Robert Doisneau Le Baiser Blotto, Paris 1953

Wonderful: “..if your goal is to understand real economies replete with real humans, modern economics is a waste of time.”

• Human Beings Are Not Efficiency Seeking Machines (Radford)

I don’t understand why people get upset when I say that economics is a waste of time. I suppose it’s because I don’t make a clear enough difference between economics as a general topic and economics as a formal, mainstream, body of knowledge. It’s the latter that is a waste of time. The former is wonderfully interesting. At its heart economics is a study of human behavior, where that behavior is specific to certain activities. It is thus deeply rooted in psychology, so it is more closely associated with biology than physics. This is not a new idea: some of the greatest economists of the past have argued as much. Trying to transfer in ideas from physics, even metaphorically, therefore tends to lead to dead ends.

Like the notion of efficiency. That’s something of great interest to engineers, but has little to do with economics. You can have an efficient physical system. You cannot have an efficient social system. There’s just too much we don’t know and can never know. Still economists all over the world are obsessed with efficiency. So what do they do? They start to abstract and simplify. They model and fine tune. They test and re-test. And still their ideas run afoul of reality: human beings are not efficiency seeking machines, and so any system filled with humans is likely to be darned near impossible to steer towards efficient outcomes. Nothing daunted economists press on. If humans are unlikely to be efficient the logical next step is to construct a theory to exclude actual humans.

That’s what’s happened in economics: the faulty decision to root economics in a physics-like setting rather than in a biology like-setting forced subsequent generations of economists to “refine” their thinking and, eventually, to force real people out of their theoretical world. Voila! Modern economics ends up as a wonderful edifice with extravagant claims as to its ability to understand human behavior precisely by eliminating all contact with humanity. Weird. Ergo, if your goal is to understand real economies replete with real humans, modern economics is a waste of time.

Go study something else. You can learn a great deal about real economies by reading psychology literature. Behavioral economics — which despite all the press it gets has had only a marginal impact on the mainstream and on textbook economics — is an attempt to do that. The behavioral economics project is in its infancy. Go get involved. By the way: anything that refers to strategic behavior is also useful. Real humans are constantly trying to outwit each other. That’s when they’re not cooperating, which is another human characteristic economics determinedly overlooks. Humans are complicated. Too complicated for an economics built on an exclusive belief in relentless rationality.

“This rosy scenario, which is the current ten-year baseline, assumes 30% more nominal GDP and wage growth per year than we’ve actually had in the past ten years.”

• Stockman: Trump’s Tax Plan Never Had a Chance (DR)

David Stockman joined Fox Business and Maria Bartiromo on Mornings with Maria to discuss President Trump’s tax plan efforts and what he viewed as a massive calamity unfolding in Washington. The Fox Business host began the conversation by asking what he thought on the Trump tax plan proposal. Stockman pressed, “I think it is a one page, $7.5 trillion wish list that has no chance of being enacted and is pretty irresponsible this late in the game.” The host then fired back by asking how the former Reagan budget director placed a price tag on the plan without a score from the Congressional Budget Office. The author fired back, “The corporate is at 15%, the pass through rate on all unincorporated business is at 15% and that will cost roughly $4 trillion. Doubling the standard deduction will cost over $1 trillion. Getting rid of the alternative minimum will cost nearly $1 trillion.”

Then when referencing the Committee for a Responsible Federal Budget (which Stockman is a Board Member of) the author highlighted, “The gross cost is $7.5 trillion and that perhaps the government could earn back $2 trillion through loophole closing and base broadening. My argument is, after ruling out charitable contributions, home mortgages and a Congress that says they won’t touch a health care exclusion… when you go through the math there is no $2 trillion that this Congress and Republican party will even remotely be able to put together.” When asked about the assumption from Treasury Secretary Mnuchin and Senior Economic Advisor Cohn that new economic growth would pay for the budget Stockman pressed on the facts as he saw them:

“Growth always helps, but what they’re failing to realize, and what I learned in the 1980’s is that there is more growth built into the baseline forecast from the CBO than you’re ever going to achieve in the real world.” “This rosy scenario, which is the current ten-year baseline, assumes 30% more nominal GDP and wage growth per year than we’ve actually had in the past ten years.” When asked about the conditions in Congress and how else the government could raise revenue he directed, “We have to look at the numbers. There’s $10 trillion of new deficits built in over the next ten years, within the current policy, with rosy scenario economics. If you are going to try to push $2-$6 billion in tax cuts on top of that with $1 trillion of defense increases, $1 trillion for infrastructure in addition to Veteran spending and more – we’re headed for a fiscal calamity.

Christopher Balding and crazy numbers.

