Giorgione The Tempest 1508

“Mankind’s only chance to not destroy its planet lies in diverging from all other species in that not all energy available to it, is used up as fast as possible. But that’s a big challenge. It would, speaking from a purely philosophical angle, truly separate us from nature for the first time ever, and we must wonder if that’s desirable.”

I wrote that 4 years and 2 months ago today, and I’m still thinking about it. It came to mind again, along with the article it comes from, see below, when I saw a few recent references to climate change, and to how any policy to halt it should be financed. It’s all painfully obvious.

Bill Gates, while on a virtual book tour, says governments should pay. In particular for the innovation needed. We’re going to solve it all with things we haven’t invented yet. That kind of thinking never fails to greatly boost my confidence in people and their ideas.

Overall, Gates’ words feel like a stale same old same old been there done that tone. But one thing is changing. Since Joe Biden became the most popular US president ever, according to his vote count, there is now a climate czar at the US Treasury, and a climate change team at the US Fed. Progress! At least for those seeking to use your money to solve their problems.

Bill Gates: Solving Covid Easy Compared With Climate

Mr Gates’s new book, How to Avoid a Climate Disaster, is a guide to tackling global warming. [..] Net zero is where we need to get to. This means cutting emissions to a level where any remaining greenhouse gas releases are balanced out by absorbing an equivalent amount from the atmosphere. One way to do this is by planting trees, which soak up CO2 through their leaves. Mr Gates’ focus is on how technology can help us make that journey. Renewable sources like wind and solar can help us decarbonise electricity but, as Mr Gates points out, that’s less than 30% of total emissions.

We are also going to have to decarbonise the other 70% of the world economy – steel, cement, transport systems, fertiliser production and much, much more. We simply don’t have ways of doing that at the moment for many of these sectors. The answer, says Mr Gates, will be an innovation effort on a scale the world has never seen before. This has to start with governments, he argues. At the moment, the economic system doesn’t price in the real cost of using fossil fuels. Most users don’t pay anything for the damage to the environment done by pollution from the petrol in their car or the coal or gas that created the electricity in their home.

“Right now, you don’t see the pain you’re causing as you emit carbon dioxide,” is how Mr Gates puts it. That’s why he says governments have to intervene. “We need to have price signals to tell the private sector that we want green products,” he says. That is going to require a huge investment by governments in research and development, Mr Gates argues, as well as support to allow the market for new products and technologies to grow, thereby helping drive down prices.

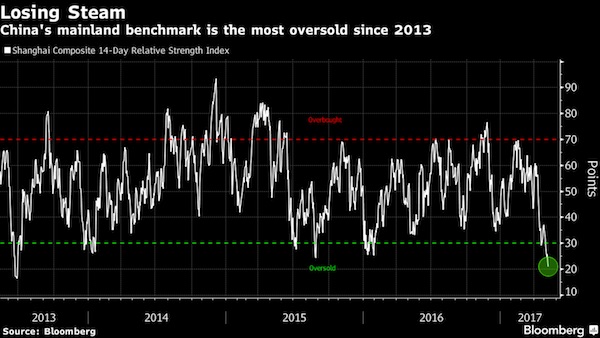

Yes, a climate change team at the US Fed. Which has been handed yet another mandate. Because the Treasury can only do so much, after all. What you want and need is something unlimited to pay for all those yet-to-be-invented tools that Bill Gates and his ilk will be happy to research with your money. Jim Rickards has this:

The overall Green New Deal calls for ending the use of oil and natural gas, moving to electric vehicles, solar, wind and geothermal power, imposing carbon taxes to reduce C02 emissions and providing government subsidies to non-carbon-based energy technologies. The U.S. would also seek to embed these policies and priorities in new trade treaties and multilateral agreements. President Biden has already begun this process by rejoining the Paris Climate Accord, which actually doesn’t mean much; it’s mostly for show. The Paris Accord is also a platform for pursuing the Green New Deal.

