Oil wells in Venice, California, bringing oil up from beach area 1952

Hitchens is a veteran. And western propaganda on Aleppo has gotten way out of hand.

• Amid The Bombs of Aleppo, All You Can Hear Are The Lies (Peter Hitchens)

[..] the old cliche ‘the first casualty of war is truth’ is absolutely right, and should be displayed in letters of fire over every TV and newspaper report of conflict, for ever. Almost nothing can be checked. You become totally reliant on the people you are with, and you identify with them. If you can find a working phone, you will feel justified in shouting whatever you have got into the mouthpiece – as simple and unqualified as possible. And your office will feel justified in putting it on the front page (if you are lucky). And that is when you are actually there, which is a sort of excuse for bending the rules.

In the past few days we have been bombarded with colourful reports of events in eastern Aleppo, written or transmitted by people in Beirut (180 miles away and in another country), or even London (2,105 miles away and in another world). There have, we are told, been massacres of women and children, people have been burned alive. The sources for these reports are so-called ‘activists’. Who are they? As far as I know, there was not one single staff reporter for any Western news organisation in eastern Aleppo last week. Not one. This is for the very good reason that they would have been kidnapped and probably murdered. The zone was ruled without mercy by heavily armed Osama Bin Laden sympathisers, who were bombarding the west of the city with powerful artillery (they frequently killed innocent civilians and struck hospitals, since you ask).

That is why you never see pictures of armed males in eastern Aleppo, just beautifully composed photographs of handsome young unarmed men lifting wounded children from the rubble, with the light just right. The women are all but invisible, segregated and shrouded in black, just as in the IS areas, as we saw when they let them out. For reasons that I find it increasingly hard to understand or excuse, much of the British media refer to these Al Qaeda types coyly as ‘rebels’ (David Cameron used to call them ‘moderates’). But if they were in any other place in the world, including Birmingham or Belmarsh, they would call them extremists, jihadis, terrorists and fanatics. One of them, Abu Sakkar, famously cut out and sank his teeth into the heart of a fallen enemy, while his comrades cheered. This is a checked and verified fact, by the way.

Sakkar later confirmed it to the BBC, when Western journalists still had contact with these people, and there is film of it if you care to watch. There is also film of a Syrian ‘rebel’ group, Nour al-din al Zenki, beheading a 12-year-old boy called Abdullah Issa. They smirk a lot. It is on the behalf of these ‘moderates’ that MPs staged a wholly one-sided debate last week, and on their behalf that so many people have been emoting equally one-sidedly over alleged massacres and supposed war crimes by Syrian and Russian troops – for which I have yet to see a single piece of independent, checkable evidence.

A real American Christmas comedy.

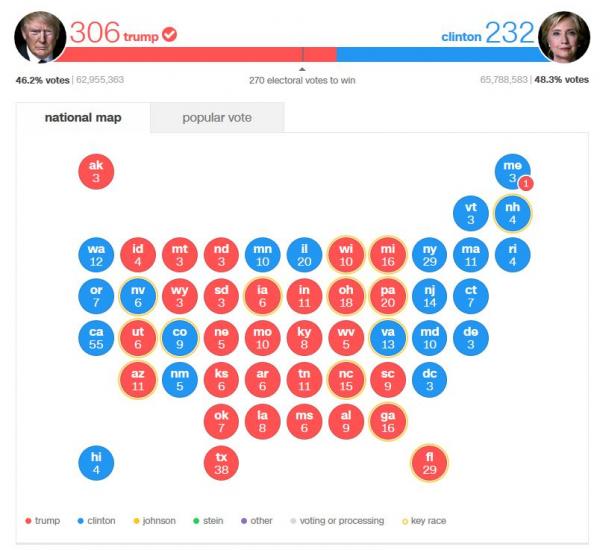

• Coup Or No Coup: The Electoral College Votes On Monday (ZH)

With even Harvard’s Larry Lessig admitting that his efforts to flip the Electoral College against Trump have failed miserably, it’s a near certainty that Trump will, in fact, be elected President when the Electoral College casts their votes tomorrow. That said, there could always be surprises and, as such, The Hill has published a list of five things you should keep an eye on as electors get set to cast their ballots. First, here is how the 538 electors should cast their ballots if they all strictly follow the will of the voters in their respective states.

That said, we know that at least one Texas elector, Chris Suprun, has vowed to go rogue tomorrow and anxious eyes will be waiting to see if anyone decides to join him. As The Hill points out, there hasn’t been an election since 1836 in which more than 1 elector changed his vote, so even 2 defectors would make history.