• Is China Really Deleveraging? (Balding)

There’s growing evidence that China is finally scaling back its epic borrowing binge. That’s important for a lot of reasons, not least for reducing risk and avoiding a financial crisis. The question is whether the government can sustain the pain. Regulators in Beijing are well aware of the risks that excessive leverage poses, and have tried many times over the years to crack down. Yet they routinely fail to rein in local government officials who get promoted by boosting economic growth, regardless of what systemic risks they may be incurring by binging on debt. To adapt a Chinese proverb: Growth is high and the banking regulator is far away. Evidence is mounting that this time is different. Lending to banks from the People’s Bank of China, which surged by 243% from December 2015 to January 2017, has declined by 12% in the past two months.

Loans to non-financial corporations are up a relatively moderate 7.3% from March 2016, which is a slower rate than nominal growth in gross domestic product. Although this clampdown followed an enormous surge of credit in the first half of last year, it does suggest real progress. Another good sign is that the government is starting to rein in shadow banking. Issuance of risky wealth-management products declined by 18% in April from March, as banks and insurance companies have been pressured to rely on them less. Because the sector is so enormous – with more than $4 trillion outstanding – getting it under control is a crucial prerequisite for any serious deleveraging. Predictably, though, these reforms have pushed down asset prices. Stocks, bonds, commodities and real estate have all turned strongly negative.

Interest rates have been inching up, inflicting losses on bond investors. Allocations of stocks and commodities in wealth-management products are at their lowest levels in almost a year, depressing prices further. This will probably get worse. Industrial capacity is widely up while demand growth is flat. Steel rebar prices have dropped by only 8% from their highs this year, and remain up by an amazing 91% since December 2015. Yet even this small dip has had a major effect. In March, when prices peaked, 85% of Hebei steel makers reported being profitable. Now that figure stands at 66%. If an 8% drop in prices results in a 19 percentage-point decline in the number of profitable steel mills, more serious price drops could well push the industry to the brink.

For a sector in which listed firms have suffered operational losses of 5.1 billion yuan since 2010 – during one of the largest building booms the world has ever seen – a sustained deleveraging effort may well spell disaster. The property market could also be in for a rough ride. Chinese consumers take the ability to buy an apartment as a birthright, and prices have risen in response to demand. Mortgage lending has grown by 31% since March 2016. But as cities place more restrictions on purchases and banking regulators get tougher about slowing mortgage growth, the resulting pressure on prices could be an unpleasant surprise for homeowners and indebted developers.

Don’t worry, the world will care yet.

• China Stocks Are Tumbling Again. Unlike 2015, World Doesn’t Care (BBG)

Global investors are still shaking off a rout that’s erased more than $560 billion from the value of Chinese equities, making them the world’s worst performers since mid-April. Below are four charts showing just how deep the pain has spread in China’s mainland. Outside of the nation’s borders, investors are indifferent to the weakness in the second-largest equity market after the U.S. The MSCI All-Country World Index is near a record and the VIX Index, the so-called fear gauge for U.S. stocks, is close to its lowest level since 1993. The ChiNext small-cap gauge, seen as a barometer for Chinese stock-market sentiment, has taken quite the hit this year, down 9.7% and close to its lowest level since February 2015. The selloff erased all that was left of a rebound from a low later that year, after a bubble in China’s markets burst.

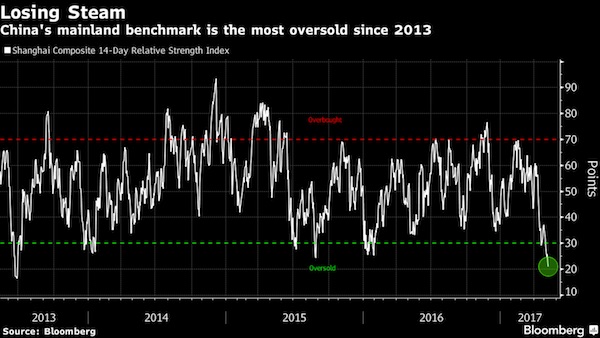

A technical indicator suggests the Shanghai Composite Index has fallen too far, too fast. The gauge’s relative strength index dipped further below the 30 level that signals to some traders an asset is oversold, and is close to levels not seen since 2013. Chart watchers are still waiting for that rebound. The benchmark for yuan-denominated shares has lost 6.9% in the past month, while global stocks are up 2.8%. That divergence means the Shanghai measure is trailing the rest of the world by the most since 2014.

