Fred Stein Subway Steps New York 1943

E�d�w�a�r�d� �S�n�o�w�d�e�n �@�S�n�o�w�d�e�n�: “�I�n� �l�i�g�h�t� �o�f� �t�o�d�a�y�’�s� �a�t�t�a�c�k�,� �C�o�n�g�r�e�s�s� �n�e�e�d�s� �t�o� �b�e� �a�s�k�i�n�g� �@�N�S�A�g�o�v� �i�f� �i�t� �k�n�o�w�s� �o�f� �a�n�y� �o�t�h�e�r� �v�u�l�n�e�r�a�b�i�l�i�t�i�e�s� �i�n� �s�o�f�t�w�a�r�e� �u�s�e�d� �i�n� �o�u�r� �h�o�s�p�i�t�a�l�s�.�”

• Hackers Hit Dozens of Countries Exploiting Stolen NSA Tool (NYT)

Hackers exploiting malicious software stolen from the National Security Agency executed damaging cyberattacks on Friday that hit dozens of countries worldwide, forcing Britain’s public health system to send patients away, freezing computers at Russia’s Interior Ministry and wreaking havoc on tens of thousands of computers elsewhere. The attacks amounted to an audacious global blackmail attempt spread by the internet and underscored the vulnerabilities of the digital age. Transmitted via email, the malicious software locked British hospitals out of their computer systems and demanded ransom before users could be let back in – with a threat that data would be destroyed if the demands were not met.

By late Friday the attacks had spread to more than 74 countries, according to security firms tracking the spread. Kaspersky Lab, a Russian cybersecurity firm, said Russia was the worst-hit, followed by Ukraine, India and Taiwan. Reports of attacks also came from Latin America and Africa.[..] The hackers’ weapon of choice on Friday was Wanna Decryptor, a new variant of the WannaCry ransomware, which encrypts victims’ data, locks them out of their systems and demands ransoms. Researchers said the impact and speed of Friday’s attacks had not been seen in nearly a decade, when the Conficker computer worm infected millions of government, business and personal computers in more than 190 countries, threatening to overpower the computer networks that controlled health care, air traffic and banking systems over the course of several weeks.

One reason the ransomware on Friday was able to spread so quickly was that the stolen N.S.A. hacking tool, known as “Eternal Blue,” affected a vulnerability in Microsoft Windows servers. Hours after the Shadow Brokers released the tool last month, Microsoft assured users that it had already included a patch for the underlying vulnerability in a software update in March. But Microsoft, which regularly credits researchers who discover holes in its products, curiously would not say who had tipped the company off to the issue. Many suspected that the United States government itself had told Microsoft, after the N.S.A. realized that its hacking method exploiting the vulnerability had been stolen.

Privacy activists said if that were the case, the government would be to blame for the fact that so many companies were left vulnerable to Friday’s attacks. It takes time for companies to roll out systemwide patches, and by notifying Microsoft of the hole only after the N.S.A.’s hacking tool was stolen, activists say the government would have left many hospitals, businesses and governments susceptible. “It would be deeply troubling if the N.S.A. knew about this vulnerability but failed to disclose it to Microsoft until after it was stolen,” Patrick Toomey, a lawyer at the American Civil Liberties Union, said on Friday. “These attacks underscore the fact that vulnerabilities will be exploited not just by our security agencies, but by hackers and criminals around the world.”

Don’t just blame the hospitals. Blame the government that squeezes them so dry they have to choose patients over computers.

• UK Health Service, Targeted in Cyberattack, Ignored Warnings for Months (NYT)

Britain’s National Health Service ignored numerous warnings over the last year that many of its computer systems were outdated and unprotected from the type of devastating cyberattack it suffered on Friday. The attack caused some hospitals to stop accepting patients, doctor’s offices to shut down, emergency rooms to divert patients, and critical operations to be canceled as a decentralized system struggled to cope. At some hospitals, nurses could not even print out name tags for newborn babies. At the Royal London Hospital, in east London, George Popescu, a 23-year-old hotel cook, showed up with a forehead injury. “My head is pounding and they say they can’t see me,” he said. “They said their computers weren’t working. You don’t expect this in a big city like London.”