There’s no evidence of a widespread number of Republican defections—just one Republican elector from Texas has gone public with plans to break from Trump. But there hasn’t been an election in which more than one elector jumped ship for reasons other than the death of a candidate since 1836, according to the nonprofit FairVote. So a defection by even one more Republican elector would make history.

The next thing to watch is whether any Democrat electors will cast protest votes. A small group of Democratic electors had vowed to join Larry Lessig’s coup attempt by throwing their support behind an alternative Republican candidate. While this now seems like a remote possibility, it is something to watch for.

Democratic electors are the ones beating the drums for the revolt, yet they’re largely powerless to change the outcome. A handful of electors are already planning on uniting around a Republican alternative as a protest, but it’s still unclear how many are willing to join the protest. In theory, a unified front of the 232 Democrats could join with 38 Republicans to elect an alternative president. But in practice, the anti-Trump electors will be lucky if more than a dozen Democrats break.

With 29 states and the District of Columbia binding their electors by law, it will also be interesting to see if anyone in those states choose to defect, and if so, what penalties will be levied upon them.

Lots of info from Parry, but basically just confirms what we already knew.

• A Spy Coup in America? (Robert Parry)

As Official Washington’s latest “group think” solidifies into certainty – that Russia used hacked Democratic emails to help elect Donald Trump – something entirely different may be afoot: a months-long effort by elements of the U.S. intelligence community to determine who becomes the next president. I was told by a well-placed intelligence source some months ago that senior leaders of the Obama administration’s intelligence agencies – from the CIA to the FBI – were deeply concerned about either Hillary Clinton or Donald Trump ascending to the presidency. And, it’s true that intelligence officials often come to see themselves as the stewards of America’s fundamental interests, sometimes needing to protect the country from dangerous passions of the public or from inept or corrupt political leaders.

It was, after all, a senior FBI official, Mark Felt, who – as “Deep Throat” – guided The Washington Post’s Bob Woodward and Carl Bernstein in their Watergate investigation into the criminality of President Richard Nixon. And, I was told by former U.S. intelligence officers that they wanted to block President Jimmy Carter’s reelection in 1980 because they viewed him as ineffectual and thus not protecting American global interests. It’s also true that intelligence community sources frequently plant stories in major mainstream publications that serve propaganda or political goals, including stories that can be misleading or entirely false. So, what to make of what we have seen over the past several months when there have been a series of leaks and investigations that have damaged both Clinton and Trump — with some major disclosures coming, overtly and covertly, from the U.S. intelligence community led by CIA Director John Brennan and FBI Director James Comey?

The WSJ headline is: “Donald Trump’s Team Tones Down Skepticism on Russia Hacking Evidence”. But all he does is say: “show us the proof, show me and the American people.” So let’s have it.

• Trump Wants To Hear Hacking Evidence Direct From FBI (WSJ)

Fresh signs emerged Sunday that President-elect Donald Trump could embrace the intelligence community’s view that the Russians were behind a computer-hacking operation aimed at influencing the November election. A senior Trump aide said Mr. Trump could accept Russia’s involvement if there is a unified presentation of evidence from the Federal Bureau of Investigation and other agencies. This followed weeks of skepticism from the president-elect and his supporters that there is sufficient evidence that Russia was responsible for cyberattacks against the Democratic National Committee or leak of stolen emails.

Speaking on Fox News Sunday, Mr. Trump’s incoming chief of staff, Reince Priebus, said the president-elect “would accept the conclusion if these intelligence professionals would get together, put out a report, show the American people that they are actually on the same page.” His statement follows an intensifying bipartisan push on Capitol Hill to launch a separate investigation into the matter. Mr. Trump has called for opening up new lines of cooperation with Russia, and some of his critics in both parties have said his refusal so far to say Russia tried to interfere in the election was a sign that he doesn’t believe that Moscow is a U.S. adversary.

That’s quite the shift.

