pretty awful number sound good.

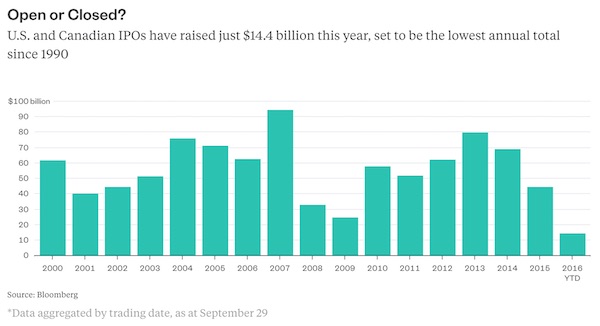

• US, Canadian IPOs Raise Lowest Annual Total Since 1990 (BBG)

It’s been a paltry year for initial public offerings. Fewer than 135 companies have made their debuts in U.S. and Canada, putting 2016 on pace to be the slowest for IPOs since 1990, according to data compiled by Bloomberg. With $14.4 billion raised so far, we’re also on track to witness the lowest annual total on that score since 1990. For the companies that have made it to market, the dearth of activity has helped underpin demand. That’s especially true in the case of tech IPOs, where (as my colleague Shira Ovide has written) the paucity of new issues has left investors scrambling for any new listing, driving valuations to potentially unsustainable levels.

Nutanix, a tech unicorn that priced Thursday evening, will likely continue the trend, with its shares poised for a surge when they begin trading Friday. But another crop of listings – backed by private equity – has also done well out of the chute this year, and may offer the potential for more lasting gains. On average, new issues of private-equity backed companies have rallied 34.5% this year through Thursday, topping the 28.2% average return for all U.S. and Canadian IPOs during the same period, according to data compiled by Bloomberg.

Read more …

David Stockman put it like this: “They shopped till they dropped.”

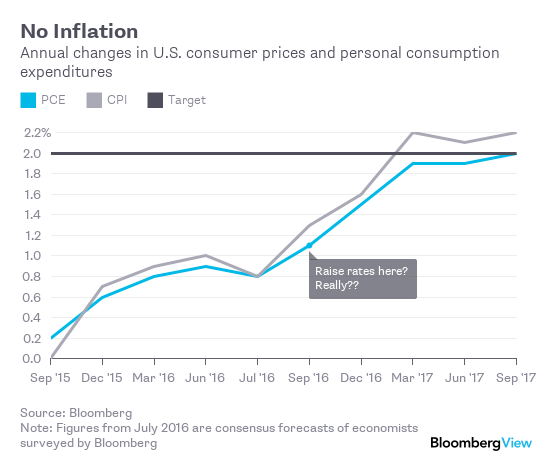

• US Consumer Spending Drops, Clouds Fed Rate Hike Outlook (R.)

U.S. consumer spending fell in August for the first time in seven months while inflation showed signs of accelerating, mixed signals that could keep the Federal Reserve cautious about raising interest rates. The Commerce Department said on Friday that consumer spending, which accounts for more than two-thirds of U.S. economic activity, fell 0.1% last month after accounting for inflation. Analysts polled by Reuters had expected a 0.1% gain. “Consumers took a breather in August,” said Chris Christopher of IHS Global Insight. Fed Chair Janet Yellen said last week she expected the U.S. central bank would raise rates once later this year to keep the economy from eventually overheating.

Prices for fed funds futures suggest investors see almost no chance of a hike at the Fed’s next policy meeting in early November and roughly even odds of an increase at its mid-December meeting, according to CME Group. The dollar was little changed against a basket of currencies while U.S. stock prices were trading higher. Consumer spending, which has been robust in recent months, partially offset the drag from weak business investment and falling inventories in the second quarter when the economy expanded at a lackluster 1.4% annual rate.

Read more …

A mixed blessing.

• China’s Yuan Joins Elite Club Of IMF Reserve Currencies (R.)

China’s yuan joins the IMF’s basket of reserve currencies on Saturday in a milestone for the government’s campaign for recognition as a global economic power. The yuan joins the U.S. dollar, the euro, the yen and British pound in the IMF’s special drawing rights (SDR) basket, which determines currencies that countries can receive as part of IMF loans. It marks the first time a new currency has been added since the euro was launched in 1999.The IMF is adding the yuan, also known as the renminbi, or “people’s money”, on the same day that the Communist Party celebrates the founding of the People’s Republic of China in 1949.