In a statement on Friday, the N.H.S. said its inquiry into the attack was in its early phases but that “at this stage we do not have any evidence that patient data has been accessed.” Many of the N.H.S. computers still run Windows XP, an out-of-date software that no longer gets security updates from its maker, Microsoft. A government contract with Microsoft to update the software for the N.H.S. expired two years ago. Microsoft discontinued the security updates for Windows XP in 2014. It made a patch, or fix, available in newer versions of Windows for the flaws that were exploited in Friday’s cyberattacks. But the health service does not seem to have installed either the newer version of Windows or the patch.

“Historically, we’ve known that N.H.S. uses computers running old versions of Windows that Microsoft itself no longer supports and says is a security risk,” said Graham Cluley, a cybersecurity expert in Oxford, England. “And even on the newest computers, they would have needed to apply the patch released in March. Clearly that did not happen, or the malware wouldn’t have spread this fast.” Just this month, a parliamentary research briefing noted that cyberattacks were viewed as one of the top threats facing Britain. The push to make medical records systems more interconnected might also make the system more vulnerable to attack. Britain plans to digitize all patient records by 2020.

The anti-Trump battle will be fought with financial weapons. And the Donald is walking into that trap.

• Hurricane Bearing Down on the Casino (Stockman)

Yesterday I said the Donald was absolutely right in canning the insufferable James Comey, but that he has also has stepped on a terminal political land-mine. And he did. That’s because the entire Russian meddling and collusion narrative is a ridiculous, evidence-free attempt to re-litigate the last election. And now that the powers that be have all the justification they need. And what is already an irrational witch-hunt will be quickly turned into a scorched-earth assault on a sitting president. I have no idea how this will play out, but as a youthful witness to history back in 1973-1974 I observed Tricky Dick’s demise in daily slow motion. But the most memorable part of the saga was how incredibly invincible Nixon seemed in early 1973. Nixon started his second term, in fact, with a massive electoral landslide, strong public opinion polls and a completely functioning government and cabinet.

Even more importantly, he was still basking in the afterglow of his smashing 1972 foreign policy successes in negotiating detente and the anti-ballistic missile (ABM) treaty with Brezhnev and then the historic opening to China on his Beijing trip. So I’ll take the unders from anyone who gives the Donald even the 19 months that Nixon survived. After all, Trump lost the popular vote, is loathed by official Washington, barely has a functioning cabinet and is a whirling dervish of disorder, indiscipline and unpredictability. To be sure, the terms of the Donald’s eventual exit from the Imperial City will ultimately by finalized by the 46th President in waiting, Mike Pence. But I’m pretty sure of one thing: Between now and then, there is not a snow ball’s chance in the hot place that Donald’s severance package will include the ballyhooed Trump Tax Cut and Fiscal Stimulus.

Markets slipped today because of carnage in the retail sector (which I’ve been warning readers about). But these fantasies are apparently still “priced-in” to a market that has now become just plain stupid. What is surely coming down the pike after the Comey firing, however, is just the opposite. That is, Washington will soon become a three-ring circus of investigations of Russia-gate and the “hidden” reasons for Trump’s action. The Imperial City will get embroiled in bitter partisan warfare and the splintering of the GOP between its populist and establishment wings. In that context, what passes for “governance” will be reduced to a moveable Fiscal Bloodbath that cycles between debt ceiling showdowns and short-term continuing resolution extensions.

The swamp that can’t be drained without causing explosions.

• $500 Trillion in Derivatives “Remain an Important Asset Class” – NY Fed (WS)

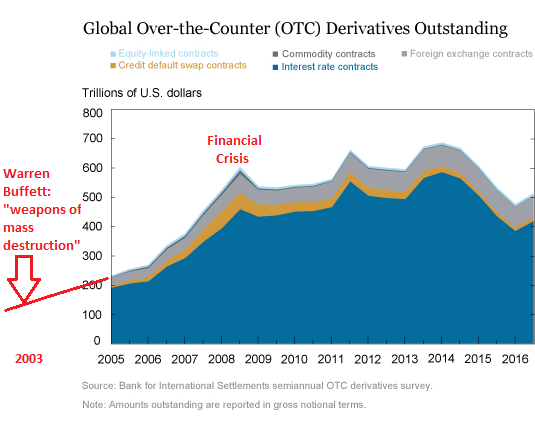

Economists at the New York Fed included this gem in their report on a two-day conference on “Derivatives and Regulatory Changes” since the Financial Crisis: “Though the notional amount [of derivatives] outstanding has declined in recent years, at more than $500 trillion outstanding, OTC derivatives remain an important asset class.” An important asset class. A hilarious understatement. Let’s see… the “notional amount” of $500 trillion is 25 times the GDP of the US and about 7 times global GDP. Derivatives are not just an “important asset class,” like bonds; they’re the largest “financial weapons of mass destruction,” as Warren Buffett called them in 2003.

