Hieronymus Bosch St. John on Patmos 1489

An inevitable story. And a too-easy trap: the Guardian presumes that it itself escapes this. It doesn’t. Blaming Trump for that is false: he doesn’t write the stories. Every news outlet is responsible for its own journalistic standards. “Trump made me do it” lacks all credibility. And besides, the Guardian, like so many US media, has been trying to put Trump down for a long time. Just like it hammered Jeremy Corbyn as ‘unfit’ and much worse until it did an embarrassing 180. Is Trump right in reacting as agressively as he has and does? Perhaps not, probably not. But is he justified? Perhaps he is. In the end for the media this is about the beam in thine own eye.

• The Trump Effect Turns Every Paper Into A Tabloid (G.)

You can find exactly the same fractured dialogue in Britain, too. What did the surprise of the Brexit vote show? Here’s another tidal wave of articles talking about the non-metropolitan forgotten masses. That, briefly, seemed a national call for understanding and change, one inchoately confirmed in the June election. But see how deafness and disdain soon set in. Let’s blame something – Boris, Rupert Murdoch, Paul Dacre, the BBC – for Brexit. Let’s contemplate the rise of Jeremy Corbyn and press a panic button. The Mail talks about “fake news, the fascist left and the REAL purveyors of hate”. Guardian columnists denounce the “open sewer” of Dacre coverage. Terms like “Tory scum” float from protesters’ posters into the new mass media. Jon Snow, amongst others, gets pasted for his supposed views about modern Conservatism. Irate Leave MPs stomp on the BBC welcome mat.

And every new day seems to bring fresh ingredients. Kensington council seeks to shut journalists out of its crucial meeting. Andrea Leadsom extols a “patriotic” press. There’s a raw edge to the debate now, sharpened after Grenfell Tower by outbreaks of pure and, sometimes, simulated rage. But: “Sit up, though, and look around. You may notice that, amid almost no public outrage whatsoever, we are quite a lot closer than once we were” to losing press freedom, says Hugo Rifkind in the Times. This is politics, and journalism, from the trenches as trust in the media plummets both here and in the US: American trust in the media down to just 38% in the latest Reuters Institute findings, the UK seven points down to 43%. Blame “deep-rooted political polarisation and perceived mainstream media bias”, says Reuters. In short, blame the frenzied state we’re in.

[..] observe how the new nihilism of scum and sewers brings its own narrow benefits. Richard Cohen in the Washington Post arrives clear-eyed. “Circulation is up. Eyeballs are popping. Trump is political pornography – gripping, exciting, lewd, fascinating. He devours adjectives so that, soon, we run out of them. The bizarre becomes ordinary. But he has done his damage. He has normalised contempt for the news media, framing it as a daily tussle between him, the tribune of the people, and us, vile overeducated snobs.”

And Jeet Heer of the New Republic pushes the argument on a notch as he charts the advantage of Trump’s alignment with the likes of the National Enquirer: “The tabloids offer a sordid vision of society, where the mainstream image of celebrities elides their secretly miserable lives (whether because of addiction, ageing, infidelity, or bankruptcy). In this nihilistic world, everyone is corrupt and every public statement is a lie. And if everyone is equally bad and untrustworthy, there’s no reason to hold Trump to any higher standard. This, ultimately, is why Trump and the tabloids were made for each other: They’re both committed to defining deviancy down.”

And while we’re at it, Guardian, let’s denounce this kind of thing for what it is. The G20 countries are responsible for poverty in Africa, and they’re not now going to solve it too. Just like the Paris agreement is complete nonsense: schemes to get rich.

• G20 Launches Plan To Fight Poverty In Africa (AFP)

G20 nations launched an unprecedented initiative Saturday at the group’s summit in Germany to fight poverty in Africa, but critics called the plan half-hearted. Under German Chancellor Angela Merkel’s “Investment Compacts”, an initial seven African countries would pledge reforms and receive technical support in order to attract new private investment. More than half of Africans are under 25 years old and the population is set to double by mid-century, making economic growth and jobs essential for the young to stop them from leaving, Merkel has said. Germany’s partner nations are Ghana, Ivory Coast and Tunisia, while Ethiopia, Morocco, Rwanda and Senegal are also taking part. Far poorer nations such as Niger or Somalia are so far not on the list.