“The inclusion into the SDR is a milestone in the internationalization of the renminbi, and is an affirmation of the success of China’s economic development and results of the reform and opening up of the financial sector,” the People’s Bank of China said in a statement. China will use this opportunity to further deepen economic reforms and open up the sector to promote global growth, the central bank added. The IMF announced last year that it would add the yuan to the basket, so actual inclusion is not expected to impact financial markets. But it puts Beijing’s often opaque economic and foreign exchange policy in the international spotlight as some central banks add yuan assets to their official reserves.

Critics argue that the move is largely symbolic and the yuan does not fully meet IMF reserve currency criteria of being freely usable, or widely used to settle trade or widely traded in financial markets. U.S. Republican presidential nominee Donald Trump has said he will formally label China a currency manipulator if he wins November’s election. China stunned investors by devaluing the currency last year and the yuan has since weakened to near six-year lows, adding to worries about already feeble global growth. Some China watchers also fear that Beijing’s commitment to further market opening and financial sector reforms will fade after its diplomatic success, despite repeated reassurances from Beijing it will continue with the process.

Read more …

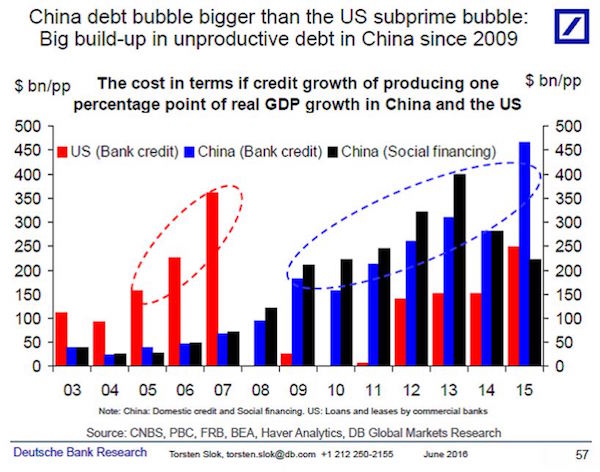

Now that China has entered the IMF basket, it’ll get much harder to keep this up: “It’s very clear that this sort of continued funding of industrial overcapacity sectors is unsustainable.”

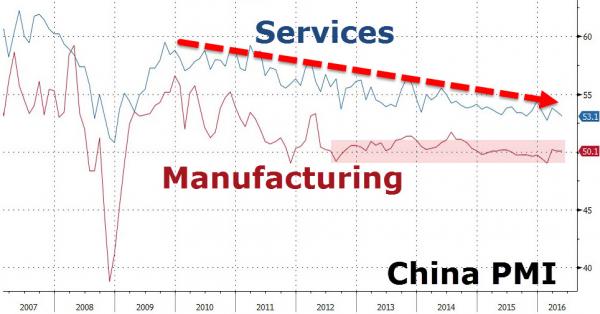

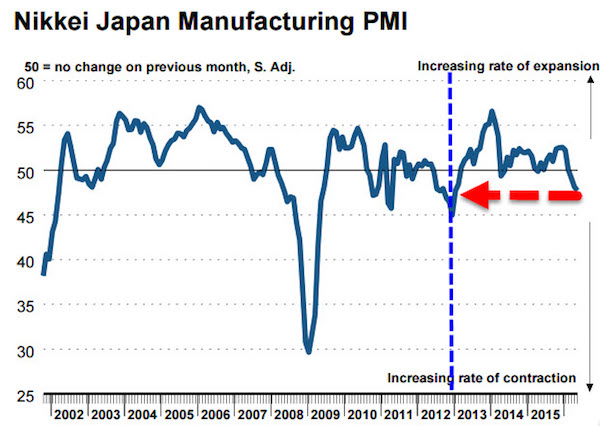

• State Spending Keeps China’s Industrial Sector Humming in September (WSJ)

Activity in China’s crucial industrial sector appeared to stabilize last month, with an official index on manufacturing holding steady, buoyed by state spending on infrastructure. China’s official manufacturing purchasing managers index was unchanged at 50.4 in September compared with August, the National Bureau of Statistics reported Saturday. The gauge has remained above 50, which separates expansion from contraction, for six out of the past seven months. The September reading matched a median forecast of 50.4 by 11 economists polled by The Wall Street Journal.