Derivatives are used for hedging economic risks. And they’re used as “speculative directional exposures” – very risky one-sided bets. It’s all tied together in an immense and opaque market interwoven with the banks. The New York Fed: The 2007-09 financial crisis highlighted weaknesses in the over-the-counter (OTC) derivatives markets and the increased risk of contagion due to the interconnectedness of market participants in these markets. This chart from the New York Fed shows how derivatives ballooned 150% – or by $360 trillion – in less than four years before the Financial Crisis. They ticked down during the Financial Crisis, then rose again during the Fed’s QE to peak at $700 trillion. After the end of QE, they declined, but recently ticked up again to $500 trillion. I added in red the Warren Buffett moment:

The vast majority of the derivatives are interest rate and credit contracts (dark blue). Banks specialize in that. For example, according to the OCC’s Q4 2016 Report on Derivatives, JPMorgan Chase holds $47.5 trillion of derivatives at notional value and Citibank $43.9 trillion. The top 25 US banks hold $164.7 trillion, or 8.5 times US GDP. So even a minor squiggle could trigger some serious heartburn.

Try use “normal” and “derivatives” in one sentence and put on a straight face.

• The Great Misconception of a Return to “Normal” (Econimica)

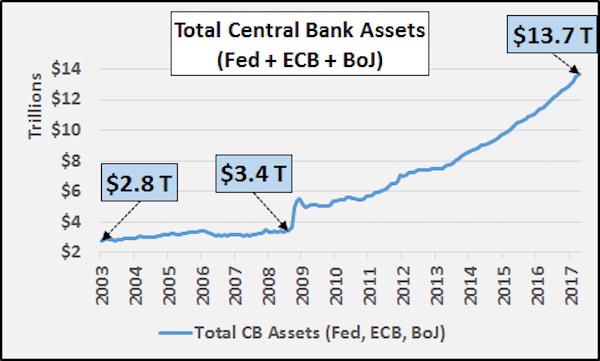

Since 2009, there has been ongoing discussion of the size & composition of major central bank balance sheets (I’m focusing on the Federal Reserve Bank, European Central Bank, and the Bank of Japan) but little discussion of why these institutions felt (and continue to feel) compelled to “buy” assets. The chart below highlights the ongoing collective explosion of these bank “assets” since 2009 after a previous period of relative stability. These institutions clearly have the capability and willingness to digitally conjure “money” from nothing and have felt compelled to remove over $10 trillion worth of assets from the markets since 2009. This swap of illiquid assets for liquid cash had (and continues to have) the effect of squeezing the prices of the remaining assets higher (more money chasing fewer assets=price appreciation).

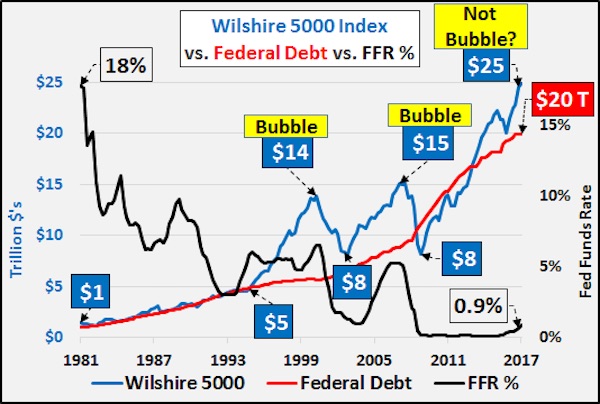

A prime example of that squeeze, the US stock market total valuation (represented by the Wilshire 5000, below) is $10 trillion higher than the “bubble” peak of 2008…and $11 trillion higher than the 2001 “bubble” peak. Likewise, US federal debt since 2008 has increased by…you guessed it, $10 trillion. The narrative seems to be that 2009 was a one off event and that the central banks role was and still is to “stabilize” the situation until things “normalize”. But right there…that idea that 2009 was a “one-off” or “abnormal” couldn’t be more wrong. So what is “normal” growth, at least from a consumption standpoint? Normal is never the same twice…it is ever changing and must be constantly rediscovered.