“We are ready to help interested African countries and call on other partners to join the initiative,” said the G20 in their final communique. The plan, as well as multinational initiatives on helping girls, rural youths and promoting renewable energy, would help “to address poverty and inequality as root causes of migration”. Some 100,000 people, most of them sub-Saharan Africans, have made the dangerous journey to Europe across the Mediterranean in rickety boats this year as the migration crisis shows no sign of abating. Anti-poverty group ONE said that the investment compacts “promised much, but too many G20 partners missed the memo and failed to contribute. “The flimsy foundations must now be firmed up, follow through and improved, especially for Africa’s more fragile states.”

“..it is the most self-sufficient and diversified economy in the world.” Which is funny when you hear Putin argue against protectionism.

• The Russian Economy If You Aren’t Wearing NATO Night-Fighting Goggles (Helmer)

If your enemy is waging economic war on you, it’s prudent to camouflage how well your farms and factories are doing. Better the attacker thinks you’re on your last legs, and are too exhausted to fight back. A new report on the Russian economy, published by Jon Hellevig, reveals the folly in the enemy’s calculation. Who is the audience for this message? US and NATO warfighters against Russia can summon up more will if they think Russia is in retreat than if they must calculate the cost in their own blood and treasure if the Russians strike back. That’s Russian policy on the Syrian front, where professional soldiers are in charge. On the home front, where the civilians call the shots, Hellevig’s message looks like an encouragement for fight-back – the economic policymaker’s equivalent of a no-fly zone for the US and European Union. It’s also a challenge to the Kremlin policy of appeasement.

Hellevig, a Finnish lawyer and investment analyst, has been directing businesses in Russia since 1992. His Moscow-based consultancy Awara has published its assessment of Russian economic performance since 2014 with the title, “What Does Not Kill You Makes You Stronger.” The maxim was first coined by the `19th century German philosopher Friedrich Nietzsche. He said it in a pep talk for himself. Subsequent readers think of the maxim as an irony. Knowing now what Nietzsche knew about his own prognosis but kept secret at the time, he did too. The headline findings aren’t news to the Kremlin. It has been regularly making the claims at President Vladimir Putin’s semi-annual national talk shows; at businessmen’s conventions like the St. Petersburg International Economic Forum (SPIEF); and in Kremlin-funded propaganda – lowbrow outlets like Russia Today and Sputnik News, and the highbrow Valdai Club.

A charter for a brand-new outlet for the claims, the Russian National Convention Bureau, was agreed at the St. Petersburg forum last month. Government promotion of reciprocal trade and inward investment isn’t exceptional for Russia; it is normal practice throughout the world. The argument of the Hellevig report is that the US and NATO campaign against Russia has failed to do the damage it was aimed to do, and that their propaganda outlets, media and think-tanks are lying to conceal the failure. Small percentage numbers for the decline in Russian GDP and related measures are summed up by Hellevig as “belt-tightening, not much more”. Logically and arithmetically, similarly small numbers in the measurement of the Russian recovery this year ought to mean “belt expanding, not much more.” But like Nietzsche, Hellevig is more optimistic.

Here’s what he concludes:

• “Industrial Production was down merely 0.6%. A handsome recovery is already on its way with an expected growth of 3 to 4% in 2017. In May the industrial production already soared by a promising 5.3%.”

• “Unemployment remained stable all through 2014 – 2016, the hoped-for effect of sanctions causing mass unemployment and social chaos failed to materialize.”

• “GDP was down 2.3% in 2014-2016, expected to more than make up for that in 2017 with 2-3% predicted growth.”

• “The really devastating news for ‘our Western partners’ (as Putin likes to refer to them) must be – which we are the first to report – the extraordinary decrease in the share of oil & gas revenue in Russia’s GDP.”

• “In the years of sanctions, Russia has grown to become an agricultural superpower with the world’s largest wheat exports. Already in the time of the Czars Russia was a big grain exporter, but that was often accompanied with domestic famine. Stalin financed Russia’s industrialization to a large extent by grain exports, but hereby also creating domestic shortages and famine. It is then the first time in Russia’s history when it is under Putin a major grain exporter while ensuring domestic abundance. Russia has made an overall remarkable turnaround in food production and is now virtually self-sufficient.”