Subindexes gave mixed readings. One measured new orders weakening, while another for production showed improvement; both remained above 50. The official nonmanufacturing PMI edged up to 53.7 in September from 53.5 in August. Economists said stepped-up bank lending and spending on government projects is helping to steady an economy that got off to a wobbly start to the year and has been slowing overall in recent years. “You’re seeing a bit of a credit-fueled holding pattern,” said Angus Nicholson, an analyst with IG Markets. “The question is: when does that turn around and when are they going to cut credit? It’s very clear that this sort of continued funding of industrial overcapacity sectors is unsustainable.”

Read more …

Better question: do other cities have the guts to follow suit?

• Has Vancouver Found The Solution To A Super-Heated Housing Market? (G.)

There is a city which is suffering a worse property bubble than Sydney, whose residents are more priced-out than Londoners, and where there is a greater divide between the housing haves and have-nots than even San Francisco. That city is Vancouver, and in response to these mounting challenges, the west-coast Canadian metropolis recently imposed an extraordinary new tax on foreign buyers – whose impact is now being watched closely by other cities grappling with bloated property markets. On 2 August, Vancouver introduced a tax on anyone from outside Canada wanting to buy a home in its super-heated market. In future, city authorities said, if you weren’t Canadian, you would have to pay an extra 15% on the purchase price.

The impact has, by some measures, been more startling than campaigners could have hoped for. The price of the average detached home reportedly slumped by an astonishing 16.7% in August alone to C$1.47m (£856,000), according to the Real Estate Board of Greater Vancouver. Some agents are reporting that the market has gone from red hot to stone cold in a matter of weeks. British Columbia’s premier, Christy Clark, who introduced the tax, told reporters there will be no going back on it. “The prices were going up way too fast and if we helped slow that down, that’s good,” she said. In the year before the tax, prices in the city were galloping ahead at a rate of 39% a year amid widespread concern that investors, from China in particular, were pricing out local residents.

It is a concern echoed in cities across the Pacific Rim. In June, Sydney introduced a 4% stamp duty surcharge on foreigners buying homes; the following month, Melbourne hiked stamp duty rates from 3% to 7% for foreign buyers – in both cases to deter rampant property speculation. Queensland, whose capital is Brisbane, has followed suit with an extra 3% duty surcharge that will be slapped on “foreign persons” buying residential property and land from 1 October. In Auckland, New Zealand – currently the world’s frothiest property market – property investors are, as of last month, required to put down at least 40% of the purchase price in cash.

Read more …

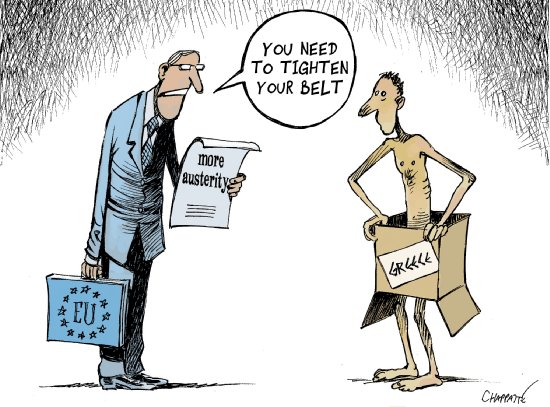

By ignoring Germany’s role in destroying the Greek and Italian economies, Weidmann ensures the downfall of the eurozone, and thereby of Germany itself.

• Bundesbank President Rejects Calls for German Stimulus (WSJ)

It’s absurd to ask Germany’s government to spend more to bolster eurozone growth, German Central Bank President Jens Weidmann said on Thursday, rejecting growing pressure on Berlin to loosen its purse strings. Speaking in the German capital, Mr. Weidmann said a fiscal stimulus program in Germany was unnecessary given the nation’s robust economy, and would have few positive effects for other countries anyway. Earlier this month, ECB President Mario Draghi joined the chorus of voices that have criticized Germany for reining in its spending at a time of weak economic growth. “Countries that have fiscal space should use it,” Mr. Draghi said at a news conference. “Germany has fiscal space.”

But Mr. Weidmann argued that Germany’s national debt was already high, and the country’s aging population “calls for lower rather than higher debts.” Mr. Draghi tempered his remarks on Wednesday after a meeting in Berlin with German lawmakers, who grilled him over the ECB’s easy-money policies and their impact on German savers and banks. “Germany does have fiscal space [but] we need to be nuanced,” Mr. Draghi said. “I never argued for irresponsible fiscal expansion.”