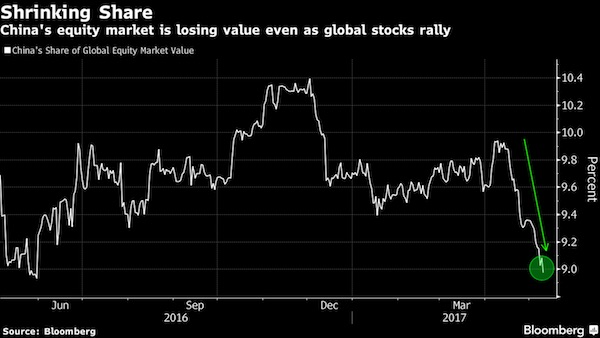

Chinese stocks now make up less than 9% of the world’s equity market, the smallest slice since June last year. The value of global equities is near a record $73 trillion reached earlier this month.

Quite shocking: “..each employed worker in China generated only 19% of the amount of GDP an American worker did.” Workers in India generate just 13%.

• China Has the World’s Biggest Productivity Problem (BBG)

Just about everybody assumes that China will overtake the U.S. as the world’s indispensable economy. One factor, however, could slow its seemingly relentless march and cast doubt on China’s prospects for becoming an advanced economy: faltering productivity. Sure, China is advancing daily in wealth, technology and expertise. But nothing is inevitable in economics. As costs rise and the labor force shrinks due to Beijing’s decades-long “one-child” policy, China will need to squeeze a lot more out of each remaining worker to keep incomes growing. If not, China could succumb to a sluggish trajectory that threatens both its future and that of the entire global economy. Despite China’s reputation as a paragon of authoritarian efficiency, the country isn’t immune to the global trend of dwindling productivity gains.

The Conference Board, using adjusted economic growth estimates, figures that Chinese labor productivity rose 3.7% in 2015, a precipitous plunge from an average of 8.1% annually between 2007 and 2013. (Official Chinese statistics also show productivity growth falling off, although settling at higher rates.) Of course, even that reduced clip looks drool-worthy to policymakers elsewhere. Labor productivity inched upwards by a mere 0.7% in the U.S. and 0.6% in the euro zone in 2015. But the smaller increases in China are a big problem, because it has so much catching up to do. Chinese workers are miserably unproductive compared to their U.S. counterparts. The Conference Board calculates that in 2015 each employed worker in China generated only 19% of the amount of GDP an American worker did.

That’s not a whole lot better than Indian workers, who created 13%. China, like other economies in Asia, is facing the consequences of its past success. The region’s economies achieved eye-popping growth rates by tossing their poor and primarily agrarian workers into industry and global supply chains. That unleashed a torrent of productivity gains, as peasant farmers started making everything from teddy bears to iPhones. In other words, China propelled its rapid development by shifting underutilized labor and capital into a modern capitalist economy. (That’s why Paul Krugman once argued that there was nothing particularly miraculous about the Asian “miracle.”) Inevitably, though, such low-hanging, productivity-enhancing fruit gets picked as the economy advances. Then the bang you get for every buck of new inputs starts to taper off.

It’s time for proof on all aleegations concerning Russia. Either that or a full stop. I was just talking to someone who said he ‘believes’ the Russians downed MH17. But belief doesn’t cut it, we need facts and proof.

• No Evidence of Russian Intrusion in US Political System (Ron Paul)

RT: Sergey Lavrov says President Trump wants productive relations with Moscow after the previous administration soured them. Can they be improved considering the storm over the alleged ties between the Trump team and Russia?

Ron Paul: Absolutely. And I think that has been. What is going on right now is an improvement. I think what is going on in Syria with these de-escalation zones; I think that is good. They are talking to each other. I just don’t understand why sometimes there is an impression that we shouldn’t be having diplomatic conversations … All the tough rhetoric doesn’t do any good. Trump’s statement to me sounded pretty good. I think the whole thing about the elections, putting that aside would be a wise thing because the evidence is not there for any intrusion in our election by the Russians. I think this is good progress, and there will be plenty individuals in this country who complain about it because it just seems like they are very content to keep the aggravation going. Right now, the relationship from my viewpoint has greatly improved. I think that is good.

RT: During the media conference, some journalists again raised the question of possible Russian involvement in US politics. How is it possible for such a great nation to think this way?

RP: If it is a fact, we should hear about it, but we haven’t. And those individuals who are trying to stir up trouble like that, they haven’t come up with any facts. Nobody wants anybody’s elections interfered with. But the facts aren’t there, so why dwell on that? Why use that as an excuse to prevent something that we think is positive and that is better relations with Russia. I think what is happening with this conversation is very beneficial.

RT: According to Lavrov, Trump also expressed his support for creating safe zones in Syria. Will this pave the way for co-operation between the two coalitions?