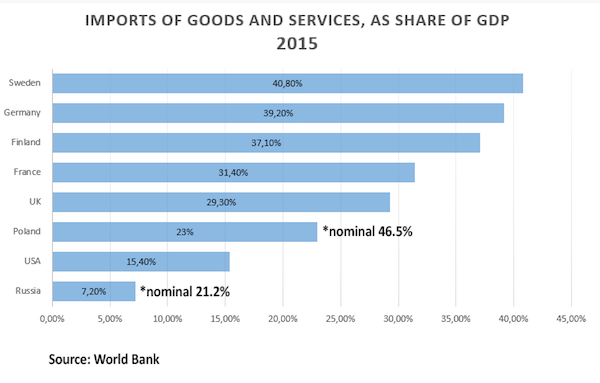

• “Russia has the lowest level of imports (as a share of the GDP) of all major countries… Russia’s very low levels of imports in the global comparison obviously signifies that Russia produces domestically a much higher share of all that it consumes (and invests), this in turn means that the economy is superbly diversified contrary to the claims of the failed experts and policymakers. In fact, it is the most self-sufficient and diversified economy in the world.

Bloomberg argues that austerity is bad for Britain but good for Greece. Blind bats.

• Britain Isn’t Greece, Prime Minister (BBG Ed.)

Britain’s government isn’t due to announce a new budget until the autumn, but debate is already raging over public-sector pay. With Brexit bearing down, the embattled prime minister, Theresa May, will have to choose between making another embarrassing U-turn and defending a policy that is both unpopular and unnecessary. Sadly for May, the U-turn makes better sense. For years it was an article of faith among Britain’s Conservatives that the budget deficit had to be eliminated — by 2020, if not yesterday. Some Tories are now ready to abandon that line of thinking; others still hold the principle, if not the timetable, sacrosanct. Speaking in Parliament on Wednesday, May came down firmly on the side of austerity: Greece shows you where fiscal indiscipline leads, she argued.

Labour leader Jeremy Corbyn was unmoved. He decried the “low-wage epidemic” and argued that the 1 percent cap on increases in public-sector wages should be removed. Corbyn has a point. Britain’s workers are getting squeezed, especially in the public sector, thanks to rising inflation caused in part by the Brexit-induced fall in sterling. But he’s wrong to look at wages in isolation. Public-sector pay is only one of many claims on the government’s budget. The National Health Service, for instance, is in a state of permanent crisis; spending on care for the elderly and other needs is woefully inadequate. The list of other worthy expenditures is endless. Trying to meet all such claims would indeed be a formula for fiscal collapse. The government has to prioritize.

Where higher wages are needed to recruit and retain workers for essential services, raise them. Where additional public spending is needed to provide vital infrastructure, spur productivity, and support growth, make the investment. In such cases, higher taxes and/or higher public borrowing can be justified. If caps and ceilings are used in a way that makes this necessary flexibility impossible – not as emergency measures, moreover, but as a system of long-term control – they’ll do more harm than good. May’s embrace of blanket austerity, by the way, is bad politics as well as bad economics. Most British voters have forgotten, or never experienced, the ruinous consequences of profligate public spending.

That’s why Corbyn’s expansive promises are more popular than you might expect – and why there’ll be greater support for fiscal control if it’s seen to be smart and discriminating, rather than an act of blind ideological faith. To be sure, the timing for a change of fiscal strategy is hardly propitious. Brexit has alarmed investors, giving the government less room for maneuver. Even so, the government shouldn’t be paralyzed – and shouldn’t argue that cautious flexibility would make the country another Greece. That line won’t fly. Targeted spending to improve vital services and drive future growth is good policy, and Britain’s best buffer against the perils ahead.

What a surprise. Maybe it’s time to inject some reality.

• Baby Boomers Not Financially Prepared For Retirement (MW)

Retirement is right around the corner for baby boomers – if they haven’t already entered it – yet so many are financially unprepared. Baby boomers, or those born between 1946 and 1964, expect they’ll need $658,000 in their defined contribution plans by the time they retire, but the average in those employer-sponsored plans is $263,000, according to a survey of 900 investors by financial services firm Legg Mason. Older boomers, who are 65 to 74, have an average of $300,000. Their asset allocation for all of their investments are also conservative, according to QS Investors, an investment management firm Legg Mason acquired in 2014, with 30% in cash, 24% in equities, 22% in fixed income, 4% in non-traditional assets, 8% in investment real estate, 2% in gold and other precious metals and 8% in other investments.