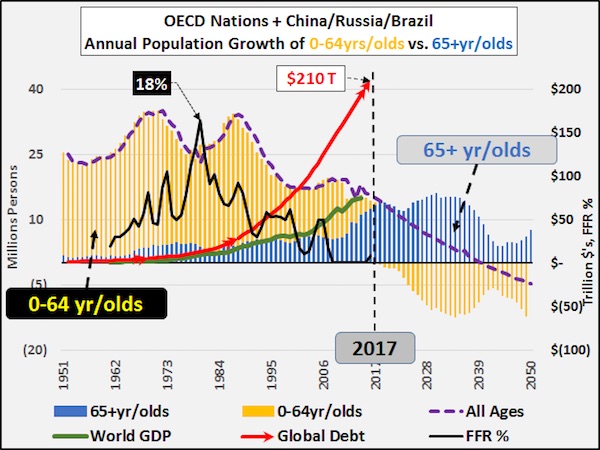

To determine “normal” growth in consumption, all we need do is figure the change in the quantity of consumers (annual population growth) and the quality of those consumers (their earnings, savings, and utilization of credit). The chart below details the ever changing “normal” that is the annual change in the under 65yr/old global population broken down by wealthy consuming nations (blue line) and the rest of the (generally poor) world (red line). The natural rate of growth in consumption has been declining ever since 1988 (persistently less growth in the population on a year over year basis)…but central banks and central governments have substituted interest rate cuts and un-repayable debt to maintain an unnaturally high consumption growth rate.

If we don’t put a stop to this, we have no chance. This is where it all begins and ends.

• US Nears $100 Billion Arms Deal For Saudi Arabia (R.)

The United States is close to completing a series of arms deals for Saudi Arabia totaling more than $100 billion, a senior White House official said on Friday, a week ahead of President Donald Trump’s planned visit to Riyadh. The official, who spoke to Reuters on condition of anonymity, said the arms package could end up surpassing more than $300 billion over a decade to help Saudi Arabia boost its defensive capabilities while still maintaining U.S. ally Israel’s qualitative military edge over its neighbors. “We are in the final stages of a series of deals,” the official said. The package is being developed to coincide with Trump’s visit to Saudi Arabia. Trump leaves for the kingdom on May 19, the first stop on his maiden international trip.

Reuters reported last week that Washington was pushing through contracts for tens of billions of dollars in arms sales to Saudi Arabia, some new, others already in the pipeline, ahead of Trump’s visit. The United States has been the main supplier for most Saudi military needs, from F-15 fighter jets to command and control systems worth tens of billions of dollars in recent years. Trump has vowed to stimulate the U.S. economy by boosting manufacturing jobs. The package includes American arms and maintenance, ships, air missile defense and maritime security, the official said. “We’ll see a very substantial commitment … In many ways it is intended to build capabilities for the threats they face.” The official added: “It’s good for the American economy but it will also be good in terms of building a capability that is appropriate for the challenges of the region. Israel would still maintain an edge.”

How many executives in jail, you said?

• Wells Fargo Bogus Accounts Balloon To 3.5 Million (R.)

Wells Fargo may have opened as many as 3.5 million unauthorized customer accounts, far more than previously estimated, according to lawyers seeking approval of a $142 million settlement over the practice. The new estimate was provided in a filing late Thursday night in the federal court in San Francisco, and is 1.4 million accounts higher than previously reported by federal regulators, in what became a national scandal. Keller Rohrback, a law firm for the plaintiff customers, said the higher estimate reflects “public information, negotiations, and confirmatory discovery.” The Seattle-based firm also said the number “may well be over-inclusive, but provides a reasonable basis on which to estimate a maximum recovery.”