[..] With the job creation mandate in its portfolio, the Fed was empowered to interfere with almost every aspect of the real economy, including jobs, inflation, interest rates, liquidity and financial regulation. As if that weren’t enough, economist Barry Eichengreen now calls on central banks, especially the Fed, to use their regulatory powers to control climate change! Part of the agenda would address racial inequality, income inequality and credit access for underprivileged groups. These may be laudable goals, but it’s a long way from the Fed’s role as lender of last resort.

What’s frightening about this push to expand the Fed’s mandate is not that it can’t work, but that it could. A central bank could require commercial banks to lend money to solar and wind generating companies and deny credit to oil companies. A central bank could require more loans to disadvantaged neighborhoods and require that no credit be made available to gun manufacturers or gun dealers. There is no aspect of the economy and business activity that could not be affected positively by mandatory credit or destroyed by the lack of credit and access to the payments system.

This is already being done to some extent by cabals of commercial banks. It would be even more powerful if required by central banks. This is exactly the outcome that has been warned about for centuries by philosophers and political scientists. It is exactly the reason Americans abolished two U.S. central banks in the 19th century.

This is precisely what I was warning about in December 2016, when the protagonists were Mark Carney and Michael Bloomberg, who wrote “How To Make A Profit From Defeating Climate Change”. If you are serious about saving your planet, you’re not going to listen to the ideas of billionaires and central bankers. Because they are the people behind the original problem, and the only tools they know of are the ones who created that problem.

You can’t solve a problem with the same tools that created it. And you’re not going to solve the climate problem by seeking to make a profit from it. Here’s from 2016. Oh wait, do remember that our societies and economies don’t run on using energy, but on wasting it. If you haven’t internalized that one, take a few steps back and try again.

Heal the Planet for Profit (December 16, 2016)

Parisians duck down to evade German sniper fire following Nazi surrender of Paris, 1945

If you ever wondered what the odds are of mankind surviving, let alone ‘defeating’, climate change, look no further than the essay the Guardian published this week, written by Michael Bloomberg and Mark Carney. It proves beyond a moonlight shadow of a doubt that the odds are infinitesimally close to absolute zero (Kelvin, no Hobbes).

Yes, Bloomberg is the media tycoon and former mayor of New York (which he famously turned into a 100% clean and recyclable city). And since central bankers are as we all know without exception experts on climate change, as much as they are on full-contact crochet, it makes perfect sense that Bank of England governor Carney adds his two -trillion- cents.

Conveniently, you don’t even have to read the piece, the headline tells you all you need and then some: “How To Make A Profit From Defeating Climate Change” really nails it. The entire mindset on display in just a few words. If that’s what they went for, kudo’s are due.

These fine gents probably actually believe that this is perfectly in line with our knowledge of, say, human history, of evolution, of the laws of physics, and of -mass- psychology. All of which undoubtedly indicate to them that we can and will defeat the problems we have created -and still are-, literally with the same tools and ideas -money and profit- that we use to create them with. Nothing ever made more sense.

That these problems originated in the same relentless quest for profit that they now claim will help us get rid of them, is likely a step too far for them; must have been a class they missed. “We destroyed it for profit” apparently does not in their eyes contradict “we’ll fix it for profit too”. Not one bit. It does, though. It’s indeed the very core of what is going wrong.

Profit, or money in general, is all these people live for, it’s their altar. That’s why they are successful in this world. It’s also why the world is doomed. Is there any chance I could persuade you to dwell on that for a few seconds? That, say, Bloomberg and Carney, and all they represent, are the problem dressed up as the solution? That our definition of success is what dooms us?

Philosophers, religious people, or you and me, may struggle with the question “what’s the purpose of life?”. These guys do not. The purpose of life is to make a profit. The earth and all the life it harbors exist to kill, drill, excavate and burn down, if that means you can make a profit. And after that you repair it all for a profit. In their view, the earth doesn’t turn of its own accord after all, it’s money that makes it go round.