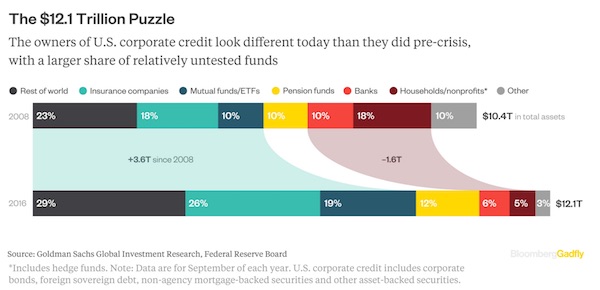

• The $12 Trillion Credit Risk Juggle (BBG)

After the financial crisis, regulators were worried about too much risk being concentrated in too few hands.They are still concerned, but the hands have changed. The U.S. Treasury’s Office of Financial Research is devoted to worrying about everything and anything that could spur another financial crisis, and near the top of the list is the post-crisis explosion in corporate credit. This pile of debt is “a top threat to stability,” according to this Treasury unit’s latest report, as Bloomberg’s Claire Boston wrote on Tuesday. In particular, these researchers are wary of the changing composition of who owns these bonds. Big banks and hedge funds own a much smaller proportion, while insurers and mutual funds own much more of it.

click

More specifically, banks and household and nonprofits, a category that includes hedge funds, have reduced their holdings of U.S. corporate credit by $1.6 trillion since 2008, while insurers, mutual funds and the rest of the world have increased it by $3.6 trillion, according to data compiled by Goldman Sachs that includes foreign sovereign debt and asset-backed securities. This is a salient matter. The Federal Reserve just raised rates for a second time in two years and predicts three rate increases next year, possibly marking the end of this era of financial repression that’s spurred a record pace of corporate-debt sales.

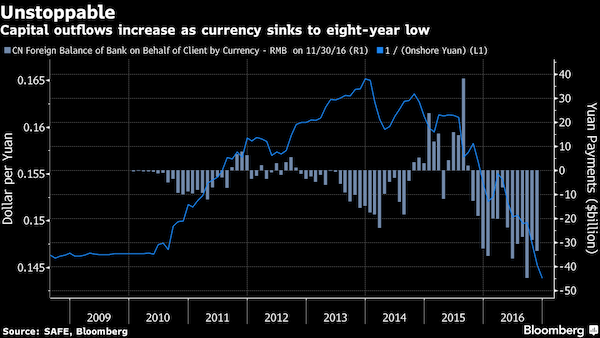

With Goldman predicting the biggest fall for the yuan in 20 years, Beijing is in a bind.

• Gone in 60 Seconds: Chinese Snap Up Dollars as Yuan Tanks (BBG)

Chinese savers, eager to convert their yuan before the currency keeps depreciating, are snapping up U.S. dollar investment products that offer options for keeping money at home instead of sending it overseas. The latest wealth management products from China Merchants Bank last week, paying 2.37% annual interest on U.S. dollars, sold out in 60 seconds flat. “You won’t be able to get it online because it’s gone in less than a minute,” said a branch manager, who would only give the surname Xu, and encourages customers to book a day in advance next time. A growing number of offerings of such U.S. dollar funds and how quickly they’re being purchased show the surging demand for foreign currency amid outflows that are estimated to have totaled more than $1.5 trillion since the beginning of 2015.

By shifting into dollars – U.S., Australian and Hong Kong are among the favorites – deposit holders are shielded from the yuan’s losses without having to take their money out of the country to seek returns. “It seems an attractive choice to convert the yuan into the dollar sooner rather than later,” Harrison Hu at NatWest Markets, a unit of RBS, wrote in a note. He estimates that household purchases of foreign exchange could double to $15 billion a month in the coming quarter, absent new controls. A more hawkish than expected outlook from the U.S. Federal Reserve after it lifted interest rates last week has helped accelerate a dollar rally, with analysts predicting further gains. As the yuan has declined, China’s authorities have tried to vigorously enforce strict rules on moving cash over the border, where it is often invested in purchases such as real estate.

In recent weeks, policy makers in Beijing have put the brakes on everything from companies buying assets overseas to offshore purchases of life insurance to stem the tide of cash outflows. The fresh measures include checks by the currency regulator on any capital account transactions involving foreign exchange of $5 million or more. That followed steps earlier this year to ban the sharing of foreign-exchange quotas. In November, banks sold 49% more foreign-currency denominated wealth management products, most of them in U.S. dollars, than in October, according to PY Standard. November’s foreign currency deposits increased 11.4% from a year earlier, more than double the 4.8% rise in October, according to the People’s Bank of China.

If you’re really a market economy, what do you do?

• As Yuan Weakens, Chinese Rush To Open Foreign Currency Accounts (R.)