Wells Fargo spokesman Ancel Martinez in an email said the new estimate was “based on a hypothetical scenario” and unverified, and did not reflect “actual unauthorized accounts.” Nonetheless, it could complicate Wells Fargo’s ability to win approval for the settlement, which has drawn opposition from some customers and lawyers who consider it too small. “This adds more credence to the fact there is not enough information to assess whether the settlement is fair and adequate,” Lewis Garrison, a partner at Heninger Garrison Davis in Birmingham, Alabama who represents some objecting customers, said in an interview. U.S. District Judge Vince Chhabria in San Francisco is scheduled to consider preliminary approval at a May 18 hearing. The accounts scandal mushroomed after Wells Fargo agreed last September to pay $185 million in penalties to settle charges by authorities including the U.S. Consumer Financial Protection Bureau.

They better be thorough, or individual countries must each formulate their own responses.

• EU To Decide Future Of Uber, Airbnb In Europe (NE)

An opinion issued by the European Court of Justice on May 11 could prevent people from using or working for services such as Uber and Airbnb. The opinion from the Advocate General of the European Court of Justice follows a case that has been brought by Spanish taxi drivers against the ride sharing service Uber. It found that Uber should be regulated like a transportation company, not as an “information society service”. If the opinion is upheld, these services could be required to apply for specific licences or be restricted in number as is the case with taxis in various European cities in an attempt to keep prices artificially high.

The court is slated to deliver a final ruling on whether Uber should be classified as a transport company or as a passive internet intermediary, in the coming months. Usually, the judges follow the opinion of the Advocate General. It remains to be seen whether the case will impact other so-called sharing economy services as Airbnb. Speaking after the opinion was issued, Dan Dalton, European Conservatives and Reformists (ECR) spokesman on the EU internal market said: “The opinion given today has huge implications for innovative, consumer driven digital services all across Europe… It is right that there are safeguards for consumers, but applying analogue era regulation to the digital world only strangles innovation and entrenches privileged monopolies.”

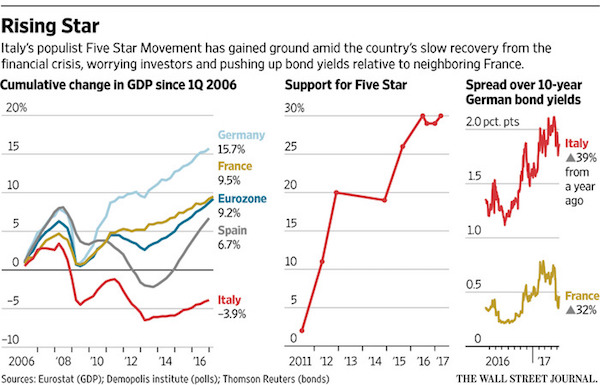

Beppe always had one goal first: get rid of corruption. The WSJ can talk all it wants about M5S teething problems, but there are bigger issues here.

• A Populist Storm Stirs in Italy (WSJ)

Europe’s establishment breathed a sigh of relief after the pro-European Union centrist Emmanuel Macron was elected French president this week. But another populist storm is brewing in Italy, where the euroskeptic 5 Star Movement has remained strong. Fueled by discontent with slow growth, high unemployment and disillusionment with mainstream politicians, 5-Star has won local elections in Rome, Turin and elsewhere, partly on the strength of its leaders’ call for a referendum on Italy’s use of the European single currency. Pollsters say about 30% of Italian voters support the movement founded by comedian Beppe Grillo, a level of popularity that has stood firm despite a series of high-profile stumbles, especially by its mayor in Rome.

The self-described association of free citizens has replaced the center-left Democratic Party at the top of most polls ahead of national elections to be held by May 2018. Now, the group that has flouted the rules of the game for establishment parties in Italy is experiencing growing pains as it prepares for the possibility of taking power. The prospect of Mr. Grillo and his supporters winning and forming a government has made investors nervous and pushed up yields on Italian bonds in recent months. On Friday, the spread between Italian and German 10-year sovereign bond yields was 1.85 percentage points, nearly five times the corresponding spread between French and German bonds.

Mr. Grillo and 5 Star waged a successful campaign to block constitutional changes sought by former Democratic Italian Prime Minister Matteo Renzi, effectively forcing him from office in December. Since then, a caretaker government has run Italy. The movement has vowed to institute tougher anticorruption laws and deliver a minimum guaranteed income for all working-age and retired Italians if it emerges from upcoming elections as head of a minority government or in a governing coalition with other euroskeptic parties.