RP: With Assad and Russia working together and getting more security for the country, at the same time the US is now talking with Russia. I think this is good. But just the acceptance of the idea that we should be talking and practicing diplomacy rather than threats and intimidation. There are obviously a lot of problems that we have to work out, but I think in the last week and the last couple of days very positive things have been happening.

RT: The meeting came after the firing of the FBI director James Comey. What do you make of the timing?

RP: I don’t think that firing had anything to do with the so-called investigation. I think it has to do with the credibility of Comey as such, where he was involved too politically in the issues. First, it looked like he was supporting Hillary, then the next time he was supporting Trump, and he should not have been out in front on either one of those issues; that should have been done more privately on these charges made that were unconfirmed. I think this represents poor judgment on Comey’s part and certainly, the president had the authority to fire him. It will be politicized now, and the question will be whether there will be a special prosecutor, but if there are no problems, then a special prosecutor in my estimation is unnecessary.

Stick a fork in it and turn it over.

• Canada’s Home Capital Seeks New Funding Sources, Uncertain Of Future (BBG)

Home Capital said it’s seeking new sources of funding after a run on deposits sparked by a regulatory investigation raised concerns about the Canadian mortgage lender’s ability to stay in business. “Material uncertainty exists regarding the company’s future funding capabilities as a result of reputational concerns that may cast significant doubt” about continued operations, Home Capital said in a statement late Thursday. “Management’s focus is on finding more sources of funding in the near term so we can be more active serving our customers, and on seeking longer-term solutions that put the business back on track.” Home Capital’s troubles are being closely watched by investors concerned about possible contagion to other lenders and to the red-hot real estate markets in Toronto and Vancouver.

The Canadian dollar has slumped, and is the worst performing currency among Group of 10 nations this year. Moody’s Investors Service late Wednesday cut the credit ratings on six Canadian banks, citing rising household debt and soaring real estate prices that make the banks more vulnerable to losses. Home Capital, accused by regulators last month of misleading investors over fraudulent mortgage loan applications, has lost almost C$1.8 billion ($1.2 billion) in high-interest deposits in five weeks, draining the Toronto-based company of funds used to finance mortgages. The company said it’s facing liquidity issues because of reputational concerns raised by the Ontario Securities Commission allegations, as well as a class action lawsuit announced earlier this year. The lack of a chief executive officer and chief financial officer is also hurting, the company said.

High-interest savings plummeted to C$134 million as of May 9 from $1.9 billion at March 31, the company said. Home Capital also lost C$344 million in cashable GICs, or guaranteed investment certificates. Tightening lending criteria and broker incentive programs will lead to a decline in originations and renewals going forward, the company said. The lender’s liquid assets are about C$1.01 billion as of May 10, it said in a separate statement Thursday. It had drawn C$1.4 billion of a C$2 billion rescue loan from an Ontario pension fund that carries an effective interest rate of 22.5%, the firm disclosed. The company also sold a C$154 million portfolio of preferred shares to raise cash.

Brussels is a cesspit obsessed with power politics, not with representing Europeans.

• Open Letter to Theresa May: Annul The Phoney Negotiations! (Varoufakis)

Dear Mrs May [..] While the clock is ticking away, and your country is caught up in pre-election fever, there are two potential mistakes I wish to warn against: First, the belief that a strong mandate on June 8 will enhance your ability to negotiate. Second, that meaningful negotiations are possible within the less than two years left after the triggering of Article 50. Your mandate will, I believe, enrage Brussels in proportion to its magnitude and steel their preordained determination to frustrate the negotiations in order to procure a mutually disadvantageous outcome. Why would they pursue mutual disadvantage? Because faced with a choice between an agreement that is to the advantage of the peoples of Europe and one that bolsters their own power within the EU institutions at the expense of Europe’s social economies, the Brussels establishment, and the powerful politicians behind them, will choose the latter every time.

In 2015 the proposals I was tabling, of a moderate Greek public debt restructure, lower tax rates and deep reforms, would have allowed the EU to reclaim more of European taxpayers’ loans to Greece. Except that getting back their taxpayers’ money was lower on their list of priorities than signalling to the Spaniards, the Irish, the Italians etc. that if they dared to elect a government promising to challenge the EU’s authority, they would be crushed. Thankfully, Britain is too rich to crush. Alas, Britain is not too big to be pushed into a disadvantageous form of Brexit as a deterrent to other Europeans voting against the edicts of the Brussels apparatchiks. The political utility to the Brussels establishment of leading the UK-EU negotiations to impasse is greater than any disutility they might experience from watching European people and businesses lose out.