Read more …

It couldn’t be more obvious.

• The “Pardon Snowden” Case Just Got Stronger (Cato)

Yesterday, the Department of Justice Inspector General (DoJ IG) issued a long overdue Congressionally-mandated report on FBI compliance with the PATRIOT Act’s Section 215 “business records” provision between 2012 and 2014. It is the first such report issued that covers the initial period of Edward Snowden’s revelations about widespread domestic mass surveillance by the federal government. Since his indictment for leaking the information to the press, Snowden’s lawyers have argued that he should not be prosecuted under the WW I-era Espionage Act because his revelations served the public interest. The DoJ IG report provides the clearest evidence yet that Snowden’s lawyers are correct (p. 6):

“In June 2013, information about the NSA’s bulk telephony metadata program was publicly disclosed by Edward Snowden. These disclosures revealed, among other things, that the FISA Court had approved Section 215 orders authorizing the bulk collection of call detail records. The telephony metadata collected by the NSA included information from local and long-distance telephone calls, such as the originating and terminating telephone number and the date, time, and duration of each call. The disclosures prompted widespread public discussion about the bulk telephony metadata program and the proper scope of government surveillance, and ultimately led Congress to end bulk collection by the government in the USA Freedom Act.”

Public discussion of the controversy. Very public action by Congress to change the law, addressing at least one major abuse brought to light by Snowden. And there was more (p. 33):

“An [National Security Division] Deputy Unit Chief noted that the number of business records orders reached its peak in 2012 and has declined annually since then, and that the number of [Electronic Communication Transation] requests has declined more than other types of requests. The Deputy Unit Chief said that the Snowden revelations have played a role in this decline, both in terms of the stigma attached to use of Section 215 and increased resistance from providers. The Deputy Unit Chief stated, “I think that it’s possible that folks … have decided it’s not worth pursuing [business records orders], you know, obviously things haven’t been great with providers since Snowden either.” ”

Translation: Snowden’s actions forced companies like Verizon, Yahoo and others to grow a spine and start defending the Fourth Amendment rights of their customers. Earlier this month, a group of non-governmental organizations and individuals launched a campaign to get President Obama to pardon Snowden before he leaves office. We now have the department seeking Snowden’s prosecution offering unambigous evidence that his whistleblowing actions served the public interest. Obama should direct DoJ to drop the case or he should pardon Snowden. Either approach would be in the public interest, just as Snowden’s actions were.

Read more …

if there’s anyone left claiming to be surprised by Brexit, they must be blind.

• Record Numbers Left Homeless After Eviction By Private Landlords In UK (G.)

Record numbers of families are becoming homeless after being evicted by private landlords and finding themselves unable to afford a suitable alternative place to live, government figures show. The end of an assured shorthold tenancy (AST) was cited by nearly a third of the 15,170 households in England who were classed as homeless in the three months to June – a number that was up 10% on the same period last year. The problem was particularly acute in London, accounting for 41% of all homelessness acceptances in the capital during the period, according to figures from the Department for Communities and Local Government (DCLG). The end of an AST has rapidly become the single biggest cause of homelessness in recent years, triggered by spiralling rent rises and cuts to housing benefit support.

In 2010 just 11% of homeless acceptances in England were caused by the end of an AST. The government’s statistical release states: “Affordability [of housing] is an increasingly significant issue, as more households facing the end of a private tenancy are unable to find an alternative without assistance.” Bob Blackman, a Tory backbencher who has drawn up a private member’s bill seeking to require councils to do more to help households at risk of losing their homes, said: “It is a national disgrace when we have the highest number of people in employment ever, we have a low rate of unemployment, that we still have people sleeping rough. Goodness knows what will happen if there is a recession.”

Read more …

Not if and when the present political climate perseveres.

• Brexit Is A ‘Once-in-a-Generation’ Chance To Save UK’s WIldlife (Ind.)

Brexit will be a “once-in-a-generation chance” to reverse the huge decline in Britain’s wildlife, according to four of the UK’s leading environmental groups. The RSPB, WWF UK, National Trust and The Wildlife Trusts said the British countryside was “key to our identity as a nation” and farmers had the ability address the “urgent challenge of restoring nature”. They called on the Government to replace the much-criticised EU Common Agricultural Policy subsidy system with a British one that pays farmers to maintain “high environmental standards”. Earlier this month, the State of Nature 2016 report – produced by more than 50 organisations – concluded the UK was one of the “most nature-depleted countries in the world”. More than one in seven species face extinction and more than half are in decline.