There is no support for a beefed up EU or eurozone. Besides, Macron will be fighting the unions over the summer.

• Macron To Visit Germany To Seek Support For A Beefed Up Eurozone (G.)

Emmanuel Macron will take power as French president on Sunday and immediately face the twin challenges of European Union reform and loosening strict labour laws in France. After walking up the red carpet to the Élysée Palace on Sunday morning, being briefed on the nuclear deterrent by the outgoing Socialist leader François Hollande, and making his first speech, Macron will on Monday fly to Berlin to meet the German chancellor, Angela Merkel. It is traditional for French leaders to make Berlin their first European trip. The pro-European centrist Macron wants to boost the French-German motor at the heart of Europe and press for closer cooperation, including creating a parliament and budget for the eurozone. Merkel welcomed Macron’s decisive election victory over the far-right Marine Le Pen, saying he carried “the hopes of millions of French people and also many in Germany and across Europe”.

But if Macron is to push for eurozone reform, he must also prove to Berlin and other European allies that he can deliver the changes he has promised on France’s sluggish economy and deficit problem. The German finance minister, Wolfgang Schäuble, in an interview with the weekly Spiegel, kept up his country’s pressure on France to reduce its budget deficit to the EU ceiling of 3%. “France can make it,” he said. Macron, 39, France’s youngest elected leader, vowed during his campaign that he would immediately loosen France’s rigid labour regulations, giving businesses more power over setting working hours and deciding working conditions. He said that if needed, he would push through these changes by decree soon after taking office. Trade unions and leftwing demonstrators are warning of street protests if changes are not handled carefully.

Jim waxes nostalgic on Nixon.

I remember that sweaty August day that he threw in the towel. (I was a young newspaper reporter when newspapers still mattered.) It was pretty much a national orgasm. “NIXON RESIGNS!” the headlines screamed. A moment later he was on the gangway into the helicopter for the last time. Enter, stage right, the genial Gerald Ford…. Forgive me for getting caught up in the very nostalgia I castigate. And now here we are in the mere early months of Trumptopia about to hit the replay button on a televised inquisition. In my humble opinion, Donald Trump is a far more troubling personality than Tricky Dick ever was, infantile, narcissistic, at times verging on psychotic, but the RussiaGate story looks pretty flimsy. At this point, after about ten months of NSA-FBI investigation, nothing conclusive has turned up about Trump’s people “colluding” with Russia to gain unfair advantage in the election against You-Know-Who.

Former NSA chief James Clapper has publicly stated twice in no uncertain terms that there’s no evidence to support the allegations (so far). And there remains the specter of the actual content of the “collusion” — conveniently ignored by the so-called “Resistance” and its water-carriers at The New York Times — the hacked emails that evince all kinds of actual misbehavior by Secretary of State HRC and the DNC. The General Mike Flynn episode seems especially squishy, since it is the routine duty of incoming foreign affairs officials to check in with the ambassador corps in Washington. Why do you think nations send ambassadors to other countries? The upshot of all this will be a political circus for the rest of the year and the abandonment of any real business in government, at a moment in history when some very weighty black swans circle above the clouds waiting to crash land. Enjoy the histrionics if you dare, and pay no attention to collapsing economy as it all plays out.

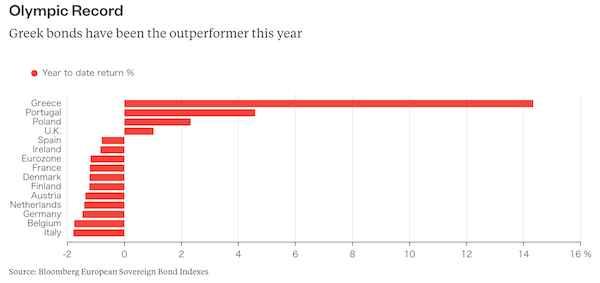

Draghi need to buy Greek bonds, and bring down those rates.

• Greece and the Bond Market. Friends Reunited? (BBG)

Greece is considering tapping the capital markets for the first time in three years. Let’s hope its second attempt to regain market access goes more smoothly for investors than its first. A bond sale in July or September is being considered – if a deal on debt relief is reached, and the ECB adds Greek debt to the shopping list of securities it can buy through its quantitative easing program, according to the Wall Street Journal. The news comes as the U.S. presses European officials to ease Greece’s debt burden at informal talks during the Group of Seven gathering currently taking place in Italy.Investors can be forgiven if they feel a sense of déjà vu.In April 2014, Greece sold €3 billion of 4.75% bonds repayable in 2019 in its first issue for almost four years.