If I am right, negotiations will be an exercise in futility and frustration. Barnier’s two-phase negotiation announcement amounts to a rejection of the principle of … negotiation. He is, effectively, saying to you: First you give me everything I am asking for unconditionally (Phase 1) and only then will I hear what you want (Phase 2). This is nothing short of a declaration of hostilities and, moreover, of his lack of a mandate to negotiate with you in good faith. Moreover, if you try to bypass Brussels, in order to communicate directly with, say, Angela Merkel, you will be given the EU runaround (i.e. Merkel refers you to Juncker, who refers you to Barnier who suggests you go back to Merkel, and so on ad infinitum). Meanwhile, the leaks about your ministers’ “lack of preparedness” will be flooding out of the meeting rooms as part of a propaganda war of attrition.

As long as the UK is as splintered as it is now, its economy will be in danger.

• Pound Stumbles As Bank Of England Releases Gloomy Economic Report (Pol.)

Less than a month ahead of the U.K. general election, the Bank of England published a gloomy report indicating British families’ finances are being squeezed that sent sterling tumbling. The BoE’s latest quarterly inflation report, published Thursday, points to a stronger-than-expected squeeze in real incomes which would translate into decreased household spending. The report also shows inflation continuing to climb above the central bank’s 2% target, and is expected to hit close to 3% by December, as the fall in the value of sterling has raised import prices and started to feed through to the real economy. Economic growth in the first quarter of this year was also weaker than expected, the BoE said.

Sterling fell sharply against the dollar after the report was released, losing half a cent to $1.288. In a warning to the British government, the central bank said, “The outlook for U.K. growth will continue to be influenced by the response of households, companies and financial market participants to the prospect of the United Kingdom’s departure from the EU including their assumptions about the nature and timing of post-Brexit trading arrangements. The Bank of England also Thursday decided to leave interest rates and the levels of monetary stimulus untouched. Its monetary policy committee voted seven to one to maintain the BoE’s benchmark rate at 0.25%, while unanimously backing the level of U.K. government bond purchases at £435 billion, and corporate bond buying at up to £10 billion.

Fun with numbers.

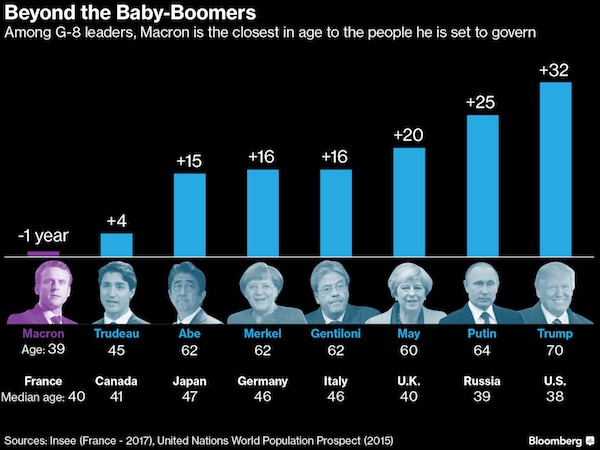

• Macron Spells the End to the Global Baby-Boomer Rule (BBG)

President-elect Emmanuel Macron will still be seven months short of his 40th birthday when he takes power on Sunday, putting him within a year of France’s median age. While voters often pick experience over youth, France chose a political rookie to chart a new course after successive baby-boomers from the establishment parties oversaw a decade of stagnation. The country’s youngest head of state since Napoleon Bonaparte is also the only leader from the old Group of Eight nations who can claim to be the same age as his people – 70-year-old Donald Trump has the biggest gap at 32 years older than the median American. Macron will get to compare notes with his G-7 peers later this month in Italy.

Yes, Le Pen was right. Merkel rules France.

When Alexis Tsipras became prime minister in 2015 he raised the hopes of the radical left across Europe. But after six months, the turnaround of the SYRIZA-Independent Greeks coalition government was complete, as it adapted to the European order of things. The conclusion is that guerrilla talk is good for coffee shops and that politics and policy are formed and enforced elsewhere. One might say that this sort of situation is confined to decadent and incoherent Greece, or that it occurred because of leftist adventurism. But possibly not. Because we all saw what happened in France. It was basic restraint that saved all those who were not enthralled by the rise of the extreme right.

At the end of the day, the only thing that Marine Le Pen achieved was to secure a little more than a third of the support of French voters, doubling the percentage received by her father Jean-Marie Le Pen in 2002, and to lift the National Front from the fringe and turn it into a political force. But we have better things to preoccupy ourselves with. During the election campaign, Emmanuel Macron projected himself as someone who will save France from the specter of the far right, but also as someone who aimed to change the profile of Europe. And immediately after his election, he proposed a way out of Europe’s dead end, but that was immediately rejected by Germany.