Zhang Yuting lives and works in Shanghai, has only visited the United States once, and rarely needs to use foreign currency. But that hasn’t stopped the 29-year-old accountant from putting a slice of her bank savings into the greenback. She is not alone. In the first 11 months of 2016, official figures show that foreign currency bank deposits owned by Chinese households rose by almost 32%, propelled by the yuan’s recent fall to eight-year lows against the dollar. The rapid rise – almost four times the growth rate for total deposits in the yuan and other currencies as recorded in central bank data – comes at a time when the yuan is under intense pressure from capital outflows. The outflows are partially a result of concerns that the yuan is going to weaken further as U.S. interest rates rise, and because of lingering concerns about the health of the Chinese economy.

U.S. President-elect Donald Trump’s threats to declare China a currency manipulator and to impose punitive tariffs on Chinese imports into the U.S., as well as tensions over Taiwan and the South China Sea, have only added to the fears. “Expectations of capital flight are clear,” said Zhang, who used her yuan savings to buy $10,000 this year. “I might exchange more yuan early next year, as long as I’ve got money.” Household foreign currency deposits in China are not huge compared to the money that companies, banks and wealthy individuals have been directing into foreign currency accounts and other assets offshore. All up, households had $118.72 billion of foreign money in their bank accounts at the end of November, while total foreign currency deposits were $702.56 billion. But the high growth rate in the household forex holdings are symbolic of a growing headache for the government as it struggles to counter the yuan’s weakness

Liquidity is one of the things central banks do not control. Not in the way China sees control.

• China Central Bank Presses Banks To Help After Interbank Lending Freezes (R.)

China’s central bank stepped in to urge major commercial banks to lend to non-bank financial institutions on Thursday afternoon after many suspended interbank operations amid tight liquidity conditions, Caixin reported. The People’s Bank of China intervened to help institutions such as securities firms and fund managers after banks, including the big four state-owned banks, became reluctant to make loans, the financial magazine said, citing traders and institutional sources. Caixin said that traders pointed to worsening sentiment among banks about market conditions and growing caution over interbank lending, especially after the U.S. Fed triggered a sell-off in the bond futures market on Thursday by signaling more rate hikes in 2017. Liquidity has become a major factor affecting the market after the central bank increased the cost of capital through open market operations in the past month, the magazine added.

Don’t believe a word of it.

• China To Strictly Limit Property Speculation In 2017 (R.)

China will strictly limit credit flowing into speculative buying in the property market in 2017, top leaders said at an economic conference on Friday, as reported by the official Xinhua news agency. “Houses are for people to live in, not for people to speculate,” Xinhua said, citing a statement issued by the leaders after the Central Economic Work Conference concluded. “We must control credits in the macro sense,” they said in the statement. China will also boost the supply of land for cities where housing prices face stiff upward pressure, they said. China must quickly establish a long-term mechanism to restrain property bubbles and prevent price volatility in 2017, Xinhua said. Top leaders began the conference on Wednesday to map out economic and reform plans. The annual event is keenly watched by investors for clues to policy priorities and economic targets in the year ahead.

That’s what the country always used to be good at after all.

• Italy Banking Crisis is Also a Huge Crime Scene (DQ)

The Bank of Italy’s Target 2 liabilities towards other Eurozone central banks — one of the most important indicators of banking stress — has risen by €129 billion in the last 12 months through November to €358.6 billion. That’s well above the €289 billion peak reached in August 2012 at the height of Europe’s sovereign debt crisis. Foreign and local investors are dumping Italian government bonds and withdrawing their funding to Italian banks. The bank at the heart of Italy’s financial crisis, Monte dei Paschi di Siena (MPS), has bled €6 billion of “commercial direct deposits” between September 30 and December 13, €2 billion of which since December 4, the date of Italy’s constitutional referendum.

Italy’s new Prime Minister Paolo Gentiloni, who took over from Matteo Renzi after his defeat in the referendum,said his government — a virtual carbon copy of the last one — is prepared to do whatever it takes to stop MPS from collapsing and thereby engulfing other European banks. His options would include directly supporting Italy’s ailing banks, in contravention of the EU’s bail-in rules passed into law at the beginning of this year. Though now, that push comes to shove, the EU seems happy to look the other way. While attention is focused on the rescue of MPS, news regarding another Italian bank, Banca Etruria, has quietly slipped by the wayside. On Friday it was announced that the first part of an investigation concerning fraudulent bankruptcy charges, in which 21 board members are implicated, had been closed.