The worrisome thing is that Mark and Michael will be listened to, that they are allowed a seat at the table in the first place, whereas you and I are not. A table that will be filled with plenty more of their ilk, as the announcement of Bill Gates’ billionaire philantropist energy fund says loud and clear:

Microsoft co-founder Bill Gates and a group of high-profile executives are investing $1 billion in a fund to spur clean energy technology and address global climate change a year after the Paris climate agreement. Gates launched the Breakthrough Energy Ventures fund on Monday along with billionaire entrepreneurs such as Facebook head Mark Zuckerberg, Alibaba Chairman Jack Ma and Amazon.com chief Jeff Bezos. The fund seeks to increase financing of emerging energy research and reduce global greenhouse gas emissions to help meet goals set in Paris, according to a statement by the investor group known as the Breakthrough Energy Coalition.

Yes, many of the same folk and/or their minions were sitting at the table with Trump on Dec 14. To see if there are any profits to be made. When a profit is involved they have no trouble sitting down with the same guy they insulted and warned against day after grueling day mere weeks ago. They have no trouble doing it because they insulted him for a potential profit too. It’s business, it’s not personal.

Billionaires will save us from ourselves, and make us -and themselves- rich while doing it. What is not to like? Well, for one thing, has anybody lately checked the energy footprint of Messrs. Bloomberg, Gates, Ma, Zuckerberg, Bezos et al? Is it possible that perhaps they’re trying to pull our collective wool over our eyes by pretending to care about those footprints? That maybe these ‘clean energy’ initiatives are merely a veil behind which they intend to extend -and expand- said footprints?

The ones in that sphere who wind up being most successful are those who are most convincing in making us believe that all we need to do to avert a climate disaster is to use some different form of energy. That all the talk about zero emissions and clean energy is indeed reflecting our one and only possible reality.

That all we need to do is to switch to solar and wind and electric cars to save ourselves (and they’ll build them for a subsidy). That that will end the threat and we can keep on doing what we always did, and keep on growing it all and as the cherry on the cake, make a profit off the endeavor.

None of it flies even a little. First of all, as I said last week in Mass Extinction and Mass Insanity, there are many more problems with our present lifestyles than ‘only’ climate change, or the use of carbon. Like the extinction of two-thirds of all vertebrate life in just 50 years leading up to 2020. There’s -close to- nothing wind and solar will do to alleviate that.

Because it’s not oil itself, or carbon in general, that kills; our use of it does. And the rush to build an entire new global infrastructure that is needed to use new energy forms, which will depend on using huge amounts of carbon, is more likely to kill off that globe than to save it. “Carbon got us in this, let’s use lots more of it to get us out”.

The trillions in -public- investment that would be needed will make us all dirt poor too, except for the gentlemen mentioned above and a handful of others who invent stuff that they manage to make us believe will save us. Still convinced?