Manfred Weber from Bavaria, who pummeled Tsipras in the European Parliament, said that Macron can talk about reforming Europe only when he has proved himself capable of implementing reforms in France. More condescendingly, German Finance Minister Wolfgang Schaeuble said Macron’s proposals were impossible to implement. Given this, there is a danger that Le Pen will be vindicated in her prediction that if she was not elected president, then France would be run by another woman, Angela Merkel. The most likely outcome is that Macron will realize that talk of changing Europe is alright for the legendary La Rotonde brasserie in Paris’s 6th arrondissement, where he celebrated his victory in the first round of the elections. Something similar happened to Tsipras on the other side of the political spectrum. Because, at the moment, Europe is Germany and everyone else.

High time for safe zones in Syria, Libya and beyond. But that would hurt arms sales.

• Anxiety Mounts As Italy Moves To Get More Migrants Out (AFP)

Behind the high fences of the repatriation centre at Ponte Galeria, just down the road from Rome’s Fiumicino airport, dozens of women sit outside, waiting for word on whether they will have to leave Italy. But as the government steps up its efforts to send more migrants home, many who pinned their hopes on asylum appeals are growing increasingly worried. This week an official decree paved the way for the creation of 11 more repatriation centres capable of housing 1,600 people pending deportation, on top of the four currently in operation. At Ponte Galeria, in courtyards easily mistaken for cages, Khadigia Shabbi, 47, can barely hold back her tears. “Here we are dying,” the former Libyan university lecturer says. Arrested in Palermo at the end of 2015 and convicted of inciting terrorism, Shabbi protests her innocence and has requested asylum.

She is not alone. Half of the 63 women at Ponte Galeria, which AFP was able to visit, have made similar requests. Several are from Nigeria, having crossed Libya to reach Italy. But there are also Ukrainians and Chinese. The country is sheltering more than 176,000 asylum-seekers, with about 45,000 migrants arriving since January 1 – a 40% rise on the same period last year – and officials are bracing for another summer of record arrivals. To cope with the influx – and to deter others from coming – Interior Minister Marco Minniti pushed through parliament last month a plan to increase migrant housing and provide new resources for expelling those who have come only to seek work. The plan includes creating fast-track asylum appeal courts for the roughly 60% of migrants who have their initial requests denied, in order to reach a binding decision that gets them out of the country sooner.

Between January and April, Italy expelled 6,242 people who did not have the right to stay, an increase of 24% on the same period last year. But the figures include more than just people rescued from the overcrowded boats coming daily from Libya who have failed in their asylum requests. Many were sent home directly because of repatriation agreements, such as those with Tunisia, Egypt or Morocco, while others were expelled after overstaying their student or tourism visas. But despite Italy’s new efforts to deter migrant arrivals, many say they won’t give up trying. “If they expel me, I’ll come back afterwards. I say this honestly — there is nothing for me back there,” said one woman at Ponte Galeria.

US pressure may be the only way out for Greece.

• G7 Finance Chiefs Can’t Agree On Trade, So They Talk About Greece (BBG)

Group of Seven finance chiefs don’t see eye-to-eye on trade, so they’re reverting to a default issue in economic diplomacy: Greece. Officials arriving on Thursday for talks in the Southern Italian port of Bari – a crossroads of commerce for more than two millenia – downplayed any focus on their festering disagreement after two abortive Group of 20 discussions this year suggested the Trump administration won’t sign up to the long-existing global consensus on free trade. That leaves sideline talks on Greece as the most fruitful arena for talks for now. On Wednesday, a senior U.S. Treasury official said they are looking for Europe to take the lead in solving the country’s debt problem. Informal talks on Greece were held on Thursday night, according to German Finance Minister Wolfgang Schaeuble.

His nation, together with Italy, France, the IMF and the ECB make up the so-called Washington Group. “Trade is explicitly off the table – they’re not going to clinch anything at all,” said Isabelle Mateos y Lago at BlackRock. But on Greece, “this is the right grouping within which to reach an agreement on some of the more political aspects.” Talks on easing Greece’s debt load have been picking up steam amid hopes of striking a deal later this month, with officials targeting the May 22 meeting in euro-area finance ministers in Brussels. Among the preferred options is the use of leftovers from the country’s latest euro-area-backed bailout to repay about €12.4 billion of IMF loans to Greece outstanding, according to EU officials. “We’ll carry on working on this debt relief package,” IMF Managing Director Christine Lagarde said on Friday. “We certainly hope that the Europeans will be far more specific in terms of debt relief which is also an imperative.”