This strand of the investigation concerns €180 million of loans offered by the bank which were never paid back, leading to the regional lender’s bankruptcy and eventual bail-in/out last November that left bondholders holding virtually worthless bonds. The Banca Etruria scandal is a reminder — and certainly not a welcome one right now for Italian authorities — that a large part of the €360 billion of toxic loans putrefying on the balance sheets of Italy’s banks should never have been created at all and were a result of the widespread culture of corruption, political kickbacks, and other forms of fraud and abuse infecting Italy’s banking sector. Etruria is also under investigation for fraudulently selling high-risk bonds to retail investors — a common practice among banks in Italy (and Spain) during the liquidity-starved years of Europe’s sovereign debt crisis.

Put simply, “misselling” subordinated debt to unsuspecting depositors was “the way they recapitalized the banking system,” as Jim Millstein, the U.S. Treasury official who led the restructuring of U.S. banks after the financial crisis, told Bloomberg earlier this year.

Yeah, it’s unfair!!

• Ireland Appeals EU Order To Collect €13 Billion In Back Taxes From Apple (AP)

Ireland will appeal the European Union’s order to force it to collect a record €13bn in taxes from Apple, the Irish government has said. The Irish finance department’s announcement on Monday comes nearly four months after EU competition authorities hit Apple with the back-tax bill based on its longtime reporting of European-wide profits through Ireland. The country charges the American company only for sales on its own territory at Europe-low rates that in turn have been greatly reduced by the controversial use of shell companies at home and abroad. In its formal legal submission, the Dublin says its low taxes are the whole point of its sales pitch to foreign investors — and said it is perfectly legal to levy far less tax on profits than imposed by competitors.

It accuses EU competition authorities of unfairness, exceeding their competence and authority, and seeking to breach Ireland’s sovereignty in national tax affairs. The ruling unveiled 30 August by the European competition commissioner Margrethe Vestager called on Apple to pay Ireland the €13bn for gross underpayment of tax on profits across the bloc from 2003 to 2014. Her report concluded that Apple used two shell companies incorporated in Ireland to permit Apple to report its Europe-wide profits at effective rates well under 1%. The scope of the order could have been even greater because EU time limits meant the judgment could include potential tax infringements dating only from 2003, not all the way back to Apple’s original 1991 tax deal with Ireland. But Irish specialists in corporate tax estimate that the EU’s order, if enforced, actually would total €19bn because of compounding interest from delayed payment.

Everybody appeals.

• Apple To Appeal EU Tax Ruling, Says It Was A ‘Convenient Target’ (R.)

Apple will launch a legal challenge this week to a record $14 billion EU tax demand, arguing that EU regulators ignored tax experts and corporate law and deliberately picked a method to maximize the penalty, senior executives said. Apple’s combative stand underlines its anger with the European Commission, which said on Aug. 30 the company’s Irish tax deal was illegal state aid and ordered it to repay up to €13 billion to Ireland, where Apple has its European headquarters. European Competition Commissioner Margrethe Vestager, a former Danish economy minister, said Apple’s Irish tax bill implied a tax rate of 0.005% in 2014. Apple intends to lodge an appeal against the Commission’s ruling at Europe’s second highest court this week, its General Counsel Bruce Sewell and CFO Luca Maestri told Reuters.

The iPhone and iPad maker was singled out because of its success, Sewell said. “Apple is not an outlier in any sense that matters to the law. Apple is a convenient target because it generates lots of headlines. It allows the commissioner to become Dane of the year for 2016,” he said, referring to the title accorded by Danish newspaper Berlingske last month. Apple will tell judges the Commission was not diligent in its investigation because it disregarded tax experts brought in by Irish authorities. “Now the Irish have put in an expert opinion from an incredibly well-respected Irish tax lawyer. The Commission not only didn’t attack that – didn’t argue with it, as far as we know – they probably didn’t even read it. Because there is no reference (in the EU decision) whatsoever,” Sewell said.

A police state that bans gold and creates a huge underground market in it.

• India Has Less And Less Reason To Exist In Its Current Form (Bhandari)

Assaults on people’s private property and the integrity of their homes through tax-raids continue. In a recent notification, government has made it clear that any ownership of jewelry above 500 grams of gold per married woman will be put under the microscopic scrutiny of tax authorities. Steep taxes and penalties will be imposed on those who cannot prove the source of their gold. In India’s Orwellian new-speak this means that because bullion has not been explicitly mentioned, its ownership will be deemed to be illegal. Courts will do what Modi wants. Huge bribes will have to be paid. Sane people are of course cleaning up their bank lockers. The secondary consequence of this will be a steep increase in unreported crimes, for people will be afraid of going to the police after a theft, fearing that the tax authorities will then ask questions.