“They have less than half the assets they hope to have in retirement,” said James Norman, president of QS Investors. “That’s a pretty big miss.” Americans across the country, and all age groups, are drastically under-saved for retirement. Only a third of Americans who have access to a 401(k) plan contribute to it, and previous research suggests the typical middle-aged American couple only has $5,000 saved for the future. Meanwhile, millennials may not be able to picture themselves in retirement at all, though are urged by financial professionals to make a habit of saving, if even only as little as $5. There are a multitude of reasons people may not have enough for retirement, such as having to leave the workforce in between their prime years to care for loved ones, not working long enough to qualify for certain government benefits. or choosing to pay for their childrens’ college tuition instead of saving for their own retirement.

Still, not saving enough was the biggest regret among older Americans, according to a survey of 1,000 participants by personal finance site Bankrate.com. Generation X, or those born between 1965 and 1981, aren’t doing all that much better, though they have the benefit of more time to reach their financial goals. More of them have a defined contribution plan, according to the Legg Mason survey, with an average of $199,000 stashed away for a goal of $541,000 by retirement. They are also investing conservatively, with 25% in cash, 21% in equities, 17% in fixed income, 11% in non-traditional assets, 16% in investment real estate, 7% in gold and other precious metals and 4% in other investments. Conversely, QS Investors suggest their Gen-X aged clients have 80% in equities, which faces more risks from the stock market but could also realize higher returns.

Retirement isn’t the picture-perfect image of lounging on a beach with the idea of a 9-to-5 job long gone. Benefits aren’t the same, either – for example, in 1985, retirees could expect Social Security to cover most of their income and employers typically covered most health-care costs. Retirees 30 years ago also probably didn’t expect to live for decades after resigning at 65, whereas now people are being told to plan to live well into their 80s.

A medieval society.

• UK Homebuyers Desperate To Know Who Really Owns Their Freehold (G.)

Buyers who purchased new properties direct from some of the UK’s biggest builders have been left in the dark as investment companies play pass-the-parcel with the land their homes stand on. Take Joanne Darbyshire, 46, and her husband Mark, 47. They bought a five-bedroom house in Bolton from Taylor Wimpey in 2010, and are among thousands of unfortunate leaseholders put on “doubling” ground rent contracts that in extreme cases have left their properties almost worthless, with mortgage lenders refusing loans to future buyers. The only way to escape the escalating payments is to buy the freehold. But in Darbyshire’s case, Taylor Wimpey sold it to Adriatic Land 2 (GR2) in 2012. In January 2017 that company transferred it to Adriatic Land 1 (GR3), while some of Darbyshire’s neighbours have seen their freeholds transferred from Adriatic Land 2 (GR2) to Abacus Land Ltd.

“You have no idea who owns the land under your feet,” says Darbyshire. “Your dream house is traded from one offshore company to another for tax reasons, or who knows what else?” Paul Griffin (not his real name) bought a property from Morris Homes in Winsford, Cheshire, in November 2014. By last year, when he decided to add a conservatory, his freehold was in the hands of Adriatic Land 3 and managed by its fee-collecting agents HomeGround. Young was horrified to discover he had to pay £108 just to look at his file. Although the conservatory didn’t need local authority planning permission and was not subject to building regulations, HomeGround then demanded £1,200 for a “licence” for the work to go ahead. This was broken down into solicitors fees (£480), surveyors (£360), and its own fee of £360.

On top of this it demanded numerous official documents at Young’s expense totalling about £400. Helen Burke (not her real name) in Ellesmere Port, meanwhile, was shocked to discover that after Bellway sold her freehold to Adriatic, the cost of seeking consent for a small single-storey extension rocketed. Initially, she had applied to Bellway – the freeholder at the time – and it wanted £300. But after putting off the work for a few months she discovered that Bellway had sold the freehold to Adriatic Land 4 (GR1) Ltd. HomeGround then demanded £2,440 for consent. That is not planning permission, which householders must obtain separately from the local authority. It is simply a fee charged without any material services provided.

“It’s daylight robbery,” says Burke. “The most disgusting thing is the developers like Bellway think they are doing nothing wrong selling the freeholds on and state that our T&Cs don’t change. Yes, the lease terms don’t change, but for a permission fee to increase from £300 to £2,440 in a matter of months is disgraceful and it should absolutely be pointed out to new homeowners, up front, that this might happen if they don’t buy the freeholds.” Burke said she was quoted £3,750 to buy the freehold off Bellway, but once it was sold to Adriatic the price quadrupled to £13,000. After a long legal battle she has acquired it for £7,680.