However, in its response to the conservation groups’ call, the Government insisted the natural environment was “cleaner and healthier than at any time since the industrial revolution”. The National Farmers Union (NFU) said its members understood “the importance of protecting the environment” and complained that some organisations were making suggestions about agricultural policy “without speaking to those the policy most affects”. In a joint statement, called A new policy for our countryside, the four conservation groups said the UK’s departure from the EU “will be one of the most defining events for farming and our environment in living memory”. “[It] provides an unprecedented opportunity to revitalise our countryside in a way that balances the needs of everyone, for generations to come,” they said.

Read more …

We have created far too great a distance between ourselves and the world that gives us life.

• Bees Added To US Endangered Species List For The First Time (G.)

Seven types of bees once found in abundance in Hawaii have become the first bees to be added to the US federal list of endangered and threatened species. The listing decision, published on Friday in the Federal Register, classifies seven varieties of yellow-faced or masked bees as endangered, due to such factors as habitat loss, wildfires and the invasion of non-native plants and insects. The bees, so named for yellow-to-white facial markings, once crowded Hawaii and Maui but recent surveys found their populations have plunged in the same fashion as other types of wild bees – and some commercial ones – elsewhere in the United States, federal wildlife managers said.

Placing yellow-faced bees under federal safeguards comes just over a week since the US Fish and Wildlife Service proposed adding the imperilled rusty patched bumble bee, a prized but vanishing pollinator once found in the upper midwest and north-eastern United States, to the endangered and threatened species list. One of several wild bee species seen declining over the past two decades, the rusty patched bumble bee is the first in the continental United States formally proposed for protections. The listing of the Hawaii species followed years of study by the conservation group Xerces Society, state government officials and independent researchers. The Xerces Society said its goal was to protect nature’s pollinators and invertebrates, which play a vital role in the health of the overall ecosystem.

Read more …

Nice, but that’s just a few of them. I think we’re going to end up sending our armies, our children and grandchildren, to Africa and far beyond, to the oceans, to try and keep alive enough of what preceded us on this planet in order to guarantee our own species can survive. But I can’t say I have high hopes.

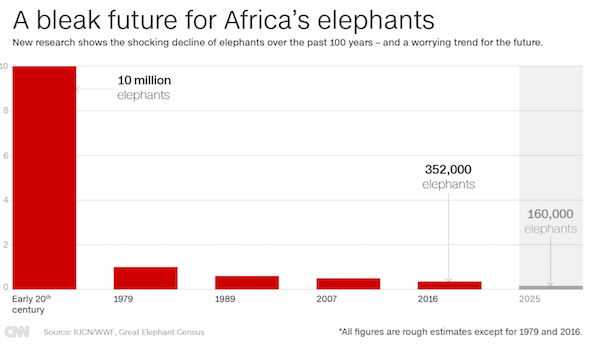

• Elephants Have Learned To Avoid Poachers By Hanging Out With Rangers (Konbini)

In an effort to protect diminishing elephant herds in the Democratic Republic of Congo’s Virunga National Park, a Kenyan conservation group fitted elephants with collars so they could monitor and track them in real time. Save the Elephants claim some of the herds they track have started changing their behavior to avoid dangerous areas, which the team believes is an adaptation to poaching. “Several elephant families [were seen] clustered around ranger posts, suggesting they had learned to distinguish the heavily armed rangers as harmless,” STE founder Iain Douglas-Hamilton said. In one rebel-afflicted area, elephants had even started hanging out at ranger checkpoints where huge trucks of charcoal and hardwood rumble through every few minutes.

“Yet somehow the elephants sensed that they were safe there and walked close to the voluble rangers.” Elephants that are able to distinguish rangers from poachers represent an incredible feat of animal ingenuity, but according to experts, it’s all quite understandable. According to My Green World, these mammals are similar to gorillas, in that they’re “smart, sensitive, loyal and aware.” But while this is great news for elephants (and bad news for outsmarted poachers), there’s still the matter of curbing the ongoing colossal hunting epidemic. Africa had 1.3 million elephants in the 1970s, but today there are only 500,000. So there is still quite a way to go before elephants can be taken off the endangered species list.

Read more …