At the same time, the gold market has mostly gone underground, and apparently the volume of gold buying has gone up. The salaried middle class is the consumption class, often heavily indebted. Poor people have limited amounts of gold. The government is merely doing what pleases the majority and their sense of envy, to the detriment of small businesses and savers. Now, the middle class is starting to face problems as well. This will worsen once the the impact of the destruction of small businesses becomes obvious. India has always had a negative-yielding economy. It has suddenly become even more negative-yielding. Business risk has gone through the roof. Savers will be victimized. It is because of negative yields that Indian savers buy gold. They will buy more going forward.

Sane Indians should stay a step ahead of their rapacious government and the evolving totalitarian society, which are less and less inhibited by any institutions or values in support of liberty. India will become a police state, likely with the full support of most Indians. Nationalism will be the thread that weaves them together. But it is a fake thread, devoid of any value. Eventually, there will be far too many stresses in the system, whose institutions are already in an advance stage of decay. India as it exists today is a British creation. With the British now gone for 69 years, it is an entity has less and less reason to exist in its current form.

Yeah, let’s all get crazy when Brussels says so.

• Greek Migration Minister Eyes ‘Closed’ Facilities On Islands (Kath.)

Despite widespread opposition in the ranks of SYRIZA to such a prospect, Migration Minister Yiannis Mouzalas has called for the creation of “closed” reception centers for migrants on Aegean islands, saying they will help minimize tensions amid local communities. A key reason for building tensions at existing centers on the islands is the slow pace at which migrants’ asylum applications are being processed. German Chancellor Angela Merkel made a pointed reference to the slow pace of migrant returns from Greece to Turkey last week. However, official figures show that an agreement signed in March between the European Union and Ankara significantly curbed arrivals in Greece. Of the 172,699 migrants that arrived in Greece from Turkey this year, only 20,457 have landed on the islands since the beginning of April, when the EU-Turkey deal went into effect.

Asylum officials on the Aegean islands have received a total of 21,314 applications, while 2,110 have appealed against initial rejections. The government hopes to create new facilities to accommodate migrants who have displayed delinquent behavior in a bid to curb the outbreak of rioting at larger centers and to stop thefts and other petty crimes that have been testing tolerance in local communities. “We propose small facilities for 150-200 people,” Mouzalas told Kathimerini, adding that authorities were not seeking the tolerance but the “solidarity” of islanders to help “normalize the situation.” As for the prospect of transferring some migrants from island centers to facilities on the mainland, Athens has asked EU officials about it but has failed to receive a response amid fears that such a move would constitute a violation of the EU-Turkey pact, Mouzalas said.

There’s far more than seven, but hey, it’s John Vidal. Who spent half his life doing this.

• The Seven Deadly Things We’re Doing To Trash The Planet (John Vidal)

A baby ibex on a precipitous cliff edge. The hyenas of Harar eating from a human hand. Leopards in Mumbai, whales breaching and baby turtles heading blindly away from the sea. We are amazed by images of wildlife seen in ever more beautifully filmed natural history documentaries. They raise awareness, entertain, inform and amuse. We weep when we hear there are fewer birds in the sky, or that thousands of species are critically endangered. But there are some metaphorical megafauna that the BBC and we in the media really do not want everyone to see. After half a lifetime writing for the Guardian about the decline of the natural world, I have to report that there is a herd of enormous elephants in the forest that are trashing the place. We avert our eyes and pretend they are not there. We hope they will go away, but they appear to be breeding. But it is now clear that they are doing so much damage that unless confronted, there is little chance that the rest of the animals, including us, will survive very long.

Hyper-consumerism is the dominant matriarch of this destructive herd and the dysfunctional economic model that supports it, generating waste and ecological damage on a massive scale. The average US supermarket offers nearly 50,000 products; in the UK we throw away millions of tonnes of food a year; mobile phones have an average lifespan of just over a year; computers and cars just a few years more. The free market economy that has been built around it celebrates speed, obsolescence and quantity over longevity and efficiency. But we know that hyper-consumerism leads directly to deforestation, over-extraction of minerals, the waste of natural resources and pollution. We simply have too much stuff that no one possibly needs. To avoid ecological disaster, it must be culled.

Home › Forums › Debt Rattle December 19 2016