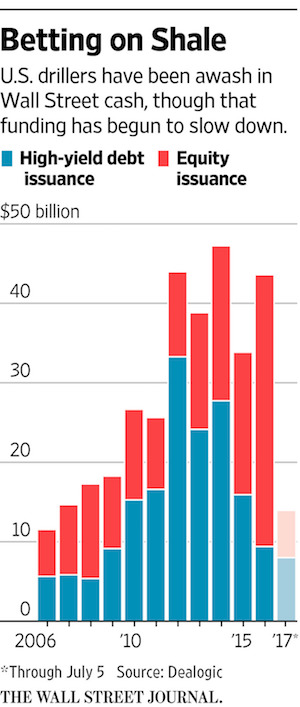

“..$57 billion Wall Street has injected into the sector over the last 18 months.”

• Wall Street Cash Pumps Up Shale Oil Production Even as Prices Sag (WSJ)

Easy Wall Street cash is leading U.S. shale companies to expand drilling, even as most lose money on every barrel of oil they bring to the surface. Despite a 17% plunge in prices since April, drillers are on pace to break the all-time U.S. oil production record, topping 10 million barrels a day by early next year if not sooner, according to government officials and analysts. U.S. crude fell again on Friday, dropping 2.8% to $44.23 a barrel on the New York Mercantile Exchange. Yet the U.S. oil rig count rose Friday to the highest level in more than two years. Operators have now put more than 100 rigs back to work from Oklahoma to North Dakota in the past three months. Companies have more capital to keep drilling thanks to $57 billion Wall Street has injected into the sector over the last 18 months.

Money has come from investors in new stock sales and high-yield debt, as well as from private equity funds, which have helped provide lifelines to stronger operators. Flush with cash, virtually all of them launched campaigns to boost drilling at the start of 2017 in the hope that oil prices would rebound. The new wave of crude has again glutted the market. The shale companies are edged even further from profitability, and a few voices have begun to question the wisdom of Wall Street financing the industry’s addiction to growth. “The biggest problem our industry faces today is you guys,” Al Walker, chief executive of Anadarko, told investors at a conference last month.

Wall Street has become an enabler that pushes companies to grow production at any cost, while punishing those that try to live within their means, Mr. Walker said, adding: “It’s kind of like going to AA. You know, we need a partner. We really need the investment community to show discipline.” Even if companies cut back on drilling now, it wouldn’t be enough to stop a new wave of oil from hitting the market in the second half of the year: U.S. shale output typically lags behind new drilling by four to six months, analysts say. “There’s been insufficient discrimination on the part of sources of capital,” said Bill Herbert, an energy analyst with Piper Jaffray’s Simmons. Big shale companies “are able to get what they want and invest what they want.”

Well, that status was declared dead too. So there. People are next.

• Polluted Indian River Reported Dead Despite ‘Living Entity’ Status (G.)

One morning in late March, Brij Khandelwal called the Agra police to report an attempted murder. Days before, the high court in India’s Uttarakhand state had issued a landmark judgment declaring the Yamuna river – and another of India’s holiest waterways, the Ganges – “living entities”. Khandelwal, an activist, followed the logic. “Scientifically speaking, the Yamuna is ecologically dead,” he says. His police report named a series of government officials he wanted charged with attempted poisoning. “If the river is dead, someone has to be responsible for killing it.” In the 16th century, Babur, the first Mughal emperor, described the waters of the Yamuna as “better than nectar”. One of his successors built India’s most famous monument, the Taj Mahal, on its banks.

For the first 250 miles (400km) of its life, starting in the lower Himalayas, the river glistens blue and teems with life. And then it reaches Delhi. In India’s crowded capital, the entire Yamuna is siphoned off for human and industrial use, and replenished with toxic chemicals and sewage from more than 20 drains. Those who enter the water emerge caked in dark, glutinous sludge. For vast stretches only the most resilient bacteria survive. The waterway that has sustained civilisation in Delhi for at least 3,000 years – and the sole source of water for more than 60 million Indians today – has in the past decades become one of the dirtiest rivers on the planet.

“We have water records which show that, until the 1960s, the river was much better quality,” says Himanshu Thakkar, an engineer who coordinates the South Asia Network on Dams, Rivers and People, a network of rights groups. “There was much greater biodiversity. Fish were still being caught.” What happened next mirrors a larger Indian story, particularly since the country’s markets were unshackled in the early 1990s: one of runaway economic growth fuelled by vast, unchecked migration into cities; and the metastasising of polluting industries that have soiled many of India’s waterways and made its air the most toxic in the world.

Home › Forums › Debt Rattle July 9 2017