The country had sought to raise €2.5 billion; orders from more than 550 investors, though, exceeded €20 billion, and, five months later, the bond was increased by a further €1 billion. The then PM Antonis Samaras called the sale “one more decisive step toward exiting the crisis.”Except … it turned out Greece was about to get worse, not better. The day after the sale, the price of the bonds slipped by a bit more than half a point. By the end of the year, they’d lost almost 20% of their value. And by the middle of 2015, they slumped to as low as 40% of face value as the government was forced to introduce capital controls in an effort to stanch the flood of money leaving the country’s banking system. The bond price recovered as the Greek government dropped its defiance against the terms demanded by its lenders, implemented pension and labor market reforms and accelerated the sale of government assets.

Does Brussels really want China to buy up Greece?

• China’s Xi Offers Indebted Greece Strong Support (R.)

Chinese President Xi Jinping offered the prime minister of deeply indebted Greece strong support on Saturday, saying the two countries should expand cooperation in infrastructure, energy and telecommunications. Xi told Prime Minister Alexis Tsipras that Greece was an important part in China’s new Silk Road strategy. “At present, China and Greece’s traditional friendship and cooperation continues to glow with new dynamism,” China’s Foreign Ministry cited Xi as saying. Cooperation in infrastructure, energy and telecommunications should be “deep and solid”, Xi added, without giving details. Tsipras is in Beijing to attend a summit to promote Xi’s vision of expanding links between Asia, Africa and Europe underpinned by billions of dollars in infrastructure investment called the Belt and Road initiative.

Greek infrastructure development group Copelouzos has signed a deal with China’s Shenhua Group to cooperate in green energy projects and the upgrade of power plants in Greece and other countries, the Greek company said on Friday. The deal will involve total investment of €3 billion, Copelouzos said in a statement, without providing further details. China has been investing heavily in Greece in recent years. Its biggest shipping company, COSCO Shipping, bought a majority stake in Piraeus Port Authority last year under a plan to turn Greece into a transhipment hub for rapidly growing trade between Asia and Eastern Europe. Xi said China and Greece should focus their efforts on turning the Piraeus port into an important international transhipment hub and key part of the new Silk Road, the Chinese ministry said.

Yanis says Greece’s future is Kosovo, Steve Keen said Somalia. They’re both right.

• Varoufakis Accuses Tsipras, Tsakalotos Of Giving In To Creditors (K.)

In an interview Friday on Skai TV, former finance minister Yanis Varoufakis hit out at his erstwhile government colleagues, accusing both his successor Euclid Tsakalotos and Prime Minister Alexis Tsipras of giving in to the country’s international creditors. “There is no new agreement, just a new surrender,” he said of the latest deal with Greece’s lenders. “The first memorandum burned Papandreou, the second Samaras, the third Tsipras. The fourth will require a new prime minister,” he said. As for Greece’s prospects, his prediction was bleak. “We will become Kosovo, a protectorate run by an employee of the European Union.”

Never seen a more broken record.

• IMF, Eurozone Say Need More Time To Reach Greek Debt Relief Deal (R.)

The IMF and eurozone government lenders need more time to reach an agreement on debt relief for Greece because the eurozone is still not sufficiently clear in its intentions, IMF chief Christine Lagarde said on Friday. Top eurozone officials and Lagarde met on Friday morning to discuss debt relief for Athens which eurozone finance ministers, or the Eurogroup, promised in May 2016, but under strict conditions. “We will carry on working on this debt relief package. There is not enough clarity yet. Our European partners need to be more specific in terms of debt relief, which is an imperative,” Lagarde told reporters in the city of Bari in Italy. German Finance Ministers Wolfgang Schaeuble, also at the meeting of the G7 advanced economies in Bari, asked if he would be prepared to ease the conditions for debt relief, said: “We are prepared to stick to what we have agreed in May 2016. That is the basis on which we are working … I am still in favor of getting a solution, at least a political solution, in the Eurogroup on the 22nd of May.”

Home › Forums › Debt Rattle May 13 2017