That so-called ‘Growth’ is achieved because Greece raises taxes and cuts pensions for its poorest, and sells its assets for pennies on the drachma. But that is not growth. That is scorched earth.

• Greek Economy to Grow Over 2% in 2017 – Economy and Development Minister (BBG)

Greece is confident that the country’s economic output will exceed 2% in 2017 boosted by investments, privatizations and exports, Economy and Development Minister Dimitri Papadimitriou said. This year will be “the year of real growth in Greece,” Papadimitriou said in a May 10 interview in Nicosia, Cyprus, at the annual meeting of the European Bank for Reconstruction and Development. With the exception of 2014, Greece’s economy shrank every year since 2008. The IMF in April cut its forecast for 2017 Greek economic growth to 2.2% from 2.8%. The European Commission revised earlier today its estimate for the Greek growth rate to 2.1% from 2.7%. Papadimitriou cited committed investments for 2017 of €300 million by Philip Morris International and €500 million by Hellenic Telecommunication as well as applications to make investments worth €1.9 billion following the introduction of new legislation that provides incentives to investors. He also highlighted higher industrial production, increased exports and a rise in employment.

Greece will also complete in 2017 an “ambitious” privatization program worth over €2 billion that mainly comprises regional airports, the country’s second-largest port of Thessaloniki, the national railroad operator Trainose and units of state-controlled Public Power Corp., the largest electricity supplier, Papadimitriou said. With almost one-quarter of Greeks without work in the fourth quarter of 2016, or 23.6%, the highest in the EU, Greece is targeting a fall in the unemployment rate by 2020/21 to the euro-area average of 12% through targeted programs for job creation, Papadimitriou said. The final conclusion of the review of Greece’s bailout program with the country’s international creditors will see the nation’s sovereign bonds included in the ECB’s asset purchase program that will mean Greece will be like “a normal country and every other member of the euro zone,” Papadimitriou said.

Growth, you said? Both sides are making up numbers that suit their book. And in the end, Greece loses.

• European Commission Slashes Greece’s Economic Forecasts (GR)

The European Commission forecast for Greece’s economic figures is not as optimistic as the one presented by Athens. Specifically, the European Commission sees growth of 2.1% of GDP in 2017 and 2.5% in 2018 (compared with 2.7% and 3.1% respectively as the Greek government projected). The government deficit is projected to fall to 1.2% of GDP in 2017 and to a surplus of 0.6% in 2018. In the Commission’s winter forecast, the deficit was slightly lower for 2017 (1.1%) and the surplus slightly higher for 2018 (0.7%). Regarding the sovereign debt, the forecasts for the decline of the state debt are also more conservative than the Commission’s winter forecasts.

It is estimated to drop from 179% of GDP in 2016 to 178.8% in 2017 (177.2% in winter forecasts) and 174.6% of GDP in 2018 (170.6% in winter forecasts). At the same time, unemployment numbers differ, as it is estimated that from 23.6% in 2016 it will fall to 22.8% in 2017 (compared with 22% in the winter forecasts) and 21.6% in 2018 (compared to 20.3% in winter forecasts). Inflation is expected to be 1.2% in 2017 and 1.1% in 2018. Finally, estimates of investment growth are also mitigated by lower growth. Specifically, investment growth is projected to increase by 6.3% in 2017 (compared with 12% in the winter forecasts) and 10.8% in 2018 (compared with 14.2% in winter forecasts).

Schaeuble blames Greece for not exiting the Eurozone in 2015. Like the EU would have let them. The world on its head.

• Schaeuble Says Greece Needs Reforms, Defends 2015 ‘Timeout’ Idea (K.)

Structural reforms are key to membership of the euro area, German Finance Minister Wolfgang Schaeuble has said while defending his 2015 offer of a Greek euro “timeout.” “If a country does not want to leave [the euro], then it has to make structural reforms – like Greece has,” Schaeuble said in an interview with Italian newspaper La Repubblica published Thursday. “With the euro, the time is over when some countries could increase their competitiveness through currency devaluation. This is a political short-cut,” he said. Asked about his proposal for a temporary Greek exit from the eurozone, put forward in the dramatic summer of 2015, the German finance minister defended his idea. “You know what [Italian Economy Minister] Pier Carlo Padoan said in public: an overwhelming majority of finance ministers were convinced that it would be better if Greece were temporarily out of the euro,” Schaeuble said. “It was Greece that decided otherwise. We are now making an effort to make sure that the third aid package is a success,” he said.

Remember 40% of Greek businesses don’t expect to survive 2017.