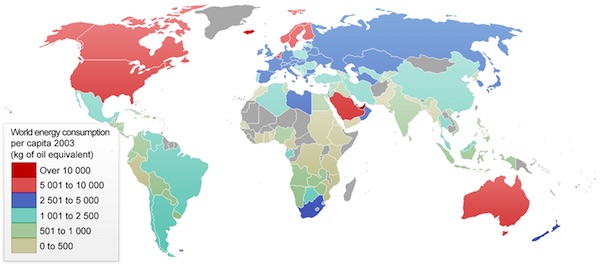

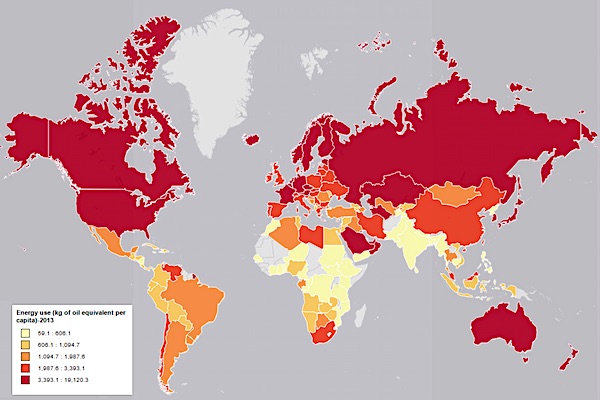

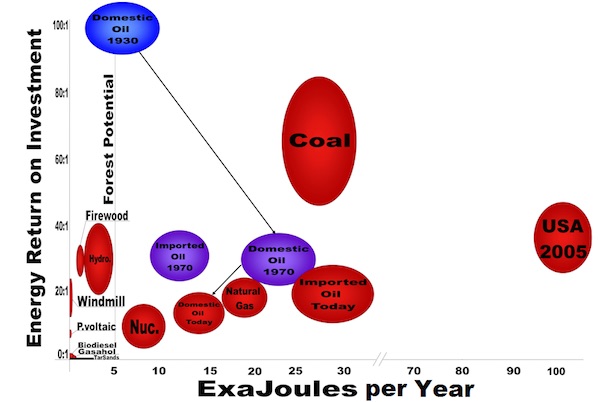

The lifestyles of the last 10 generations of us, especially westerners, are characterized more than anything else by the huge increase in the use of energy, of calories and joules. As we went from wood to peat to coal to oil and gas, the energy return on energy investment kept going higher. But that stopped with oil and gas. And from now on in it will keep going down.

“Free carbon excess” was a one-off ‘gift’ from nature. It will not continue and it will not return. Different forms of carbon have offered us a one-time source of free energy that we will not have again. The idea that we can replace it with ‘clean energy’ is ludicrous. The energy return on energy investment doesn’t even come close. And you can’t run a society with our present levels of complexity on a much lower ‘net energy’. We must dress down. No profit in that, sorry.

We built what we have now with oil at an EROEI of 100:1. There are no forms of energy left that come remotely close, including new, unconventional, forms of oil itself. Peak oil has been a much maligned and misunderstood concept, but its essence stands: when it takes more energy to ‘produce’ energy than it delivers, there will be no production.

This graph is a few years old, and wind and solar may have gained a few percentage points in yield, but it’s still largely correct. And it will continue to be.

We have done with all that free energy what all other life forms do when ‘gifted’ with an excess of available energy: spend it as fast as possible, proliferate to speed up the process (we went from less than 1 billion people to 7 billion in under 200 years, 2 billion to 7 billion in 100 years) and, most of all, waste it.

Ever wonder why everybody drives a car that is ten times heavier then her/himself and has a 10% efficiency rate in its energy use? Why there’s an infrastructure everywhere that necessitates for every individual to use 1000 times more energy than it would take herself to get from A to B on foot? Sounds a lot like deliberately wasteful behavior, doesn’t it?

The essence here is that while we were building this entire wasteful world of us, we engaged in the denying and lying behavior that typifies us as a species more than anything: we disregarded externalities. And there is no reason to believe we would not continue to do just that when we make the illusionary switch to ‘clean’ energy.

To begin with, the 2nd law of thermodynamics says there’s no such thing as clean energy. So stop using the term. Second, that we call wind and solar ‘clean energy’ means we’re already ignoring externalities again. We pretend that producing windmills and solar panels does not produce pollution (or we wouldn’t call it ‘clean’). While enormous amounts of carbon are used in the production process, and it involves pollution, loss of land, loss of life, loss of resources (once you burn it it’s gone).

An example: If we want to ‘save’ the earth, we would do good to start by overthrowing the way we produce food. It presently easily takes more than 10 calories of energy -mostly carbon- for every calorie of food we make. Then we wrap it all in (oil-based) plastic and transport it sometimes 1000s of miles before it’s on our plates. And at the end of this process, we will have thrown away half of it. It’s hard to think of a more wasteful process.

It’s a process obviously devised and executed by idiots. But it’s profitable. There is a profit to be made in wasting precious resources. And there is a key lesson in that. There is no profit in producing food in a more efficient way. At least not for the industries that produce it. And perhaps not even for you, if you produce most of your food – it takes ‘precious’ time.

It would still be hugely beneficial, though. And there’s the key. There is no direct link between what is good for us, and the planet, on the one side, and profit, money, on the other. What follows from that is that it’s not the people whose entire lives are centered around money who are the most obvious choices to ‘save the planet’. If anything, they are the least obvious.

But in an economic and political system that is itself as focused on money as ours is, they are still the ones who are allowed to assume this role. It’s a circle jerk around, and then into, a drain.

Mankind’s only chance to not destroy its planet lies in diverging from all other species in that not all energy available to it, is used up as fast as possible. But that’s a big challenge. It would, speaking from a purely philosophical angle, truly separate us from nature for the first time ever, and we must wonder if that’s desirable.

We would need to gain much more knowledge of who we are and what makes us do what we do, and why. But that is not going to happen if we focus on making a profit. Using less energy means less waste means less profit.

Yes, there may be energy sources that produce a bit less waste, a bit less pollution, than those that are carbon based. But first, our whole infrastructure has been built by carbon, and second, even if another energy source would become available, we would push to grow its use ever more, and end up initially in the same mess, and then a worse one.

I stumbled upon an excellent example of the effects of all this today:

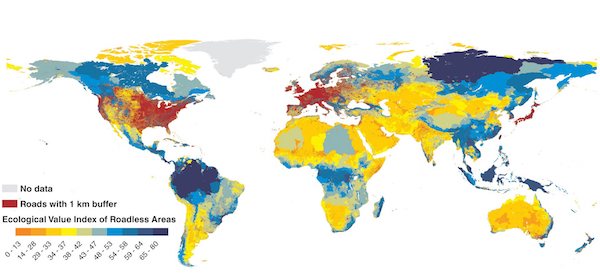

The Shattering Effect Of Roads On Nature

Rampant road building has shattered the Earth’s land into 600,000 fragments, most of which are too tiny to support significant wildlife, a new study has revealed. The researchers warn roadless areas are disappearing and that urgent action is needed to protect these last wildernesses, which help provide vital natural services to humanity such as clean water and air. The impact of roads extends far beyond the roads themselves, the scientists said, by enabling forest destruction, pollution, the splintering of animal populations and the introduction of deadly pests.

An international team of researchers analysed open-access maps of 36m km of road and found that over half of the 600,000 fragments of land in between roads are very small – less than 1km2. A mere 7% are bigger than 100km2, equivalent to a square area just 10km by 10km (6mi by 6 mi). Furthermore, only a third of the roadless areas were truly wild, with the rest affected by farming or people.

The last remaining large roadless areas are rainforests in the Amazon and Indonesia and the tundra and forests in the north of Russia and Canada. Virtually all of western Europe, the eastern US and Japan have no areas at all that are unaffected by roads.

It’s a good example because it raises the question: how much of this particular issue do you think will be solved by the promotion of electric cars, or windmills? How much of it do you think can be solved for a profit? Because if there’s no profit in it, it will not happen.

One more for the philosophy class: I know many people will be inclined to suggest options like nuclear fusion. Or zero point energy. And I would suggest that not only do these things exist in theory only, which is always a bad thing if you have an immediate problem. But more than that: imagine providing the human race with a source of endless energy, and then look at what it’s done with the free energy available to it over the past 10 generations.

Give man more energy and he’ll just destroy his world faster. It’s not about carbon, it’s about energy and about what you yourself do with it. And no, money and profit will not reverse climate change, or any other detrimental effects they have on our lives. They will only make them worse.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.