• One In Six Greek Businesses Are Late Payers – Central Bank Chief (Amna)

About one in six businesses in Greece has the characteristics of a late payer, Bank of Greece Governor Yannis Stournaras said on Thursday, addressing an audience at the Federation of Industries of Northern Greece (FING) in Thessaloniki. Stournaras said it is urgent to address the problem of non-performing loans (NPLs), saying it should be a priority among the reforms discussed between Greece and its lenders, as it is a very significant obstacle to economic recovery. “This is the biggest challenge facing today, not just the banking system but the Greek economy,” he said, adding that according to a conservative estimate based on a sample of 13,000 businesses with loans over one million euros, an average of one in six has the characteristics of a bad payer.

He said there are indications that the analogy is significantly higher for smaller businesses and households. “But this will change in the immediate future with a series of initiatives that have already underway to address the aforementioned causes and which have hindered banks’ efforts to resolve the problem for years,” he said. Stournaras also expressed confidence that the approval of the prior actions by the parliament agreed during the second program review will open the way for the disbursement of the next loan tranche from the Eurogroup on May 22. “The financial markets are already expecting this result,” he said.

“Somebody’s going to suffer. Should it the wealthy billionaires and the bankers, or should it be the Greek workers? Well, the Greek workers are not the IMF’s constituency.”

• Somebody’s Going To Suffer: Greece’s New Austerity Measures (Michael Hudson)

Michael Hudson: I wouldn’t call it a negotiation. Greece is simply being dictated to. There is no negotiation at all. It’s been told that its economy has shrunk so far by 20%, but has to shrink another 5% making it even worse than the depression. Its wages have fallen and must be cut by another 10%. Its pensions have to be cut back. Probably 5 to 10% of its population of working age will have to immigrate. The intention is to cut the domestic tax revenues (not raise them), because labor won’t be paying taxes and businesses are going out of business. So we have to assume that the deliberate intention is to lower the government’s revenues by so much that Greece will have to sell off even more of its public domain to foreign creditors. Basically it’s a smash and grab exercise, and the role of Tsipras is not to represent the Greeks because the Troika have said, “The election doesn’t matter. It doesn’t matter what the people vote for. Either you do what we say or we will smash your banking system.” Tsipras’s job is to say, “Yes I will do whatever you want. I want to stay in power rather than falling in election.”

Sharmini Peries: Right. Michael you dedicated almost three chapters in your book “Killing the Host” to how the IMF jjunkeconeconomists actually knew that Greece will not be able to pay back its foreign debt, but yet it went ahead and made these huge loans to Greece. It’s starting to sound like the mortgage fraud scandal where banks were lending people money to buy houses when they knew they couldn’t pay it back. Is it similar?

Michael Hudson: The basic principle is indeed the same. If a creditor makes a loan to a country or a home buyer knowing that there’s no way in which the person can pay, who should bear the responsibility for this? Should the bad lender or irresponsible bondholder have to pay, or should the Greek people have to pay? IMF economists said that Greece can’t pay, and under the IMF rules it is not allowed to make loans to countries that have no chance of repaying in the foreseeable future. The then-head of the IMF, Dominique Strauss-Kahn, introduced a new rule – the “systemic problem” rule.

It said that if Greece doesn’t repay, this will cause problems for the economic system – defined as the international bankers, bondholder’s and European Union budget – then the IMF can make the loan. This poses a question on international law. If the problem is systemic, not Greek, and if it’s the system that’s being rescued, why should Greek workers have to dismantle their economy? Why should Greece, a sovereign nation, have to dismantle its economy in order to rescue a banking system that is guaranteed to continue to cause more and more austerity, guaranteed to turn the Eurozone into a dead zone? Why should Greece be blamed for the bad malstructured European rules? That’s the moral principle that’s at stake in all this.

[..] Yanis Varoufakis, the finance minister under Syriza, said that every time he talked to the IMF’s Christine Lagarde and others two years ago, they were sympathetic. They said, “I am terribly sorry we have to destroy your economy. I feel your pain, but we are indeed going to destroy your economy. There is nothing we can do about it. We are only following orders.” The orders were coming from Wall Street, from the Eurozone and from investors who bought or guaranteed Greek bonds. Being sympathetic, feeling their pain doesn’t really mean anything if the IMF says, “Oh, we know it is a disaster. We are going to screw you anyway, because that’s our job. We are the IMF, after all. Our job is to impose austerity. Our job is to shrink economies, not help them grow. Our constituency is the bondholders and banks.” Somebody’s going to suffer. Should it the wealthy billionaires and the bankers, or should it be the Greek workers? Well, the Greek workers are not the IMF’s constituency. It says: “We feel your pain, but we’d rather you suffer than our constituency.”

Home › Forums › Debt Rattle May 12 2017